Overview

Understanding the factors that can impact your home appraisal is crucial for homeowners looking to enhance their property’s value. We know how challenging this can be, especially when considering aspects like:

- The property’s condition

- Location

- Comparative sales

- Market trends

- The quality of upgrades or renovations

Poor maintenance and unfavorable neighborhood characteristics can significantly lower your home’s perceived value. Additionally, a lack of recent comparable sales can further complicate matters. It’s essential to recognize these elements, as they play a vital role in determining your home’s worth.

By addressing these concerns, you can take actionable steps to improve your property. Whether it’s investing in maintenance or understanding your local market, every effort counts. We’re here to support you every step of the way as you navigate this process.

Introduction

Understanding the nuances of home appraisals is crucial for families navigating the complex landscape of real estate. We know how challenging this can be. These evaluations not only determine a property’s market value but also significantly influence mortgage approvals and refinancing options. However, many homeowners remain unaware of the factors that can negatively impact these appraisals, potentially jeopardizing their financial decisions.

What are the hidden pitfalls that could lower a home’s worth?

How can families proactively safeguard their investments?

We’re here to support you every step of the way.

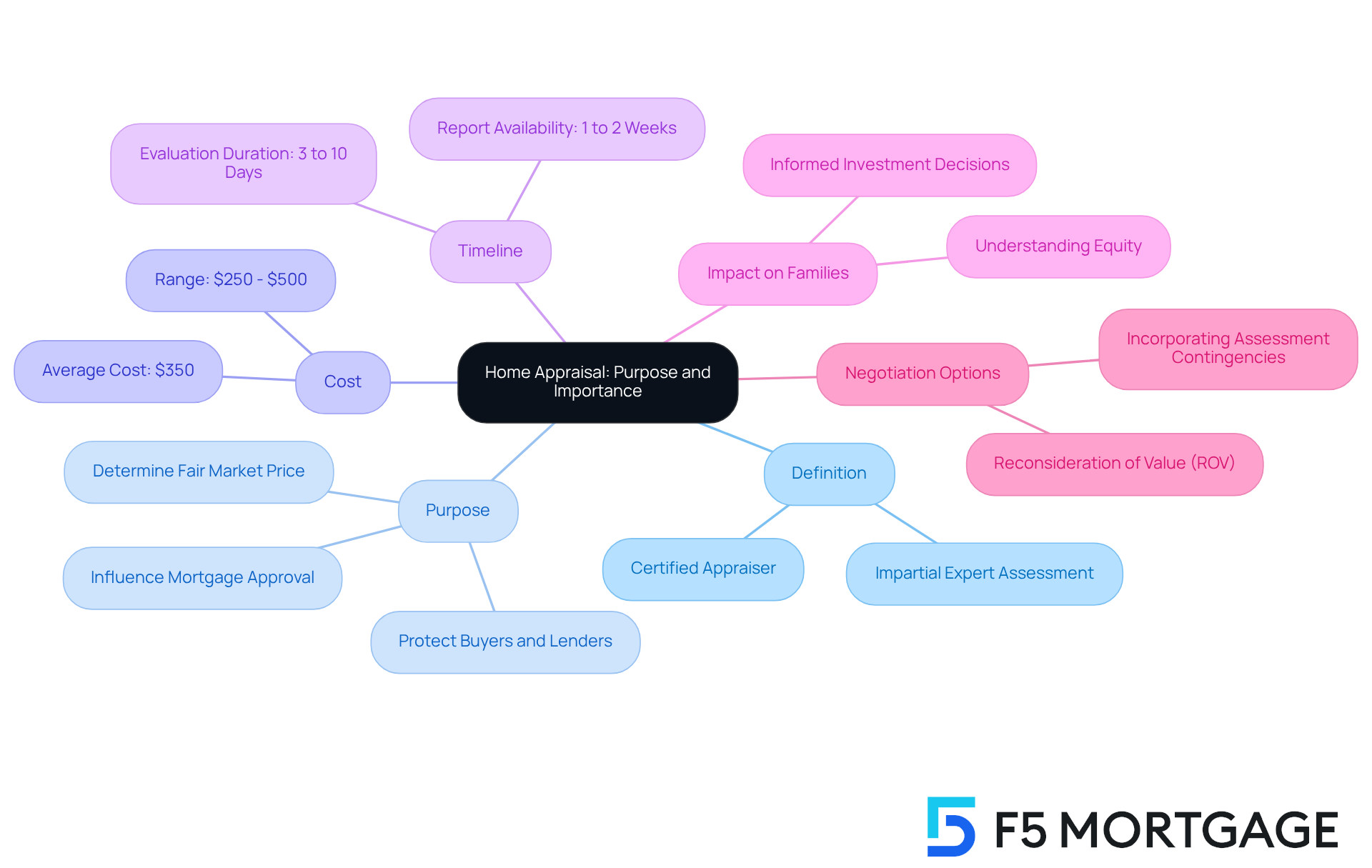

Define Home Appraisal: Purpose and Importance

Navigating the world of residential evaluations can feel overwhelming, but understanding this process is essential for families looking to make informed decisions. A residential evaluation is an impartial expert assessment of a property’s worth, usually carried out by a certified appraiser. The primary goal is to ascertain the fair market price of a property, which is crucial for lenders when approving mortgage loans. We know how challenging this can be, and we’re here to support you every step of the way.

When lenders request a , they aim to determine the current market value of your asset. This evaluation reveals how much equity you possess, which can significantly influence your mortgage rates. Appraisals are crucial in both purchasing and refinancing processes because they help determine what hurts a home appraisal, ensuring that buyers do not overpay for a residence and that lenders do not finance more than the property’s value.

On average, a home valuation costs between $250 and $500, with a typical amount around $350. This cost is an important consideration for families. The evaluation process typically takes between 3 to 10 days to finalize, providing a timeline for families to expect. Furthermore, lenders are required to supply a copy of the evaluation no later than three days before closing, ensuring transparency in the process.

Grasping the significance of evaluations empowers families to navigate the mortgage landscape more effectively. It allows you to make informed decisions regarding your investments. Additionally, if you believe your evaluation is too low, you have the option to contest it by requesting a reconsideration of value (ROV) from your lender, particularly in light of what hurts a home appraisal. This can be a crucial negotiation tool.

Incorporating assessment contingencies in purchase proposals is also a wise step. This practice safeguards buyers from potential evaluation gaps, ensuring your investment is protected. Remember, you are not alone in this journey; there are resources and support available to guide you through the evaluation process.

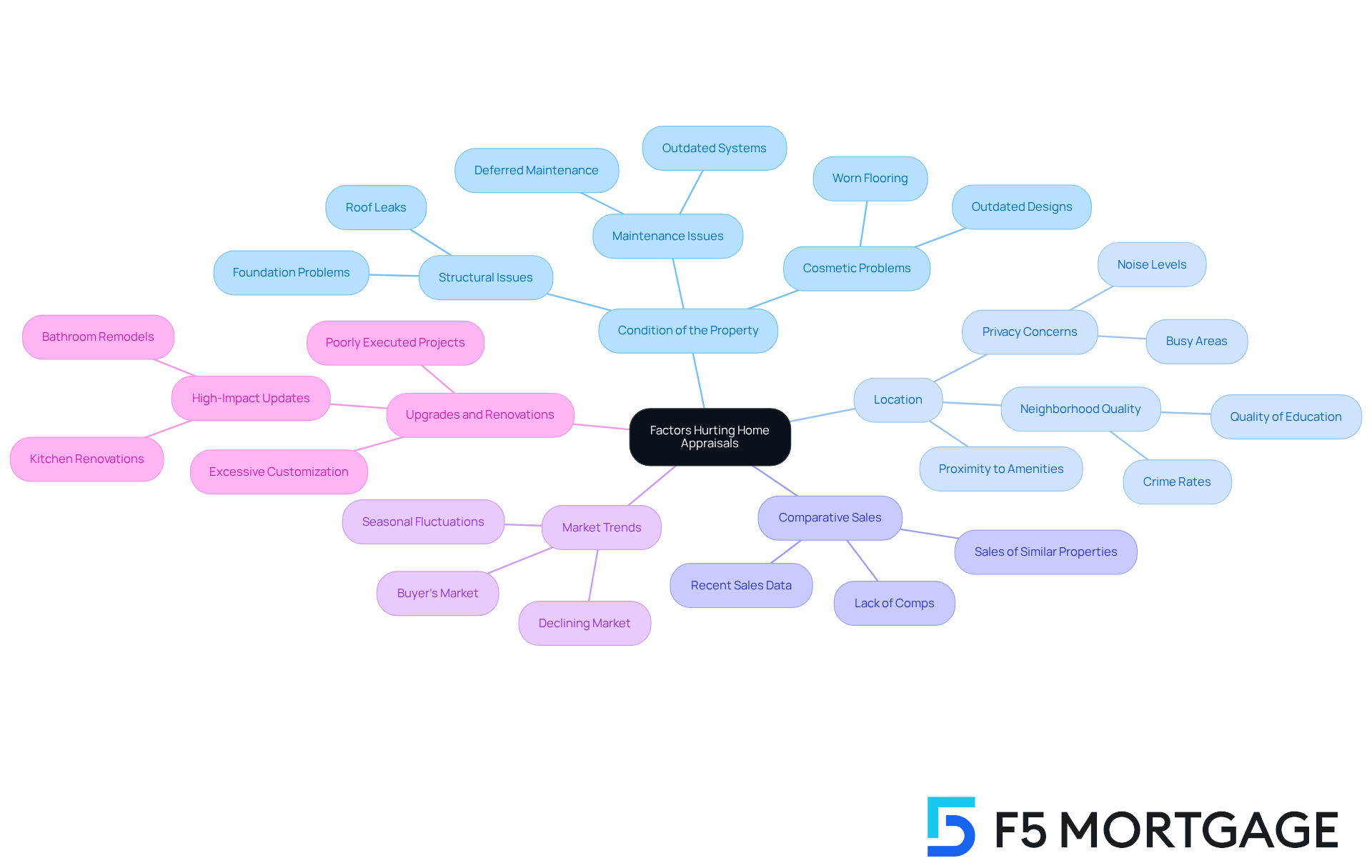

Identify Key Factors That Hurt Home Appraisals

Several key factors can adversely affect , and understanding is essential for homeowners looking to enhance their property’s worth.

- Condition of the Property: We know how challenging it can be to maintain a home. Poorly maintained properties or those that require significant repairs are often what hurts a home appraisal. Appraisers focus on overall condition, including structural integrity and aesthetic appeal. For instance, foundation problems and roof leaks are examples of what hurts a home appraisal and can significantly reduce a home’s perceived value. Additionally, cosmetic problems such as outdated designs or worn flooring are examples of what hurts a home appraisal and can further influence valuation results.

- Location: The appeal of your neighborhood plays a crucial role in determining your home’s worth. Factors like crime rates, quality of education, and proximity to amenities are all considered in the evaluation process. Properties in prime locations usually demand higher prices, while those in noisy or busy areas may experience a decrease in assessment due to privacy concerns.

- Comparative Sales: Appraisers rely heavily on recent sales of similar properties in the area, known as comps, to establish value. If similar houses have sold for less, this situation can demonstrate what hurts a home appraisal. In a competitive market, the lack of recent sales information can complicate this process, potentially leading to lower evaluations.

- Market Trends: We understand that the real estate market can be unpredictable. A declining market is an example of what hurts a home appraisal, as appraisers must take current conditions into account. For example, in a buyer’s market where supply exceeds demand, property prices may drop, influencing overall assessment figures.

- Upgrades and Renovations: While certain enhancements can increase your property’s value, not all renovations yield a return on investment. Excessive customization can deter potential buyers, illustrating what hurts a home appraisal and adversely affecting valuation results. For instance, a kitchen renovation typically boosts a home’s worth the most, but overly personalized updates might not attract a wider audience.

By tackling maintenance concerns, considering the advantages of your location, and implementing strategic enhancements, you can greatly influence your property value results. We’re here to support you every step of the way as you navigate this process.

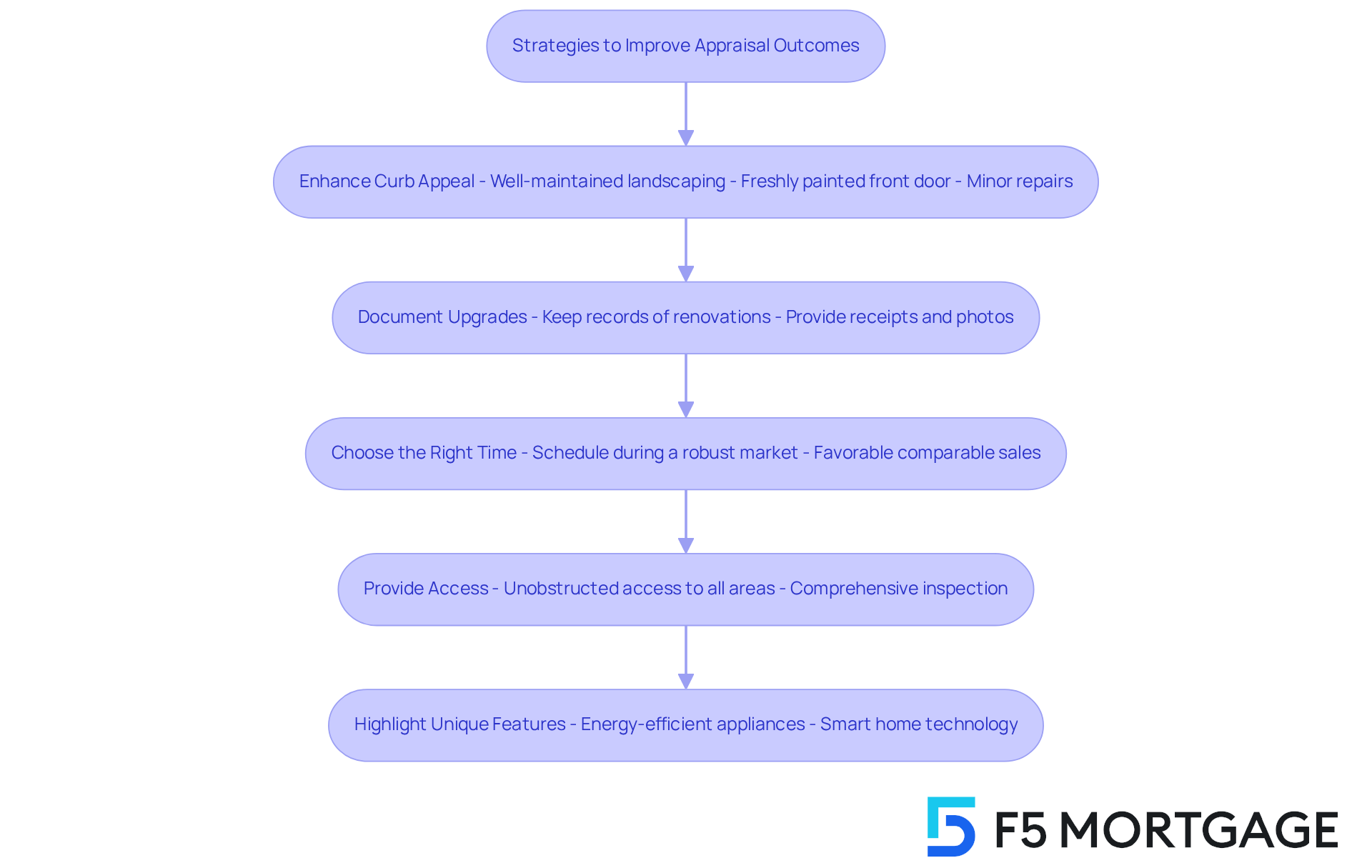

Explore Strategies to Improve Appraisal Outcomes

To increase the likelihood of a favorable appraisal, families can adopt several effective strategies that truly make a difference:

- Enhance Curb Appeal: First impressions matter, and we know how crucial they can be. Simple enhancements like well-maintained landscaping, a freshly painted front door, and minor repairs can significantly elevate a property’s exterior. In fact, studies indicate that a well-maintained exterior can enhance a home’s worth by as much as 10%. This makes one of the factors that contribute to what hurts a home appraisal in the evaluation process.

- Document Upgrades: Keeping thorough records of renovations and improvements is essential. We’re here to support you in providing appraisers with documentation of these upgrades, such as receipts, before-and-after photos, and descriptions of the work completed. This can help substantiate a higher property value.

Choosing the right time is important because timing can be what hurts a home appraisal in evaluation outcomes. Scheduling an appraisal during a robust market period, when comparable sales are favorable, can positively influence the valuation. We know how challenging this can be, but being strategic can yield great results.

- Provide Access: Ensure that the appraiser has unobstructed access to all areas of the residence, including the basement and attic. A comprehensive inspection can reveal what hurts a home appraisal, allowing for a more precise evaluation of the property’s worth. Remember, the more the appraiser can see, the better the assessment.

- Highlight Unique Features: If your property boasts unique characteristics or upgrades, such as energy-efficient appliances or smart home technology, it’s important to bring these to the appraiser’s attention. These elements can significantly enhance the perceived value of the property.

By concentrating on these strategies, families can effectively enhance their home’s assessment results, ensuring they receive the best possible valuation. We’re here with you every step of the way, supporting your journey.

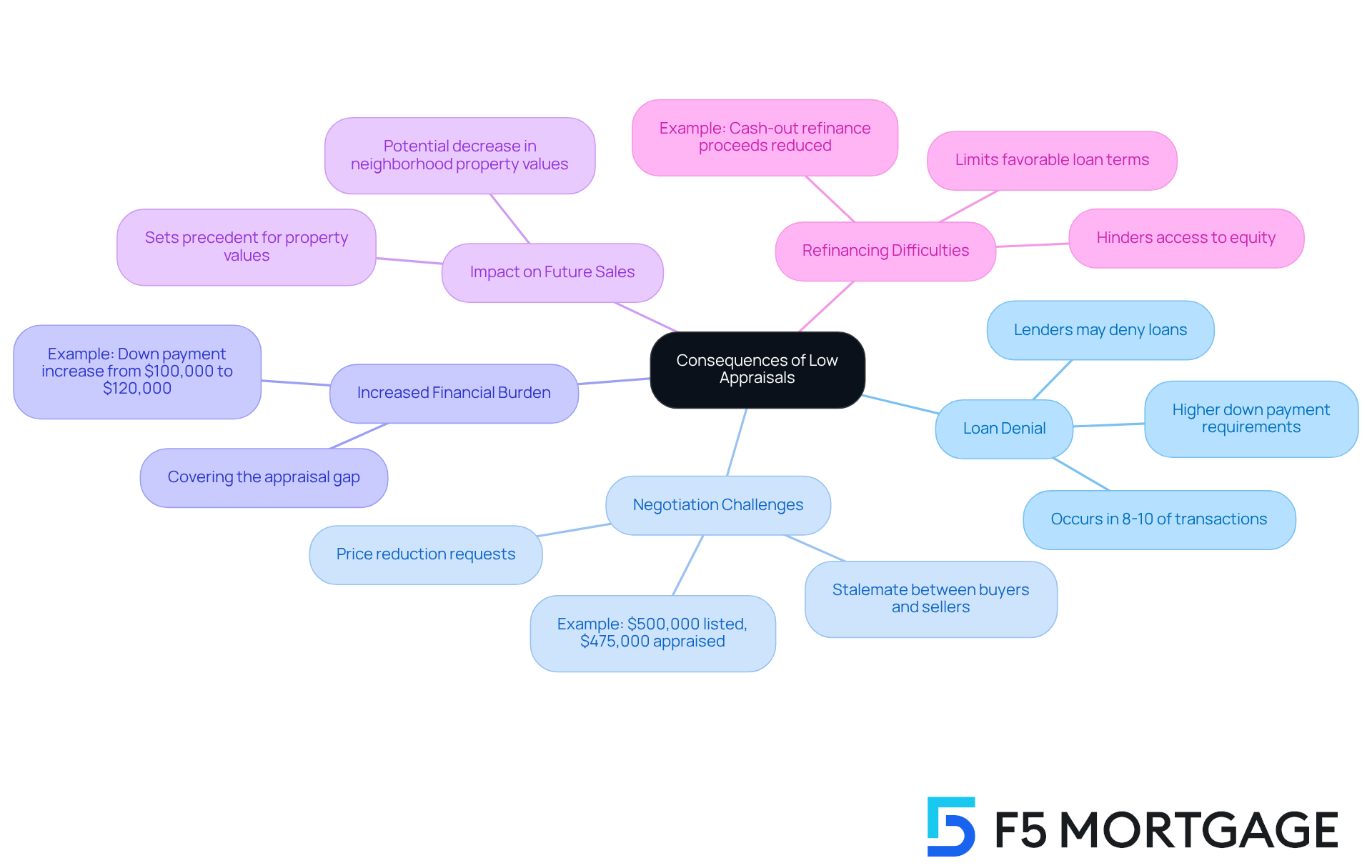

Understand Consequences of Low Appraisals

Low appraisals can have significant consequences for families, and it’s essential to understand these impacts.

- Loan Denial: When an appraisal falls short of the purchase price, lenders may deny the loan or require a larger down payment to bridge the gap. This situation can lead to financial stress, as purchasers must locate extra funds to satisfy lender requirements. In fact, low evaluations occur in approximately 8-10 percent of real estate transactions, highlighting how common this issue can be.

- Negotiation Challenges: A low appraisal complicates discussions between purchasers and sellers, often resulting in a stalemate. Buyers may seek a price reduction, but sellers might resist, leading to potential breakdowns in the sale. For instance, if a home is listed at $500,000 but appraised at $475,000, the purchaser may need to negotiate a lower price or increase their down payment to maintain an acceptable loan-to-value (LTV) ratio.

- Increased Financial Burden: Families may face the challenging task of covering the difference between the appraised amount and the purchase price, which can strain their finances. For example, if a purchaser must raise their down payment from $100,000 to $120,000 to counterbalance a low valuation, this extra financial load can affect their overall budget and financial strategy.

- Impact on Future Sales: A low evaluation can set a worrying precedent for upcoming sales in the area, potentially influencing property prices and market views. This ripple effect can reduce the perceived worth of properties in the neighborhood, complicating future transactions for other property owners.

- Refinancing Difficulties: Homeowners seeking to refinance may find that a low valuation hinders their ability to access equity or secure favorable loan terms. This limitation can significantly affect their financial flexibility, as they may miss out on opportunities to lower their monthly payments or access their property’s equity for other investments. Furthermore, including a financing contingency in the purchase agreement is essential, as it safeguards the buyer’s earnest money if the valuation does not justify the purchase price.

Understanding these consequences is crucial for families navigating the home buying and refinancing process. It equips them with the knowledge to address potential appraisal issues proactively. We know how challenging this can be, and when shopping for lenders, considering F5 Mortgage can provide families with . We’re here to support you every step of the way, ensuring you have the assistance needed to navigate these challenges effectively.

Conclusion

Understanding what hurts a home appraisal is crucial for families navigating the complexities of property evaluations. We know how challenging this can be. This article has highlighted the importance of appraisals in determining a property’s fair market value, which plays a significant role in mortgage approvals and overall investment decisions. By grasping the factors that can negatively impact appraisals, homeowners can take proactive steps to enhance their property’s worth and ensure they make informed choices in the real estate market.

Key points discussed include various elements that can lead to lower appraisals, such as:

- The condition of the property

- Location

- Comparative sales

- Market trends

- The impact of upgrades and renovations

Additionally, strategies to improve appraisal outcomes—like enhancing curb appeal, documenting upgrades, and providing access to appraisers—were explored. Understanding the consequences of low appraisals, including loan denial and negotiation challenges, underscores the need for families to be well-prepared and informed throughout the appraisal process.

Ultimately, taking these insights into account empowers families to enhance their home’s value and navigate the appraisal landscape with confidence. By being proactive and strategic, homeowners can safeguard their investments and ensure they are well-equipped to handle any appraisal-related challenges that may arise. Embracing this knowledge not only benefits individual homeowners but also contributes to a healthier real estate market overall.

Frequently Asked Questions

What is a home appraisal?

A home appraisal is an impartial expert assessment of a property’s worth, typically conducted by a certified appraiser to determine the fair market price of a property.

Why is a home appraisal important?

Home appraisals are crucial for lenders when approving mortgage loans, as they help ascertain the current market value of a property, influencing mortgage rates and ensuring that buyers do not overpay.

How much does a home appraisal typically cost?

The cost of a home appraisal usually ranges from $250 to $500, with an average cost around $350.

How long does the home appraisal process take?

The evaluation process typically takes between 3 to 10 days to finalize.

When will I receive the appraisal report from my lender?

Lenders are required to provide a copy of the appraisal no later than three days before closing.

What can I do if I believe my home appraisal is too low?

If you believe your appraisal is too low, you can contest it by requesting a reconsideration of value (ROV) from your lender.

What are assessment contingencies in purchase proposals?

Assessment contingencies are clauses included in purchase proposals that protect buyers from potential gaps in the appraisal, ensuring their investment is safeguarded.

How can understanding home appraisals help families?

Understanding home appraisals empowers families to navigate the mortgage landscape more effectively, allowing them to make informed decisions regarding their investments.