Overview

Navigating home equity loan rates can feel overwhelming, but understanding the key factors at play can empower you. Your credit score, loan-to-value (LTV) ratio, home appraisals, and the broader economic landscape all influence the rates you may encounter. We know how challenging this can be, but remember, a higher credit score typically leads to lower rates. Favorable LTV ratios and stable market conditions can further enhance your borrowing terms.

Imagine being able to secure a loan with more attractive rates compared to higher-interest alternatives like credit cards. This possibility can make a significant difference in managing your finances. By exploring home equity loans, you might find a solution that meets your needs and alleviates some financial stress. We’re here to support you every step of the way as you consider your options.

Introduction

Understanding home equity loans can unlock significant financial opportunities for homeowners eager to leverage their property’s value. As real estate prices rise and the lending landscape becomes increasingly competitive, many are turning to these loans as a strategic way to fund major expenses, such as renovations or debt consolidation. However, navigating the complexity of home equity loan rates can be daunting. Factors like credit scores, loan-to-value ratios, and broader economic conditions shape these rates, presenting challenges for borrowers seeking the best terms.

We know how challenging this can be, but there are insights that can help homeowners navigate these rates effectively. By understanding the landscape and arming themselves with knowledge, families can make informed financial decisions that truly benefit them. We’re here to support you every step of the way as you explore your options and take control of your financial future.

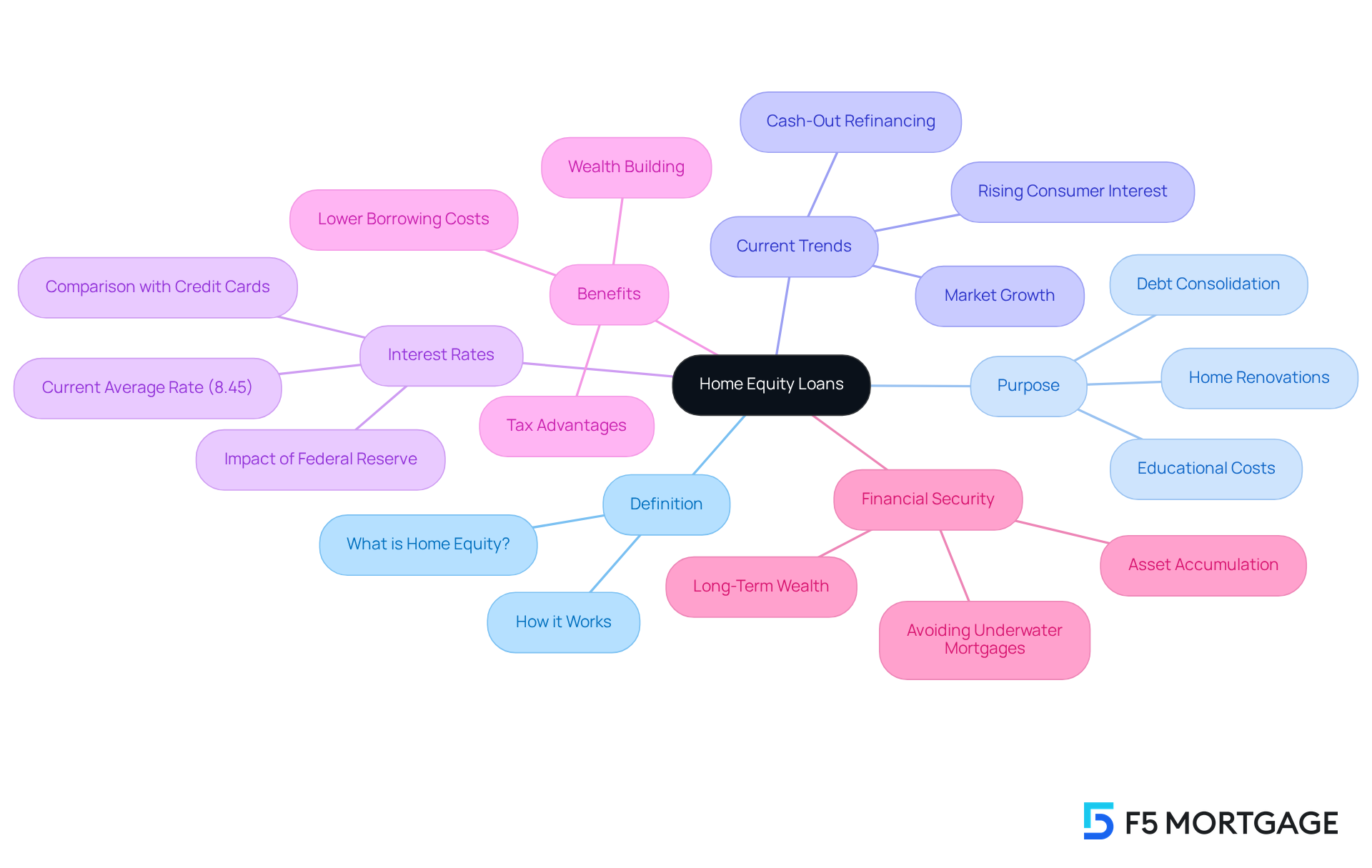

Define Home Equity Loans and Their Purpose

A property equity line, often known as a second mortgage, allows homeowners to tap into the equity they’ve built in their homes. Equity is simply the difference between your property’s current market value and what you still owe on your mortgage. This financial product provides a one-time sum of money, usually repaid over a set period at a consistent interest rate. It can be a wonderful option for significant expenses, such as home renovations, consolidating debt, or covering educational costs.

We know how important it is for property owners to make the most of their investments. In fact, around 81% of those refinancing are opting for cash-out alternatives to access their home equity for renovations. This trend highlights how homeowners are strategically using their residential assets to and improve their living spaces. Currently, the typical interest rate for residential property financing is 8.45%, but what are home equity loan rates compared to the almost 23% median credit card interest rate? This makes it a more budget-friendly borrowing choice.

Financial consultants often emphasize the benefits of residential property loans, including potential tax advantages through mortgage interest deductibility. As residential property values continue to rise—nearly 90% of metropolitan areas reported growth in the third quarter of 2024—homeownership can serve as a significant source of wealth. By wisely utilizing their property value, homeowners can not only finance renovations but also build long-term financial security. Remember, we’re here to support you every step of the way as you navigate these opportunities.

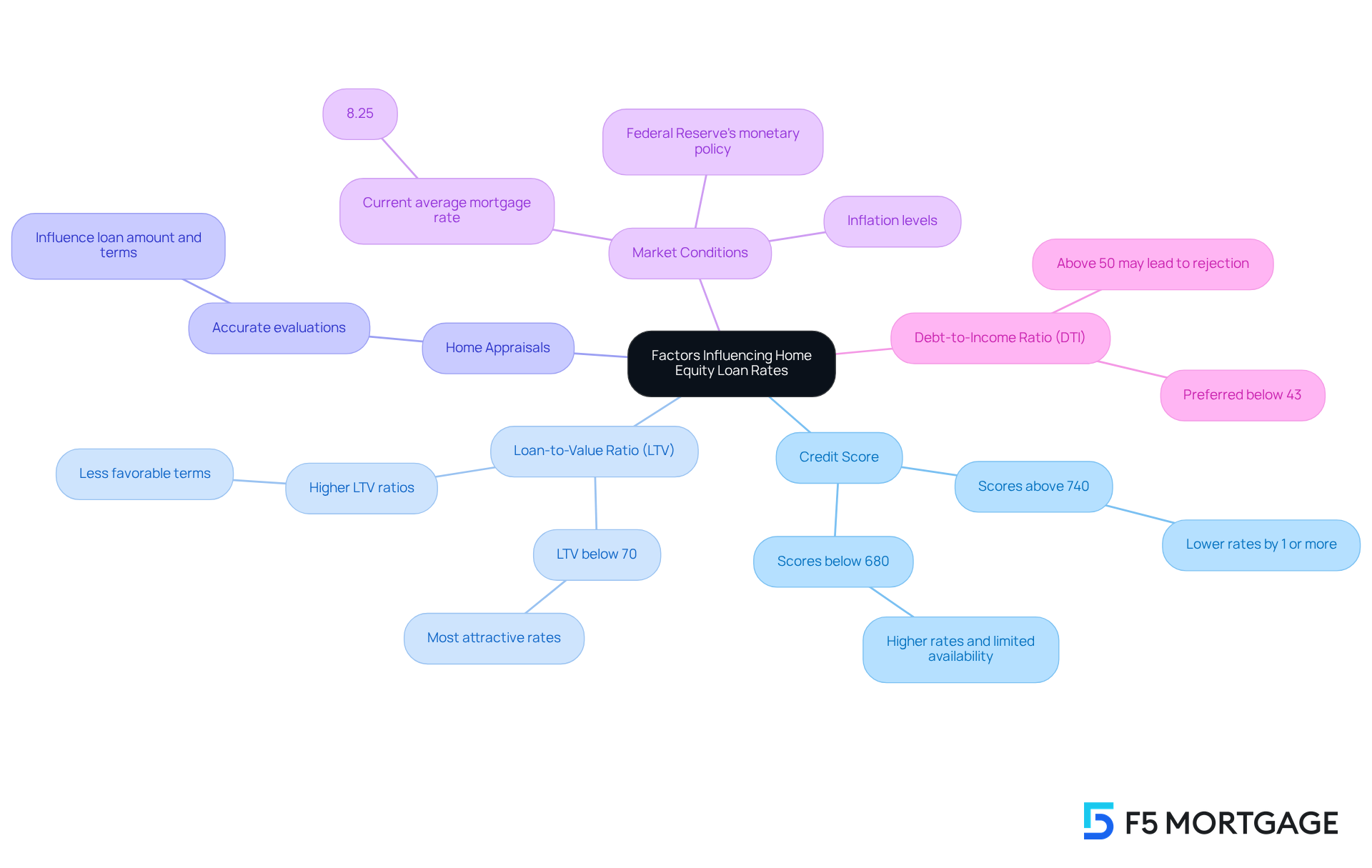

Examine Factors Influencing Home Equity Loan Rates

Navigating what are home equity loan rates can feel overwhelming, but understanding the key factors can help ease your concerns. Several essential elements influence what are home equity loan rates, such as your credit score, loan-to-value (LTV) ratio, home appraisals, and current market conditions. Generally, a higher credit score can lead to lower interest rates, signaling to lenders that you pose a reduced risk. For example, borrowers with credit scores exceeding 740 may enjoy terms that are 1% or more lower than those with scores below 680. This difference can significantly impact the overall cost of your borrowing.

The , which compares the loan amount to your home’s appraised value, is another critical factor to consider. Typically, lower LTV ratios result in more favorable terms, reflecting a decreased risk for lenders. If your LTV is below 70%, you are likely to receive the most attractive offers. As we look ahead to 2025, the average LTV ratio for property value financing is trending towards these lower thresholds, indicating a cautious approach among property owners.

Home evaluations play a vital role in determining your property’s worth and equity, directly influencing the loan amount and interest options available to you. A thorough appraisal ensures that your home’s value is accurately represented, allowing you to secure the best possible terms for your situation.

Moreover, broader economic factors, such as the Federal Reserve’s monetary policy and inflation levels, significantly impact what are home equity loan rates. Currently, the national average mortgage interest rate hovers around 8.25%, shaped by these market dynamics. As competition among lenders increases and economic conditions stabilize, costs may continue to fluctuate. This is why it’s essential to stay informed and evaluate your credit profile when considering residential financing.

Once your application is approved, securing your mortgage terms with F5 Mortgage is crucial to protect yourself from market changes during the processing period. Additionally, lenders typically prefer a debt-to-income (DTI) ratio under 43% to ensure you can manage additional borrowing. Remember to consider possible charges related to home financing as you assess your options. We understand how challenging this can be, and we’re here to support you every step of the way.

Analyze Current Trends in Home Equity Loan Rates

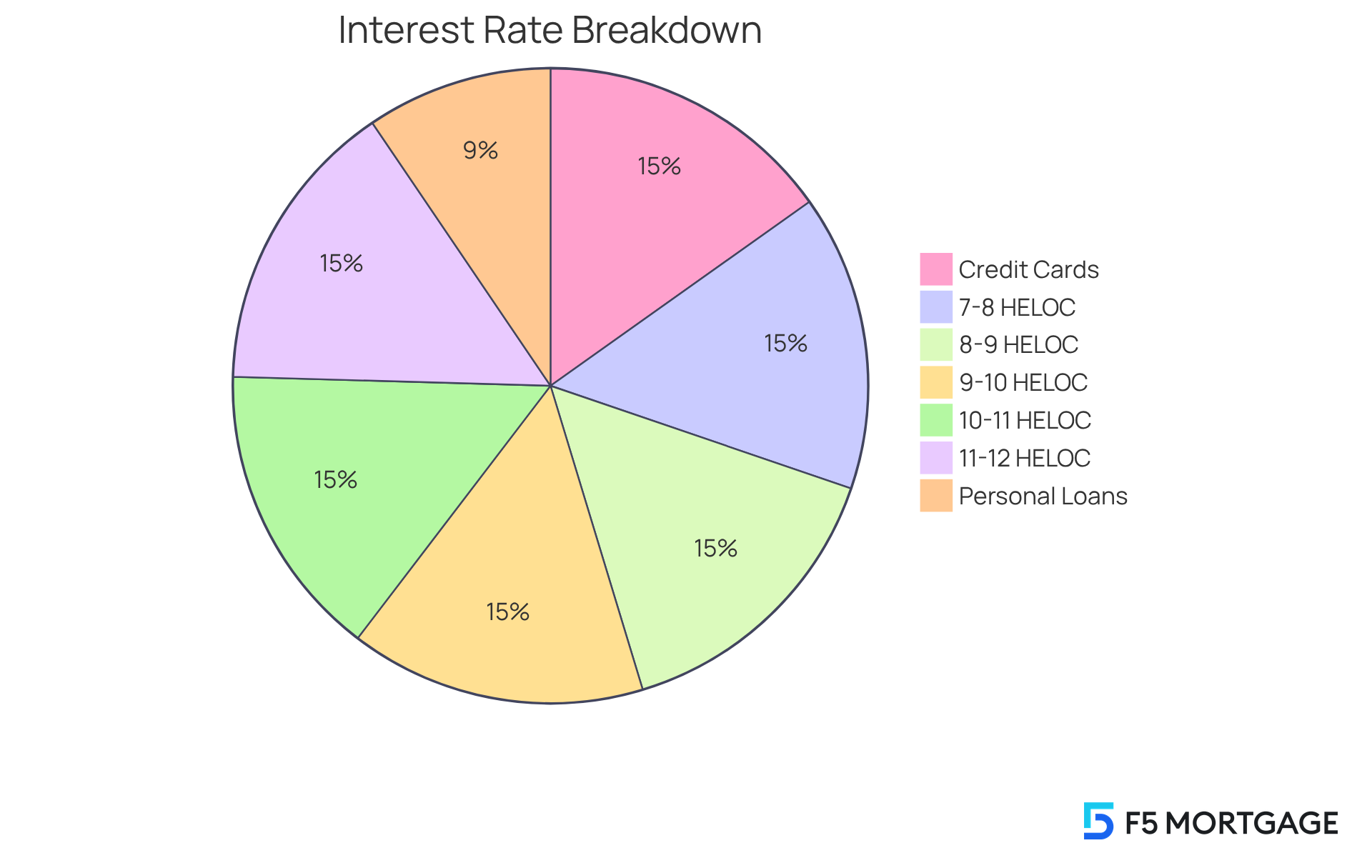

Home financing interest figures have shown significant stability in recent months, with average percentages lingering around 8.25% as of August 2025. This stability is primarily a result of the Federal Reserve’s careful position on interest adjustments and the competitive environment among lenders. We know how challenging it can be to navigate these waters. When considering what are , it’s important to note that they can vary widely from 7% to 12%, depending on various factors, including the borrower’s credit score and loan-to-value (LTV) ratio.

The demand for residential value-based financing has surged as property owners seek to leverage rising real estate prices. In fact, over 47% of mortgaged properties are now deemed value-rich, providing homeowners enhanced access to advantageous borrowing alternatives. Furthermore, when considering what are home equity loan rates, they continue to be quite economical compared to other borrowing choices. Average personal loan percentages stand at 12.58%, while credit card percentages are at 20.13%. Given this competitive atmosphere, it is essential for borrowers to search for lenders and evaluate costs, fees, and terms to ensure they align with their requirements.

Collaborating with F5 Mortgage can offer advantageous pricing and tailored support, simplifying the process of exploring these choices. Once your application is approved, it is crucial to secure your mortgage terms with F5 Mortgage promptly. This step safeguards you from market changes during the processing period. Economists propose that unless substantial economic changes take place, these figures are likely to stay steady.

For prospective borrowers, understanding these trends is crucial for making informed choices about when to obtain financing. We’re here to support you every step of the way, particularly considering the current borrowing environment.

Understand the Impact of Home Equity Loan Rates on Borrowers

Interest charges on property financing are crucial in shaping borrowers’ financial situations. We understand how increased costs can lead to significantly higher monthly payments, putting a strain on household finances and limiting your borrowing capacity. For instance, consider a property-backed loan with an interest rate of 8.25%. This rate can result in a total interest payment that far exceeds that of agreements with lower percentages. Such a difference can heavily influence your decisions about refinancing existing debts or seeking alternative financing options.

Moreover, the impact of fluctuating interest levels necessitates that you remain vigilant and strategic about when to apply for financing. By understanding market trends and rate forecasts—like the current average residential asset financing rate of 8.25%—you can position yourself to secure more favorable terms, ultimately reducing your overall borrowing costs. Financial planners often suggest that homeowners reflect on their financial goals and the larger economic landscape before asking what are home equity loan rates. This thoughtful approach ensures that you make informed decisions that align with your long-term financial well-being. We’re here to support you every step of the way as you .

Conclusion

Home equity loans can be a valuable resource for homeowners looking to tap into the equity they’ve built in their properties. We understand how important it is to make informed decisions that bolster your financial security. In this article, we’ve explored the key factors that influence home equity loan rates, such as:

- Credit scores

- Loan-to-value ratios

- Home appraisals

- The broader economic landscape

By maintaining a strong credit profile and staying aware of market trends, you can secure more favorable loan terms. With current average interest rates around 8.25%, homeowners can potentially save significantly compared to other borrowing options like personal loans and credit cards. As the demand for home equity loans increases, it’s crucial for you to remain vigilant and proactive in seeking the best rates and terms.

Ultimately, understanding home equity loan rates is essential for homeowners looking to finance renovations, consolidate debt, or invest in their future. By leveraging this knowledge, you can navigate the complexities of home financing more effectively, ensuring that your financial choices align with your long-term goals. Embracing these opportunities can lead to enhanced financial well-being and stability in an ever-changing economic landscape. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is a home equity loan?

A home equity loan, often referred to as a second mortgage, allows homeowners to borrow against the equity they have built in their homes. Equity is the difference between the property’s current market value and the remaining mortgage balance.

What is the purpose of a home equity loan?

The purpose of a home equity loan is to provide homeowners with a one-time sum of money that can be used for significant expenses, such as home renovations, debt consolidation, or educational costs.

How do homeowners typically use home equity loans?

Homeowners often use home equity loans to finance renovations, consolidate debt, or cover educational expenses, thereby enhancing property value and improving their living spaces.

What is the current interest rate for home equity loans compared to credit cards?

The typical interest rate for residential property financing is 8.45%, which is significantly lower than the median credit card interest rate of almost 23%, making home equity loans a more budget-friendly borrowing option.

Are there any tax advantages to home equity loans?

Yes, financial consultants often highlight potential tax advantages associated with residential property loans, particularly through mortgage interest deductibility.

How has the value of residential properties changed recently?

Residential property values have been rising, with nearly 90% of metropolitan areas reporting growth in the third quarter of 2024, indicating that homeownership can be a significant source of wealth.

What should homeowners consider when using their home equity?

Homeowners should consider that wisely utilizing their property value can help finance renovations and build long-term financial security.