Overview

The VA Cash-Out Loan is a valuable refinancing option designed for eligible veterans and service members, allowing them to tap into the equity of their homes. By replacing their current mortgage with a new one that exceeds the existing balance, families can access funds that may help them in various ways.

We understand that managing finances can be challenging, which is why this loan offers several benefits. There’s no private mortgage insurance required, competitive interest rates, and a straightforward application process. These features make it an appealing financial tool for needs such as home renovations or debt consolidation.

We’re here to support you every step of the way as you explore this option. The VA Cash-Out Loan could be the solution you’ve been looking for, helping you achieve your financial goals with ease and confidence.

Introduction

The VA Cash-Out Loan is a valuable financial resource for veterans, active-duty service members, and eligible surviving spouses, allowing them to access the equity in their homes. This unique refinancing option not only provides favorable terms—such as no private mortgage insurance and competitive interest rates—but also offers the flexibility to use the cash for:

- Home improvements

- Debt consolidation

- Other financial needs

We understand that navigating the eligibility requirements and application process can feel overwhelming. What steps must you take to successfully seize this opportunity and enjoy the benefits it brings? We’re here to support you every step of the way, ensuring you feel confident and informed throughout the process.

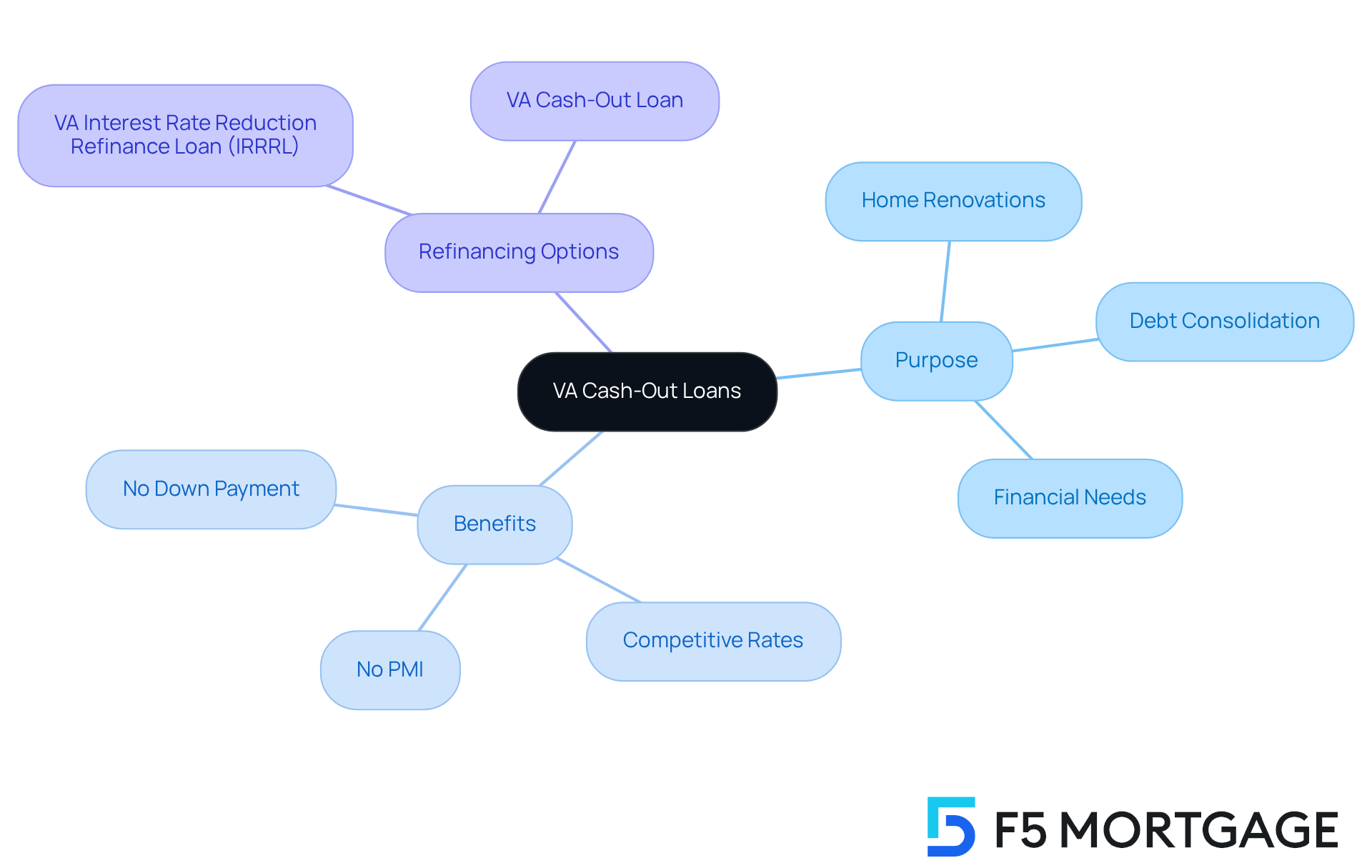

Define VA Cash-Out Loans and Their Purpose

The offers a valuable for eligible veterans, active-duty service members, and certain surviving spouses. These loans allow you to replace your current mortgage with a new one that exceeds your existing balance, giving you the opportunity to access the equity you’ve built in your home. The can be used for various purposes, such as home renovations, , or other financial needs.

Supported by the U.S. Department of Veterans Affairs (VA), this financing option comes with favorable terms compared to traditional mortgages. You benefit from no private mortgage insurance (PMI) requirements, , and the significant advantage of .

When it comes to refinancing a VA loan, you have two main options:

- The VA Interest Rate Reduction Refinance Loan (IRRRL), which aims to lower your interest rate and monthly payment.

- A VA cash out loan, which allows you to access your equity for greater financial flexibility.

We know how challenging navigating these choices can be. Understanding the can empower families like yours to make informed decisions about utilizing your equity effectively. Remember, we’re here to support you every step of the way.

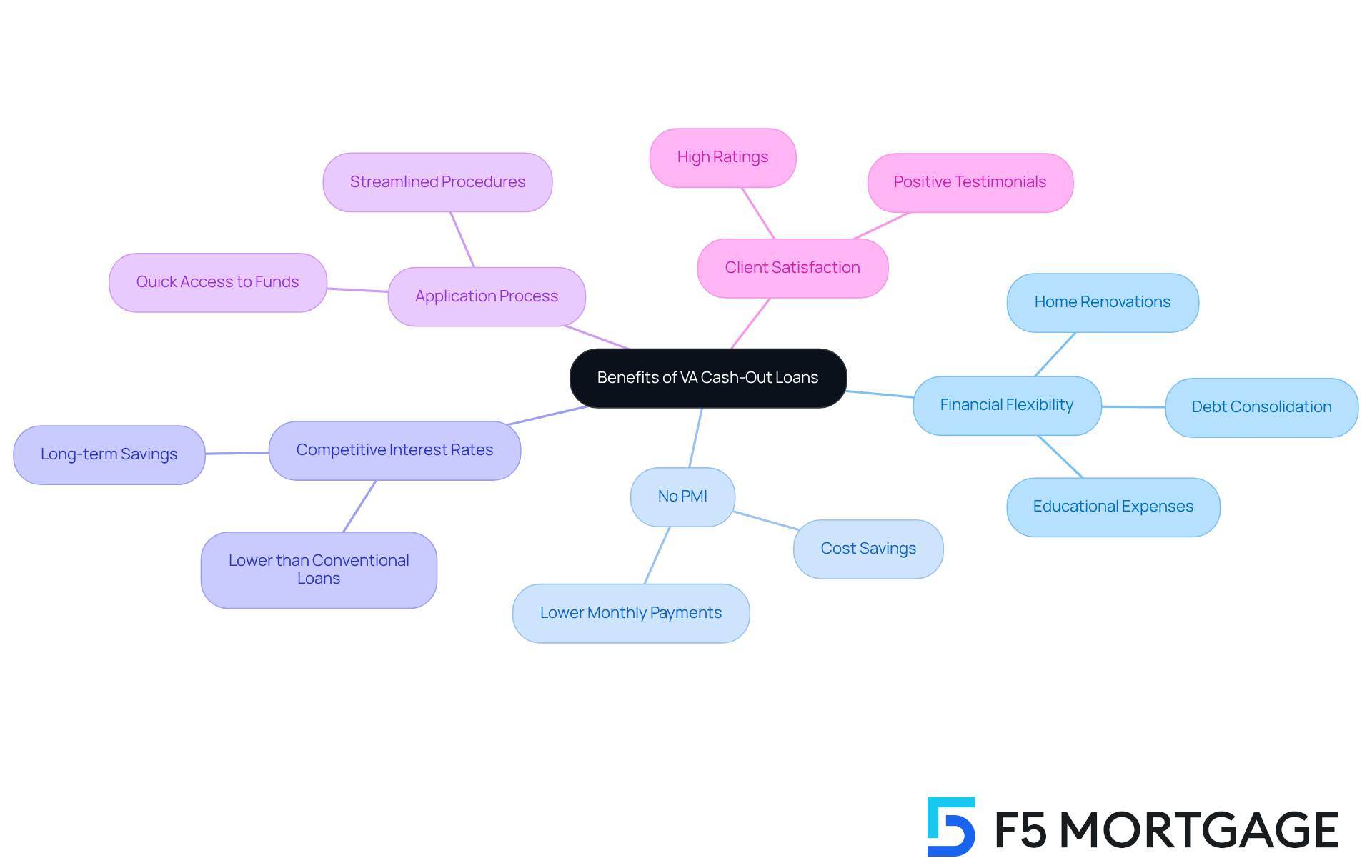

Explore the Benefits of VA Cash-Out Loans

offer a valuable opportunity for property owners to access their equity, allowing them to secure funds for various needs without the burden of an additional mortgage. This can be especially beneficial for those looking to finance , consolidate debt, or cover educational expenses.

One of the most appealing aspects of a is the (PMI), which often adds significant monthly costs to conventional loans. By eliminating PMI, borrowers can enjoy , making homeownership more affordable. Imagine the relief of reducing monthly payments—this can truly make a difference in your financial journey.

In 2025, the VA cash out loan options stand out due to their , which are typically lower than those of conventional refinancing options. This difference can lead to significant savings over the life of the loan, making VA loans an attractive choice for many homeowners. With a of up to $325,000, depending on the property value and mortgage balance, borrowers have considerable financial leverage at their disposal.

The funds obtained through a VA Loan can be used for various purposes, giving borrowers the flexibility to meet their financial goals. Whether you’re investing in home improvements or managing existing debts, the possibilities are abundant.

Additionally, the is often more straightforward, especially for those familiar with VA loan procedures. This efficiency can lead to quicker access to funds, enabling homeowners to address their financial needs promptly. At F5 Mortgage, we take pride in offering fast and flexible mortgage solutions, ensuring that our clients can realize their with exceptional service. With a 4.9 rating from over 300 reviews, our clients have shared their satisfaction, highlighting the smooth process and transparency with no hidden costs. Security features, such as a verification code during the application process, further enhance the safety and efficiency of obtaining a VA Loan.

As noted by experts like Will Lewis and Chris Birk, understanding the intricacies of VA Loans can empower individuals to make informed decisions that align with their financial aspirations. F5 Mortgage has successfully assisted over 1,000 families in achieving their dream of homeownership, reinforcing the effectiveness of our services. We understand how challenging this journey can be, and we’re here to support you every step of the way.

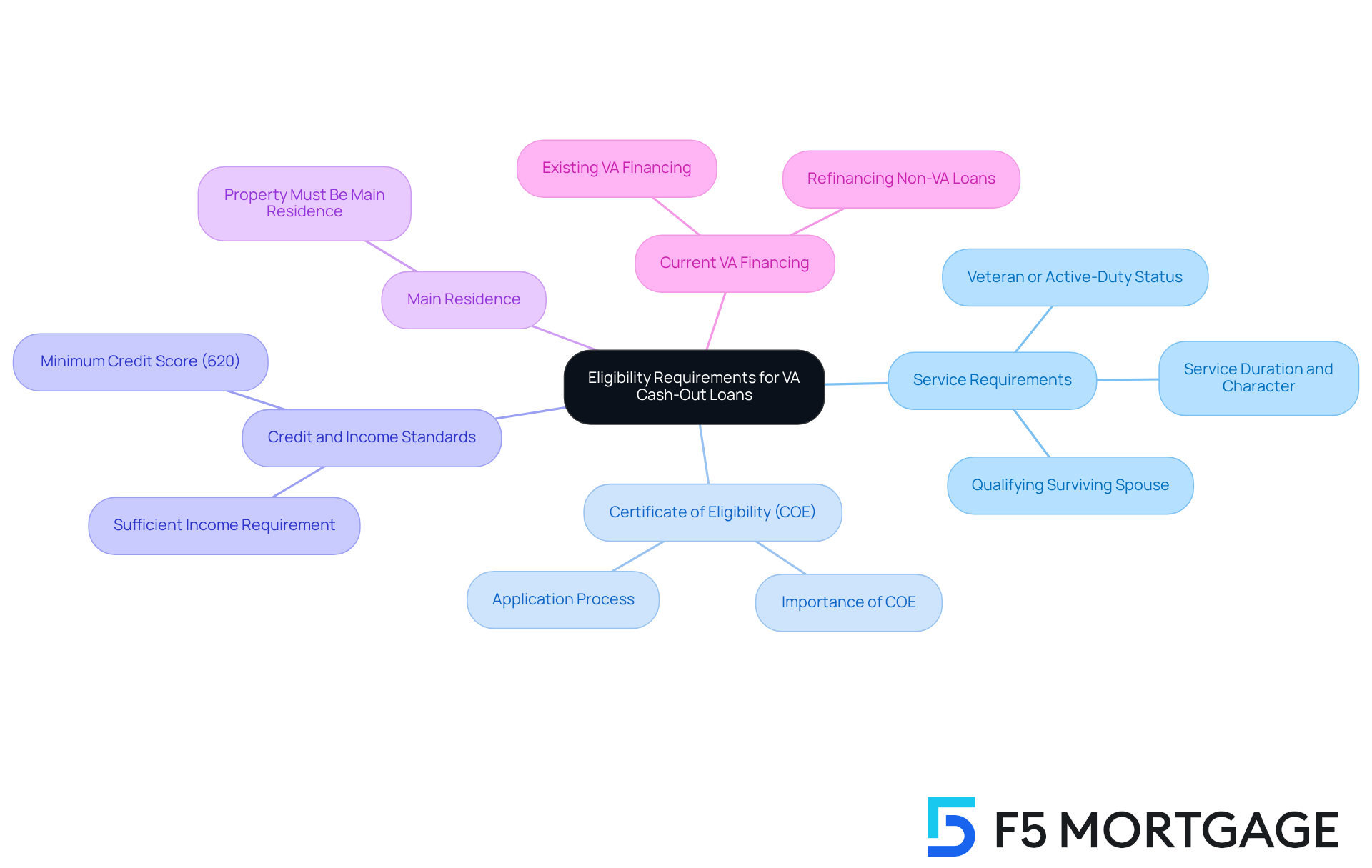

Identify Eligibility Requirements for VA Cash-Out Loans

Qualifying for a may seem overwhelming, but we’re here to support you every step of the way. Understanding the is key to navigating this process with confidence.

- Service Requirements: If you’re a veteran, an active-duty service member, or a qualifying surviving spouse, you may be eligible. The VA does have specific criteria regarding service duration and character of service, so it’s important to be aware of these details.

- (COE): This document is essential for your application, as it confirms your eligibility for VA benefits. Securing your COE can be a straightforward step that opens doors for you.

- Credit and Income Standards: While the VA doesn’t require a minimum credit score, most lenders typically look for a score of at least 620. Additionally, demonstrating sufficient income to manage your new payment obligations is crucial. We know how challenging this can be, but can help you prepare.

- : It’s important to note that the property you wish to refinance must be your main residence. This ensures that the funding is utilized for your personal housing needs.

- : To qualify, you need to have either current VA financing or a non-VA loan that you plan to refinance into a VA withdrawal mortgage. This is an opportunity to leverage your existing financing effectively.

VA loans are a , allowing you to access multiple times. Many veterans successfully qualify for a VA cash out loan, for various needs, such as debt consolidation or home improvements. This program not only provides financial relief but also empowers you to make the most of your home investments.

For residents of Colorado, grasping these eligibility requirements is vital for making informed decisions about your mortgage options. Remember, you’re not alone in this journey, and understanding your options can lead to a brighter financial future.

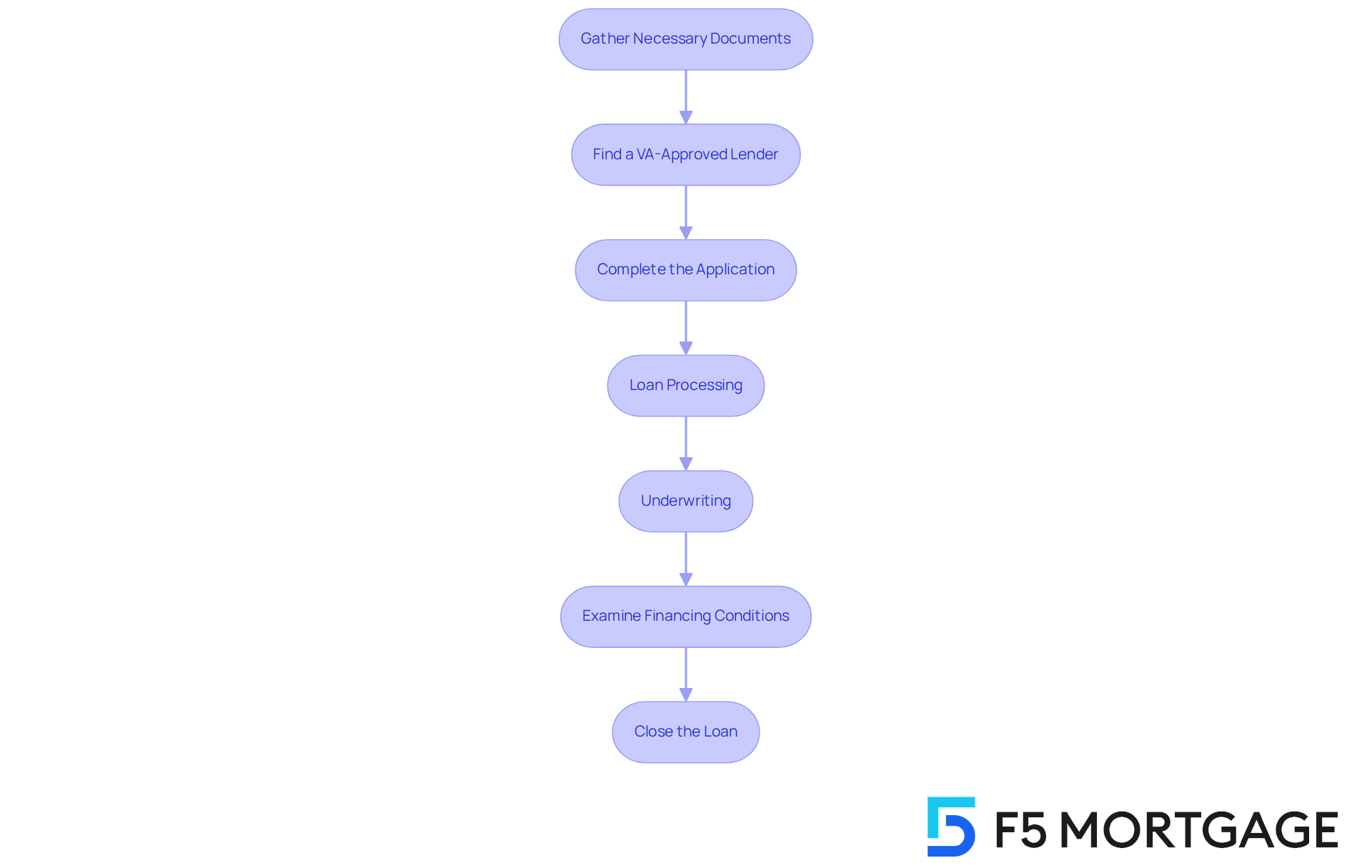

Guide to Applying for a VA Cash-Out Loan

- Gather Necessary Documents: We know how overwhelming this can be, but collecting essential documents is a crucial first step. Make sure to gather your (COE), recent pay stubs, W-2s or tax returns, and information about your current mortgage. This preparation will help ease your journey.

- Find a : Take the time to research and choose a lender that specializes in VA financing. Compare rates and terms to find the best fit for your needs, ensuring you feel comfortable and supported in your decision.

- Complete the Application: When you’re ready, fill out the with your lender. Provide all required information and documentation, and remember, we’re here to support you every step of the way.

- Loan Processing: Once submitted, your lender will process your application. This may include an appraisal of your home to determine its current value, which is an important part of the process.

- Underwriting: The lender will carefully examine your financing application, credit history, debt-to-income ratio, and other prerequisites to finalize the credit approval process. It’s a thorough review, but it’s designed to ensure you’re on the right path.

- Examine Financing Conditions: After approval, take the time to carefully. Pay attention to interest rates, fees, and repayment options. This is your opportunity to ensure everything aligns with your financial goals.

- : If you agree to the terms, you can proceed to close the loan. This step involves signing the final paperwork and receiving the , which you can use as needed. Remember, this is a significant milestone, and we’re here to celebrate with you!

Conclusion

The VA Cash-Out Loan is a vital financial resource for veterans, active-duty service members, and qualifying surviving spouses, enabling them to access their home equity for various needs. By refinancing their existing mortgage with a new loan that exceeds the current balance, borrowers can obtain funds for home improvements, debt consolidation, or other financial goals. This process comes with favorable terms, such as no PMI and competitive interest rates, ensuring that you can make the most of your home’s value.

We understand how overwhelming financial decisions can be, and that’s why it’s essential to highlight the numerous benefits of VA Cash-Out Loans. These loans offer financial flexibility, a straightforward application process, and clear eligibility requirements. By grasping these key aspects, you can navigate your options with confidence, making informed decisions that align with your financial aspirations. The process involves gathering necessary documentation, selecting a VA-approved lender, and carefully reviewing loan terms before closing.

Ultimately, embracing the advantages of VA Cash-Out Loans can significantly enhance your financial well-being. This pathway can help you achieve personal goals and improve your overall quality of life. If you are eligible, taking the first step toward applying for a VA Cash-Out Loan can lead to substantial benefits and a brighter financial future. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is a VA Cash-Out Loan?

A VA Cash-Out Loan is a mortgage refinance option for eligible veterans, active-duty service members, and certain surviving spouses that allows you to replace your current mortgage with a new one that exceeds your existing balance, enabling you to access the equity in your home.

What can the cash from a VA Cash-Out Loan be used for?

The cash received from a VA Cash-Out Loan can be used for various purposes, such as home renovations, debt consolidation, or other financial needs.

What are the benefits of a VA Cash-Out Loan compared to traditional mortgages?

VA Cash-Out Loans offer favorable terms, including no private mortgage insurance (PMI) requirements, competitive interest rates, and no down payment necessary.

What are the two main options for refinancing a VA loan?

The two main options for refinancing a VA loan are the VA Interest Rate Reduction Refinance Loan (IRRRL), which aims to lower your interest rate and monthly payment, and the VA Cash-Out Loan, which allows you to access your equity for greater financial flexibility.

Why is it important to understand the refinancing process in California?

Understanding the refinancing process in California can empower families to make informed decisions about utilizing their equity effectively, helping them navigate their options confidently.