Overview

Seller concessions on VA loans represent a compassionate effort from sellers to assist buyers in managing the costs associated with purchasing a home. These financial contributions can cover various expenses, including closing costs and the VA funding fee, with a generous limit of up to 4% of the home’s purchase price. We understand how challenging this process can be, especially for veterans and their families. These concessions play a crucial role in alleviating the financial burden, making homeownership more attainable.

In today’s competitive market, where every advantage counts, these incentives are becoming increasingly common. This support not only eases the transition into homeownership but also empowers families to take that significant step towards stability and security. We’re here to support you every step of the way as you navigate these options, ensuring that your journey toward owning a home is as smooth as possible.

Introduction

Navigating the complex real estate landscape can be challenging for families, especially when it comes to understanding the nuances of seller concessions on VA loans. These financial contributions from vendors hold the potential to significantly ease the burden of closing costs and other expenses, making homeownership more accessible for veterans and their loved ones. We know how important this is, and we’re here to support you every step of the way.

However, the potential for confusion around limits and regulations can leave families feeling uncertain. How can you effectively leverage these concessions to maximize your benefits? Exploring the intricacies of seller concessions not only reveals their importance but also uncovers strategic approaches to negotiation. This knowledge can lead to a smoother home-buying experience, empowering you to make informed decisions and feel confident in your journey toward homeownership.

Define Seller Concessions in VA Loans

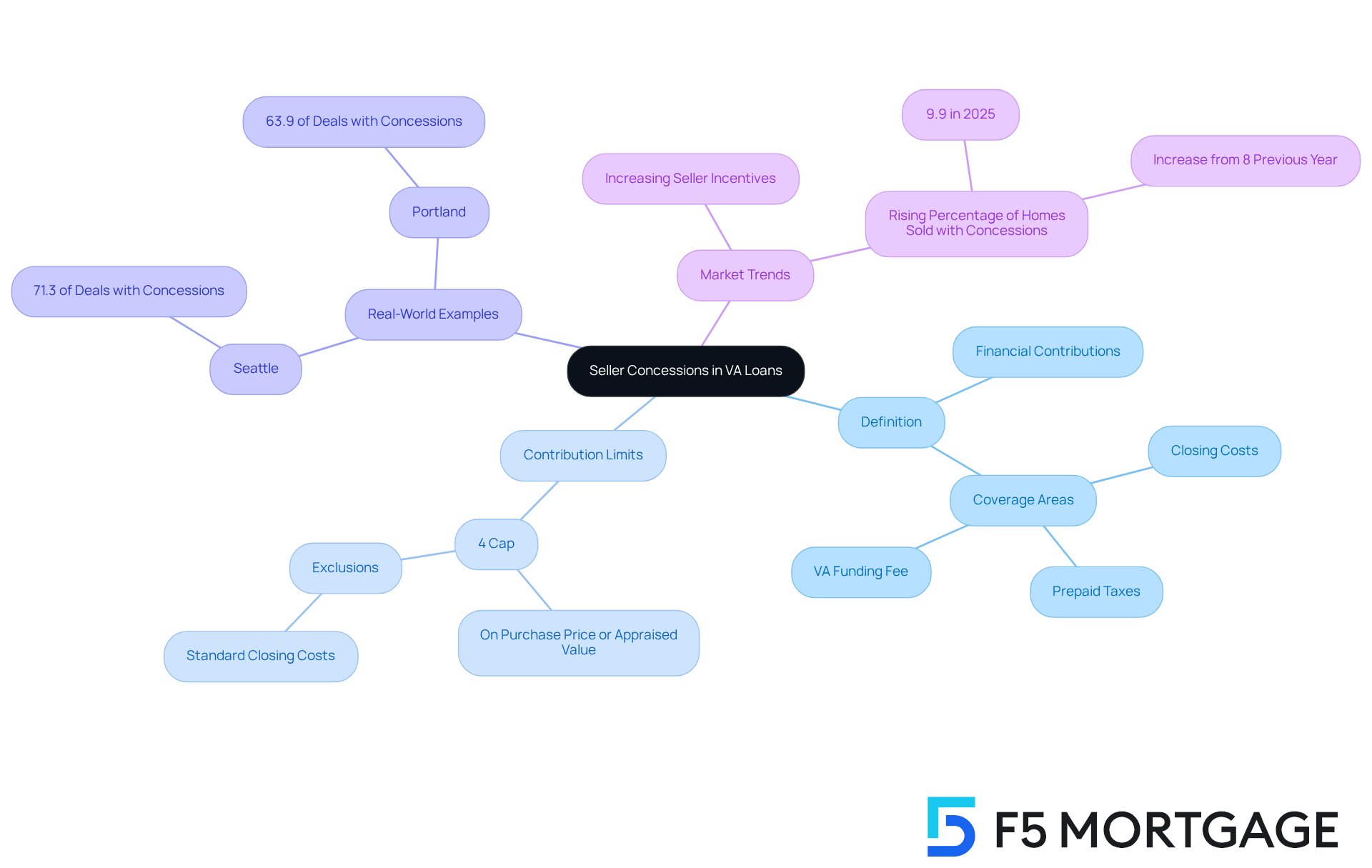

Seller concessions on VA loan are financial contributions that vendors provide as monetary aids to assist buyers with various expenses related to acquiring a property. Seller concessions on VA loan can cover closing costs, prepaid taxes, and even the VA funding fee. The Department of Veterans Affairs permits seller concessions on VA loan contributions of up to 4% of the home’s purchase price or appraised value, whichever is lower. This provision significantly alleviates the financial burden on purchasers, making for veterans and their families, especially in competitive housing markets, through seller concessions on VA loan.

In 2025, the typical contributions provided in VA loans have become increasingly beneficial, with numerous providers recognizing the importance of these offerings in finalizing transactions. For instance, on a $300,000 property, a vendor could provide up to $12,000 in incentives, which can be crucial for purchasers with limited cash reserves. Additionally, around 9.9% of residences sold included a discount, a price reduction, and a final sale amount below the initial list price, rising from 8% the previous year. This suggests a growing trend in offers from vendors, which can ease the path to homeownership.

Real-world instances illustrate the impact of vendor allowances: in Seattle, for example, 71.3% of deals in the first quarter of 2025 featured vendor allowances, indicating a shift in market dynamics that benefits buyers. Similarly, Portland saw a 14.2 percentage point rise in seller incentives, reaching 63.9% during the same timeframe. Seller concessions on VA loan not only help cover initial expenses but also enhance the overall affordability of homes for veterans.

Citations from industry specialists emphasize the advantages of seller concessions on VA loan allowances: ‘Sellers can settle the purchaser’s debts to assist them in qualifying for a VA loan, which also contributes to the 4% seller concessions on VA loan limit.’ This highlights the strategic use of allowances to facilitate property acquisitions. It’s important to note that standard closing costs paid by the vendor do not count toward the 4% limit, clarifying the financial implications for purchasers. Overall, understanding vendor allowances is essential for veterans and their families as they navigate the property purchasing process. We know how challenging this can be, and we’re here to support you every step of the way.

Explain How Seller Concessions Work

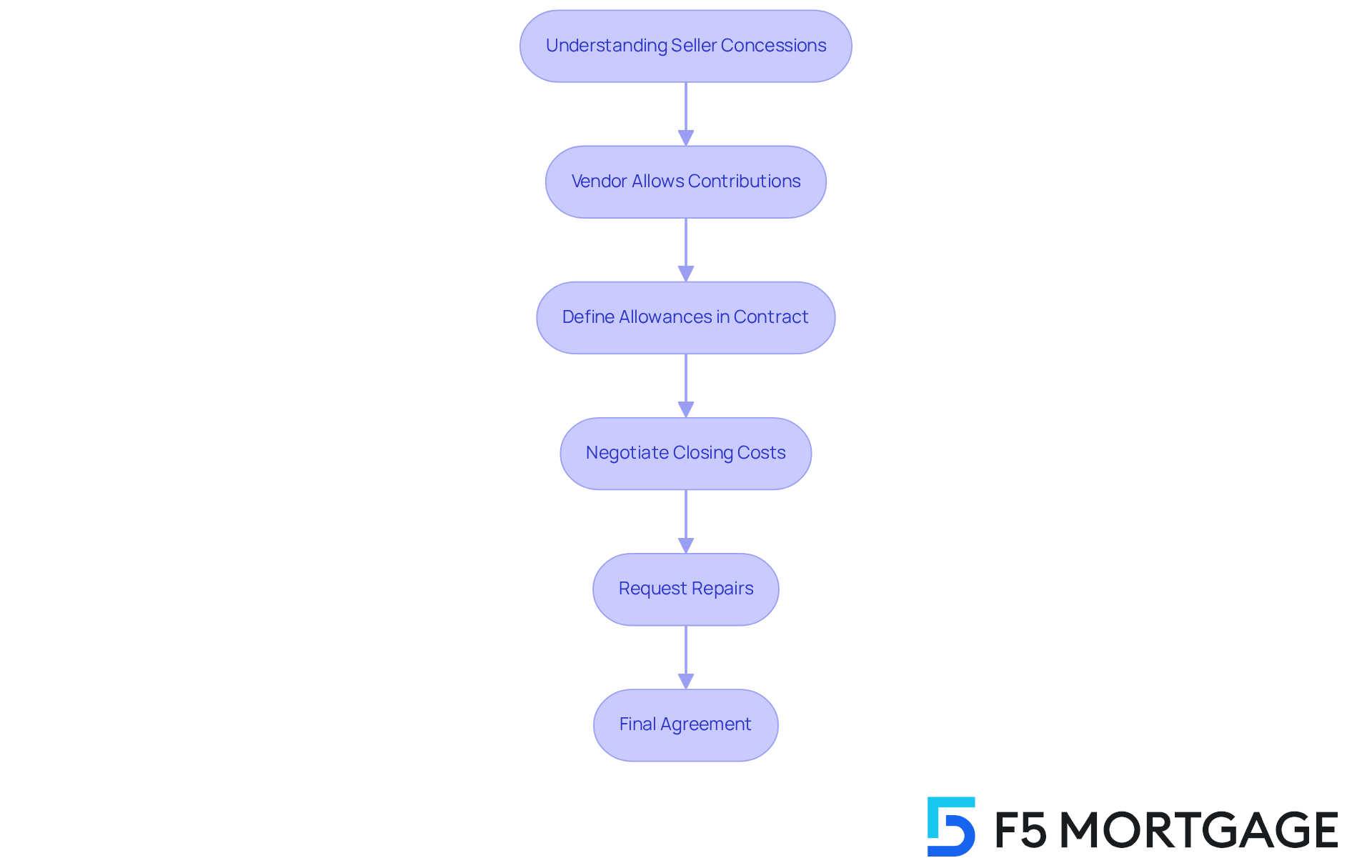

Vendor allowances can be a helpful tool for vendors to assist purchasers with certain expenses that often arise at closing, making property acquisitions more attainable. For instance, consider a $300,000 property transaction; an owner can contribute up to $12,000—4% of the sale price—toward the purchaser’s expenses. These allowances cover various closing costs, including appraisal charges, title insurance, and loan origination fees. However, it’s important to note that vendor allowances do not apply to the purchaser’s down payment or mortgage insurance.

Negotiating these allowances is crucial in the purchase agreement. Both parties should clearly define them in the contract to avoid any misunderstandings during the closing process. In 2025, average closing costs for VA loans may vary, but they often include fees that seller concessions on VA loans can help alleviate. For example, in recent transactions, vendors have successfully negotiated seller concessions on VA loans to cover closing costs, which can be especially beneficial for first-time homebuyers facing initial expenses.

Moreover, purchasers can request that vendors perform repairs as part of the negotiation. This might involve asking for specific upgrades or repairs identified during inspections, ensuring the home is in good condition before purchase. For instance, if roof repairs are needed, sellers might offer incentives like credits or price reductions, allowing purchasers to make the best choice for their needs. This approach not only facilitates the sale but also underscores the importance of addressing potential issues before they deter buyers.

As the market evolves, understanding and effectively negotiating vendor allowances, along with being informed about loan estimates and closing disclosures, can significantly enhance the purchasing experience. We know how challenging this process can be, but with the right support and knowledge, you can navigate it successfully. We’re here to .

Outline VA Seller Concession Limits and Rules

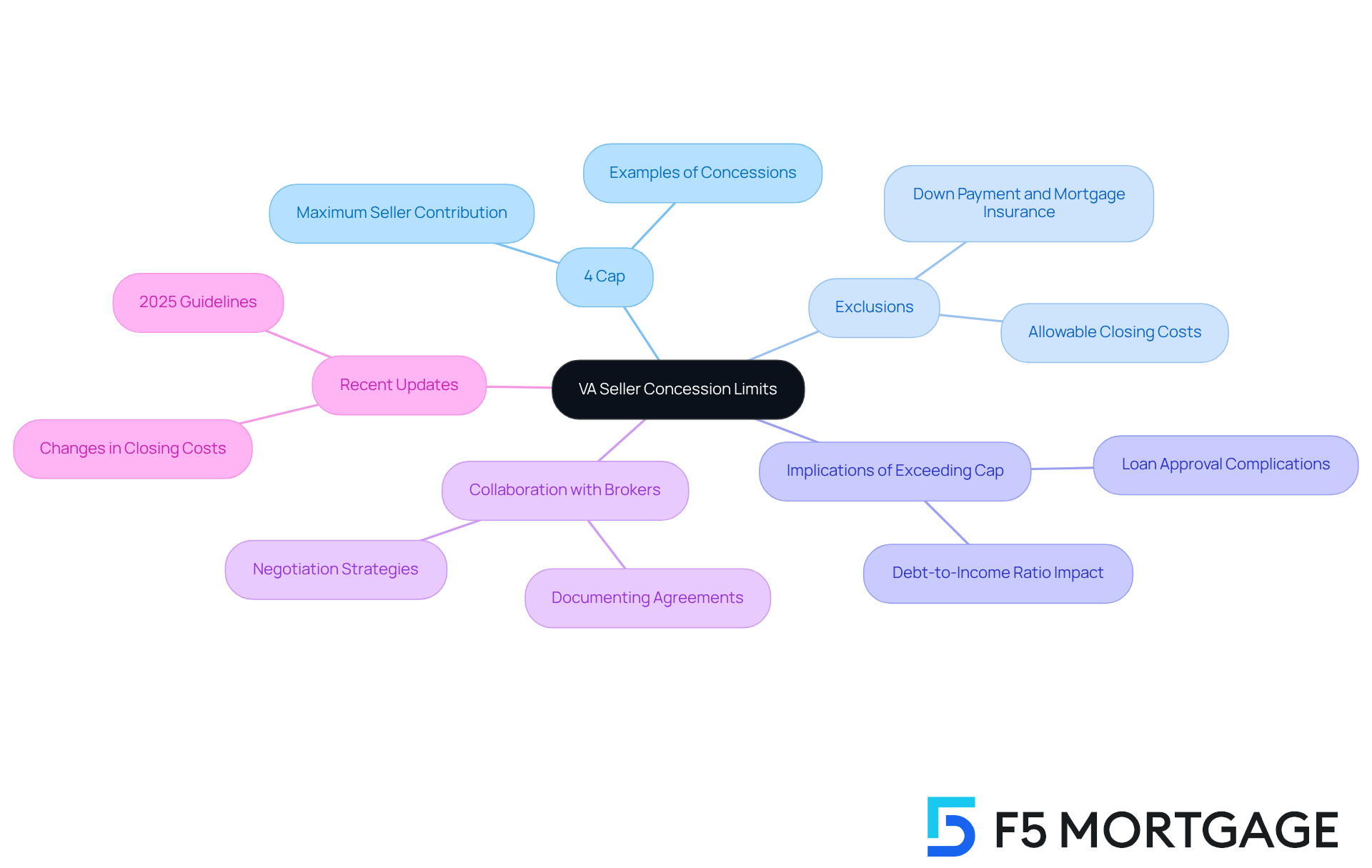

Navigating the world of VA loans can feel overwhelming, and we understand how challenging this can be. The VA has established specific boundaries on vendor allowances to safeguard the interests of both purchasers and vendors. It’s important to note that the highest permissible vendor discount is capped at 4% of the home’s purchase price or assessed value, whichever is lower. This limit includes all contributions from the vendor, such as payments towards closing costs and the VA funding fee.

However, it’s crucial to recognize that vendor allowances cannot be used to cover the purchaser’s down payment or mortgage insurance. Exceeding the 4% threshold may lead to complications during the loan approval process, as excessive allowances can raise concerns for lenders. For example, if a vendor offers to pay off a buyer’s existing debts, like an auto loan, this could significantly improve the buyer’s debt-to-income ratio, making loan approval easier.

We encourage purchasers to to ensure that all agreements are properly documented and comply with VA regulations. Recent updates in 2025 have reinforced these guidelines, highlighting the importance of adherence to avoid potential issues during the closing process. Understanding these rules is vital for families looking to maximize their benefits while navigating the VA loan landscape. Remember, we’re here to support you every step of the way.

Highlight Benefits of Seller Concessions for Homebuyers

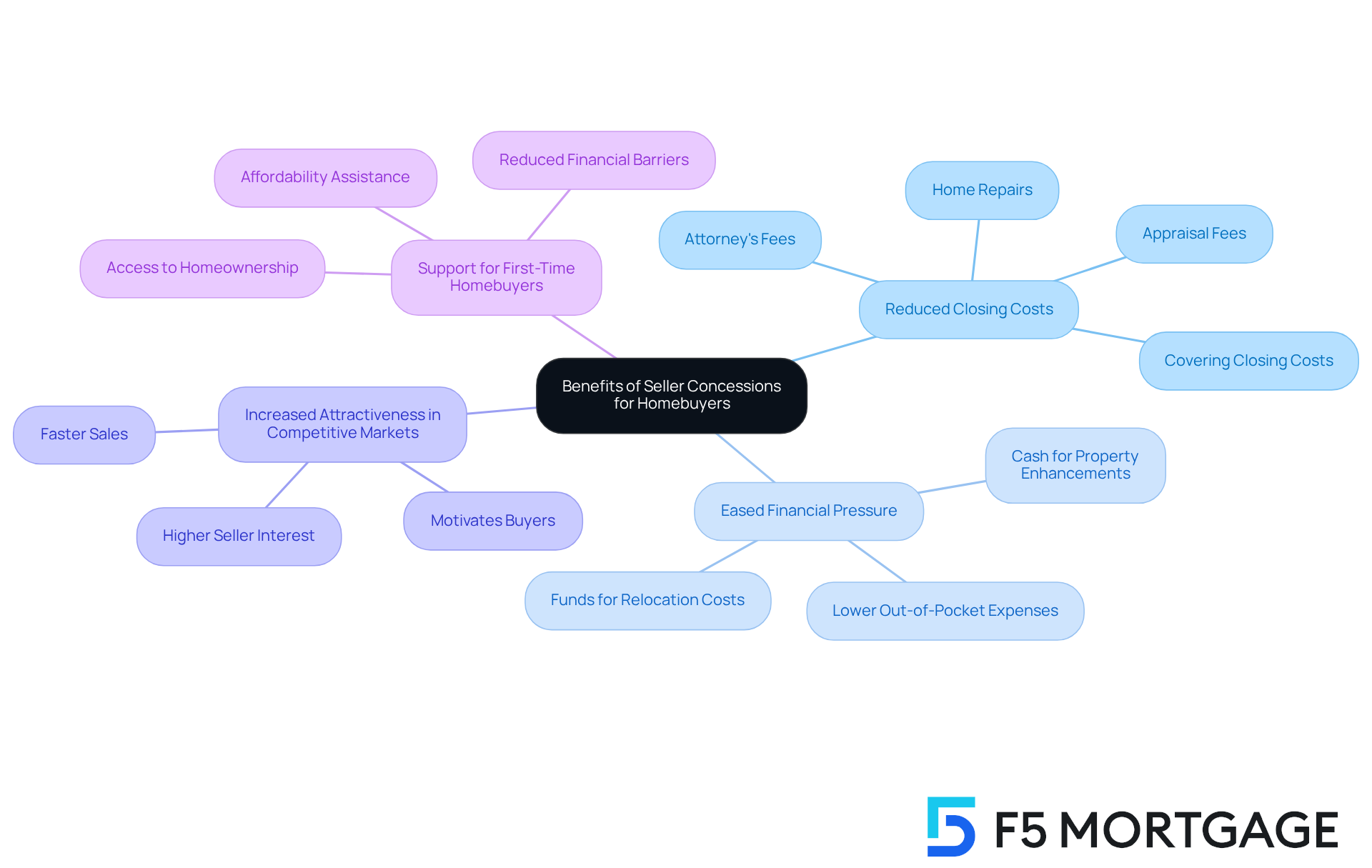

Seller concessions on VA loan can be a game changer for home purchasers, especially those using these loans, which limit allowances to 4% of the purchase price. We understand how challenging it can be to gather the necessary funds for closing. Seller concessions on VA loan can significantly reduce the cash needed at closing, making homeownership a more attainable dream for families.

These financial incentives, including seller concessions on VA loan to , appraisal fees, attorney’s fees, and various other expenses, help ease monetary pressures. This allows you to allocate your funds toward essential expenses, such as relocation costs or property enhancements. In a competitive market, where 44.4% of U.S. home vendors offered incentives in the first quarter of 2025, properties that provide seller concessions on VA loan become increasingly attractive. This motivates buyers to choose one residence over another, particularly benefiting first-time homebuyers or those with limited savings.

At F5 Mortgage, we pride ourselves on exceptional customer satisfaction, as shown by our 5/5 star reviews on platforms like Google and Lending Tree. Our dedicated team is here to support you every step of the way, helping families understand and utilize vendor incentives along with various down payment aid programs available in states like California, Texas, and Florida. By leveraging these resources, you can secure better deals and make informed decisions, ultimately leading to a smoother transition into homeownership.

Guide on Negotiating Seller Concessions

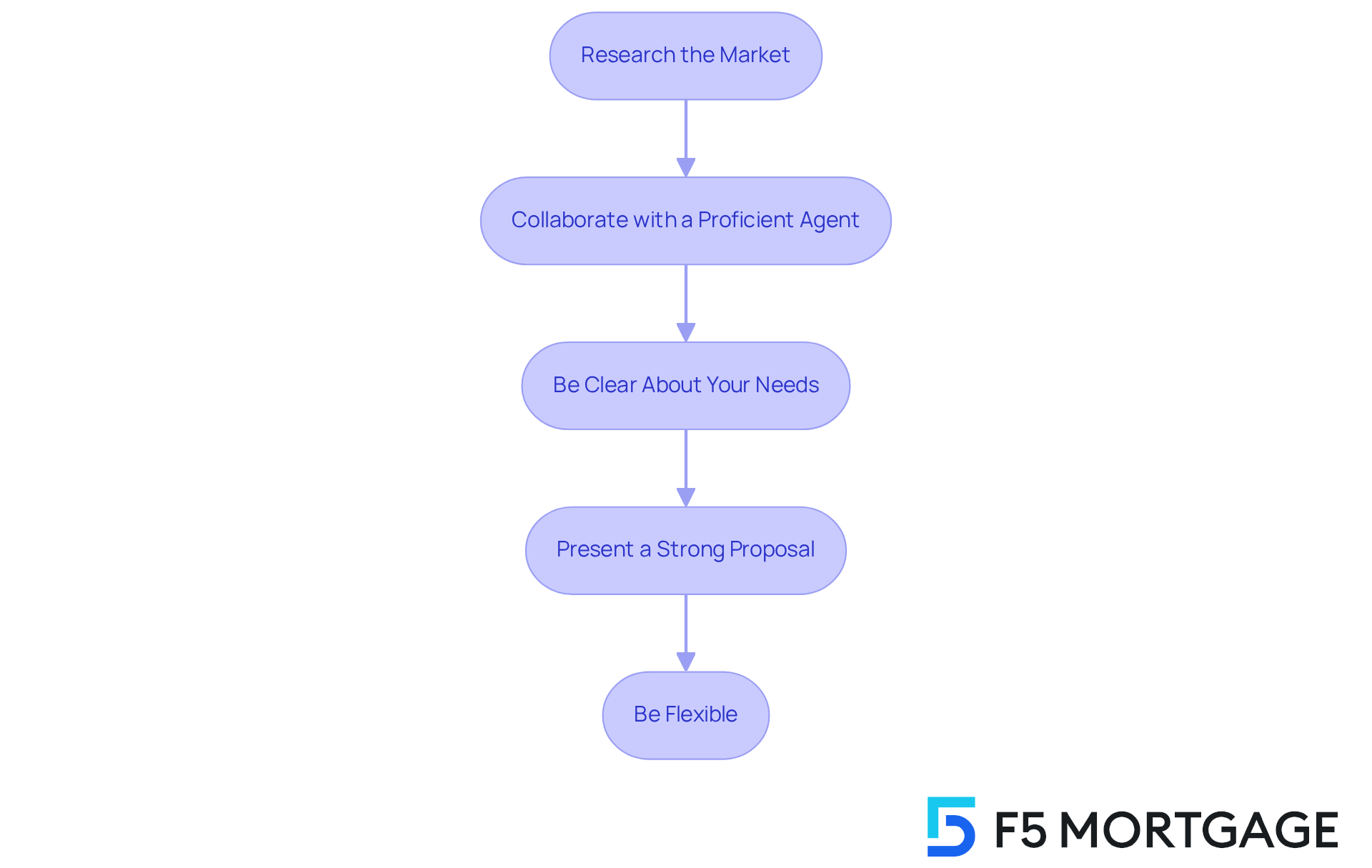

Bargaining for compromises from the vendor requires a thoughtful approach to ensure both parties feel satisfied with the arrangement. We understand how challenging this can be, so here are essential tips for families looking to negotiate effectively:

- Research the Market: It’s important to understand the current real estate conditions in your area. In the first quarter of 2025, almost 45% of U.S. home transactions involved vendor incentives, indicating a shift toward a buyer’s market where vendors may be more willing to offer incentives to finalize agreements. Staying informed about these trends can empower your negotiation process.

- [Collaborate with a Proficient Agent](https://f5mortgage.com/?p=10893): Partnering with an experienced real estate agent can make a significant difference. They can represent you and provide insights into fair compromises based on similar sales. As Sherief Elbassuoni, a real estate specialist, notes, “If you’re a buyer aiming to maximize the advantages of vendor concessions, it’s essential to collaborate with a Realtor who understands how to identify opportunities.”

- Be Clear About Your Needs: Communicate your financial requirements clearly to the vendor. If you need assistance with closing costs, specify the amount and explain how it benefits both parties. For instance, a vendor in Spokane provided a $7,000 repair credit, which facilitated a smoother transaction for everyone involved.

- Present a Strong Proposal: When making an offer, consider including a request for vendor allowances. A well-organized proposal can help facilitate the acceptance of your terms, especially in a market where 71.3% of property transactions in Seattle involved compromises in Q1 2025. This statistic highlights the importance of regional market awareness when negotiating.

- Be Flexible: Being open to negotiation is key. If the vendor cannot meet your exact request, think about alternative compromises that may still provide value, such as covering certain fees or offering a reduced purchase price. This flexibility can lead to a win-win situation, as demonstrated in case studies where families successfully to make home purchases more affordable.

By employing these strategies, families can enhance their chances of successfully negotiating seller concessions, ultimately making their home-buying experience more manageable and fulfilling.

Conclusion

Understanding seller concessions on VA loans is crucial for families navigating the complexities of home buying. We know how challenging this can be, and these financial contributions from sellers can significantly ease the burden of closing costs and other expenses. This makes homeownership a more attainable goal for veterans and their families. By leveraging these concessions, buyers can enhance their purchasing power and secure better deals in a competitive market.

Throughout this article, we’ve shared key insights about the nature of seller concessions, including their definition, limits, and the benefits they offer. It’s important to note that seller concessions can cover various expenses, such as closing costs and repairs, while adhering to the 4% cap set by the VA. Real-world examples illustrate the growing trend of sellers offering these incentives, which not only facilitate transactions but also improve overall affordability for buyers.

In conclusion, the importance of understanding and effectively negotiating seller concessions cannot be overstated. Families are encouraged to take proactive steps in researching market conditions, collaborating with experienced agents, and clearly communicating their needs. By doing so, they can enhance their chances of securing favorable terms and ultimately make their dream of homeownership a reality. Embracing the advantages of seller concessions is a strategic move that can lead to significant financial benefits and a smoother transition into a new home.

Frequently Asked Questions

What are seller concessions in VA loans?

Seller concessions in VA loans are financial contributions made by vendors to assist buyers with various expenses related to acquiring a property. These can include closing costs, prepaid taxes, and the VA funding fee.

How much can sellers contribute as concessions on a VA loan?

The Department of Veterans Affairs allows seller concessions of up to 4% of the home’s purchase price or appraised value, whichever is lower.

How do seller concessions benefit veterans and their families?

Seller concessions significantly alleviate the financial burden on purchasers, making homeownership more attainable for veterans and their families, especially in competitive housing markets.

Can you provide an example of how seller concessions work?

For a $300,000 property, a vendor could provide up to $12,000 in seller concessions, which can be crucial for buyers with limited cash reserves.

What trends have been observed regarding seller concessions in 2025?

In 2025, approximately 9.9% of residences sold included a discount or price reduction below the initial list price, indicating a growing trend in vendor offers that can ease the path to homeownership.

Are there specific examples of locations where seller concessions are prevalent?

Yes, in Seattle, 71.3% of deals in the first quarter of 2025 featured vendor allowances, while Portland saw a 63.9% rate, indicating a shift in market dynamics that benefits buyers.

What types of expenses can seller concessions cover?

Seller concessions can cover various closing costs, including appraisal charges, title insurance, and loan origination fees, but they do not apply to the purchaser’s down payment or mortgage insurance.

How should seller concessions be negotiated in a purchase agreement?

It is crucial for both parties to clearly define seller concessions in the purchase agreement to avoid misunderstandings during the closing process.

Can purchasers request repairs as part of the seller concessions?

Yes, purchasers can negotiate for sellers to perform repairs or offer incentives like credits or price reductions for necessary repairs identified during inspections.

Why is understanding seller concessions important for veterans?

Understanding seller concessions is essential for veterans and their families as they navigate the property purchasing process, helping them to effectively manage costs and enhance affordability.