Overview

Understanding FHA loan limits is essential for potential homebuyers. These limits determine the maximum amount you can borrow under FHA financing, which can significantly impact your journey to homeownership. We recognize that navigating this process can be overwhelming, especially for first-time homeowners and those with lower incomes.

FHA loan limits vary by region, reflecting local housing prices. This variance influences not only affordability but also the accessibility of homeownership for diverse buyers. We know how challenging this can be, but understanding these limits can empower you to make informed decisions.

By familiarizing yourself with the FHA loan limits in your area, you can better assess your options and find a home that fits your budget. We’re here to support you every step of the way, helping you turn your dream of homeownership into a reality.

Introduction

Understanding the nuances of FHA loans is essential for potential homebuyers navigating the complex landscape of real estate financing. We know how challenging this can be. With the Federal Housing Administration’s backing, these loans offer a lifeline to those who may struggle to secure traditional mortgages, particularly first-time buyers and lower-income families.

However, misconceptions about FHA loan limits can cloud judgment and hinder informed decision-making. How can you, as a prospective homeowner, effectively leverage these limits to unlock your path to homeownership while avoiding common pitfalls? We’re here to support you every step of the way.

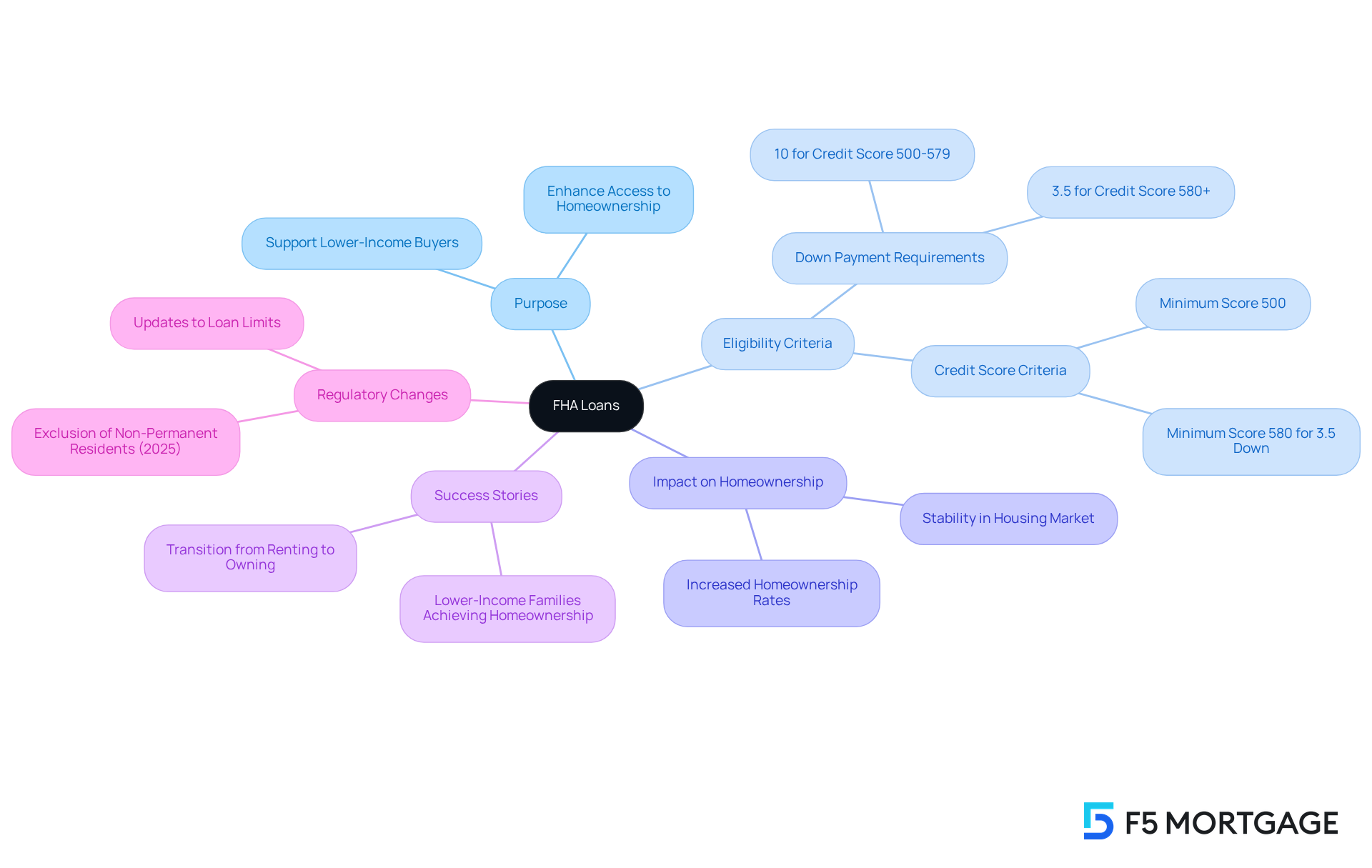

Define FHA Loans and Their Purpose

FHA mortgages, which are Federal Housing Administration mortgages, are government-supported financing options designed to help lower-income and first-time homebuyers secure funding for their homes, subject to the FHA loan limit. These financial products typically require down payments as low as 3.5% and offer more flexible credit score criteria. For individuals making a down payment of at least 10%, a minimum score of 500 is required, while those contributing 3.5% need a score of 580. In 2025, it’s estimated that around 30% of first-time homebuyers will rely on FHA financing, which is influenced by the FHA loan limit, highlighting its crucial role in today’s housing market.

The primary goal of FHA financing, specifically in relation to the FHA loan limit, is to enhance access to homeownership for a diverse range of individuals, particularly those who may struggle to obtain funding through traditional channels. By providing insurance to lenders, the FHA encourages them to extend credit to borrowers who might otherwise be seen as too risky, thereby influencing the FHA loan limit. This support not only fosters homeownership but also contributes to greater stability within the housing market.

There are numerous success stories, with many lower-income families achieving their dreams of homeownership through FHA financing. For instance, one family with a modest income successfully purchased their first home thanks to the lower down payment and flexible credit requirements of an FHA program. Another family, who had been renting, found that FHA financing allowed them to transition to homeownership with manageable monthly payments. This was possible due to the , which is required for the duration of the financing if the down payment is below 10%. These stories underscore the vital role that the FHA loan limit plays in transforming lives and fostering community stability, making it a cornerstone of home funding for first-time buyers.

It’s important to note that as of May 25, 2025, non-permanent residents will no longer be eligible for FHA financing. This significant change is something prospective borrowers should be aware of as they consider their options.

Explain the Importance of FHA Loan Limits

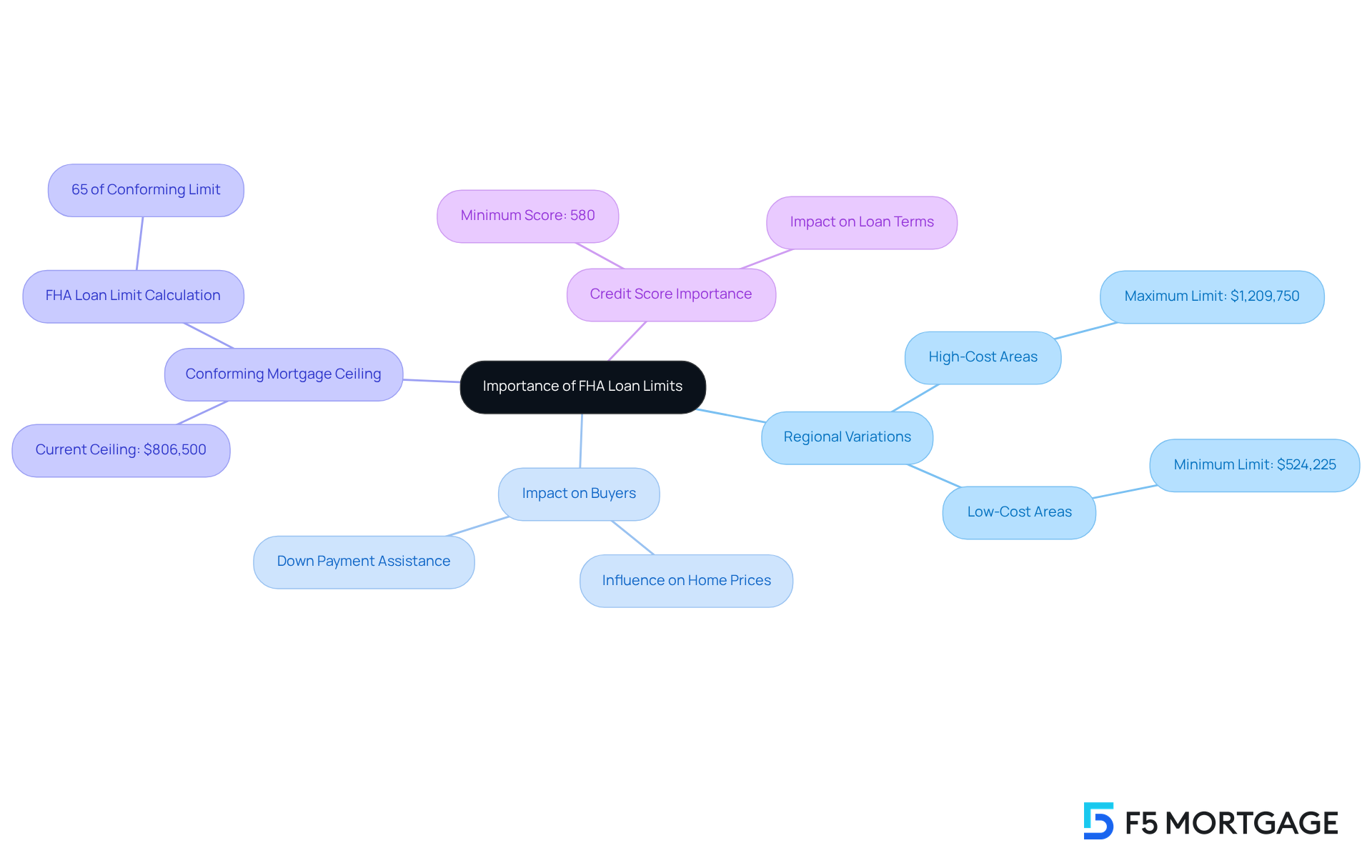

Understanding the is crucial for anyone looking to buy a home. These thresholds determine the fha loan limit that the FHA will guarantee in different regions, and they vary by county based on local housing prices. We know how challenging navigating these limits can be, but grasping them is essential for prospective property buyers. They directly influence the price range of homes eligible for FHA financing.

In high-cost areas, these thresholds are set higher, allowing buyers to consider more expensive properties. For instance, in 2025, the fha loan limit for a single-unit home can reach $1,209,750 in pricier regions, while the minimum threshold is set at $524,225 in less costly areas. This disparity highlights the importance of understanding the fha loan limit, as it defines the range of properties you can purchase with an FHA mortgage.

[FHA borrowing thresholds are determined at 65% of the conforming mortgage ceiling](https://usbank.com/about-us-bank/company-blog/article-library/how-new-government-backed-mortgage-limits-affect-homebuyers-in-2025.html) set by the Federal Housing Finance Agency (FHFA), which is currently $806,500. By being aware of these limits, you can make informed decisions about your home purchase, ensuring that you select homes that fit your financial situation and available funding options.Additionally, monitoring your credit score before applying for an FHA mortgage is vital. A good credit score can lead to better financing terms, making the process smoother. FHA financing is particularly beneficial for buyers with limited funds for down payments, making it an attractive option for families looking to improve their living situations. Remember, we’re here to support you every step of the way in this journey.

Outline the Calculation Methodology for FHA Loan Limits

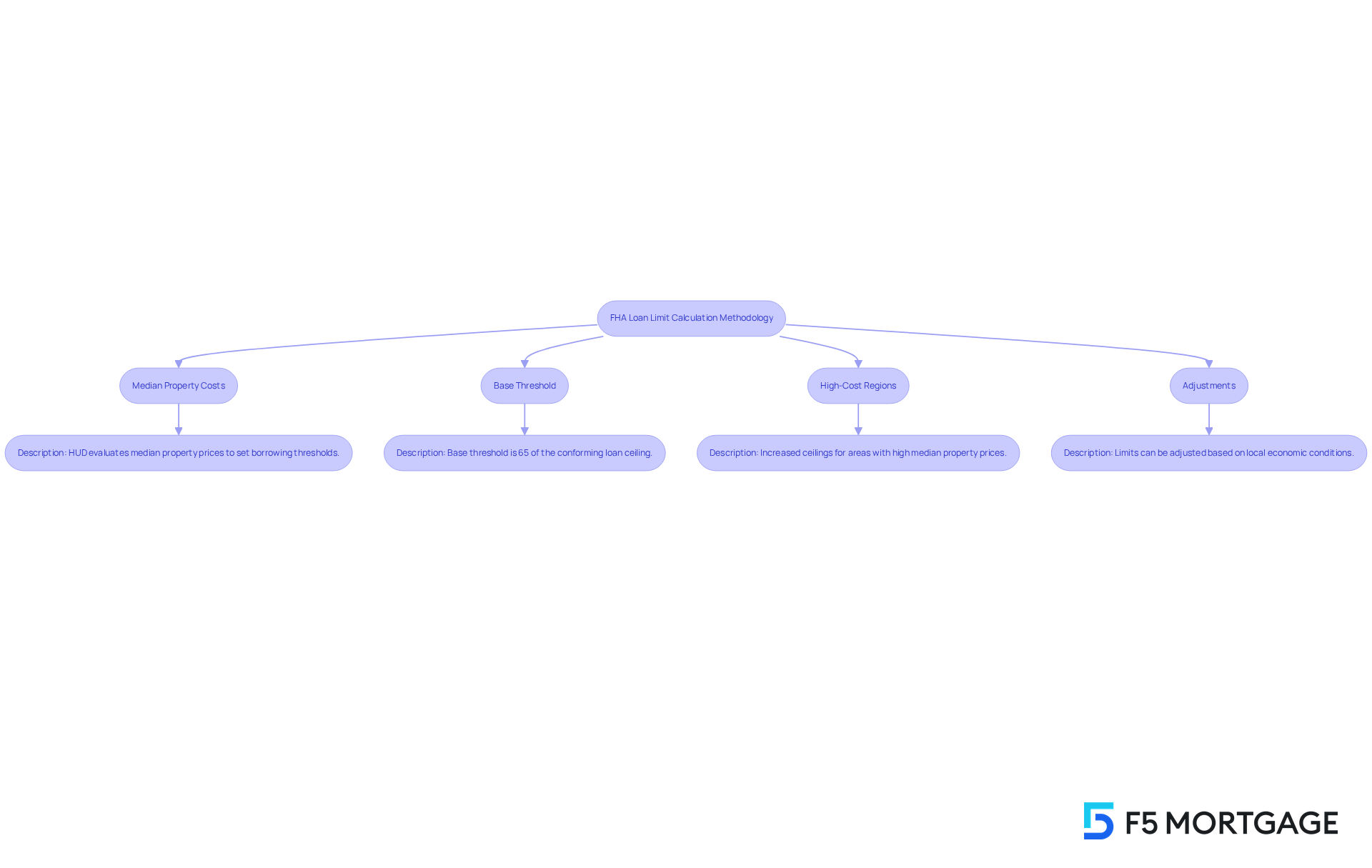

Understanding the FHA loan limit thresholds can feel overwhelming, but we’re here to support you every step of the way. These thresholds, known as FHA loan limits, are determined based on the median property prices in your area, evaluated yearly by the Department of Housing and Urban Development (HUD). Here’s how it works:

- Median Property Costs: HUD looks at the median property costs in each county to set appropriate borrowing thresholds. This means they consider the FHA loan limit when assessing what homes typically cost in your community.

- Base Threshold: The base threshold is set at 65% of the conforming loan ceiling established by the Federal Housing Finance Agency (FHFA). This provides a solid foundation for your borrowing options.

- High-Cost Regions: If you live in an area where the median property price exceeds the FHA loan limit, you may benefit from increased ceilings. This allows for greater borrowing potential, which can make a significant difference in your home search.

- Adjustments: Remember, these limits can be adjusted based on local economic conditions and housing market trends, ensuring they reflect the realities of your area.

By grasping this methodology, you can better assess your financing options and find the home that meets your needs. We know how challenging this can be, and having this knowledge empowers you to .

Clarify Common Misconceptions About FHA Loan Limits

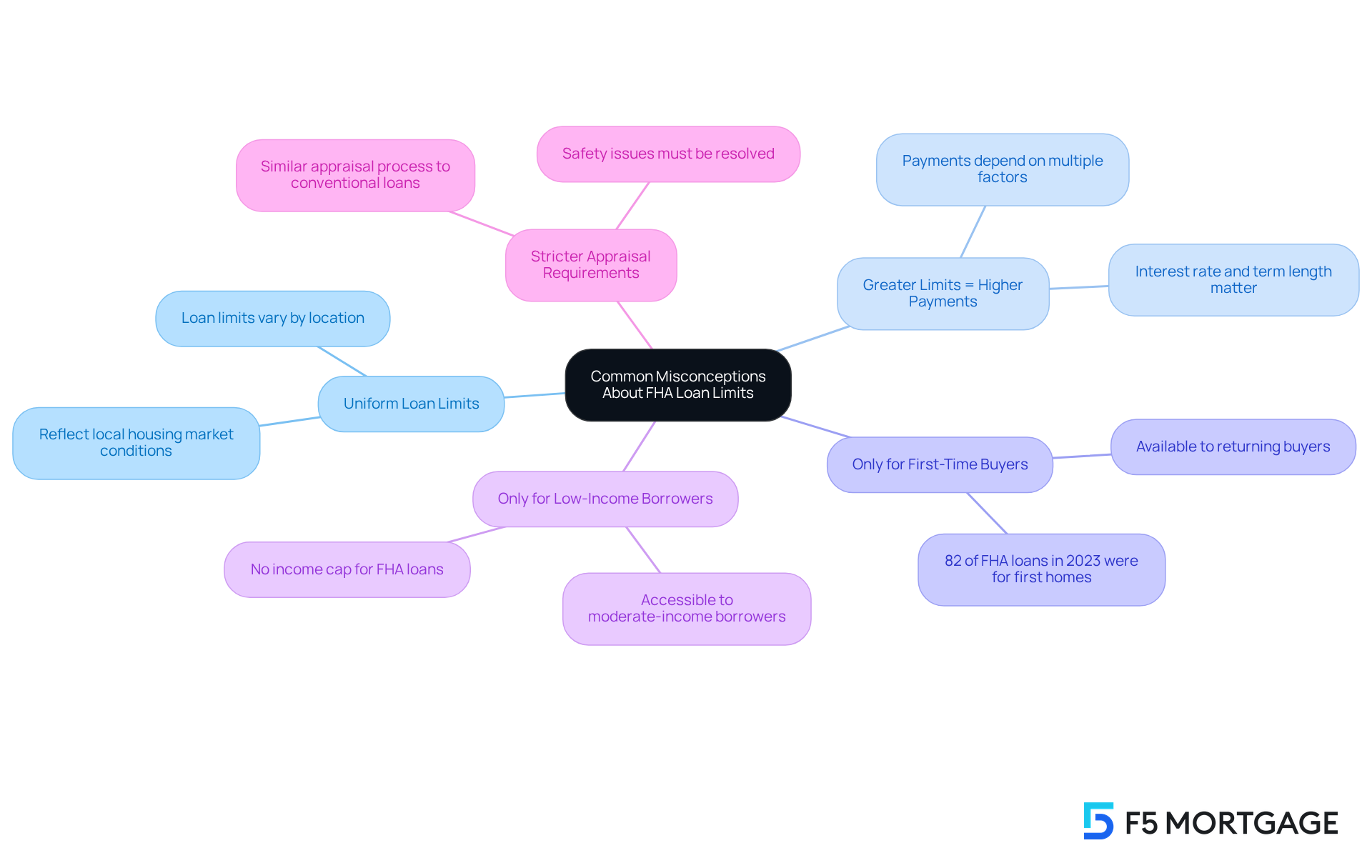

Many potential borrowers hold misconceptions about the FHA loan limit, which can lead to confusion and uncertainty. Let’s explore and clarify these misunderstandings together.

The FHA loan limit restrictions are the same nationwide: It’s a common belief that FHA financing thresholds are uniform across the country. However, these restrictions vary significantly based on local housing markets, reflecting the unique economic conditions and property values in different regions. Understanding this can help you navigate your options more effectively.

- Greater Thresholds Indicate Increased Payments: Some borrowers may think that higher borrowing thresholds automatically result in larger monthly payments. In reality, your actual payments depend on various factors, such as the amount borrowed, interest rate, and term length, rather than just the limit itself. We know how challenging it can be to make sense of these details, but you’re not alone in this.

- FHA Financing Is Exclusively for First-Time Purchasers: While FHA financing is particularly popular among —82% of individuals who utilized FHA financing in 2023 were acquiring their initial residences—it is also available to returning buyers. This means FHA financing can be a viable option for anyone looking to refinance or purchase a property, as long as they stay within the FHA loan limit, regardless of their previous buying history.

- FHA Financing Is Only for Low-Income Borrowers: Although FHA financing is designed to assist lower-income individuals, it is accessible to a wider range of borrowers, including those with moderate incomes. As mortgage officer Dianne Steffey points out, ‘there’s no income cap for FHA mortgages,’ enabling higher-priced home buyers to qualify as long as they stay within the FHA loan limit set by their county. Furthermore, FHA financing permits debt-to-income ratios up to 57%, which can help buyers with less-than-perfect credit find a path to homeownership.

By debunking these myths, we hope to empower you with a clearer understanding of the FHA loan process. This knowledge enables you to make more informed decisions about your financing options, and we’re here to support you every step of the way.

Conclusion

Understanding FHA loans and their limits is essential for anyone navigating the homebuying process. We know how challenging this can be, especially for lower-income and first-time homebuyers. These government-backed loans are designed to provide opportunities, making homeownership more accessible. The FHA loan limit plays a pivotal role in determining the range of properties eligible for financing, effectively influencing the choices available to prospective buyers.

Throughout this article, we shared key insights regarding:

- The importance of FHA loan limits

- The methodology behind their calculation

- Common misconceptions that can cloud understanding

It’s important to recognize that these limits vary by region and are influenced by local housing prices, which can significantly affect your purchasing power. Additionally, we clarified that FHA financing is not solely for first-time buyers or low-income individuals, debunking prevalent myths that can deter potential homebuyers from exploring their options.

Ultimately, comprehending the nuances of FHA loan limits can empower you to make informed decisions in your homebuying journey. As the housing market continues to evolve, staying informed about these changes is crucial. Whether you’re considering an FHA loan for the first time or seeking to refinance, understanding these limits can open doors to homeownership and foster greater financial stability in your community. We’re here to support you every step of the way.

Frequently Asked Questions

What are FHA loans?

FHA loans, or Federal Housing Administration mortgages, are government-supported financing options designed to help lower-income and first-time homebuyers secure funding for their homes.

What is the purpose of FHA loans?

The primary goal of FHA loans is to enhance access to homeownership for individuals who may struggle to obtain funding through traditional channels, thereby fostering greater stability within the housing market.

What are the down payment requirements for FHA loans?

FHA loans typically require down payments as low as 3.5%. For individuals making a down payment of at least 10%, a minimum credit score of 500 is required, while those contributing 3.5% need a score of 580.

How does FHA financing affect first-time homebuyers?

It is estimated that around 30% of first-time homebuyers will rely on FHA financing in 2025, highlighting its crucial role in helping these individuals secure homeownership.

What role does mortgage insurance play in FHA loans?

Mortgage insurance is required for the duration of the financing if the down payment is below 10%, which helps make homeownership more accessible for lower-income families.

Can non-permanent residents apply for FHA loans?

No, as of May 25, 2025, non-permanent residents will no longer be eligible for FHA financing.

What impact do FHA loans have on families?

FHA loans have enabled many lower-income families to achieve homeownership through lower down payments and flexible credit requirements, contributing to community stability.