Overview

Today’s HELOC rates can feel overwhelming, influenced by factors such as:

- Credit scores

- Loan-to-value ratios

- Economic conditions

- Lender policies

- Market competition

We know how challenging this can be for families navigating these waters. Understanding these factors is crucial; it empowers you to make informed decisions about borrowing costs.

Current trends show a slight decline in average rates, which is encouraging. Additionally, increased accessibility due to favorable economic policies means that families might find it easier to secure the financing they need. Remember, we’re here to support you every step of the way as you explore your options.

Introduction

Understanding the dynamics of Home Equity Lines of Credit (HELOC) can truly be a game-changer for families eager to leverage their home equity. We know how challenging financial decisions can be, especially when it comes to accessing funds for renovations, debt consolidation, or unexpected expenses. With today’s HELOC rates remaining notably lower than many other borrowing options, homeowners are presented with a unique opportunity. However, as interest rates fluctuate, how can families ensure they are making the most informed decisions about their financial futures? We’re here to support you every step of the way.

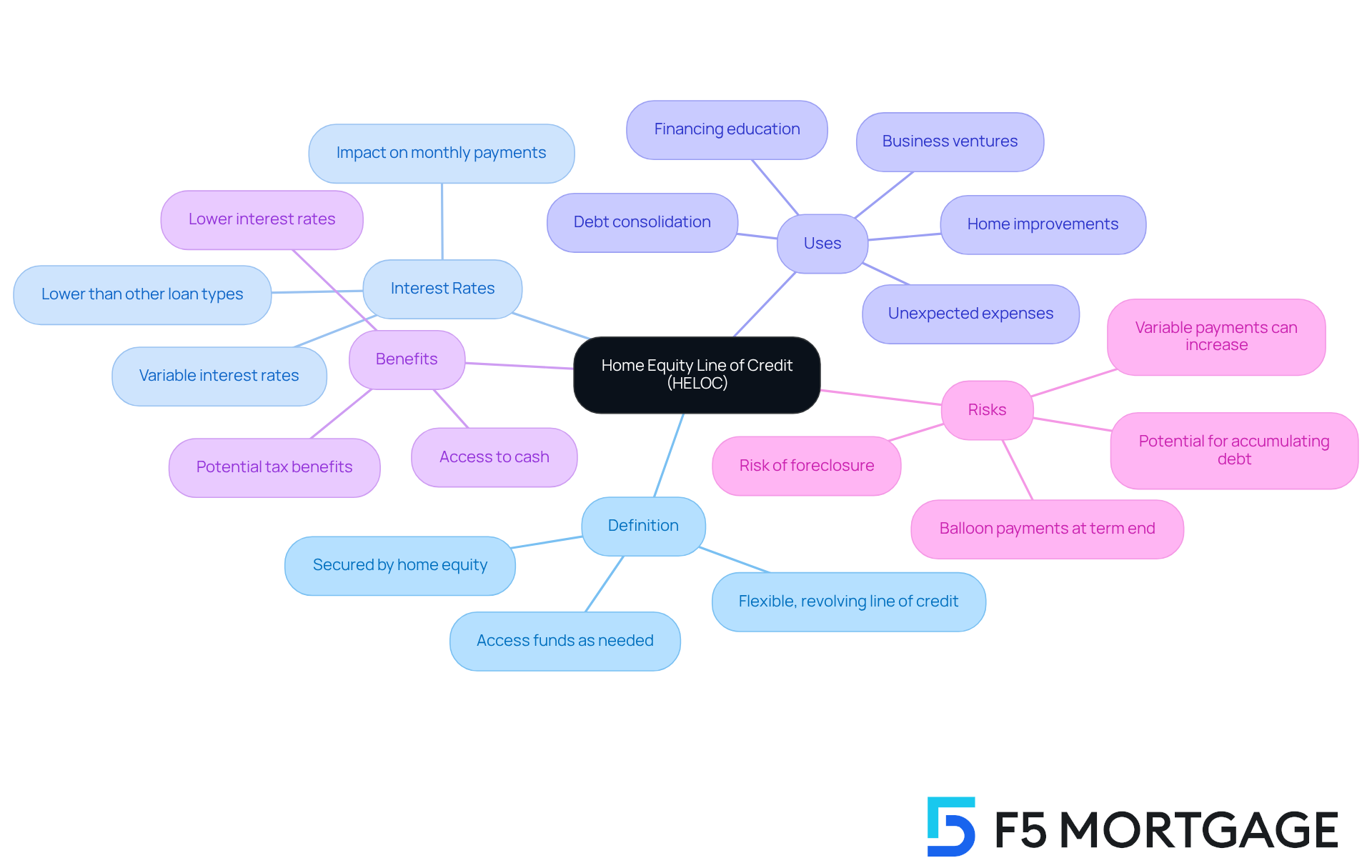

Define Home Equity Lines of Credit (HELOC)

A Home Equity Line of Credit (HELOC) is a flexible, revolving line of credit that allows homeowners to borrow against the equity in their property. Unlike conventional equity loans, which provide a lump sum, HELOCs enable you to access funds as needed, up to a defined limit. This type of credit is secured by your home, meaning it serves as collateral.

We understand how important it is to manage your finances effectively. Typically, today’s HELOC rates come with variable interest rates that can change according to market conditions. It’s essential to grasp how today’s HELOC rates operate and understand their potential impact on your monthly payments. Today’s HELOC rates are significantly lower than those of other loan types, making them an appealing choice for many families.

HELOCs are often used for various purposes, such as funding renovations, consolidating debt, or handling unexpected expenses. For instance, many households have successfully utilized HELOCs to consolidate higher-interest debts, simplifying their finances and reducing monthly payments.

Understanding the benefits and risks associated with HELOCs is crucial for families looking to leverage their home equity effectively. We know how challenging this can be, and we’re here to .

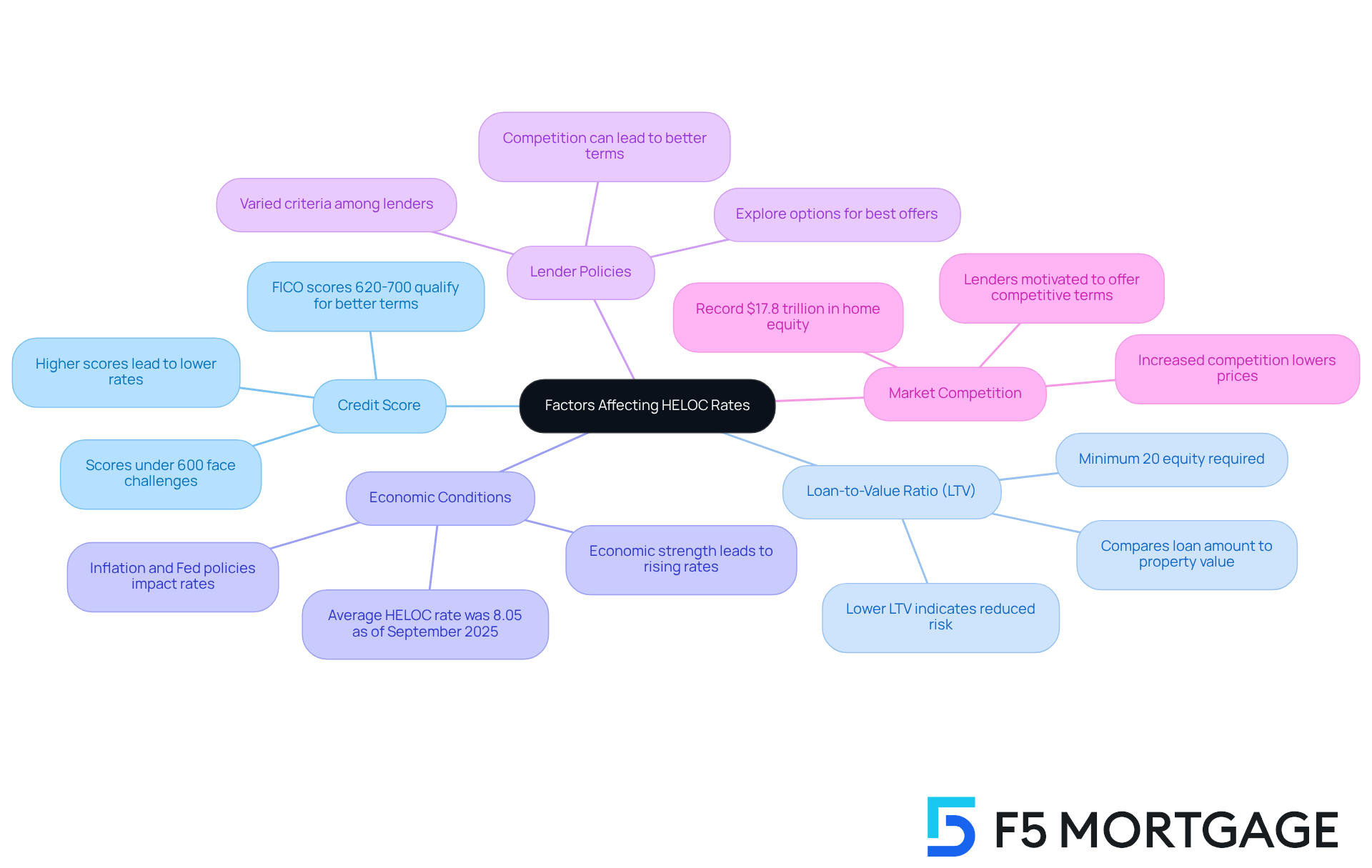

Examine Factors Affecting HELOC Rates

Several key factors significantly influence today’s HELOC rates, and understanding these factors can empower you in your financial journey. We know how challenging this can be, so let’s explore these factors together:

- Credit Score: A higher credit score generally leads to lower interest rates. Lenders perceive borrowers with strong credit histories as less risky, which can result in more favorable terms. For instance, borrowers with FICO scores ranging from 620 to 700 may qualify for attractive terms, while those with scores under 600 might face more challenges in obtaining a HELOC.

- Loan-to-Value Ratio (LTV): This ratio compares the loan amount to the assessed value of your property and plays a crucial role in determining costs. Most lenders require a minimum of 20% equity in your home. For example, if your home is valued at $200,000, you should have at least $40,000 in equity. A lower LTV often leads to improved terms, as it signifies reduced risk to the lender.

- Economic Conditions: Broader economic factors, such as inflation and the Federal Reserve’s interest rate policies, can influence home equity line of credit charges. As of September 2025, today’s HELOC rates show an average percentage of 8.05%, reflecting a decrease from the previous year. Economic strength generally results in increasing levels, while downturns may encourage decreases.

- Lender Policies: Different lenders have varying criteria and guidelines that can influence the terms they provide. We encourage families to explore various options to find the , as competition among lenders can lead to more advantageous terms.

- Market Competition: Heightened competition among lenders frequently results in reduced prices as they strive to attract customers. With cumulative home equity levels in the U.S. reaching a record $17.8 trillion, lenders are motivated to offer competitive terms to tap into this significant borrowing potential.

By comprehending these elements, you can make knowledgeable choices when considering a home equity line of credit, ensuring you obtain the most favorable terms based on your unique financial situation. Remember, we’re here to support you every step of the way.

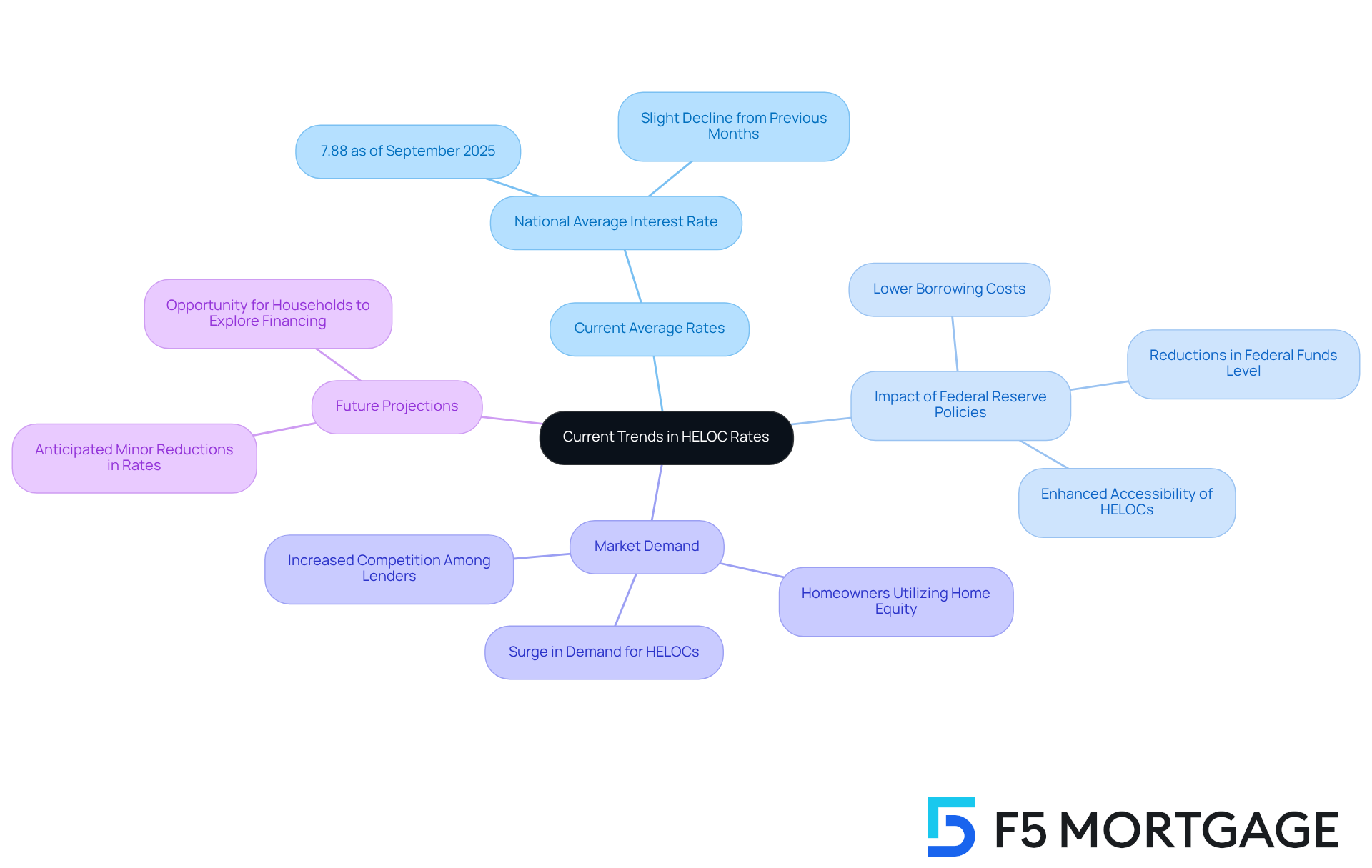

Analyze Current Trends in HELOC Rates

As of September 2025, today’s HELOC rates have exhibited some significant trends that families should consider.

Current Average Rates: We understand how crucial it is for families to find favorable borrowing options. Today’s HELOC rates reflect a national average interest rate of around 7.88%, which shows a slight decline from previous months. This trend suggests a more favorable borrowing atmosphere for families looking to tap into their property equity, in light of today’s HELOC rates.

Impact of Federal Reserve Policies: Recently, reductions in the federal funds level have significantly lowered borrowing costs. This change enhances the accessibility of HELOCs for homeowners considering today’s HELOC rates. We recognize that these policy adjustments are vital in , making it easier for families to consider their options.

Market Demand: Many homeowners are choosing to utilize their home equity rather than relocating, which is driving a surge in demand for today’s HELOC rates. This increased interest in today’s HELOC rates has prompted lenders to enhance their offerings and foster competition in the market. We know how important it is for families to have choices that suit their needs.

Future Projections: Looking ahead, specialists anticipate that today’s HELOC rates may continue to see minor reductions as financial conditions stabilize. This presents a timely opportunity for households to explore this financing option, helping them align their financial goals with the current market dynamics. Remember, we’re here to support you every step of the way as you navigate these decisions.

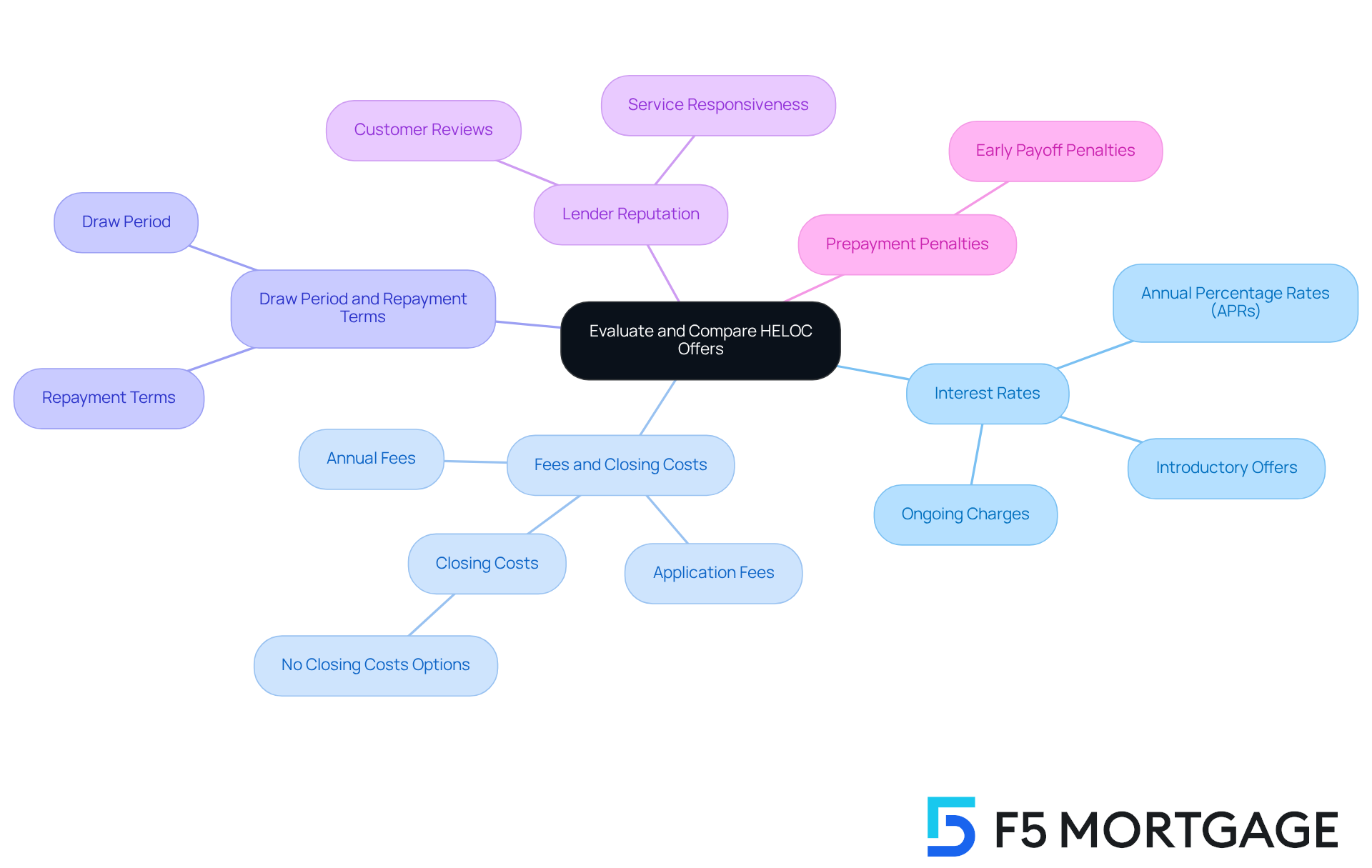

Evaluate and Compare HELOC Offers

When evaluating and comparing , we know how challenging this can be for families. Here are some important steps to consider:

- Interest Rates: It’s essential to compare the annual percentage rates (APRs) from different lenders. Look for both introductory offers and ongoing charges after the initial period. F5 Mortgage offers competitive rates, including today’s heloc rates, that can help households save money throughout the duration of their loan.

- Fees and Closing Costs: Take a close look at any associated fees, such as application fees, annual fees, and closing costs. Some lenders, including F5 Mortgage, may offer no closing costs, which can save you money upfront.

- Draw Period and Repayment Terms: Understanding the draw period (the time you can borrow) and repayment terms (how long you have to pay back the borrowed amount) is crucial. A longer draw period can offer greater flexibility, helping families manage their finances more effectively.

- Lender Reputation: Researching lender reviews and ratings is vital to ensure you choose a reputable institution. Customer service and responsiveness can significantly impact your experience, and F5 Mortgage prides itself on personalized service to meet your needs.

- Prepayment Penalties: Be sure to check if there are any penalties for paying off the HELOC early, as this can affect your overall cost if you plan to pay it off quickly.

By carefully evaluating these factors and considering F5 Mortgage’s offerings, you can make informed decisions that align with your financial goals. Remember, we’re here to support you every step of the way.

Conclusion

Understanding the dynamics of Home Equity Lines of Credit (HELOC) is essential for families looking to leverage their home equity effectively. We know how challenging this can be, especially when navigating financial options. With the current landscape of HELOC rates being more favorable than in previous years, homeowners have a unique opportunity to access funds for various needs, from home renovations to debt consolidation. By grasping the intricacies of how HELOCs work, families can make informed decisions that align with their financial aspirations.

Key factors influencing today’s HELOC rates include:

- Credit scores

- Loan-to-value ratios

- Economic conditions

- Lender policies

- Market competition

Each of these elements plays a significant role in determining the terms and accessibility of HELOCs. Additionally, recent trends indicate a slight decline in average interest rates, driven by favorable economic policies and increased demand for home equity borrowing. This combination of factors underscores the importance of thorough research and comparisons when evaluating HELOC offers.

As families navigate the complexities of HELOCs, it is crucial to remain proactive in understanding the available options and the potential benefits. Taking the time to evaluate different lenders and their offerings can lead to significant savings and better financial outcomes. Engaging with trusted financial advisors or institutions can provide the necessary support to make sound decisions that enhance financial stability and growth. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is a Home Equity Line of Credit (HELOC)?

A Home Equity Line of Credit (HELOC) is a flexible, revolving line of credit that allows homeowners to borrow against the equity in their property. It enables access to funds as needed, up to a defined limit, and is secured by the home.

How does a HELOC differ from conventional equity loans?

Unlike conventional equity loans that provide a lump sum, HELOCs allow homeowners to access funds as needed, making them more flexible.

What are the typical interest rates for HELOCs?

Today’s HELOC rates typically come with variable interest rates that can change according to market conditions, and they are generally lower than those of other loan types.

What are common uses for a HELOC?

HELOCs are often used for various purposes, including funding renovations, consolidating debt, or handling unexpected expenses.

How can a HELOC help with debt management?

Many households have successfully utilized HELOCs to consolidate higher-interest debts, which simplifies their finances and reduces monthly payments.

Why is it important to understand the benefits and risks of HELOCs?

Understanding the benefits and risks associated with HELOCs is crucial for families looking to leverage their home equity effectively and manage their finances responsibly.