Overview

We know how challenging the home buying process can be, especially for those utilizing VA loans. The VA amendatory clause serves as a protective measure for homebuyers, allowing you to withdraw from a purchase agreement without penalty if the home’s appraised value falls short of the agreed purchase price. This important clause safeguards your financial interests, ensuring you won’t overpay for a property.

It’s mandatory to include this clause in contracts, which means you have the right to reclaim your earnest money in the event of a low appraisal. By understanding this provision, you can approach your home purchase with confidence, knowing that your investment is protected. We’re here to support you every step of the way as you navigate this process.

Introduction

Navigating the complexities of home buying can feel overwhelming, particularly for veterans and active-duty service members as they explore the VA loan landscape. We understand how challenging this can be, and that’s where the VA amendatory clause comes into play as a vital safeguard. This essential provision not only protects homebuyers from the financial strain of overvalued properties but also empowers them to make informed decisions throughout the purchasing journey.

However, what happens when the appraisal falls short of expectations? How can this clause be effectively leveraged to help avoid potential financial pitfalls? We’re here to support you every step of the way.

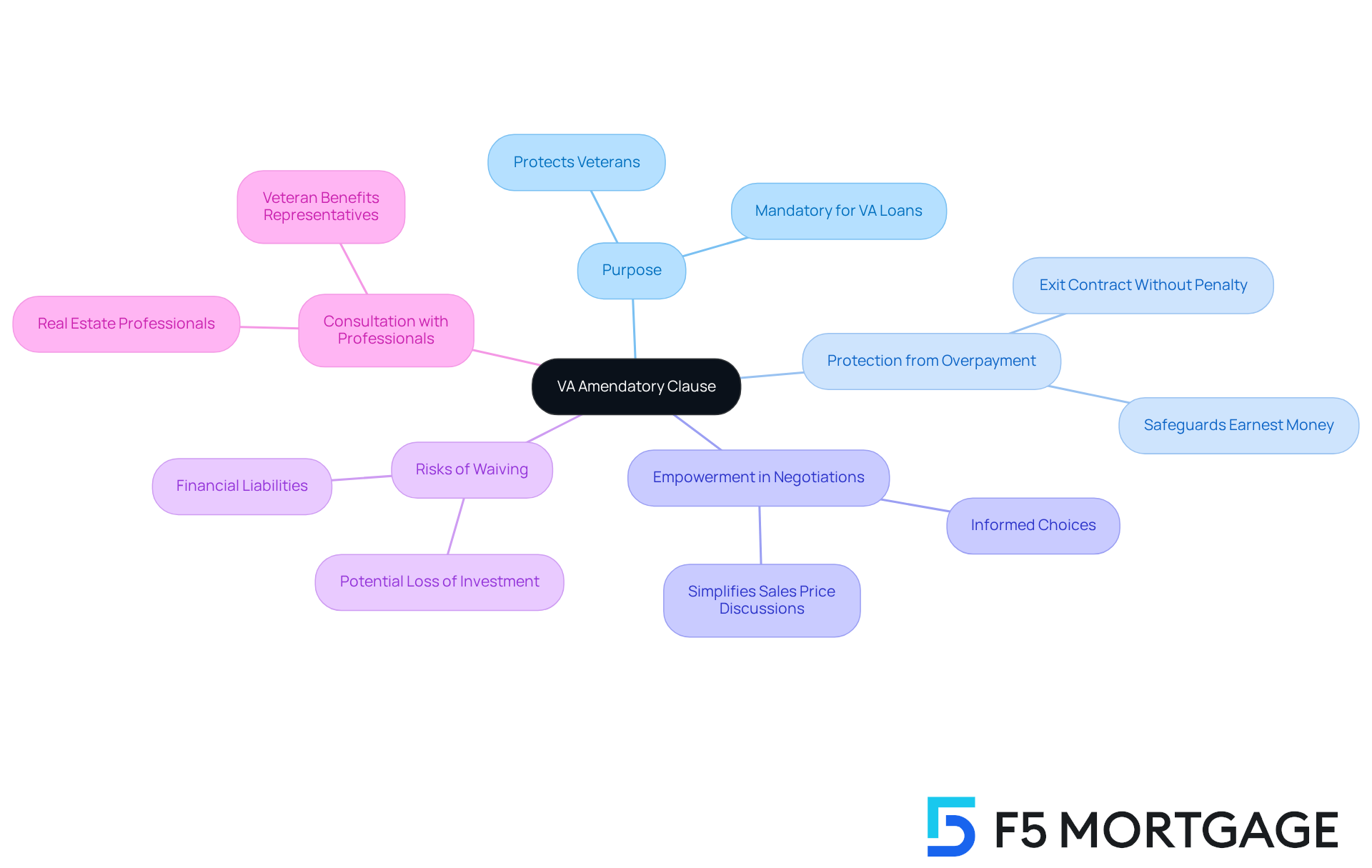

Define the VA Amendatory Clause and Its Purpose

Including the is essential in purchase agreements for homes financed through a . We understand how important it is for veterans and active-duty service members to feel secure in their investments. This VA amendatory clause primarily protects you from being obligated to complete a purchase if the appraised value of the home is less than the agreed purchase price. It ensures that you are not financially penalized for overpaying, safeguarding your investment and economic stability. The VA amendatory clause serves as a mandatory requirement for all VA loans, highlighting the ‘ commitment to protecting its borrowers.

For instance, the VA amendatory clause allows veterans to exit a contract without losing their earnest money if the appraisal is lower than the sales price. This provision not only simplifies discussions regarding the sales price but also empowers you to make informed choices without the fear of financial loss. We encourage veterans to grasp the implications of this clause and to to ensure favorable contract terms. Additionally, with F5 Mortgage, you can explore various , such as the VA Interest Rate Reduction Refinance Loan (IRRRL) and VA cash-out refinancing, which can help you access home equity and meet your financial needs effectively.

It’s crucial for the potential risks of waiving the VA amendatory clause, as doing so may expose them to if the property’s appraisal does not meet expectations. By incorporating the VA amendatory clause, the homebuying process becomes more secure and equitable for those who have served our country. Remember, F5 Mortgage is here to provide tailored to your unique financial situation, ensuring you feel confident every step of the way.

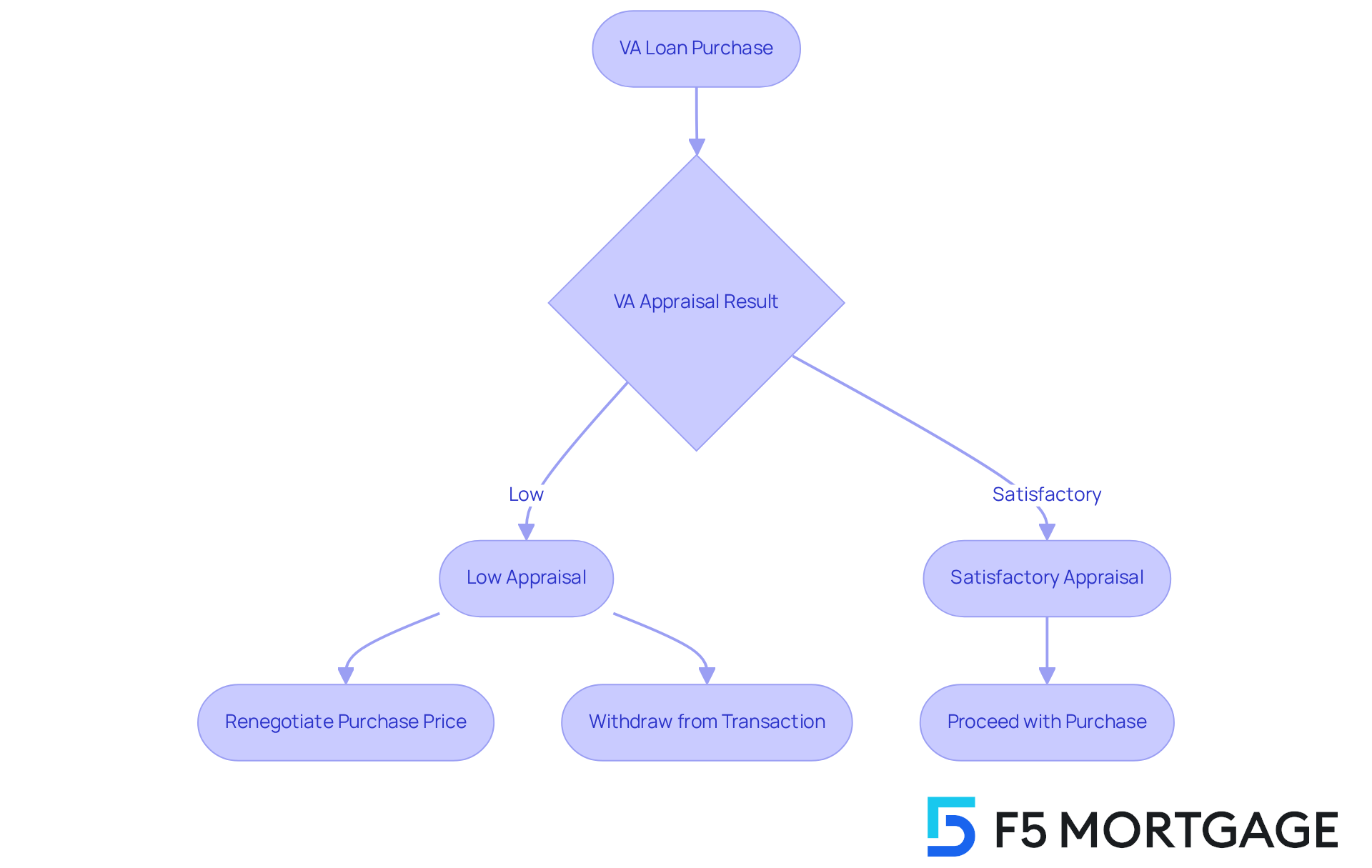

Explain How the VA Amendatory Clause Works in Home Purchases

When purchasing a home with a , understanding the is crucial. This clause serves as an for you, allowing you to terminate the agreement without penalties if the VA assessment reveals that the property’s value falls short of the agreed purchase price. If the appraisal comes in low, you have the option to with the seller or withdraw from the transaction completely, ensuring that your is returned. This protective measure helps you avoid unfavorable financial commitments, fostering a fairer and more transparent real estate process.

We know how challenging the home buying journey can be. Statistics indicate that in recent years, about 20% of homes have sold for prices exceeding their appraised values, highlighting the importance of the VA amendatory clause in protecting you from overpaying. Additionally, the VA amendatory clause must be signed by the buyer, seller, and sometimes real estate agents before finalizing the sale, highlighting its importance in the transaction process. You can also up to 4% of the assessed value of the property, which is especially helpful in light of a low appraisal. By understanding and utilizing this clause, you can navigate the complexities of the VA evaluation process with confidence, knowing you have the right to .

At F5 Mortgage, we’re here to support you every step of the way as you pursue with our exceptional service and competitive rates. Our flexible mortgage solutions empower you to make informed decisions throughout the , including grasping the importance of appraisals and negotiations. With our guidance, you can confidently navigate your home purchase, secure in the knowledge that your financial interests are safeguarded.

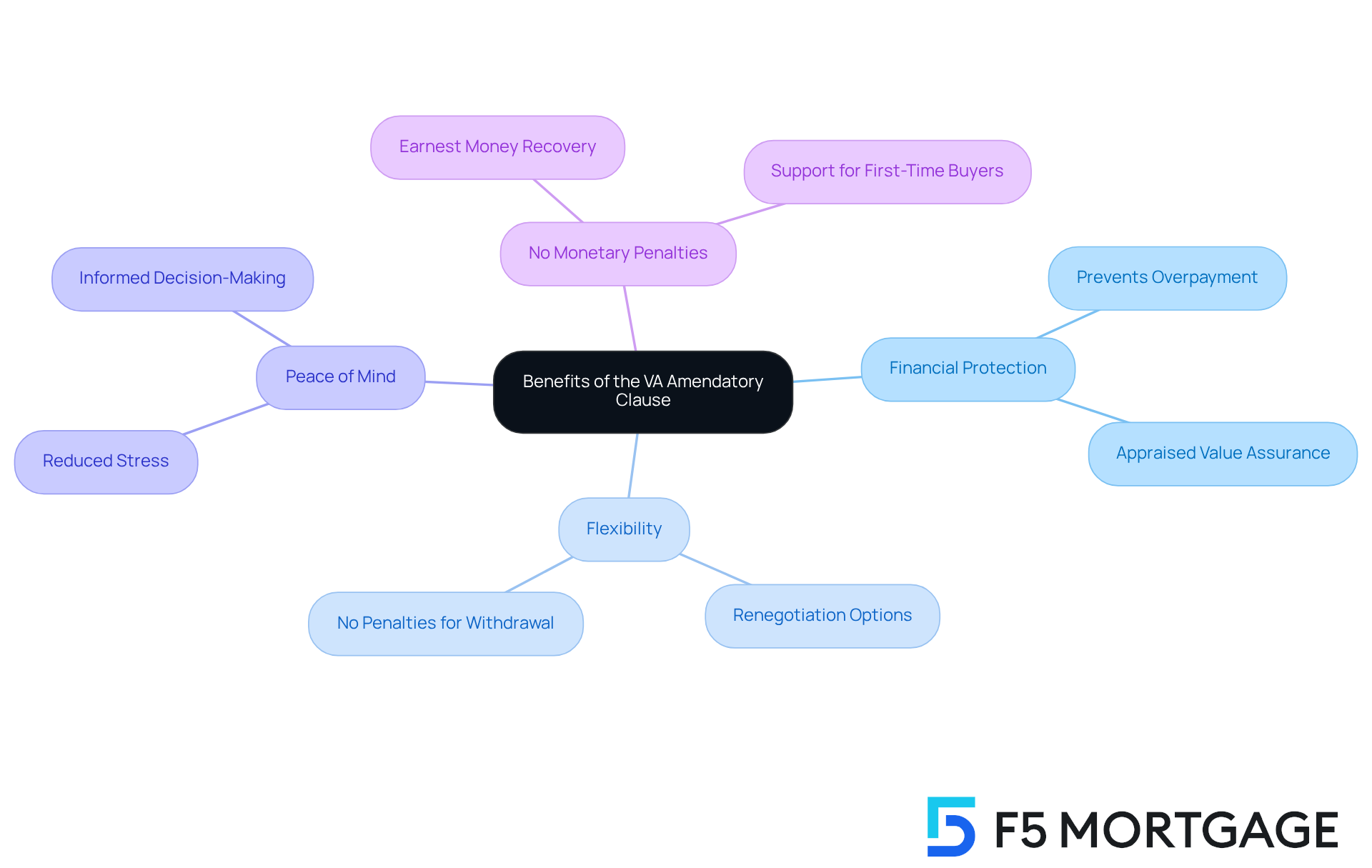

Outline the Benefits of the VA Amendatory Clause for Homebuyers

The provides invaluable benefits for homebuyers, particularly in terms of and .

- Financial Protection: This clause ensures that purchasers do not overpay for a home, allowing them to pay only the appraised value determined by the VA. In a fluctuating market, where property values can shift dramatically, this protection is crucial.

- Flexibility: If the appraisal comes in lower than the agreed purchase price, or walk away from the deal without any penalties. This flexibility empowers buyers, enabling them to make informed decisions based on the property’s true value.

- Peace of Mind: with greater confidence thanks to the VA Amendatory Clause in place. Knowing they have a safety net reduces stress and anxiety, making the experience much more manageable.

- No Monetary Penalties: In the event that a deal falls through due to a low appraisal, buyers can reclaim their earnest money, protecting their . This aspect is particularly reassuring for who may feel anxious about the financial implications of their purchase.

In 2024, the National Association of Realtors® underscored the significance of such protections, advocating for policies that ensure veterans can engage fully in the housing market. The VA’s dedication to is further highlighted by the fact that nearly 80% of veterans today enjoy homeownership, showcasing the effectiveness of programs designed to support them. Ultimately, the va amendatory clause serves as a , enhancing their ability to secure homes without the fear of financial loss.

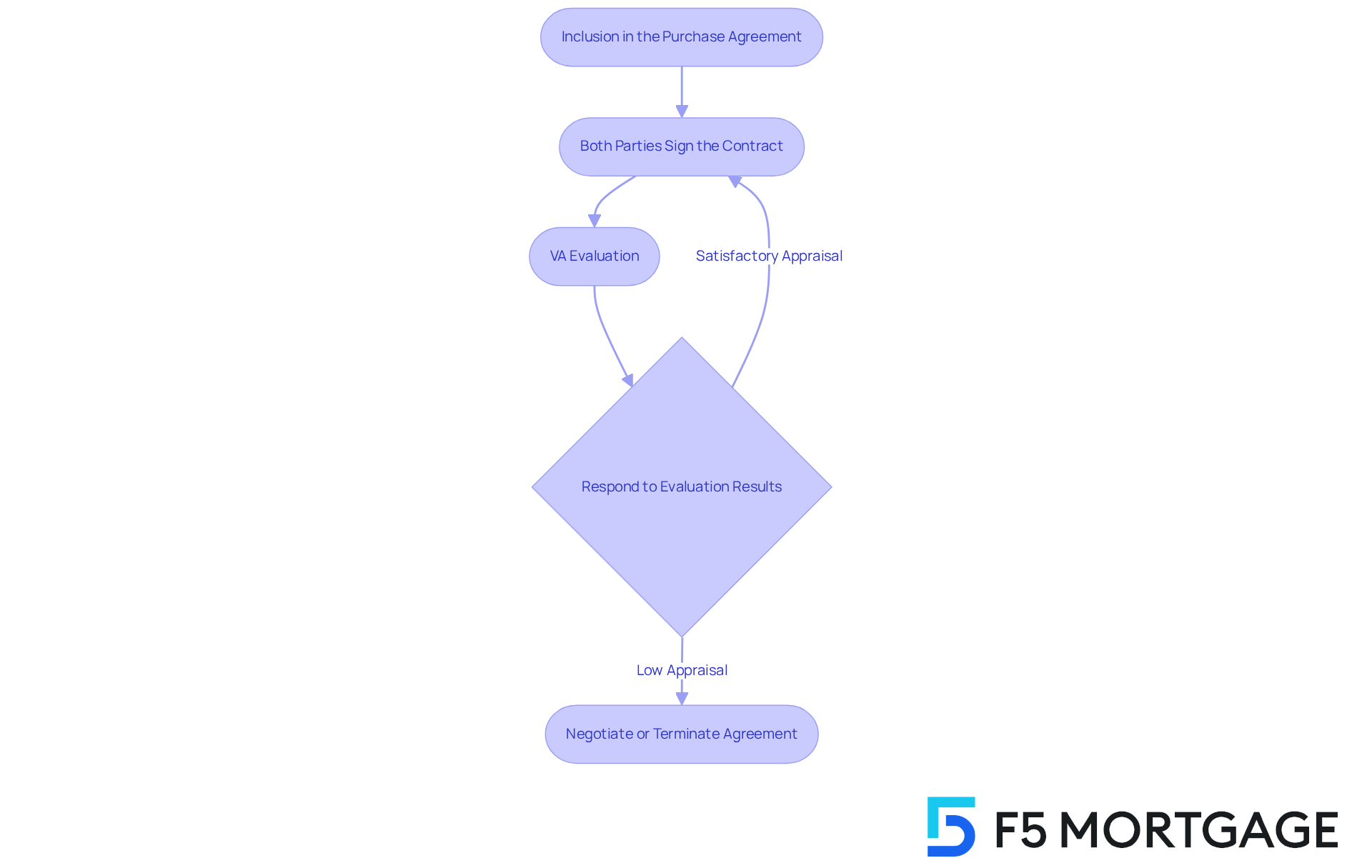

Detail the Requirements for Utilizing the VA Amendatory Clause

Navigating the VA loan process can feel overwhelming, but understanding the can empower you as a homebuyer. Here are some to help you through this journey:

- Inclusion in the Purchase Agreement: It’s crucial to explicitly state the [VA amendatory clause](https://gustancho.com/fha-and-va-amendatory-clause) within your . This ensures that everyone involved is aware of its presence, providing clarity and peace of mind.

- Both you and the seller must sign the contract that includes the VA amendatory clause as part of the signature requirement. This mutual acknowledgment of the terms and conditions fosters trust and transparency in the transaction.

- : A is necessary to determine the property’s value. The results of this evaluation can significantly influence your decisions regarding the clause. If the evaluation comes in below the agreed price, you have the opportunity to negotiate a lower sale price or request repairs based on the evaluation results. This is essential to ensure you don’t overpay for your new home.

- If the evaluation reveals a figure below the agreed price, it’s important to respond quickly in accordance with the VA amendatory clause. You can either renegotiate the terms or terminate the agreement, as specified by the clause. Remember, if the appraisal is low, you face no financial risk, allowing you to exit the agreement without repercussions.

By understanding these requirements, you can navigate the complexities of the VA loan process with confidence. We’re here to support you every step of the way, safeguarding your and ensuring a fair transaction.

Conclusion

The VA amendatory clause is a vital part of the homebuying journey for veterans and active-duty service members. It protects you from financial challenges that can arise from property appraisals. By including this clause in your purchase agreements, you can feel secure as you navigate real estate transactions, knowing you can walk away if the appraised value doesn’t meet the agreed price.

In this article, we’ve explored the essential roles of the VA amendatory clause. It provides not only financial protection but also flexibility and peace of mind for homebuyers like you. We highlighted the importance of including this clause in your agreements, the steps to utilize it, and the risks of waiving such protections. Understanding these aspects empowers you to make informed decisions that safeguard your investments.

Ultimately, the VA amendatory clause is more than just a protective measure; it reflects the Department of Veterans Affairs’ commitment to supporting its borrowers. As the housing market evolves, it’s crucial for you to take advantage of this valuable resource and connect with real estate professionals to secure favorable terms. By doing so, you can embark on your homeownership journey with confidence, knowing that your financial interests are well-protected.

Frequently Asked Questions

What is the VA amendatory clause?

The VA amendatory clause is a provision included in purchase agreements for homes financed through a VA loan that protects borrowers from being obligated to complete the purchase if the appraised value of the home is less than the agreed purchase price.

What is the purpose of the VA amendatory clause?

The purpose of the VA amendatory clause is to safeguard veterans and active-duty service members from financial loss by ensuring they are not penalized for overpaying on a home. It highlights the Department of Veterans Affairs’ commitment to protecting its borrowers.

How does the VA amendatory clause benefit homebuyers?

The VA amendatory clause allows veterans to exit a contract without losing their earnest money if the appraisal is lower than the sales price, simplifying discussions about the sales price and empowering them to make informed choices without fear of financial loss.

What are the risks of waiving the VA amendatory clause?

Waiving the VA amendatory clause may expose homebuyers to financial liabilities if the property’s appraisal does not meet expectations, potentially leading to overpayment for the home.

What refinancing options are available through F5 Mortgage?

F5 Mortgage offers various refinancing options, such as the VA Interest Rate Reduction Refinance Loan (IRRRL) and VA cash-out refinancing, which can help borrowers access home equity and meet their financial needs effectively.

Why is it important for veterans to understand the VA amendatory clause?

It is important for veterans to understand the VA amendatory clause to ensure they can negotiate favorable contract terms and protect themselves from potential financial risks during the homebuying process.