Overview

Navigating the mortgage process can feel overwhelming, but understanding your financial situation is the first step towards homeownership. Start by calculating your debt-to-income ratio and following the 28/36 rule. It’s also essential to evaluate your credit score. We know how challenging this can be, but taking these steps will help you establish a realistic budget.

By understanding your income, debts, and additional homeownership costs, you can make informed decisions. This knowledge empowers you to stay within your financial means. Remember, we’re here to support you every step of the way as you pursue your dream of owning a home.

Introduction

Navigating the complex landscape of mortgage affordability can feel overwhelming for prospective homeowners, especially as financial pressures mount in 2025. We understand how challenging this can be. By grasping key concepts such as:

- Debt-to-income ratios

- The 28/36 rule

- The impact of credit scores

you can empower yourself to make informed decisions about your home-buying journey. However, with so many factors at play, how can you accurately assess what you can truly afford without overextending your finances? This article delves into the critical steps and considerations necessary for determining a realistic mortgage budget. Our goal is to ensure that financial stability remains a priority while you pursue the dream of homeownership.

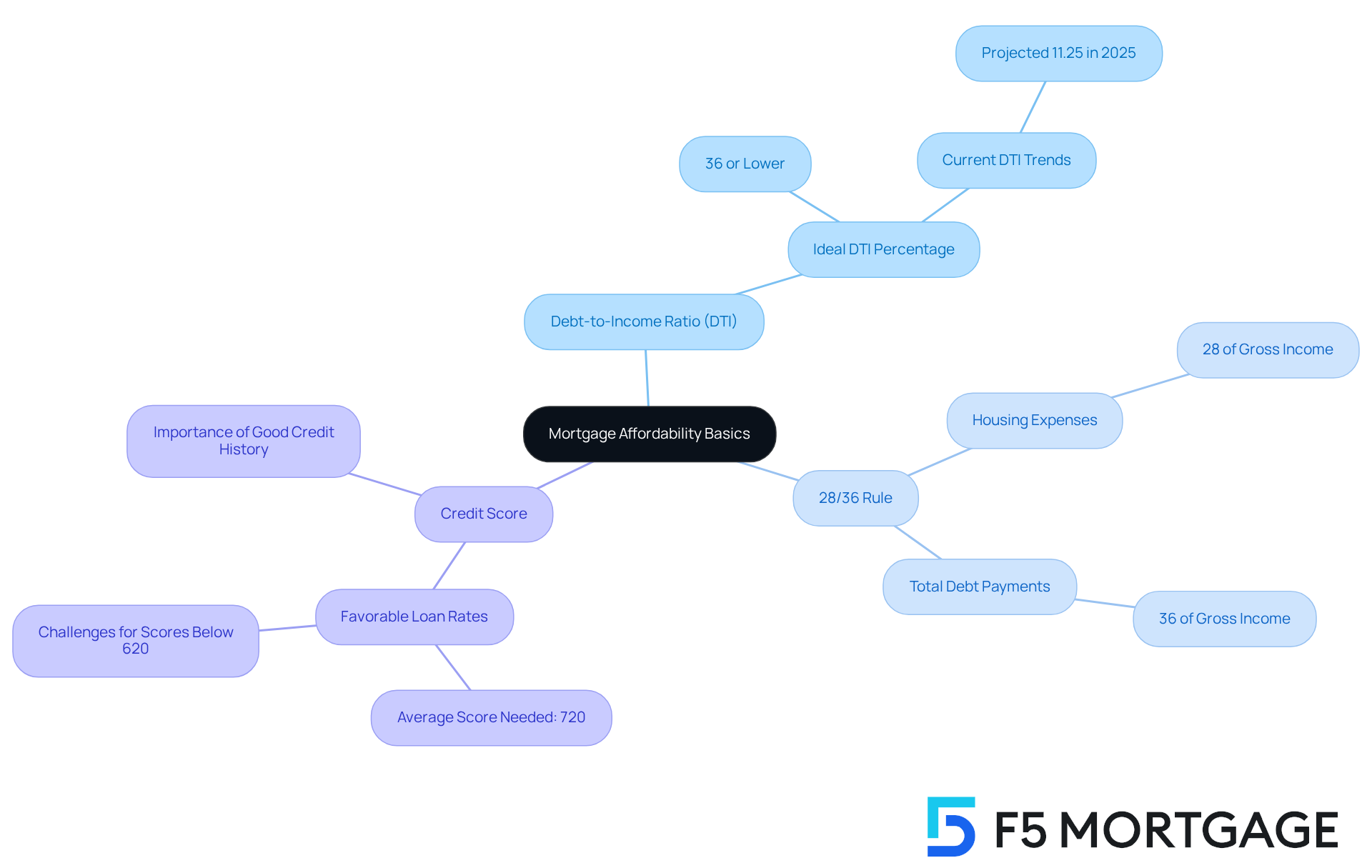

Understand Mortgage Affordability Basics

is a crucial aspect of the home buying process, and we understand how important it is to answer the question of based on your financial situation. Let’s explore some key concepts that can help you navigate this journey with confidence.

- : This ratio represents the percentage of your gross monthly income allocated to debt payments. We know that lenders typically favor a or lower, as this indicates a manageable level of debt relative to income. In 2025, keeping a low DTI is more crucial than ever, as are expected to reach 11.25% of disposable income.

- : This guideline suggests that no more than 28% of your gross monthly income should be allocated to housing expenses, which include loan costs, property taxes, and insurance. Additionally, total debt payments should not exceed 36%. Following this guideline can assist in maintaining your financial stability while handling your loan.

- : An elevated credit score greatly affects the loan rates accessible to you, directly influencing your affordability. In 2025, the is anticipated to be approximately 720 for favorable rates, while individuals with scores under 620 may encounter difficulties obtaining financing. Maintaining a good credit history is essential for accessing better loan options.

When , it’s crucial to search for lenders and compare rates, costs, and terms to ensure they align with your needs. can offer you competitive rates and customized service, making the process more seamless and better suited to your economic circumstances. Grasping these basics will enable you to establish practical expectations as you maneuver through the loan process, ensuring that you make informed choices that correspond with your economic abilities. Remember, we’re here to support you every step of the way.

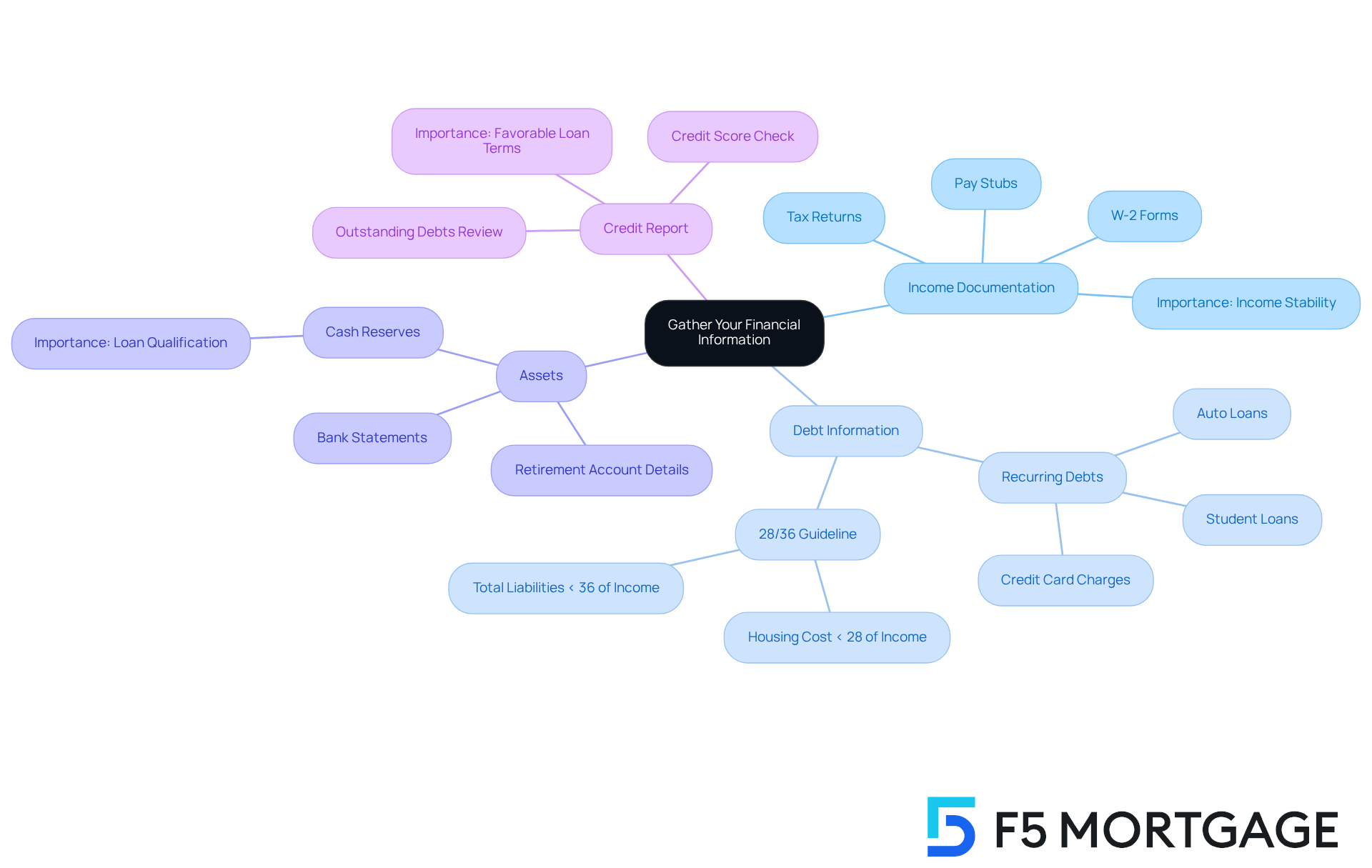

Gather Your Financial Information

To accurately assess your loan affordability, we understand how important it is to . Let’s explore the key elements together:

- : Start by including pay stubs, tax returns, and W-2 forms from the last two years. This information is vital, as lenders look at your income stability and ability to repay the loan. We know how challenging this can be, but having these documents ready can ease your worries.

- : Create a detailed list of all your recurring debts, such as credit card charges, student loans, and auto loans. Understanding your is crucial. Remember, creditors often follow the 28/36 guideline, meaning your monthly housing cost should ideally not exceed 28% of your gross monthly income, and total monthly liabilities should stay below 36%.

- Assets: Collect your bank statements, retirement account details, and any other resources that might help with your deposit. Having significant assets can improve your chances of loan qualification. Lenders appreciate applicants with cash reserves to cover several months of payments, and we’re here to support you in gathering this information.

- : Obtain a copy of your credit report to check your and identify any outstanding debts. A strong credit score is essential for securing favorable loan terms. Understanding your credit history can empower you to address any issues before applying.

By organizing this information, you not only simplify the but also equip yourself to understand and make informed decisions about your . Remember, we’re here for you every step of the way.

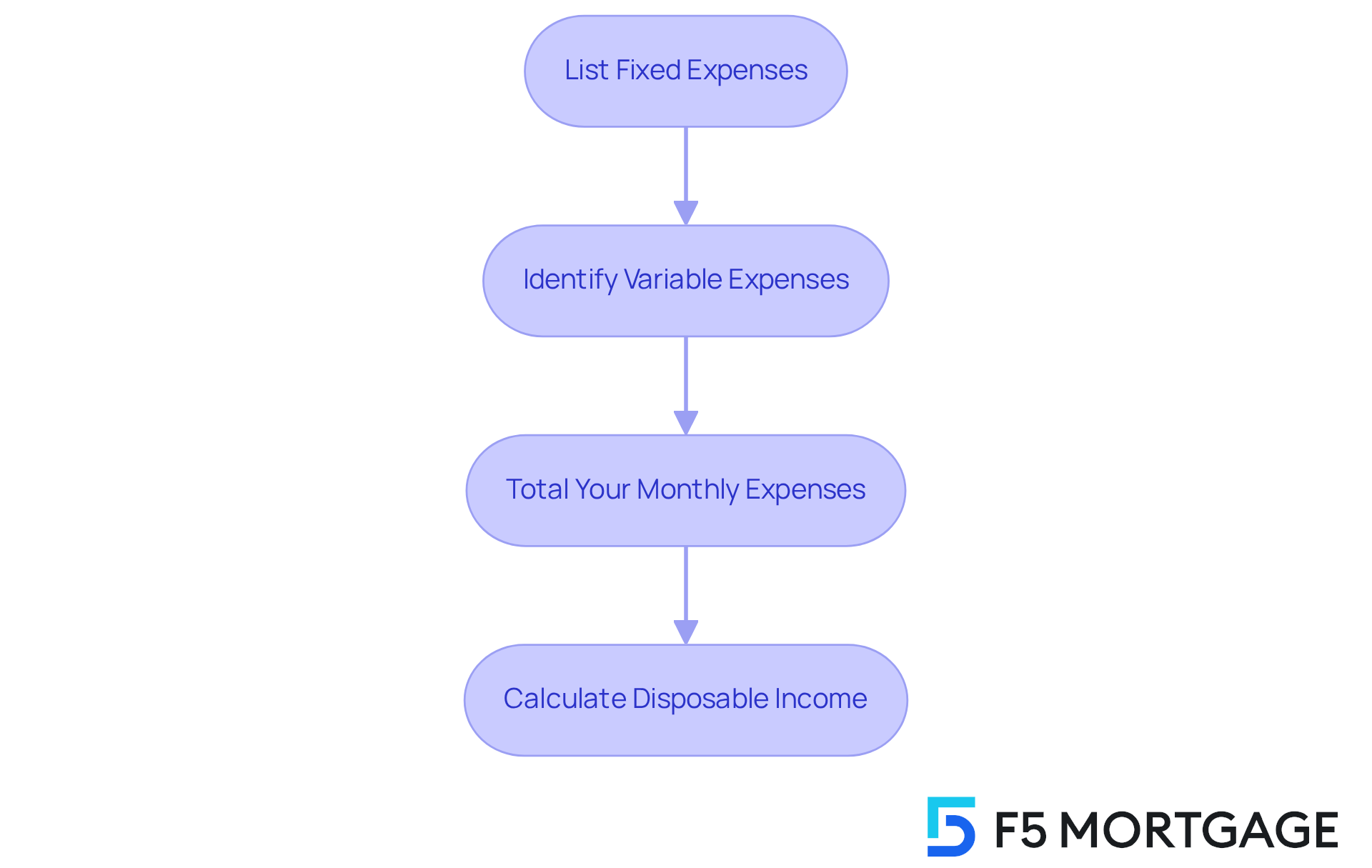

Calculate Your Monthly Expenses

To effectively determine your , let’s walk through these steps together:

- List : Begin by jotting down or rent, utilities, insurance, and any other regular payments that remain constant each month. These are the foundational expenses that help you maintain stability in your life.

- Identify Variable Expenses: Next, estimate your discretionary spending. This may include groceries, transportation, entertainment, and other costs that can fluctuate from month to month. Recognizing these can help you understand where your money goes.

- Total Your Monthly Expenses: Combine both fixed and variable expenses to gain a comprehensive view of your . This total will serve as a guide for your budgeting journey.

- Calculate : Finally, subtract your total monthly expenses from your total monthly income. This calculation shows how much you can set aside for future needs, including housing expenses.

Understanding the distinction between fixed and variable expenses is crucial for effective budgeting. We know how challenging this can be, especially when , which represent a significant share of household costs, usually consist of rent or loan payments, insurance premiums, and utility bills. In contrast, variable expenses can fluctuate based on lifestyle choices and consumption patterns. For instance, in 2025, families reported that fixed expenses constituted approximately 60% of their total monthly budget, while variable expenses made up the remaining 40%. This highlights the importance of tracking both types of expenses to .

As Omid Sanie, a Money Advisor, wisely states, “An advantage of budgeting is the tranquility that arises from having a strategy in place.” By precisely determining your available income, you can make educated choices regarding your , helping you understand that aligns with your economic capability. This approach not only aids in budgeting but also fosters . Remember, we’re here to support you every step of the way.

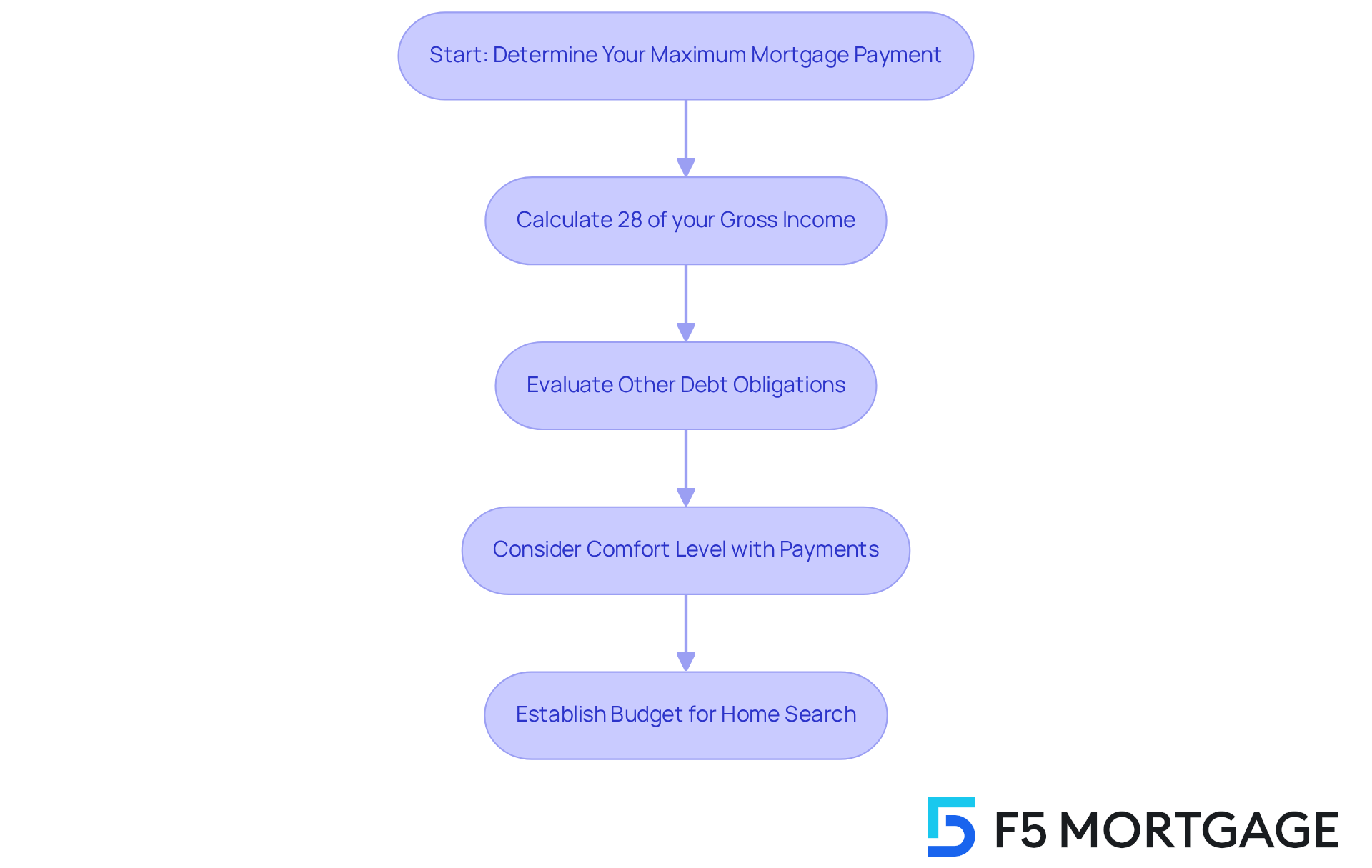

Determine Your Maximum Mortgage Payment

Determining can feel daunting, but we’re here to guide you through the process. Start by calculating . Multiply your monthly gross income by 0.28. For example, if your gross income is $5,000, your should be around $1,400.

Next, evaluate your other debt obligations. It’s important to ensure that your total debt, including the new mortgage, doesn’t exceed . For instance, if your monthly gross income is $5,000, aim to keep your under $1,800.

Finally, take a moment to reflect on your . Remember, it’s wise to maintain some flexibility for unexpected costs. Excessive spending on housing can strain your budget and impact your other financial goals, like savings or home repairs.

By following these steps, you can establish a and figure out [what can I afford mortgage](https://f5mortgage.com). This way, you’ll remain within your while . We know how challenging this can be, but together, we can navigate this journey.

Account for Additional Homeownership Costs

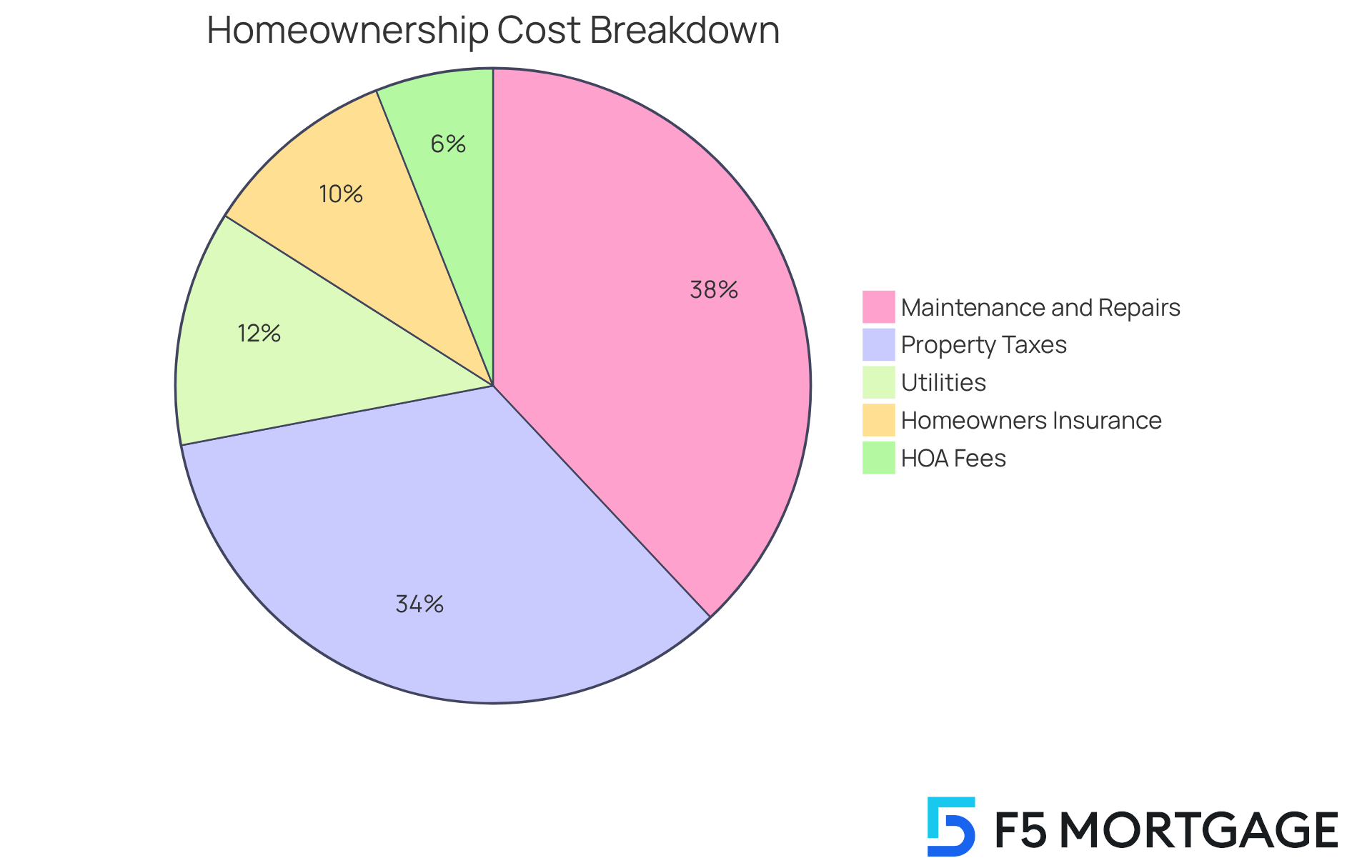

In addition to your mortgage payment, it’s important to consider these :

- : Typically paid annually or semi-annually, these can vary significantly based on your location. We know how challenging it can be to navigate these fluctuations.

- : This protects your home and belongings, but costs can vary based on the coverage you choose and where you live. Understanding your options is key.

- : It’s wise to and unexpected repairs, which are typically estimated at about 1% of your home’s value annually. We’re here to support you in planning for these expenses.

- Utilities: Don’t forget to include , as these can add up.

- HOA Fees: If applicable, homeowners association fees can also contribute to your recurring expenses.

By factoring in these costs, you can gain a more accurate picture of your , allowing you to understand and empowering you to .

Utilize Mortgage Calculators for Accurate Estimates

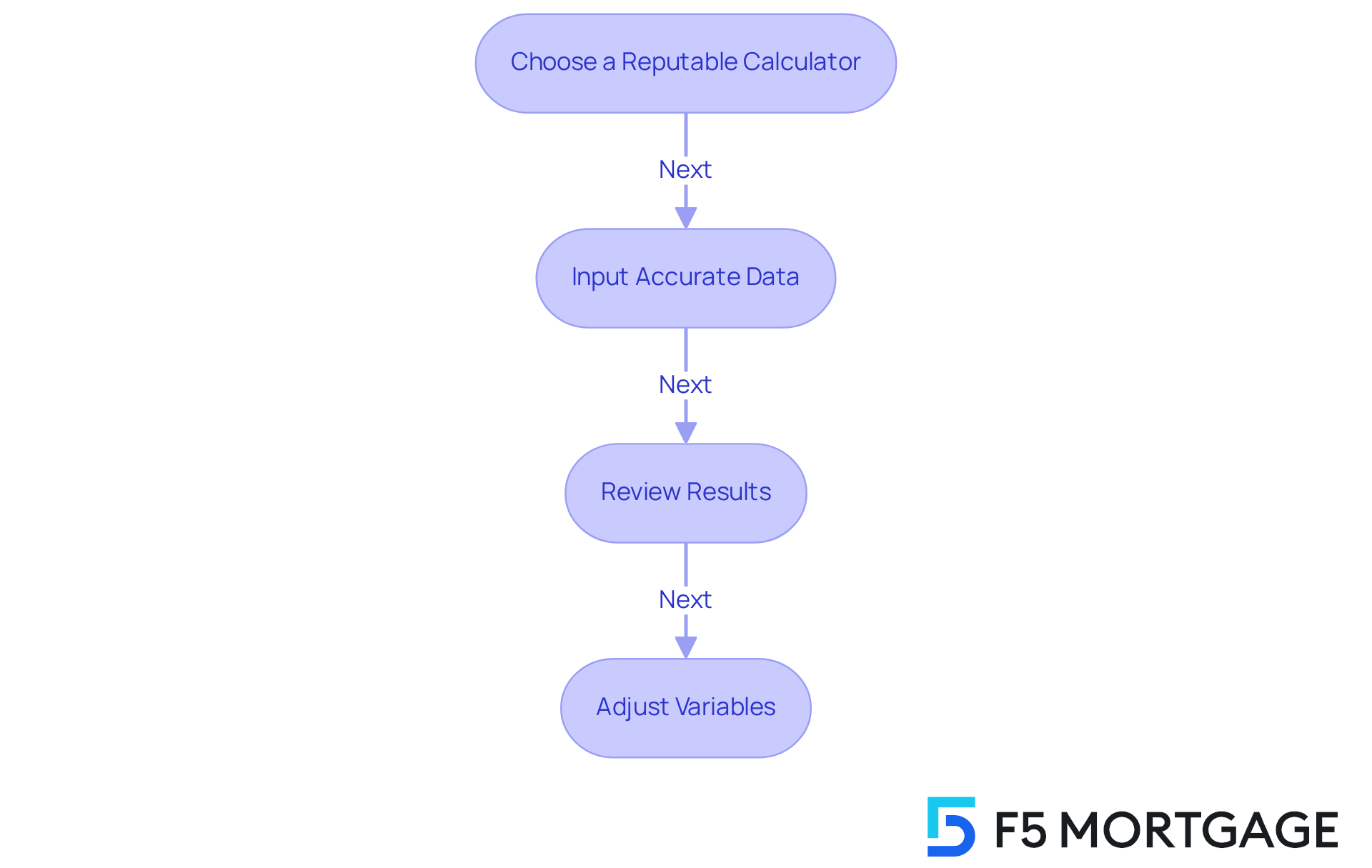

To utilize effectively, it’s important to approach the process with care and understanding:

- : We know how overwhelming it can be to find the right tools. Opt for calculators from trusted sources like Zillow, NerdWallet, or your bank’s website to ensure accuracy and peace of mind.

- Input : Enter precise information regarding your income, existing debts, down deposit, and desired loan amount. Accurate data entry is vital; even small mistakes can lead to significant differences in your projected monthly expenses. As Sherlock Holmes wisely noted, “Theories without data are mere assumptions,” reminding us of the importance of accurate information in making informed decisions.

- : Take a moment to examine the , which should include principal, interest, taxes, and insurance. A well-structured calculator will provide a comprehensive breakdown, helping you understand the . Remember, mortgage calculators often make assumptions about closing costs, lender’s fees, and other significant expenses, which can affect your overall estimate.

- : Don’t hesitate to experiment with different loan amounts, interest rates, and terms to see how they influence your regular installment. For instance, consider a $265,375 loan at a 6.25% interest rate, which results in an estimated monthly payment of $1,663 and an APR of 7.478%. This illustrates how changing these factors can modify your financial obligation.

These calculators not only help but also empower you to make informed choices regarding your . By understanding the interplay of different variables, you can better assess that aligns with your budget and financial goals. We’re here to support you every step of the way.

Consult with Mortgage Professionals for Guidance

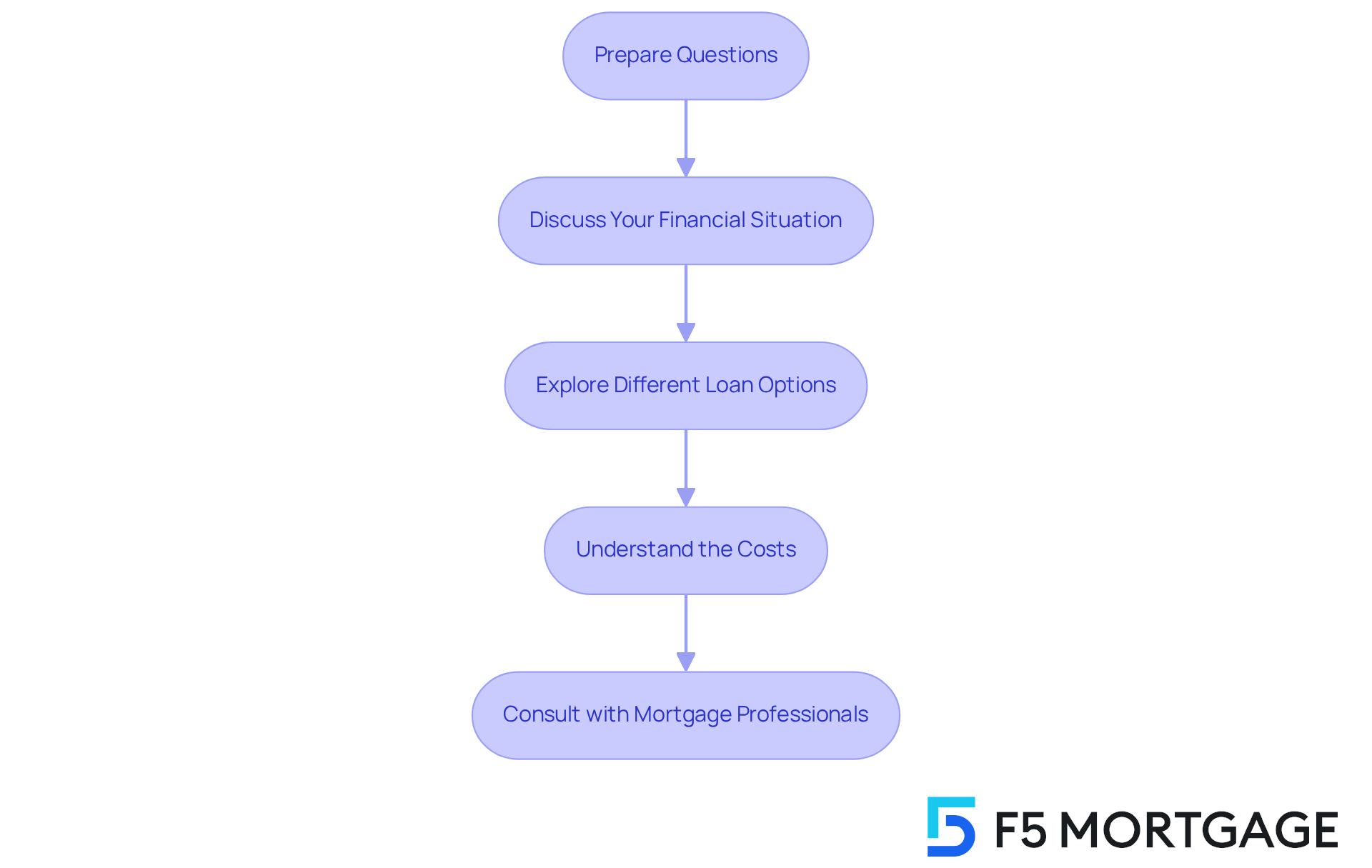

Maximize the benefits of your by following these key steps:

- Prepare Questions: We know how important it is to feel informed. Write down any inquiries about the financing process, current rates, and available options. This preparation ensures a thorough discussion that addresses your concerns regarding .

- : Transparency about your income, debts, and financial aspirations is crucial. Sharing this information allows financial advisors to provide personalized guidance tailored to your unique circumstances, helping you feel more secure in your decisions.

- : Engage in discussions about various loan types, such as , adjustable-rate, FHA, and VA loans. In 2025, clients typically review an average of five loan options during consultations, which offers a broad perspective on what suits your needs best. We’re here to support you in finding the right fit.

- : Clarify all , including closing costs and fees, to avoid surprises later in the process. Knowing what to expect can alleviate stress and help you plan effectively.

not only clarifies the complexities of financing a house but also instills confidence as you embark on your home-buying journey. As , understanding what can I afford mortgage and your financial landscape is more critical than ever. Remember, we’re here to guide you every step of the way.

Conclusion

Understanding what you can afford for a mortgage is essential for a successful home-buying journey. We know how challenging this can be. By grasping the fundamentals of mortgage affordability, you can make informed decisions that align with your financial capabilities. This guide has illuminated the various factors that impact mortgage affordability, from debt-to-income ratios and credit scores to the importance of budgeting for additional homeownership costs.

Key insights discussed include:

- The significance of the 28/36 rule, which helps maintain a balanced financial outlook

- The necessity of gathering accurate financial documentation

- Calculating monthly expenses

- Utilizing mortgage calculators to provide clarity on potential payments

- Engaging with mortgage professionals to enhance your understanding of available options and associated costs

Ultimately, being proactive in assessing your financial readiness and understanding the intricacies of mortgage affordability can empower you to navigate your journey with confidence. By taking these steps, you can not only secure a mortgage that fits your budget but also lay the groundwork for a stable and fulfilling homeownership experience. We’re here to support you every step of the way.

Frequently Asked Questions

What is mortgage affordability?

Mortgage affordability refers to the ability to manage monthly mortgage payments based on your financial situation, including income, debt, and credit score.

What is the Debt-to-Income Ratio (DTI)?

The Debt-to-Income Ratio (DTI) is the percentage of your gross monthly income that goes towards debt payments. Lenders typically prefer a DTI of 36% or lower to indicate manageable debt levels.

What is the 28/36 Rule?

The 28/36 Rule suggests that no more than 28% of your gross monthly income should be spent on housing expenses, and total debt payments should not exceed 36%. This guideline helps maintain financial stability.

How does my credit score affect mortgage affordability?

A higher credit score can lead to better loan rates, which directly impacts affordability. In 2025, an average credit score of around 720 is expected for favorable rates, while scores below 620 may face financing challenges.

What financial information should I gather for loan affordability assessment?

You should gather income documentation (pay stubs, tax returns, W-2 forms), a list of recurring debts, assets (bank statements, retirement accounts), and a copy of your credit report.

Why is it important to have accurate income documentation?

Accurate income documentation helps lenders assess your income stability and ability to repay the loan, making it crucial for the loan approval process.

How can I improve my chances of loan qualification?

Collecting significant assets and maintaining a strong credit score can improve your chances of loan qualification, as lenders prefer applicants with cash reserves for several months of payments.

What should I do if I find issues in my credit report?

If you find issues in your credit report, addressing them before applying for a loan can help you secure more favorable loan terms and improve your overall credit score.

How can collaborating with a mortgage lender help me?

Collaborating with a mortgage lender, like F5 Mortgage, can provide competitive rates and customized service, making the loan process more seamless and tailored to your financial circumstances.