Overview

Navigating the journey to homeownership can feel overwhelming, especially when it comes to understanding costs like Private Mortgage Insurance (PMI). This article serves as a caring guide, offering a step-by-step approach to calculating PMI, which is crucial for managing your overall expenses. We know how challenging this can be, and by breaking down the calculation process, we aim to empower you.

First, we’ll explore how to determine the following elements:

- Loan amount

- Appraised value

- LTV ratio

These elements are essential in understanding your PMI. Additionally, we’ll discuss factors that influence PMI rates, such as:

- The size of your down payment

- Your credit score

By equipping you with this knowledge, we hope to help you make informed financial decisions that align with your family’s needs.

Remember, you’re not alone in this process. We’re here to support you every step of the way, ensuring you feel confident as you take on the responsibilities of homeownership. Together, we can navigate these complexities and work towards a brighter future in your new home.

Introduction

Understanding the intricacies of Private Mortgage Insurance (PMI) can feel overwhelming, especially for homebuyers navigating the complex landscape of mortgage financing. We know how challenging it can be to secure a sufficient down payment, and that’s where PMI becomes a pivotal factor in determining overall homeownership costs.

In this article, we will guide you through the step-by-step process of calculating PMI, uncovering the factors that influence its rates and offering strategies for potential savings.

How can you effectively manage this often-overlooked expense and ensure that you make informed financial decisions?

We’re here to support you every step of the way.

Understand Private Mortgage Insurance (PMI)

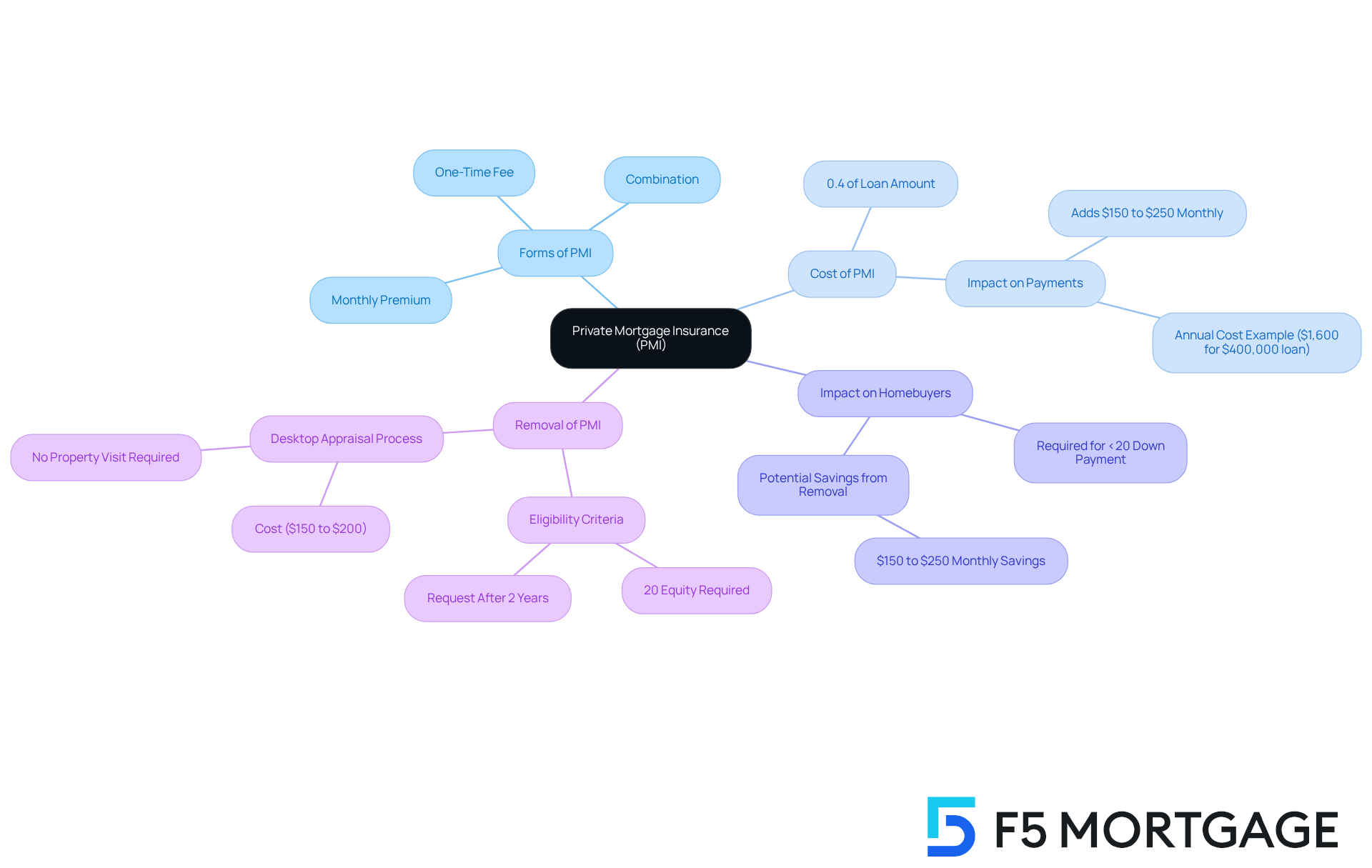

Private Mortgage Insurance (PMI) plays a vital role in the mortgage landscape, especially for families who might struggle to gather a down payment of at least 20% of the home’s purchase price. This insurance is designed to protect lenders in case of borrower default, making it a requirement for many homebuyers. We understand how crucial it is to grasp how to , as this significantly affects the overall cost of homeownership.

PMI can come in different forms:

- It may be paid as a monthly premium

- A one-time upfront fee

- A combination of both

Currently, the typical cost of PMI hovers around 0.4% of the loan amount, which translates to about $1,600 annually for a $400,000 mortgage. This additional expense can add between $150 to $250 to monthly payments, especially as home insurance costs rise.

Consider a scenario where a family buys a home for $400,000 with a 10% deposit of $40,000. In this case, knowing [how to calculate PMI](https://f5mortgage.com/steps-to-remove-pmi-from-your-mortgage-for-families) is important, as it would typically be included in the monthly mortgage payment, increasing the total cost of homeownership. Conversely, if a buyer can provide a 20% deposit, they can avoid PMI altogether, leading to significant savings.

As we look ahead to 2025, average PMI rates fluctuate depending on the type of financing. Traditional loans often require PMI for down payments under 20%, while government-backed loans, such as FHA loans, do not. Families with lower credit scores or smaller down payments may face PMI costs exceeding 1% annually, further impacting their financial responsibilities.

Real-world examples highlight the importance of understanding PMI. Homeowners who have lived in their homes for at least two years and have built up 20% equity may qualify to remove PMI, resulting in lower monthly expenses. However, it’s essential for homeowners to actively assess their situations, as lenders typically do not inform them about increased home values that could allow for PMI removal.

In conclusion, understanding how to calculate PMI is crucial for homebuyers in 2025, as it directly affects their mortgage expenses and long-term financial planning. We’re here to support you every step of the way as you navigate this journey.

Identify Factors Affecting PMI Calculation

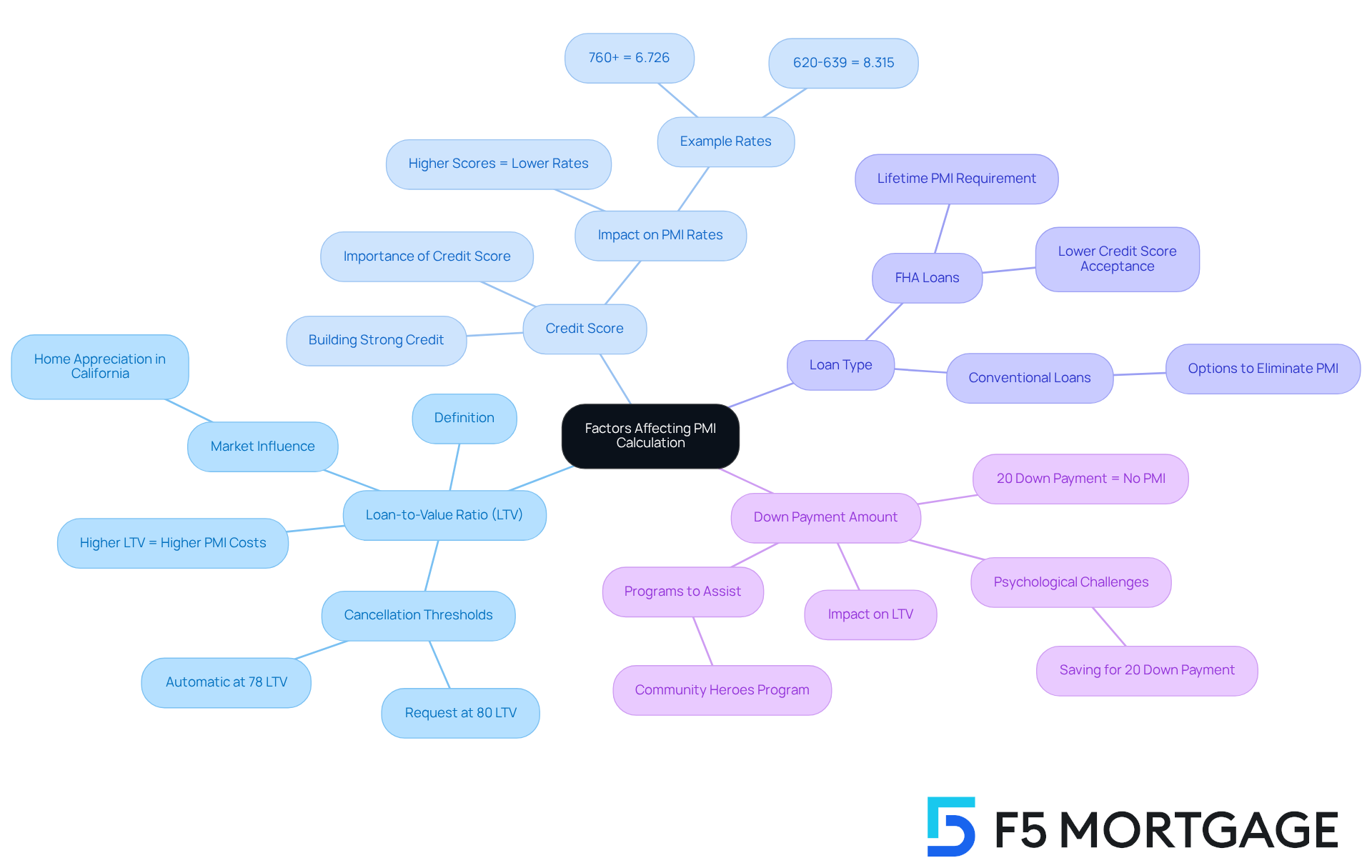

Several factors significantly influence how to calculate PMI, and understanding these factors can help you navigate your mortgage journey with confidence.

- Loan-to-Value Ratio (LTV): This ratio compares the loan amount to the appraised value of your property. A higher LTV generally leads to increased PMI costs, as it indicates a greater risk to lenders. For instance, if you have a mortgage amount of $320,000 on a home valued at $400,000, your LTV is 80%. This may allow for PMI cancellation once you achieve 20% equity. You can when your LTV ratio falls to 80%, or it will be automatically canceled at 78% LTV or after the midpoint of your mortgage term. In markets like California, home appreciation rates can help you reach a favorable LTV more quickly, potentially allowing for PMI removal sooner than expected.

- Credit Score: We know how important your credit score is. Borrowers with higher credit scores typically qualify for lower PMI rates. Lenders view these borrowers as less risky, which can lead to significant savings. For example, a borrower with a credit score of 760 or above may secure a refinance APR of approximately 6.726%, while those with scores between 620 and 639 could face rates as high as 8.315%. This disparity highlights the importance of maintaining a strong credit profile. As Lindsay Miles wisely noted, “A higher credit score not only enhances your chances of being approved for a mortgage but also assists you in qualifying for better financing terms, lower interest rates, and decreased upfront costs.”

- Loan Type: Different financing options, such as FHA and conventional loans, come with varying PMI requirements and rates. FHA loans may allow for lower credit scores but often require PMI for the life of the loan. On the other hand, conventional loans might offer options to eliminate PMI once certain equity thresholds are met. If you’re considering refinancing, exploring these options could be beneficial for removing PMI.

- Down Payment Amount: The size of your down payment directly affects the LTV and, consequently, the PMI rate. A larger initial deposit decreases the LTV, which can reduce PMI expenses. For instance, a 20% deposit on a $400,000 house totals $80,000, effectively removing the necessity for PMI altogether. However, many prospective homebuyers face the psychological challenge of saving for a 20% down payment, especially amid high inflation and rising housing costs. Programs like the Community Heroes First-Time Homebuyer Program offer no down payment and eliminate PMI, providing valuable options for eligible buyers.

Furthermore, if you have significant expenses such as medical bills or education fees, you might consider a cash-out refinance to access equity while potentially reducing your LTV ratio. Just be sure to approach this cautiously, ensuring that the new mortgage comes with a more affordable interest rate.

By comprehending these elements, you can understand how to calculate PMI expenses accurately and make informed financial choices, ultimately leading to better mortgage conditions. Average PMI expenses generally range from 0.30% to 1.15% of the balance each year, which is an important factor for budgeting. For competitive rates and personalized service, we encourage you to consider working with F5 Mortgage. We’re here to support you every step of the way.

Calculate Your PMI: Step-by-Step Process

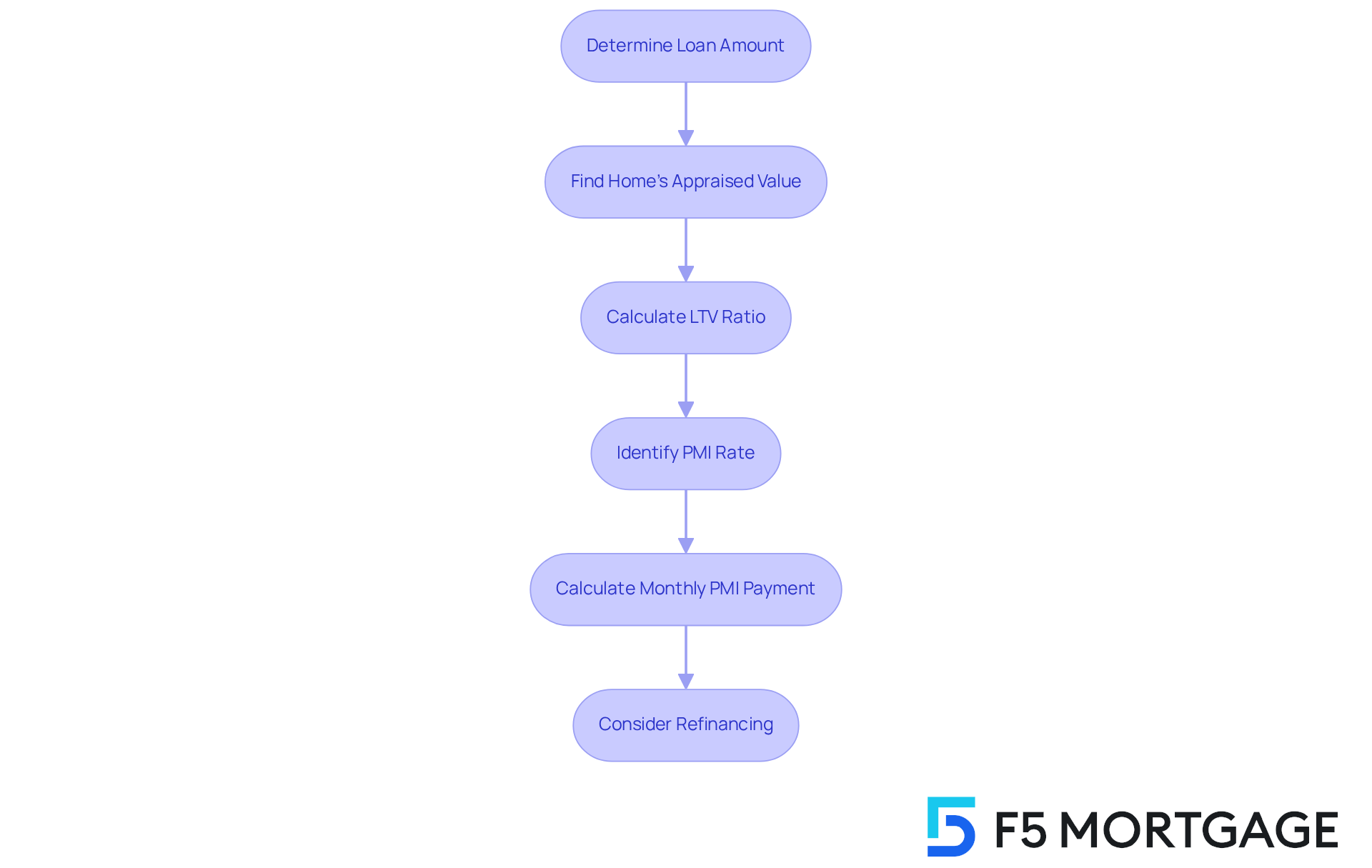

Calculating your PMI can feel overwhelming, but we’re here to support you with how to calculate PMI every step of the way. Let’s break it down together into manageable steps:

- Determine the Loan Amount: Start by identifying the total amount you plan to borrow. This is your foundation.

- Find the Home’s Appraised Value: Next, obtain the appraised value of your home. You can do this through a professional appraisal or by checking recent sales of similar homes in your area.

- Calculate the LTV Ratio: Now, let’s calculate your Loan-to-Value (LTV) ratio using this formula:

LTV = (Loan Amount / Appraised Value) x 100

For example, if you are borrowing $200,000 for a home valued at $250,000, your LTV would be 80%. - Identify Your PMI Rate: It’s essential to check with your lender for the PMI rate that applies to your situation. Rates can vary from 0.5% to 2% of the initial amount each year. For instance, for a $400,000 loan with a 5% deposit, the PMI is roughly $120 each month, indicating a PMI rate of 0.36%.

- Calculate Your Monthly PMI Payment: Finally, let’s calculate your monthly PMI payment using this formula:

Monthly PMI = (Loan Amount x PMI Rate) / 12

If your PMI rate is 0.5%, your monthly PMI would be:

Monthly PMI = ($200,000 x 0.005) / 12 = $83.33.

By following these steps, you can understand how to calculate PMI accurately and incorporate it into your monthly budget. Understanding how refinancing can affect your total mortgage expenses is also crucial. For example, determining your break-even point during refinancing can help you figure out how long it will take to recover the expenses through savings in monthly installments. To compute your break-even threshold, assess your refinancing expenses, calculate your monthly savings by subtracting your new monthly fee from your existing fee, and divide your refinancing expenses by your monthly savings.

This holistic approach to understanding your mortgage can lead to better financial decisions. We know how challenging this can be, especially when considering the current assessed value trends in the real estate market, as variations can and, therefore, your PMI expenses. Many homebuyers make common mistakes when learning how to calculate PMI, such as not considering the most recent appraised value or failing to verify their PMI rate with lenders. Additionally, it’s important to note that PMI can adjust after 10 years, which may affect your long-term financial planning.

Explore Strategies to Reduce or Eliminate PMI

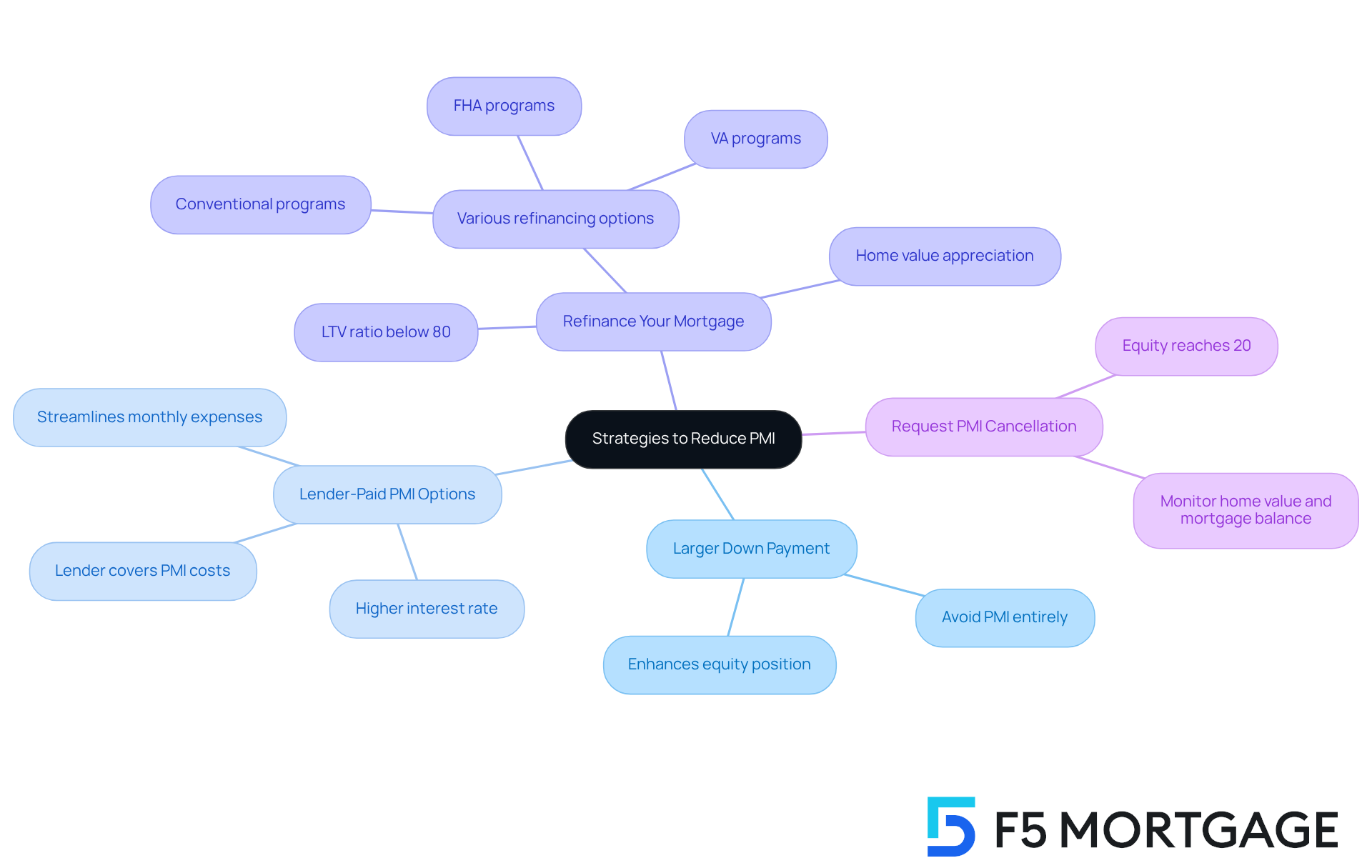

To effectively reduce or eliminate Private Mortgage Insurance (PMI), consider the following strategies:

- Make a Larger Down Payment: Aiming for a down payment of 20% or more can help you avoid PMI entirely. This not only reduces your monthly expenses but also enhances your equity position from the very beginning. We know how important it is to make the most of your investment.

- Explore Lender-Paid PMI Options: Some lenders, including F5 Mortgage, provide the option of lender-paid PMI, where they cover the PMI costs in exchange for a slightly higher interest rate. This can be beneficial for individuals intending to remain in their residences for an extended period, as it streamlines monthly expenses and alleviates financial stress.

- Refinance Your Mortgage: If your home has appreciated in value, refinancing your mortgage could be a way to learn how to calculate PMI, especially if your new loan-to-value (LTV) ratio falls below 80%. Given that home values in Colorado have surged significantly in recent years, many homeowners may find themselves in a favorable position to refinance. F5 Mortgage provides several refinancing choices, such as conventional, FHA, and VA programs, which can assist you in obtaining competitive rates and possibly removing PMI. A recent case study highlights how homebuyers have successfully eliminated PMI amid rising home values, showcasing the possibilities available to you.

- Request PMI Cancellation: Once your equity reaches 20%, you can formally request your lender to cancel PMI. It’s crucial to monitor your home’s value and mortgage balance to support this request effectively, ensuring you are empowered in this process.

Implementing these strategies can lead to significant savings, potentially reducing monthly payments by $150 to $250. Homeowners should understand how to calculate PMI, as it typically costs between 0.5% and 1.5% of the original loan amount per year, so we encourage them to review their PMI policies regularly. Many may not realize they are eligible for elimination. By taking proactive steps, you can make your mortgage more manageable and financially beneficial, and we’re here to support you every step of the way.

Conclusion

Understanding how to calculate Private Mortgage Insurance (PMI) is essential for homebuyers aiming to make informed decisions about their mortgage expenses. We know how challenging this can be, and this knowledge not only helps in budgeting but also plays a crucial role in long-term financial planning. PMI can significantly impact monthly payments and overall affordability.

Key insights discussed throughout the article highlight the various factors influencing PMI calculations. These include:

- Loan-to-value ratio

- Credit score

- Loan type

- Down payment amount

By grasping these elements, homebuyers can effectively estimate their PMI costs and explore strategies to reduce or eliminate this expense. Options such as making a larger down payment, refinancing, or requesting PMI cancellation once sufficient equity is reached can make a meaningful difference.

Ultimately, being proactive in understanding and managing PMI can lead to substantial savings and a more favorable mortgage experience. We’re here to support you every step of the way. Homebuyers are encouraged to utilize the outlined strategies and stay informed about their options, ensuring they take control of their financial future in the real estate market.

Frequently Asked Questions

What is Private Mortgage Insurance (PMI)?

Private Mortgage Insurance (PMI) is insurance designed to protect lenders in case of borrower default, often required for homebuyers who make a down payment of less than 20% of the home’s purchase price.

Why is PMI important for homebuyers?

PMI is important because it allows homebuyers who may struggle to gather a 20% down payment to still secure a mortgage, although it adds to the overall cost of homeownership.

How can PMI be paid?

PMI can be paid in several ways: as a monthly premium, as a one-time upfront fee, or a combination of both.

What is the typical cost of PMI?

The typical cost of PMI is around 0.4% of the loan amount, which translates to about $1,600 annually for a $400,000 mortgage.

How does PMI affect monthly mortgage payments?

PMI can add between $150 to $250 to monthly mortgage payments, depending on the loan amount and other factors.

What happens if a buyer makes a 20% down payment?

If a buyer can provide a 20% down payment, they can avoid PMI altogether, leading to significant savings on their mortgage expenses.

How do PMI rates change over time?

PMI rates fluctuate depending on the type of financing. Traditional loans typically require PMI for down payments under 20%, while government-backed loans, like FHA loans, do not.

Who might face higher PMI costs?

Families with lower credit scores or smaller down payments may face PMI costs exceeding 1% annually, which can further impact their financial responsibilities.

Can homeowners remove PMI after a certain period?

Yes, homeowners who have lived in their homes for at least two years and have built up 20% equity may qualify to remove PMI, resulting in lower monthly expenses.

Should homeowners actively monitor their PMI status?

Yes, homeowners should actively assess their situations regarding PMI removal, as lenders typically do not inform them about increased home values that could allow for PMI elimination.