Overview

Understanding earnest money can be a daunting task, but we’re here to support you every step of the way. Generally, earnest money is refundable under specific conditions, such as financing, inspection, or appraisal contingencies. These contingencies allow buyers to cancel the contract without losing their deposit, providing a safety net during the home-buying process.

It’s crucial to grasp the terms of your purchase agreement. By acting in good faith and adhering to deadlines, you can protect your earnest money. However, be mindful that waiving contingencies or missing deadlines can lead to forfeiting these funds. We know how challenging this can be, but with the right knowledge, you can navigate this process with confidence.

Introduction

Navigating the world of real estate can feel overwhelming, especially when it comes to understanding the nuances of earnest money. We know how challenging this can be. This crucial deposit not only reflects a buyer’s commitment but also plays a significant role in the negotiation process.

However, a pressing question arises: under what circumstances can this money be reclaimed? What risks do buyers face if the deal falls through? By exploring the ins and outs of earnest money, homebuyers can empower themselves with the knowledge needed to protect their interests and secure their dream home.

We’re here to support you every step of the way.

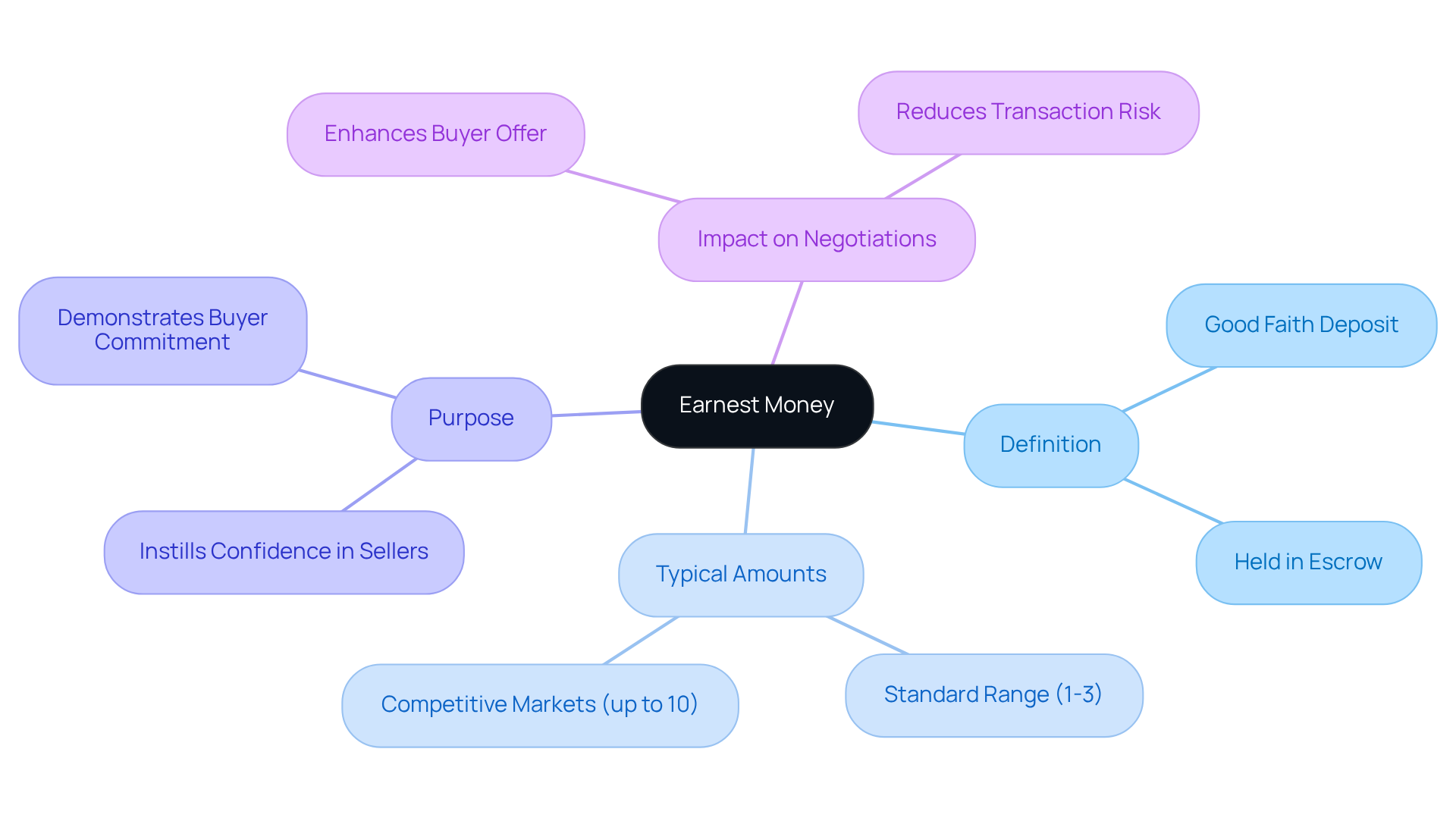

Define Earnest Money and Its Purpose

Earnest money is a vital payment made by a purchaser to show their serious intent to acquire a property. Typically, this down payment ranges from 1% to 3% of the purchase price; however, in competitive markets, it can soar to as high as 10%. This deposit is held in escrow until the transaction is finalized, serving as a testament to the purchaser’s commitment to the deal. If everything goes as planned, the deposit is usually applied toward the purchaser’s down payment or closing expenses.

The primary aim of deposit funds is to instill confidence in sellers, assuring them that purchasers are genuinely committed to their proposals. We understand how challenging this can be; without a good faith deposit, sellers may hesitate to accept an offer. This deposit signifies the buyer’s dedication and reduces the likelihood of the transaction falling through. If the deal collapses due to conditions specified in the purchase agreement—such as financing, appraisal, or home inspection issues—it raises the question of whether earnest money is refundable, depending on the circumstances.

Understanding the importance of deposit funds is crucial for home purchasers. Not only do they represent good faith, but they also play a significant role in negotiations and contract terms. For instance, in a $400,000 home purchase, good faith payments typically range from $4,000 to $12,000. This amount can significantly influence the seller’s decision, especially in competitive markets. emphasize that offering a substantial deposit can enhance a purchaser’s position, making their proposal more appealing to sellers. As Jessica Rapp, a real estate specialist, notes, ‘Earnest funds are utilized to demonstrate to the seller that you, as the purchaser, are dedicated to acquiring the property from them.’ This commitment can be a decisive factor in securing your dream home.

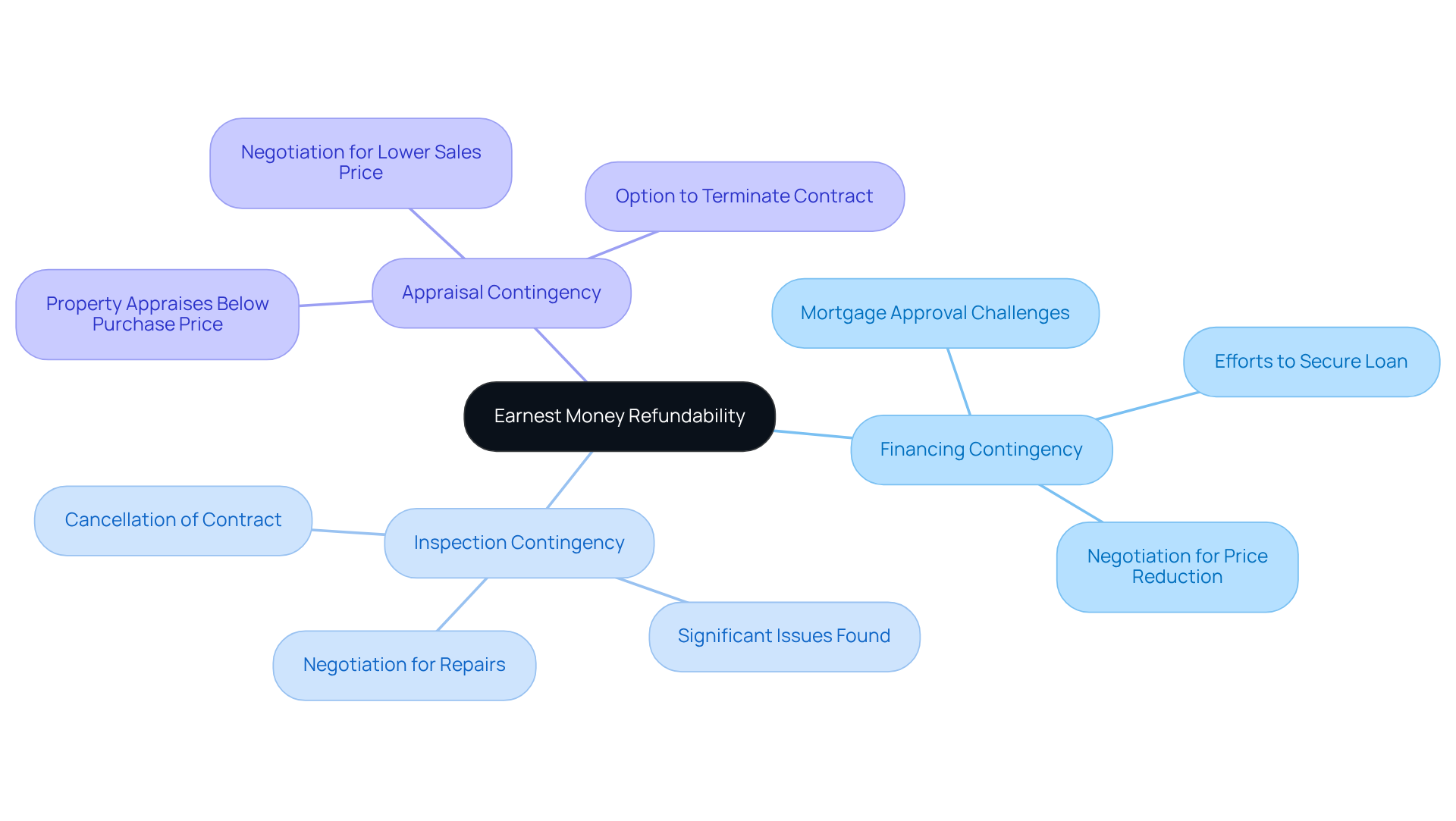

Determine If Earnest Money Is Refundable

When considering whether , it’s essential to carefully review the conditions outlined in your purchase contract. We understand how important this decision is for you, and knowing your rights can provide peace of mind. Generally, earnest money can be reclaimed if you decide to cancel the contract due to specific contingencies, such as:

- Financing Contingency: If securing a mortgage proves challenging, you typically have the right to recover your earnest money. This safeguard is crucial, as it protects you from losing your deposit if financing falls through, provided you’ve made every effort to secure the necessary loan.

- Inspection Contingency: Should a home inspection uncover significant issues, you can choose to exit the transaction and receive your deposit back. This contingency allows you to negotiate repairs or a price reduction, ensuring that you’re not financially burdened by unexpected problems.

- Appraisal Contingency: If the property appraises for less than the agreed purchase price, you often have the option to terminate the contract and recover your deposit. This clause is especially important in competitive markets, where appraisal discrepancies can greatly affect financing.

To determine if earnest money is refundable, it’s vital to act in good faith and adhere to all timelines specified in the agreement. We know how challenging this can be, and missing these obligations may jeopardize your ability to reclaim your funds. In fact, statistics show that a significant number of purchasers who include contingencies in their offers often wonder if earnest money is refundable, and they are more likely to retain their deposits. This highlights the importance of these protective measures in your real estate journey. Remember, we’re here to support you every step of the way.

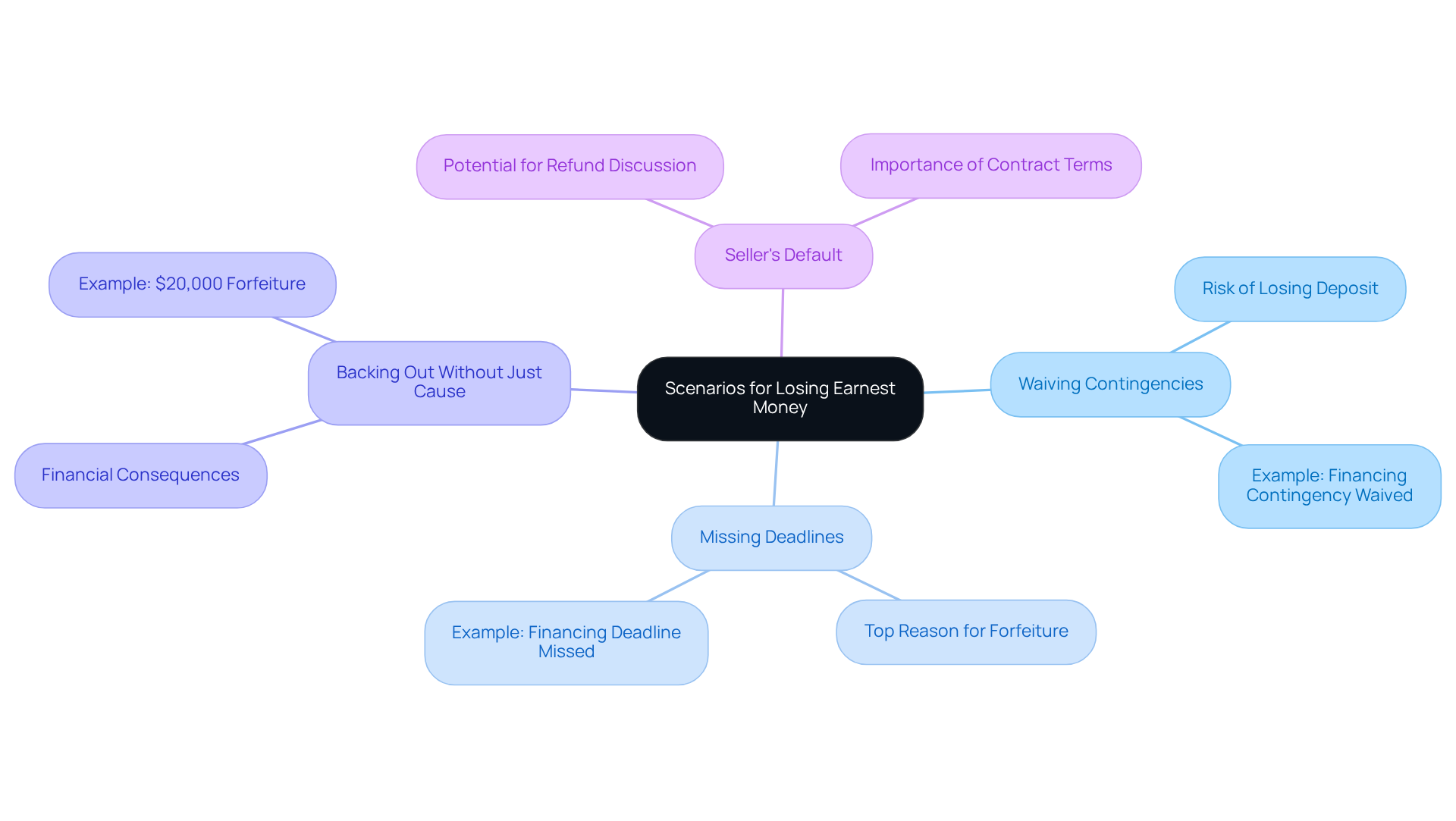

Identify Scenarios Where Earnest Money Is Lost

Several scenarios can lead to the loss of a buyer’s earnest money deposit, each carrying significant implications that we know can be concerning:

- Waiving Contingencies: Buyers often waive contingencies to strengthen their offers in competitive markets. However, this choice can have negative consequences. If they later decide to retract from the agreement, they risk losing their deposit. For example, a purchaser who relinquished their financing contingency may forfeit their earnest money if they cannot obtain a mortgage.

- Missing Deadlines: Adhering to deadlines specified in the purchase agreement is crucial. In fact, failing to meet deadlines is the top reason purchasers forfeit their security payment. For instance, if a buyer misses the financing contingency deadline, the seller may keep the funds if the purchaser is unable to obtain a loan.

- Backing Out Without Just Cause: If a purchaser withdraws from the transaction without a legitimate reason as defined in the contract, they may lose their deposit. A significant instance included a purchaser who forfeited a $20,000 advance after canceling a $1.2 million agreement just prior to closing, illustrating the financial dangers of such choices.

- Seller’s Default: In situations where the seller does not fulfill their contractual responsibilities, the purchaser may still need to discuss the refund of their deposit. The outcome often depends on the specific terms outlined in the purchase agreement, underscoring the importance of .

Being aware of these scenarios enables purchasers to take proactive steps to protect their earnest funds. This includes including suitable contingencies and maintaining open communication with their real estate agents and lawyers. Additionally, buyers should be aware that California Civil Code section 1057.3 states that refusal to sign a release can lead to liability for up to $1,000 and attorney’s fees. As Matthew B. Lane, a paralegal at Lane, Lane & Kelly, LLP, wisely observes, “By incorporating contingencies, being mindful of deadlines, negotiating advantageous terms, and seeking legal counsel, you can protect your funds and prevent unnecessary financial losses.” We’re here to support you every step of the way.

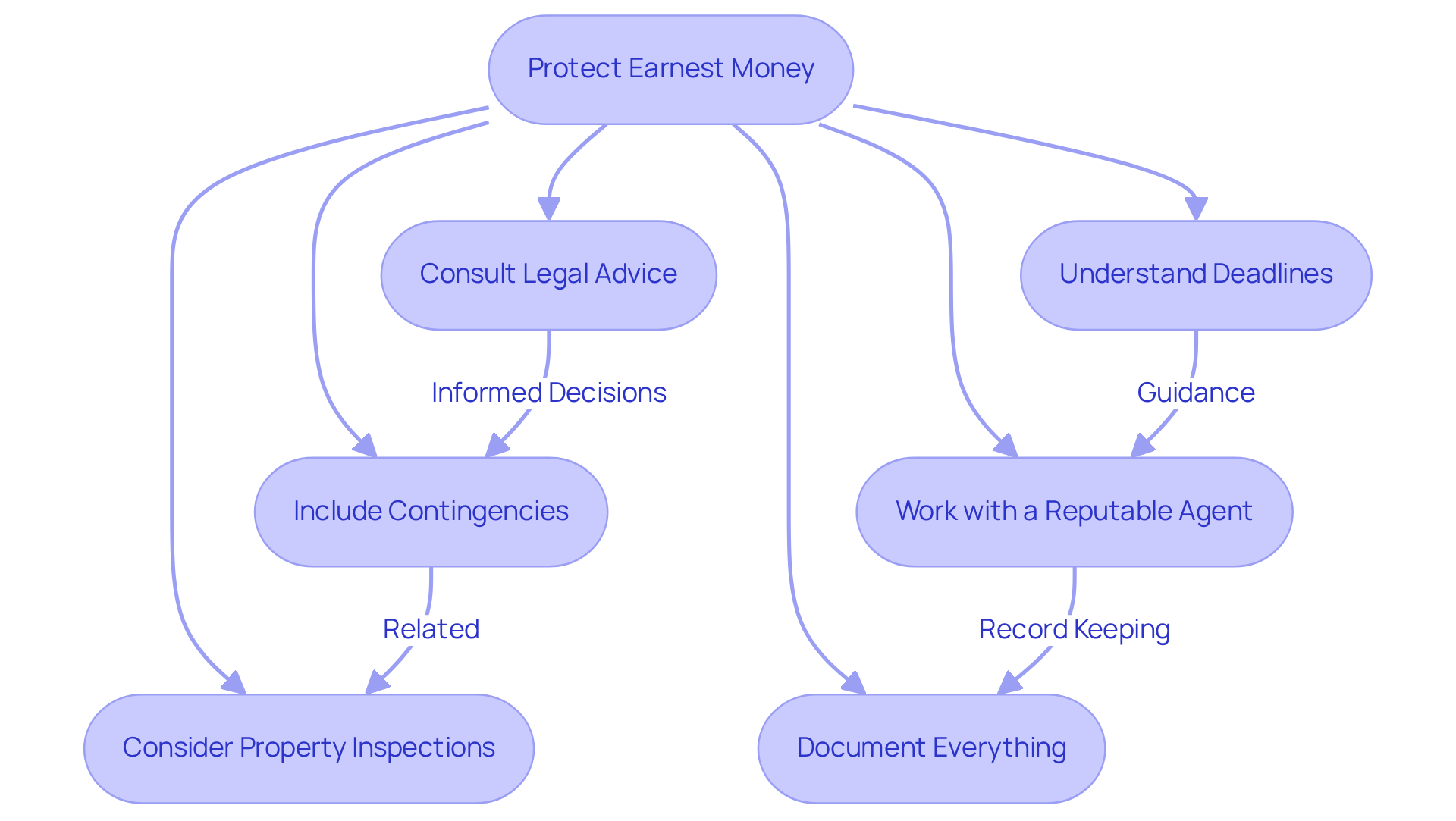

Implement Strategies to Protect Your Earnest Money

To effectively protect your earnest money deposit, we know how important it is to consider implementing the following strategies:

- Include Contingencies: Incorporate essential contingencies in , such as financing, inspection, and appraisal contingencies. These clauses serve as safeguards, allowing you to withdraw from the transaction without losing your deposit if certain conditions are not met.

- Understand Deadlines: Familiarize yourself with all deadlines associated with these contingencies. Adhering to these deadlines is essential for preserving your rights and preventing the loss of your deposit.

- Work with a Reputable Agent: Collaborate with who can provide guidance throughout the process. Their expertise can help you navigate potential pitfalls and ensure that your interests are protected.

- Document Everything: Maintain thorough records of all communications and agreements related to the transaction. This documentation can be invaluable in resolving disputes and protecting your rights.

- Consult Legal Advice: If you have any uncertainties regarding the terms of your contract, seek legal counsel. Comprehending your rights and duties regarding initial funds is crucial for making informed choices.

- Consider Property Inspections: Be aware that lenders may require an inspection to ensure the property is in good condition. A home needing major repairs may not qualify for refinancing loans, which could impact your financial strategy. Grasping these requirements can assist you in negotiating more effectively and safeguarding your deposit.

By implementing these strategies, you can significantly mitigate the risk of losing your earnest money, which raises the question of whether earnest money is refundable, allowing you to enjoy greater peace of mind during your home buying journey. We’re here to support you every step of the way.

Conclusion

Understanding the intricacies of earnest money is essential for homebuyers navigating the real estate market. This deposit signifies a buyer’s commitment to a property and plays a pivotal role in the negotiation process. While earnest money can often be refundable, the conditions surrounding its return depend on the specific terms of the purchase agreement. We know how challenging this can be, so it’s crucial for buyers to be well-informed about their rights and the potential scenarios that could lead to the loss of their deposit.

Key insights from this guide highlight the importance of:

- Including contingencies

- Adhering to deadlines

- Maintaining open communication with real estate professionals

By doing so, buyers can protect their earnest money and minimize the risk of forfeiture due to missed deadlines or waived contingencies. Additionally, understanding the legal implications and seeking professional advice can empower buyers to make informed decisions throughout their home buying journey.

Ultimately, safeguarding earnest money is a critical aspect of securing a property. Buyers are encouraged to implement best practices, such as:

- Documenting communications

- Consulting with experts

By taking these proactive steps, homebuyers can navigate the complexities of earnest money with confidence, ensuring that their investment is protected as they work toward acquiring their dream home.

Frequently Asked Questions

What is earnest money?

Earnest money is a payment made by a purchaser to demonstrate their serious intent to acquire a property. It typically ranges from 1% to 3% of the purchase price, but can be as high as 10% in competitive markets.

What is the purpose of earnest money?

The purpose of earnest money is to instill confidence in sellers by showing that purchasers are genuinely committed to their offers. It serves as a testament to the buyer’s dedication and reduces the likelihood of the transaction falling through.

How is earnest money handled during a transaction?

Earnest money is held in escrow until the transaction is finalized. If everything goes as planned, the deposit is usually applied toward the purchaser’s down payment or closing expenses.

Is earnest money refundable?

Whether earnest money is refundable depends on the circumstances surrounding the deal. If the transaction collapses due to conditions specified in the purchase agreement, such as financing or inspection issues, the refundability of the earnest money may vary.

How does earnest money influence negotiations?

Earnest money can significantly influence negotiations and contract terms. A substantial deposit can make a purchaser’s proposal more appealing to sellers, especially in competitive markets.

What is a typical amount for earnest money in a home purchase?

In a home purchase, good faith payments typically range from $4,000 to $12,000 for a $400,000 home. This amount can play a crucial role in the seller’s decision-making process.