Overview

Streamline refinance offers a simplified path for homeowners with existing FHA-insured mortgages, enabling them to lower their interest rates and monthly payments. We understand how overwhelming this process can feel, which is why this option requires minimal documentation and no new appraisal. This article highlights the benefits, eligibility criteria, and the process of streamline refinancing, focusing on how it can ease your financial burden.

Imagine being able to save money with faster closing times and reduced paperwork. These advantages make streamline refinancing an appealing financial strategy for eligible homeowners. We know how challenging this can be, and we’re here to support you every step of the way.

By exploring this option, you can take control of your finances and find relief from high monthly payments. If you meet the eligibility criteria, we encourage you to consider this opportunity to improve your financial situation. Remember, you don’t have to navigate this journey alone; there are resources available to guide you through the process.

Introduction

Streamline refinancing offers a wonderful opportunity for homeowners with FHA-insured mortgages. We understand how daunting the process of securing better financial terms can feel. By minimizing documentation and eliminating the need for appraisals, this option not only reduces costs but also helps you achieve lower monthly payments more quickly.

As more homeowners seek to benefit from these advantages, it’s natural to have questions about who qualifies and what potential drawbacks may exist. We know how challenging this can be, and understanding the intricacies of streamline refinancing could be the key to unlocking significant savings and enhancing your financial stability. We’re here to support you every step of the way.

Define Streamline Refinance: Key Concepts and Overview

A specialized financial option designed for homeowners with existing is the . We understand how challenging it can be to navigate the complexities of refinancing, and this process aims to . By requiring , a streamline refinance becomes an appealing choice for those looking to or monthly payments.

Unlike conventional loan restructuring, the streamline refinance process does not necessitate a new appraisal. This can greatly reduce both time and expenses, making it easier for families to achieve their . It’s especially advantageous for those who have consistently maintained a on their current FHA loan, enabling them to use a streamline refinance to take advantage of lower interest rates without the usual hurdles associated with refinancing.

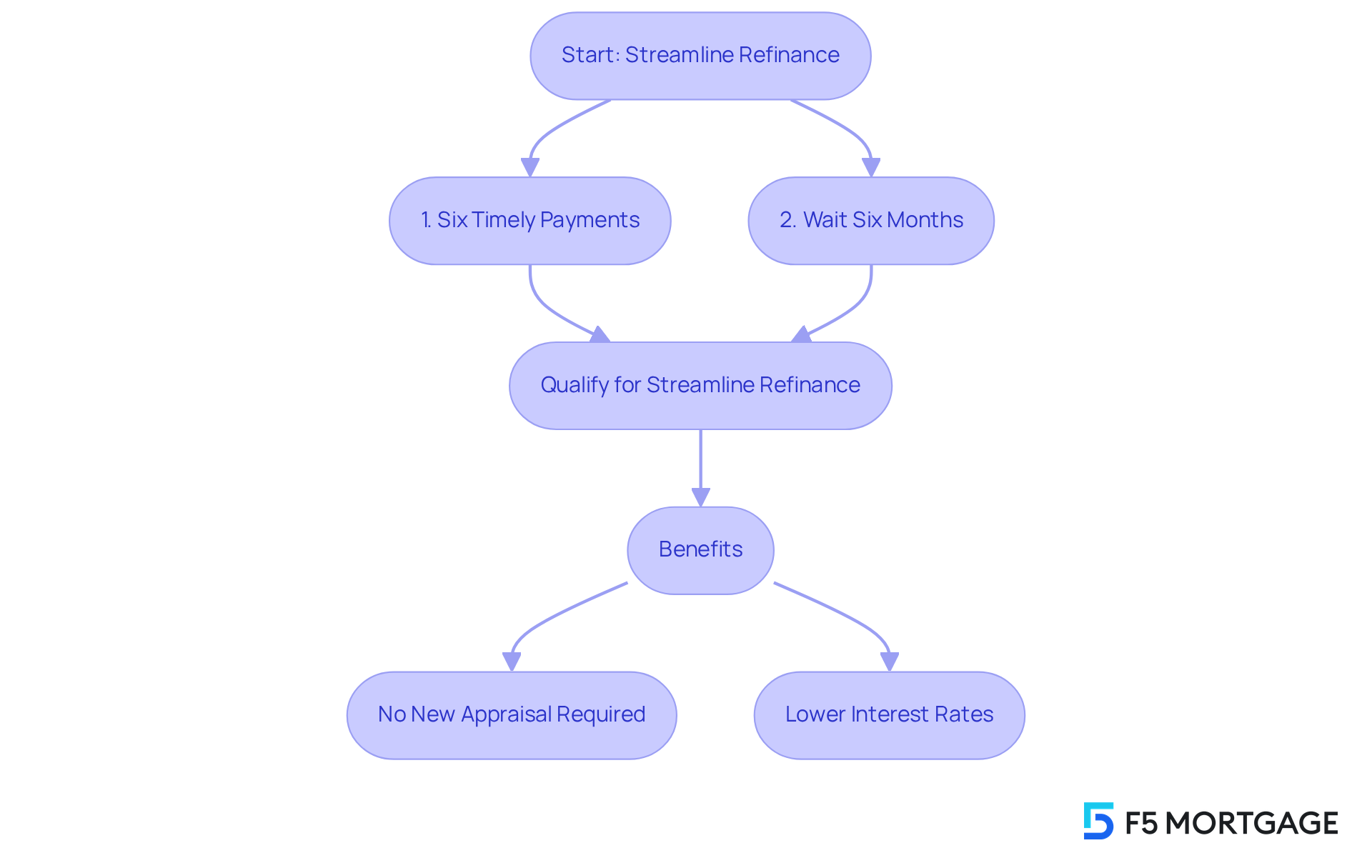

To qualify for an FHA simplified refinance, property owners must:

- Have made at least six timely payments.

- Wait at least six months since their first payment due date.

As we look ahead to 2025, a significant number of property owners are anticipated to embrace streamline refinance options, highlighting its growing appeal as a viable solution for .

Professionals in the mortgage sector, including Afton Lambert and Bradley Thompson, emphasize that these simplified processes not only provide smoother access to improved credit conditions but also enhance overall financial security for eligible homeowners. Remember, while efficient refinancing offers many benefits, it does not permit the financing of closing costs, which typically range from $1,000 to $5,000. We’re here to support you every step of the way as you .

Explore Benefits of Streamline Refinance: Cost Savings and Simplified Process

The offers several compelling benefits for homeowners that can truly make a difference in their financial journey:

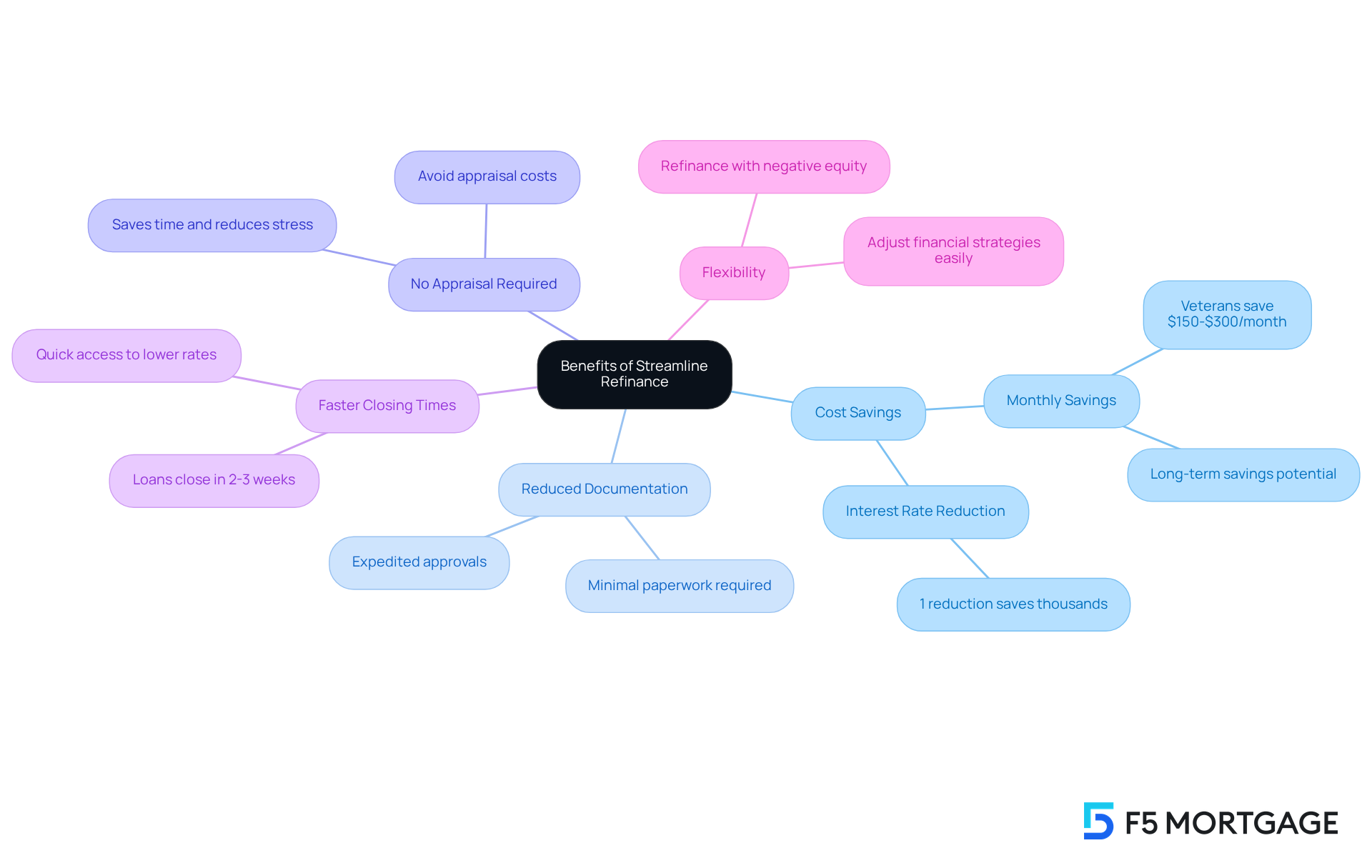

- : By securing a reduced interest rate, homeowners can significantly lower their monthly mortgage payments, leading to substantial savings over the loan’s duration. For instance, veterans utilizing the (IRRRL) often save between $150 and $300 monthly, translating to thousands in long-term savings. As Phil Crescenzo, Vice President of the Southeast Division, notes, “Reduction in interest rates creates the perfect environment because a homeowner must save a specific amount to meet the threshold for enough benefit to the homeowner, or the loan cannot close. This is for the consumer’s protection.”

- : We understand how overwhelming paperwork can be. This loan option requires considerably than traditional loans, allowing for a streamline refinance process that makes it more accessible for borrowers. Many lenders report that the documentation needed is minimal, which can expedite approvals. Sean Wilkoff, Assistant Professor of Finance, emphasizes, ‘To get the best terms on a streamline refinance, .’ Borrowers who compare multiple lenders often secure better rates.

- No Appraisal Required: Imagine . Streamline refinancing removes this necessity, enabling property owners to sidestep related expenses and setbacks, further enhancing the refinancing process. This not only saves time but also reduces out-of-pocket expenses.

- : The simplified nature of the process often results in , with many loans closing in just 2-3 weeks. This efficiency allows property owners to take advantage of lower rates without prolonged waiting periods.

- Flexibility: We know how challenging fluctuating real estate markets can be. Borrowers can refinance even if they owe more than their home is worth, a significant advantage. This flexibility allows homeowners to adjust their financial strategies without being hindered by current property values.

In conclusion, the streamline refinance process is designed to empower homeowners, providing them with the support and options they need to navigate their financial landscape confidently.

Understand Eligibility Requirements: Who Can Benefit from Streamline Refinance?

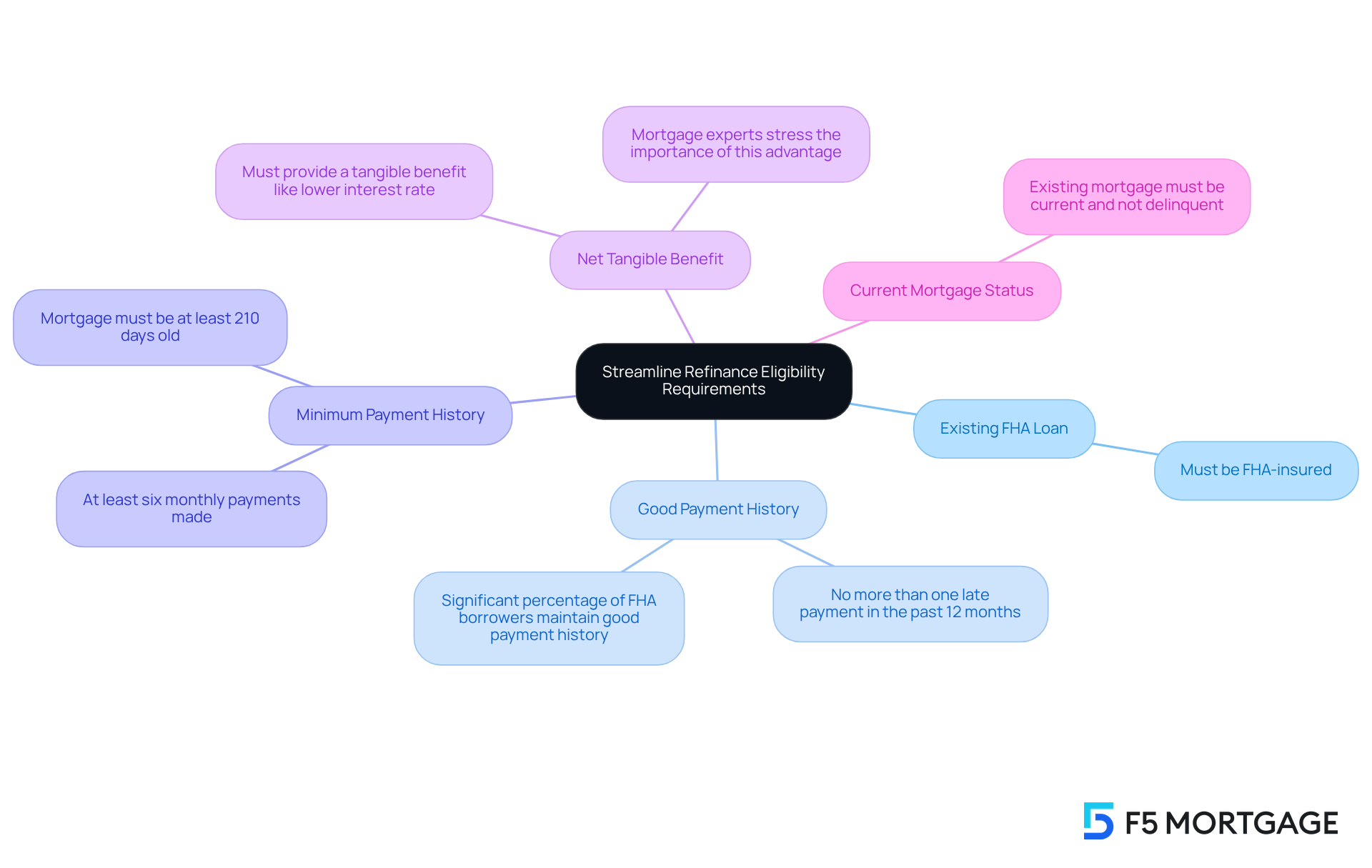

To qualify for a , we know how important it is for borrowers to meet :

- Existing : The mortgage being refinanced must be FHA-insured.

- : It’s essential for borrowers to have a good payment history to qualify for a streamline refinance, with no more than one late payment in the past 12 months. In 2025, a significant percentage of FHA borrowers maintain a good payment history, reflecting the program’s reliability.

- Minimum Payment History: Homeowners must have made at least six monthly payments on their current FHA mortgage to qualify for a streamline refinance, and the mortgage must be at least 210 days old.

- Net : The streamline refinance must provide a tangible benefit, such as a lower interest rate or a more stable loan product. Mortgage experts stress that this advantage is vital for borrowers to validate the loan modification process.

- : The existing mortgage must be current and not delinquent to qualify for a streamline refinance at the time of restructuring.

Homeowners who fulfill these requirements can greatly benefit from a streamline refinance, particularly those looking to or secure a more advantageous interest rate. For instance, individuals with a and a desire to alleviate their financial burden can find a streamline refinance particularly beneficial. As pointed out by industry specialists, efficient loan restructuring can be a strategic decision for numerous property owners seeking to enhance their . We’re here to in navigating this process.

Navigate the Streamline Refinance Process: Steps from Application to Closing

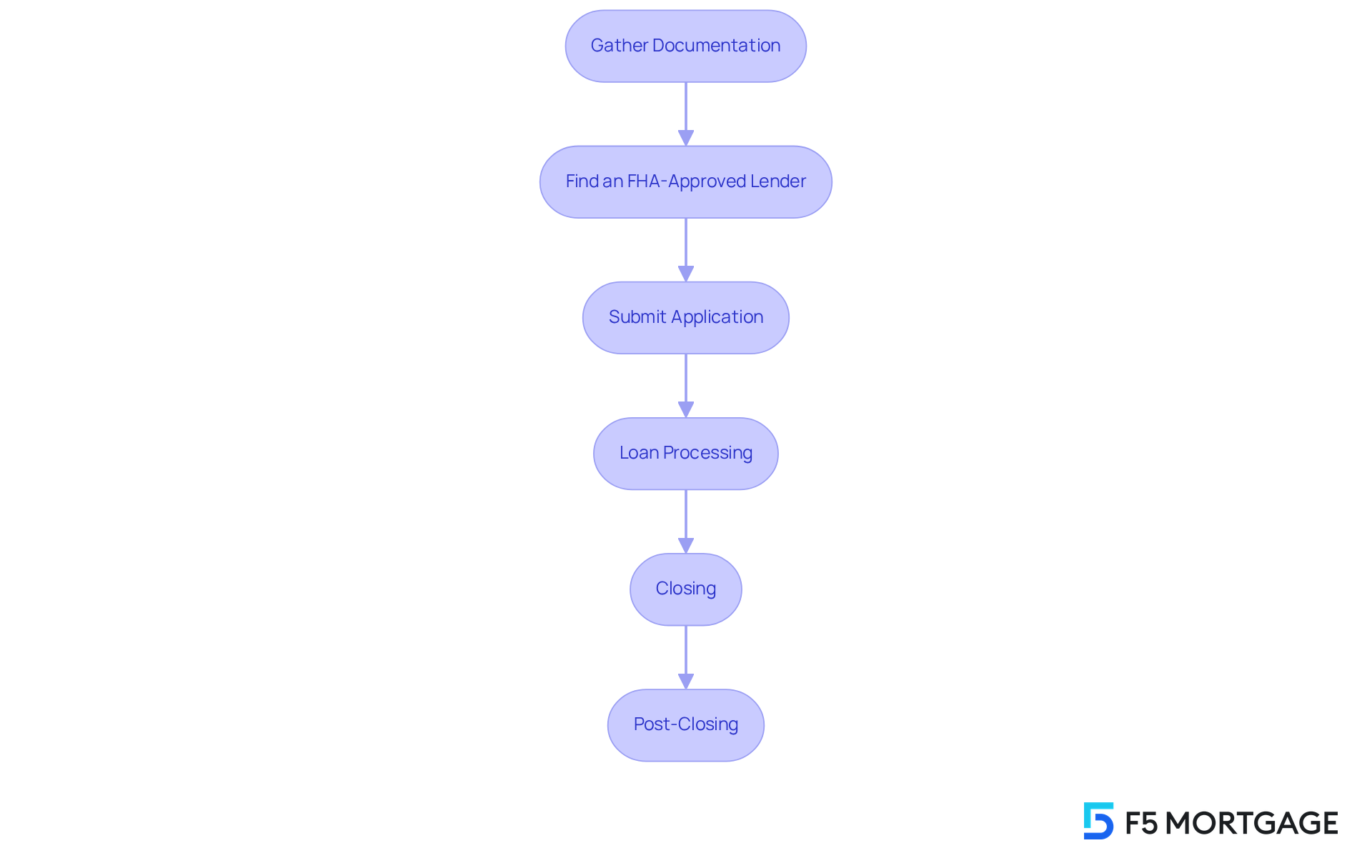

The from the FHA is designed to support homeowners with current FHA loans, making the process more accessible. We understand how daunting this can be, so let’s walk through the key steps together:

- Gather Documentation: Even though the process is streamlined, it’s important to prepare essential documents, such as proof of income and . This preparation can help speed up your application.

- Find an : Choose a lender that offers . It’s crucial to compare rates and terms to secure the best deal for your needs.

- Submit Application: Complete the application with your chosen lender, ensuring that all required documentation is provided. This will help facilitate a smooth review process.

- Loan Processing: Your lender will assess your application, verify your eligibility, and evaluate your current mortgage status. This step is vital for .

- Closing: Once approved, the lender will schedule a closing date. During this meeting, you’ll sign the necessary paperwork to finalize your refinance.

- Post-Closing: After closing, take some time to familiarize yourself with your new financing terms and start making payments on your new mortgage.

Statistics show that many borrowers express high satisfaction with the , with F5 Mortgage boasting a remarkable 94% . Successful applications often highlight how homeowners have effectively navigated these steps, resulting in and improved financing terms. FHA mortgages are the preferred choice for in America, making the refinance process especially important for those looking to enhance their financial situation. Remember, we’re here to support you every step of the way.

Additional Considerations: Closing Costs and Potential Drawbacks

While offers many benefits, we understand that there are some important considerations to keep in mind:

- : We know how challenging it can be to manage expenses. Although streamline refinance usually involves lower closing costs compared to traditional refinancing, it’s important to be ready for certain costs, which can vary from 2% to 5% of the loan amount.

- No Cash-Out Option: It’s important to note that with a streamline refinance, borrowers cannot take cash out from their home equity. This may limit options for those looking to access funds, and we want you to be aware of this.

- Limited to : The is only available for . We recognize this may not be suitable for all homeowners, so it’s crucial to evaluate your situation carefully.

- Potential for Higher Rates: Depending on market conditions, the may not always be significantly lower than your existing rate. We encourage you to evaluate your options thoughtfully, ensuring you make the best decision for your family.

Conclusion

The streamline refinance option stands as a valuable resource for homeowners with existing FHA-insured mortgages, helping them navigate the refinancing landscape with both ease and efficiency. By minimizing documentation and removing the need for a new appraisal, this process not only simplifies the journey but also empowers homeowners to seize lower interest rates and enjoy reduced monthly payments.

Throughout this discussion, we’ve highlighted the numerous benefits of streamline refinancing. These include:

- Cost savings

- Faster closing times

- The flexibility to refinance even when owing more than the property’s worth

Eligibility requirements ensure that only those with a solid payment history and current FHA loans can take advantage of these benefits, reinforcing the program’s reliability. While considerations like closing costs and the absence of cash-out options exist, the overall framework of streamline refinancing presents a compelling case for homeowners seeking financial relief.

Ultimately, understanding the streamline refinance process is essential for those looking to enhance their financial stability. We encourage homeowners to explore their options and consider how this streamlined approach can lead to significant savings and improved loan terms. With the right preparation and guidance, the path to a more favorable mortgage can be both accessible and rewarding, paving the way for a brighter financial future. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

Frequently Asked Questions

What is a streamline refinance?

A streamline refinance is a specialized financial option designed for homeowners with existing FHA-insured mortgages. It simplifies the refinancing process by requiring minimal documentation and underwriting, making it appealing for those looking to lower their interest rates or monthly payments.

What are the key advantages of a streamline refinance?

The key advantages include cost savings from reduced interest rates, less documentation required than traditional loans, no appraisal needed, faster closing times (often within 2-3 weeks), and flexibility for homeowners who owe more than their home is worth.

What are the qualification requirements for a streamline refinance?

To qualify for a streamline refinance, property owners must have made at least six timely payments and wait at least six months since their first payment due date.

How much can homeowners potentially save with a streamline refinance?

Homeowners can significantly lower their monthly mortgage payments, potentially saving between $150 and $300 monthly, leading to thousands in long-term savings.

Is an appraisal required for a streamline refinance?

No, a streamline refinance does not require a new appraisal, which saves time and reduces out-of-pocket expenses for homeowners.

How long does the streamline refinance process typically take?

The streamline refinance process often results in quicker closing times, with many loans closing in just 2-3 weeks.

Can homeowners refinance if they owe more than their home is worth?

Yes, homeowners can refinance even if they owe more than their home is worth, providing flexibility in their financial strategies.

Are closing costs covered in a streamline refinance?

No, streamline refinancing does not allow for the financing of closing costs, which typically range from $1,000 to $5,000.