Overview

Navigating the world of home equity loans or lines of credit can feel overwhelming. We understand how challenging this can be. That’s why it’s essential to have a checklist that guides you through the process. Start by understanding the value of your property. This is a crucial first step.

Next, evaluate your financial needs and goals. Consider what you truly need and how these options can fit into your life. It’s important to analyze the associated costs and fees as well. A thorough assessment of your equity, financial situation, and potential expenses is vital. This careful consideration will empower you to make informed borrowing decisions.

Remember, utilizing your home’s value wisely is key. We’re here to support you every step of the way, helping you avoid excessive debt while achieving your financial goals.

Introduction

Navigating the nuances of home equity can feel both empowering and overwhelming for homeowners. With property values changing and financial needs evolving, the choice to access home equity through loans or lines of credit presents a significant opportunity. But how can you confidently maneuver through the complex landscape of options, costs, and potential pitfalls?

We understand how challenging this can be, and that’s why this article provides a comprehensive checklist. It will guide you through the essential factors to consider when deciding on a home equity loan or line of credit. Our goal is to ensure you make choices that align with your financial aspirations and stability, empowering you every step of the way.

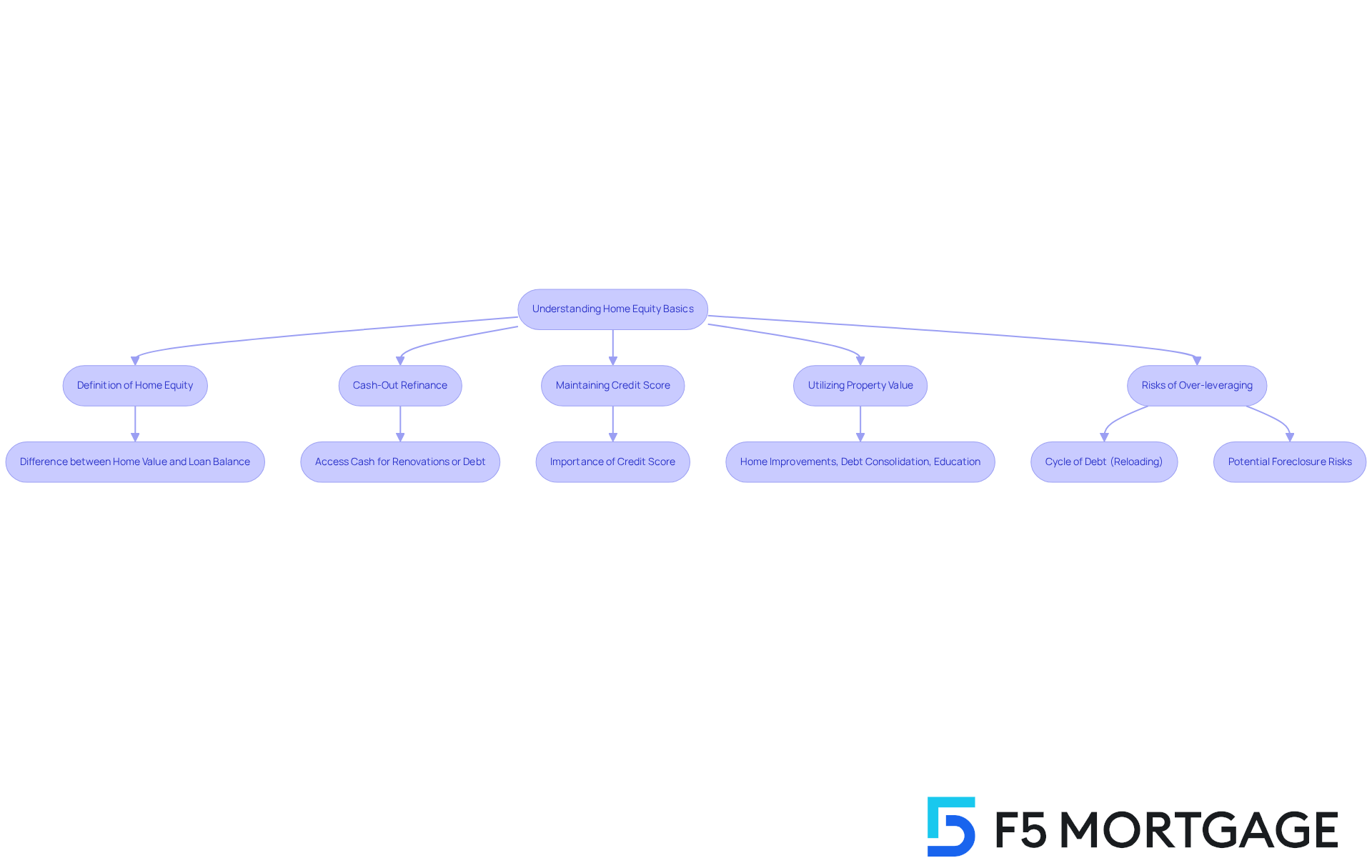

Understand Home Equity Basics

Understanding the value of property ownership can be a crucial step in your financial journey. It represents the difference between your home’s current market worth and the remaining balance on your loan. This equity can serve as security for a home equity loan or line of credit, enabling you to tap into your property’s value to meet your financial needs.

In California, a cash-out refinance presents an opportunity for homeowners to refinance their existing mortgage for a higher amount. This means you can access the difference in cash, which can be particularly beneficial for covering substantial costs like renovations or debt consolidation. Imagine being able to improve your home or consolidate high-interest debts, especially when the new interest rate is lower than your current mortgage rate.

To secure favorable financing conditions, maintaining a strong credit score and a low debt-to-income ratio is essential. On average, property owners have an ownership percentage of about 15-20%, which is vital for qualifying for property value loans. A stable credit score, ideally above 600, can significantly impact the interest rates and terms offered by lenders.

Your property’s value can be utilized for various purposes, such as renovations, debt consolidation, or . For instance, using a property collateral borrowing option to fund renovations not only enhances your living space but can also increase your home’s overall worth. Merging high-interest debt through a home equity loan or line of credit can lead to significant savings, as these options typically offer lower interest rates than credit cards.

Financial consultants emphasize the importance of using property value wisely. Tapping into a home equity loan or line of credit for productive investments, such as home improvements or educational expenses, can yield long-term financial benefits. However, it’s crucial to ensure that your equity is not over-leveraged, as this could jeopardize your homeownership.

We know how challenging this can be, and it’s important to be cautious of potential risks, such as falling into a cycle of debt known as ‘reloading.’ This occurs when one acquires funds to pay off existing debts, which can lead to financial instability. Once your application for a cash-out refinance is accepted, securing your mortgage terms is vital to protect yourself from market fluctuations during the processing period. Remember, we’re here to support you every step of the way.

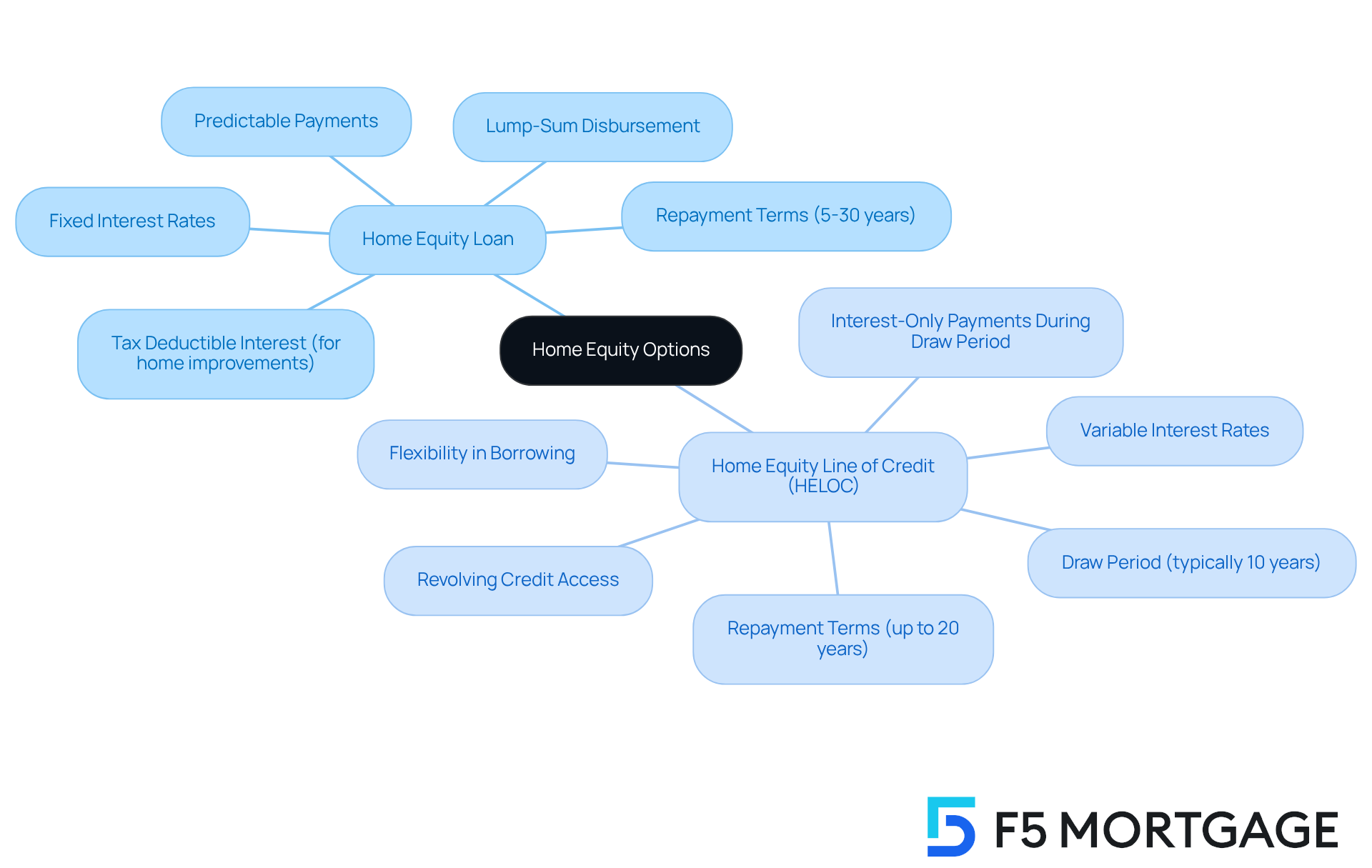

Compare Home Equity Loan and Line of Credit Features

Home equity loans or lines of credit provide several key features that can be beneficial for families considering their financial options. These loans typically come with fixed interest rates, providing stability in your monthly payments. Additionally, they offer a lump-sum disbursement, which can be ideal for larger, one-time expenses. This predictability in payments can bring peace of mind as you plan your budget.

On the other hand, a home equity loan or line of credit presents a different set of advantages. They usually feature variable interest rates, which can be advantageous if rates decrease. HELOCs provide revolving credit access, allowing you to borrow what you need when you need it. This flexibility in borrowing and repayment options can be particularly helpful for ongoing costs, such as home renovations or educational expenses.

When deciding between these two options, such as a home equity loan or line of credit, consider your . For instance, if you have a significant, one-time expense, using a home equity loan or line of credit might be the better choice. Conversely, if you anticipate ongoing costs, a home equity loan or line of credit could provide the flexibility you need. We understand how challenging these decisions can be, and we’re here to support you every step of the way.

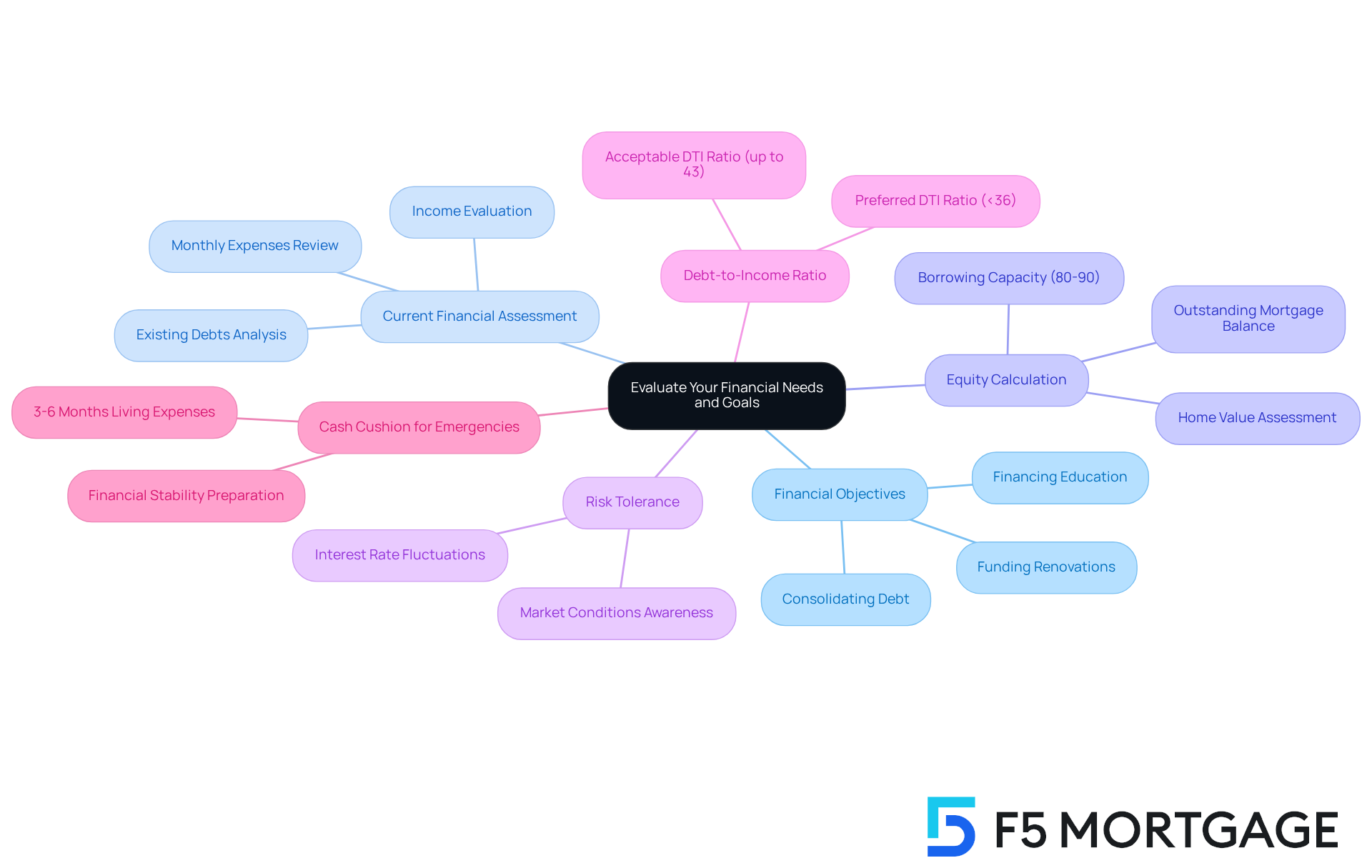

Evaluate Your Financial Needs and Goals

Clearly outline your main financial objectives, such as:

- Funding renovations

- Consolidating debt

- Financing education

Understanding your objectives will guide your borrowing decisions and help you feel more in control of your financial journey.

Next, conduct a thorough assessment of your current financial situation. Take a close look at your income, monthly expenses, and existing debts. This evaluation is crucial for determining your borrowing capacity and ensuring you do not overextend yourself financially.

Now, calculate the amount of equity accessible in your residence. Property owners can generally borrow up to 80-90% of their residence’s value through a home equity loan or line of credit, based on the lender’s policies and their financial profile. For instance, if your home is valued at $500,000 and you owe $300,000, you may be eligible to borrow an additional $100,000 to $150,000. This could provide you with the financial support you need.

It’s also important to assess your risk tolerance, especially regarding interest changes. Home equity loans or lines of credit (HELOCs) frequently feature fluctuating terms that can change according to market conditions. Being ready for possible price increases is crucial for ensuring your financial stability.

Financial planners emphasize the importance of examining your entire financial picture before borrowing. This includes assessing your debt-to-income (DTI) ratio, which most lenders prefer to keep below 36%. However, for residential loans, a DTI ratio up to 43% may be acceptable under certain conditions, especially when refinancing. A better DTI can lead to more competitive mortgage rates, making it vital to understand how your current debts and income affect your borrowing options.

Consider real-life scenarios that illustrate the importance of understanding your financial situation. Property owners are encouraged to thoughtfully consider the risks of accessing residential value, particularly in a market where property prices are elevated but may vary. This understanding can and ensure that borrowing aligns with your long-term financial goals.

Lastly, remember that maintaining a cash cushion for emergencies is vital. Specialists advise setting aside a minimum of three to six months of living costs prior to obtaining a home equity loan or line of credit. This safety net can provide peace of mind during unforeseen financial difficulties, ensuring you feel secure as you navigate your financial landscape.

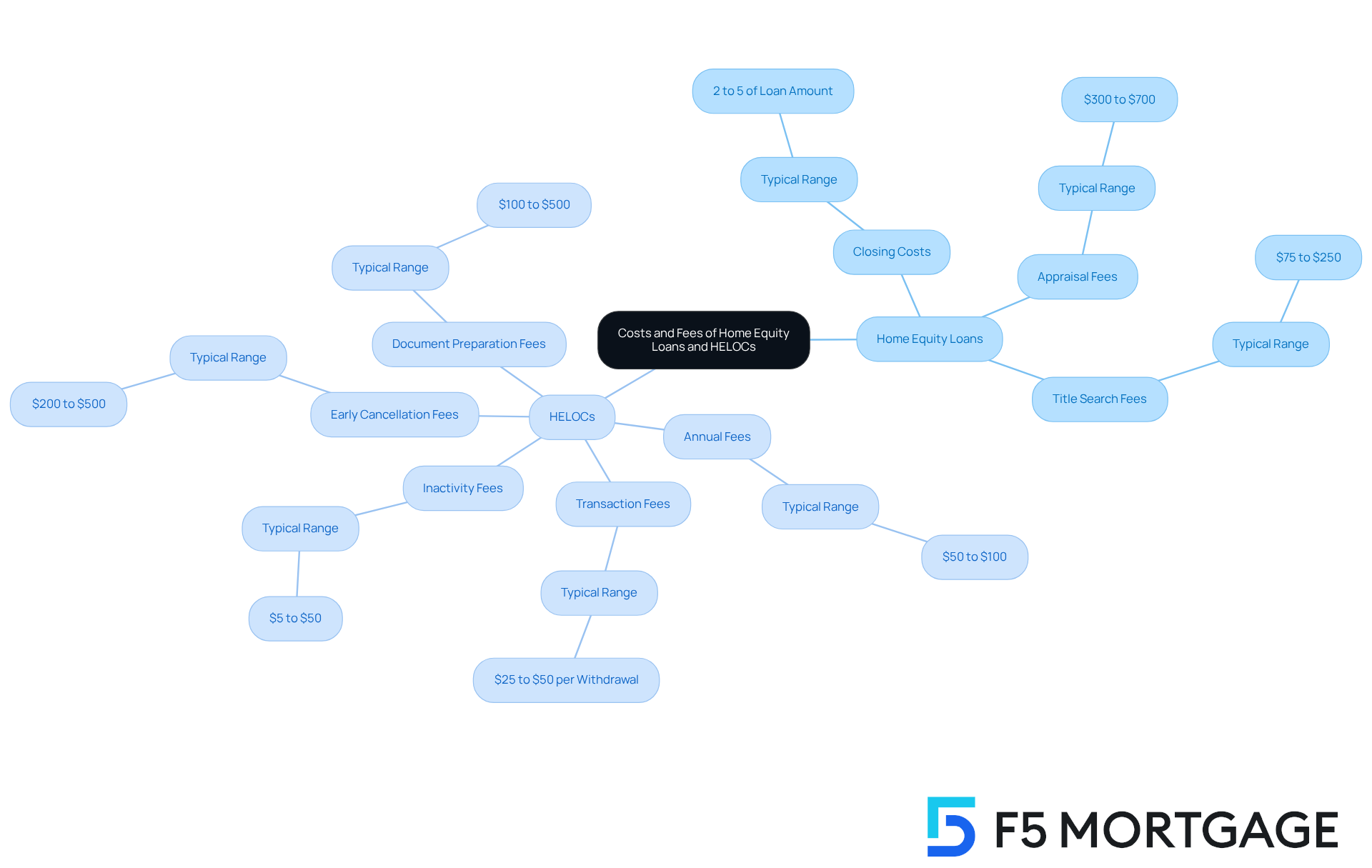

Analyze Costs and Fees Involved

Navigating the costs associated with a home equity loan or line of credit can feel overwhelming, but understanding them is the first step toward making informed decisions. Common costs include:

- Closing costs typically range from 2% to 5% of the loan amount. We know how important it is to find competitive rates, and lenders like F5 Mortgage may offer personalized service that could help reduce these costs.

- Appraisal fees usually average between $300 and $700, depending on your property’s location and size. While traditional lenders often charge this fee, F5 Mortgage provides options to help , which can be a relief for many borrowers.

- Title search fees generally cost between $75 and $250, ensuring that no liens exist on your property. This step is crucial for peace of mind.

When it comes to Home Equity Lines of Credit (HELOCs), there are additional costs to consider:

- Annual fees can range from $50 to $100, which are charged to maintain your line of credit.

- Transaction fees for draws are often between $25 and $50 per withdrawal, varying by lender policies.

- Potential inactivity fees may apply if your line of credit is unused for an extended period, typically ranging from $5 to $50.

- Early cancellation fees can be imposed by traditional lenders if a HELOC is closed early, usually between $200 and $500.

Additionally, document preparation fees typically range from $100 to $500 and may include attorney review. Understanding these costs is essential for a clear picture of what to expect.

To navigate these expenses effectively, we recommend asking lenders, like F5 Mortgage, for a comprehensive fee breakdown. This will empower you to compare offers and fully comprehend the total expenses involved in obtaining a property financing option or HELOC. Remember, some lenders may even offer a home equity loan or line of credit with no closing costs, which can be a significant consideration. Shopping around can lead to better deals, and we’re here to support you every step of the way.

Conclusion

Understanding the intricacies of home equity loans and lines of credit is essential for homeowners looking to leverage their property’s value for financial needs. We know how challenging this can be. By grasping the fundamentals of home equity, evaluating personal financial goals, and analyzing associated costs, individuals can make informed decisions that align with their long-term financial objectives.

Key discussions throughout the article highlight the importance of assessing your financial situation. Understanding the differences between home equity loans and lines of credit is crucial, as is recognizing the potential risks involved. Homeowners are encouraged to:

- Maintain a solid credit profile

- Evaluate their borrowing capacity

- Be cautious of over-leveraging their equity

Additionally, being aware of the various costs associated with these financing options can prevent unexpected financial burdens.

Ultimately, the decision to utilize home equity should be approached with careful consideration and planning. By setting clear financial goals and understanding the implications of borrowing against property value, homeowners can navigate their financial journeys more confidently. Embracing these insights can lead to more effective use of home equity, fostering a path toward financial stability and growth. We’re here to support you every step of the way.

Frequently Asked Questions

What is home equity?

Home equity is the difference between your home’s current market value and the remaining balance on your mortgage loan. It represents the value you own in your property.

How can home equity be used?

Home equity can be used for various purposes, such as funding renovations, consolidating debt, or financing educational costs. It can serve as security for a home equity loan or line of credit.

What is a cash-out refinance?

A cash-out refinance allows homeowners to refinance their existing mortgage for a higher amount, enabling them to access the difference in cash. This can be beneficial for covering substantial costs like renovations or debt consolidation.

What factors influence favorable financing conditions for home equity loans?

Maintaining a strong credit score and a low debt-to-income ratio are essential for securing favorable financing conditions. A stable credit score, ideally above 600, can significantly impact the interest rates and terms offered by lenders.

What percentage of ownership do property owners typically have?

On average, property owners have an ownership percentage of about 15-20%, which is important for qualifying for property value loans.

What are the risks associated with tapping into home equity?

Potential risks include over-leveraging your equity, which could jeopardize homeownership, and falling into a cycle of debt known as ‘reloading,’ where funds are acquired to pay off existing debts, leading to financial instability.

Why is it important to be cautious when using home equity?

It is crucial to use home equity wisely for productive investments, such as home improvements or educational expenses, to yield long-term financial benefits and avoid jeopardizing your homeownership.

What should homeowners do once their cash-out refinance application is accepted?

Homeowners should secure their mortgage terms to protect themselves from market fluctuations during the processing period after their cash-out refinance application is accepted.