Overview

Calculating mortgage payments can feel overwhelming, but understanding the key components can make a significant difference. These components include:

- principal

- interest

- property taxes

- homeowners insurance

- private mortgage insurance (PMI)

Together, they determine your total monthly payment.

We know how challenging this can be, especially with the changes expected in 2025. That’s why this article outlines a step-by-step process for calculating these payments. It emphasizes the importance of including all costs to ensure accurate budgeting and financial planning.

By taking these steps, you can empower yourself to make informed decisions about your mortgage. Remember, we’re here to support you every step of the way.

Introduction

Navigating the intricacies of mortgage payments can feel overwhelming for families, especially as the financial landscape evolves in 2025. We know how challenging this can be, and understanding these complexities is essential for successful homeownership. This guide will explore the various components of a mortgage payment, providing practical steps to help you accurately calculate your monthly obligations.

However, with fluctuating interest rates and additional costs like property taxes and insurance, how can your family be fully prepared for these financial commitments? We’re here to support you every step of the way, ensuring you have the knowledge and tools to face these challenges with confidence.

Understand Mortgage Payment Components

To accurately , we know how essential it is to understand the , especially with recent changes in 2025 that may affect your budgeting:

- Principal: This is the sum of money you obtain from the lender, forming the foundation of your mortgage obligation.

- Interest: This represents the cost of borrowing the principal amount, expressed as a percentage. In 2025, , affecting your regular expenses considerably.

- : Imposed by your local government according to the evaluated worth of your property, these taxes are generally incorporated in your regular installment and maintained in an escrow account. Recent adjustments in tax rates can affect your total amount due.

- : This insurance protects your home and belongings from damage or loss. Similar to property taxes, it is frequently incorporated in your monthly fee, and comprehending the coverage can assist you in selecting the appropriate policy.

- : If your deposit is less than 20%, you may be required to pay PMI, which protects the lender in case of default. As of 2025, the costs associated with PMI may have changed, so it’s crucial to factor this into .

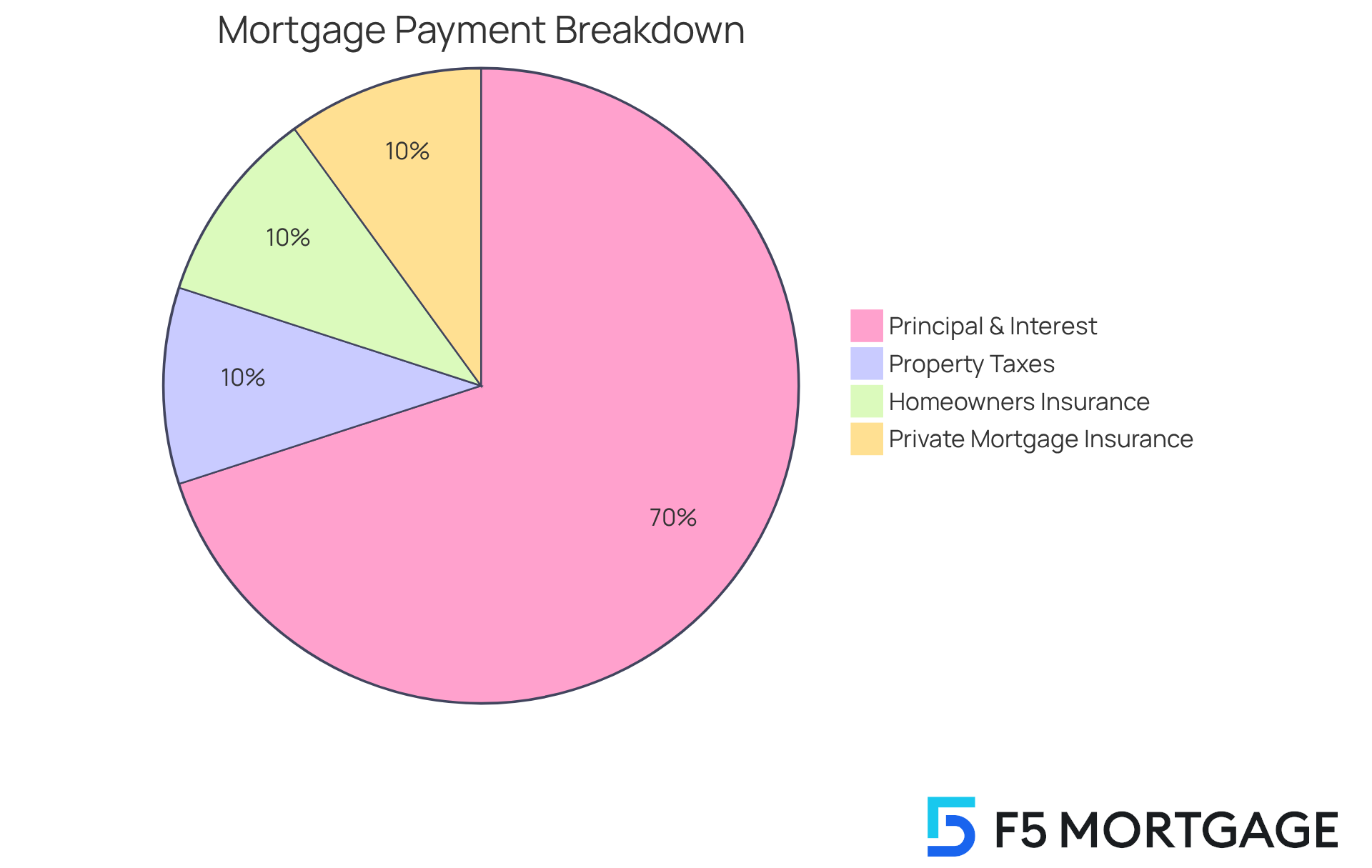

Understanding these elements will assist you in recognizing how they influence your and aid in calculating mortgage payments suitably. Financial consultants stress that a clear understanding of these components is essential for , ensuring you can handle your loan obligations without strain. For example, a breakdown of a typical loan installment in 2025 might indicate that principal and interest constitute 70% of your charge, while taxes, insurance, and PMI represent the remaining 30%. This insight can guide you in making informed decisions about your home financing. We’re here to support you every step of the way.

Calculate Your Monthly Mortgage Payment

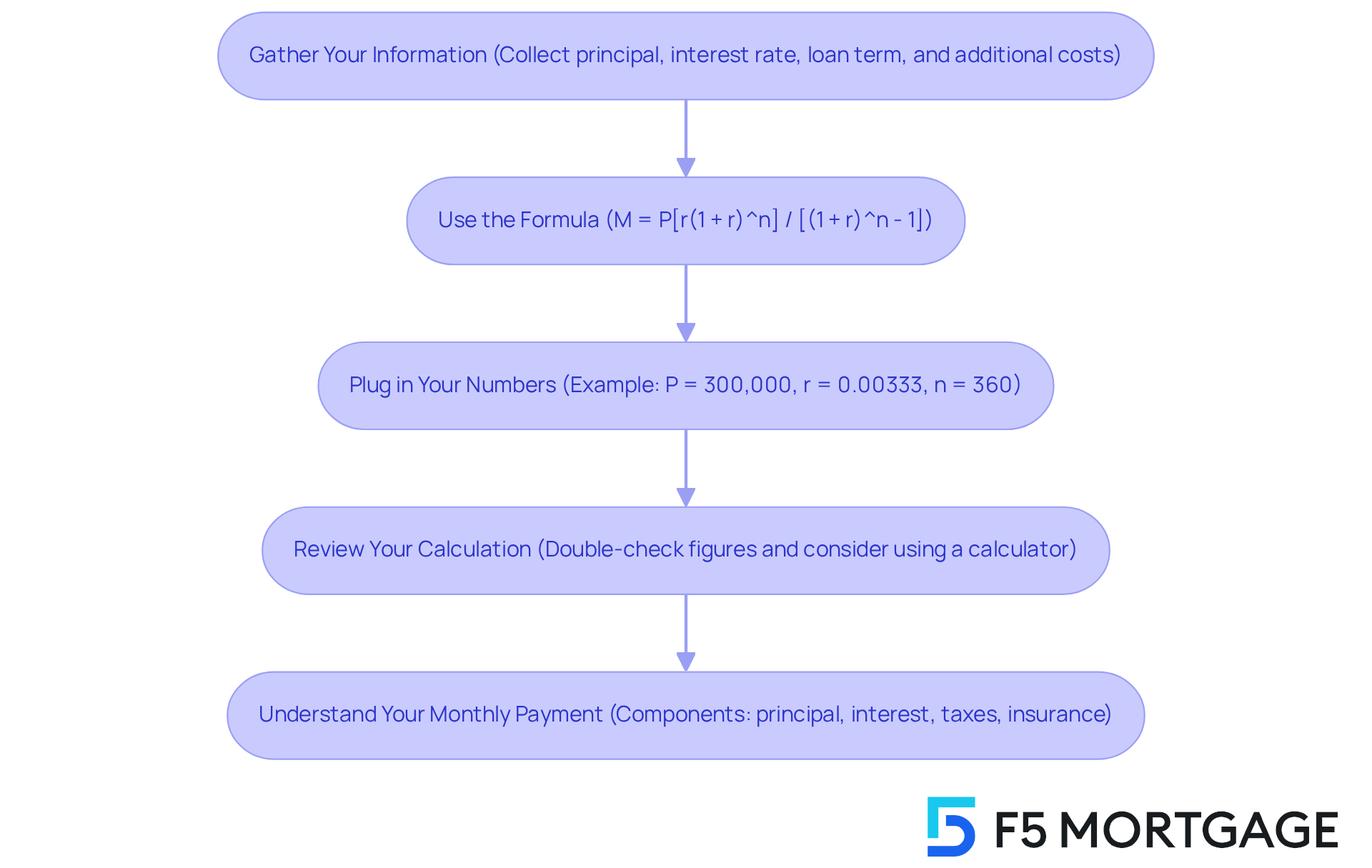

payments each month can feel overwhelming, but we’re here to . Follow these simple steps to gain clarity:

Gather Your Information: Begin by collecting the amount you’ve borrowed (the principal), your interest rate, the term of your loan (in years), and any additional costs such as property taxes, homeowners insurance, and private insurance (PMI). This foundational information is crucial for calculating mortgage accurately.

Use the Formula: The formula for determining your (M) is:

M = P[r(1 + r)^n] / [(1 + r)^n - 1]Where:

- P = principal loan amount

- r = monthly interest rate (annual rate divided by 12)

- n = number of payments (loan term in years multiplied by 12)

Plug in Your Numbers: Let’s say you have a $300,000 loan at a 4% interest rate for 30 years. Here’s how it looks:

- P = 300,000

- r = 0.04 / 12 = 0.00333

- n = 30 * 12 = 360

- M = 300,000[0.00333(1 + 0.00333)^360] / [(1 + 0.00333)^360 – 1] = $1,432.25

Review Your Calculation: It’s important to double-check all your figures for accuracy. Consider using for verification. These tools can simplify the process and provide you with quick estimates, making it easier to manage your finances.

is essential for calculating mortgage and for budgeting to ensure that your home purchase aligns with your financial capabilities. In 2025, the is projected to be around $2,259, based on a 20% down payment on a $435,300 house at a 6.75% interest rate for a 30-year mortgage. This statistic emphasizes the and other expenses to avoid financial strain. Remember, your monthly payment typically includes several components: loan principal, loan interest, property taxes, and insurance—collectively known as PITI.

Consider the Advantages of Your Loan Duration: A longer loan duration can help keep your monthly payments lower, giving you extra cash for home improvements or savings. Conversely, a shorter duration means you’ll pay off your loan sooner, incur less interest, and build equity in your home more quickly. We know how challenging these decisions can be, but assessing your options is crucial for making as you prepare for .

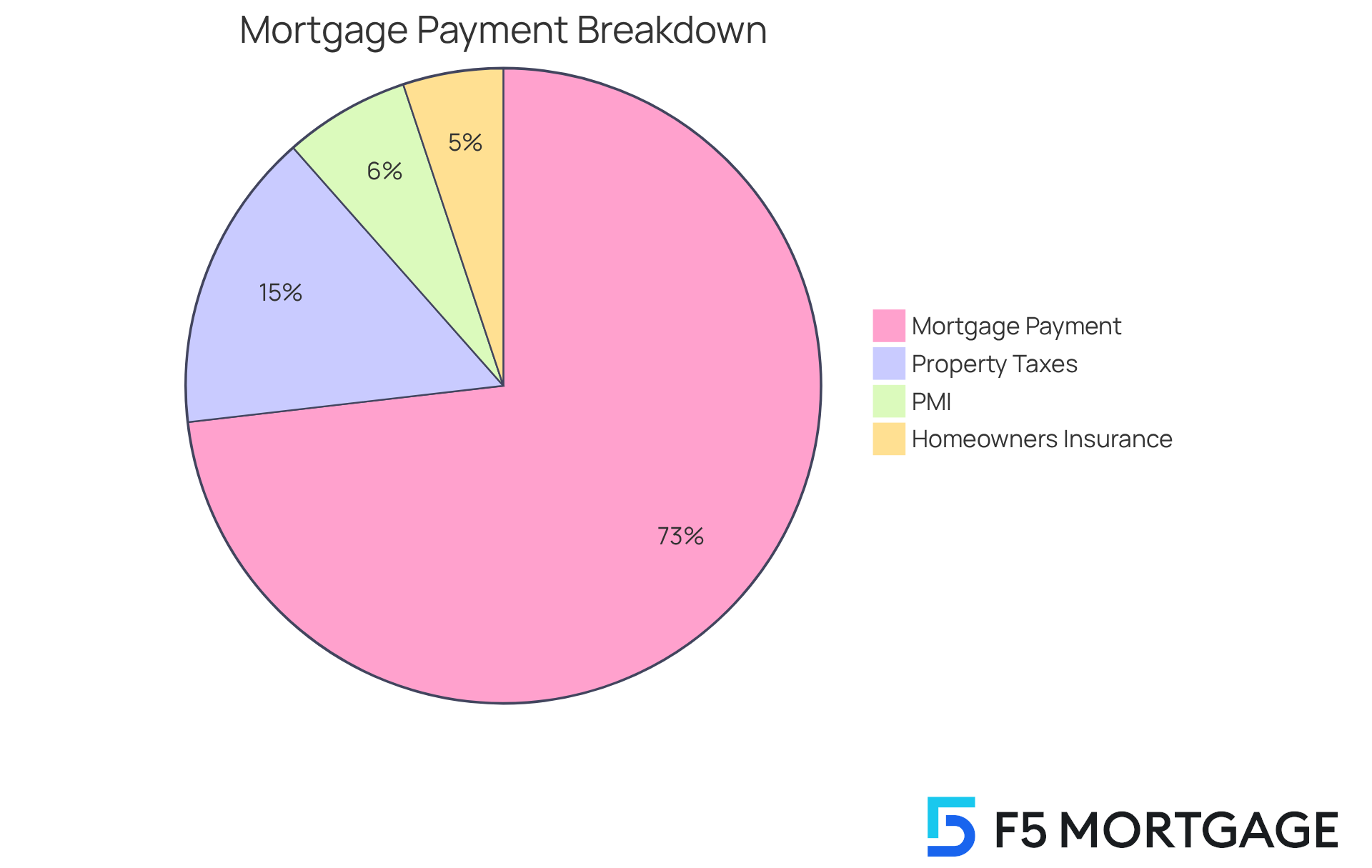

Incorporate Additional Costs and Fees

When calculating , we understand how crucial it is to consider . Understanding these can make a significant difference in your .

Property Taxes: Start by estimating your and divide it by 12 to find your monthly amount. For example, if your yearly property tax is $3,600, your would be $300. This step helps you anticipate your expenses better.

: Next, get a quote for your homeowners insurance and divide it by 12. If your annual premium is $1,200, your monthly cost would be $100. Knowing this figure can ease your budgeting process.

PMI: If applicable, calculate your based on your borrowing amount and down payment. For instance, if your PMI is 0.5% of the loan amount annually, for a $300,000 loan, it would amount to $1,500 per year or $125 per month. This ensures you are fully aware of all potential costs.

Total Monthly Charge: Finally, add these extra expenses to your calculated loan cost. Using the previous example, your breakdown would look like this:

- Mortgage Payment: $1,432.25

- Property Taxes: $300

- Homeowners Insurance: $100

- PMI: $125

- : $1,432.25 + $300 + $100 + $125 = $1,957.25

This comprehensive approach ensures you have a clear picture of your . Remember, we’re here to support you every step of the way as you navigate this important process.

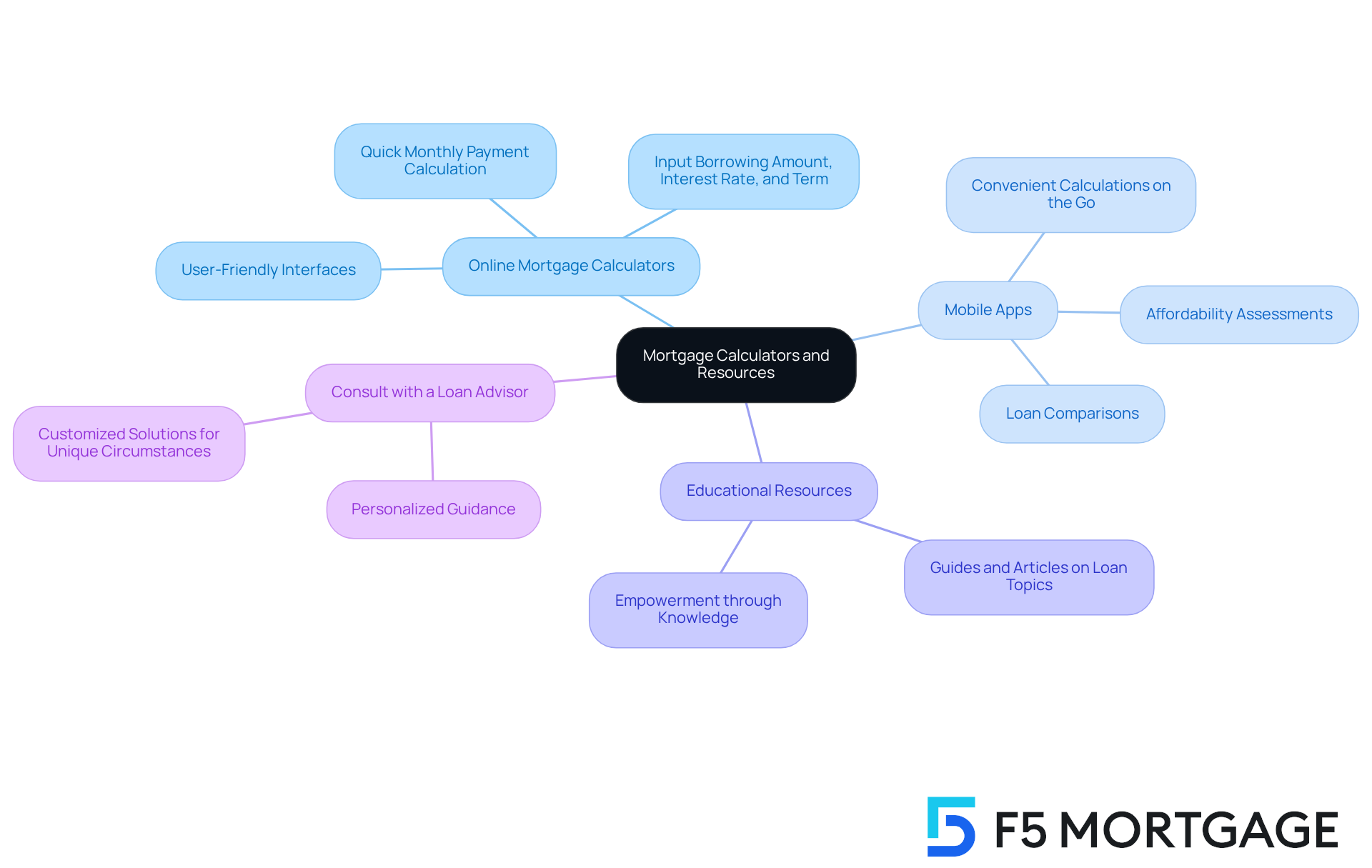

Utilize Mortgage Calculators and Resources

Navigating mortgage payments can feel overwhelming, but there are helpful tools and resources available to simplify the process:

- Online Mortgage Calculators: Platforms like F5 Mortgage provide . You can easily input your borrowing amount, interest rate, and term for to quickly determine your monthly payment. These tools are designed to assist in calculating mortgage in a straightforward and efficient manner, easing some of your worries.

- : Imagine having a loan calculator right in your pocket! Downloading on your smartphone allows for convenient calculations wherever you are. Many of these apps also offer features like affordability assessments and loan comparisons, making it easier to explore your options.

- : We understand that knowledge is power. Dive into guides and articles focused on loan topics to enhance your understanding. tailored to various financial situations, empowering you to make informed decisions.

- : Sometimes, personalized guidance is essential. If you have unique financial circumstances, seeking advice from a loan advisor can be incredibly beneficial. They can help you and provide customized solutions tailored to your needs.

By leveraging these tools and resources, you’re not just ; you’re that align with your financial goals. Remember, we’re here to support you every step of the way.

Conclusion

Understanding the intricacies of mortgage payments is crucial for families looking to make informed financial decisions. We know how challenging this can be. By breaking down the components—principal, interest, property taxes, homeowners insurance, and private mortgage insurance—homebuyers can gain clarity on their total financial obligations. This knowledge empowers individuals to budget effectively and navigate the complexities of home financing with confidence.

The article outlines a step-by-step approach to calculating monthly mortgage payments. It emphasizes the importance of gathering necessary information and utilizing the correct formula. Additionally, it highlights how additional costs, such as property taxes and insurance, significantly impact the overall monthly payment. By incorporating these elements into the calculation, families can ensure they are fully aware of their financial commitments and avoid potential pitfalls.

Ultimately, leveraging available resources such as online mortgage calculators and consulting with loan advisors can greatly enhance the mortgage calculation process. These tools not only simplify the math but also provide valuable insights. Embracing this knowledge is essential for achieving homeownership goals while maintaining financial stability. We’re here to support you every step of the way.

Frequently Asked Questions

What are the key components of a mortgage payment?

The key components of a mortgage payment include Principal, Interest, Property Taxes, Homeowners Insurance, and Private Mortgage Insurance (PMI).

What is the Principal in a mortgage?

The Principal is the sum of money obtained from the lender, forming the foundation of your mortgage obligation.

How does Interest affect mortgage payments?

Interest represents the cost of borrowing the principal amount, expressed as a percentage, and may fluctuate in 2025, affecting your regular expenses.

What role do Property Taxes play in mortgage payments?

Property Taxes are imposed by the local government based on the evaluated worth of your property and are generally included in your regular installment, often maintained in an escrow account.

Why is Homeowners Insurance important in a mortgage?

Homeowners Insurance protects your home and belongings from damage or loss and is often included in your monthly fee. Understanding your coverage helps in selecting the right policy.

What is Private Mortgage Insurance (PMI) and when is it required?

PMI is required if your deposit is less than 20%, protecting the lender in case of default. The costs associated with PMI may have changed in 2025.

How can understanding these components aid in financial planning?

Understanding these components helps recognize how they influence your total loan cost and aids in calculating mortgage payments accurately, ensuring you can manage your loan obligations effectively.

What might a typical mortgage payment breakdown look like in 2025?

A typical mortgage payment breakdown in 2025 might indicate that Principal and Interest constitute 70% of your charge, while Property Taxes, Homeowners Insurance, and PMI represent the remaining 30%.