Overview

Zero down mortgage loans offer families a wonderful opportunity to purchase homes without an initial payment, making homeownership more accessible, especially for first-time buyers. We understand how challenging this can be, and we want to guide you through this journey. Options like VA and USDA loans are available, each with unique benefits and qualification criteria. These loans can truly support families in enhancing their living conditions without the burden of a down payment.

Imagine stepping into your new home, a place where your family can grow and thrive. With zero down mortgage loans, this dream can become a reality. We’re here to support you every step of the way, providing the information you need to make informed decisions. Explore the possibilities and take the first step towards homeownership today.

Introduction

Navigating the pathway to homeownership can feel overwhelming, especially for families who carry the weight of financial constraints. We know how challenging this can be, and that’s why zero down mortgage loans present a unique opportunity. These loans allow families to purchase homes without the burden of an initial payment, making homeownership more accessible than ever.

However, with these enticing benefits come important considerations. What are the true implications of diving into a mortgage without a down payment? This guide delves into the various options available, the advantages and disadvantages of these loans, and the criteria families need to meet to secure their dream home.

We’re here to support you every step of the way.

Define Zero Down Mortgage Loans

A no down payment mortgage is a valuable option that allows families to purchase a home without needing to make an initial payment. This means that the financing covers 100% of the home’s purchase price, making it especially appealing for first-time homebuyers or those with limited savings. Common examples of zero down mortgage loans include programs like VA financing for veterans and USDA financing for rural properties.

VA financing, backed by the Department of Veterans Affairs, offers significant benefits. Not only does it eliminate the need for an initial contribution, but it also provides favorable refinancing options. Once you’ve built equity in your home, you can take advantage of a VA Interest Rate Reduction Refinance Option (IRRRL) to lower your rate and monthly payments. Alternatively, a VA cash-out refinance allows you to access your home equity for various financial needs.

These financial solutions are designed to make homeownership more accessible, particularly for families looking to enhance their living conditions without the burden of a hefty upfront cost. We understand how challenging this journey can be, and we’re here to support you every step of the way.

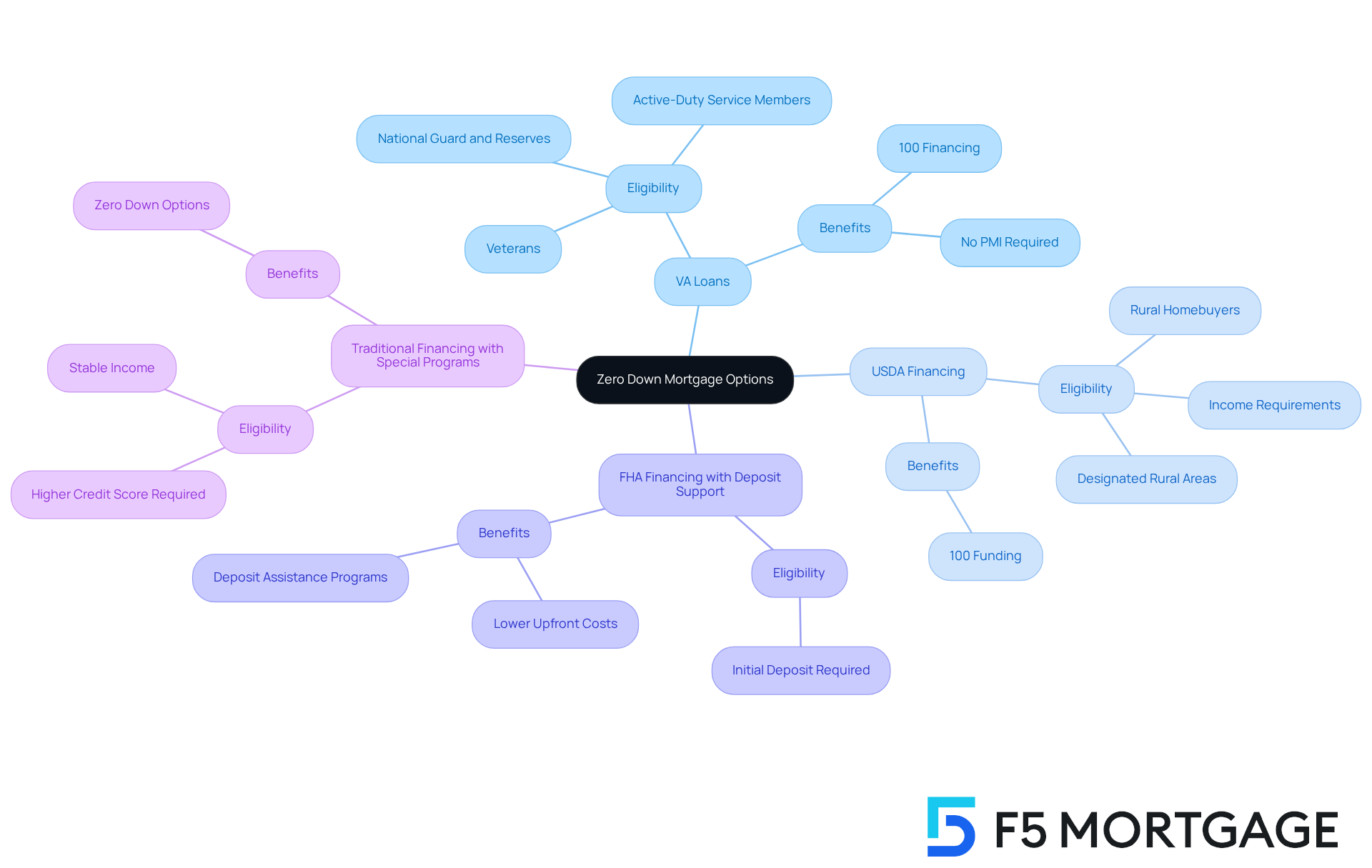

Explore Types of Zero Down Mortgage Options

Navigating the world of home financing can feel overwhelming, but several zero down mortgage loans are available to help you achieve your dream of homeownership. Here are some possibilities to consider:

-

VA Loans: If you’re a veteran, active-duty service member, or part of the National Guard and Reserves, VA loans offer 100% financing with no down payment required. Plus, there’s no need for private mortgage insurance (PMI), making it a fantastic option for those who qualify.

-

USDA Financing: Designed for rural homebuyers, USDA financing provides 100% funding for qualifying properties. To take advantage of this, you’ll need to meet specific income requirements, and the home must be situated in a designated rural area.

-

FHA Financing with Deposit Support: While FHA financing typically requires an initial deposit, certain programs are available that offer deposit assistance. This can help lower your upfront costs to nothing through zero down mortgage loans, making homeownership even more accessible.

-

Traditional Financing with Special Programs: Some lenders offer conventional financing options, such as zero down mortgage loans for eligible borrowers. This often requires a higher credit score and a stable income, but it’s worth exploring.

At F5 Mortgage, we understand that saving for a down payment can be a concern. That’s why we provide various loan options that require as little as 3% down, and in some cases, even 0% down. This flexibility means that saving for a down deposit doesn’t have to be an obstacle to your homeownership journey.

To discover the best low initial cost option for your family, we encourage you to connect with an F5 Mortgage Home Loan Expert today or apply online to explore your alternatives. We’re here to support you every step of the way.

Evaluate Pros and Cons of Zero Down Mortgages

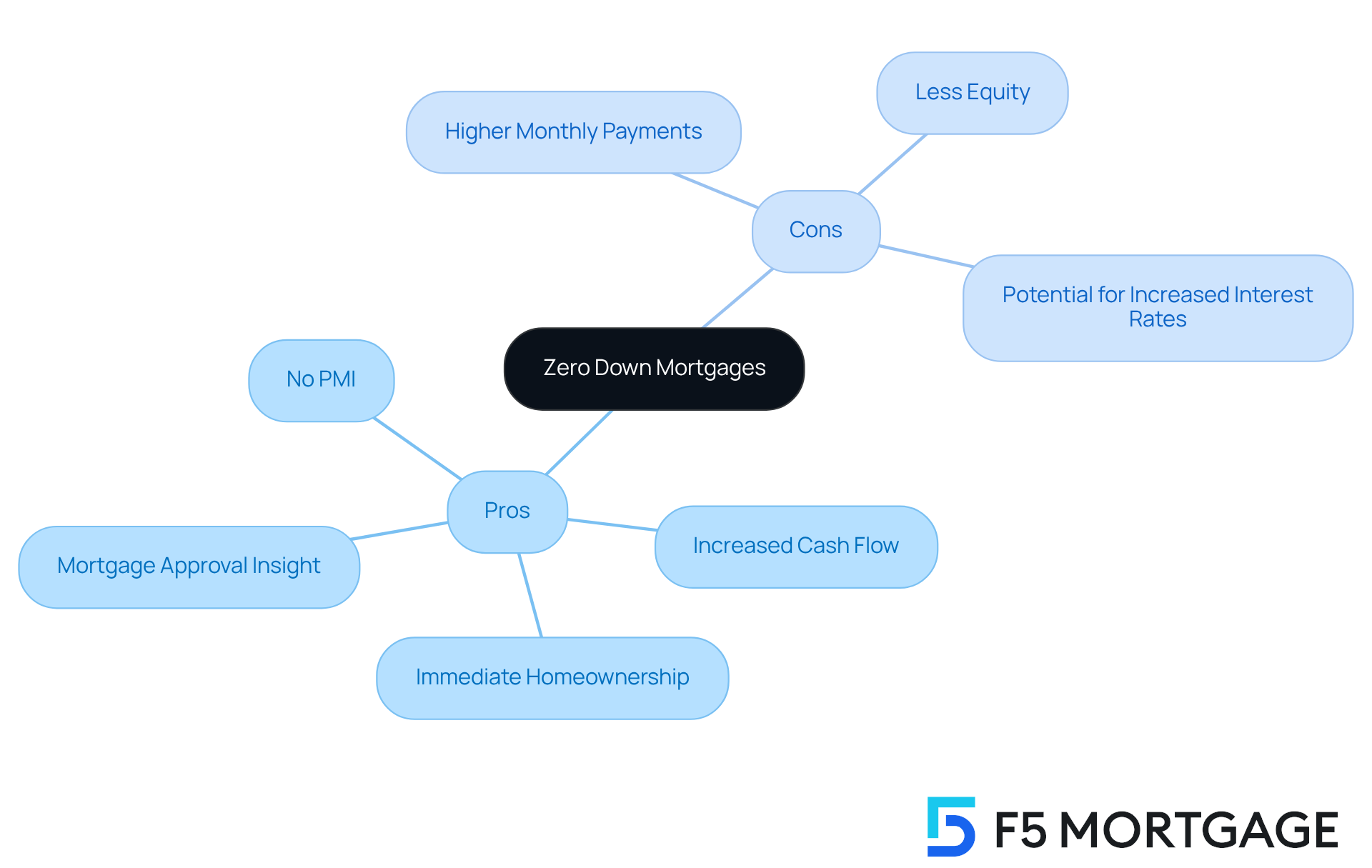

When considering a zero down mortgage, it’s essential to evaluate both the pros and cons with care and understanding:

Pros:

- Immediate Homeownership: Families can purchase a home without the burden of saving for a down payment, allowing them to embrace homeownership sooner than they might have thought possible.

- Increased Cash Flow: With no initial cost, families can redirect their savings toward other vital expenses, such as home enhancements or building an emergency fund.

- No PMI: Many options for zero down mortgage loans, such as VA loans, do not require private mortgage insurance, which can significantly lower monthly costs and ease financial pressure.

- Mortgage Approval Insight: An approval from a lender means they see you as a suitable candidate for a mortgage based on your financial details. This approval provides an estimate of your potential loan amount, interest rate, and monthly contributions, helping you plan ahead.

Cons:

- Higher Monthly Payments: Financing the entire home price may lead to larger monthly mortgage payments, which could strain family budgets and create stress.

- Less Equity: Without a down payment, homeowners start with no equity in their home. This can be a disadvantage if property values decline, leaving families feeling vulnerable.

- Potential for Increased Interest Rates: Some lenders may impose higher interest rates on zero down mortgage loans, which can raise the total cost of the mortgage, adding to your financial concerns.

Navigating the world of mortgages can be challenging, and we know how overwhelming it can feel. We’re here to support you every step of the way, ensuring you make informed decisions that align with your family’s needs.

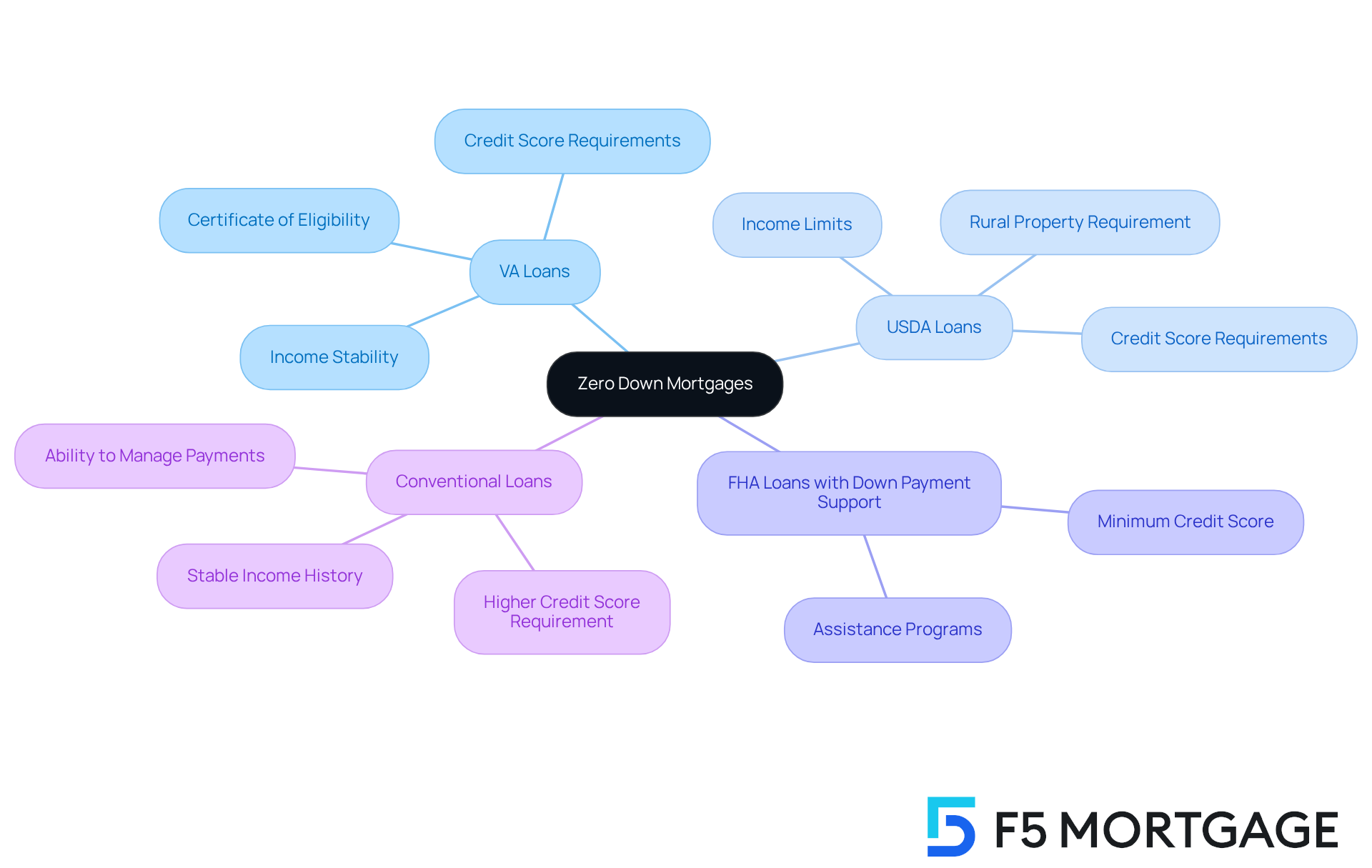

Understand Qualification Criteria for Zero Down Mortgages

Navigating the world of mortgages can be overwhelming, especially when considering zero down mortgage loans. To help families like yours, it’s important to understand the criteria that may vary by loan type:

-

VA Loans: If you’re a veteran or an active-duty service member, you may qualify for a VA loan. You’ll need to provide a Certificate of Eligibility (COE), and lenders will look at your credit scores and income stability to ensure you’re set up for success.

-

USDA Loans: For those considering USDA loans, remember that you must meet certain income limits—typically not exceeding 115% of the median income for your area. Additionally, the property must be in a designated rural area. A credit score of at least 640 is often required, which is achievable with some planning.

-

FHA Loans with Down Payment Support: FHA loans usually require a minimum credit score of 580 for a 3.5% down payment. However, there are assistance programs available that can help cover this cost, making it possible for you to start your homeownership journey with no initial expense.

-

Conventional Loans: If you’re looking into zero down mortgage loans, be prepared for lenders to ask for a higher credit score—often 700 or above—and a stable income history. It’s essential to demonstrate your ability to manage monthly payments comfortably, and we know how challenging this can be.

By understanding these options, you can take empowered steps toward homeownership. Remember, we’re here to support you every step of the way as you explore the best mortgage solutions for your family.

Conclusion

Zero down mortgage loans offer a wonderful opportunity for families eager to achieve homeownership without the weight of a large upfront payment. By removing the down payment requirement, these loans empower families to invest in their future and improve their living conditions, making homeownership more achievable than ever.

In this article, we’ve explored various types of zero down mortgage options, including:

- VA loans

- USDA financing

- Special FHA programs

Each of these options brings unique benefits tailored to different needs. For instance, VA loans come with no private mortgage insurance, while USDA financing opens doors for eligibility on rural properties. However, it’s important to carefully consider the pros and cons, such as potentially higher monthly payments and the absence of initial equity, to make a well-informed decision.

Ultimately, grasping the landscape of zero down mortgage loans can greatly influence a family’s journey to homeownership. By delving into these options and understanding the qualification criteria, families can take empowered steps toward their dream home. Engaging with mortgage experts can offer personalized guidance, ensuring that the path to homeownership is both accessible and aligned with their financial goals. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is a zero down mortgage loan?

A zero down mortgage loan is a type of financing that allows families to purchase a home without needing to make an initial down payment, covering 100% of the home’s purchase price.

Who can benefit from zero down mortgage loans?

Zero down mortgage loans are particularly appealing for first-time homebuyers or individuals with limited savings.

What are some common examples of zero down mortgage loans?

Common examples include VA financing for veterans and USDA financing for rural properties.

What are the benefits of VA financing?

VA financing eliminates the need for an initial down payment and provides favorable refinancing options, such as the VA Interest Rate Reduction Refinance Option (IRRRL) and VA cash-out refinance.

What is the VA Interest Rate Reduction Refinance Option (IRRRL)?

The VA IRRRL allows homeowners who have built equity in their home to lower their interest rate and monthly payments.

What is a VA cash-out refinance?

A VA cash-out refinance allows homeowners to access their home equity for various financial needs.

How do zero down mortgage loans make homeownership more accessible?

These financial solutions help families enhance their living conditions without the burden of a large upfront cost, making homeownership more attainable.