Overview

Applying for a Home Equity Line of Credit (HELOC) can feel overwhelming, but we’re here to support you every step of the way. Homeowners should follow a structured process that begins with:

- Researching lenders

- Gathering necessary documentation

- Completing the application

- Understanding the terms before closing the loan

These crucial steps can help ease your journey.

We know how challenging this can be, which is why it’s important to be well-prepared. Essential eligibility criteria include:

- Your credit rating

- Property equity

- Debt-to-income ratio

By being informed and organized, you can enhance your chances of approval and ensure that this financial product aligns with your long-term goals.

Remember, you’re not alone in this process. Taking these steps can empower you to make decisions that benefit your financial future.

Introduction

Navigating the world of home financing can feel overwhelming, and we understand how daunting it can be, especially when considering a Home Equity Line of Credit (HELOC). This flexible financial tool offers homeowners the chance to tap into their property’s equity for various needs, ranging from renovations to debt consolidation. With interest rates around 7.84% in 2025, many families are embracing this opportunity to enhance their living spaces and improve their financial stability. However, securing a HELOC comes with its own set of challenges. What are the key steps and considerations that can truly make a difference in your application?

In this guide, we’ll explore essential insights into eligibility, documentation, and strategies for overcoming common hurdles. We’re here to support you every step of the way, empowering you to make informed financial decisions that align with your goals.

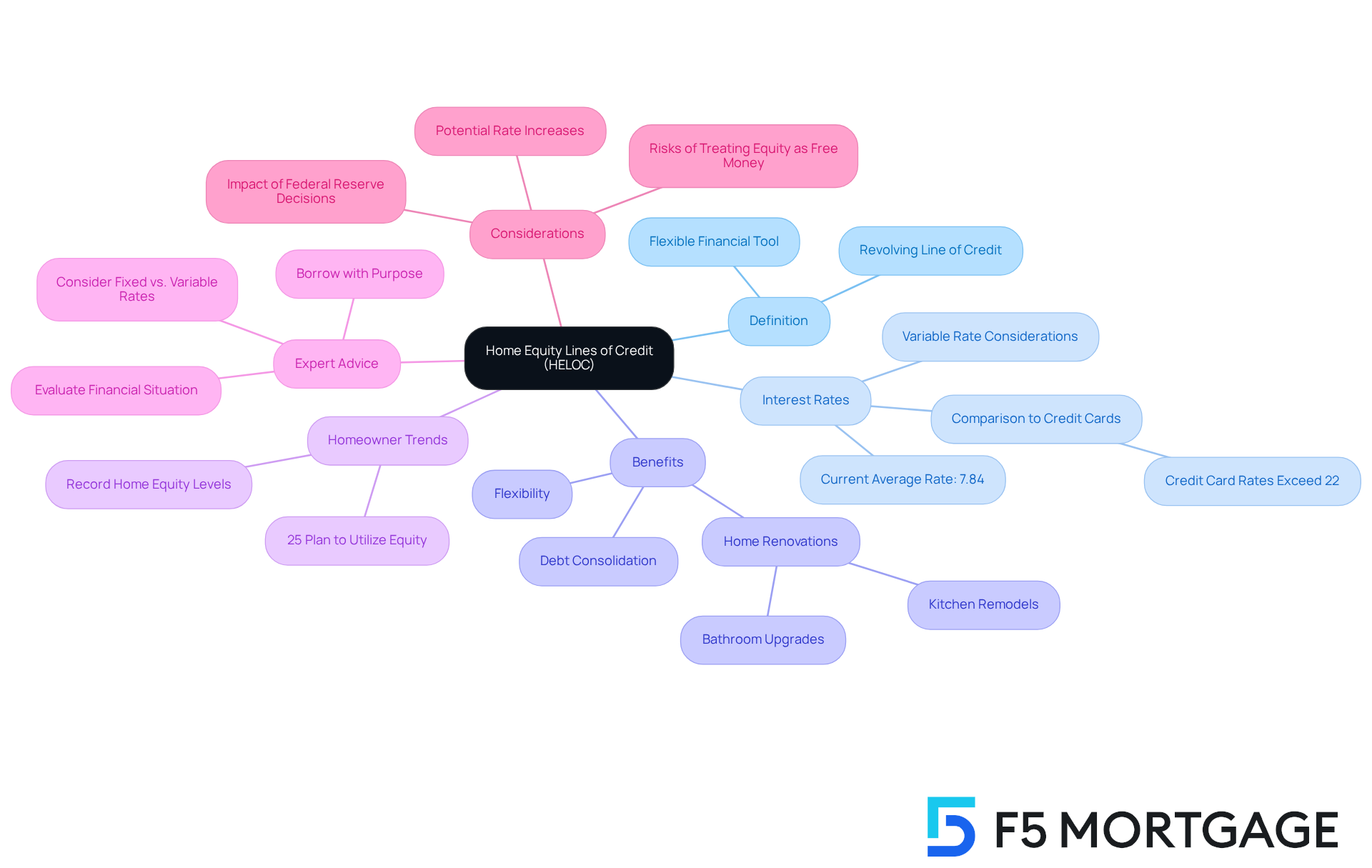

Understand Home Equity Lines of Credit (HELOC)

A Home Equity Line of Credit (HELOC) is a flexible financial tool that allows property owners to tap into their equity. Unlike traditional loans that provide a lump sum, a HELOC offers a revolving line of credit, giving you the freedom to access funds as needed. This flexibility is particularly appealing for homeowners who wish to fund renovations, consolidate debts, or manage unexpected expenses.

As we look ahead to 2025, the average interest rate for HELOCs is approximately 7.84%. This makes them a more affordable option compared to credit cards, which typically exceed 22%. Many homeowners are recognizing this opportunity; nearly 25% plan to utilize their home equity within the year for projects like kitchen remodels or bathroom upgrades, which can significantly enhance both their living spaces and property value.

We understand how important it is to borrow wisely. Financial advisors often emphasize the need to borrow with purpose. As one expert wisely stated, “Above all else, borrow with purpose,” reminding us that every dollar borrowed should align with a specific financial goal. Additionally, using a home equity line of credit for debt consolidation can lead to substantial savings, as it generally offers lower interest rates compared to personal loans or credit cards.

However, it’s essential to be aware that HELOCs come with variable interest rates that can change based on market conditions. While you may enjoy lower payments in a declining rate environment, it’s crucial to prepare for potential increases. Therefore, evaluating your overall financial situation and comparing offers from different institutions is vital before you apply for a home equity line of credit. By taking these steps, you can ensure that this financial product aligns with your long-term goals and provides the flexibility you truly need.

Determine Eligibility and Requirements for HELOC

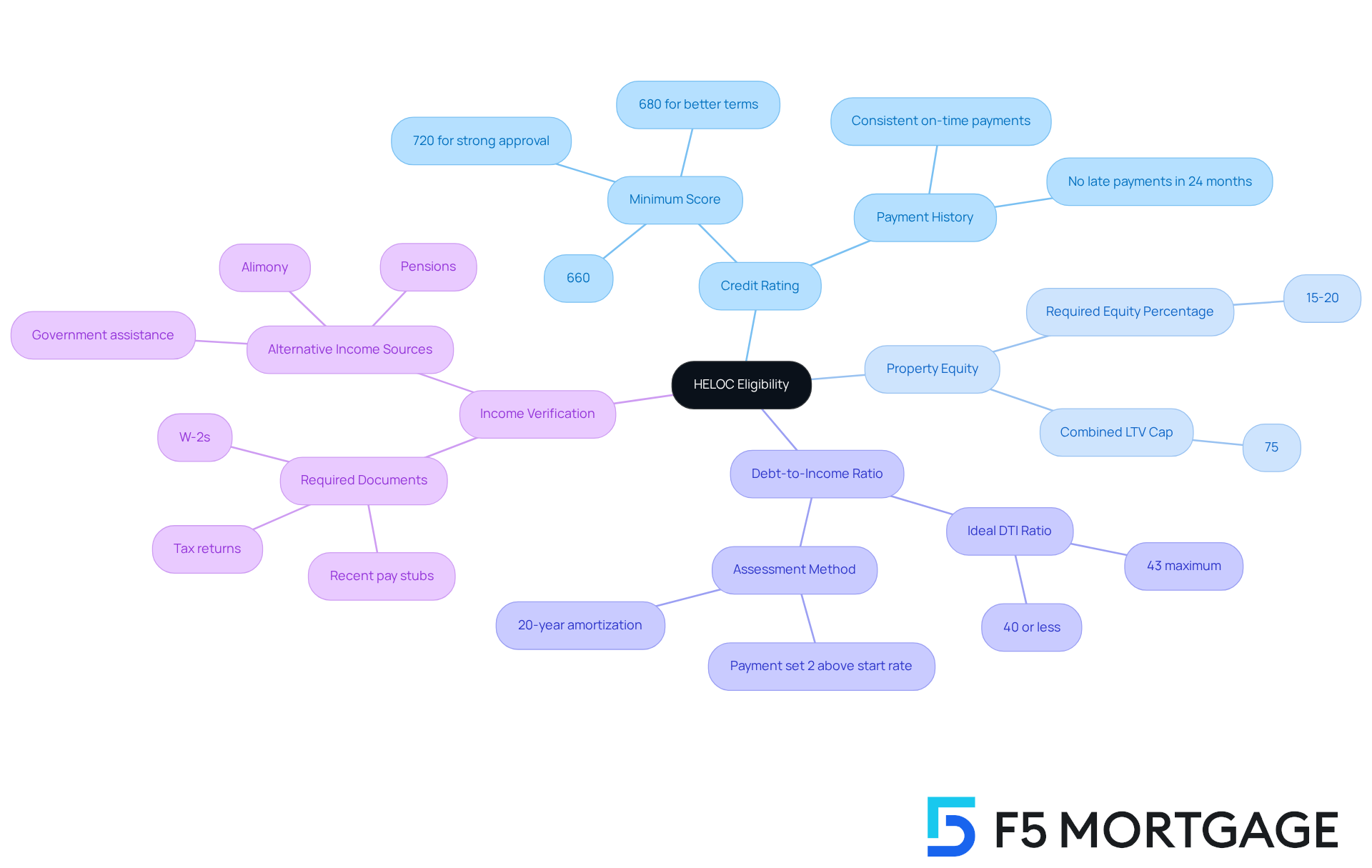

Qualifying for a home equity line of credit can feel overwhelming, but understanding the key factors can make the process smoother and less stressful. Here’s what you need to know:

-

Credit Rating: Most lenders look for a minimum credit score of around 620. However, if you can achieve a score of 680 or higher, you’ll likely enjoy better approval chances and more favorable terms. A solid credit history is crucial, so lenders typically want to see consistent, on-time payments over the past 24 months. We know how challenging it can be to maintain a good credit score, but it’s an essential step toward securing your HELOC.

-

Property Equity: Having enough equity in your home is vital. Generally, you’ll need at least 15-20% of your property’s value. For example, if your home is valued at $400,000, you should aim for $60,000 to $80,000 in equity to qualify. This requirement can feel daunting, but it’s a key factor in the approval process.

-

Debt-to-Income Ratio (DTI): Lenders will assess your DTI to ensure you can handle additional debt comfortably. A DTI ratio below 43% is often preferred, with an ideal target of 40% or less to boost your chances of approval. We understand that managing finances can be tough, but keeping your DTI in check is a proactive way to enhance your eligibility.

-

Income Verification: Be ready to provide proof of your income, such as recent pay stubs, W-2s, or tax returns. This documentation is crucial for showing your ability to repay the loan. Gathering these documents might feel like a chore, but it’s an important step in demonstrating your financial stability.

By grasping these standards and preparing the necessary paperwork, you can better assess your eligibility and confidently apply for a home equity line of credit. Remember, maintaining a strong credit score is paramount, as it reflects your reliability in managing and repaying debt. We’re here to support you every step of the way as you embark on this journey.

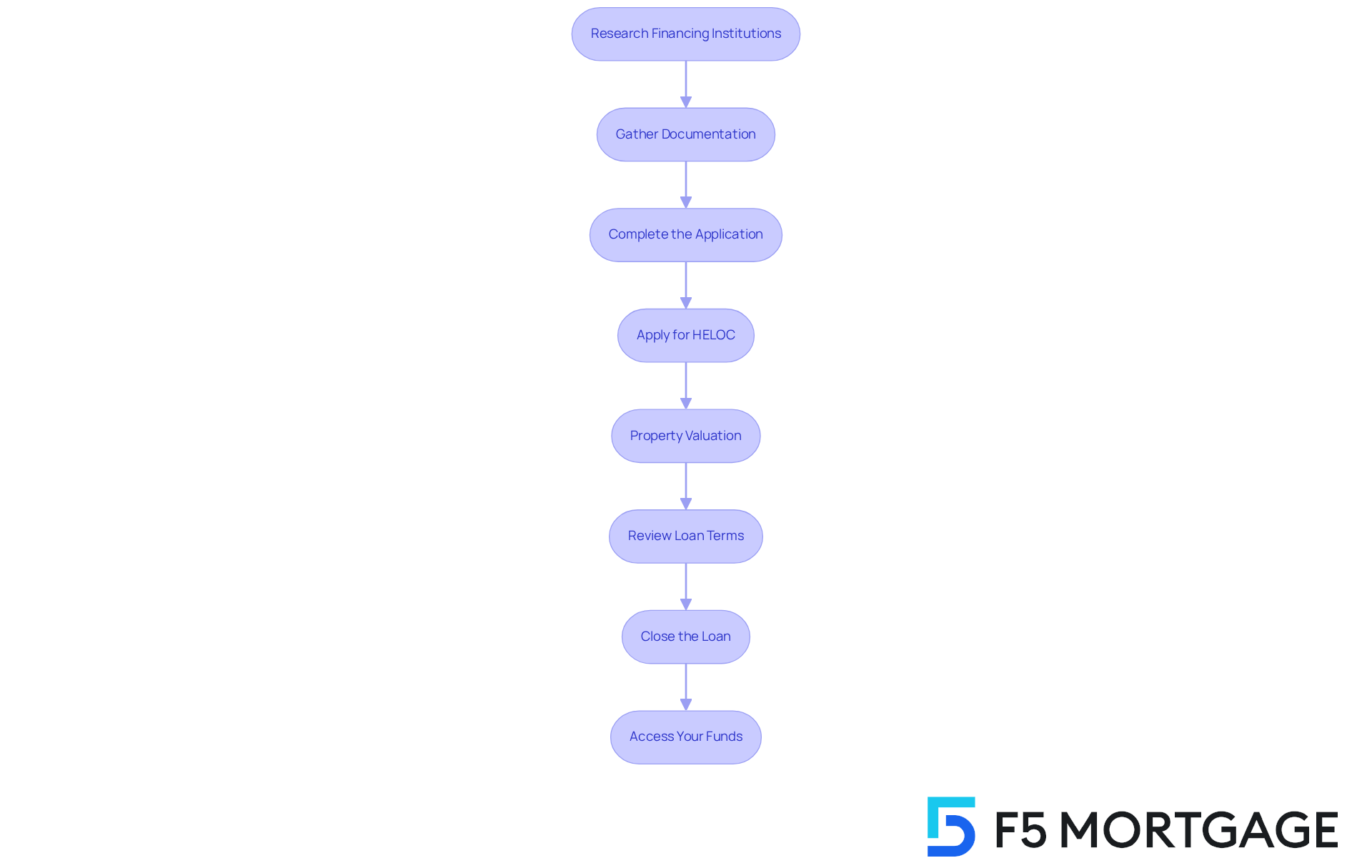

Follow the Step-by-Step Application Process for HELOC

-

Research Financing Institutions: We understand that navigating financing options can be overwhelming. Start by exploring various sources to compare interest rates, fees, and terms. Focus on institutions that specialize in HELOCs, as they often offer tailored solutions to help you apply for a home equity line of credit. Many financial institutions require property owners to maintain a minimum of an 80% loan-to-value ratio, meaning you should ideally have reduced at least 20% of your initial loan amount or your property has appreciated in value. Additionally, cash-out home equity loans may come with even higher equity requirements. Some financial institutions might waive closing costs or provide attractive introductory rates, which can significantly impact your overall borrowing expenses. As Greg McBride, Chief Financial Analyst at Bankrate, wisely states, “When you’re searching for a financial provider, the cost of borrowing from them is paramount.” Consider partnering with F5 Mortgage for competitive rates and personalized service that truly understands your situation.

-

Gather Documentation: We know how important it is to be prepared. Assemble all necessary documents, including proof of income, credit reports, and details about your home. Commonly required documentation includes W-2s, pay stubs, bank statements, and mortgage statements. Having these ready can greatly streamline the application process, reducing stress along the way.

-

Complete the application to apply for a home equity line of credit: When filling out the financing institution’s application form, be sure to provide accurate details about your financial situation and the intended use of the HELOC. Prepare to share personal information, co-applicant details, and collateral information, as financial institutions will assess your overall financial health. Remember, this step is crucial for your journey.

-

Apply for home equity line of credit: After completing the necessary steps, make sure to submit your application along with the required documentation. Double-check everything to avoid delays in processing. Many financial institutions allow online submissions, which can help expedite the process, making it easier for you.

-

Property Valuation: The financial institution may arrange an evaluation to determine your home’s worth, which is essential for setting your credit limit. Be ready for this step, as it can take anywhere from a few days to a few weeks, depending on the lender’s requirements. Understanding the importance of home appraisals in determining property value and equity for mortgage rates is key to your success.

-

Review Loan Terms: Once approved, take the time to carefully review the loan terms. Pay close attention to the interest rate, repayment period, and any associated fees. Understanding these details is vital, as they will influence your financial obligations over time. We’re here to support you in making informed decisions.

-

Close the Loan: If you agree to the terms, you can proceed to close the loan. This process may involve signing documents and covering any closing expenses, which can range from 2% to 5% of your highest borrowing limit. Remember, this is a significant step towards achieving your financial goals.

-

Access Your Funds: After closing, you can access your line of credit funds as needed, whether through checks, a credit card, or online transfers. This flexibility allows you to manage your finances efficiently, whether for home improvements or consolidating higher-interest debt. We’re here to help you navigate this process with confidence.

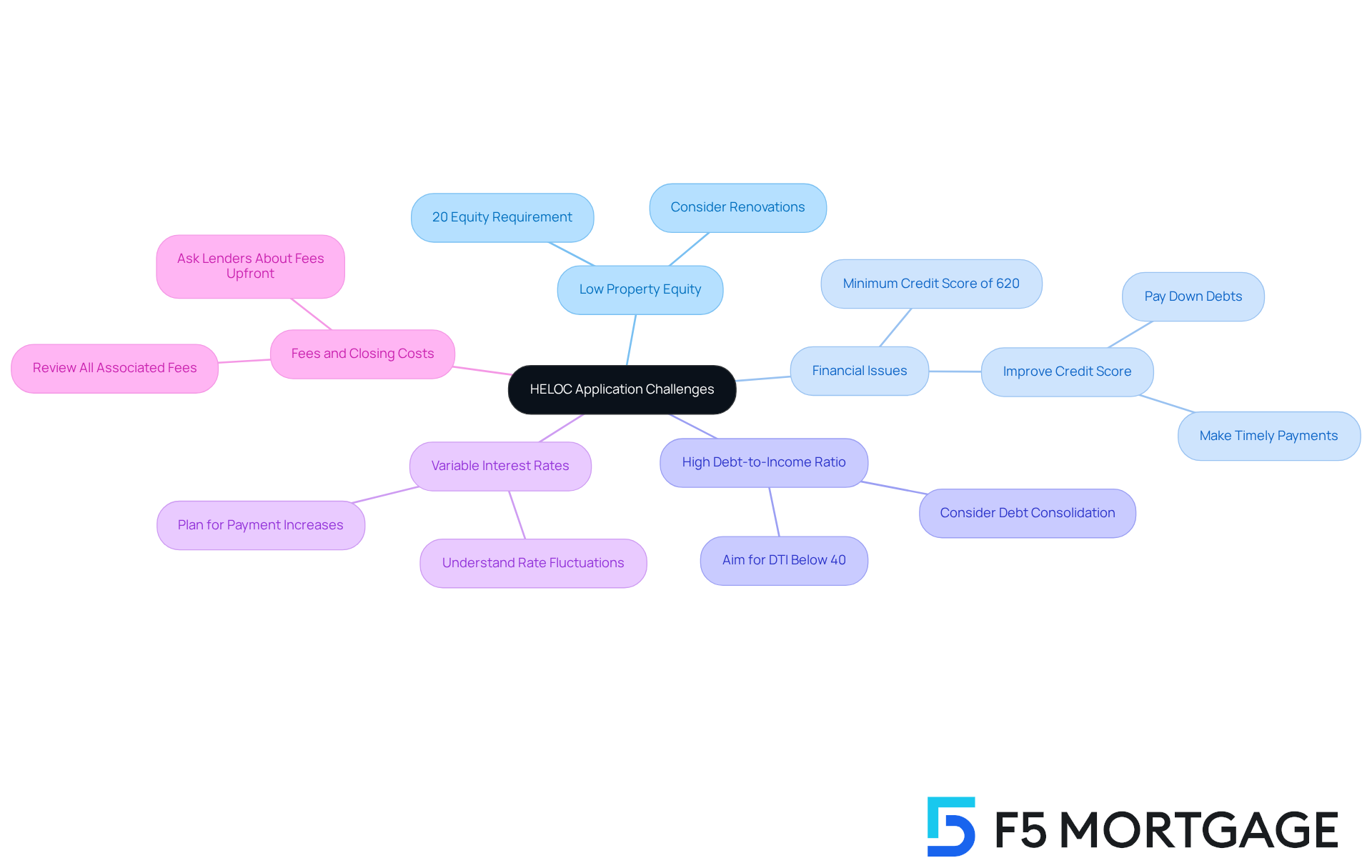

Address Common Challenges and Considerations in HELOC Applications

Understanding the challenges ahead can help you navigate the process with confidence when you apply for a home equity line of credit. Here are some key considerations:

-

Low Property Equity: We understand that if your home hasn’t appreciated significantly, you might worry about your equity. Most lenders, including F5 Mortgage, typically require at least 20% equity in your property. To enhance your home’s value, think about renovations that can improve its market appeal. Homeowners who invested in kitchen remodels often found a substantial return on investment, helping boost their equity.

-

Financial Issues: A low credit score can be a significant hurdle. In 2025, most financial institutions will require a score of at least 620 for HELOC approval. If your score is below this, focus on improving it by paying down debts and making timely payments. Even small changes, like reducing credit card balances, can lead to noticeable improvements in your score.

-

High Debt-to-Income Ratio: A high debt-to-income (DTI) ratio may also pose a challenge. Aim for a DTI below 40% to increase your chances of approval, as lenders usually favor a DTI under 43%. Consider strategies like consolidating debts or finding ways to increase your income to improve this ratio.

-

Variable Interest Rates: It’s important to be aware that HELOCs often come with variable interest rates that can fluctuate based on market conditions. This means your payments could increase over time. Having a plan to manage potential payment increases is essential, especially if rates rise significantly. Understanding the terms of your home equity line of credit can prepare you for changes in your monthly payments. F5 Mortgage offers competitive rates and personalized service to help you navigate these changes effectively, with no hidden costs.

-

Fees and Closing Costs: Familiarize yourself with all associated fees, such as application, appraisal, and closing costs. HELOCs can come with additional fees that add up and impact your overall borrowing costs. By reviewing the fine print and asking lenders about potential fees upfront, you can avoid unexpected expenses. F5 Mortgage is committed to transparency, ensuring you understand all costs associated with your home equity line of credit.

By anticipating these challenges and preparing accordingly, you can enhance your chances to apply for home equity line of credit successfully. Engaging with financial advisors can also provide tailored strategies for managing low home equity and improving your financial standing before you apply for a home equity line of credit. We know how challenging this can be, but many satisfied customers have shared their positive experiences with F5 Mortgage, highlighting the smooth process and exceptional service they received. We’re here to support you every step of the way.

Conclusion

A Home Equity Line of Credit (HELOC) can be a valuable financial resource, helping homeowners tap into their property equity for various needs. We understand how important it is to navigate this process with confidence. This guide has outlined essential steps and considerations for applying for a HELOC, highlighting the importance of understanding eligibility requirements, gathering necessary documentation, and effectively navigating the application process.

Key insights include the significance of:

- Maintaining a strong credit score

- Ensuring sufficient property equity

- Managing your debt-to-income ratio

We know how challenging this can be, but by being well-prepared and informed about potential hurdles—like variable interest rates and associated fees—you can position yourself for a successful HELOC application. This financial tool not only offers flexibility but can also lead to significant savings when used wisely, especially for debt consolidation or home improvements.

Ultimately, taking the time to educate yourself on the HELOC process empowers you to make informed financial decisions. Engaging with financial advisors and exploring options from reputable lenders can enhance your chances of approval and ensure a smooth application experience. By strategically harnessing the benefits of a HELOC, you can achieve your financial goals while enhancing your property’s value and overall financial stability. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is a Home Equity Line of Credit (HELOC)?

A Home Equity Line of Credit (HELOC) is a flexible financial tool that allows property owners to access their home equity through a revolving line of credit, rather than a lump sum, enabling them to withdraw funds as needed.

What are some common uses for a HELOC?

Homeowners commonly use a HELOC to fund renovations, consolidate debts, or manage unexpected expenses.

What is the average interest rate for HELOCs as of 2025?

The average interest rate for HELOCs is approximately 7.84% in 2025.

How does the interest rate of a HELOC compare to credit cards?

HELOCs generally offer a more affordable option compared to credit cards, which typically have interest rates exceeding 22%.

What percentage of homeowners plan to utilize their home equity within the year?

Nearly 25% of homeowners plan to utilize their home equity within the year for projects such as kitchen remodels or bathroom upgrades.

What should borrowers consider before taking out a HELOC?

Borrowers should evaluate their overall financial situation, compare offers from different institutions, and ensure that borrowing aligns with specific financial goals, as HELOCs come with variable interest rates that can change based on market conditions.

What is the advice given by financial advisors regarding borrowing?

Financial advisors emphasize the importance of borrowing with purpose, meaning every dollar borrowed should align with a specific financial goal.

How can using a HELOC for debt consolidation be beneficial?

Using a HELOC for debt consolidation can lead to substantial savings, as it typically offers lower interest rates compared to personal loans or credit cards.