Overview

Navigating the online mortgage application process can feel overwhelming, but we’re here to support you every step of the way. This article outlines a straightforward four-step process designed to help you master your application.

- First, we focus on gathering the necessary documentation, ensuring you have everything you need at your fingertips.

- Next, we guide you through completing the application form, making this part as simple as possible.

- Once your application is complete, we emphasize the importance of reviewing and submitting it carefully. This step is crucial, as it can significantly enhance your chances of a successful mortgage application.

- Finally, we help you understand the subsequent steps after submission, so you know what to expect.

To make this journey easier, we provide a detailed checklist of required documents along with clear instructions for each stage. We know how challenging this can be, but with thorough preparation and careful review, you can approach this process with confidence and clarity. Remember, you’re not alone in this; we’re here to guide you through every step.

Introduction

Completing an online mortgage application can often feel like navigating a complex maze, filled with numerous steps and documentation. We understand how challenging this can be. However, by mastering a few straightforward strategies, prospective homeowners can streamline the process and significantly enhance their chances of approval.

What essential steps and common pitfalls should applicants be aware of to ensure a smooth experience? This guide will illuminate the path to a successful online mortgage application, empowering you to tackle the process with confidence and clarity. We’re here to support you every step of the way.

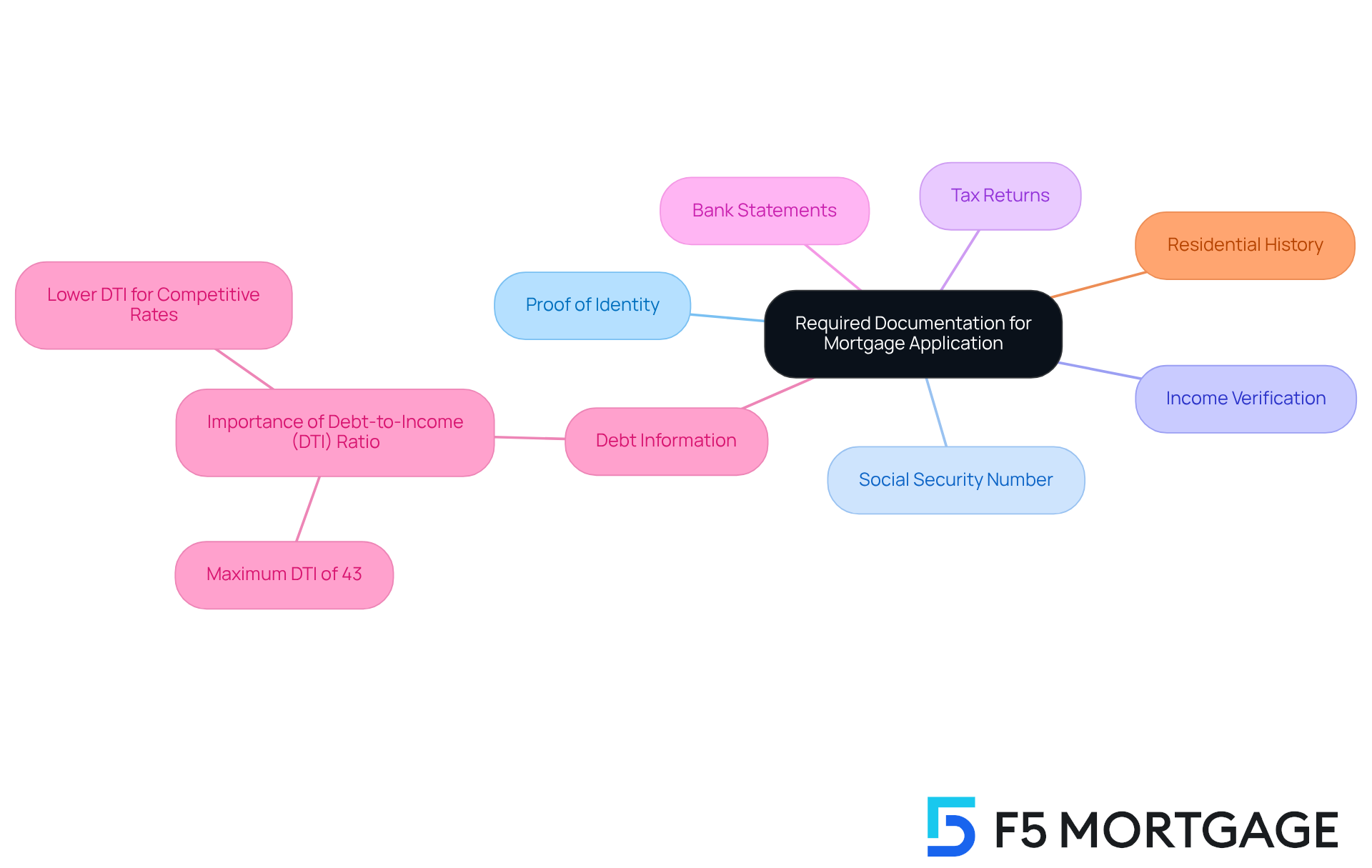

Gather Required Documentation for Your Application

Completing your online mortgage application can feel overwhelming, but gathering the right documents can make the process smoother. Here’s a helpful checklist to prepare you:

- Proof of Identity: A government-issued ID (like a driver’s license or passport) is essential.

- Social Security Number: This will be needed for credit checks.

- Income Verification: Recent pay stubs from the last 30 days and W-2 forms from the past two years are necessary.

- Tax Returns: Complete tax returns for the last two years are crucial, especially for those who are self-employed.

- Bank Statements: Collect statements from the last two months for all your accounts.

- Debt Information: Provide details of any outstanding debts, including credit cards and borrowings. Understanding your is vital, as a maximum of 43% DTI is typically required for home loans. A lower DTI can lead to more competitive mortgage rates, which is particularly important for families looking to upgrade their homes.

- Residential History: List the addresses where you have lived over the past two years.

Having these documents ready will simplify your online mortgage application submission process and help you avoid unnecessary delays. Remember, if you’re considering refinancing, F5 Mortgage is here to support you every step of the way, offering various options tailored to your needs, including conventional loans, FHA loans, and VA loans. We want to ensure you have the best possible solutions for your financial situation.

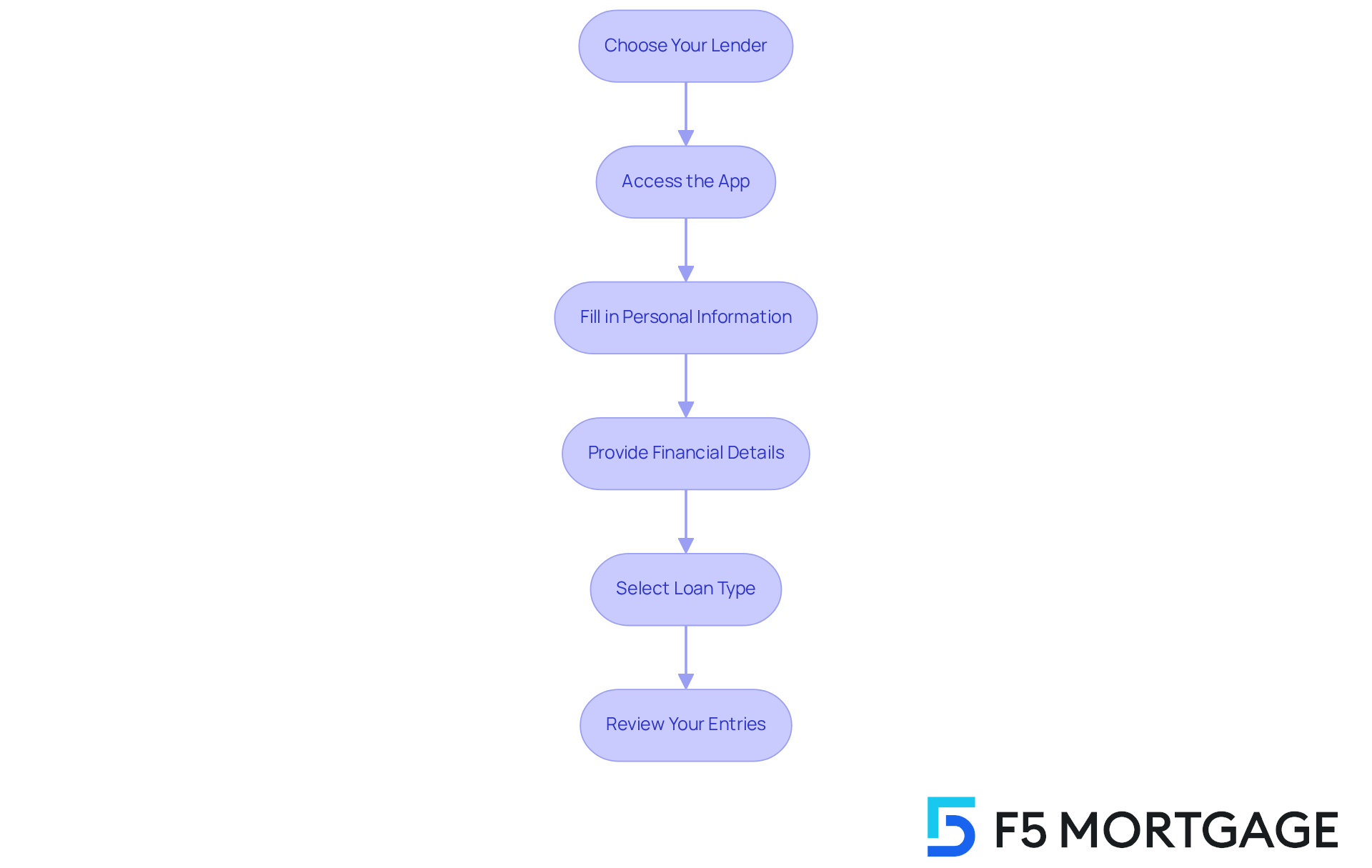

Complete the Online Mortgage Application Form

To successfully complete your online mortgage application, we know how important it is to follow these essential steps:

- Choose Your Lender: Begin by selecting F5 Mortgage or another lender that meets your needs.

- Access the App: Visit the lender’s website and find the loan request section.

- Fill in Personal Information: Provide your full name, contact details, and Social Security number, ensuring accuracy to avoid delays.

- Provide Financial Details: Enter your income, employment history, and a comprehensive overview of your assets and debts. Remember, a two-year work history is typically required.

- Select Loan Type: Indicate the type of mortgage you are applying for, such as a fixed-rate, FHA, or VA loan.

- Review Your Entries: Carefully double-check all information for precision before submitting your form.

Filling out the form correctly is essential, as it can greatly enhance your processing experience. Typically, the procedure for the may require around a month to finalize. However, with careful planning, you can accelerate this duration. Digital tools enable secure document uploads and e-signatures, which can shorten closing times by as much as 20%.

As highlighted by industry specialists, “Applying for a home loan is the official beginning of the financing process.” This makes it essential to approach this step with diligence. By adhering to these steps, you can improve your likelihood of a successful submission and enjoy a more seamless financing process. We’re here to support you every step of the way.

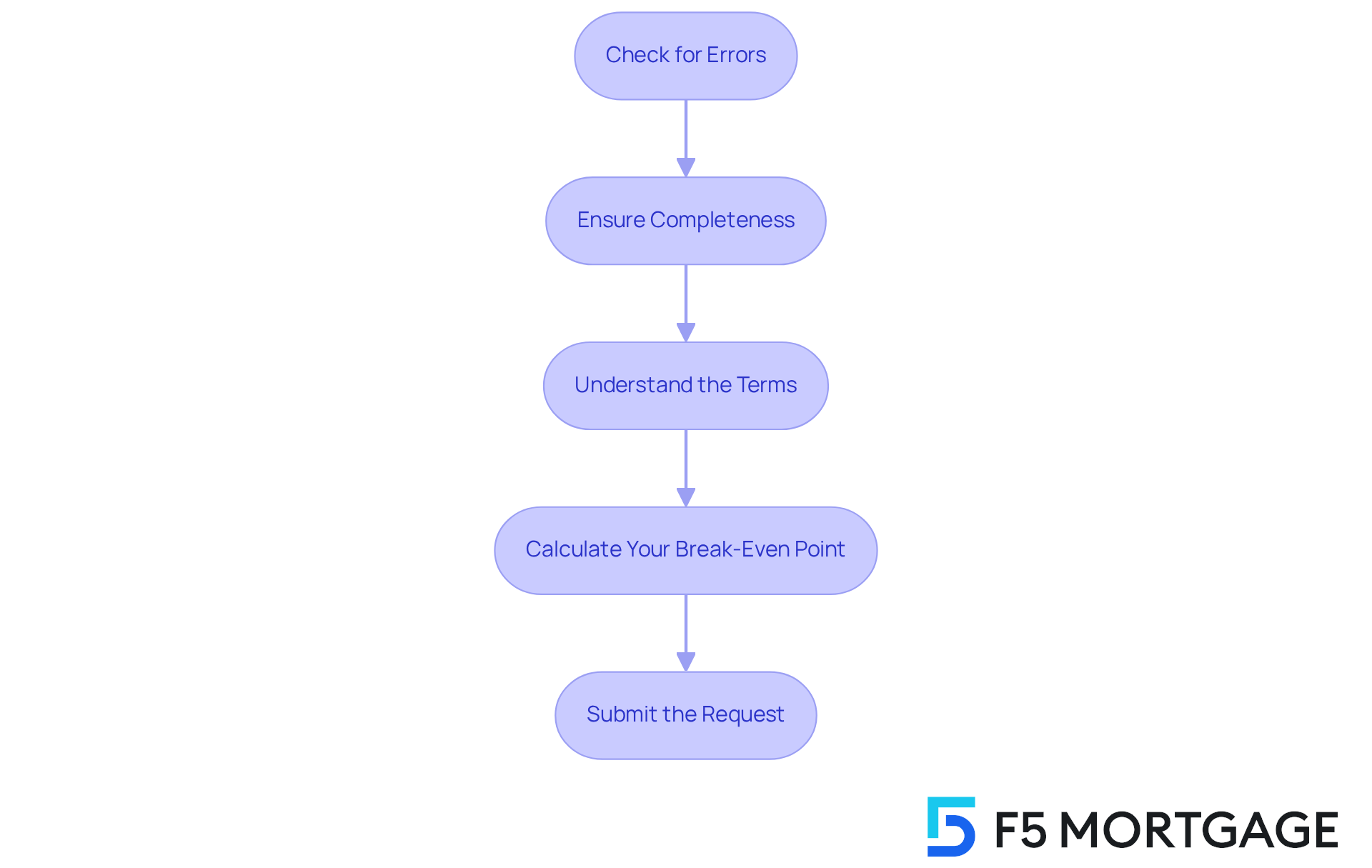

Review and Submit Your Application

After finishing the form, we know how important it is to take the time to examine it thoroughly. Here’s how you can do it:

- Check for Errors: Look for any typos or incorrect information in your personal and financial details. This step is crucial to ensure everything is accurate.

- Ensure Completeness: Make sure all required fields are filled out and that you have attached any necessary documents. We want to help you avoid any delays in the process.

- : Read through the terms and conditions related to the loan. It’s essential to ensure you feel comfortable with them before moving forward.

- Calculate Your Break-Even Point: Before submitting, consider calculating your break-even point for refinancing. This involves determining your refinancing costs, calculating your monthly savings, and dividing the costs by the savings to see how long it will take to recoup your expenses. For example, if your refinancing costs are $4,000 and your monthly savings are $100, your break-even point would be 40 months. This step is vital to ensure that refinancing makes sense for your financial situation.

- Submit the Request: Once you are satisfied with your review, submit the request through the lender’s online portal.

Presenting a thoroughly evaluated submission enhances your likelihood of a swift endorsement. By comprehending your financial situation and the consequences of your loan, you can look forward to a more seamless experience. Remember, we’re here to support you every step of the way.

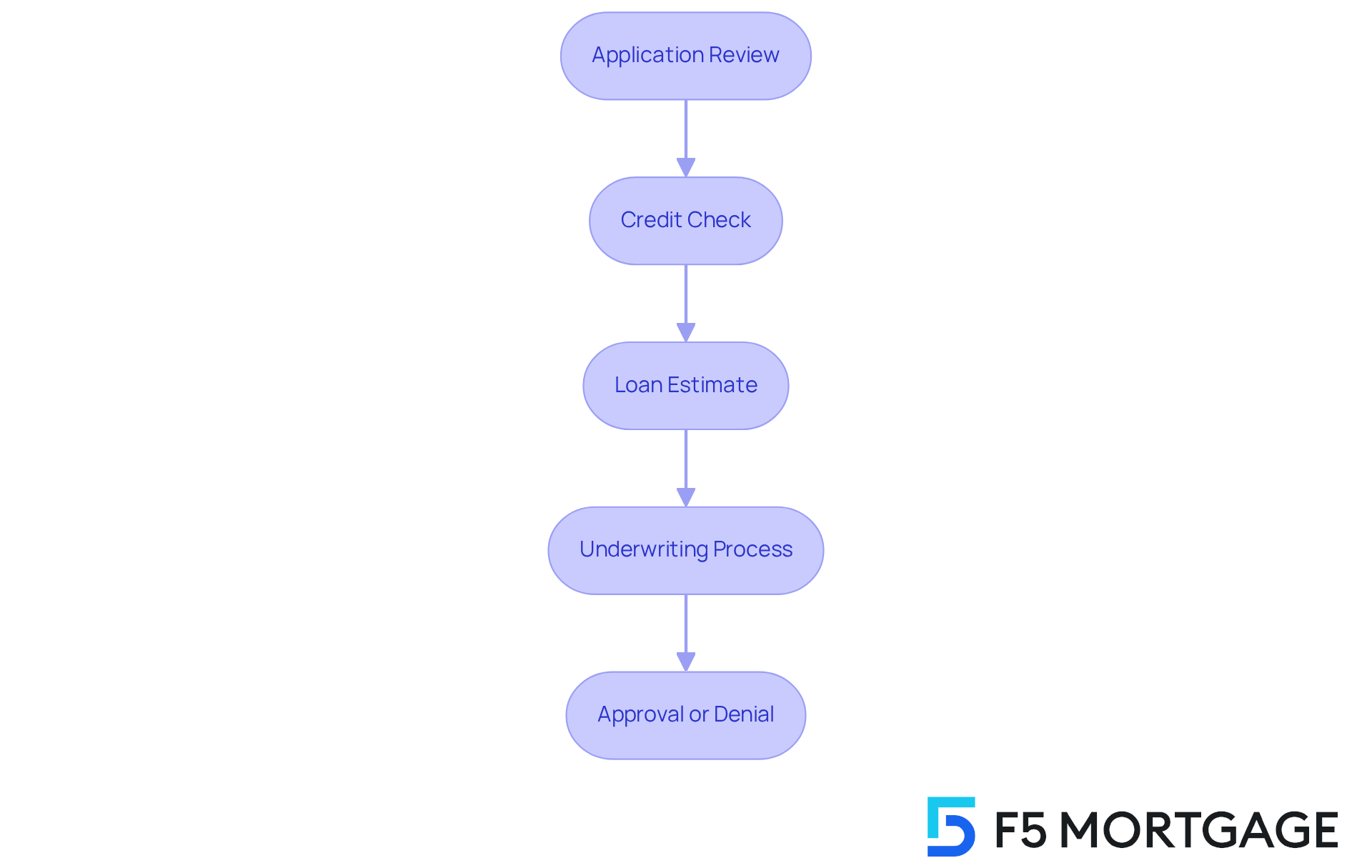

Understand the Next Steps After Submission

After you submit your mortgage application with F5 Mortgage, we want you to feel confident about the next steps ahead:

- Application Review: Our team will carefully review your application and supporting documents. We understand how important this is for you, and we strive to make this process seamless.

- Credit Check: We will evaluate your credit history to determine your creditworthiness. This step is essential in the approval process, and we’re here to guide you through it.

- Loan Estimate: Within a few days, you’ll receive a Loan Estimate outlining the terms of your financing, including interest rates and closing costs. This will help you make informed decisions. At F5 Mortgage, we pride ourselves on offering competitive rates to help you achieve homeownership faster.

- Underwriting Process: Your request will undergo underwriting, where we you provided. This ensures accuracy and compliance with lending standards. It’s important to note that about 80% of loan applications go through this evaluation, and we are committed to assisting you every step of the way.

- Approval or Denial: Finally, you will be informed of the lender’s decision. If approved, you will receive comprehensive guidelines on the closing procedure, reflecting our dedication to outstanding service.

Understanding these steps is crucial, especially since nearly 30% of essential workers and self-employed individuals face loan rejections during the online mortgage application process. This highlights the importance of thorough preparation in your application. As Jill, a financing specialist, shares, “If someone is serious about moving forward, on my site, they’re only a click away.” Successful outcomes often depend on how well applicants prepare their documentation and grasp the review process. By staying informed and proactive, you can navigate the complexities of securing your mortgage with confidence, knowing that F5 Mortgage is here to support you every step of the way.

Conclusion

Mastering the online mortgage application process is essential for achieving homeownership with confidence and ease. We know how challenging this can be, but by understanding the necessary steps—from gathering documentation to submitting your application—you can navigate this journey smoothly and effectively. Each phase, whether it’s selecting the right lender or ensuring accuracy in your submission, plays a critical role in enhancing your chances of success.

Key insights from this guide emphasize the importance of thorough preparation and attention to detail. By compiling the required documents, completing the application form accurately, and reviewing your entries diligently, you set the stage for a seamless experience. Furthermore, understanding the subsequent steps after submission can help alleviate any uncertainties, ensuring you stay informed throughout the process.

Ultimately, taking proactive measures can significantly impact your mortgage application journey. Whether you are a first-time homebuyer or considering refinancing, prioritizing careful preparation and utilizing available resources will empower you to make informed decisions. Embrace the steps outlined in this guide and approach your online mortgage application with confidence, knowing that we’re here to support you every step of the way.

Frequently Asked Questions

What documents do I need to gather for my online mortgage application?

You need to gather the following documents: a government-issued ID (like a driver’s license or passport), your Social Security number, recent pay stubs from the last 30 days, W-2 forms from the past two years, complete tax returns for the last two years, bank statements from the last two months for all accounts, details of any outstanding debts, and a list of addresses where you have lived over the past two years.

Why is proof of identity required for a mortgage application?

Proof of identity, such as a government-issued ID, is essential to verify your identity during the mortgage application process.

How does my income affect my mortgage application?

Income verification is necessary to assess your ability to repay the loan. You need to provide recent pay stubs and W-2 forms to demonstrate stable income.

What tax documents are needed for the mortgage application?

You must provide complete tax returns for the last two years, which is particularly important if you are self-employed.

How many months of bank statements should I provide?

You should collect bank statements from the last two months for all your accounts.

What information about my debts do I need to include?

You need to provide details of any outstanding debts, including credit cards and borrowings, as this information helps determine your Debt-to-Income (DTI) ratio.

What is the maximum allowable DTI ratio for home loans?

The typical maximum DTI ratio required for home loans is 43%. A lower DTI can lead to more competitive mortgage rates.

What should I include in my residential history?

You should list all the addresses where you have lived over the past two years.

What support does F5 Mortgage offer for refinancing?

F5 Mortgage offers various options tailored to your needs, including conventional loans, FHA loans, and VA loans, to help you through the refinancing process.