Overview

The title “Master Streamline Refinance Rates: 5 Steps to Secure the Best Deal” addresses a significant concern for homeowners: how to effectively obtain favorable streamline refinance rates. We understand how challenging this can be, and that’s why we’ve outlined a clear five-step process designed to guide you through it.

- First, it’s essential to grasp the basics of streamline refinancing. This knowledge will empower you as you move forward.

- Next, identifying eligibility criteria is crucial; knowing whether you qualify can save you time and effort.

- Once you’ve established your eligibility, collecting the required documentation will be your next step. We’re here to support you every step of the way, ensuring you have everything needed to proceed.

- After that, comparing rates from multiple lenders becomes vital. This step helps you find the best possible terms tailored to your situation.

- Finally, submitting the refinance application is the last step in this journey.

By following these steps, you can secure the best refinancing terms available, ultimately leading to a more manageable mortgage experience.

Introduction

Streamline refinancing offers a wonderful opportunity for homeowners with existing FHA or VA mortgages to simplify their financial commitments and potentially lower monthly payments. We understand how overwhelming the mortgage process can be, and this approach helps you avoid traditional hurdles like extensive paperwork and appraisals. By doing so, you can easily capitalize on favorable interest rates.

However, as you navigate the intricacies of eligibility criteria and documentation requirements, you may wonder: how can you secure the best streamline refinance deal amidst a sea of options? We’re here to support you every step of the way, ensuring you feel empowered to make the best decision for your financial future.

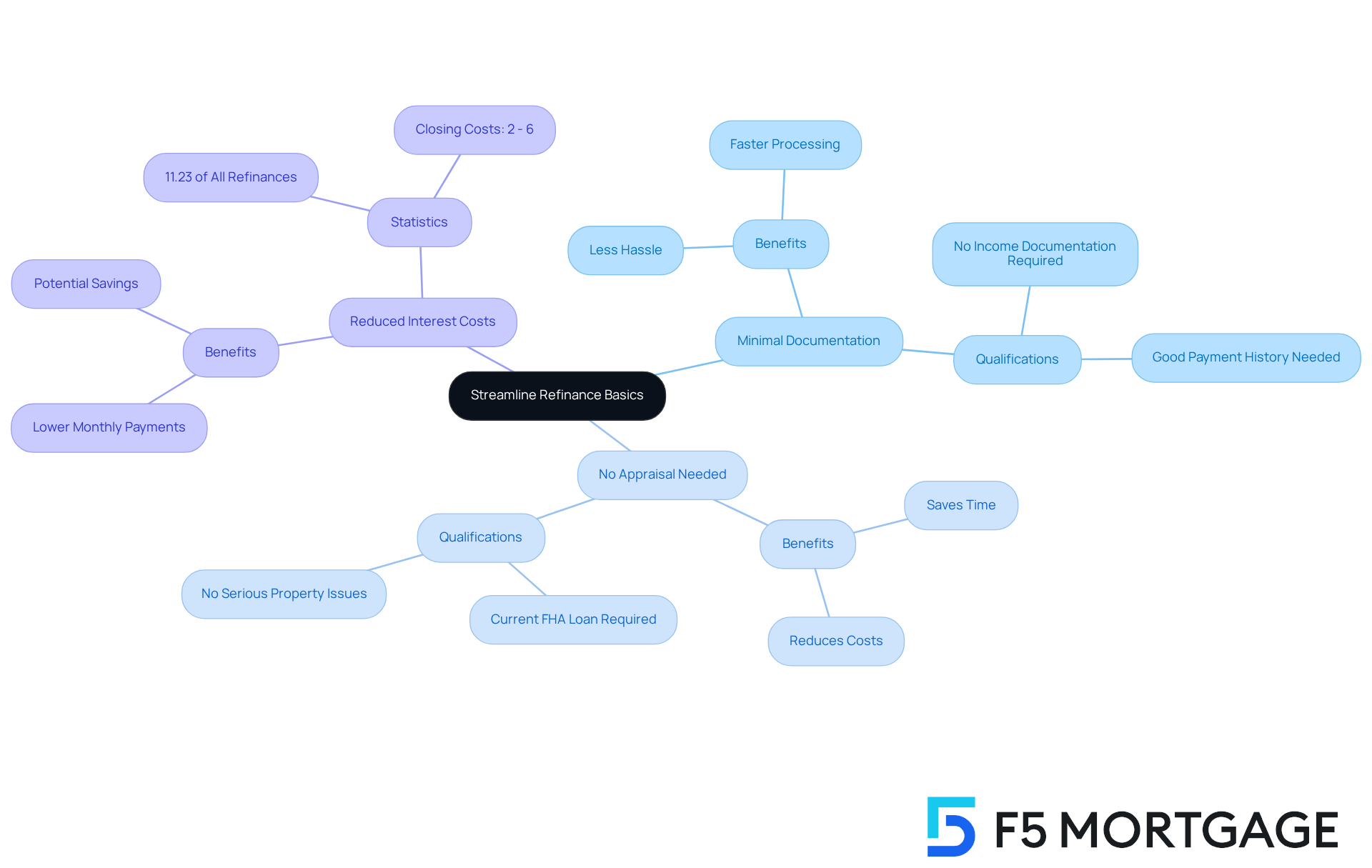

Understand Streamline Refinance Basics

Streamline refinance rates offer a simplified procedure designed for homeowners with existing FHA or VA mortgages. It allows you to streamline refinance rates with minimal paperwork and fewer requirements, ultimately aiming to reduce your interest rates and monthly payments. Importantly, this process does not necessitate a new appraisal or extensive credit checks. If you have consistently maintained a good payment history on your current loans, this approach can help you capitalize on potential savings.

Key features of streamline refinancing include:

- Minimal Documentation: Unlike traditional refinancing, streamline options often require significantly less documentation. This expediting of the process reduces hassle and stress.

- No Appraisal Needed: You can refinance without undergoing a new property appraisal, saving both time and associated costs.

- Reduced Interest Costs: Streamline refinance rates typically offer lower interest costs, which can lead to significant decreases in your monthly payments.

At F5 Mortgage, we understand that navigating refinancing can feel overwhelming. That’s why we provide a variety of loan modification choices tailored to meet your needs, including FHA, VA, USDA, and conventional simplified refinances. Our dedicated team is here to support you throughout the refinancing process, ensuring you obtain the most favorable terms and conditions possible. To qualify for an FHA streamlined refinance rates, at least 210 days must have passed since closing on the mortgage being refinanced. Additionally, your existing FHA loan must be up to date, with no late payments in the past three months. We also want to ensure that you demonstrate a net tangible benefit, such as a reduction in interest rate or monthly payment, to qualify for the streamline refinance rates.

Statistics show that FHA simplified refinances make up 11.23% of all refinance mortgages in the U.S., highlighting their popularity in today’s market. Closing costs for an FHA Streamline Refinance usually range between 2% and 6% of the loan value, which is an important consideration for homeowners like you.

Moreover, efficient loan restructuring does not require income documentation, further simplifying the process. Many borrowers have successfully achieved substantial savings, often indicating monthly payment decreases that offset closing expenses within just 24 months.

By familiarizing yourself with these basics and understanding the various loan options available through F5 Mortgage, you can better evaluate whether this financial solution aligns with your financial goals. We know how challenging this can be, but we’re here to .

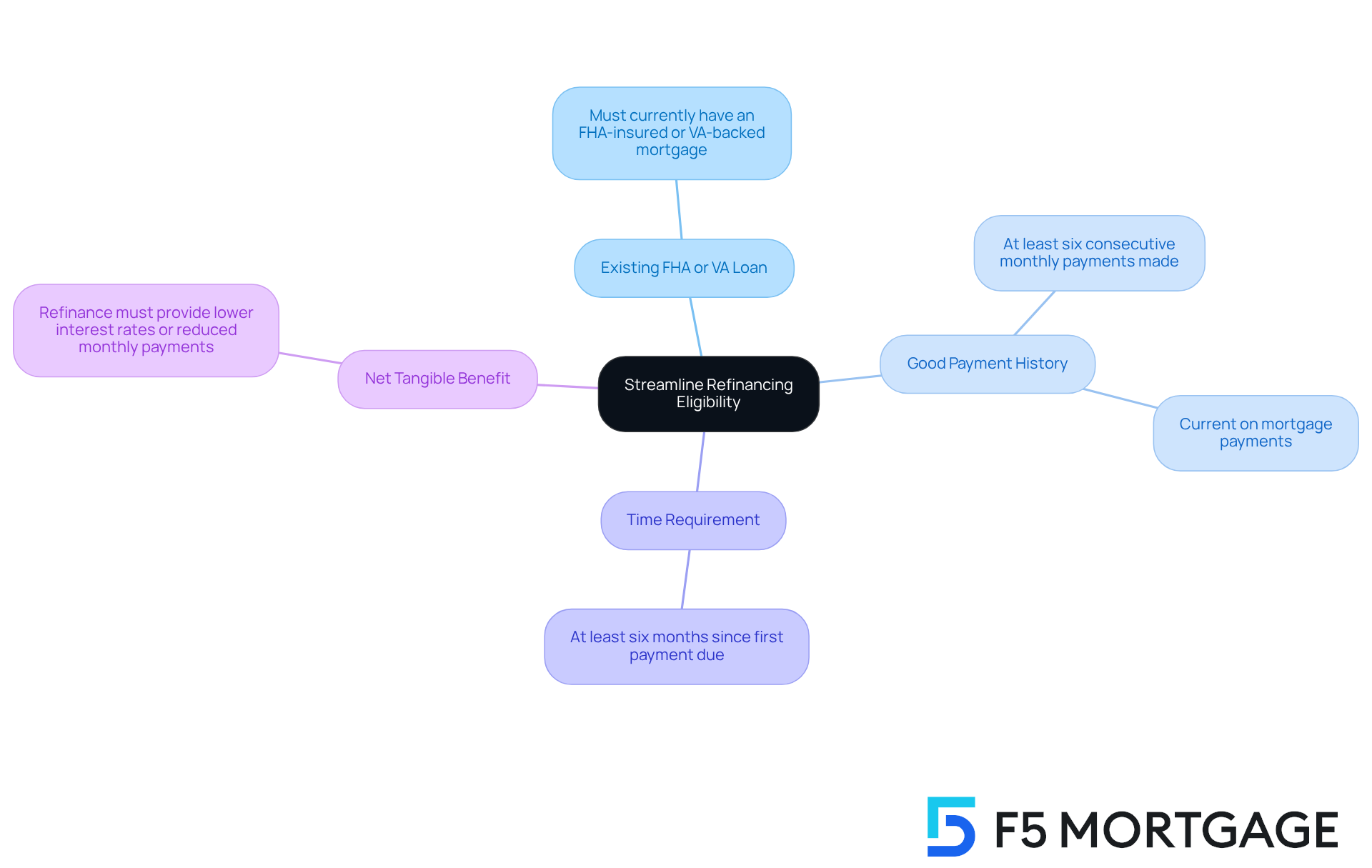

Identify Eligibility Criteria for Streamline Refinancing

Navigating the mortgage process can feel overwhelming, but we’re here to support you every step of the way. To qualify for simplified options, homeowners must meet specific criteria, which can vary slightly between FHA and VA mortgages. Here are the general eligibility requirements:

- Existing FHA or VA Loan: You must currently have an FHA-insured or VA-backed mortgage to apply for streamline refinancing.

- Good Payment History: Typically, you should have made at least six consecutive monthly payments on your existing credit and be current on your mortgage payments.

- Time Requirement: At least six months must have passed since your first payment was due on the original loan.

- Net Tangible Benefit: The refinance must provide a tangible benefit, such as lower interest rates or reduced monthly payments, which can be achieved through streamline refinance rates.

By ensuring you meet these standards, you can simplify your loan process and avoid unnecessary difficulties. We understand how challenging this can be, and we’re committed to helping you find the .

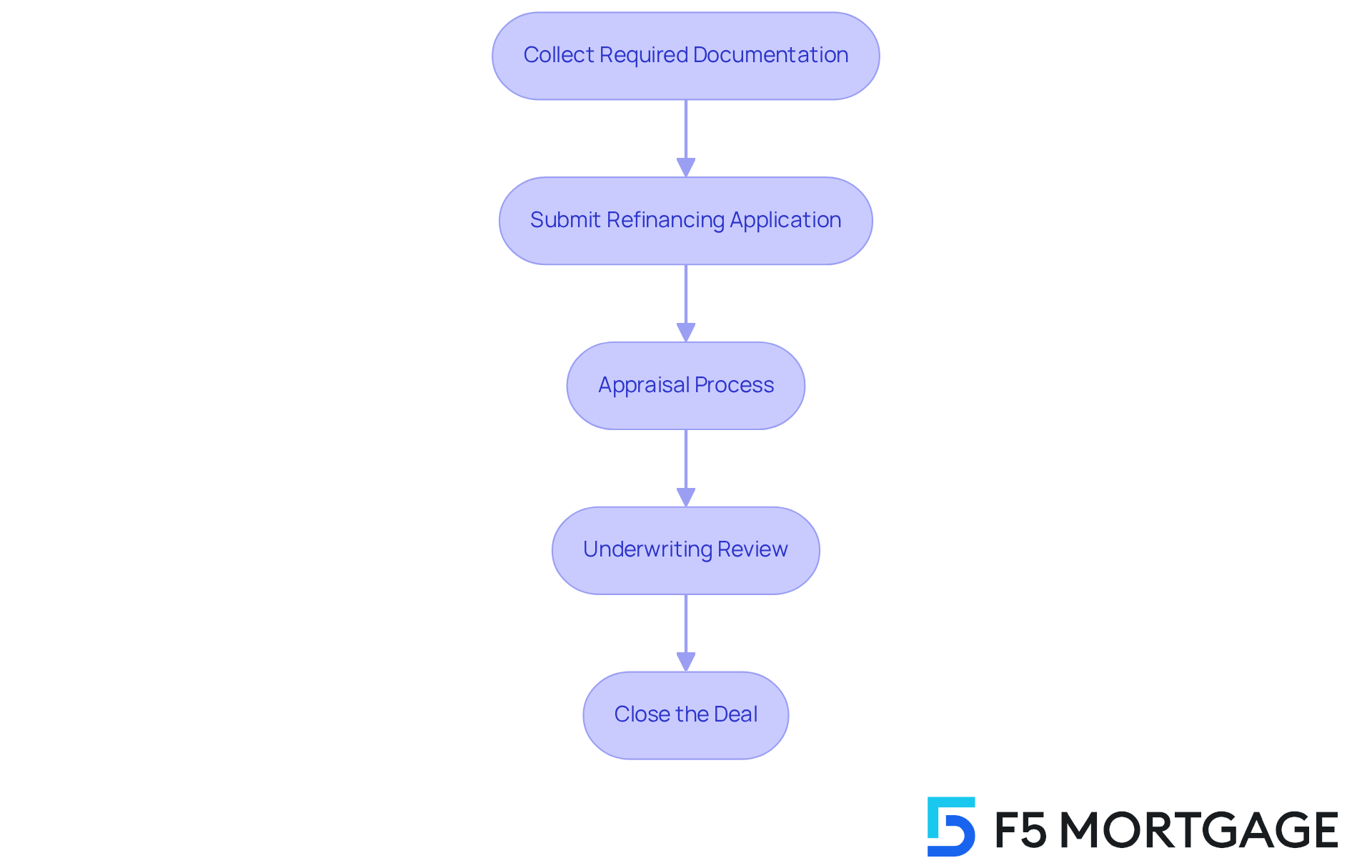

Collect Required Documentation for Application

When you’re exploring with F5 Mortgage, we understand how important it is to gather the necessary documentation to support your application. Here’s a helpful list of commonly required documents:

- Current Mortgage Statement: This document shows your payment history and confirms that you are current on your mortgage.

- FHA or VA Loan Note: A copy of your existing loan note is essential to verify the terms of your current mortgage.

- Homeowner’s Insurance Information: Proof of insurance is typically required to ensure the property is adequately covered.

- Employment Verification: While simplified loan processes often require minimal income verification, some lenders may still ask for proof of employment.

Once you’ve collected these documents, the next step is to submit a refinancing application. This application will include information about your property and other financial documents. We know how challenging this can be, but this step will lead you through an appraisal process where the lender assesses your property’s current value. After the appraisal, the underwriting process will follow, during which the lender reviews your application and financial history. Finally, once your application has been accepted, you can close the deal, sign the new documents, and pay closing costs. By preparing these documents ahead of time, you can simplify the application process and avoid potential delays, ensuring a smoother transition to your new mortgage with F5 Mortgage.

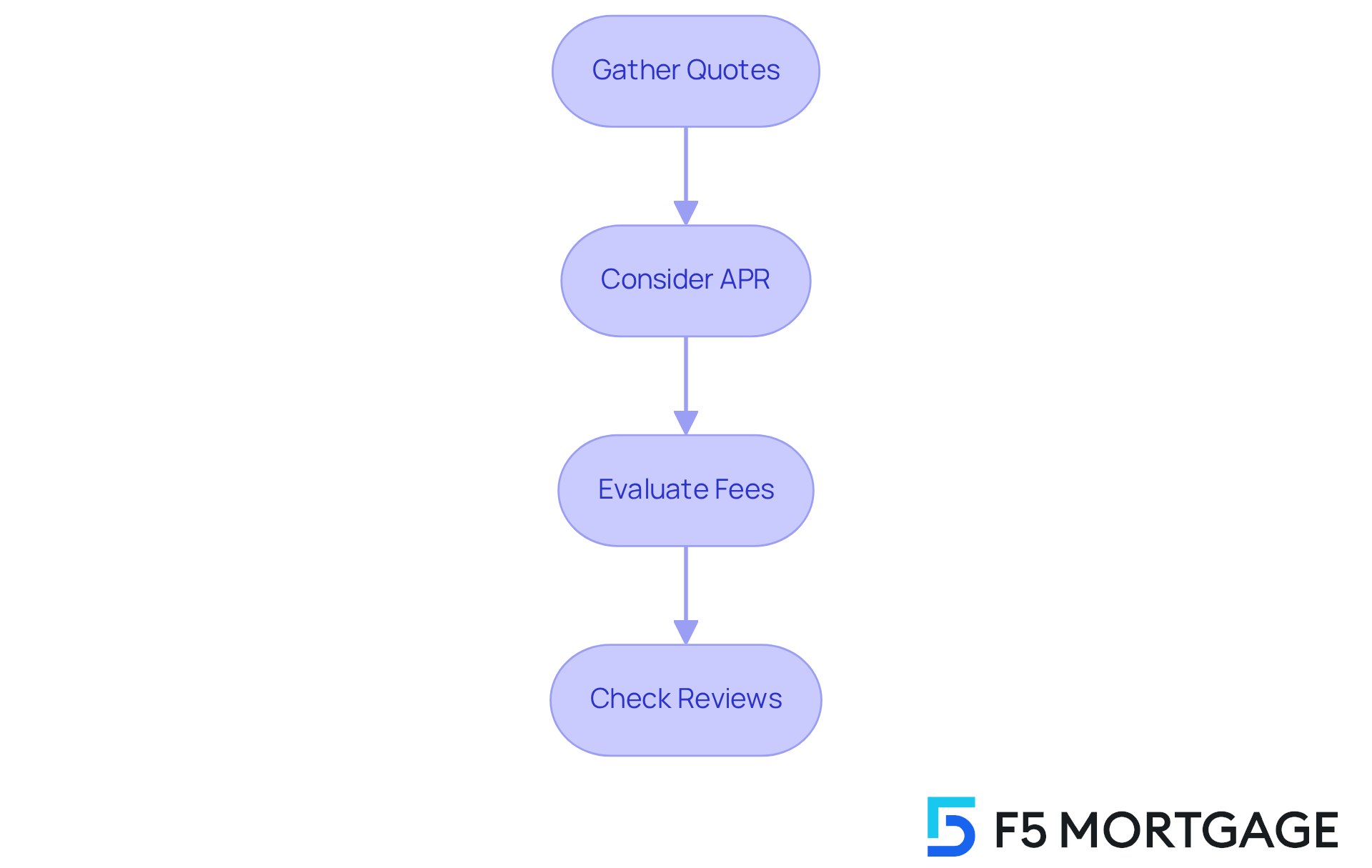

Compare Rates from Multiple Lenders

To secure the best , we understand how important it is to compare offers from multiple lenders. Here’s how you can effectively evaluate rates and make a choice that feels right for you:

- Gather Quotes: Reach out to at least three to five lenders for quotes on your refinance. Make sure to request the same financing terms for accurate comparisons.

- Consider APR: Look beyond just the interest figure; the Annual Percentage Rate (APR) includes fees and other expenses linked to the loan. This gives you a clearer view of the overall borrowing cost.

- Evaluate Fees: Inquire about closing costs, origination fees, and any other charges. Some lenders may offer lower charges but balance them with increased fees, which can affect your total savings.

- Check Reviews: Research lender reviews and customer satisfaction ratings. This will help you assess their service quality and reliability.

By carefully contrasting prices and conditions, you can make a knowledgeable choice regarding streamline refinance rates that aligns with your financial objectives. We know how challenging this can be, but data indicate that borrowers can save considerably by comparing loan options. Many families realize monthly savings that recover costs within just two to three years. This thorough assessment not only improves your likelihood of obtaining a beneficial offer but also empowers you to manage the refinancing process with confidence. Remember, we’re here to support you every step of the way.

Submit Your Streamline Refinance Application

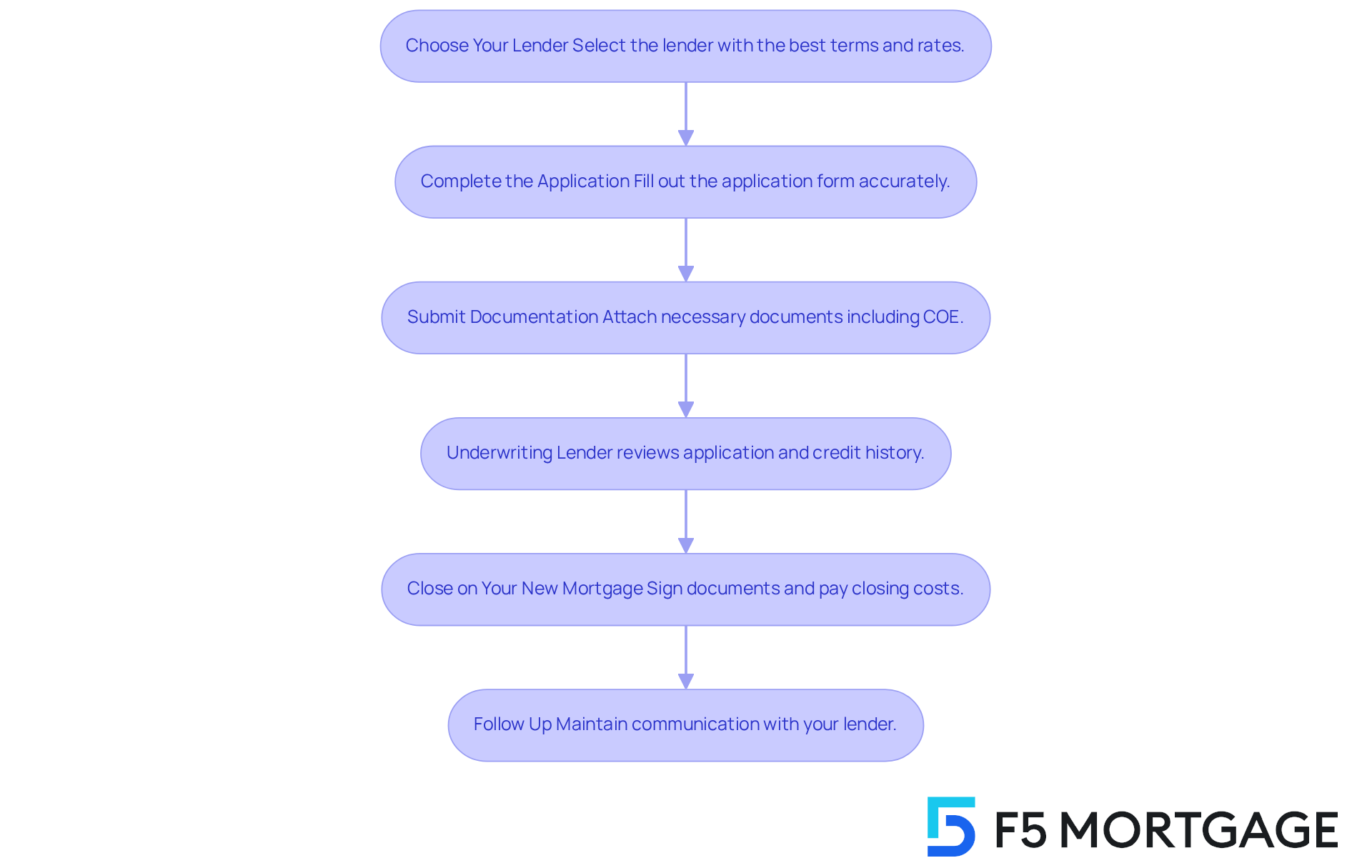

Once you have gathered your documentation and assessed costs, it’s time to submit your VA streamline refinance application. Here’s how to proceed:

- Choose Your Lender: We understand that selecting the right lender can feel overwhelming. Choose the lender who offers the most favorable terms and rates based on your comparisons. A well-chosen lender can significantly impact your refinancing experience and savings. According to mortgage experts, opting for a lender with a solid history in VA financing can lead to improved service and reduced rates. At F5 Mortgage, we leverage user-friendly technology to simplify this process, ensuring you have the information you need to make an informed decision.

- Complete the Application: Filling out the lender’s application form accurately is crucial. Ensure that all required information is provided, as incomplete submissions can lead to delays. Statistics show that homeowners who submit complete applications are 30% more likely to receive timely approvals. Our goal at F5 Mortgage is to guide you through this step without pressure, allowing you to choose what feels right for you.

- Submit Documentation: Attach the necessary documents you collected earlier, such as proof of income, credit history, and property details. Ensuring that everything is complete will help expedite the process. For VA streamline refinances, it’s especially important to include your Certificate of Eligibility (COE) to confirm your VA benefits. F5 Mortgage is dedicated to quick and effective financing closings, with most agreements completed in under three weeks.

- Underwriting: After your application is submitted, the lender will review your application, credit history, debt-to-income ratio, and other requirements to complete the credit approval process. This step is crucial for .

- Close on Your New Mortgage: Once your application has been approved, you can close the deal, sign the new documents, and pay closing costs. After the agreement is finalized, your new lender will settle your initial debt, and your monthly mortgage payments will be sent to your new lender.

- Follow Up: After submission, maintain communication with your lender to track the progress of your application. Promptly respond to any requests for additional information to keep the process moving smoothly. Many homeowners report that regular follow-ups can reduce processing times by up to a week. At F5 Mortgage, we prioritize a stress-free experience, ensuring you feel supported throughout the process.

By adhering to these steps, you can effectively submit your VA streamline refinance application and take a significant step toward securing better streamline refinance rates. For instance, one homeowner shared that by following these guidelines, they were able to refinance their loan in just two weeks, significantly lowering their monthly payments.

Conclusion

Streamline refinancing offers a wonderful opportunity for homeowners with existing FHA or VA loans to lower their interest rates and monthly payments with ease. By simplifying the refinancing process, this approach allows you to take advantage of favorable market conditions without the heavy burdens typically tied to traditional refinancing. Understanding the basics of streamline refinancing is essential for anyone looking to seize potential savings.

This article outlines key steps to navigate the streamline refinance process effectively:

- Know the eligibility criteria.

- Gather the necessary documentation.

- Compare rates from different lenders.

- Submit a thorough application.

Each of these steps helps ensure a smoother experience, ultimately leading to significant financial benefits, such as reduced monthly payments and lower overall borrowing costs.

In conclusion, if you’re considering streamline refinancing, we encourage you to take proactive steps to educate yourself and prepare adequately. By leveraging the insights shared here, you can make informed decisions that align with your financial goals. Engaging with knowledgeable lenders and understanding the nuances of the process can lead to substantial savings and a more manageable mortgage experience. Take action today to explore the best streamline refinance deals and secure a more favorable financial future. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

Frequently Asked Questions

What is streamline refinancing?

Streamline refinancing is a simplified process designed for homeowners with existing FHA or VA mortgages, allowing them to refinance with minimal paperwork and fewer requirements, ultimately aiming to reduce interest rates and monthly payments.

What are the key features of streamline refinancing?

Key features include minimal documentation, no need for a new appraisal, and reduced interest costs, which can lead to significant decreases in monthly payments.

What are the eligibility criteria for streamline refinancing?

To qualify, homeowners must have an existing FHA or VA loan, a good payment history, at least six months since the first payment on the original loan, and demonstrate a net tangible benefit from refinancing.

Is a new appraisal required for streamline refinancing?

No, streamline refinancing does not require a new property appraisal, saving time and associated costs.

How long must I have my current FHA loan before I can refinance?

At least 210 days must have passed since closing on the mortgage being refinanced to qualify for an FHA streamlined refinance.

What is considered a net tangible benefit in streamline refinancing?

A net tangible benefit typically refers to a reduction in interest rate or monthly payment resulting from the refinance.

What are the typical closing costs for an FHA streamline refinance?

Closing costs usually range between 2% and 6% of the loan value.

Do I need to provide income documentation for streamline refinancing?

No, streamline refinancing does not require income documentation, further simplifying the process.

How popular are FHA simplified refinances in the U.S.?

FHA simplified refinances make up 11.23% of all refinance mortgages in the U.S., indicating their popularity in the market.

How can F5 Mortgage assist with streamline refinancing?

F5 Mortgage offers a variety of loan modification choices and provides support throughout the refinancing process to help homeowners obtain the most favorable terms and conditions.