Overview

F5 Mortgage is here for you, offering personalized support that truly understands your needs. We know how challenging the home buying process can be, which is why we provide a diverse range of competitive loan options designed to enhance your experience. Our commitment to customer satisfaction ensures that families feel valued every step of the way.

As an independent brokerage, F5 Mortgage stands out by delivering tailored solutions that cater to your unique situation. This flexibility allows us to streamline processes, ultimately leading to significant savings and a smoother journey toward homeownership. Imagine a mortgage experience where your concerns are heard and addressed, making your dream home a reality.

Let us support you in this important journey. With F5 Mortgage, you’re not just another client; you’re part of our family. We’re here to guide you through the process, ensuring you feel confident and empowered in your decisions. Reach out today, and let’s take the first step together toward making your homeownership dreams come true.

Introduction

In a crowded lending landscape, F5 Mortgage truly stands out. We understand how overwhelming the mortgage process can be for families, and that’s why we prioritize your individual needs and aspirations. Our unique partnership offers a diverse range of competitive loan solutions, ensuring that you feel empowered as you navigate the complexities of financing. With our commitment to personalized service, we’re here to support you every step of the way.

As the market evolves, it’s natural to wonder: how can you discern the true advantages of choosing F5 Mortgage over traditional lending companies? We know how challenging this decision can be, and we’re dedicated to helping you find the best path forward.

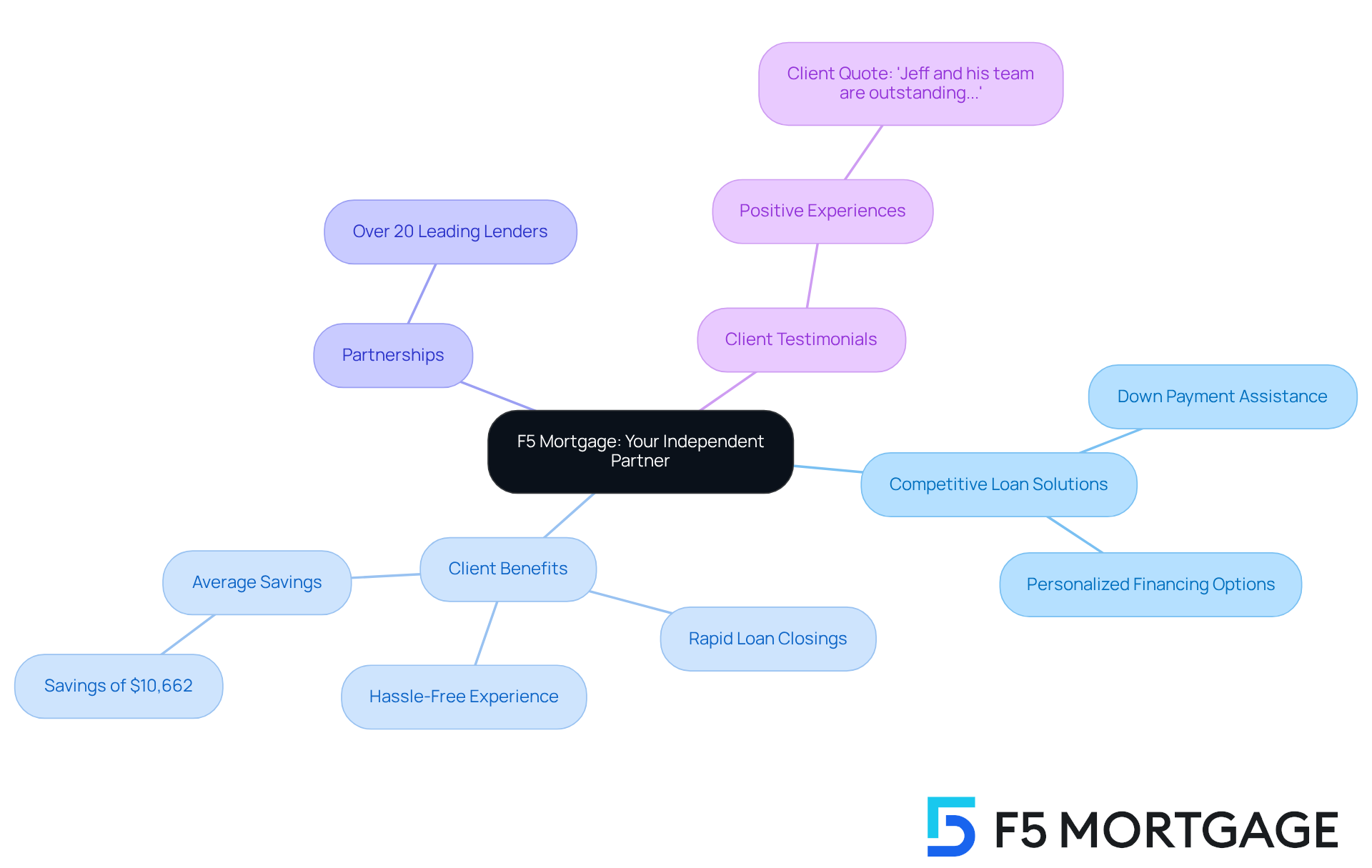

F5 Mortgage: Your Independent Partner for Competitive Mortgage Solutions

At F5 Home Financing, we understand how important it is for families to feel supported in their journey toward homeownership. As an independent brokerage, we prioritize your needs over those of a lending company, which allows us to offer a diverse range of competitive loan solutions tailored to your unique financial situation. Whether you’re seeking down payment assistance programs or personalized financing options, our independence empowers us to serve you better.

By partnering with over twenty leading lenders, including our lending company, we ensure you have access to the most advantageous rates and conditions available. This thoughtful approach not only enhances your home buying and refinancing experience but also reinforces our commitment to being a reliable partner in achieving your homeownership goals.

We know how challenging this process can be, and that’s why our dedication to a hassle-free financing experience shines through. Our client-focused strategy emphasizes no-pressure assistance and rapid loan closings in less than three weeks. Many clients have shared their positive experiences, with testimonials highlighting the personalized attention and expertise we provide. One client expressed, “Jeff and his team are outstanding to work with. They made the process easy and worry-free, ensuring we understood everything fully.”

Industry insights reveal that borrowers who work with independent loan brokers can save an average of $10,662 over the duration of their loans compared to those who go through a lending company. This trend underscores the growing recognition of the value independent brokers bring, especially in navigating complex economic environments. As the market evolves, the emphasis on personalized service and tailored solutions continues to set independent brokers apart, making us an essential resource for families looking to upgrade their homes.

We’re here to support you every step of the way, ensuring that your path to homeownership is as smooth and rewarding as possible.

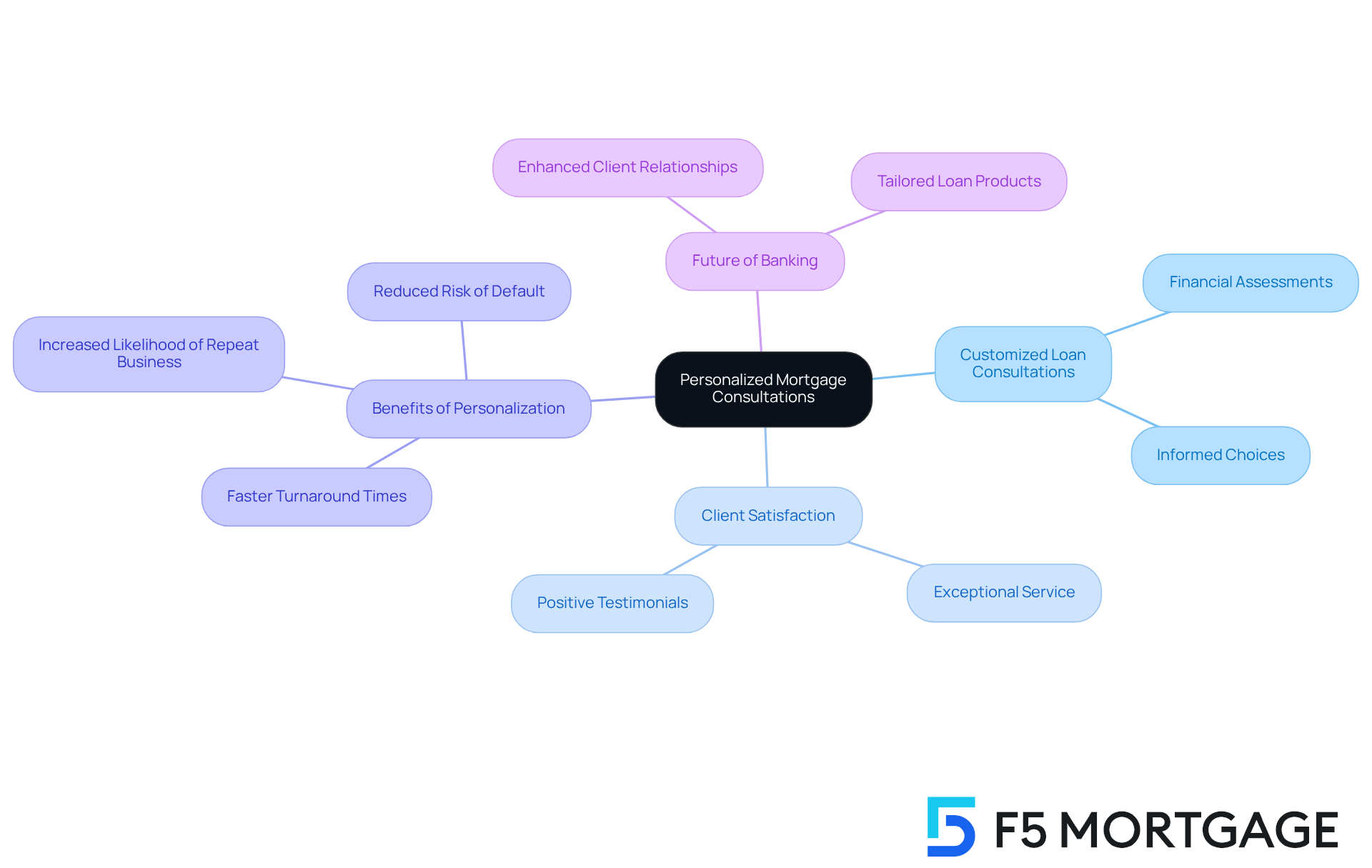

Personalized Mortgage Consultations: Tailored Guidance for Homebuyers

At F5 Mortgage, we understand how challenging the mortgage process can be. That’s why we offer customized loan consultations tailored to meet the unique needs of each individual. During these sessions, our seasoned brokers from the lending company assess your personal financial circumstances, guiding you through your options and helping you choose the loan products that are right for you.

This personalized approach not only simplifies the loan process with a lending company but also empowers you to make informed choices, nurturing your confidence throughout your home purchasing journey. Our clients have shared their gratitude for the exceptional service they received, with testimonials highlighting the friendly and knowledgeable support from our dedicated team.

Research shows that customized loan solutions offered by a lending company lead to faster turnaround times in the application and approval process, significantly enhancing customer satisfaction. A case study on improved borrower experiences reveals that personalization in loan solutions offered by a lending company fosters greater satisfaction and increases the likelihood of repeat business or referrals.

As the banking sector evolves, a lending company will continue to enhance client satisfaction and business success through tailored loans. Our advisors emphasize that understanding your unique situation is essential for sound decision-making and lasting success with a lending company in the journey of homeownership. We’re here to support you every step of the way.

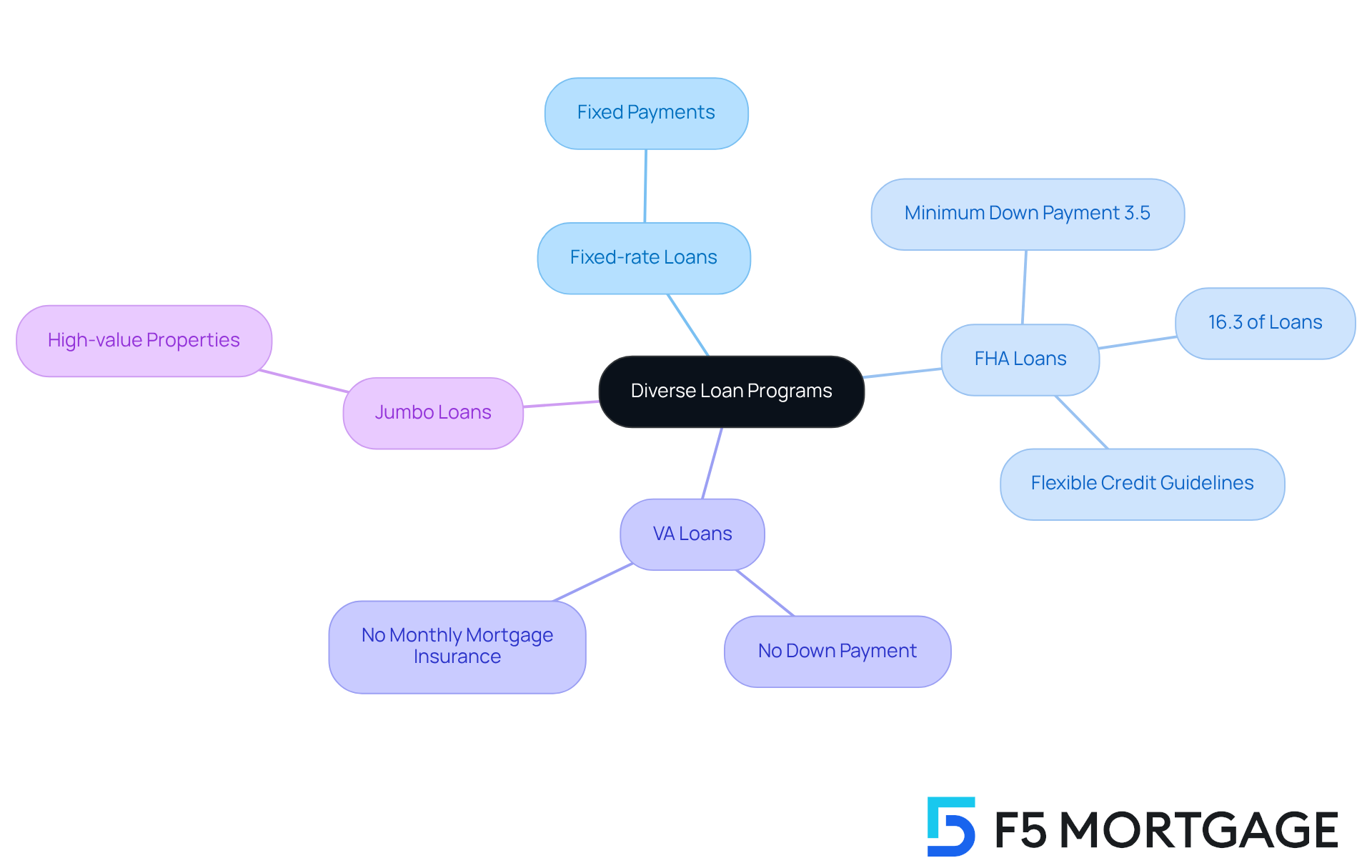

Diverse Loan Programs: Options for Every Homebuyer’s Needs

At F5 Mortgage, we understand that navigating the world of loans provided by a lending company can be overwhelming. That’s why our lending company offers a comprehensive selection of loan programs, including:

- Fixed-rate loans

- FHA loans

- VA loans

- Jumbo loans

This diversity is essential, as it empowers individuals from various financial backgrounds to find a solution through a lending company that meets their unique needs. As industry experts highlight, having access to multiple loan options through a lending company is crucial for enhancing borrowers’ chances of achieving their dream of homeownership.

Recent trends show that FHA and VA loans continue to play a vital role in the housing finance market. In 2022, FHA loans represented 16.3% of closed-end home purchase loans. VA loans, which require no down payment, are especially beneficial for veterans and active-duty service members, making homeownership more accessible for those who have selflessly served our country. Jumbo loans, on the other hand, cater to buyers seeking higher-value properties, reflecting the growing demand in the luxury market.

By offering customized choices and professional support, the lending company simplifies the financing process, ensuring that you can confidently manage the intricacies of funding your home. We know how challenging this can be, and our lending company is committed to providing varied loan options that not only improve accessibility but also establish F5 as a reliable ally in realizing your homeownership aspirations. Together, we can make your dream of owning a home a reality.

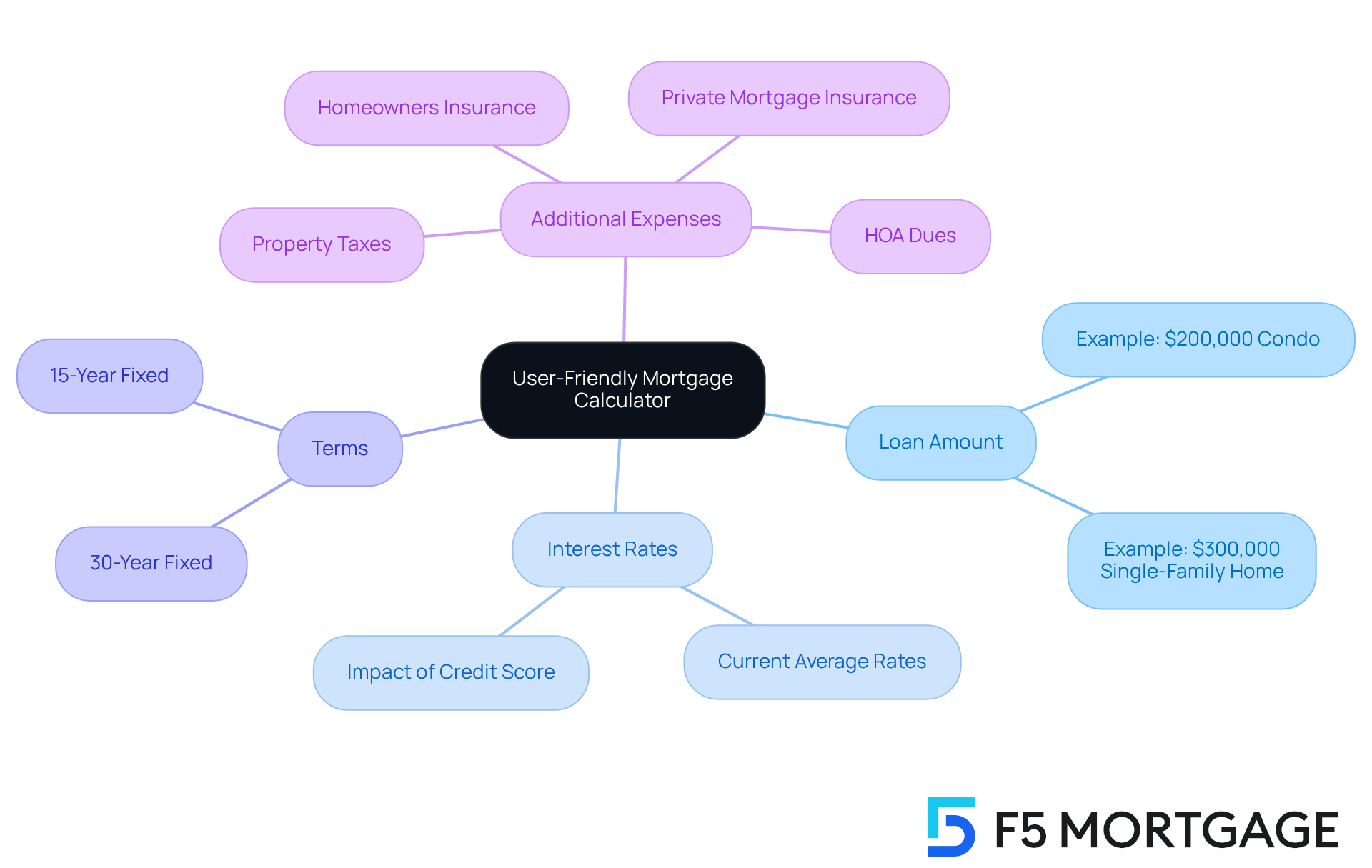

User-Friendly Mortgage Calculator: Simplifying Financial Planning

At F5 Mortgage, we understand how overwhelming the mortgage process can be. That’s why we provide a user-friendly loan calculator on our website, allowing you to estimate your monthly payments based on different loan amounts, interest rates, and terms. This tool not only streamlines your budgeting but also helps you see your loan commitments clearly. By including essential elements like property taxes, insurance, and possible loan insurance, our calculator gives you a more comprehensive view of your total monthly expenses. For example, a $200,000 condo with $500 monthly dues may equate to the same overall cost as a $300,000 single-family home without dues. This highlights the importance of considering all expenses when budgeting for your future.

Studies show that borrowers who utilize loan calculators can make more informed choices, leading to better financial outcomes. Dan Green, a loan specialist, emphasizes that these resources clarify the financing process, empowering you to explore your options with confidence. By offering tools like this, F5 enhances your overall experience, ensuring that you are well-prepared to make sound financial decisions throughout your loan journey. We know how challenging this can be, and we’re here to support you every step of the way.

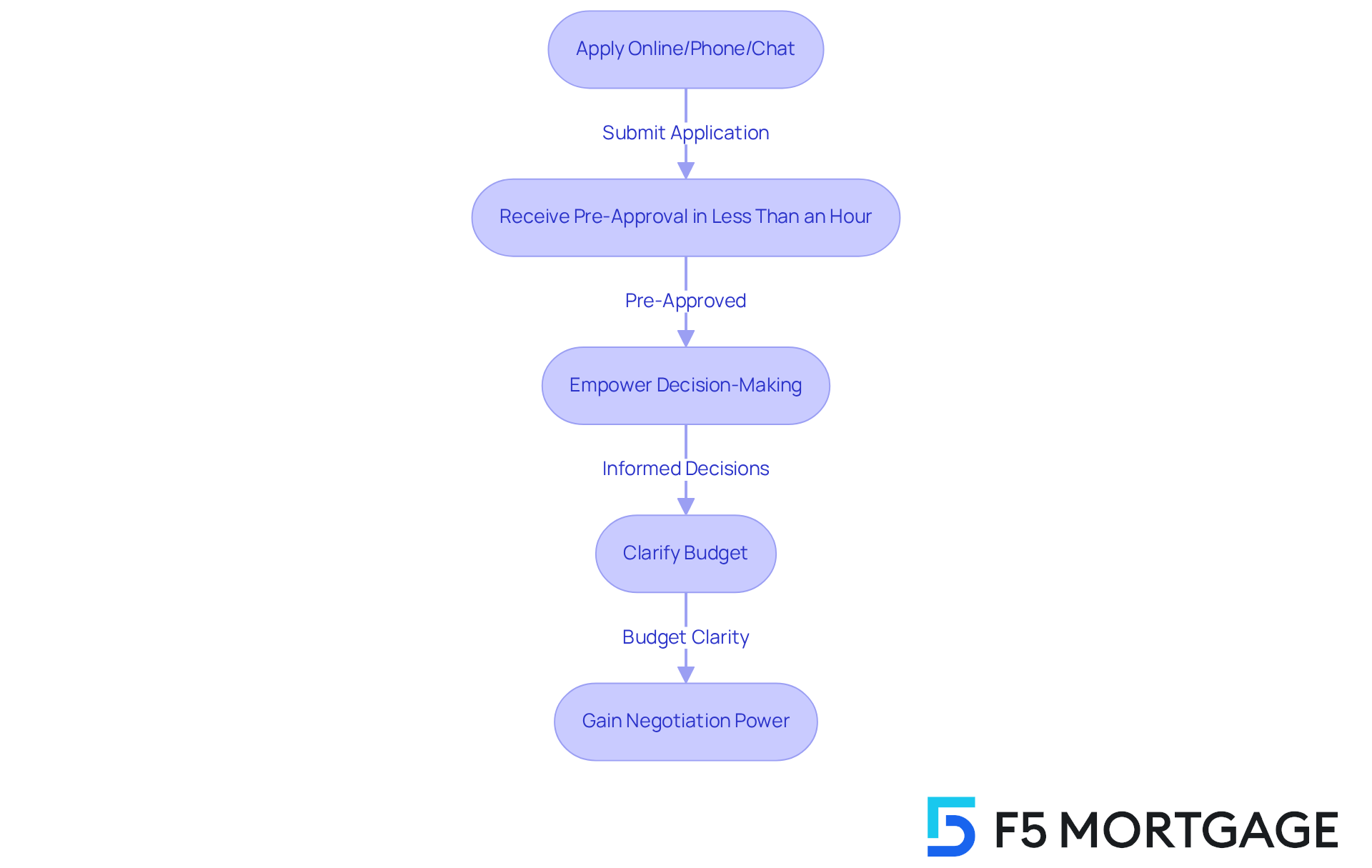

Streamlined Application Process: Quick Pre-Approval for Homebuyers

At F5 Finance, we understand how overwhelming the mortgage process can be when navigating a lending company, especially for first-time homebuyers. That’s why our lending company excels at providing a streamlined application procedure, allowing you to obtain pre-approval in less than an hour. This rapid turnaround is not just a convenience; it gives you a significant competitive edge in the housing market as a lending company, empowering you to make informed decisions.

Imagine being able to apply online, by phone, or through chat—whatever works best for you. Our personalized loan solutions are tailored to your specific needs, ensuring you feel supported every step of the way. In 2023, a lending company revealed that mortgage lenders approved 85.76% of purchase mortgage applications, highlighting how crucial pre-approval is in a landscape where timely decisions matter.

By minimizing paperwork and simplifying the application process, F5 enables you to focus on what truly matters: finding your perfect home without unnecessary delays. Our satisfied clients often share their testimonials, praising the exceptional service provided by the F5 Mortgage team. We guide you through each step, ensuring you feel informed and confident.

As the mortgage landscape evolves, obtaining quick pre-approval from a lending company is becoming increasingly vital. Buyers who are pre-approved can make offers with confidence, leading to faster transactions and better negotiation power. Industry experts emphasize that pre-approval not only clarifies your budget but also reassures sellers of your financial readiness. This makes it a key strategy in today’s competitive market.

We know how challenging this can be, and we’re here to support you every step of the way. Let’s take this journey together, empowering you to achieve your homeownership dreams.

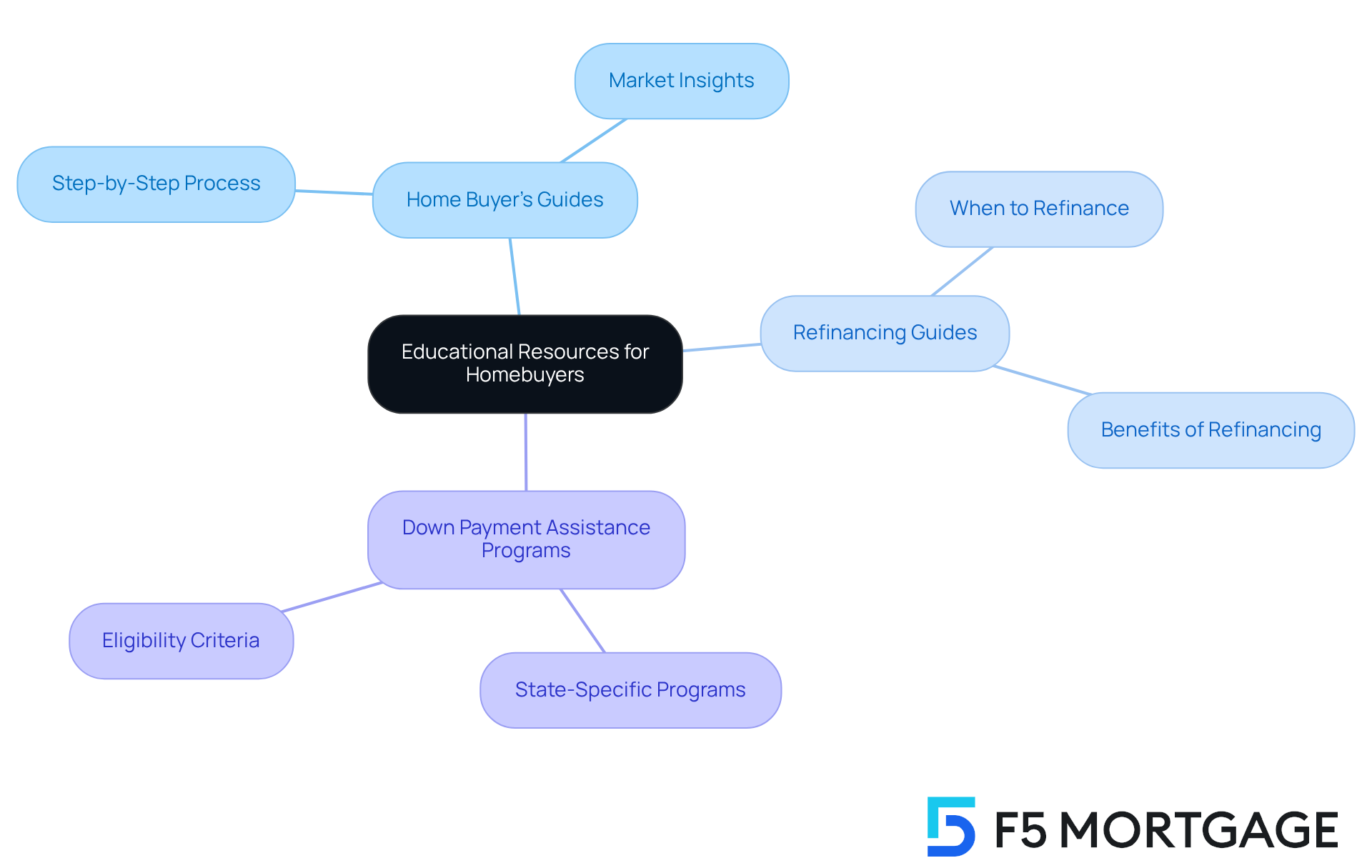

Comprehensive Educational Resources: Empowering Homebuyers with Knowledge

At F5 Lending, we understand how challenging it can be to navigate the financing landscape as a lending company. That’s why we provide a wealth of educational resources, including:

- Comprehensive home buyer’s guides

- Refinancing guides

- Down payment assistance programs tailored to specific states

Our goal is to empower you with the knowledge you need to move forward confidently.

We’re here to support you every step of the way. By utilizing user-friendly technology and emphasizing personalized guidance, F5 Financial ensures a stress-free process for homebuyers. Our dedication to education helps you understand your options, including what mortgage approval involves, allowing you to make informed choices throughout your home purchasing journey.

Remember, you are not alone in this process. With F5, the lending company, you have the tools and support to navigate your path to homeownership with ease.

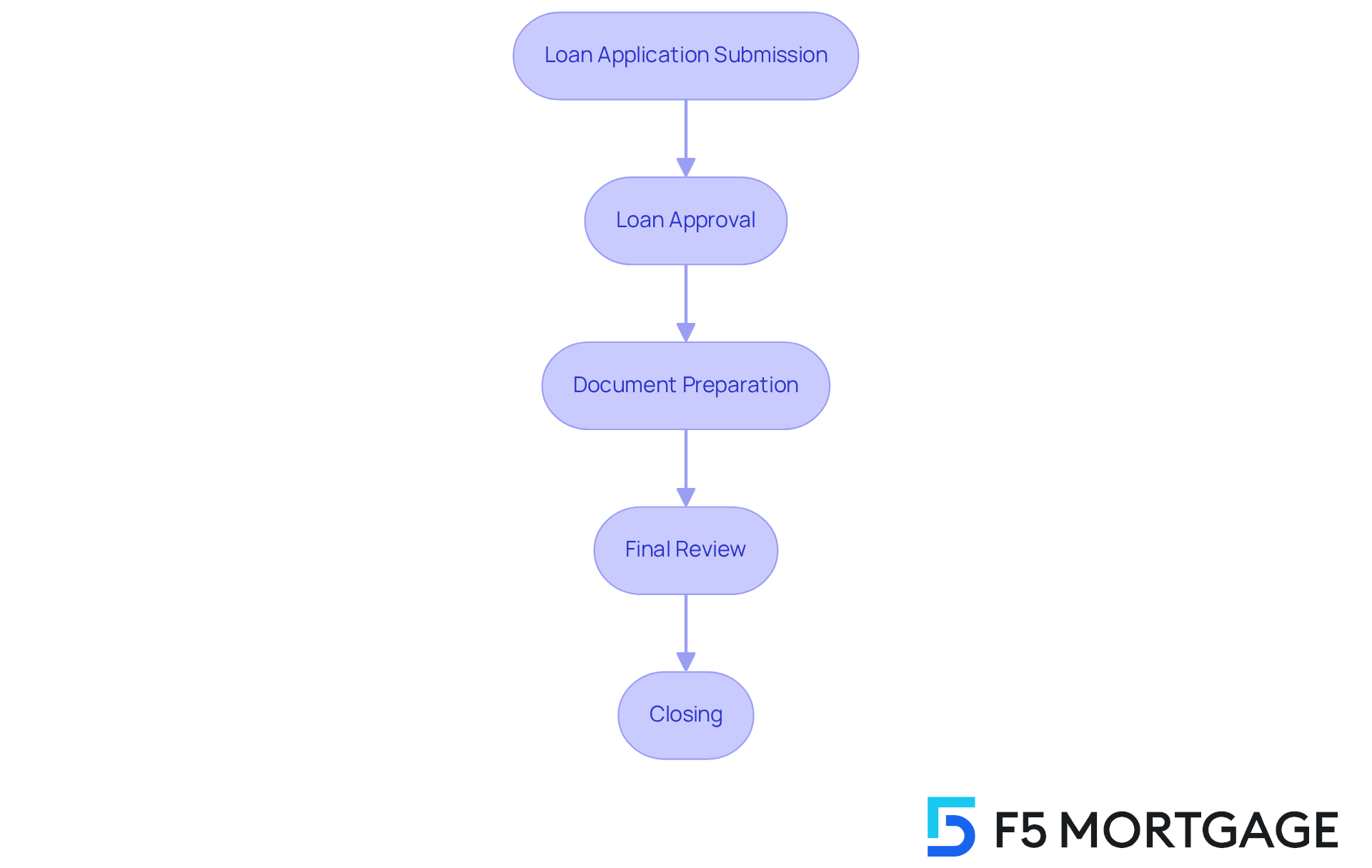

Fast and Efficient Closing Process: Closing Loans in Less Than Three Weeks

At F5 Financing, we understand how crucial it is for families to move into their new homes quickly. That’s why we pride ourselves on our swift and effective closing process, with most loans completed in under three weeks. This rapid turnaround is particularly appealing to homebuyers eager to settle into their new residences without delay.

By enhancing the closing process and fostering clear communication with our customers, we ensure a smooth transition from loan approval to homeownership. We know how challenging this can be, and our commitment to efficiency reduces the stress often associated with financing. Statistics show that quick loan closings significantly boost homebuyer satisfaction. Clients appreciate the reduced waiting time, allowing them to move forward with their plans seamlessly.

Ultimately, this focus on a caring and efficient process positions F5 as a preferred lending company for families looking to upgrade their homes. We’re here to support you every step of the way, making your journey to homeownership as smooth and fulfilling as possible.

Support for First-Time Homebuyers: Navigating Unique Challenges

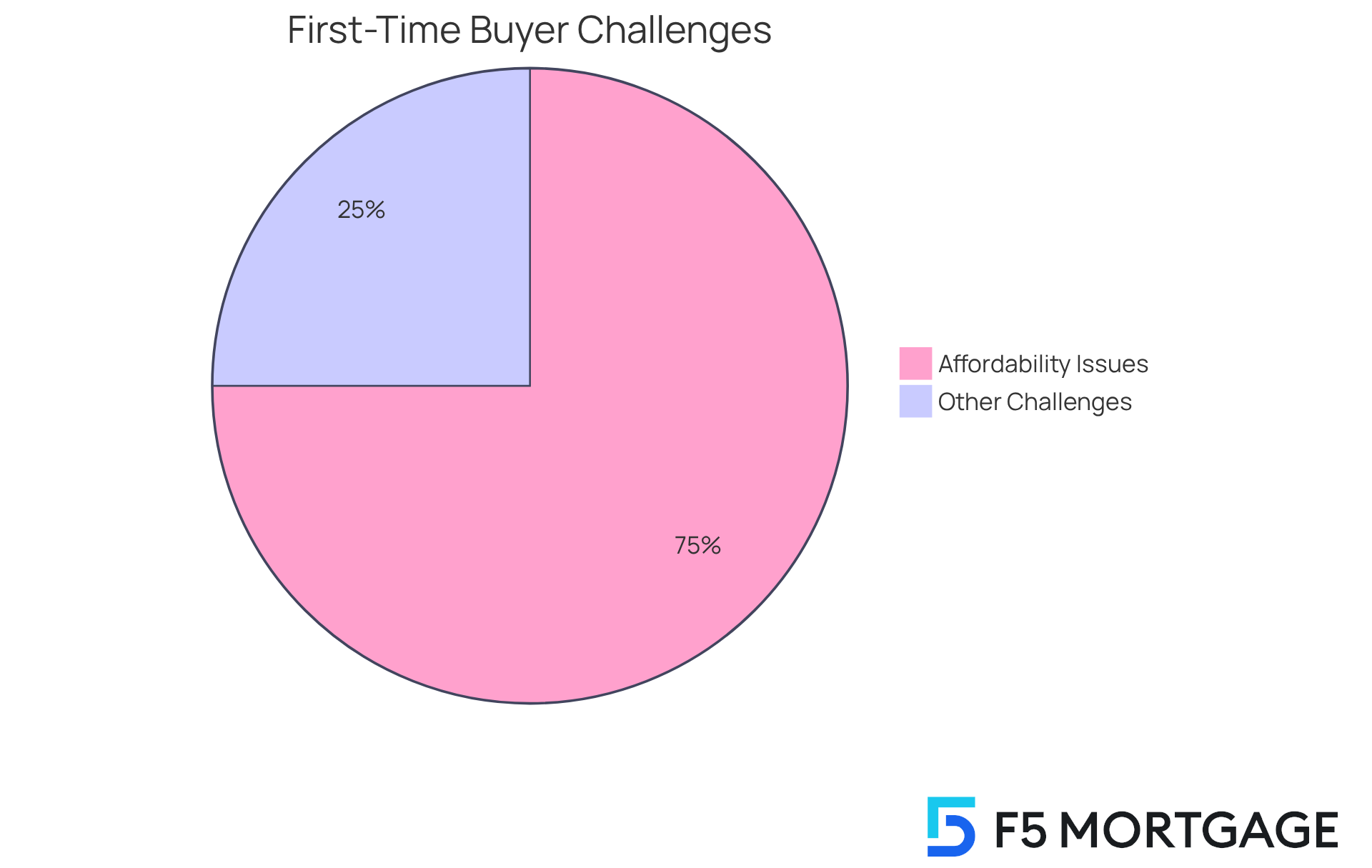

At F5 Mortgage, we understand how daunting the journey to homeownership can be, especially for first-time buyers working with a lending company. That’s why our lending company is dedicated to empowering you with tailored resources and expert guidance to help you navigate the complexities of purchasing a home. Through personalized consultations and comprehensive educational materials, we ensure that you feel well-informed and confident in your decisions. This support is crucial, particularly in 2025, as many first-time buyers face unique challenges like rising interest rates and affordability concerns, with 75% citing affordability as their top issue.

Support services from a lending company play a vital role in helping new homeowners overcome obstacles. Many first-time buyers struggle with down payments, often relying on personal savings or gift funds from family. In fact, around 60% use savings for their down payment, while 29% receive support from relatives. The typical down payment for first-time homebuyers is $8,220, highlighting the economic challenges you may encounter. Additionally, the average first-time homebuyer is now 35 years old, with a median household income of $95,900. This demographic shift underscores the need for tailored support, especially since 64% of first-time buyers are married couples.

As a lending company, F5 Home Loan offers extensive assistance through several down payment aid programs available in California. For instance, the Credit Certificate in Los Angeles County provides a dollar-for-dollar decrease in your federal income tax obligation. Moreover, the MyHome Assistance Program from the California Housing Finance Authority (CalHFA) offers up to 3% of the home’s purchase price, providing extra monetary support. Housing counselors emphasize the importance of comprehensive resources, noting that first-time buyers greatly benefit from educational programs that address their specific needs. Additionally, F5 can connect you with leading real estate agents and help you secure the best loan offers, ensuring you’re prepared to make informed choices in today’s housing market. To navigate these complexities effectively, we encourage you to seek professional advice and utilize the resources available to you.

Refinancing Assistance: Helping Homeowners Improve Financial Health

At F5 Mortgage, our lending company understands how challenging financial decisions can be, which is why we provide extensive refinancing support aimed at improving homeowners’ economic well-being. Our customized solutions empower clients to decrease their interest rates, lower monthly payments, or tap into home equity, all while aligning with their specific monetary objectives. This tailored approach not only streamlines the refinancing process through a lending company but also empowers homeowners to make informed choices that positively influence their overall economic health.

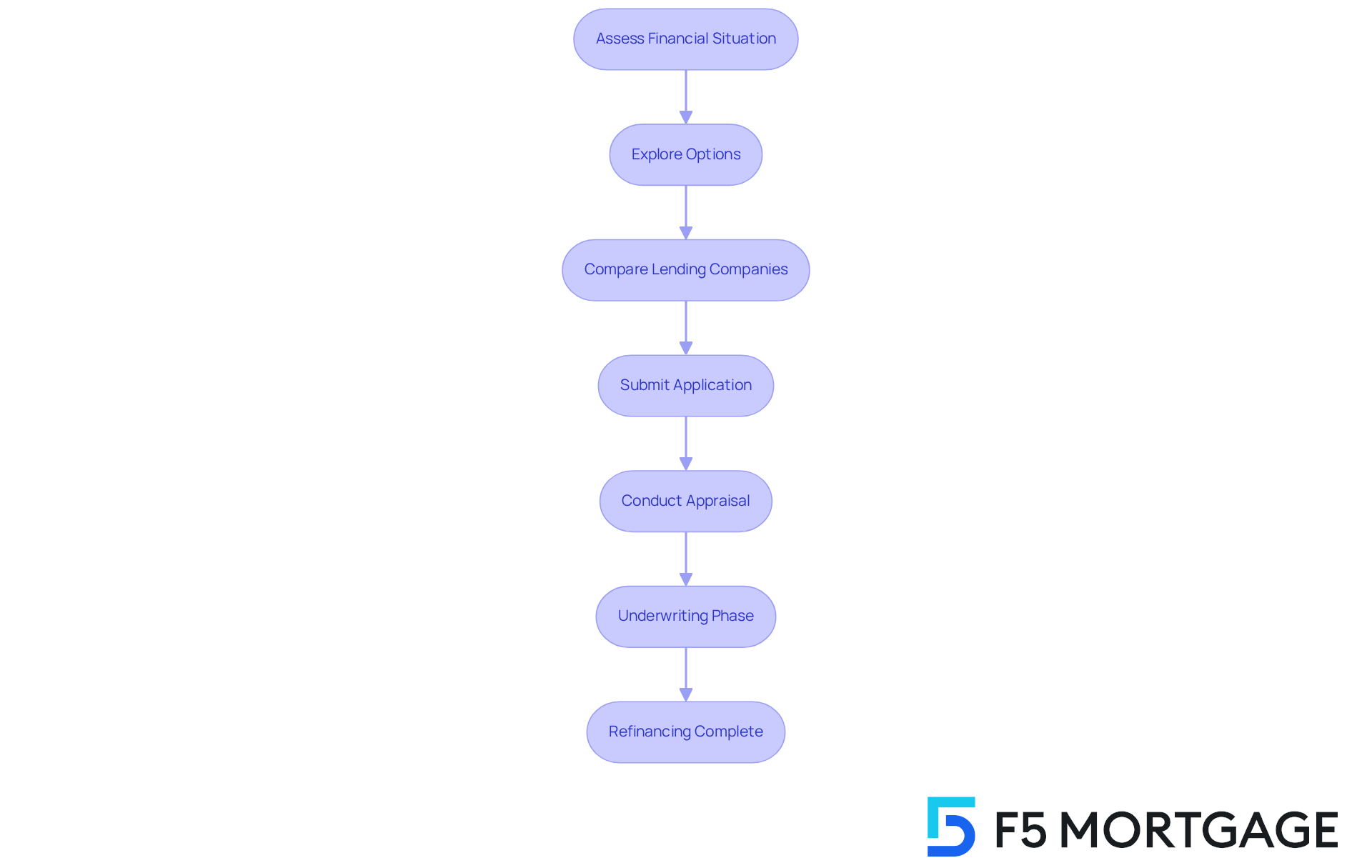

To begin the refinancing journey, we encourage homeowners to first assess their financial situation and explore their options with a lending company. This includes comparing multiple lending companies and their loan choices to find the best rates and terms. Once ready, clients can submit a refinancing application along with necessary documentation, such as pay stubs and tax returns. Following this, the lending company will conduct an appraisal to assess the property’s current value, leading to the underwriting phase where the loan application is carefully reviewed.

For example, families who work with a lending company to refinance their FHA loans can benefit from reduced monthly payments and lower insurance costs, potentially saving hundreds of dollars each year. With current FHA borrowers anticipating to pay around 0.55% in annual insurance premiums—down from 0.85%—the financial relief can be substantial. Furthermore, nearly 60% of active loans from the lending company have interest rates under 4%, highlighting the potential savings for homeowners currently in higher-rate loans.

Additionally, the FHA Streamline Refinance program exemplifies how F5, a lending company, assists in creating a smoother refinancing experience. Homeowners can complete the process with minimal documentation, often closing in as little as 14 days. This is particularly beneficial in fluctuating interest rate environments, allowing families to respond swiftly and secure better rates from a lending company, especially when current loan rates hover around 6.5%, with predictions indicating further declines.

F5 Mortgage, as a lending company, is committed to assisting clients throughout the refinancing process to ensure that homeowners are well-prepared to tackle their economic challenges. We encourage homeowners to explore mortgage relief programs or grants that can offer additional support for those facing financial difficulties. Ultimately, this comprehensive support leads to improved financial health and stability for families.

Commitment to Customer Satisfaction: Building Trust and Loyalty

At F5 Mortgage, we understand how challenging the mortgage process can be. Our strong dedication to customer satisfaction is reflected in our impressive 94% satisfaction rate among clients. This commitment to outstanding service not only builds trust but also nurtures loyalty, ensuring that you feel appreciated every step of the way.

Clients like Ruth Vest have shared their positive experiences, praising our team’s financial expertise and excellent customer service. Ruth stated, “F5 handled my financial needs exceptionally well.” By prioritizing clear communication, personalized support, and streamlined processes, we establish lasting relationships with our customers.

Testimonials from pleased clients, such as Joe Simms, emphasize how we simplify the mortgage process and alleviate concerns. Joe remarked, “He guided us through each step, making sure we comprehended everything completely.” This level of support is crucial in a lending company, as it directly impacts client retention.

At F5 Mortgage, we recognize the significance of exceptional customer service, making us a preferred lending company for homebuyers and homeowners seeking reliable mortgage solutions. We’re here to support you every step of the way, ensuring your experience is as smooth and stress-free as possible.

Conclusion

F5 Mortgage is a premier choice for families seeking reliable and personalized lending solutions. As an independent brokerage, F5 Mortgage truly prioritizes the unique needs of each client. They offer tailored loan options and a commitment to customer satisfaction that enhances the homeownership journey.

The advantages of partnering with F5 Mortgage are clear:

- Personalized consultations empower homebuyers to make informed decisions.

- A diverse array of loan programs meets various financial situations.

- F5 Mortgage shows its dedication to providing comprehensive support.

- The user-friendly mortgage calculator, streamlined application process, and fast closing times illustrate how F5 simplifies the often daunting path to homeownership, especially for first-time buyers.

In today’s competitive mortgage landscape, choosing a trusted partner like F5 Mortgage is essential. Whether navigating the complexities of refinancing or seeking educational resources, families can rely on F5’s expertise and commitment. Embracing the support and resources available through F5 Mortgage leads to a smoother home buying experience and fosters long-term financial health and stability.

For anyone looking to achieve their homeownership dreams, F5 Mortgage is the go-to lending company that understands and supports its clients every step of the way. We know how challenging this can be, and we’re here to support you on your journey to homeownership.

Frequently Asked Questions

What is F5 Mortgage and what do they offer?

F5 Mortgage is an independent brokerage that provides a diverse range of competitive mortgage solutions tailored to the unique financial situations of families. They prioritize client needs over those of lending companies and offer personalized financing options, including down payment assistance programs.

How does F5 Mortgage ensure competitive rates?

F5 Mortgage partners with over twenty leading lenders, including their own lending company, to provide clients with access to the most advantageous rates and conditions available for home buying and refinancing.

What is the typical timeline for loan closings with F5 Mortgage?

F5 Mortgage emphasizes a hassle-free financing experience, with rapid loan closings typically taking less than three weeks.

How do clients feel about the service provided by F5 Mortgage?

Clients have shared positive experiences, highlighting the personalized attention, expertise, and friendly support they received, which made the mortgage process easier and worry-free.

What are the financial benefits of working with independent loan brokers like F5 Mortgage?

Research indicates that borrowers who work with independent loan brokers can save an average of $10,662 over the duration of their loans compared to those who go through a lending company.

What types of mortgage consultations does F5 Mortgage offer?

F5 Mortgage offers customized loan consultations where seasoned brokers assess personal financial circumstances and guide clients through their options to choose the right loan products.

What loan programs are available through F5 Mortgage?

F5 Mortgage offers a comprehensive selection of loan programs, including fixed-rate loans, FHA loans, VA loans, and jumbo loans, catering to individuals from various financial backgrounds.

Why are FHA and VA loans significant in the housing finance market?

FHA loans represented 16.3% of closed-end home purchase loans in 2022, and VA loans, which require no down payment, are particularly beneficial for veterans and active-duty service members, making homeownership more accessible.

How does F5 Mortgage support clients throughout the home financing process?

F5 Mortgage simplifies the financing process by offering customized choices, professional support, and a client-focused strategy, ensuring that clients can confidently navigate the intricacies of funding their homes.