Overview

Navigating the home upgrade process can feel overwhelming for families in Texas. We understand how challenging this can be, but there’s a helpful tool that can make a significant difference: the home loan calculator. By mastering this tool, prospective buyers can accurately estimate their monthly payments and assess their affordability with confidence.

Imagine being able to adjust variables like down payments and interest rates to see how they impact your financial decisions. This not only helps in making informed choices but also boosts your confidence as you embark on your home-buying journey. We’re here to support you every step of the way, ensuring that you feel empowered in your decision-making process.

Ultimately, using a home loan calculator is about more than just numbers; it’s about creating a brighter future for your family. Take the time to explore this tool, and see how it can facilitate your home upgrade process. You deserve to feel secure and informed as you make this important investment.

Introduction

Mastering the intricacies of a home loan calculator can be the key to unlocking a successful home upgrade for families in Texas. We know how challenging this process can be, and these powerful tools can help. They not only assist prospective buyers in estimating their monthly payments but also provide insights into various financial scenarios. This enables families to make informed decisions that align with their budgets and goals.

However, with numerous factors to consider—from down payments to interest rates—how can families ensure they are making the most of these calculators? By exploring essential steps and strategies for effective use of home loan calculators, families can navigate the mortgage landscape with confidence and clarity.

Understand Home Loan Calculators and Their Importance

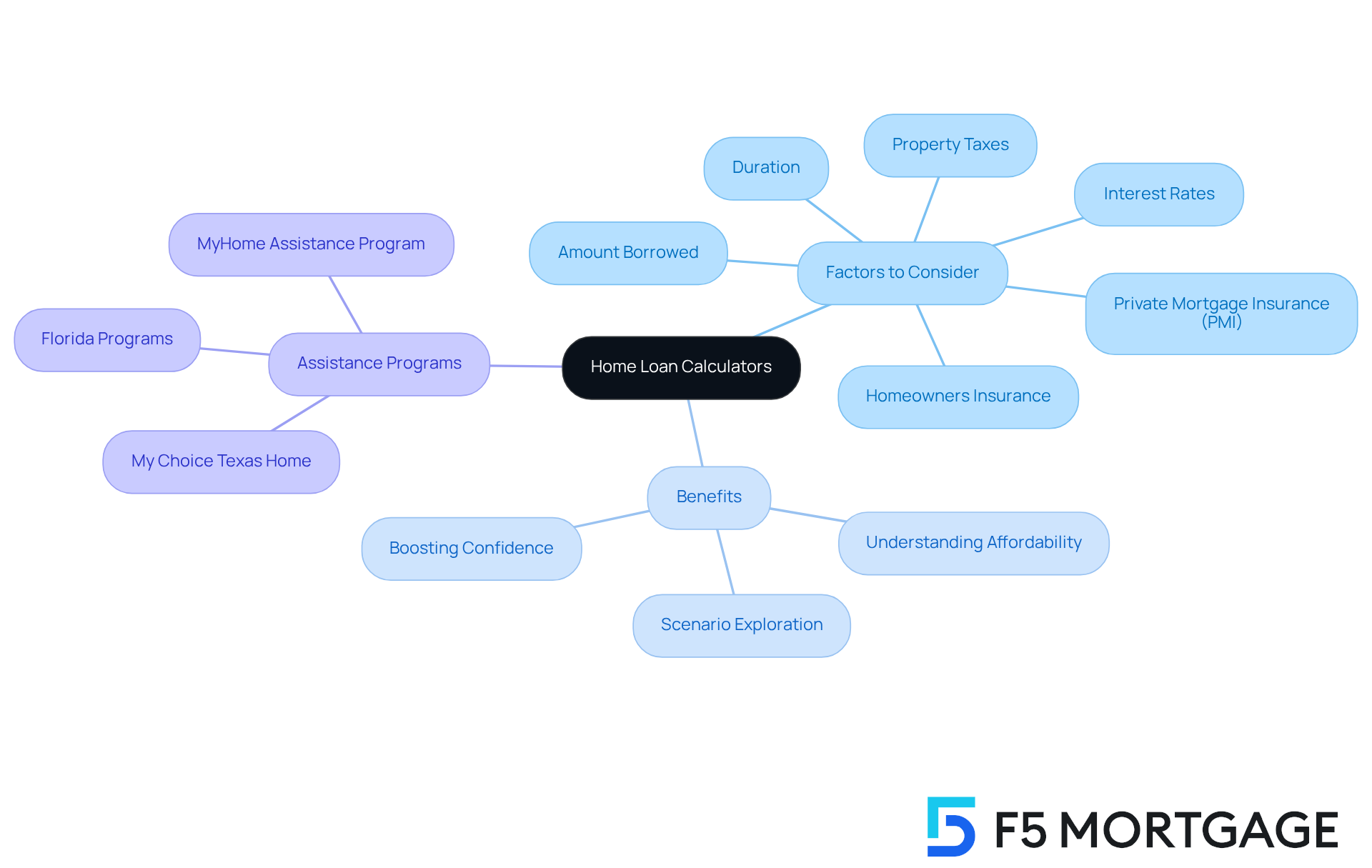

The home loan calculator Texas serves as an invaluable resource for prospective buyers and homeowners. They help you anticipate monthly costs by using a home loan calculator Texas that considers key factors such as the amount borrowed, interest rates, and the duration of the financing. These calculators also include additional expenses like property taxes, homeowners insurance, and private mortgage insurance (PMI). For families looking to upgrade their homes, mastering these tools is essential, as they provide a comprehensive understanding of affordability and financial planning.

By using the home loan calculator Texas, families can explore different scenarios, adjusting factors like down payments and interest rates to see how they affect monthly payments. This flexibility empowers you to make informed decisions tailored to your unique financial situation. Many homebuyers express that utilizing these calculators boosts their confidence in navigating the loan landscape, as they can visualize how various options influence their overall budget.

Practical examples highlight the effectiveness of these tools: families have successfully used loan calculators to identify the best financing options, ensuring they select terms that align with their financial goals. Furthermore, specific down payment assistance programs available through F5 Mortgage, such as:

- the MyHome Assistance Program in California

- the My Choice Texas Home program in Texas

- various programs in Florida

can enhance home buying opportunities, making it easier for families to secure the financing they need.

This proactive approach not only simplifies the home buying process but also empowers families to find the , ultimately leading to more fulfilling homeownership experiences.

Access and Input Data into the Calculator

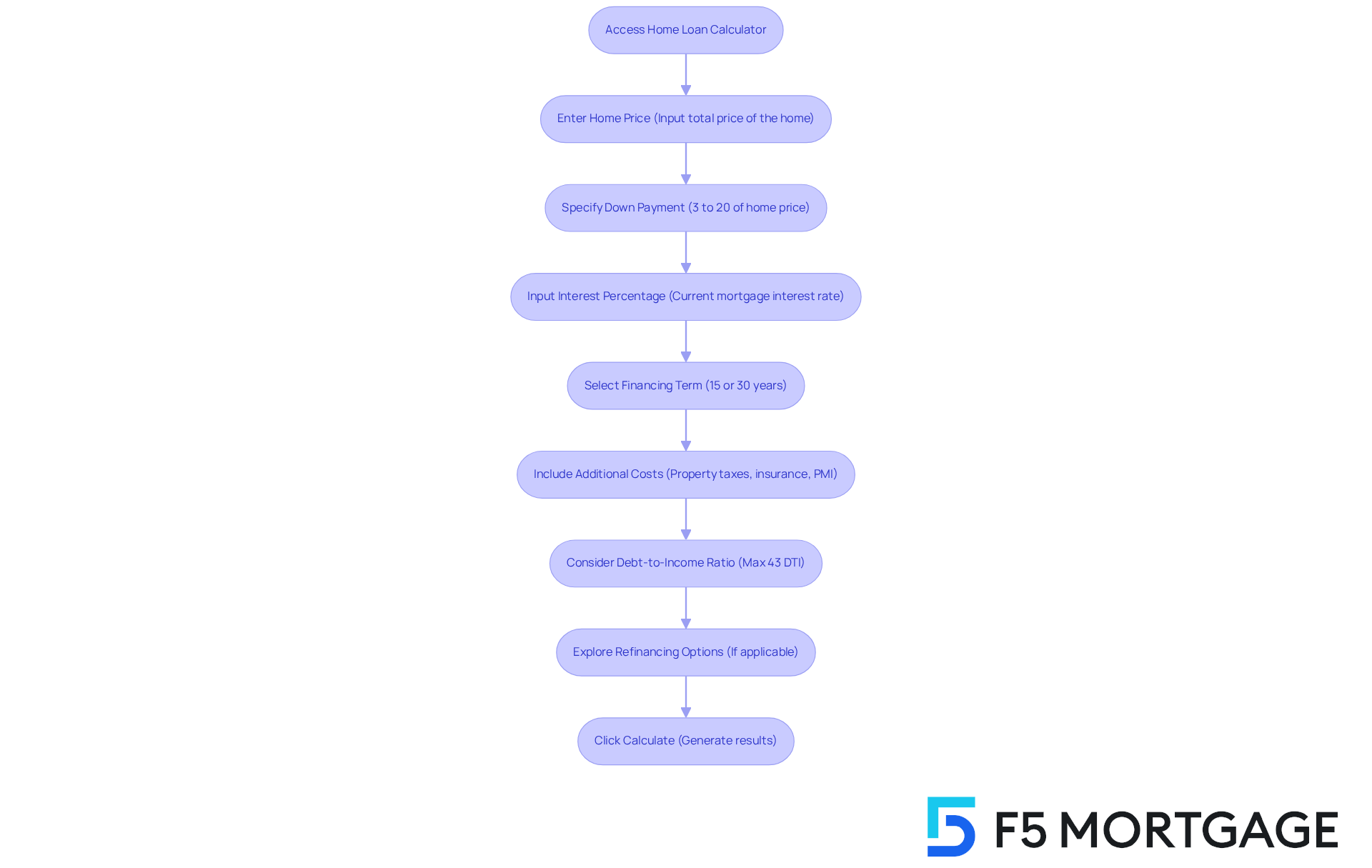

Accessing a home loan calculator Texas is straightforward and can be done through various online platforms, including F5 Mortgage‘s website. We know how challenging this can be, so to effectively use the calculator, follow these simple steps to input your data:

- Enter the Home Price: Input the total price of the home you wish to purchase.

- Specify the Down Payment: Enter the amount you plan to put down, which typically ranges from 3% to 20% of the home price. In Texas, the average down deposit percentage for homebuyers in 2025 is around 10%. However, we encourage homebuyers to strive for a down payment of at least 20% to avoid private loan insurance (PMI).

- Input the Interest Percentage: Use the current mortgage interest percentage, which can be found on financial news websites or through your mortgage broker. Even a small variation in interest rates can result in considerable savings throughout the duration of the borrowing.

- Select the Financing Term: Choose the duration of the financing, commonly 15 or 30 years, depending on your financial objectives. Understanding the benefits of longer versus shorter terms can help you make a more informed decision.

- Include Additional Costs: If applicable, input estimates for property taxes, homeowners insurance, and PMI to get a more comprehensive view of your monthly payment.

- Consider Your Debt-to-Income Ratio: Remember that a maximum DTI ratio of 43% is usually required for home loans. This ratio is essential for comprehending your loan qualifications and can influence the terms you obtain.

- Explore Refinancing Options: If you currently have a home loan, consider the refinancing options available in Colorado, which can help you secure better rates and terms.

Once you have entered all relevant data, click the ‘Calculate’ button to generate your results. This process not only assists you in grasping your possible but also empowers you to make informed choices regarding your financing alternatives. As mentioned by a financing consultant, ‘Precise data entry is essential for acquiring trustworthy assessments from calculator tools.’ Families have successfully utilized the home loan calculator Texas to evaluate their financial readiness and explore various loan scenarios, ensuring they select the best path for their home upgrade. Additionally, remember to compare mortgage offers from multiple lenders, including F5 Mortgage, which offers competitive rates and personalized service. We’re here to support you every step of the way, so consider negotiating costs to maximize your savings.

Interpret Calculator Results to Evaluate Mortgage Options

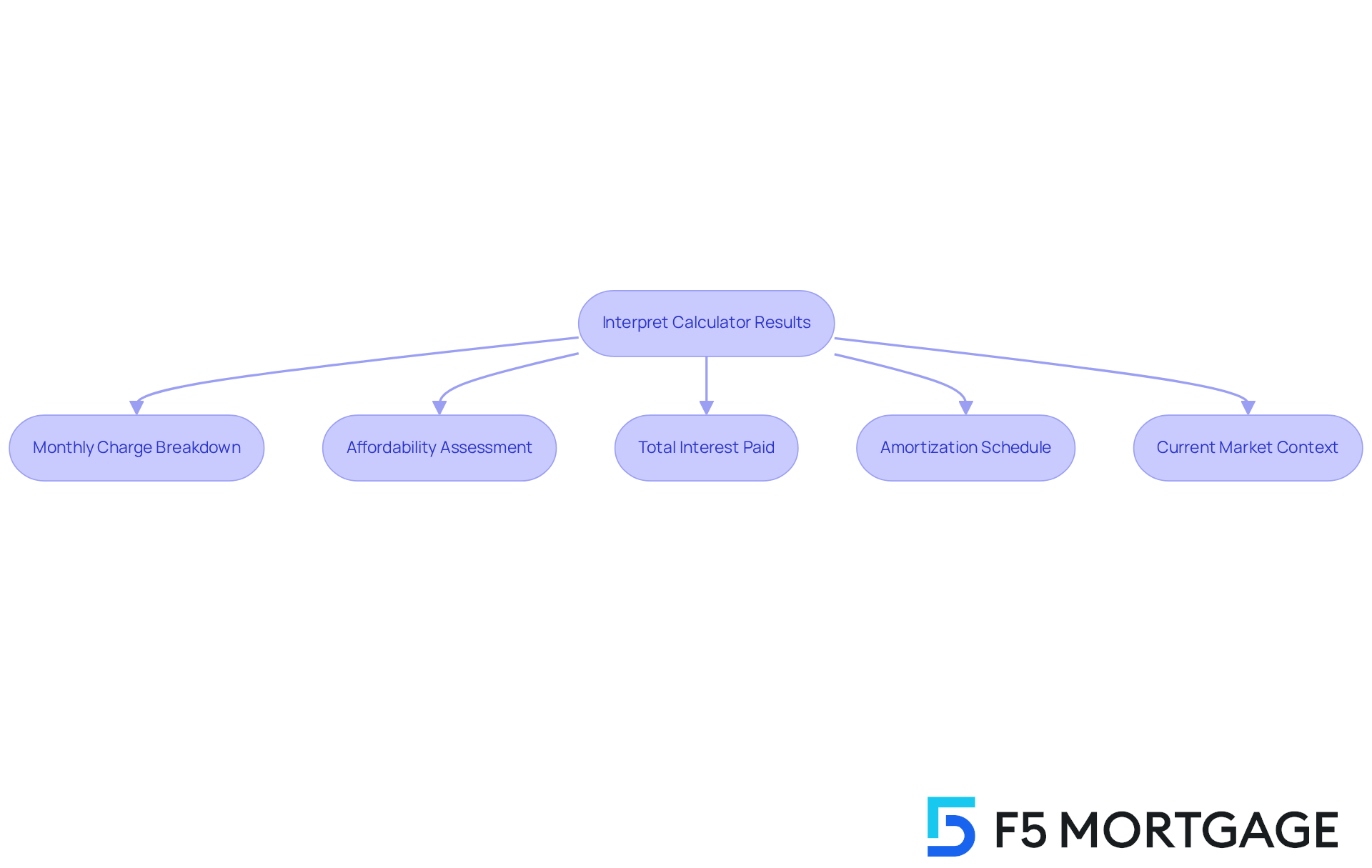

Once you have determined your estimated monthly amount, it’s crucial to interpret the results accurately. We know how challenging this can be, so here’s how to evaluate the output:

- Monthly Charge Breakdown: Review the total monthly charge, which typically includes principal and interest. If you accounted for extra expenses, like property taxes and homeowner’s insurance, assess how they influence your total amount. Don’t forget to consider any HOA dues, as these can significantly impact your total monthly costs.

- Affordability Assessment: Compare the calculated monthly payment to your budget. Most financial experts recommend that your housing costs should not exceed 28-30% of your gross monthly income. For instance, if your monthly income is $6,000, aim for housing costs between $1,680 and $1,800. This ensures that you can manage your expenses comfortably.

- Total Interest Paid: Examine the total interest you will incur over the duration of the borrowing. Understanding this figure can help you grasp the , influencing your decision on loan terms. It’s essential to consider how this will fit into your overall financial picture.

- Amortization Schedule: If accessible, examine the amortization schedule to understand how your contributions will be distributed between principal and interest over time. This insight can provide clarity on how quickly you will build equity in your home, which is an important aspect of homeownership.

- Current Market Context: As of September 1, 2025, the estimated payment for a 30-Year Fixed loan at an interest of 5.875% is $1,893. This context can help you assess the competitiveness of your loan options. Think about collaborating with F5 Mortgage, which provides attractive terms and tailored assistance, to ensure you discover the ideal match for your financial circumstances.

By understanding these results, families can better evaluate their mortgage options and make choices that align with their financial goals. Furthermore, keep in mind that evaluating several lenders, including F5 Mortgage, will assist you in identifying the most suitable lender for your requirements and the lowest borrowing cost. We’re here to support you every step of the way.

Compare Loan Options and Rates for Optimal Choices

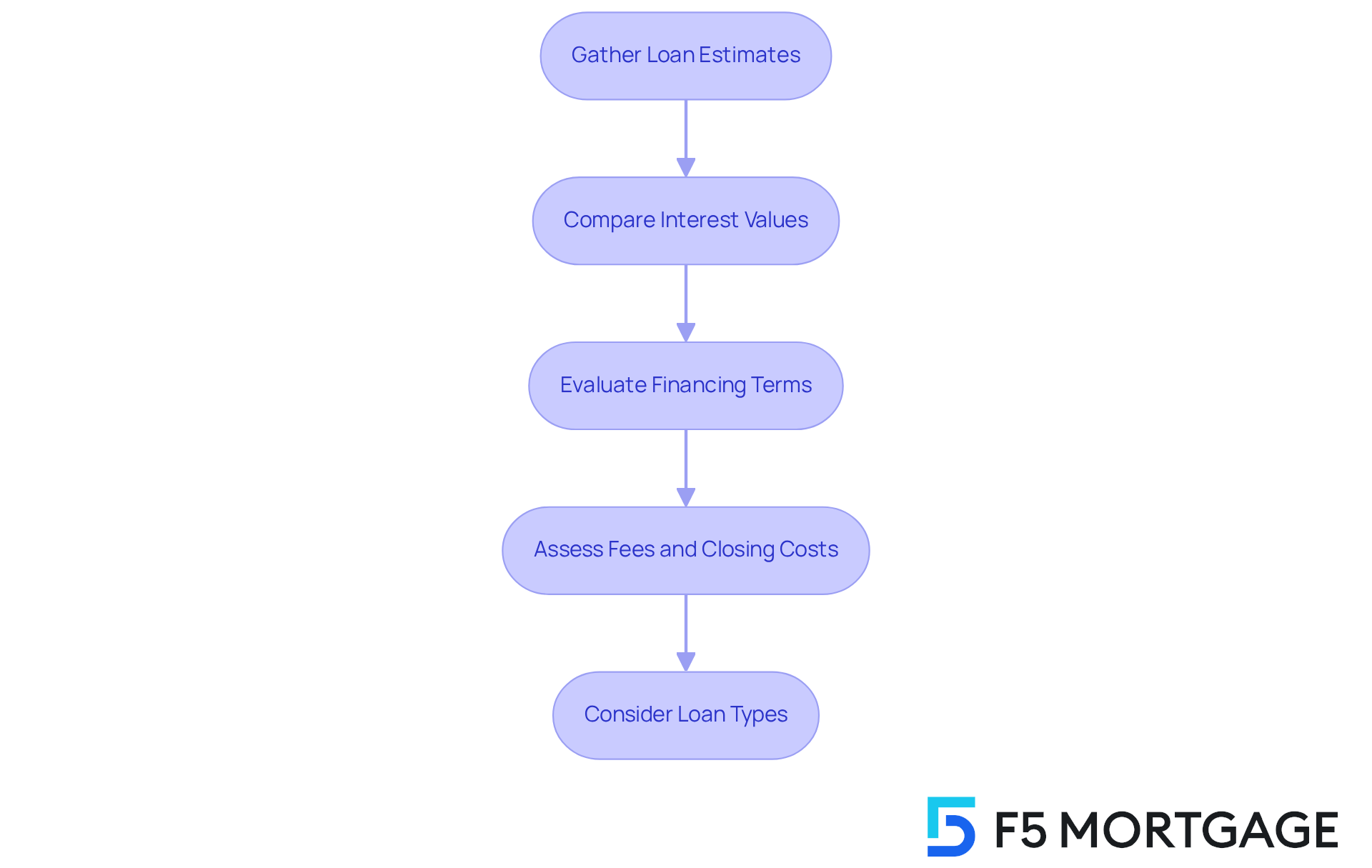

After analyzing your calculator results, it’s important to explore various financing options and charges with care. Here’s how to navigate this process effectively:

- Gather Loan Estimates: Start by requesting Loan Estimates from multiple lenders, including F5 Mortgage. These documents provide essential details about financing conditions, interest charges, and closing expenses, helping you understand the .

- Compare Interest Values: Look for the lowest interest values available. Remember, even a slight difference in fees can lead to significant savings over the life of the loan. F5 Mortgage collaborates with top lenders, making it easier for you to compare rates and find the most affordable options.

- Evaluate Financing Terms: Think about the duration of the financing and whether it aligns with your financial goals. Shorter terms may come with higher monthly payments but lower total interest costs, which can be advantageous if refinancing is in your plans.

- Assess Fees and Closing Costs: Pay close attention to any fees related to the financing, such as origination fees, appraisal fees, and closing costs. In Colorado, refinancing expenses can range from 2% to 5% of the total amount borrowed, so understanding these costs is crucial for your budget.

- Consider Loan Types: Explore the different types of loans available (e.g., fixed-rate vs. adjustable-rate) to find the one that best suits your financial situation and comfort with risk. F5 Mortgage offers personalized service to help you navigate these options with confidence.

By thoughtfully comparing these factors, families can make informed decisions that lead to optimal mortgage choices. We know how challenging this can be, and we’re here to support you every step of the way.

Conclusion

Mastering the home loan calculator in Texas is an essential step for families looking to upgrade their homes. We understand how challenging this can be. By leveraging these tools, prospective buyers can gain a clearer understanding of their financial landscape, enabling them to make informed decisions that align with their unique circumstances. Visualizing various scenarios not only enhances confidence but also empowers families to navigate the complexities of home financing effectively.

In this article, we shared key insights on how to access and utilize a home loan calculator, interpret its results, and compare different mortgage options. From understanding the importance of inputting accurate data to evaluating monthly payments and total costs, each step plays a significant role in ensuring a successful home-buying experience. Additionally, exploring various loan types and seeking assistance from reputable lenders like F5 Mortgage can further optimize the financing process.

Ultimately, using a home loan calculator is significant beyond mere calculations; it fosters a proactive approach to homeownership. Families are encouraged to take charge of their financial future by utilizing these resources, comparing loan options, and seeking personalized guidance. By doing so, they can secure the best mortgage solutions that not only meet their current needs but also pave the way for a fulfilling and sustainable homeownership journey. We’re here to support you every step of the way.

Frequently Asked Questions

What is a home loan calculator and why is it important?

A home loan calculator is a tool that helps prospective buyers and homeowners estimate their monthly mortgage costs by considering factors such as the amount borrowed, interest rates, and the duration of the loan. It also accounts for additional expenses like property taxes, homeowners insurance, and private mortgage insurance (PMI), making it essential for financial planning and understanding affordability.

How can families benefit from using a home loan calculator?

Families can benefit from using a home loan calculator by exploring different financial scenarios. They can adjust factors like down payments and interest rates to see how these changes affect their monthly payments, which empowers them to make informed decisions tailored to their financial situations.

How does using a home loan calculator affect homebuyers’ confidence?

Many homebuyers find that using a home loan calculator boosts their confidence in navigating the loan landscape. By visualizing how various options influence their overall budget, they feel more equipped to make decisions regarding their mortgage.

Can you provide examples of down payment assistance programs mentioned in the article?

Yes, the article mentions several down payment assistance programs, including the MyHome Assistance Program in California, the My Choice Texas Home program in Texas, and various programs available in Florida. These programs can enhance home buying opportunities for families.

How do home loan calculators simplify the home buying process?

Home loan calculators simplify the home buying process by allowing families to identify the best financing options that align with their financial goals. This proactive approach helps them secure the financing they need and leads to more fulfilling homeownership experiences.