Overview

When it comes to buying a home, the down payment can feel overwhelming. Typically, it ranges from 3% to 20% of the home’s purchase price. This range is influenced by several factors, including:

- Loan type

- Credit score

- Location

- Your unique financial situation

We understand how challenging this can be, and it’s crucial for potential homebuyers to grasp these factors. They directly affect your mortgage options and overall affordability. By taking the time to assess your personal finances and exploring available assistance programs, you can determine the ideal down payment that suits your needs. Remember, we’re here to support you every step of the way.

Introduction

Understanding the intricacies of a down payment can feel overwhelming for prospective homebuyers. We know how challenging this can be, especially as the real estate landscape evolves. The amount required upfront not only influences mortgage options but also significantly impacts your long-term financial health.

With various factors at play—such as loan types, credit scores, and regional housing markets—how can you navigate this complex terrain to find the ideal down payment? This article delves into the essential elements that shape down payment requirements. We’re here to support you every step of the way, offering insights and strategies to empower you on your journey to homeownership.

Understand the Concept of a Down Payment

A down deposit is the initial cash amount you make when acquiring a home, and many people wonder how much is a house down payment, which is typically expressed as a percentage of the home’s purchase cost. For example, if you purchase a house for $300,000 and are considering how much is a house down payment at 20%, you would pay $60,000 initially. This transaction not only decreases the sum you need to borrow, but it also shows lenders that you are .

It is crucial to understand how much is a house down payment. It affects your mortgage choices, interest rates, and monthly expenses. Moreover, a larger initial contribution can help you avoid private mortgage insurance (PMI), which is often required for contributions below 20%.

For first-time homebuyers, FHA loans present an appealing option with low deposit requirements, making homeownership more attainable. These loans are designed to assist families in improving their homes while offering flexible choices that can ease the financial burden of an initial cost. We know how challenging this can be, and we’re here to support you every step of the way.

Identify Key Factors Affecting Down Payment Amount

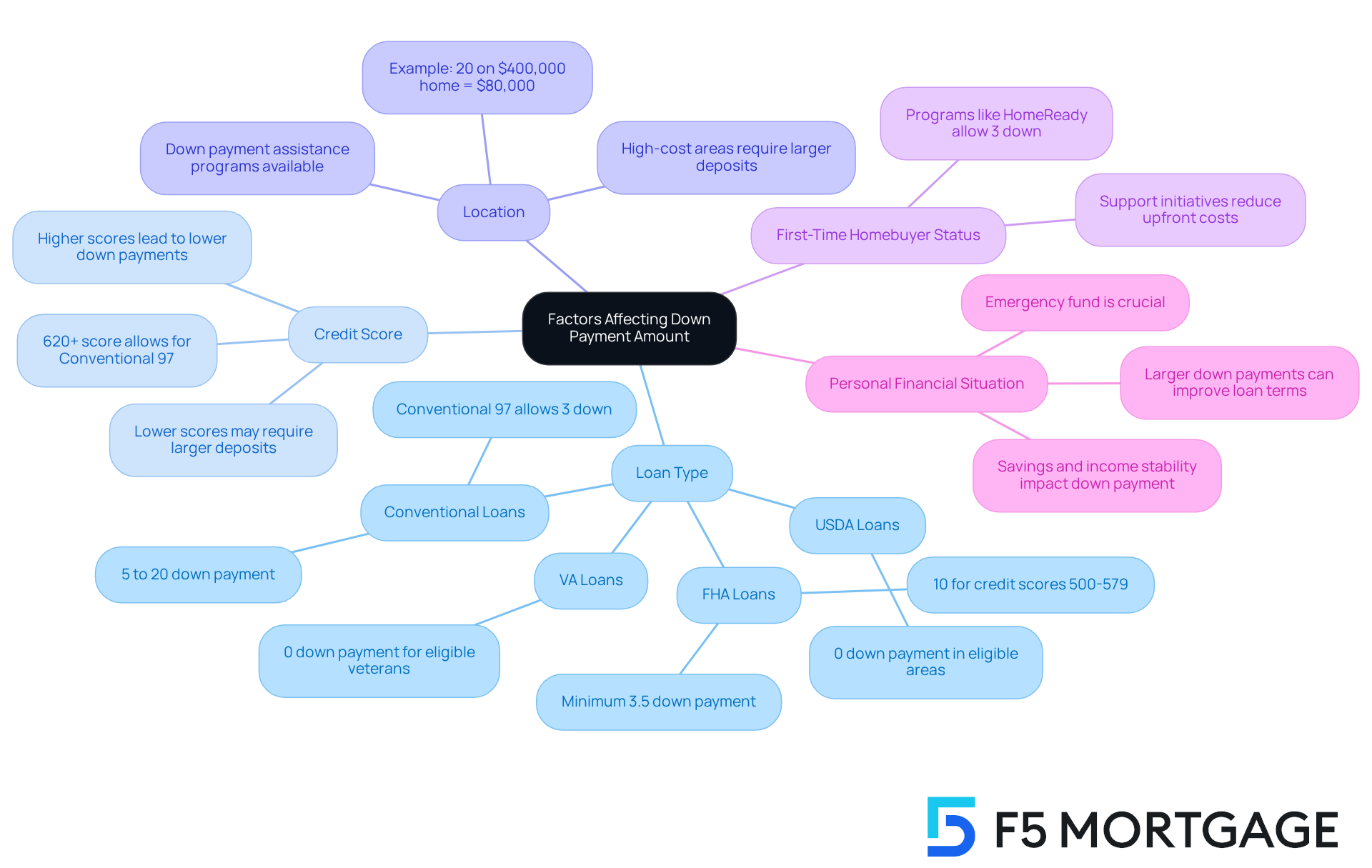

Several key factors can significantly influence the amount of down payment required when purchasing a home:

- Loan Type: Different mortgage programs come with varying down deposit requirements. For instance, FHA loans generally necessitate a minimum deposit of 3.5%, while conventional loans often expect deposits ranging from 5% to 20%. Government-supported loans, like VA and USDA loans, may even offer options with no upfront costs, making them appealing for qualified purchasers. Notably, the Conventional 97 loan allows qualifying borrowers with a minimum credit score of 620 to secure a mortgage with just a 3% deposit.

- Credit Score: Your credit score is vital in determining your down deposit options. A higher credit score can help you qualify for lower upfront costs and better interest rates. For example, borrowers with a credit score of 620 or above may access programs such as the Conventional 97, which permits a deposit as low as 3%. Conversely, a lower credit score may necessitate a larger upfront contribution, as lenders perceive higher risk. Recent data indicates that how much is a house down payment for first-time purchasers typically stands at 9%, highlighting the challenges many face in saving for a home.

- Location: Housing markets vary significantly across different areas, impacting deposit expectations. In high-cost regions, where the median property price can exceed $400,000, initial deposits may be substantially higher. For instance, determining how much is a house down payment on a median-priced home would require a 20% deposit of over $83,000, which can be a considerable hurdle for many buyers. However, programs like the Mortgage Credit Certificate in Los Angeles County can provide a dollar-for-dollar reduction of the buyer’s federal income tax obligation, helping to alleviate some of this financial strain. Additionally, exploring alternative down payment assistance options in California can further support buyers in overcoming these challenges.

- First-Time Homebuyer Status: Many initiatives exist to support first-time purchasers with reduced upfront costs. For example, Fannie Mae’s HomeReady program enables qualifying borrowers to obtain a mortgage with only a 3% down payment, making homeownership more attainable for those entering the market for the first time. According to mortgage professionals, these programs significantly lower the barriers to homeownership for first-time buyers.

- Personal Financial Situation: Your , including savings, income stability, and existing debts, will also influence how much you can afford to put down. It’s crucial to maintain an emergency fund, as it serves as a financial safety net for unexpected expenses that may arise during homeownership. Thoughtfully assessing your financial condition can help you determine the appropriate upfront sum that aligns with your long-term goals. Furthermore, making a larger initial contribution can lead to benefits such as improved mortgage interest rates and increased home equity, which are important considerations for buyers.

Calculate Your Ideal Down Payment Based on Financial Goals

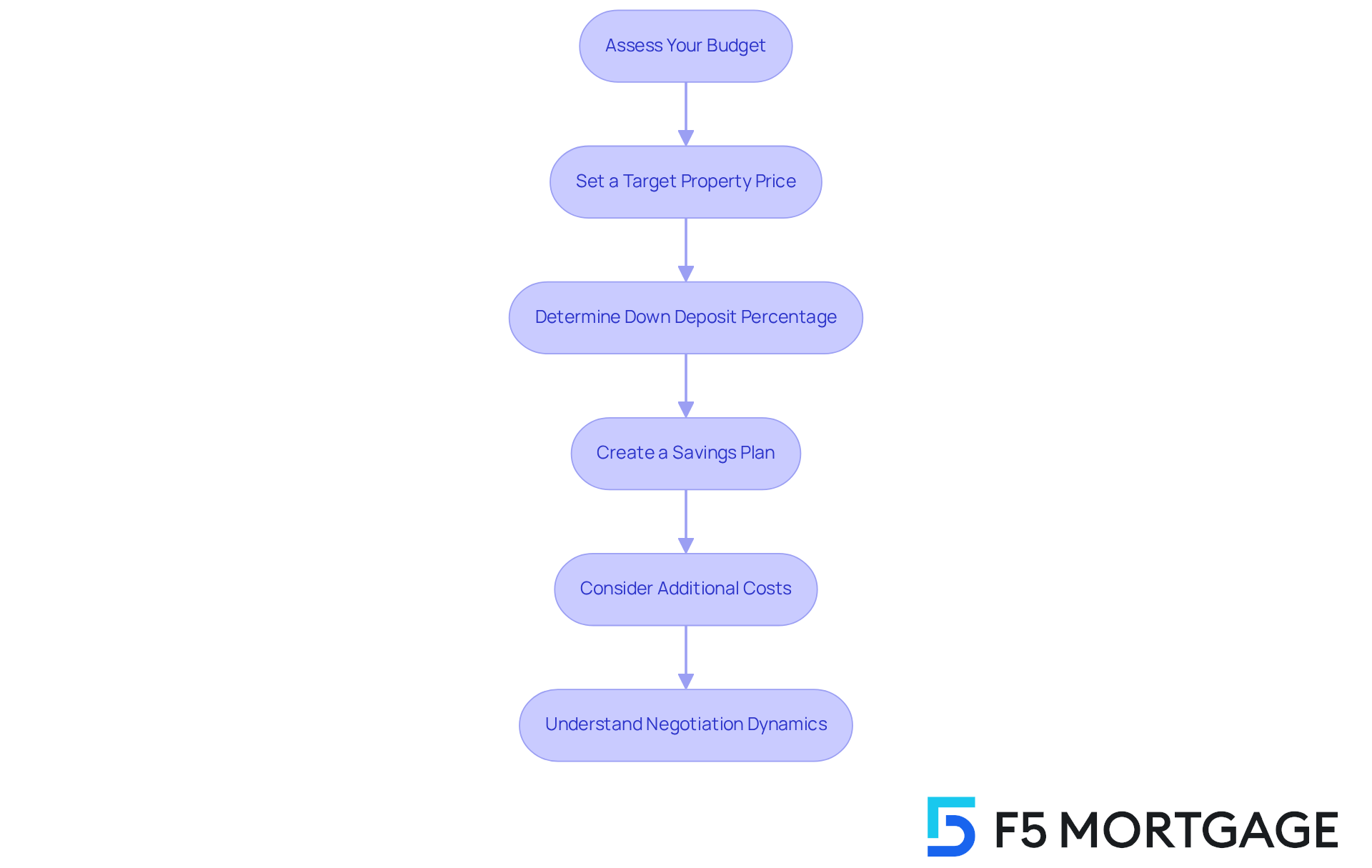

To calculate your ideal down payment, let’s walk through these important steps together:

- Assess Your Budget: It’s crucial to determine how much you can comfortably save for a down payment without jeopardizing your financial stability. Take a moment to consider your monthly expenses, savings goals, and any upcoming financial obligations that may arise.

- Set a Target Property Price: Research the housing market in your desired area. Establishing a realistic price range for properties you are interested in can make a significant difference. As of 2025, the average property purchaser is contributing 18.6% of the purchase price, highlighting a trend towards larger deposits.

- Determine Down Deposit Percentage: Based on the loan type and your unique financial situation, decide on a down deposit percentage that aligns with your goals. For instance, if you aim for a 10% deposit on a $300,000 property, you would need to save $30,000. Remember, though, that when considering how much is a house down payment for a conventional loan, it can be as low as 3%, requiring only $9,000 for the same home.

- Create a Savings Plan: Developing a timeline for reaching your down payment goal can help you stay on track. Break the total sum into monthly financial goals to make it more manageable. For example, saving $30,000 over three years means setting aside about $833 each month.

- Consider Additional Costs: It’s essential to factor in closing costs and other expenses related to purchasing a property, which can total 2-5% of the purchase price. For a $300,000 home, budgeting an additional $6,000 to $15,000 for these costs is a wise move.

- Understand Negotiation Dynamics: As you prepare for homeownership, remember that negotiating with the seller can significantly impact your financial strategy. It’s common to request repairs or upgrades as part of your offer, which can influence the overall purchase price. Your lender will provide a and a Closing Disclosure detailing the costs involved, so ensure you review these documents carefully to understand your financial commitments.

By following these steps, you can establish a realistic goal for your down deposit and ensure you feel financially ready for homeownership. We know how challenging this can be, but we’re here to support you every step of the way.

Explore Strategies and Resources for Saving for a Down Payment

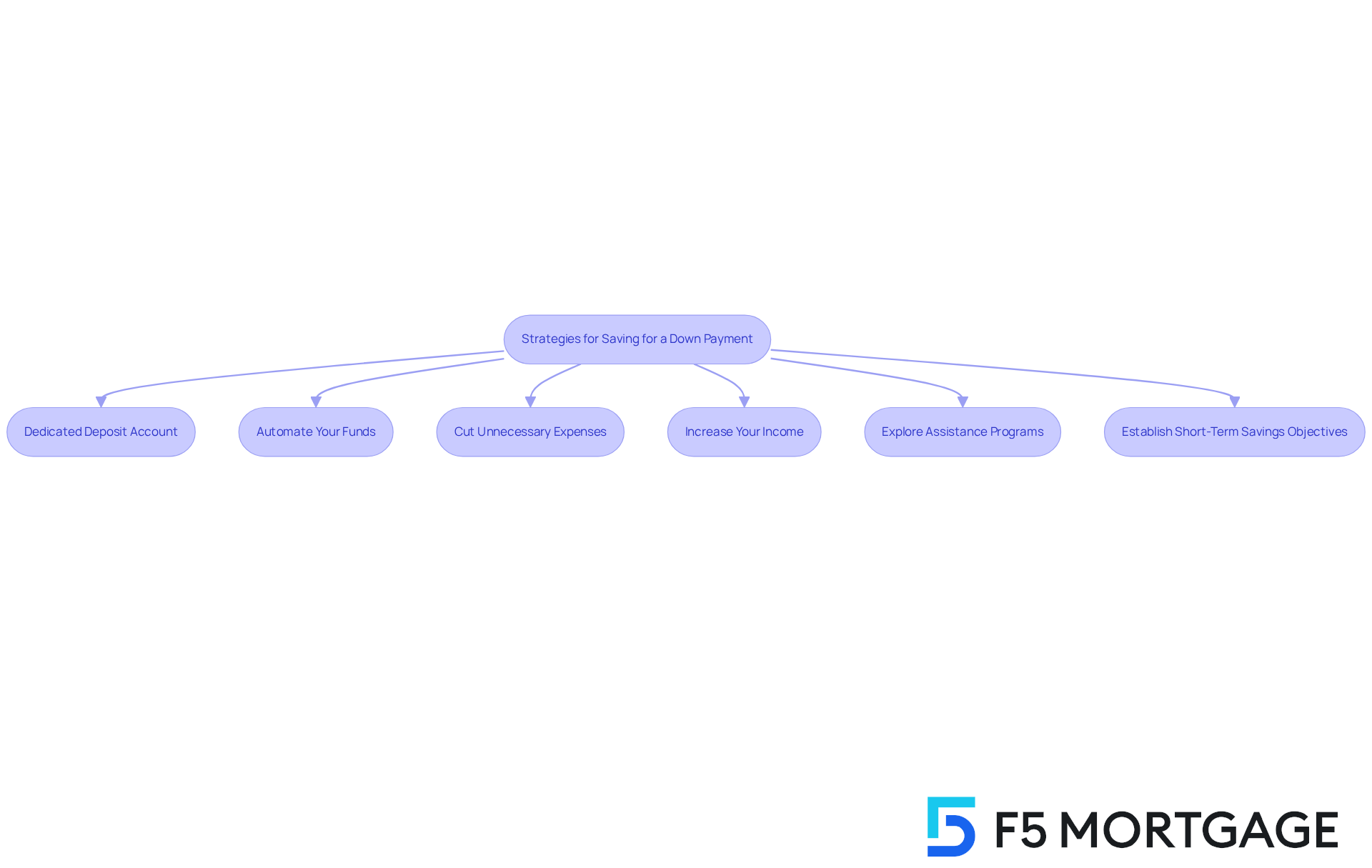

Here are some effective strategies and resources to help you save for a down payment:

- Establish a Dedicated Deposit Account: We know how important it is to keep your savings organized. Consider opening a high-yield deposit account specifically for your down payment. This keeps your funds distinct and can accumulate interest over time, with for top accounts.

- Automate Your Funds: To make saving even easier, establish automatic transfers from your checking account to your reserve account each month. This method streamlines the accumulation process and ensures consistency, helping you achieve your goals with less stress. Research indicates that automated financial plans can substantially enhance fund accumulation efficiency, assisting you in gathering resources more effectively.

- Cut Unnecessary Expenses: We understand that budgeting can be challenging. Take a moment to review your monthly expenses and identify areas where you might reduce spending. Minor adjustments, like eating out less or terminating unused subscriptions, can free up extra money for your deposit.

- Increase Your Income: If you’re looking for ways to boost your savings, explore opportunities to increase your income. This could involve taking on a part-time job, freelancing, or selling items you no longer need. Every bit of extra income can be directly funneled into your dedicated savings account, bringing you closer to your goal.

- Explore Assistance Programs: Don’t forget to explore local and state initiatives that provide assistance for first-time homebuyers. For instance, F5 Mortgage can guide you through various options, such as the MyHome Assistance initiative in California, which offers up to 3% of the home’s purchase cost, or the My Choice Texas Home scheme, providing up to 5% for down payment and closing support. In Florida, initiatives like the Florida Assist Second Mortgage Initiative can provide up to $10,000 to help with upfront expenses. These programs can offer grants or loans to assist with your initial costs, making homeownership more attainable.

- Establish Short-Term Savings Objectives: To keep your motivation high, consider dividing your total down payment aim into smaller, attainable milestones. Celebrating each milestone can help you stay focused on your savings journey. For example, if your aim is $80,000 for a 20% deposit on a $400,000 property, knowing how much is a house down payment and setting a target to save $10,000 every few months can make the process feel more achievable.

At F5 Mortgage, we pride ourselves on exceptional customer satisfaction, as reflected in our 5-star reviews on platforms like Google and Zillow. Our dedicated team is here to support you through the home financing process, ensuring you have access to the best down payment assistance programs available.

Conclusion

Understanding the intricacies of a house down payment is essential for prospective homebuyers. We know how challenging this can be, as the amount required for a down payment varies significantly based on several factors, including loan type, credit score, location, and individual financial situations. Recognizing these elements can empower you to make informed decisions, ultimately leading to a more manageable and successful home purchasing experience.

Throughout this article, we’ve highlighted key insights, such as the different loan programs available and the impact of credit scores on down payment requirements. The importance of location in determining financial expectations has also been discussed. Additionally, we’ve shared practical steps for calculating an ideal down payment and strategies for saving effectively, emphasizing the need for a structured approach to achieving your homeownership goals.

In conclusion, navigating the complexities of down payments can feel daunting, but with the right knowledge and resources, it becomes an attainable goal. We encourage you to actively explore various assistance programs, establish solid savings plans, and remain aware of your financial health. By taking these proactive steps, you can not only ease the burden of upfront costs but also lay a strong foundation for your future in homeownership.

Frequently Asked Questions

What is a down payment?

A down payment is the initial cash amount you make when acquiring a home, typically expressed as a percentage of the home’s purchase cost.

How is a down payment calculated?

To calculate a down payment, you multiply the purchase price of the home by the percentage you plan to pay. For example, on a $300,000 home with a 20% down payment, the initial payment would be $60,000.

Why is a down payment important?

A down payment reduces the amount you need to borrow and demonstrates to lenders that you are financially committed to the property. It also affects mortgage choices, interest rates, and monthly expenses.

How does a larger down payment benefit the buyer?

A larger down payment can help buyers avoid private mortgage insurance (PMI), which is often required for down payments below 20%.

What options are available for first-time homebuyers?

First-time homebuyers may find FHA loans appealing, as they offer low down payment requirements and flexible options to ease the financial burden of the initial cost.