Overview

A home equity loan offers a valuable opportunity for homeowners to tap into the equity of their property. This type of borrowing typically provides a lump sum that you can repay at a fixed interest rate over a set period. We understand how important it is to have access to funds for significant expenses, whether it’s for home improvements, consolidating debt, or covering educational costs.

However, it’s essential to recognize the associated risks. Understanding these risks can empower you to make informed decisions. For instance, failing to make repayments could lead to foreclosure, a situation we know how challenging this can be. This is why it’s crucial to weigh your options carefully and consider how a home equity loan fits into your overall financial plan.

We’re here to support you every step of the way as you navigate this process. By staying informed and seeking guidance, you can take control of your financial future with confidence.

Introduction

Homeowners often find themselves at a pivotal moment, where the value of their properties can be transformed into a significant financial resource. A home equity loan presents a unique opportunity to leverage the equity built in a residence, offering access to funds for essential expenses like renovations, education, or debt consolidation.

Yet, with this potential comes the challenge of understanding the associated risks and navigating the complexities of borrowing against one’s home. We know how challenging this can be—how can homeowners effectively utilize this financial tool while safeguarding their most significant investment?

We’re here to support you every step of the way.

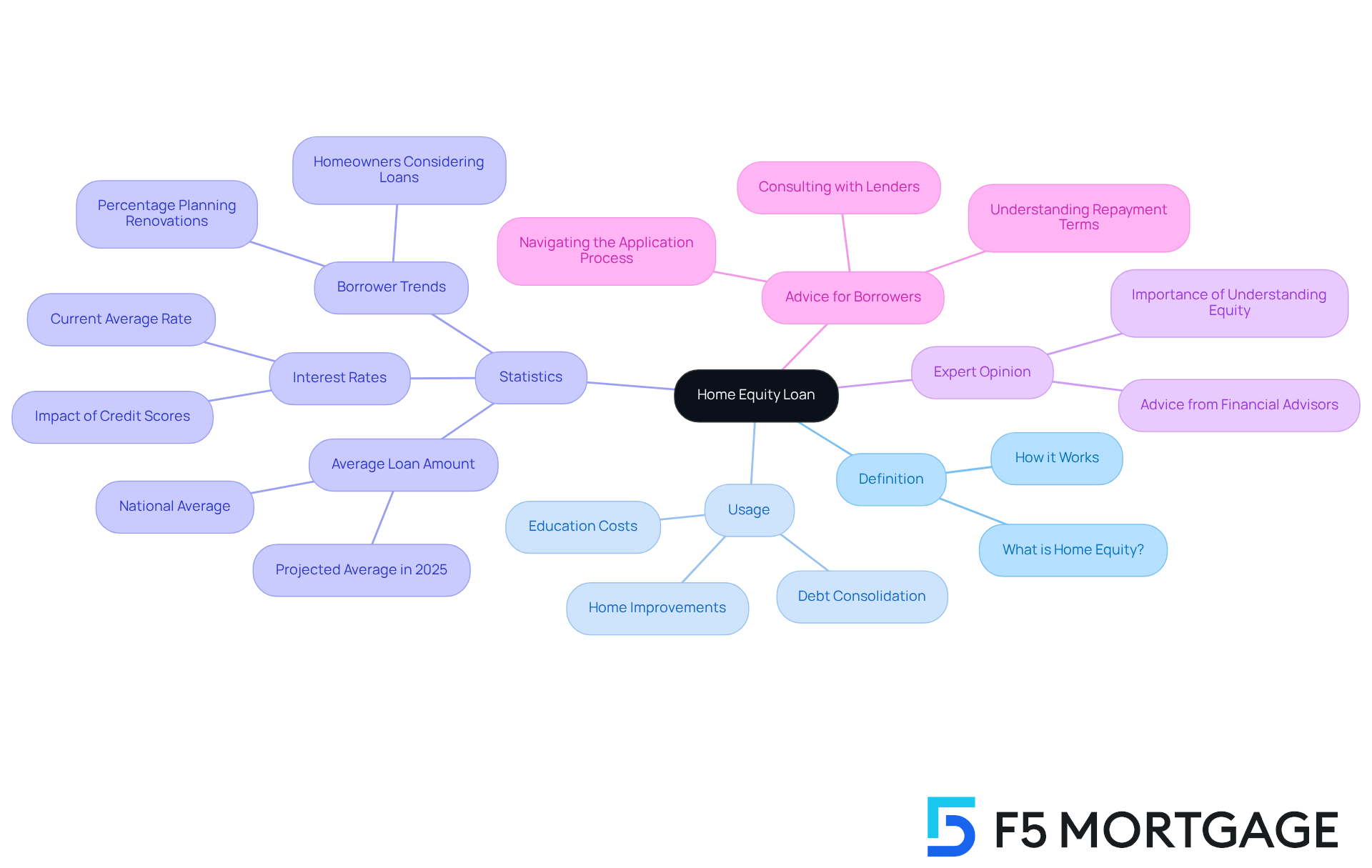

Define Home Equity Loan: Understanding the Basics

Property value financing, commonly understood as [what’s a home equity loan](https://f5mortgage.com/whats-a-home-equity-loan-key-features-and-practical-uses-explained), provides homeowners with a way to tap into the value they’ve built in their homes. Equity, which is what’s a home equity loan, is simply the difference between your property’s current market value and what you still owe on your mortgage. This type of borrowing typically provides a lump sum, which is paid back over a set period at a fixed interest rate, making it a dependable financing option. However, it’s important to remember that what’s a home equity loan refers to loans secured by your property, meaning that failure to repay could lead to foreclosure.

For many families, understanding what’s a home equity loan can be a lifesaver for significant expenses, such as home improvements, debt consolidation, or education costs. In fact, a recent survey found that 45% of potential borrowers plan to use their home equity to fund renovations that enhance their property’s value. As we look ahead to 2025, the average amount borrowed against property collateral is projected to be around $46,700, reflecting a cautious approach to leveraging home value in a fluctuating market.

We know how challenging navigating financial options can be, which is why financial advisors emphasize the importance of understanding how residential value works. As one expert put it, “Utilizing your assets is one of the greatest advantages of possessing a residence and a method to make your money serve you.” This perspective highlights what’s a home equity loan and how property-backed financing can serve as a strategic tool for homeowners striving to achieve their financial goals.

If you’re considering this path, take the time to explore your options and consult with a financial advisor who can guide you through the process. We’re here to support you every step of the way, ensuring you that align with your family’s needs.

Context and Importance of Home Equity Loans in Financing

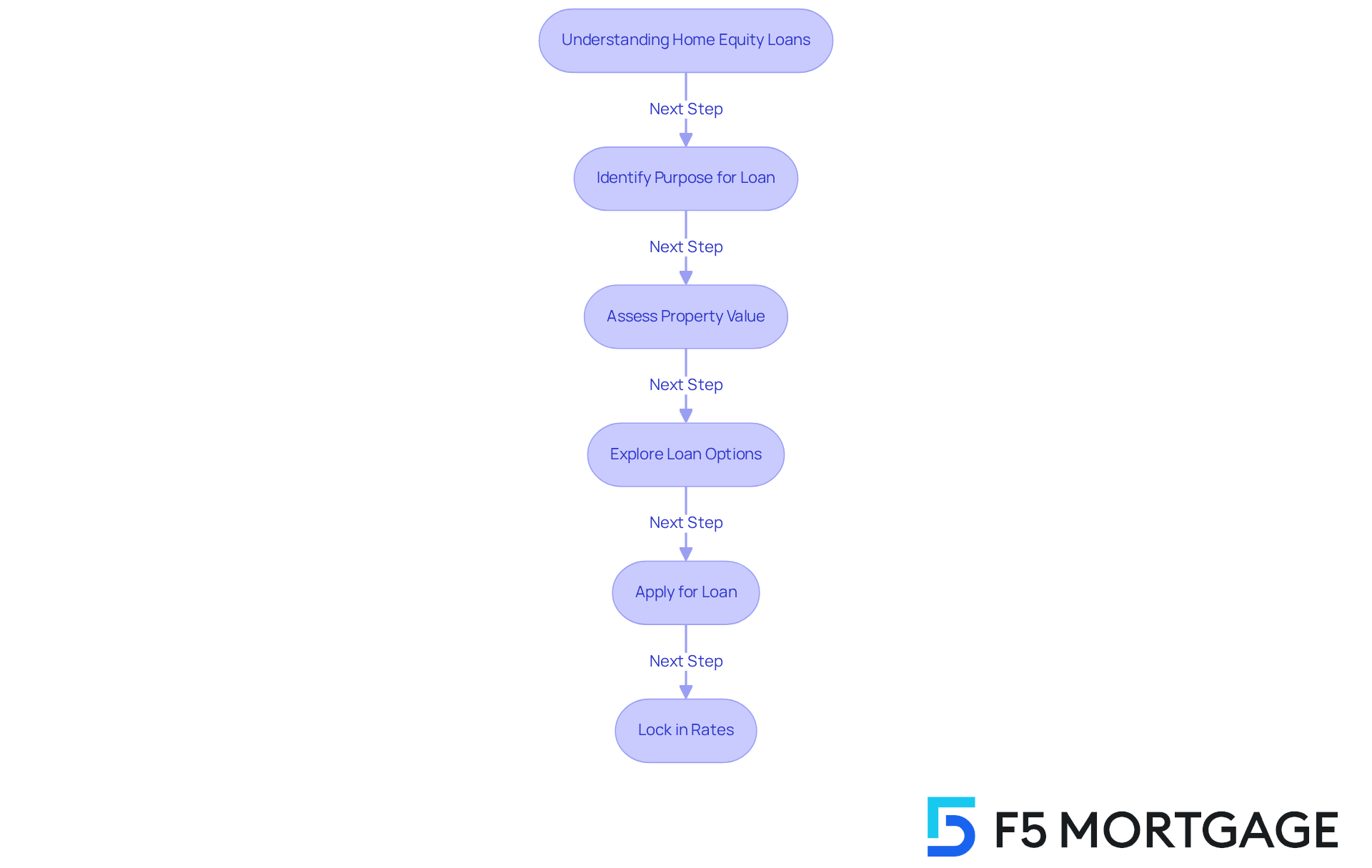

Residential value financing has become increasingly popular as a valuable financial resource, particularly amid rising property values. We understand that as property owners build value, they often seek resources for various purposes, such as renovations, debt consolidation, or unexpected expenses. One significant benefit of residential financing is the lower average interest rates, currently below 8.50%. This stands in contrast to unsecured financing or credit cards, which frequently carry higher rates. This makes residential financing an appealing option for those looking to fund significant expenditures.

Moreover, the interest paid on property-backed financing may be tax-deductible if the funds are utilized for specific projects. This added benefit enhances their attractiveness in today’s economic environment. As many households grapple with rising expenses, property-backed financing offers a practical solution for obtaining cash without resorting to high-interest borrowing options. We know how challenging this can be, and recognizing the value of property as a versatile financial asset is crucial.

As the need for property-backed financing continues to grow, it signals a shift in how families manage their financial challenges. To fully leverage the advantages of refinancing in California, it’s essential for property owners to understand the refinancing process. This process involves replacing an existing mortgage with a new one, which can help lower payments or access additional value.

Once the application is approved, locking in mortgage rates becomes crucial. This step protects against market fluctuations during the processing period, ensuring that families can secure favorable terms as they navigate their financial options. We’re here to support you every step of the way, helping you make for a brighter financial future.

Key Features of Home Equity Loans: Structure and Functionality

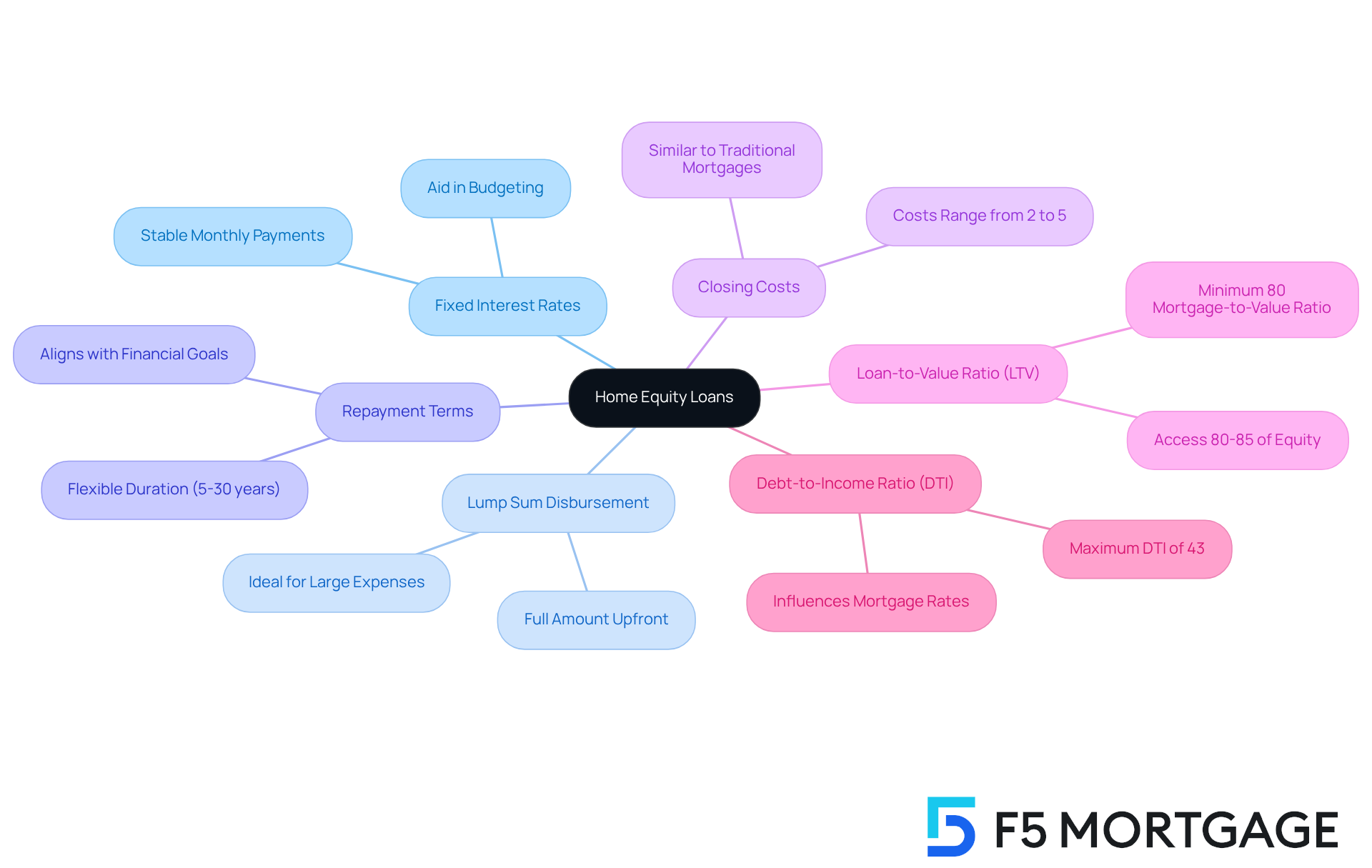

Home equity loans come with several important features designed to meet the financial needs of homeowners like you:

- Fixed Interest Rates: Most home equity loans offer fixed interest rates, which means your monthly payments will remain stable throughout the loan term. This predictability can significantly aid in budgeting and financial planning, helping you feel more secure.

- Lump Sum Disbursement: With these loans, you receive the full amount upfront. This can be particularly beneficial for substantial expenses, such as property renovations, debt consolidation, or major purchases. Having immediate access to funds can be a crucial advantage for homeowners facing large financial decisions.

- Repayment Terms: The repayment duration for home equity financing typically spans from 5 to 30 years. This flexibility allows you to choose a term that aligns with your financial circumstances and long-term goals, ensuring that you can manage your payments comfortably.

- Closing Costs: Similar to traditional mortgages, home equity products may involve closing costs. These can include appraisal fees, title insurance, and other associated expenses. In California, these costs usually range from 2% to 5% of the borrowed sum. For instance, if you borrow $300,000, you might expect closing expenses between $6,000 and $15,000. Understanding these costs is crucial for evaluating the overall expense of your financing.

- Loan-to-Value Ratio (LTV): Lenders typically allow you to access 80-85% of your property’s equity, calculated based on the appraised value minus any outstanding mortgage balance. Many lenders require homeowners to maintain a minimum 80% mortgage-to-value ratio, meaning you should have reduced at least 20% of your initial amount or that your property has appreciated in value. This ratio plays a vital role in determining how much you can borrow.

- Debt-to-Income Ratio (DTI): Generally, a maximum DTI ratio of 43% is necessary for home equity financing. DTI reflects the relationship between your existing debt and income. A better DTI can lead to more competitive mortgage rates, making it easier for you to secure favorable terms.

Mortgage experts emphasize that the framework of home financing, particularly what’s a home equity loan, allows property owners to utilize their asset’s worth effectively. The lump sum disbursement feature is especially advantageous for those looking to finance significant projects or consolidate higher-interest debts. It serves as a strategic financial tool for managing expenses, and we know how challenging this can be. We’re here to in navigating these options.

Practical Applications: How Home Equity Loans Can Be Used

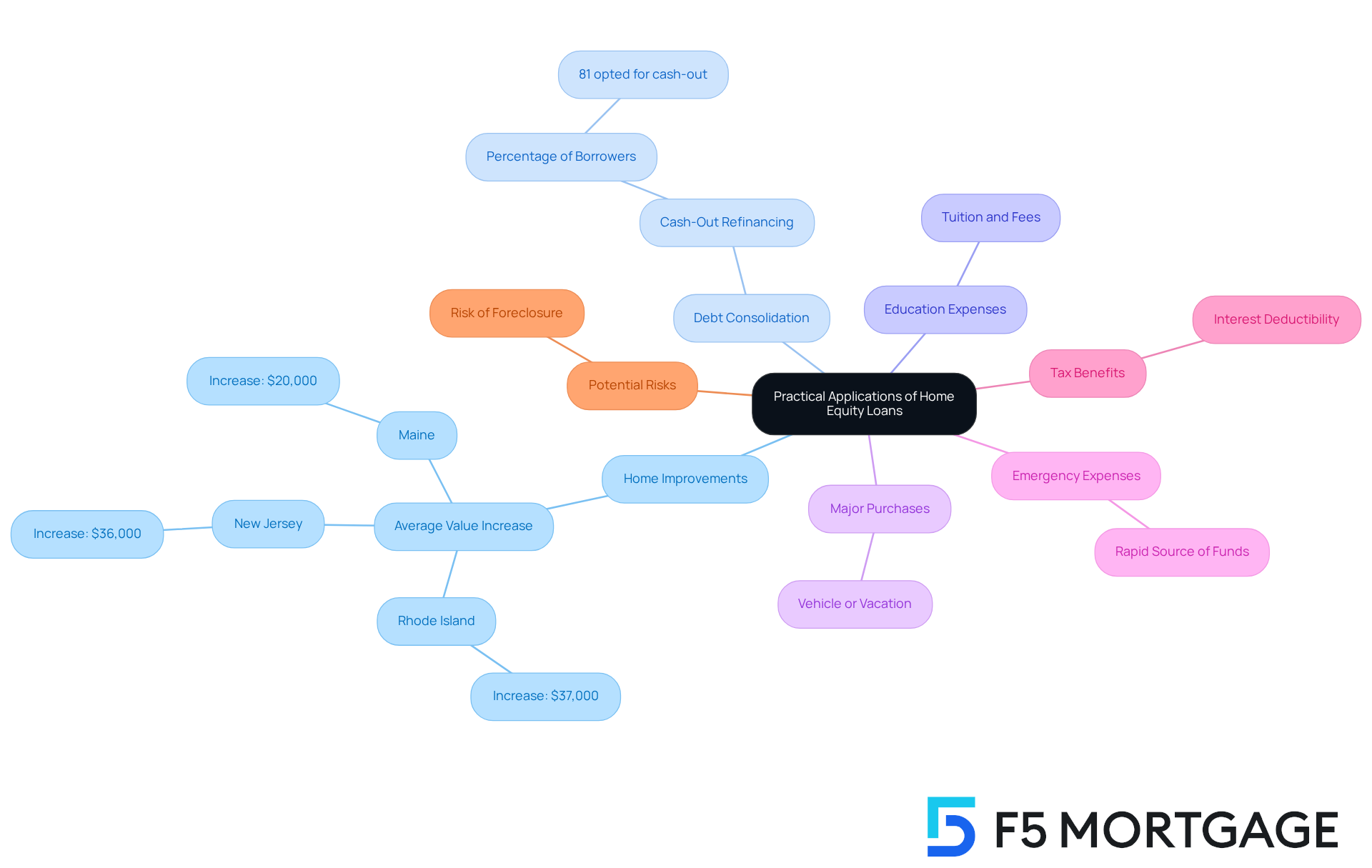

Home value financing serves various practical functions, enabling property owners to utilize their property’s worth efficiently. We know how important it is to make the most of your investment, and understanding these applications can empower you to make informed decisions.

- Home Improvements: Many homeowners utilize these loans to finance renovations or repairs that can significantly enhance the property’s market value. For instance, property owners in Rhode Island observed an average value increase of $37,000 annually, while those in New Jersey and Maine noted increases of $36,000 and $20,000 respectively. This highlights the potential for enhanced property worth through strategic renovations.

- Debt Consolidation: A frequent application of property value financing is to combine high-interest obligations, such as credit card balances, into a single arrangement with a reduced interest rate. In 2025, a significant portion of borrowers opted for property-backed financing specifically for this purpose, indicating a rising trend in handling personal finances more effectively. Notably, 81% of individuals who refinanced in the second quarter chose cash-out refinancing, showing robust consumer interest in utilizing home value for debt management.

- Education Expenses: These financial aids can also help in covering tuition fees or other educational costs, whether for children or the borrowers themselves. Investing in education is a powerful way to secure future opportunities for your family.

- Major Purchases: Homeowners can utilize their assets for significant purchases, such as a new vehicle or a family vacation. This allows you to make substantial investments without depleting your savings, providing peace of mind.

- Emergency Expenses: During periods of financial distress, such as unforeseen medical crises, property asset financing provides a rapid source of funds. This ensures reassurance in difficult circumstances, allowing you to focus on what truly matters—your family’s well-being.

- Tax Benefits: Interest on a property financing option may be tax-deductible if the funds are utilized to purchase, construct, or significantly enhance the residence securing the financing. This provides an additional advantage for property owners, adding to the benefits of home value financing.

- Potential Risks: It’s important to note that obtaining a property-backed loan raises the risk of foreclosure if borrowers fail to meet their payments. We understand that this can be a concern, making it essential for property owners to evaluate their financial situation thoroughly before proceeding.

By understanding these applications, you can make informed decisions about what’s a home equity loan and how to use your home equity effectively. We’re here to support you every step of the way, ensuring you of your investment.

Conclusion

A home equity loan serves as a vital financial resource for homeowners, allowing them to access the value accumulated in their properties. We know how challenging financial decisions can be, and by understanding the mechanics and benefits of these loans, individuals can make informed choices that align with their financial goals. This type of financing not only provides a lump sum at a fixed interest rate but also offers the potential for significant tax benefits and lower interest rates compared to unsecured options.

Throughout this article, we highlighted key points regarding the various applications of home equity loans. These include:

- Funding home improvements

- Consolidating debt

- Covering education expenses

- Addressing emergency costs

It’s essential to understand the structure and features of these loans, such as fixed interest rates, repayment terms, and associated costs. Recognizing the potential risks, like foreclosure, underscores the need for careful financial planning before proceeding.

Ultimately, leveraging home equity can empower homeowners to manage their finances more effectively and pursue their aspirations. As property values continue to rise, understanding how to utilize home equity loans strategically can lead to improved financial stability and growth. We encourage homeowners to engage with financial advisors and explore their options, ensuring they make the most of their investments and navigate the complexities of home financing successfully.

Frequently Asked Questions

What is a home equity loan?

A home equity loan is a type of borrowing that allows homeowners to tap into the value they’ve built in their homes. It is the difference between the property’s current market value and the remaining mortgage balance.

How does a home equity loan work?

A home equity loan typically provides a lump sum that is paid back over a set period at a fixed interest rate. It is secured by the property, meaning failure to repay could result in foreclosure.

What are common uses for a home equity loan?

Home equity loans are often used for significant expenses such as home improvements, debt consolidation, or education costs.

What is the average amount projected to be borrowed against home equity by 2025?

The average amount borrowed against property collateral is projected to be around $46,700.

Why is it important to understand home equity?

Understanding home equity is crucial as it allows homeowners to utilize their assets effectively, helping them achieve financial goals and make informed decisions regarding their finances.

Should I consult a financial advisor before taking a home equity loan?

Yes, it is advisable to consult with a financial advisor to explore your options and guide you through the process of obtaining a home equity loan.