Overview

Navigating the world of homebuying can be overwhelming, especially when it comes to understanding your debt-to-income (DTI) ratio. A good DTI ratio for homebuyers is generally considered to be 36% or lower. This level indicates a manageable amount of debt relative to your income, which can significantly increase your chances of qualifying for favorable mortgage terms.

Lenders typically prefer a DTI below 43%. If your ratio exceeds this threshold, you may face higher interest rates or even rejection of your loan application. We know how challenging this can be, and it’s crucial to maintain a low DTI to access better mortgage options.

By keeping your DTI in check, you not only enhance your eligibility for loans but also empower yourself to make informed financial decisions. Remember, we’re here to support you every step of the way as you embark on this important journey.

Introduction

Understanding the nuances of financial health is crucial for anyone looking to purchase a home. We know how challenging this can be, and the debt-to-income (DTI) ratio serves as a vital indicator in this equation. This percentage not only reflects your ability to manage monthly payments but also plays a significant role in determining your mortgage eligibility.

As prospective homebuyers navigate the complexities of financing, you may wonder: what constitutes a good debt-to-income ratio, and how does it impact your options in the competitive housing market? Exploring this ratio can empower you to make informed decisions and enhance your chances of securing favorable loan terms. We’re here to support you every step of the way.

Define Debt-to-Income Ratio

In today’s financial landscape, it’s essential to understand what’s a good debt to income ratio. This important indicator helps determine what’s a good debt to income ratio by measuring your total monthly financial obligations against your gross income, expressed as a percentage. To calculate your DTI, simply divide your total monthly payments by your gross income for that period. For instance, if you have $2,000 in monthly obligations and a gross income of $5,000, your DTI would be 40%.

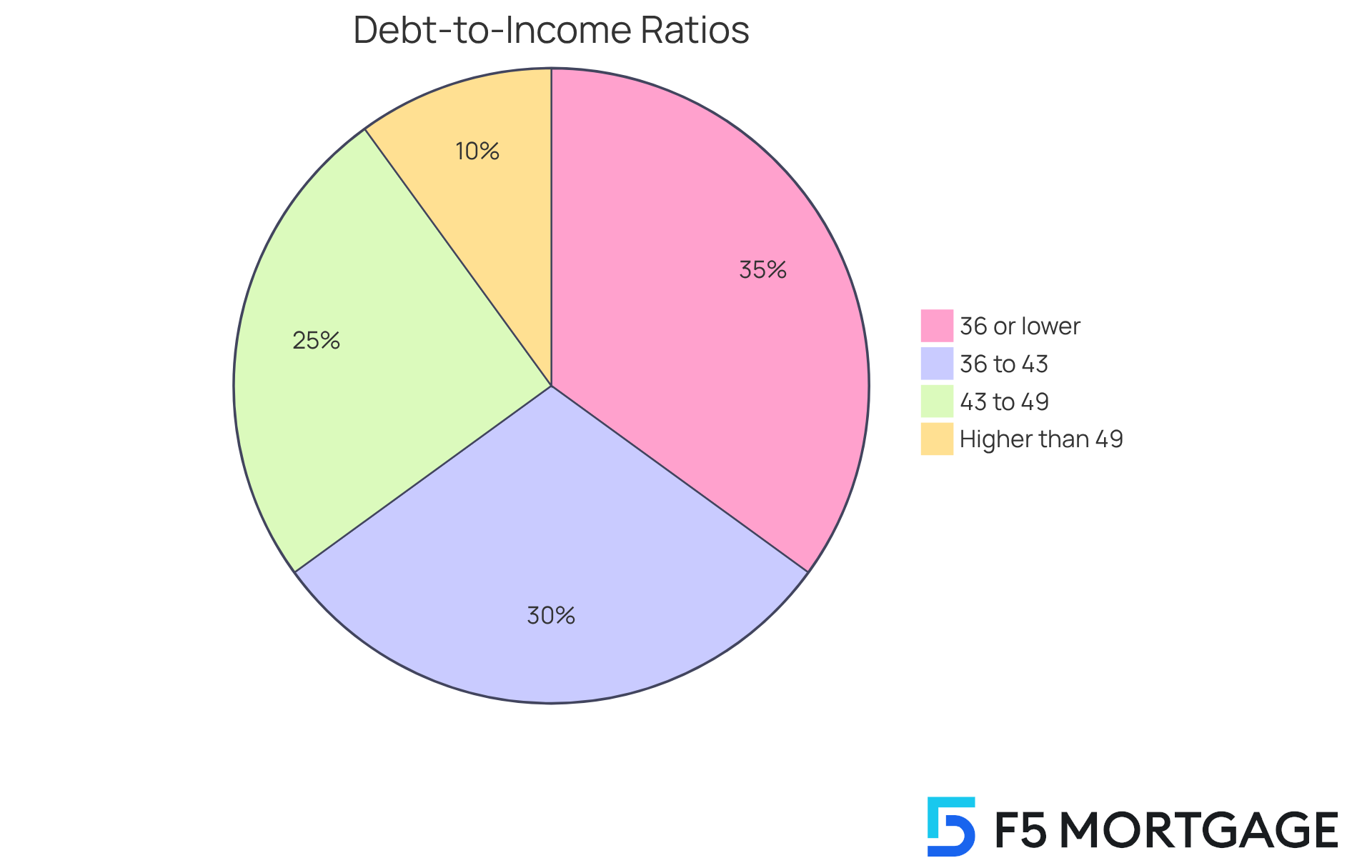

This ratio plays a significant role in mortgage financing. Lenders use it to assess your ability to manage monthly payments and repay debts. Generally, what’s a good debt to income ratio is 36% or lower, which is considered favorable and indicates that your obligations are manageable relative to your income. However, many lenders consider what’s a good debt to income ratio, looking for a maximum DTI of 43% for home loans, with a preference for a front-end ratio of no more than 28% and a back-end ratio of no higher than 36%. If your DTI falls between 36% and 49%, it suggests that while you are managing your finances adequately, you should evaluate what’s a good debt to income ratio to identify areas for improvement.

For those considering FHA and VA loans, you might find that higher DTI ratios are permissible, which can be beneficial for specific situations. In places like Colorado, options such as FHA refinance loans are available for individuals with lower credit scores, offering a pathway to homeownership.

We know how challenging financial management can be, especially when over 40% of Americans are actively seeking ways to handle their debts. This highlights the importance of understanding what’s a good debt to income ratio while you navigate the home buying process. When considering what’s a good debt to income ratio, a DTI of 35% or lower is viewed positively, suggesting that your debt is manageable in relation to your income. Remember, we’re here to support you every step of the way.

Explain the Importance of Debt-to-Income Ratio in Home Financing

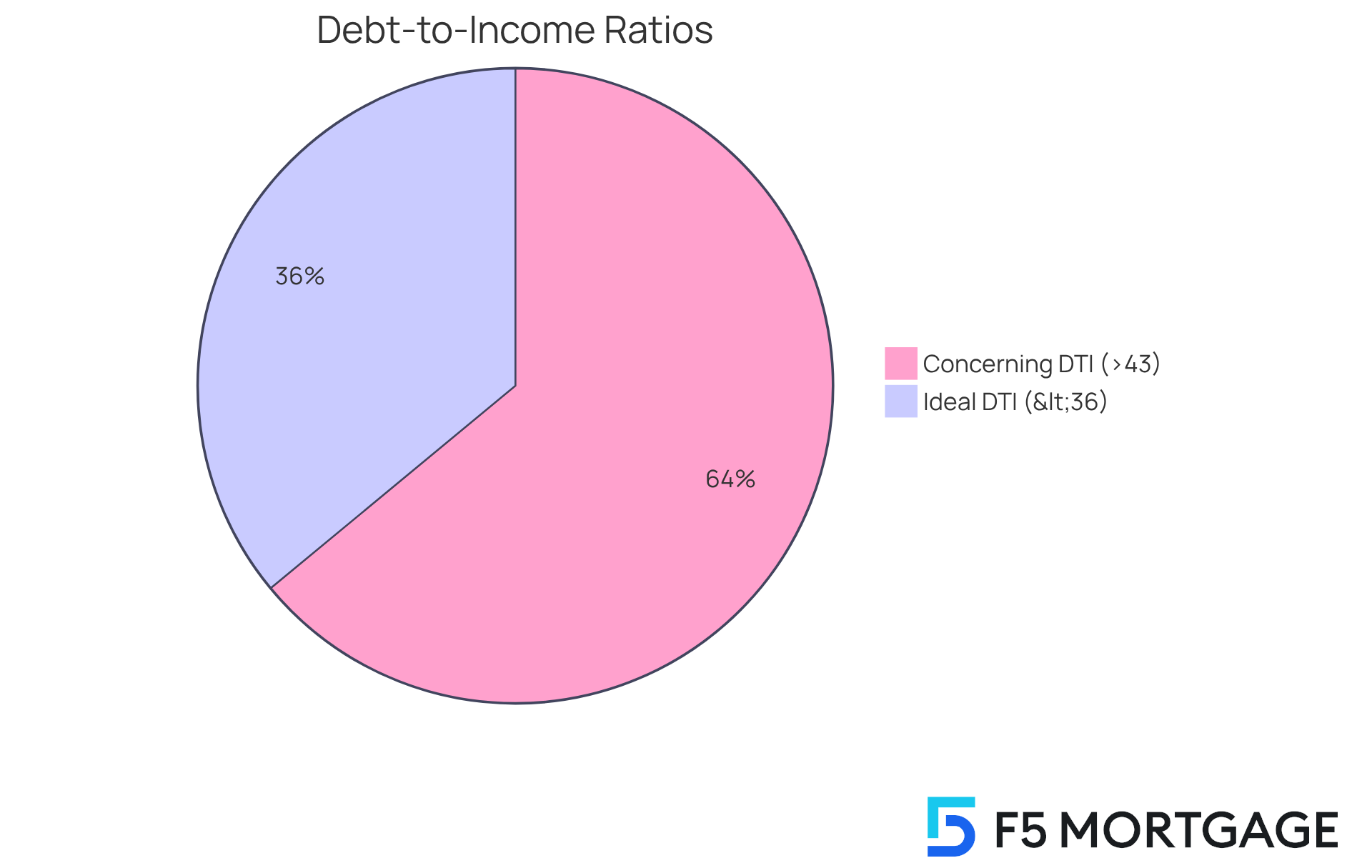

We know how challenging navigating the mortgage approval process can be. One crucial factor to consider is understanding what’s a good debt to income ratio. Lenders use DTI to assess your ability to manage monthly payments and evaluate the risk associated with lending to you. A lower DTI indicates that you have a manageable level of debt relative to your income, making you a more attractive candidate for a mortgage.

Conversely, a high DTI may signal financial strain. This could lead lenders to either deny your application or offer less favorable terms. Generally, when assessing what’s a good debt to income ratio:

- A DTI below 36% is considered ideal.

- Figures above 43% may raise red flags for lenders.

Understanding your DTI is a vital step in empowering yourself during this process, and we’re here to support you every step of the way.

Outline How to Calculate Your Debt-to-Income Ratio

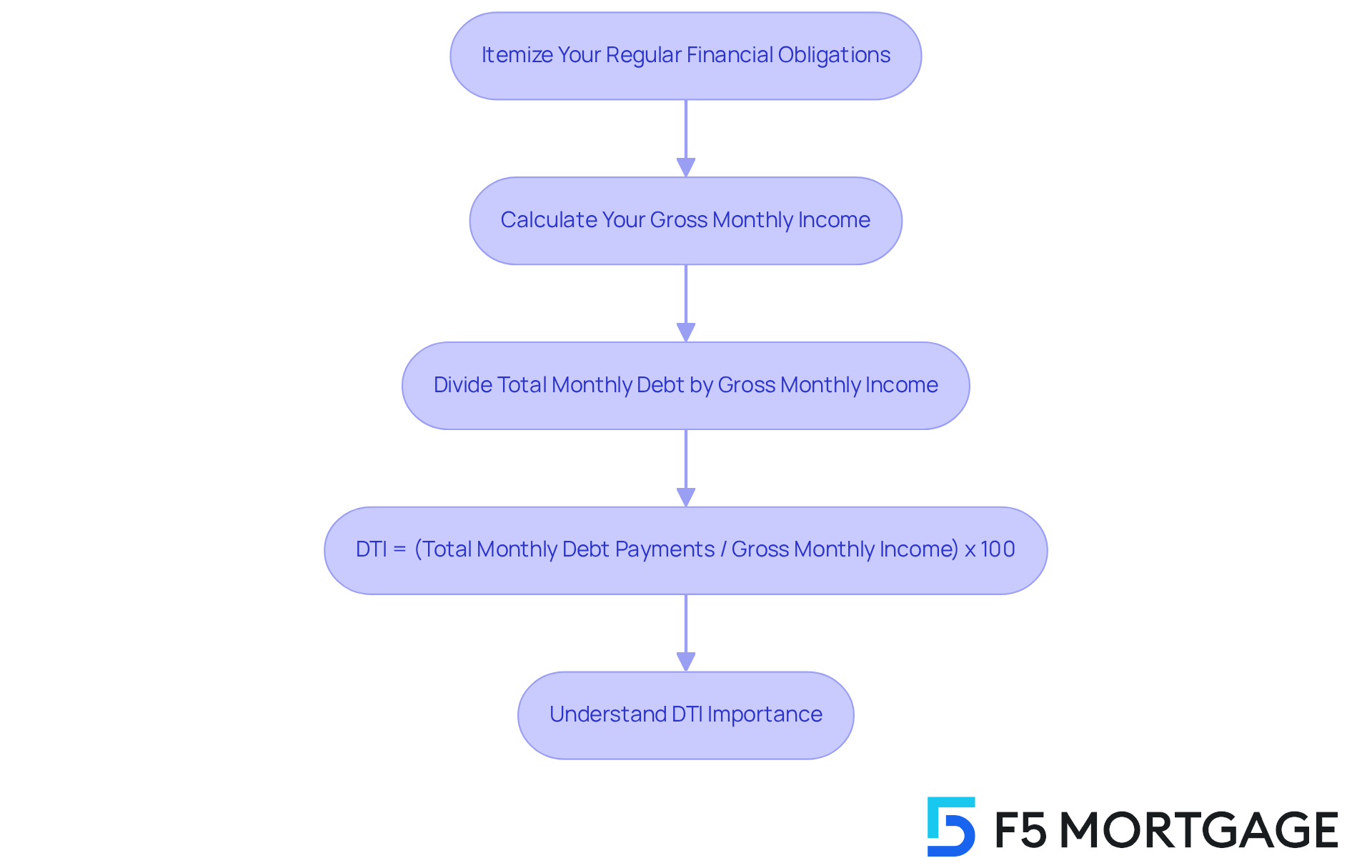

When applying for a mortgage, understanding what’s a good debt to income ratio is crucial for your financial well-being. We know how challenging this process can be, and we’re here to support you every step of the way. Follow these straightforward steps to gain clarity:

Itemize Your Regular Financial Obligations: Start by listing all your recurring liabilities, such as mortgage payments, car loans, student loans, credit card payments, and other consistent commitments. For instance, if your total obligations amount to $2,500, this figure will be key in your calculations.

Calculate Your Gross Monthly Income: This includes your salary, bonuses, and any additional income sources before taxes. For example, if your gross income is $6,000 each month, this will form the basis of your DTI calculation.

Divide Total Monthly Debt by Gross Monthly Income: Use this formula: DTI = (Total Monthly Debt Payments / Gross Monthly Income) x 100. In our example, with a total recurring obligation of $2,500 and a gross income of $6,000, your DTI would be approximately 41.67%.

Understanding what’s a good debt to income ratio is essential, as lenders typically prefer a DTI level below 43% for mortgage approval. This ratio helps evaluate your ability to manage monthly payments and indicates whether you can responsibly take on additional financial commitments. By calculating your DTI, you empower yourself to make informed decisions about your home purchase, ensuring you are financially prepared for the responsibilities of homeownership.

Discuss Good vs. Bad Debt-to-Income Ratios and Their Impact on Mortgage Options

What’s a good debt to income ratio is generally considered to be below 36%. This indicates that a borrower maintains a manageable level of debt relative to their income. Most lenders consider what’s a good debt to income ratio to be 36% or below, as this range increases the likelihood of qualifying for favorable mortgage conditions, such as reduced interest rates and larger loan amounts.

At F5 Mortgage, we understand how challenging navigating the mortgage landscape can be for families. Our loan experts are here to provide personalized support, helping you achieve your homeownership goals with compassion and care.

Conversely, when considering what’s a good debt to income ratio, a DTI measurement exceeding 43% can severely limit mortgage choices. This often results in higher interest rates or even outright rejection of the loan application. For instance, a borrower with a DTI of 50% may struggle to secure a mortgage, while another with a DTI of 30% typically enjoys access to a broader array of loan products, such as FHA or VA loans, along with more favorable terms, leading to the question of what’s a good debt to income ratio.

It’s important to remember that when lenders review mortgage applications, they consider what’s a good debt to income ratio along with several other factors. Other elements, including credit score and employment history, also play a crucial role. At F5 Mortgage, we empower our clients by ensuring they understand what’s a good debt to income ratio, including both front-end and back-end ratios. These are essential metrics that lenders evaluate to assess a borrower’s overall financial health.

This distinction underscores the importance of managing debt effectively to enhance mortgage prospects. We know how overwhelming this process can feel, but we are committed to guiding you through the underwriting process to ensure loan compliance and your success. Together, we can navigate these challenges and work towards your dream of homeownership.

Conclusion

Understanding the concept of debt-to-income (DTI) ratio is crucial for homebuyers aiming to secure favorable mortgage terms. We know how challenging this can be, but a good DTI ratio can provide insight into your financial health and ability to manage monthly payments. With a benchmark of 36% or lower often considered ideal, this metric serves as a key indicator for lenders. It influences not only approval decisions but also the types of mortgage options available to you.

Throughout this article, we’ve discussed essential aspects of DTI, including:

- How to calculate it

- The implications of various DTI levels on mortgage eligibility

- The potential for higher ratios in specific loan types like FHA and VA loans

By breaking down the calculation process and explaining the significance of maintaining a low DTI, we hope to equip you with the knowledge to navigate the complexities of mortgage financing.

Ultimately, managing debt effectively is paramount for anyone looking to achieve homeownership. By striving for a favorable DTI ratio, you can enhance your chances of securing better loan terms and avoid the pitfalls of financial strain. Remember, empowerment through knowledge of DTI not only aids in making informed decisions but also paves the way for your successful journey toward owning a home. We’re here to support you every step of the way.

Frequently Asked Questions

What is a debt-to-income (DTI) ratio?

A debt-to-income (DTI) ratio is a financial indicator that measures your total monthly financial obligations against your gross income, expressed as a percentage.

How do you calculate your DTI?

To calculate your DTI, divide your total monthly payments by your gross income for that period. For example, if you have $2,000 in monthly obligations and a gross income of $5,000, your DTI would be 40%.

Why is the DTI ratio important for mortgage financing?

Lenders use the DTI ratio to assess your ability to manage monthly payments and repay debts. It helps them determine your creditworthiness for home loans.

What is considered a good DTI ratio?

A DTI ratio of 36% or lower is generally considered favorable, indicating that your financial obligations are manageable relative to your income.

What DTI ratios do lenders typically look for when approving home loans?

Many lenders prefer a maximum DTI of 43% for home loans, with a front-end ratio of no more than 28% and a back-end ratio of no higher than 36%.

What does it mean if your DTI falls between 36% and 49%?

If your DTI falls between 36% and 49%, it suggests that while you are managing your finances adequately, you should evaluate your debt-to-income ratio to identify areas for improvement.

Are there special considerations for FHA and VA loans regarding DTI ratios?

Yes, for FHA and VA loans, higher DTI ratios may be permissible, which can be beneficial for specific situations.

What is a positive DTI ratio when considering homeownership?

A DTI of 35% or lower is viewed positively, suggesting that your debt is manageable in relation to your income.