Overview

Home loan brokers offer invaluable support for first-time buyers, providing personalized guidance that truly understands your needs. They grant access to a variety of loan options and wield negotiation power to help secure better rates, easing the financial burden. We know how challenging this can be, and that’s why these brokers are here to simplify the mortgage process for you.

Imagine having someone by your side, educating you on your financial options while offering ongoing support throughout your journey. This partnership makes the path to homeownership feel less daunting and far more manageable. With their expertise, you can navigate the complexities of securing a loan with confidence.

By choosing to work with a home loan broker, you’re not just getting a service; you’re gaining a trusted ally. They stand ready to empower you every step of the way, ensuring that you feel informed and supported in making this significant decision. Let’s take this journey together, turning your dream of homeownership into a reality.

Introduction

Navigating the journey to homeownership can feel like an overwhelming challenge, particularly for first-time buyers. We know how complex securing a mortgage can be, especially with rising household incomes and increasing down payment expectations. This is why expert guidance is more critical than ever.

In this article, we explore the invaluable benefits that home loan brokers provide, offering tailored support and insights that empower buyers to make informed decisions.

How can first-time homebuyers leverage these advantages to simplify their mortgage process and enhance their overall buying experience? We’re here to support you every step of the way.

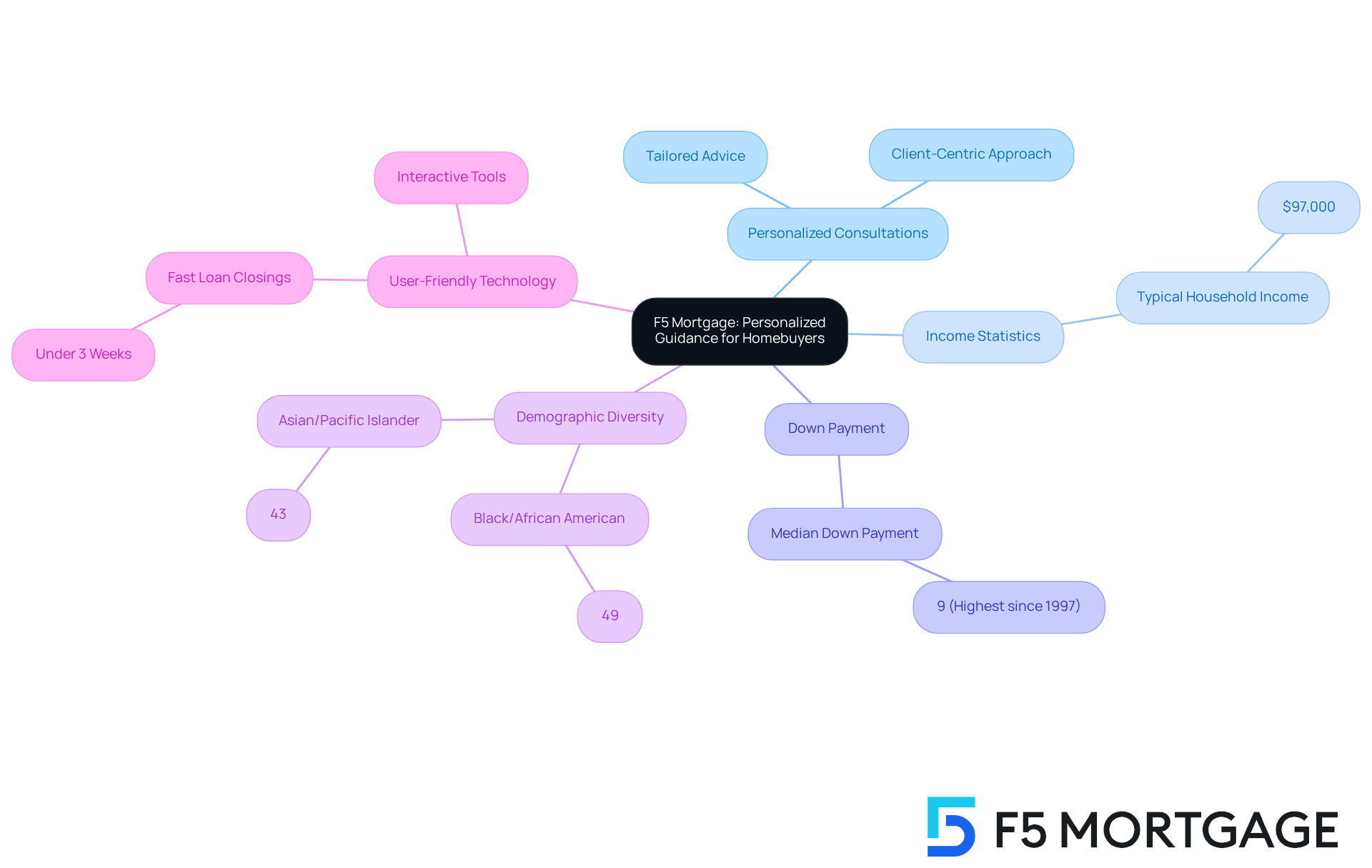

F5 Mortgage: Personalized Guidance for First-Time Homebuyers

At F5 Mortgage, we understand how daunting the journey to homeownership can be, especially for first-time buyers seeking guidance from . That’s why we excel in providing tailored specifically for you. By taking the time to thoroughly understand your and homeownership aspirations, our brokerage delivers customized advice and solutions designed to empower you. This personalized approach not only enhances your confidence but also helps you with ease, especially when working with home loan brokers.

With the typical first-time purchaser having a household income of $97,000 and facing a of 9%—the highest it has been since 1997—the need for is more critical than ever. We know how challenging securing a loan can be, and our home loan brokers are here to support you every step of the way. As the demographic landscape evolves, with 49% of identifying as Black/African American and 43% as Asian/Pacific Islander, we ensure that individuals from varied backgrounds receive informed choices that align with their long-term financial objectives.

Our dedication to a stress-free financing process is evident through our user-friendly technology and the assistance of home loan brokers who offer no-pressure guidance. We want you to feel comfortable selecting what feels right for you. This client-centric approach not only enhances your overall homebuying experience but also facilitates in under three weeks, ensuring that you can upgrade your home with confidence.

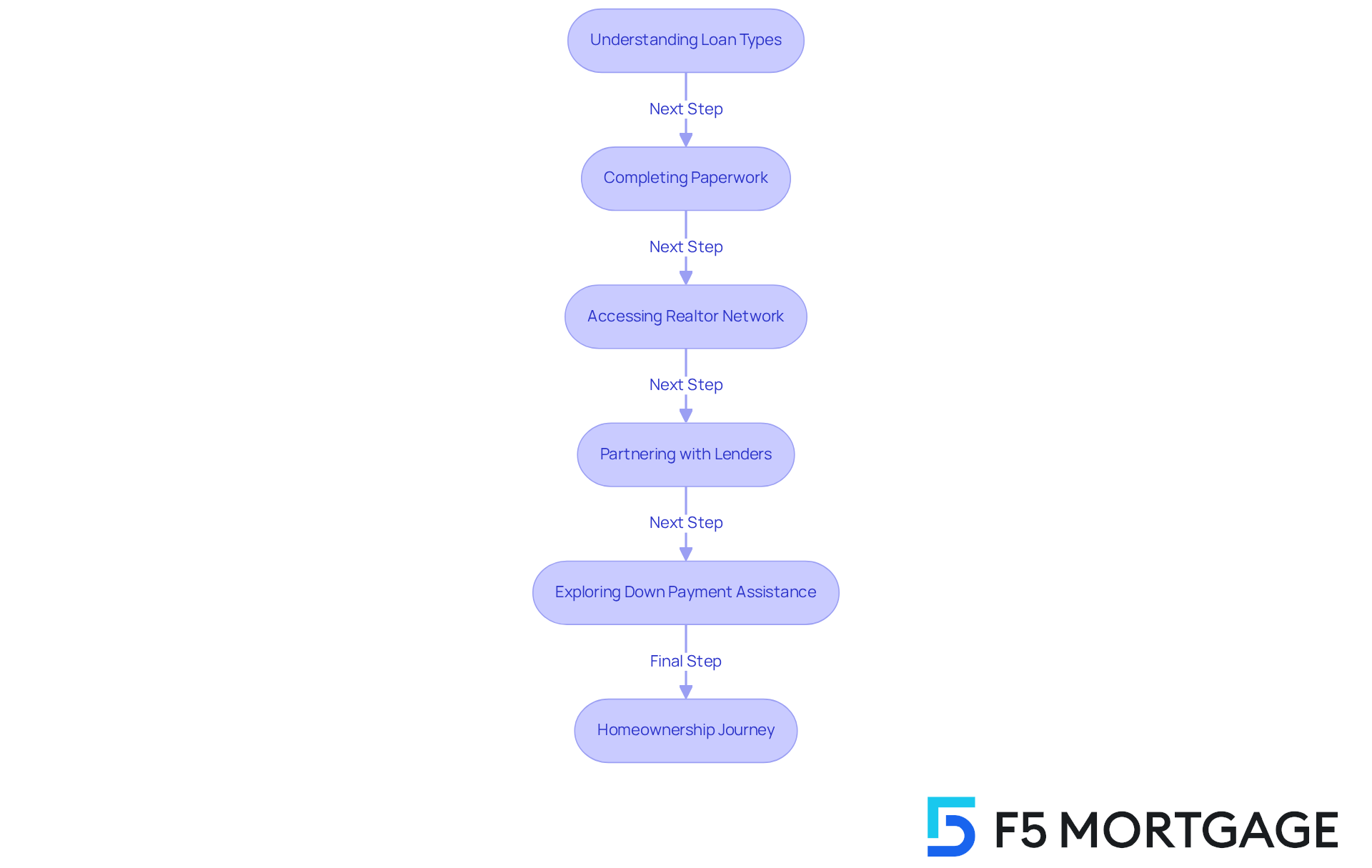

Expert Advice: Navigating the Mortgage Process with Confidence

Navigating the loan process can feel overwhelming for . We understand how challenging this can be, and that’s why our at F5 Mortgage are here to support you every step of the way. Our is available at every stage, from understanding the —including both traditional and nontraditional options—to completing the necessary paperwork. We want you to feel confident and supported throughout this journey.

With access to a vast network of top realtors and partnerships with over two dozen leading lenders, we prioritize securing the tailored to your unique needs. Additionally, we offer insights into that can enhance your . Our comprehensive understanding of the mortgage landscape, supported by home loan brokers, empowers you to ask questions and make informed decisions.

Ultimately, our goal is to provide you with the confidence and knowledge necessary for a smoother home-buying experience. Remember, we’re here to guide you through this process, ensuring you feel understood and supported as you take these important steps toward homeownership.

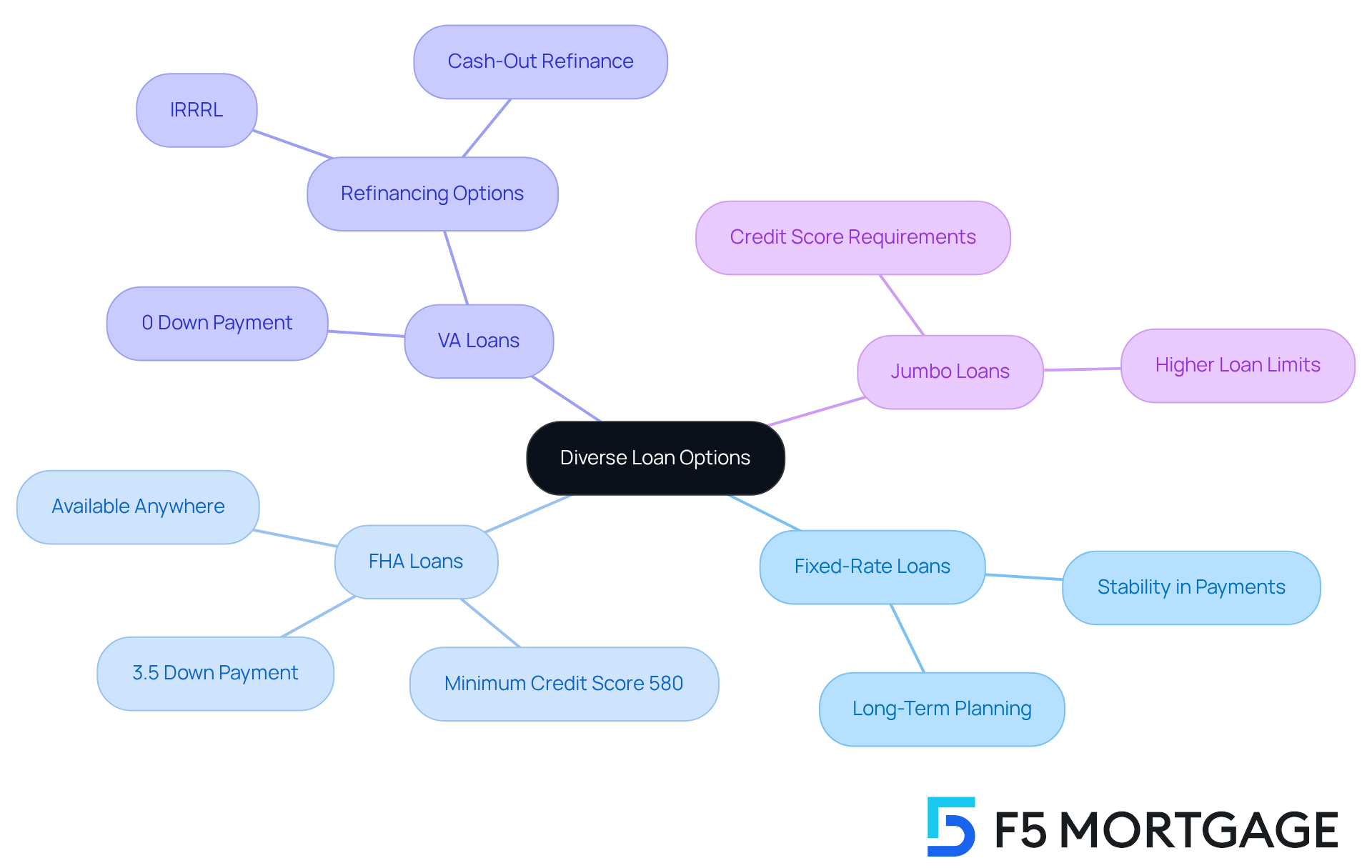

Diverse Loan Options: Unlocking Access to Various Mortgage Products

At , we understand that navigating the mortgage process can feel overwhelming, especially for . That’s why we partner with over twenty prominent lenders to offer a wide range of , including , FHA, VA, and jumbo loans. This extensive selection empowers you to explore different products and find the one that aligns with your financial situation and .

For military personnel, present significant advantages, such as 0% down payment options. This makes them an attractive choice for qualified individuals looking to achieve homeownership. Once you begin to build equity in your home, you can consider . The VA Interest Rate Reduction Refinance Loan (IRRRL) is designed to help lower your monthly payments, while a VA cash-out refinance can be utilized to meet various financial needs.

By leveraging this diverse portfolio, you can secure the most favorable terms available, enhancing your overall mortgage experience. In 2023, we saw that first-time purchasers made up 32% of all clients, underscoring the importance of having a to cater to the unique needs of this demographic. We’re here to support you every step of the way as you embark on this .

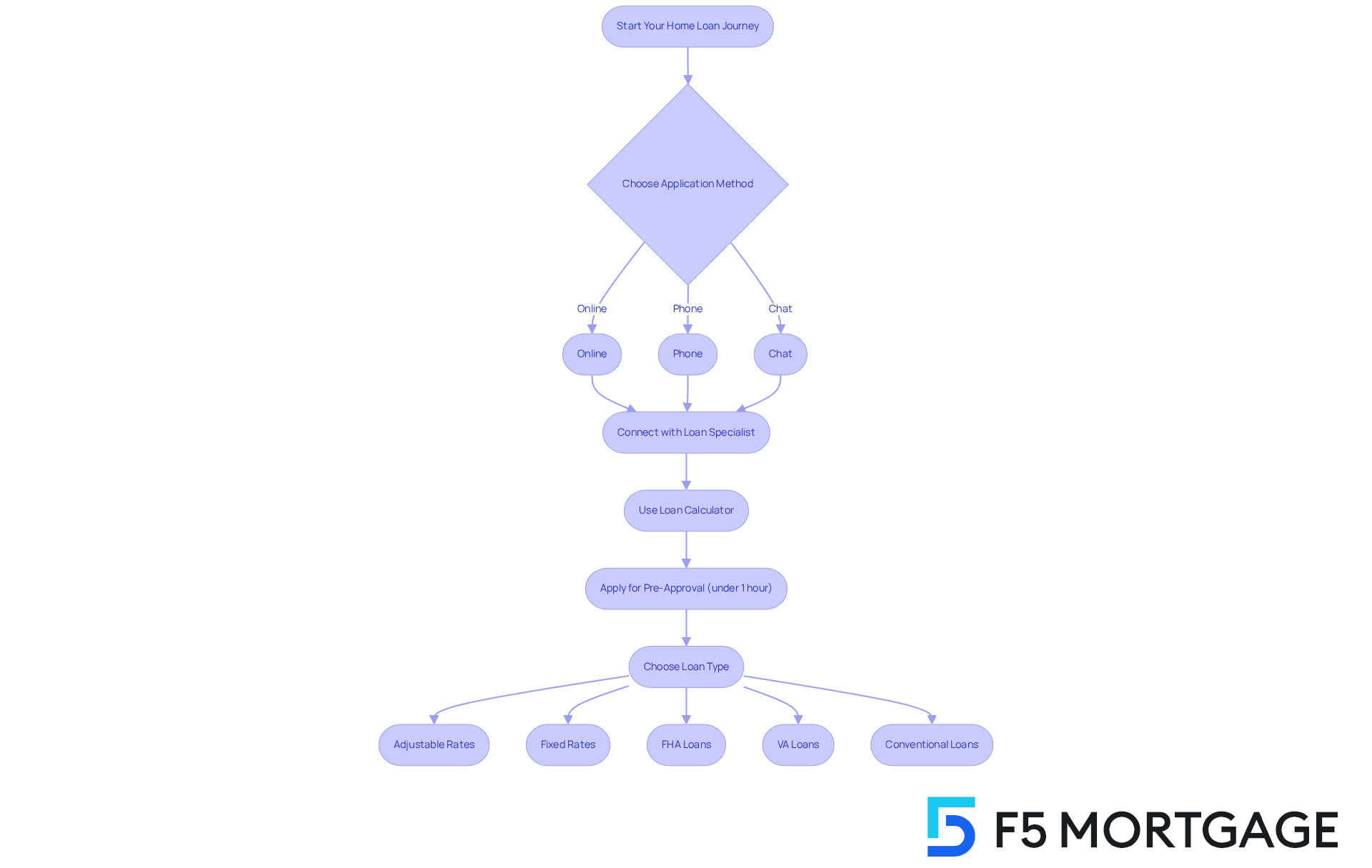

Simplified Process: Streamlining Your Home Loan Journey

At F5 Mortgage, we understand how challenging the process can be for working with . That’s why we are dedicated to simplifying it for you. With available online, by phone, or through chat, you can easily connect with our . They are here to help you that aligns with your goals.

Imagine having access to our and a streamlined application process that guarantees pre-approval in under an hour. This efficiency not only saves you time but also alleviates the stress often associated with home buying. We know how important it is to navigate these complexities with the help of home loan brokers.

Additionally, our team is committed to connecting Colorado homeowners to various . Whether you’re interested in:

Adjustable rates

VA loans

Conventional loans

We’re here to support you every step of the way. Let us help you take the next step toward your dream home.

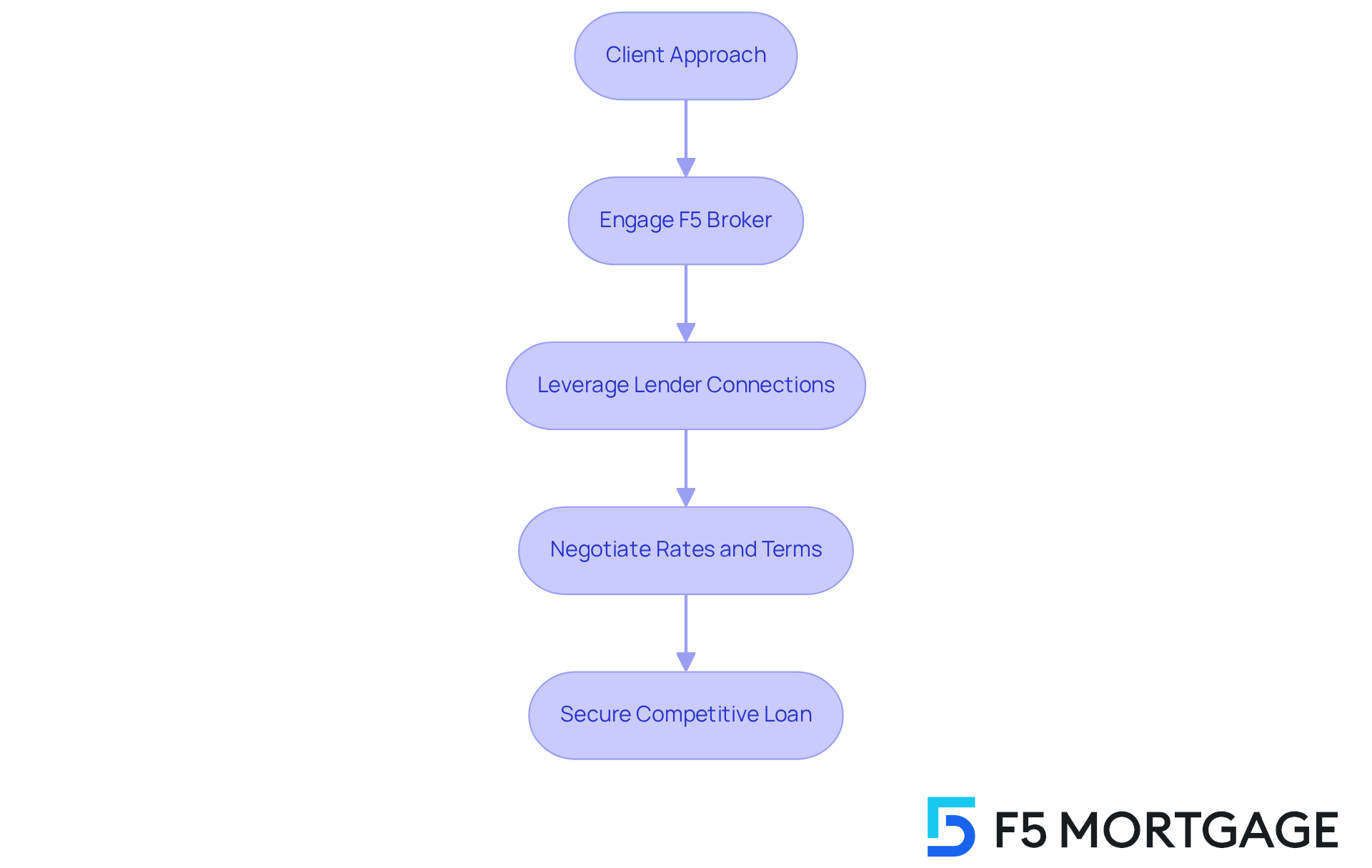

Negotiation Power: Securing Better Rates Through Broker Relationships

A significant advantage of collaborating with F5 is its , rooted in strong connections with a diverse network of lenders. We understand how challenging can be, and that’s why F5 is here as your . This brokerage effectively secures more than individuals might attain independently, making your journey smoother.

Clients have expressed their satisfaction, with one stating, “Everything went very smoothly!” Another highlighted the team’s expertise in guiding them through the process. By leveraging these industry connections, F5 Home Loans tailors to fit each individual’s .

Research shows that borrowers who utilize often enjoy compared to those who approach lenders directly. This strategic advantage not only enhances the cost-effectiveness of loans but also instills confidence in your financing choices when consulting with home loan brokers. We’re here to , ensuring that you feel empowered in making for your family’s future.

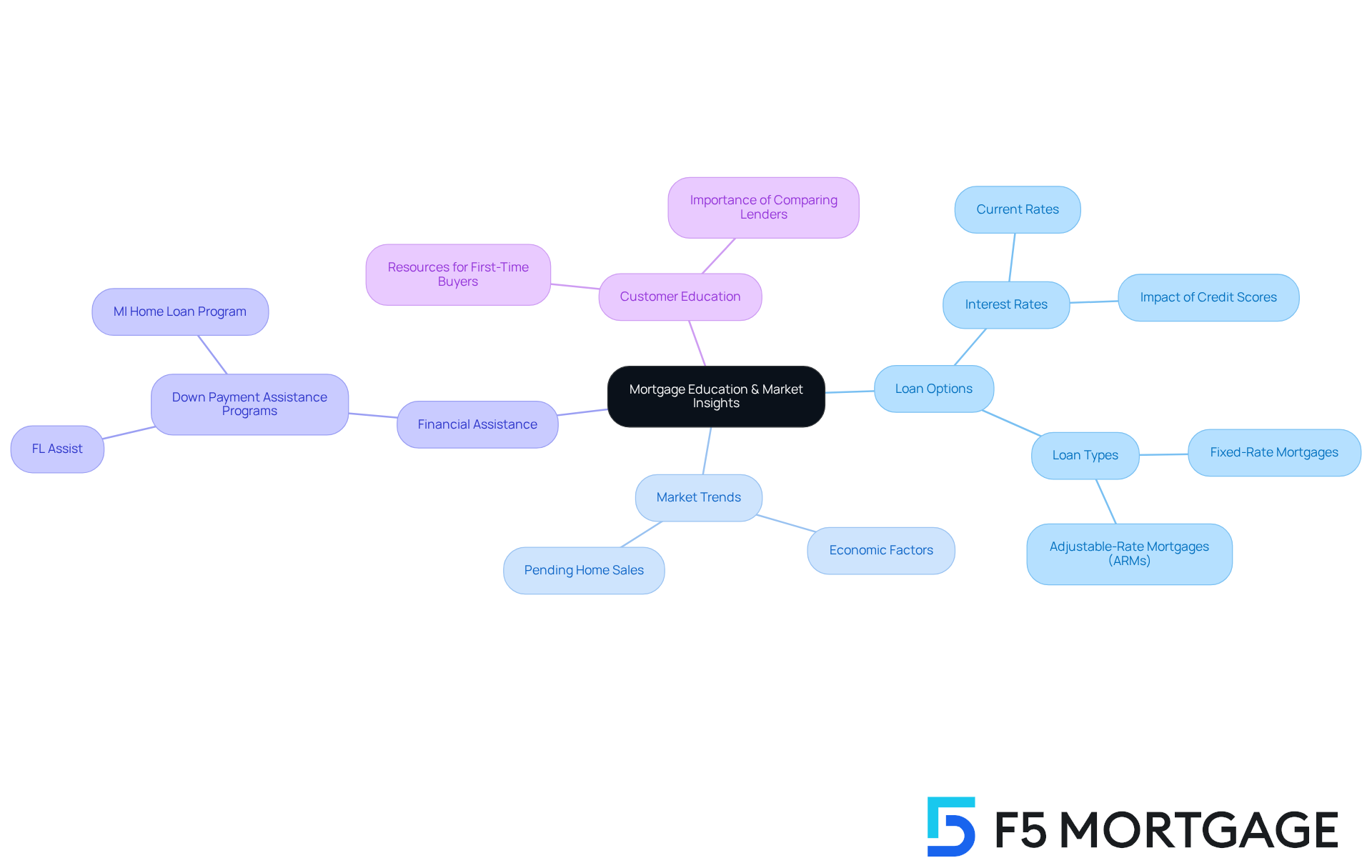

Financial Insights: Educating Buyers on Mortgage Options and Market Trends

At F5 Mortgage, we understand how daunting the home-buying process can be, especially for who rely on . That’s why we place a strong emphasis on , providing and current market dynamics. By offering insights into interest rates, loan types, and the economic factors , we empower individuals to make informed choices that align with their financial objectives.

Right now, with , prospective buyers have a unique opportunity to secure favorable conditions. Understanding these trends is crucial; approximately 80% of borrowers would face higher costs if they purchased the same home today. We’re here to support you through this journey, offering various like FL Assist, which provides up to $10,000 as a deferred second loan, and the MI Home Loan program, offering $10,000 loans specifically for first-time homebuyers.

plays a pivotal role in your decision-making process. Borrowers with credit scores in the high 700s or above are more likely to qualify for competitive offers. By cultivating a knowledgeable customer base and encouraging the comparison of lenders, home loan brokers assist you in obtaining the . At F5 Mortgage, we strive to improve your home-buying experience and assist you in navigating the intricacies of financing with confidence.

Our customers truly cherish us, as reflected in our 5/5 star ratings on Lending Tree, Google, and Zillow, where they praise our expertise and seamless procedures. We know how challenging this can be, and we’re here to support you every step of the way.

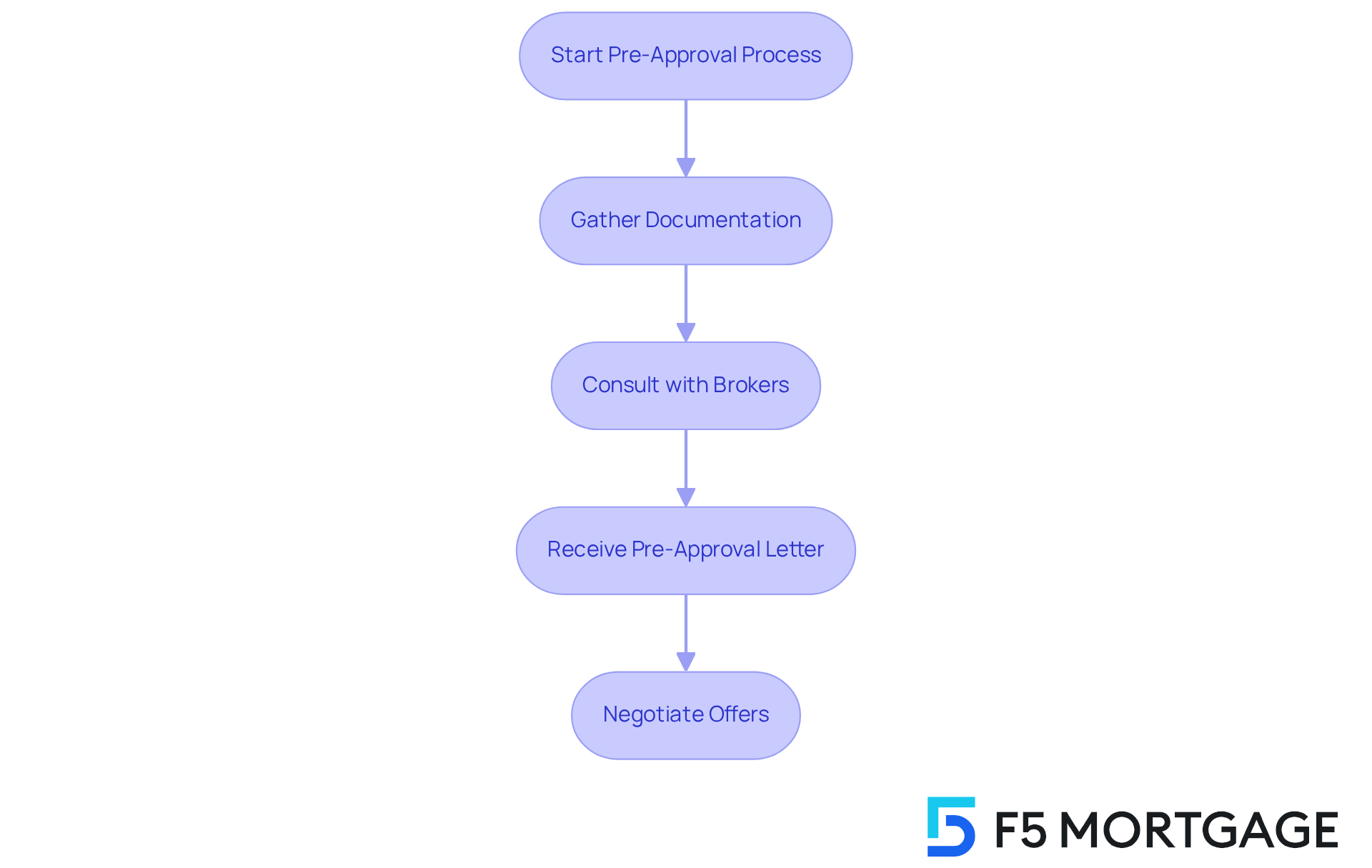

Pre-Approval Assistance: Strengthening Your Buying Position

F5 Mortgage understands that the journey to homeownership can be daunting, especially for . That’s why we offer essential , a crucial step that helps you improve your position in a competitive real estate market. By guiding you expertly through the , we enable you to gain a clear understanding of your borrowing capacity. This clarity empowers you to make informed decisions, positioning you as a serious contender in the eyes of sellers.

As Jonathan Mullins, our Chief Mortgage Officer, shares, signals to sellers that you are . This significantly increases your chances of . Current trends show that pre-approval rates among first-time purchasers are on the rise, reflecting a growing awareness of its importance.

In competitive markets, where desirable homes often attract multiple offers within hours, pre-approval can be the differentiator that enhances your position. It allows you to negotiate improved conditions, including requests for repairs or enhancements that can be tactically included in your proposals. This capability is crucial, as you can ask sellers to make repairs as a contingency for acquiring the home, boosting your negotiation leverage.

The case study titled “Competitive Edge in Home Buying” illustrates how having a pre-approval letter in multiple-offer situations. Additionally, understanding available , such as those provided by F5 Mortgage in California, Texas, and Florida, can further assist you in evaluating your financial options. By leveraging pre-approval and assistance programs, you can navigate the complexities of homeownership with confidence, ensuring you are well-prepared to seize opportunities as they arise.

To begin the , we recommend gathering necessary documentation, such as income verification and credit history. can help streamline your journey, and remember, we’re here to support you every step of the way.

Emotional Support: Guiding First-Time Buyers Through the Home Loan Process

The can be emotionally taxing for first-time buyers, often filled with anxiety and uncertainty, especially when with . We know how challenging this can be. and prioritizes throughout your journey. By being easily accessible to respond to inquiries, handle issues, and offer reassurance, the brokerage cultivates a feeling of safety and trust in customers. This but also improves overall satisfaction, ensuring that you feel empowered as you navigate the .

Effective client support approaches, including , further reinforce F5’s dedication to assisting in achieving their homeownership aspirations through home loan brokers. We’re here to .

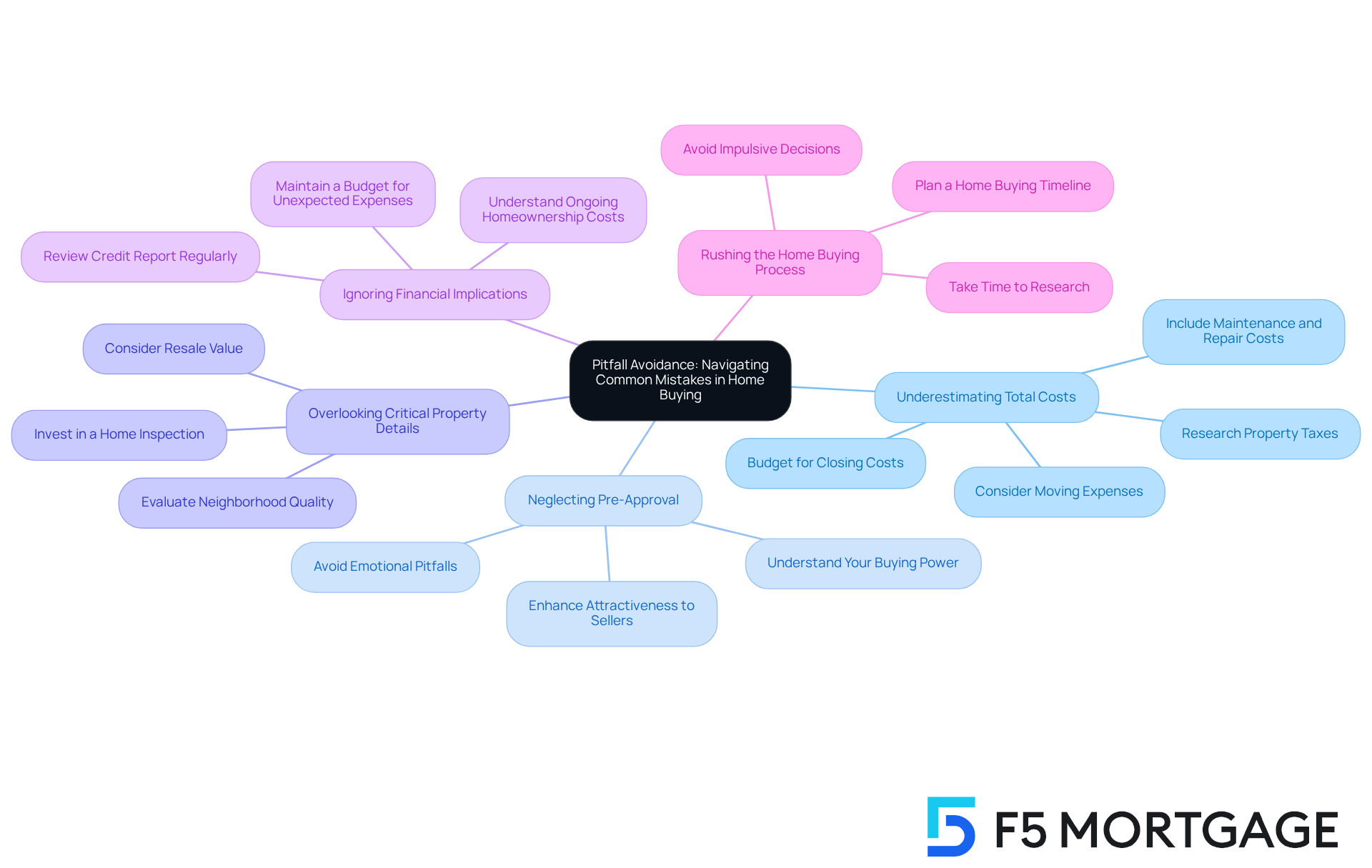

Pitfall Avoidance: Navigating Common Mistakes in Home Buying

At F5 Financing, we understand how daunting the home-acquisition process can be for . Navigating this journey often involves overcoming . By shedding light on frequent missteps—like , neglecting to secure pre-approval, and overlooking —we they need to sidestep these traps. This educational approach not only fosters confidence but also enhances clarity, paving the way for a more successful home purchase.

emphasize the importance of grasping the . Understanding recurring expenses, such as property taxes and upkeep, is essential for making informed decisions. We recommend that buyers and seek advice from experienced homeowners to avoid .

By prioritizing education and proactive planning, F5 ensures that individuals are well-prepared to . Together, we can lead you toward informed decisions and a smoother purchasing experience. Remember, we’re here to support you every step of the way.

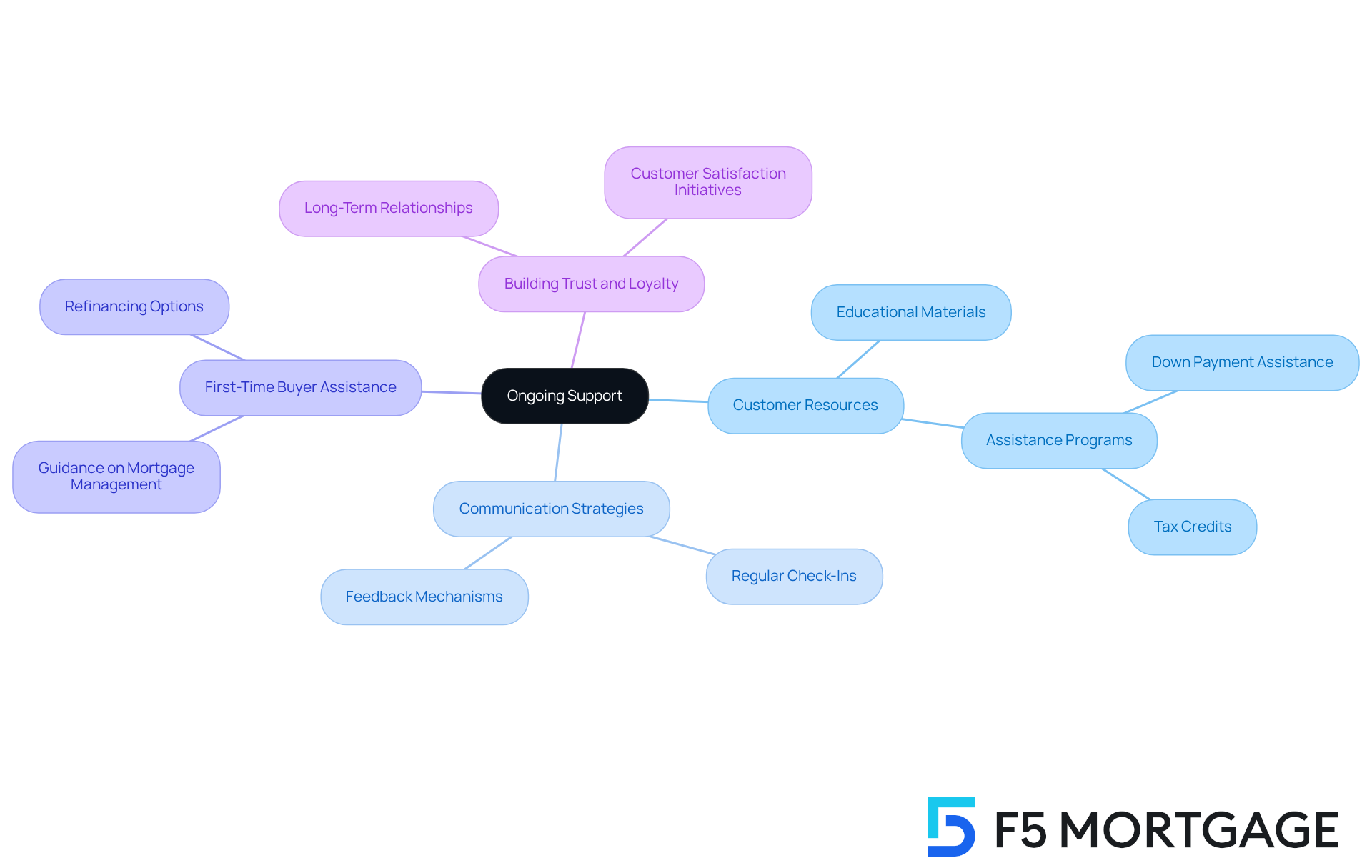

Ongoing Support: Ensuring Continued Guidance After Closing

At F5 Financing, we understand how important it is for you to feel supported, even after you’ve acquired your new home. That’s why we are dedicated to offering ongoing assistance to our customers. Whether you have questions, need valuable resources, or are considering in the future, we are here for you. By nurturing with our clients, we ensure that you remain informed and supported long after you’ve moved in.

This continuous support is especially crucial for who may have concerns about managing their mortgage or exploring as market conditions change. In fact, studies show that 32% of first-time homebuyers utilized , highlighting the significance of having a knowledgeable partner throughout your .

We believe that —like —do more than just enhance customer satisfaction; they also build trust and loyalty. This makes it more likely for you to return for future financing needs. Our emphasize that maintaining these relationships is key to ensuring you feel valued and supported. Ultimately, this leads to a more positive homeownership experience, and we’re here to .

Conclusion

Navigating the path to homeownership can be a complex journey, especially for first-time buyers. We know how challenging this can be. Engaging with a home loan broker like F5 Mortgage offers invaluable support, personalized guidance, and a wealth of resources tailored to meet your individual needs. This partnership not only simplifies the mortgage process but also empowers you to make informed decisions, ultimately leading to a more confident and satisfying home-buying experience.

Throughout this article, we’ve highlighted key benefits of working with home loan brokers. You gain access to diverse loan options, expert advice, and negotiation power that can secure better rates. Additionally, the importance of emotional support, ongoing assistance, and education on financial insights and market trends cannot be overlooked. Brokers can help you avoid common pitfalls and navigate challenges effectively.

The significance of having a knowledgeable partner in the home-buying process cannot be overstated. First-time buyers are encouraged to leverage the expertise of home loan brokers to enhance their purchasing power and ensure a smoother transition into homeownership. By prioritizing personalized guidance and ongoing support, you can embark on your journey with confidence, equipped to make the best choices for your financial future.

Frequently Asked Questions

What services does F5 Mortgage offer for first-time homebuyers?

F5 Mortgage provides personalized consultations tailored to the unique financial circumstances and homeownership aspirations of first-time buyers, helping them navigate the mortgage process with ease.

Why is personalized guidance important for first-time homebuyers?

Personalized guidance is crucial as it enhances confidence, helps buyers understand their options, and simplifies the complexities of securing a mortgage, especially given the current financial landscape.

What is the typical financial profile of a first-time homebuyer?

The typical first-time purchaser has a household income of $97,000 and faces a median down payment of 9%, the highest since 1997.

How does F5 Mortgage support diverse demographics in homebuying?

F5 Mortgage ensures that individuals from varied backgrounds receive informed choices that align with their long-term financial objectives, with 49% of first-time purchasers identifying as Black/African American and 43% as Asian/Pacific Islander.

What advantages do home loan brokers at F5 Mortgage provide?

Home loan brokers at F5 Mortgage offer no-pressure guidance, user-friendly technology, and expert advice throughout the loan process, ensuring clients feel comfortable and supported.

How quickly can F5 Mortgage facilitate loan closings?

F5 Mortgage can facilitate fast loan closings in under three weeks, allowing clients to upgrade their homes with confidence.

What types of loan options does F5 Mortgage offer?

F5 Mortgage partners with over twenty lenders to provide a wide range of loan options, including fixed-rate, FHA, VA, and jumbo loans.

What benefits do VA loans offer to military personnel?

VA loans offer significant advantages such as 0% down payment options, making them an attractive choice for qualified military personnel seeking homeownership.

How does F5 Mortgage assist with refinancing options?

F5 Mortgage provides insights into refinancing options, such as the VA Interest Rate Reduction Refinance Loan (IRRRL) to lower monthly payments, and VA cash-out refinance for various financial needs.

What percentage of F5 Mortgage clients are first-time purchasers?

In 2023, first-time purchasers made up 32% of all clients at F5 Mortgage, highlighting the importance of diverse financing options for this demographic.