Overview

Are you considering home upgrades but feeling overwhelmed by the financing options? This article highlights nine benefits of using an online lending platform tailored to your needs. Imagine quick approvals, convenient accessibility, and personalized loan options designed just for you.

These advantages stem from the platform’s ability to streamline the borrowing process using advanced technology. We understand how challenging this can be, and we’re here to support you every step of the way. With tailored financial solutions, your experience becomes not only easier but also more satisfying.

By choosing an online lending platform, you empower yourself to make informed decisions about your home upgrades. Let us guide you through this journey, ensuring you feel confident and supported as you explore your options.

Introduction

The landscape of home financing is changing rapidly, and we understand how overwhelming this can feel. Online lending platforms are making the mortgage process more convenient and accessible than ever before. These platforms not only simplify the journey but also open up a world of opportunities for homeowners eager to enhance their living spaces. By utilizing advanced technology and offering personalized services, borrowers can explore their options with confidence and ease.

However, as the benefits of online lending become clearer, it’s essential to consider the challenges or risks that may arise. What should potential borrowers keep in mind before embarking on this digital financing journey? We’re here to support you every step of the way, ensuring you have the information needed to make informed decisions.

F5 Mortgage: Personalized Mortgage Solutions for Home Financing

At F5 Mortgage, we understand how challenging the mortgage process can be for families. That’s why we excel in delivering tailored to your . Our dedicated team employs a structured approach that includes thorough evaluations of your and preferences, ensuring we present the most suitable financing options for you.

With a —such as fixed-rate, —you can find solutions that truly align with your financial circumstances. This personalized method not only simplifies the loan process but also significantly enhances your satisfaction, empowering you to navigate your with confidence.

We prioritize education and transparency, ensuring you are well-informed every step of the way. This commitment fosters strong relationships built on trust and understanding. We also recognize the unique challenges faced by , and our team is here to effectively address these complexities.

As one mortgage expert aptly noted, our goal is to assist you in making that best suit your circumstances. We’re here to support you every step of the way, reinforcing the value of in achieving your dream of homeownership.

Rapid Approval Process: Quick Access to Funds with Online Lending

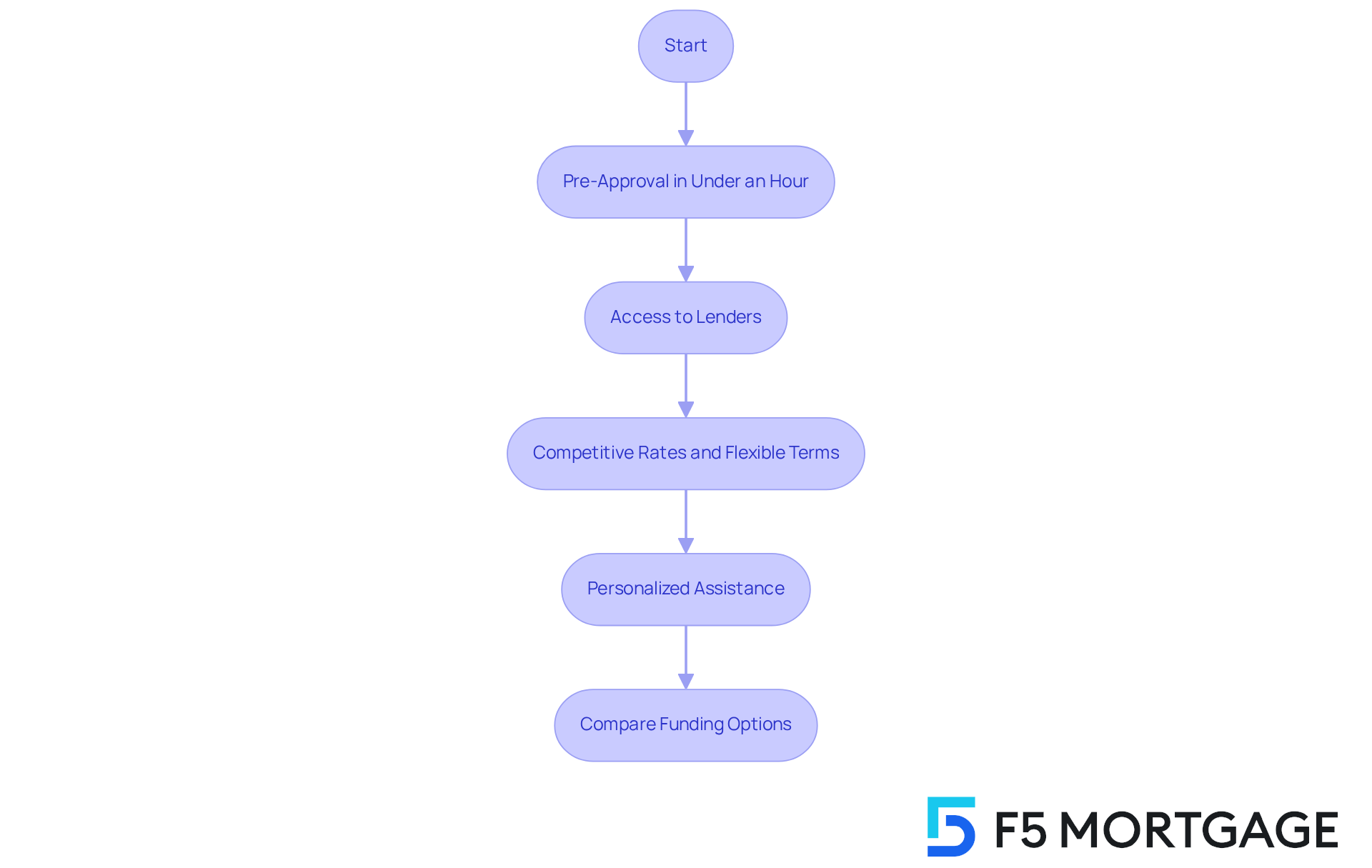

One of the standout advantages of utilizing an is the swift approval process offered by F5. We know how challenging it can be to navigate , and clients can expect . This allows them to act quickly in securing their desired home, enhancing the buying experience and providing peace of mind. Knowing that funds are readily accessible when needed makes all the difference.

Additionally, F5 Mortgage serves as an online lending platform that provides , ensuring customers receive . Our dedicated team is here to support you every step of the way, offering throughout the and linking individuals with top realtors.

To enhance your refinancing experience, consider comparing various funding options. This step empowers you to find the best match for your financial requirements, ensuring that you feel confident and informed in your decisions.

Convenient Accessibility: Manage Your Loans Anytime, Anywhere

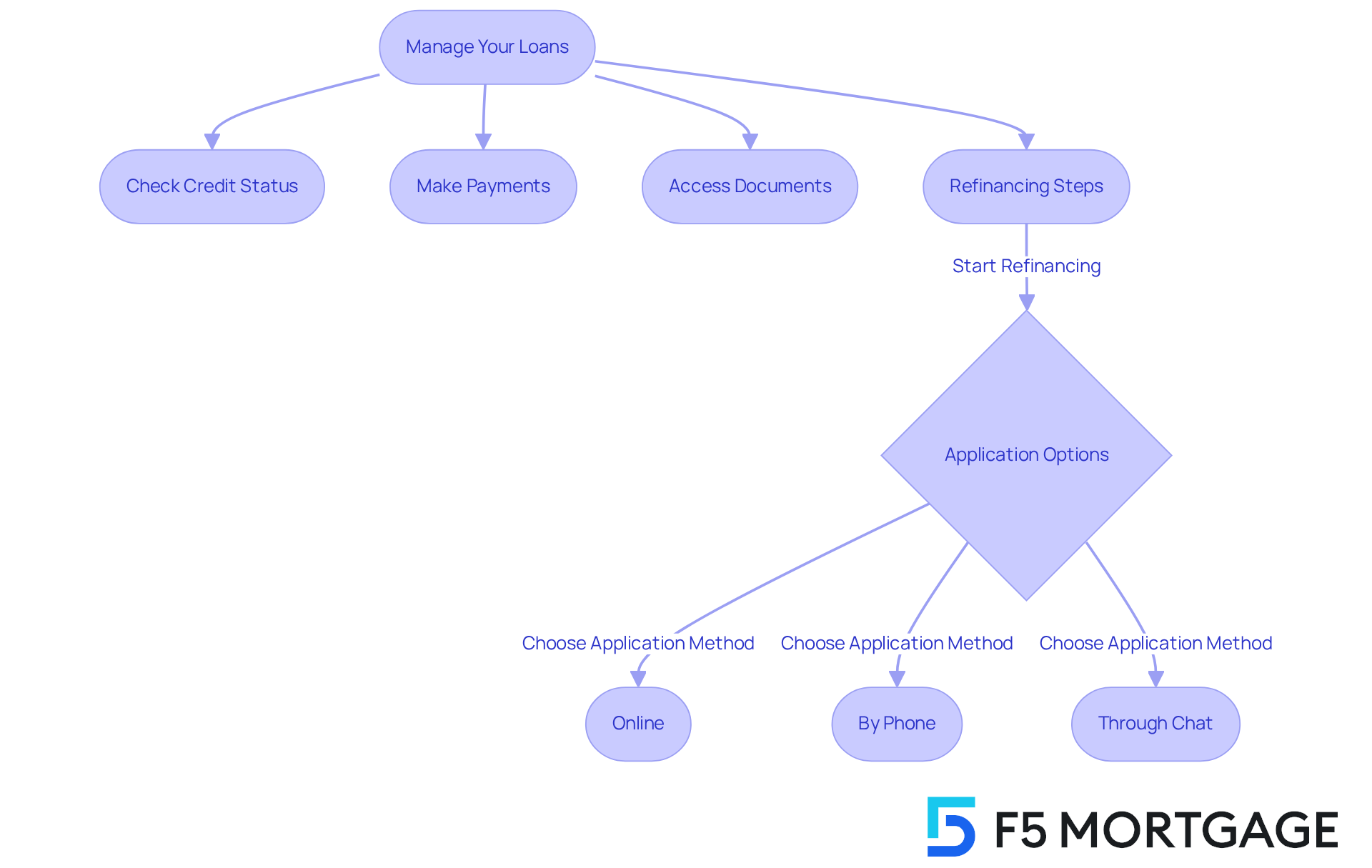

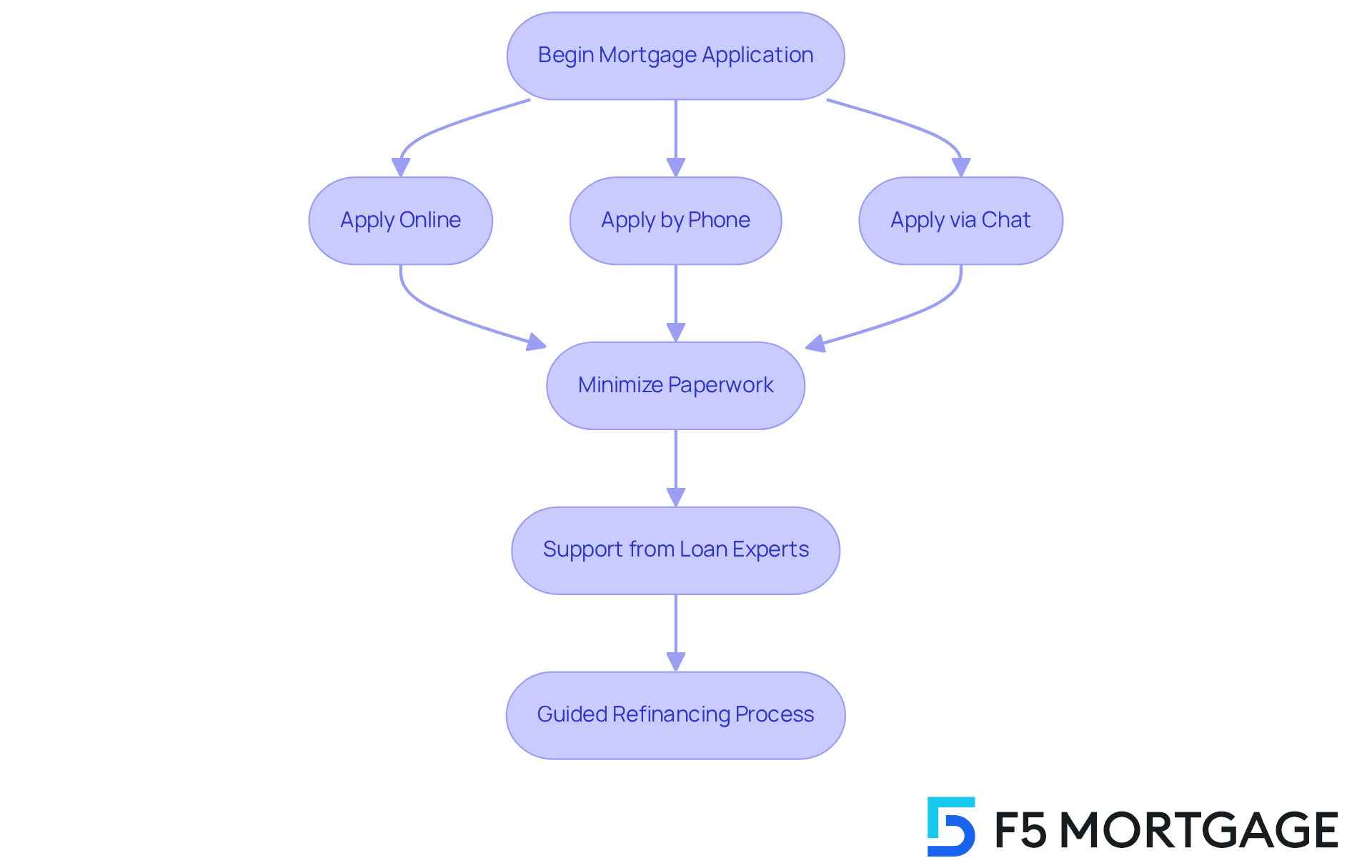

offer a unique level of ease, enabling you to manage your finances anytime and anywhere. We know how challenging this can be, whether you’re checking your credit status, making payments, or accessing important documents. With just a few clicks, you can take control. At , we understand your needs and offer multiple —online, by phone, or through chat—ensuring tailored just for you.

This accessibility empowers you to stay informed and in control of your financial journey. Imagine having a detailed that covers everything from researching your options to finalizing your new loan. We’re here to support you every step of the way, ensuring a smooth process.

With F5 Home Loans, you also benefit from our commitment to . We connect you with top realtors and help secure the , making your experience as stress-free as possible. Let us help you navigate this journey with care and expertise.

Higher Approval Rates: Boost Your Chances of Securing a Loan

Navigating the world of can be daunting, but using an can significantly enhance approval rates for borrowers. At , we understand how challenging this process can be. That’s why we collaborate with over two dozen leading lenders, creating a robust network that accommodates a .

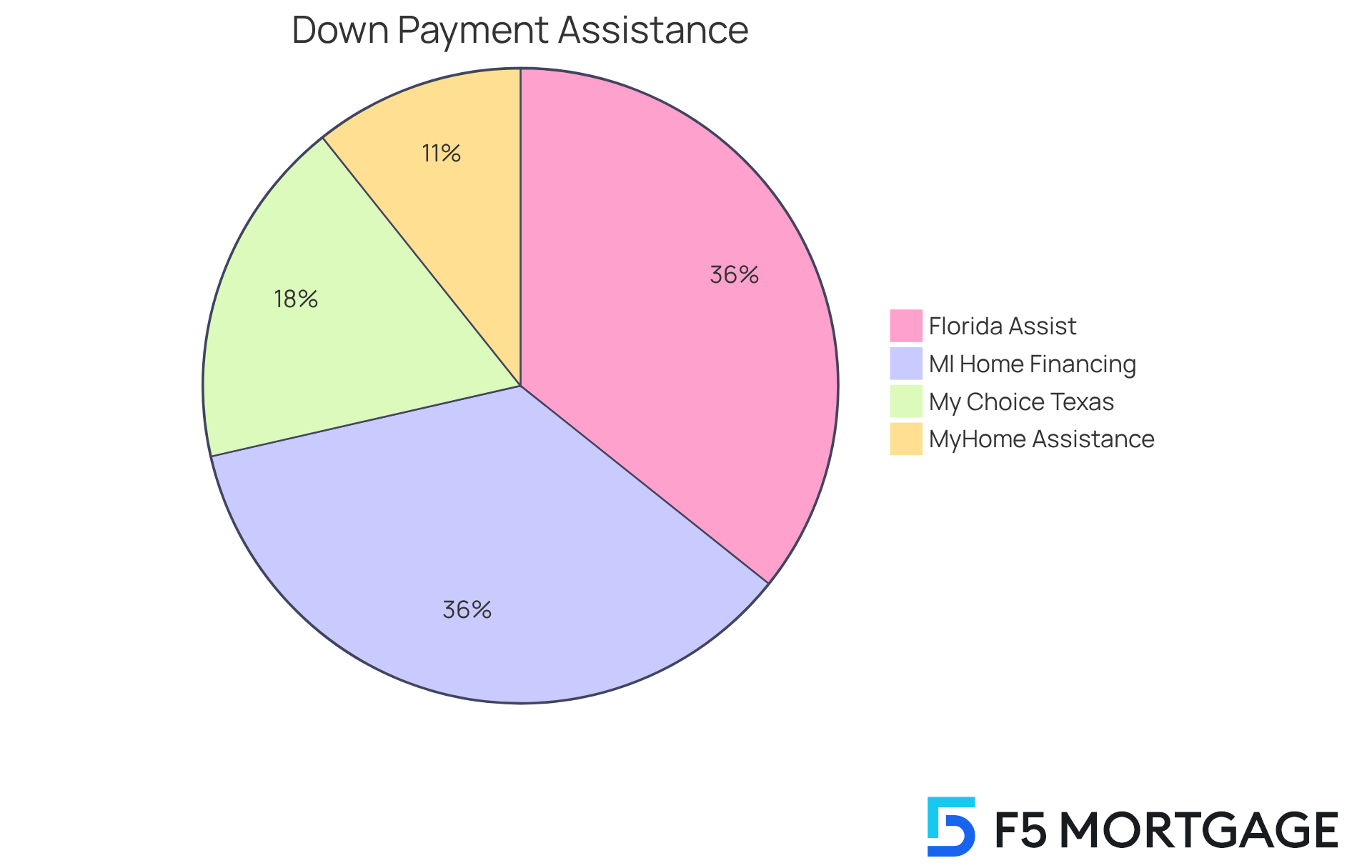

This extensive partnership is particularly beneficial for and individuals with unique financial circumstances. By broadening the spectrum of available , we aim to ease your journey. F5 Lending provides access to various , such as:

- The MyHome Assistance Program in California, which offers up to 3% of the home’s purchase price.

- The My Choice Texas Home program, which provides up to 5% for down payment and closing assistance.

In Florida, programs like the Florida Assist Second Loan Program can offer up to $10,000 for initial expenses. Furthermore, the MI Home Financing program in Michigan provides $10,000 for first-time homebuyers, with repayment postponed until the home is sold or the primary mortgage is settled. These not only improve home buying opportunities but also demonstrate our dedication to outstanding .

We know how important it is to feel supported during this process. Testimonials, such as Bryce Leonard’s, who rated us 5/5 on Google, reflect this commitment. He stated, ‘Awesome work.’ We’re here to support you every step of the way, ensuring you receive the through F5 Financing.

Advanced Technology: Streamlined Processes and Enhanced User Experience

At F5 Mortgage, we understand how daunting the can feel. That’s why we utilize to transform it, significantly improving efficiency and enhancing your experience. With and automated updates, we simplify the complexities of financing, allowing you to explore your options with confidence. We know how challenging this can be, especially considering that 64% of consumers find the time it takes to finalize financing to be the most stressful part of buying a home. Many expect closure within just 15 to 30 days after applying, and we’re here to support you every step of the way.

Our integration of digital tools not only speeds up the application process but also boosts . For example, 81% of borrowers prefer signing loan documents electronically, which can accelerate turnaround times by up to 25 times compared to traditional methods. This shift towards has been shown to enhance customer satisfaction scores by an impressive 127%.

The pandemic has also spurred a significant rise in the adoption of , as 91% of lenders are now providing online applications. This trend highlights a broader industry shift, as legacy banks find it challenging to digitize their lending processes, managing only 7% of products digitally from start to finish. In contrast, F5’s proactive strategy positions us as a leader in the evolving landscape of .

By prioritizing technology and providing a dedicated team to assist you throughout the , we not only meet the expectations of modern borrowers—who increasingly prefer mobile applications and online services—but also set a standard for streamlined loan processes via our online lending platform. You can apply online, by phone, or via chat, ensuring a tailored to your needs. This emphasis on innovation guarantees that you receive timely updates and a seamless experience, ultimately making your journey to homeownership more achievable and less stressful.

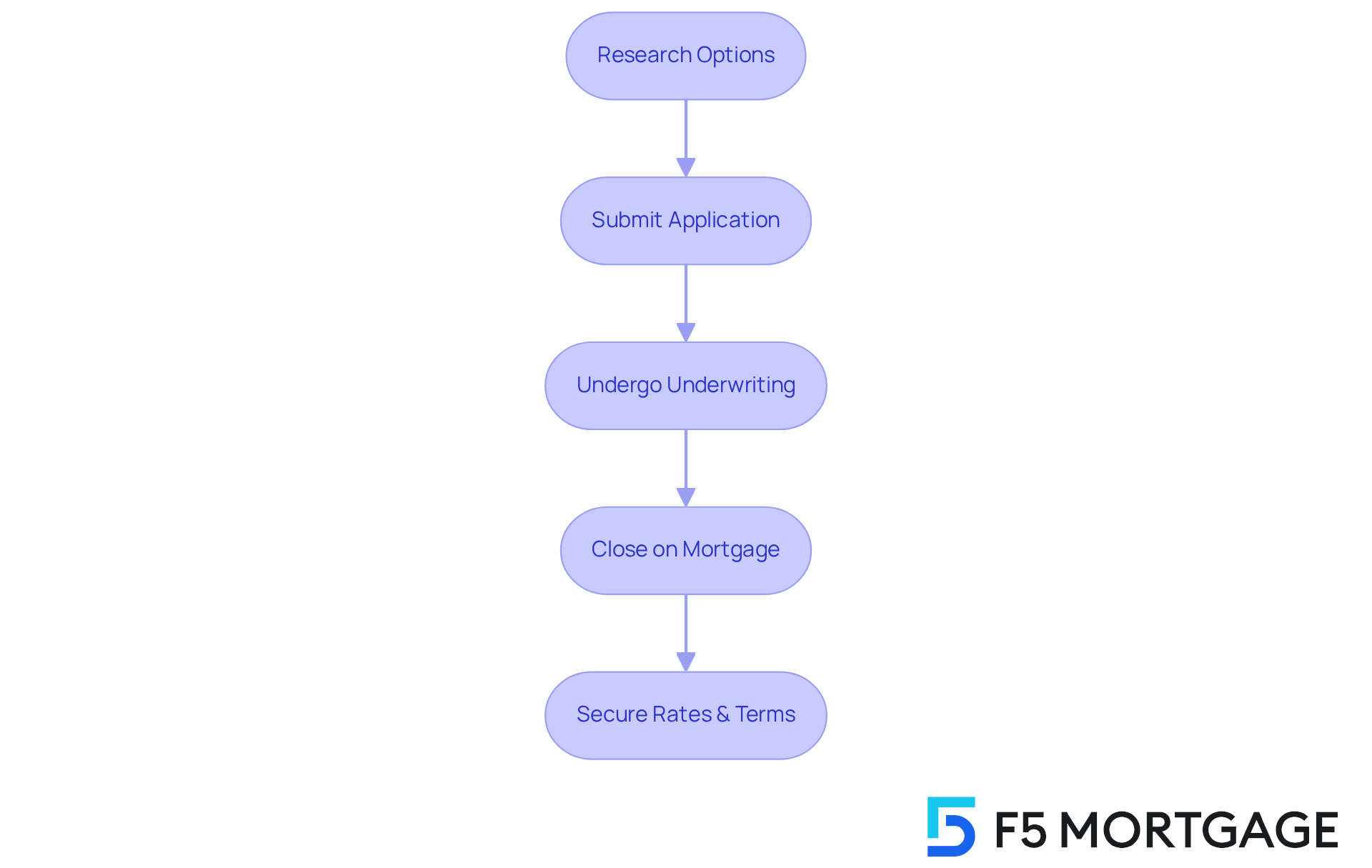

To refinance with F5 Mortgage, you can follow a straightforward process:

- Research your options to compare lenders and terms.

- Submit your application with property information and financial documents.

- Undergo underwriting where the lender reviews your application.

- Close on your new mortgage, directing payments to the new lender.

This comprehensive approach, combined with access to multiple lenders, empowers you to secure the and terms.

Accurate Business Assessments: Tailored Loan Options for Your Needs

At F5 Mortgage, we understand how challenging navigating financing options can be. That’s why precise are essential for identifying the optimal choices tailored to your needs. We perform comprehensive assessments of each client’s , ensuring that the products we offer align with your particular situation.

Our leverage user-friendly technology combined with from our skilled officers, making the process smooth and efficient. This tailored approach not only enhances your satisfaction but also increases the likelihood of successful loan approval.

We know how important it is for families to feel supported on their journey toward . That’s why we provide insights into various available in states like California, Texas, and Florida. We’re here to .

Simplified Documentation: Less Paperwork, More Efficiency

One of the key benefits of utilizing an is the combined with convenient application options like those offered by F5. We know how challenging this can be, and that’s why clients can apply online, by phone, or through chat, allowing them to choose the method that best fits their busy lifestyles. F5 Mortgage minimizes paperwork, enabling families to complete necessary forms quickly and efficiently. This reduction in documentation not only saves time but also reduces stress, making the mortgage process more manageable.

Additionally, with a ready to assist throughout the , families can feel confident that they have the collaborative support needed to secure the best possible loan terms. With access to a vast network of lenders, F5 streamlines the process of , ensuring that customers can take advantage of .

Throughout the refinancing process, families are guided step-by-step, from researching options to finalizing their new loan. We’re here to support you every step of the way, making the experience seamless and supportive.

Flexible Loan Options: Catering to Diverse Financial Situations

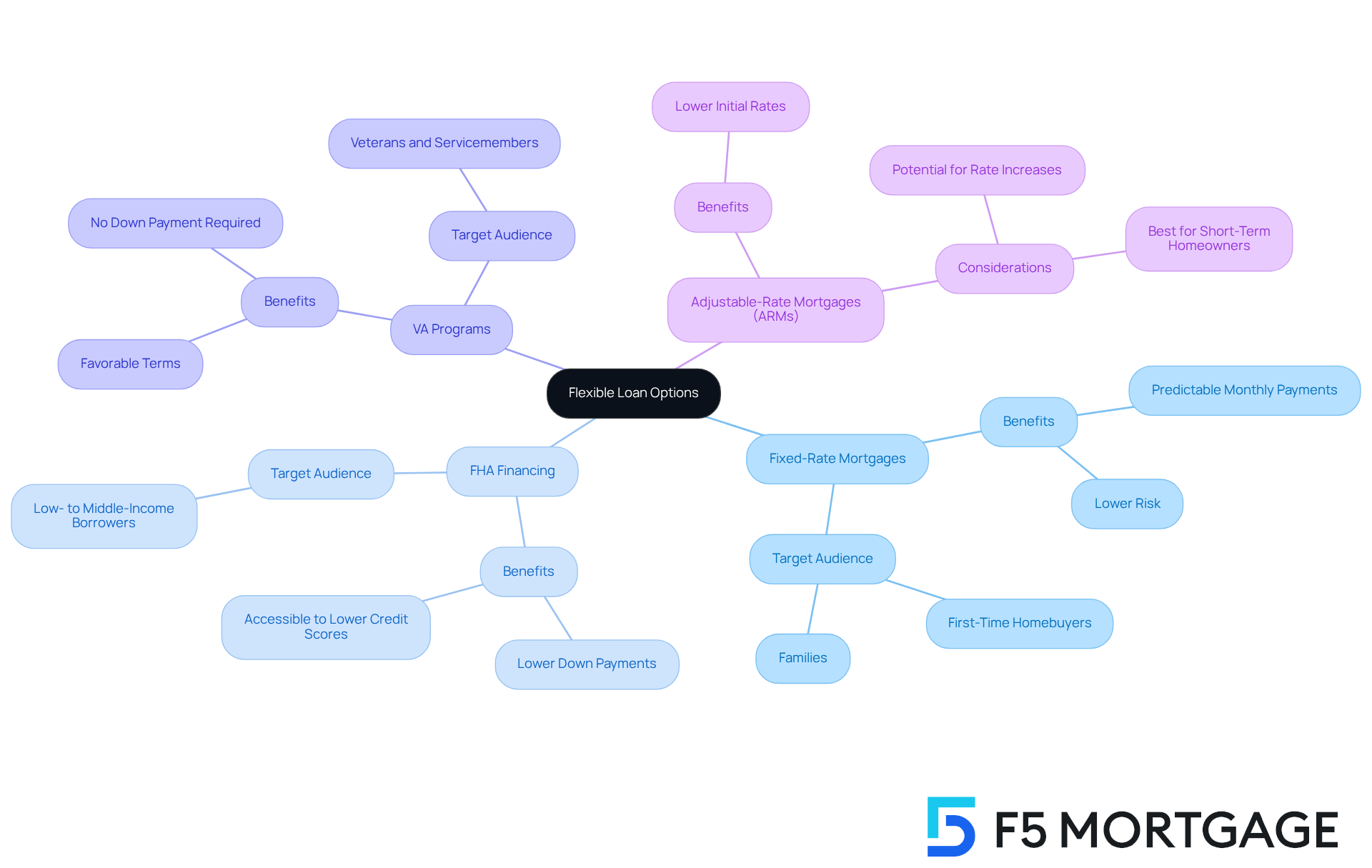

At F5, we understand that navigating the world of financing can feel overwhelming. That’s why we offer a wide range of adaptable of our customers. In 2025, statistics reveal that a significant number of first-time homebuyers are choosing , with 85-95% opting for this stable choice due to its predictable monthly payments. This trend highlights the importance of or individuals with unique financial circumstances, such as self-employed borrowers.

To support these varied needs, F5 Mortgage provides that guide clients in exploring their options, ensuring they find a financing solution that fits their unique situations. For instance, can benefit from , which requires lower down payments. Meanwhile, veterans may find value in that offer favorable terms.

Moreover, loan brokers play a crucial role in addressing the specific requirements of borrowers by providing access to a and leveraging connections with various lenders. This approach allows them to deliver that consider each individual’s financial profile and long-term goals. By focusing on personal circumstances, F5 Financial empowers customers to make informed decisions, ultimately . We know how challenging this can be, and we’re here to support you every step of the way.

Educational Resources: Empowering Borrowers with Knowledge

At F5 Lending, we understand how challenging the borrowing process can be, and we are dedicated to . Our wealth of resources includes:

- Comprehensive

- tailored specifically to your state

As a broker, we offer a diverse array of loan programs, including both standard and nontraditional options, ensuring you have access to various choices—even if other lenders have declined.

We know that can feel overwhelming. That’s why to streamline the experience. We assist you without pressure, allowing you to select what suits your unique circumstances. Our educational resources provide you with the understanding you need to navigate the financing process confidently.

We’re here to , ensuring you feel informed and empowered as you make important financial decisions.

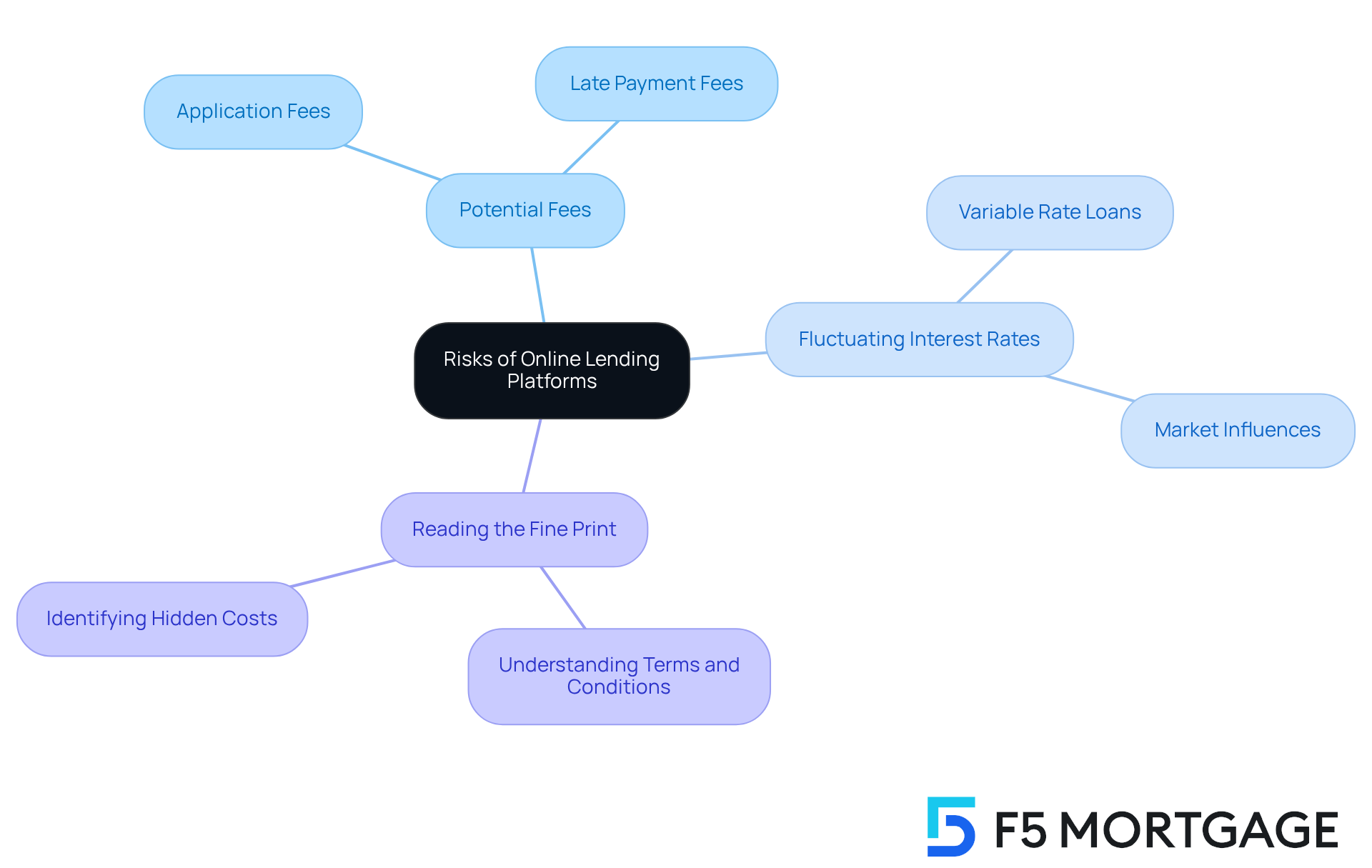

Considerations: Understanding the Risks of Online Lending Platforms

While the advantages of are numerous, we understand that borrowers may feel apprehensive about the . These risks can include:

- Potential fees

- Fluctuating interest rates

- The necessity of reading the fine print carefully

At F5 Mortgage, we recognize the importance of understanding . This process signifies that a lender considers you a strong candidate for a mortgage based on your financial information.

The approval process can vary, and having empowers you to make informed choices regarding your financing options. We encourage you to conduct thorough research and evaluate all aspects of your loan options. This ensures they align with your and needs.

Our commitment to transparency and technology means you can expect without the pressure of hard sales tactics. We aim to make your mortgage experience smoother and more straightforward. Remember, we’re here to .

Conclusion

Exploring online lending platforms reveals their transformative potential for home upgrades and financing. We understand how challenging navigating the mortgage process can be, but these platforms leverage technology to streamline it, offering personalized solutions that cater to diverse financial situations. With rapid approval, accessible management, and tailored loan options, borrowers can navigate their financial journeys with confidence and ease.

Platforms like F5 Mortgage provide quick access to funds and enhance approval rates through extensive lender networks. We know that being well-informed is crucial, so the focus on education and transparency ensures that borrowers can make decisions that align with their unique circumstances. Additionally, the reduction of paperwork and simplified documentation processes significantly alleviates the stress often associated with securing a mortgage.

Ultimately, the shift towards online lending signifies a broader evolution in home financing, making it more accessible and efficient for everyone. As this landscape continues to evolve, embracing these innovative solutions can lead to smarter financial choices and a more fulfilling path to homeownership. Engaging with online lending platforms not only opens doors to immediate funding but also fosters a deeper understanding of the borrowing process. We’re here to support you every step of the way, encouraging individuals to take charge of their financial futures.

Frequently Asked Questions

What services does F5 Mortgage provide for home financing?

F5 Mortgage offers personalized consultations tailored to individual needs, thorough evaluations of financial situations, and a diverse array of loan options such as fixed-rate, FHA, VA, and jumbo loans.

How does F5 Mortgage ensure client satisfaction during the mortgage process?

F5 Mortgage simplifies the loan process through a personalized approach, prioritizes education and transparency, and builds strong relationships based on trust and understanding.

What is the approval process like at F5 Mortgage?

F5 Mortgage offers a rapid approval process, with clients expecting pre-approval in under an hour, allowing them to act quickly in securing their desired home.

How does F5 Mortgage help clients access competitive rates?

F5 Mortgage serves as an online lending platform that provides access to over two dozen lenders, ensuring customers receive competitive rates and flexible terms.

What options do clients have for managing their loans with F5 Mortgage?

Clients can manage their loans anytime and anywhere through online platforms, allowing them to check credit status, make payments, and access important documents easily.

What support does F5 Mortgage offer for refinancing?

F5 Mortgage provides personalized assistance throughout the refinancing process, including comparing various funding options to help clients find the best match for their financial requirements.

How does F5 Mortgage assist self-employed individuals?

F5 Mortgage recognizes the unique challenges faced by self-employed individuals and has a dedicated team to effectively address these complexities.

What additional services does F5 Mortgage provide to enhance the client experience?

F5 Mortgage connects clients with top realtors and helps secure the best loan deals, ensuring a stress-free experience throughout the home financing journey.