Overview

The article titled “7 Key Insights on Minimum Down Payment for a House” addresses the various aspects and implications of down payment requirements for homebuyers. We know how challenging this can be, and it’s important to understand that the minimum down payment can vary significantly based on financing options.

- Traditional loans typically require a down payment of 5% to 20%.

- FHA loans can allow as low as 3.5%.

This flexibility makes homeownership more accessible to a broader range of buyers.

This conclusion is supported by the article’s detailed exploration of different financing options and their associated down payment requirements. It includes statistics that illustrate how these contributions can affect overall mortgage costs and loan terms. Ultimately, this information guides potential homeowners in making informed financial decisions. We’re here to support you every step of the way as you navigate this important process.

Introduction

Understanding the intricacies of down payments is essential for anyone embarking on the journey of homeownership. We know how challenging this can be. With the minimum down payment for a house varying based on financing options and home prices, prospective buyers face a labyrinth of choices that can significantly impact their financial futures.

This article delves into key insights about down payment strategies, revealing how informed decisions can lead to substantial savings and better loan terms. Yet, with so many options available, how can homebuyers navigate this complex landscape to ensure they make the best choices for their unique situations?

We’re here to support you every step of the way.

F5 Mortgage: Personalized Mortgage Consultations for Down Payment Guidance

At F5 Mortgage, we understand how daunting the mortgage process can be, especially when it comes to exploring the . Our are designed to help you navigate these choices efficiently. By taking the time to evaluate your , we can suggest a variety of loan options and deposit strategies that are customized to your personal needs.

This not only enhances your understanding but also instills confidence in your decisions. We know how challenging this can be, and we’re here to support you every step of the way. For , our consultations are particularly beneficial, providing targeted advice that demystifies the complexities of the [minimum down payment for a house](https://bankrate.com/mortgages/down-payment-assistance) and financing.

Insights from our seasoned loan brokers highlight the importance of assessing your personal financial circumstances. This ensures you have the knowledge needed to make informed decisions. Additionally, F5 Mortgage is dedicated to your . We connect you with top realtors and work tirelessly to secure the , ensuring a stress-free experience as you embark on your home buying adventure.

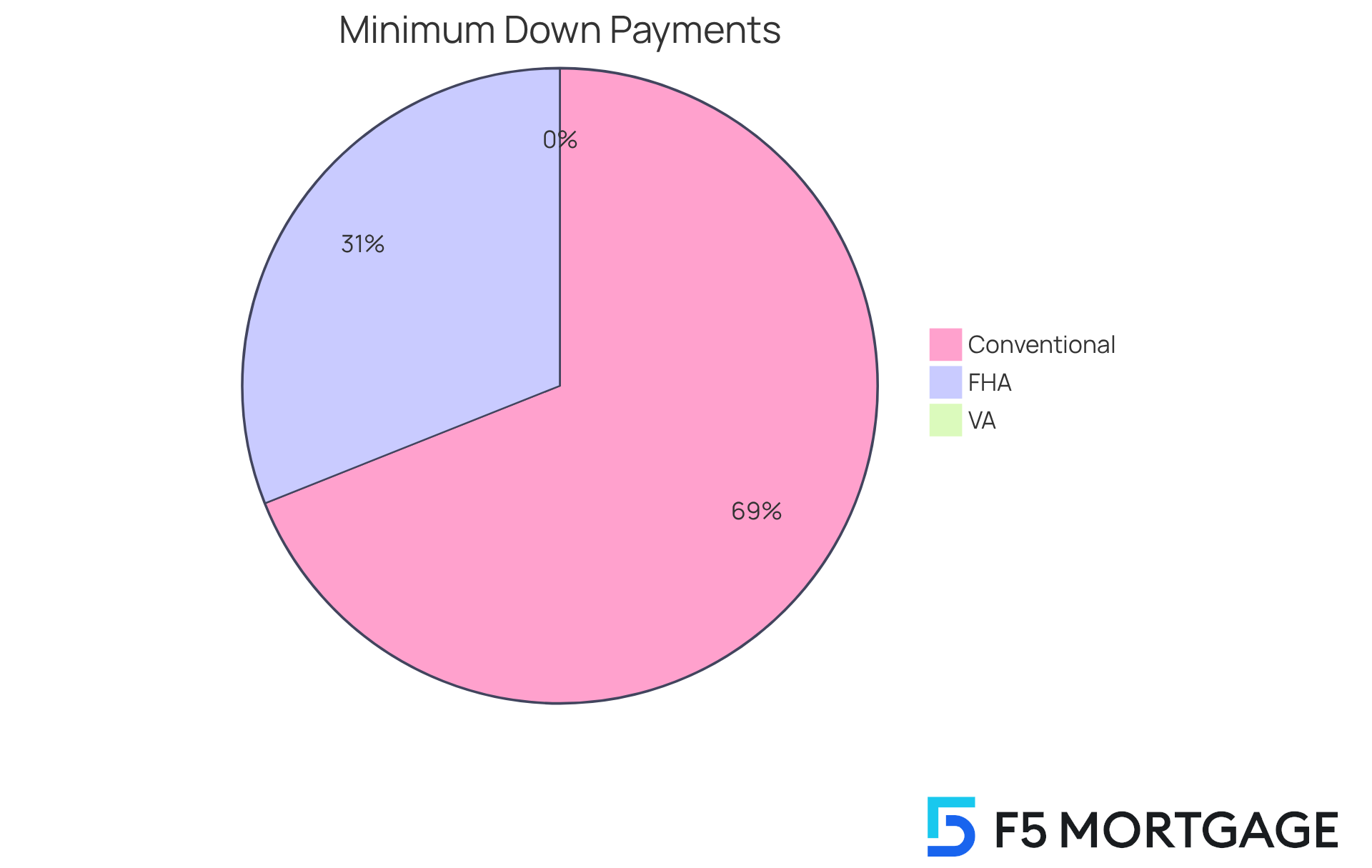

Minimum Down Payment Requirements Based on Home Price

The can vary widely based on the type of financing and the cost of the home. For traditional financing, the minimum down payment for a house typically ranges from 5% to 20%, depending on the lender and the borrower’s credit history. However, offers a more attainable option, allowing a minimum down payment for a house as low as 3.5% for borrowers with a credit score of 580 or above. For individuals with lower credit scores, the minimum down payment for a house is a 10% deposit. stand out by providing the opportunity for zero upfront cost, making them a compelling choice for qualified veterans and active military members.

Current trends reveal that the average minimum down payment for a house for in 2023 was around 8%, while repeat buyers had a minimum down payment of approximately 19%. These statistics highlight the importance of the minimum down payment for a house. For example, on a $350,000 home, a 10% deposit would amount to $35,000, whereas a 20% deposit would require $70,000.

Real-world scenarios illustrate various deposit strategies based on home prices. If you’re considering a $300,000 home, the minimum down payment for a house with a conventional loan might necessitate a deposit of at least $15,000 (5%), whereas an FHA loan could allow for a down payment of only $10,500 (3.5%). This flexibility can significantly influence your financial planning and overall affordability.

Looking ahead, in 2025, the FHA lending limits are projected to be $524,225 for single-family homes, with higher limits in certain areas, reflecting the rising housing market. It’s crucial to remember that using credit cards for FHA deposits is not permitted, ensuring that borrowers rely on more stable forms of financing. Understanding the minimum down payment for a house and its connection to home prices is vital for prospective buyers to set realistic expectations and budget effectively. We encourage you to seek advice from a , who can provide tailored to your financial situation.

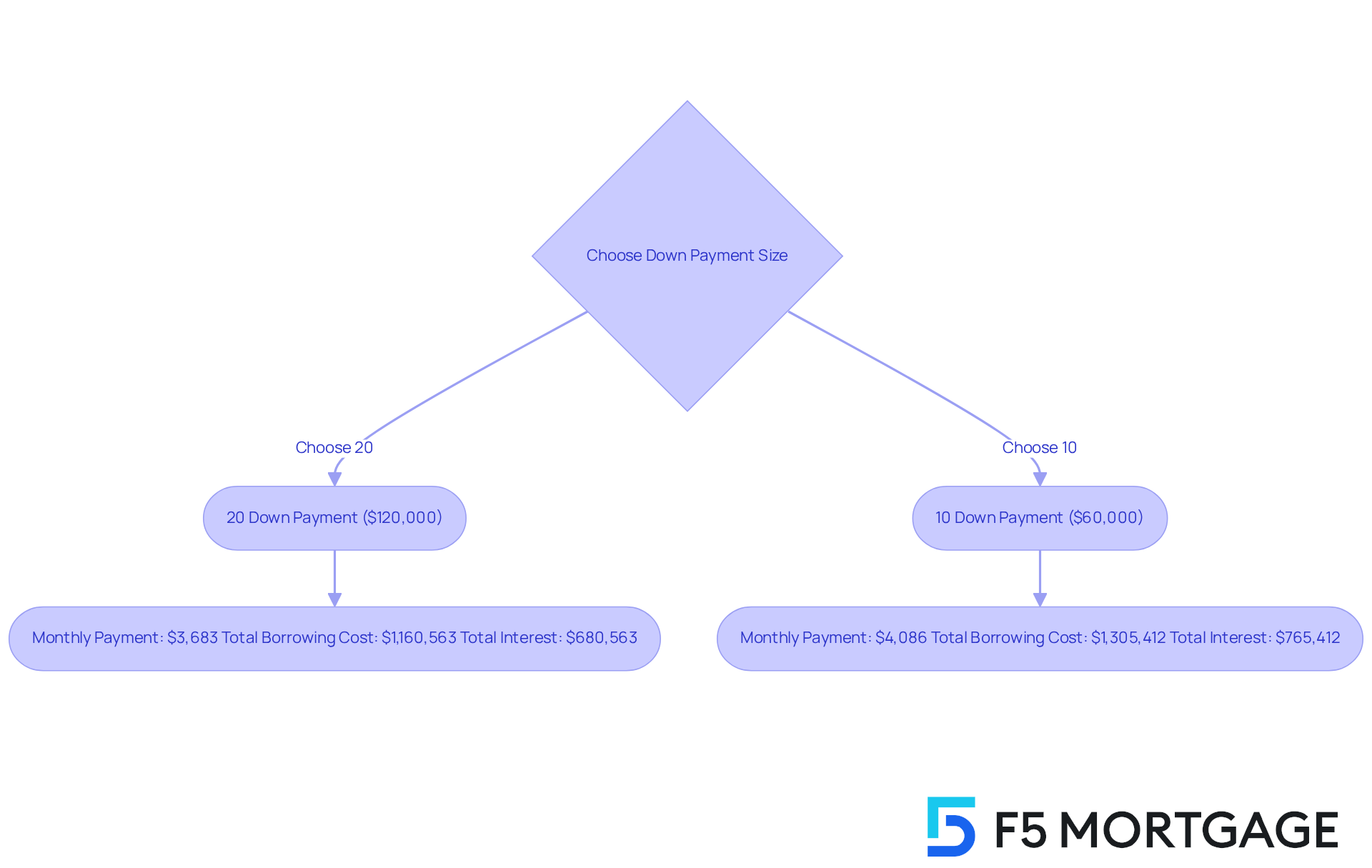

How Down Payment Size Affects Total Mortgage Costs

The is crucial in determining your . We understand how overwhelming this can be, but a not only decreases the borrowed amount but also significantly reduces your monthly costs and the overall interest paid throughout the duration of the financing. For instance, on a $600,000 house with a 20% deposit of $120,000, your monthly amount would be around $3,683. This leads to a total borrowing cost of $1,160,563 and total interest of $680,563 over 30 years. In contrast, a smaller , such as 10% ($60,000), increases your monthly amount to about $4,086, resulting in a total borrowing cost of $1,305,412 and total interest of $765,412.

Financial advisors highlight that making a than the minimum down payment for a house can lead to . This is especially important as it frequently , which can add between 0.2% and 2.0% of the amount borrowed to your yearly expenses. Additionally, with current mortgage rates averaging above 7%, the minimum down payment for a house can be increased to help mitigate the impact of , making it a strategic option for purchasers.

It’s also essential to consider the associated with different loan types, which can vary significantly and typically range from 2% to 5% of the home’s value. We encourage you to thoughtfully assess your when determining the amount of your initial contribution. This decision not only affects immediate affordability but also shapes the overall financial landscape of homeownership. Furthermore, keeping some resources for emergencies after making a down deposit is vital to prevent being cash-strapped.

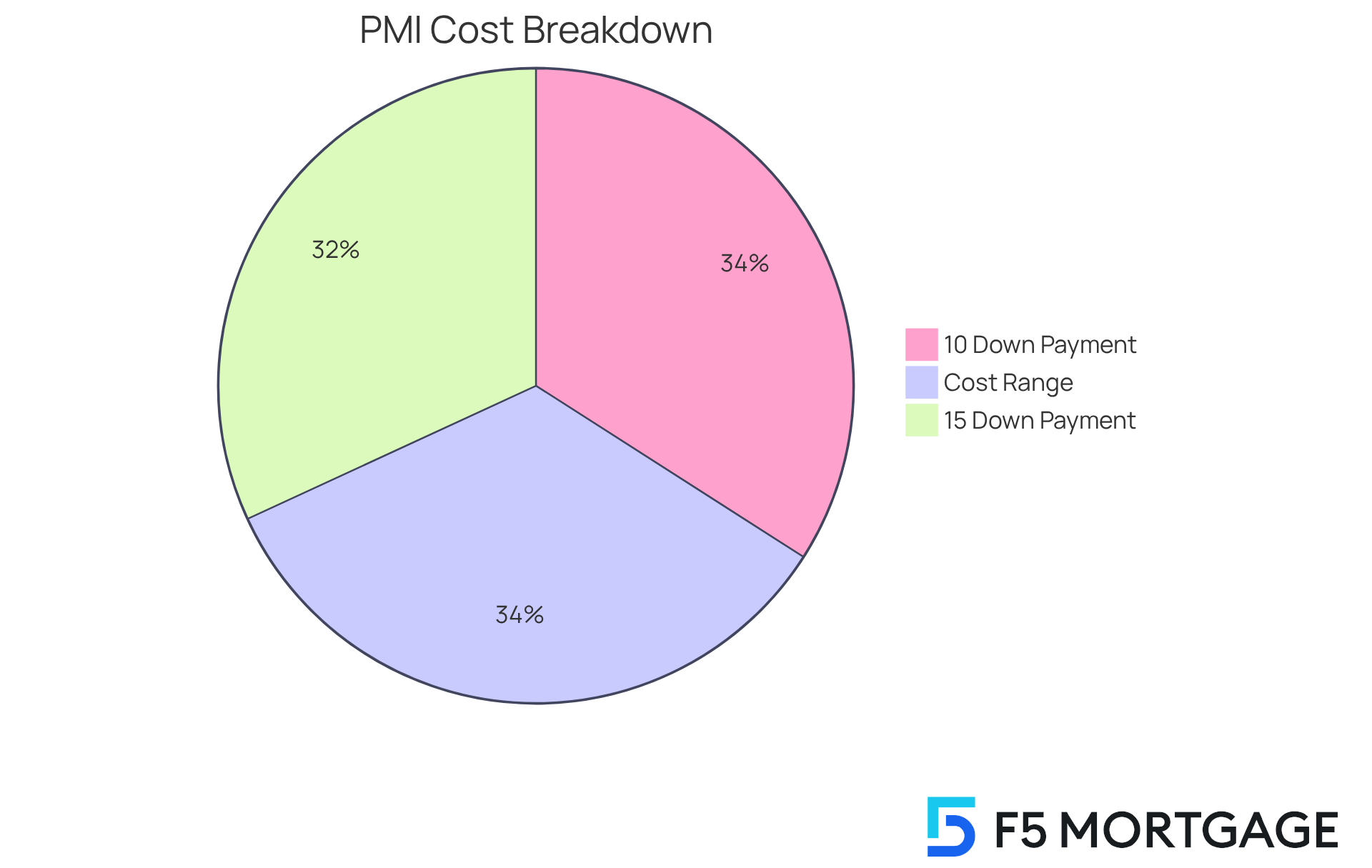

Understanding Mortgage Default Insurance for Low Down Payments

When considering the for a house of less than 20%, many purchasers find themselves needing to secure . This insurance serves as a safety net for lenders against potential defaults, and it can significantly impact your . It’s essential to fully grasp the and how it affects your overall budget.

Typically, the average cost of PMI ranges from 0.5% to 1.5% of the loan amount each year. For instance, on a $300,000 mortgage, PMI could add an extra $125 to $375 to your monthly payments, depending on your down payment and credit profile. If you’re making a 10% deposit, you might face a PMI expense of around $250 each month, while a 15% down payment could lower that to approximately $234.

Financial experts often highlight the importance of viewing PMI as a . We understand that for many, PMI can facilitate earlier homeownership, enabling you to enter the market sooner, especially when considering the for a house, rather than waiting to save for a larger deposit. This approach can lead to over time, as home values tend to appreciate.

It’s also comforting to know that PMI costs can be temporary. Homeowners can in their home, or it will be automatically canceled when the loan-to-value (LTV) ratio reaches 78%. Understanding these dynamics is crucial for prospective purchasers, as it empowers you to make informed decisions regarding your and .

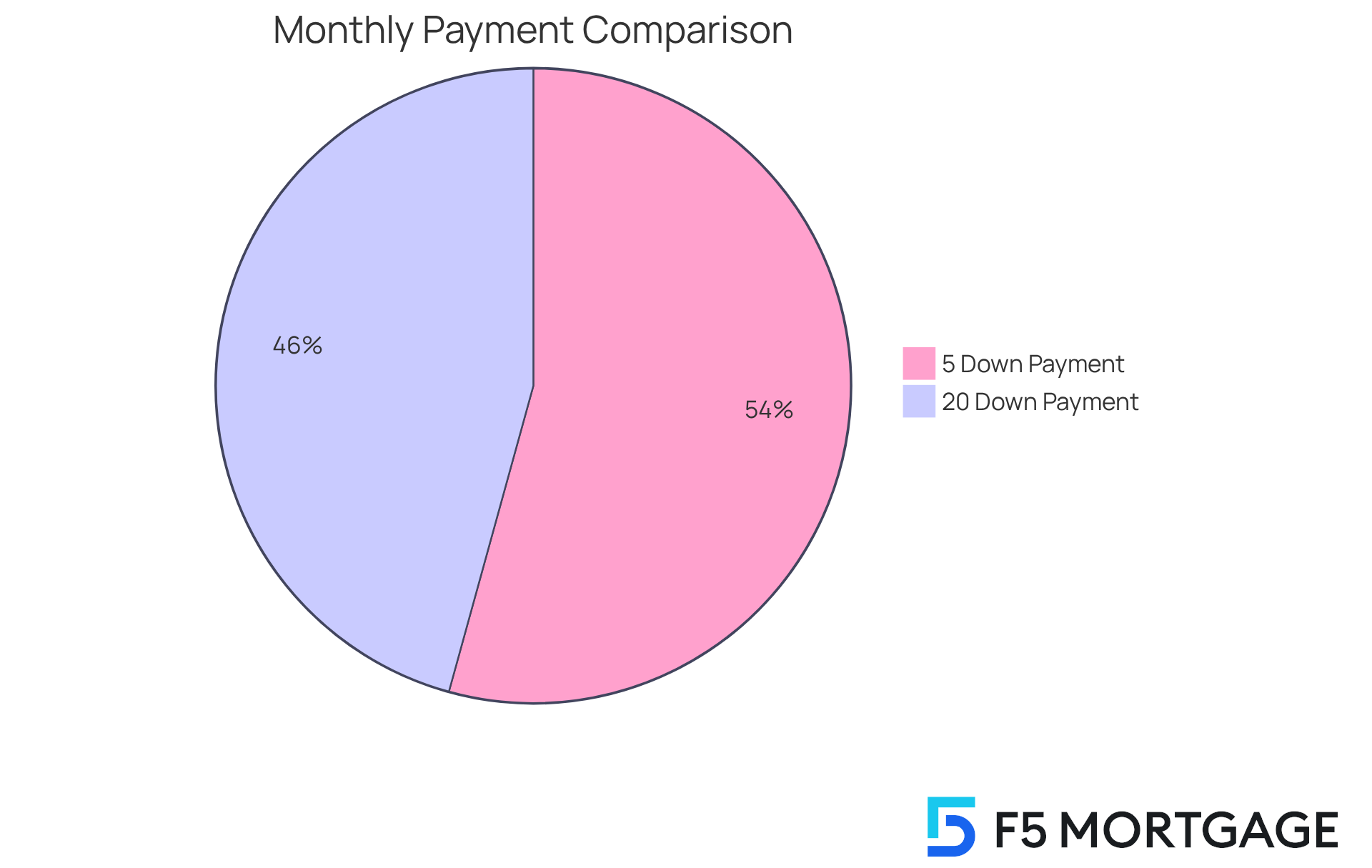

Advantages of a Larger Down Payment for Homebuyers

Making a can bring about significant , particularly when considering the and how important this is for your family’s future. One of the main benefits is the decrease in monthly housing costs, especially when considering the minimum down payment for a house. For instance, if you raise your down payment from 5% to 20% on a $300,000 mortgage, you could see your monthly costs drop from around $1,709 to $1,439. That’s a savings of $270 each month! Over the life of the loan, this can translate to a staggering $97,200 in interest savings.

Furthermore, a larger upfront contribution often leads to a lower minimum down payment for a house and reduced interest rates. Lenders view as a sign of diminished risk, which can improve the overall affordability of the loan. This is especially beneficial for individuals with lower credit scores, as putting down more can .

Additionally, making a deposit that meets the minimum down payment for a house of at least 20% generally allows you to (PMI). This can increase annual housing expenses by thousands of dollars. By eliminating PMI, you can further reduce your monthly financial obligations, making the minimum down payment for a house more attainable for your family.

In competitive real estate markets, individuals who can provide larger initial funds may also find themselves in a more advantageous negotiating position. Sellers often favor proposals with significant upfront amounts, as they signify financial stability and serious intent to buy. This can lead to better terms and conditions on the mortgage, ultimately saving you money in the long run.

Overall, the financial effects of providing the minimum down payment for a house are clear: , reduced interest rates, and can significantly improve your family’s financial situation and long-term . We’re here to support you every step of the way as you navigate this important journey.

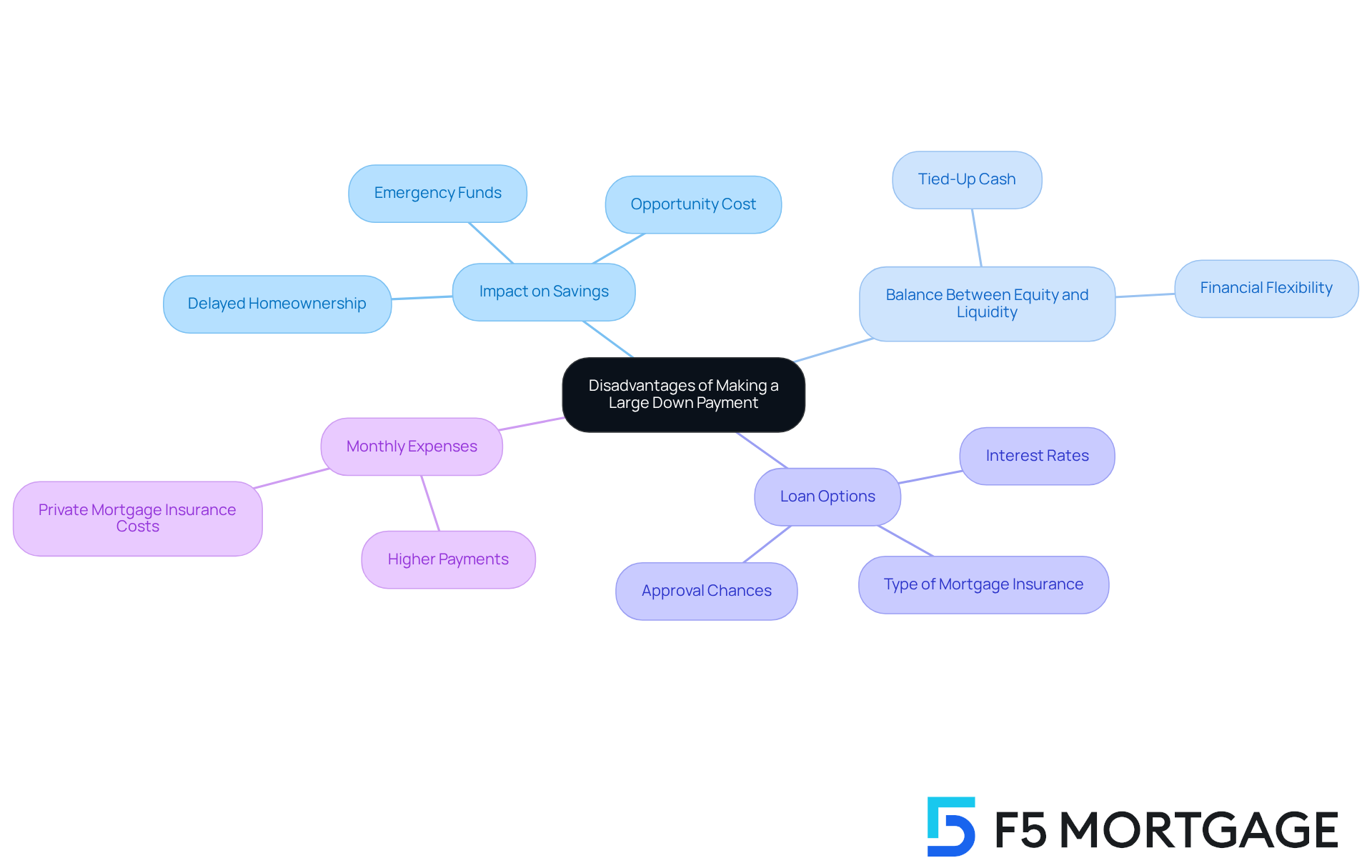

Disadvantages of Making a Large Down Payment

While making a significant initial contribution, which is often the for a house, can have its advantages—like potentially lowering your interest rate and monthly costs—it’s important to consider the . We know how challenging it can be to , especially when those savings might be needed for emergencies or other investments. Reflecting on whether committing a substantial amount of cash in a deposit is the best choice for your overall situation is crucial.

It’s vital to maintain a balance between and liquidity. Understanding the can also help you and overall financing. Remember, can and influence the type of mortgage insurance required, which ultimately impacts your monthly expenses, especially considering the .

We’re here to support you every step of the way as you .

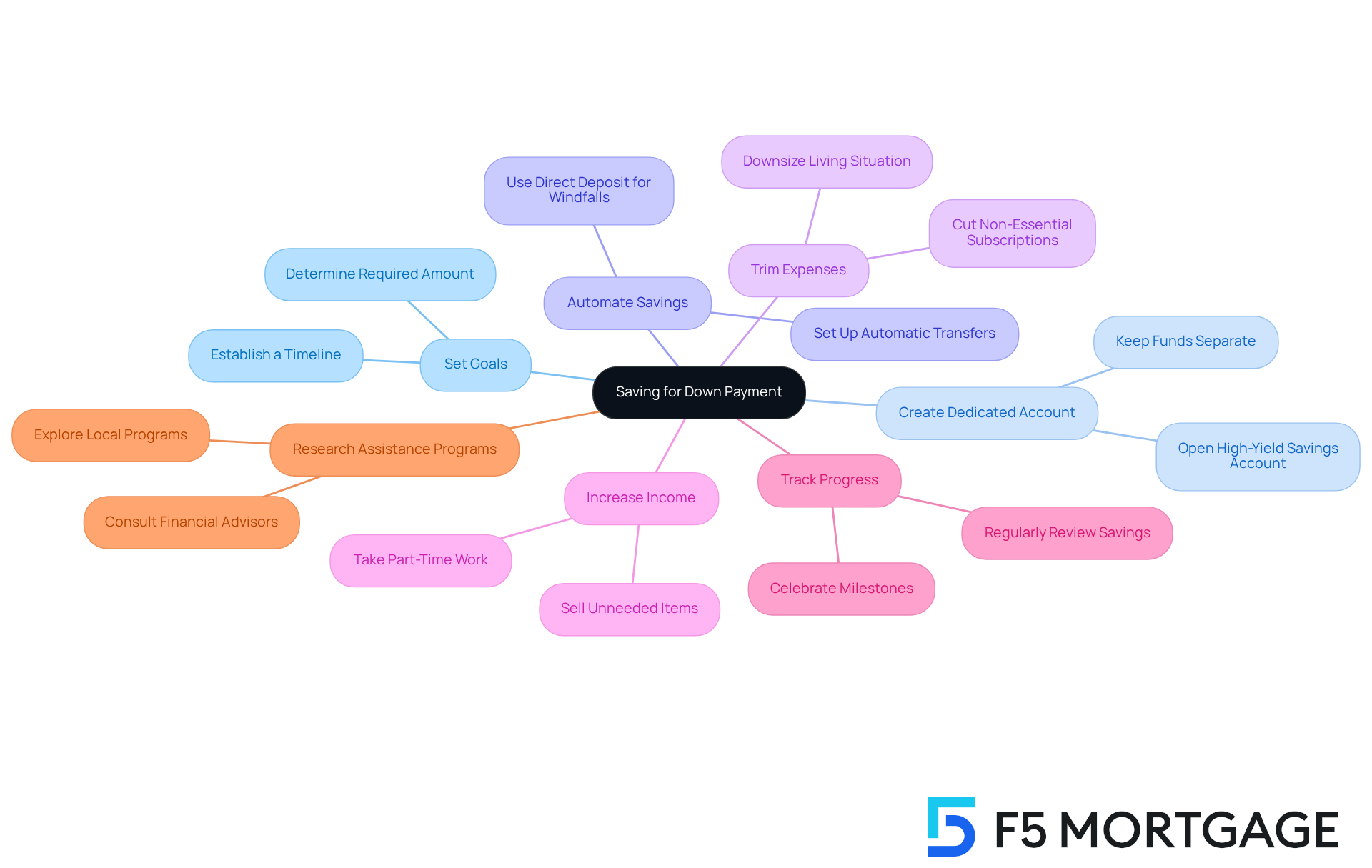

Tips for Saving for Your Down Payment

Saving for the minimum for a house can feel overwhelming, but with , you can make this journey easier. Start by setting a specific savings goal and timeline based on your home’s price range and the [minimum down payment for a house](https://f5mortgage.com/loan-programs/down-payment-assistance/georgia), which typically ranges from 3% to 20%. For instance, on a median-priced house of $412,300, the minimum down payment for a house at 20% would be approximately $82,460.

Creating a just for your deposit can help keep these funds separate from your everyday expenses, reducing the temptation to dip into them for unplanned purchases. Automating your savings through regular transfers from your checking account ensures consistent contributions, helping your grow steadily over time.

To , consider . Reviewing your monthly subscriptions or dining habits can free up significant funds. For example, many individuals have found that by downsizing their living situations or sharing housing costs, they could redirect those savings into their deposit fund, greatly improving their savings rate.

Additionally, look for ways to increase your income to help meet the minimum down payment for a house. Taking on part-time work, freelancing, or selling items you no longer need can provide extra cash to add to your savings. Also, consider funneling windfalls—like tax refunds or bonuses—directly into your down deposit fund for a substantial boost.

It’s essential to regularly track your progress and adjust your strategies as needed. Celebrate milestones to keep your motivation high, and think about consulting a tailored to your unique situation. Furthermore, researching in Ohio, such as:

- YourChoice!

- Grant for Grads

- Ohio Heroes

can provide valuable resources and financial support to help you achieve your down deposit goals. By implementing these strategies and utilizing available assistance programs, you can confidently navigate your path to homeownership.

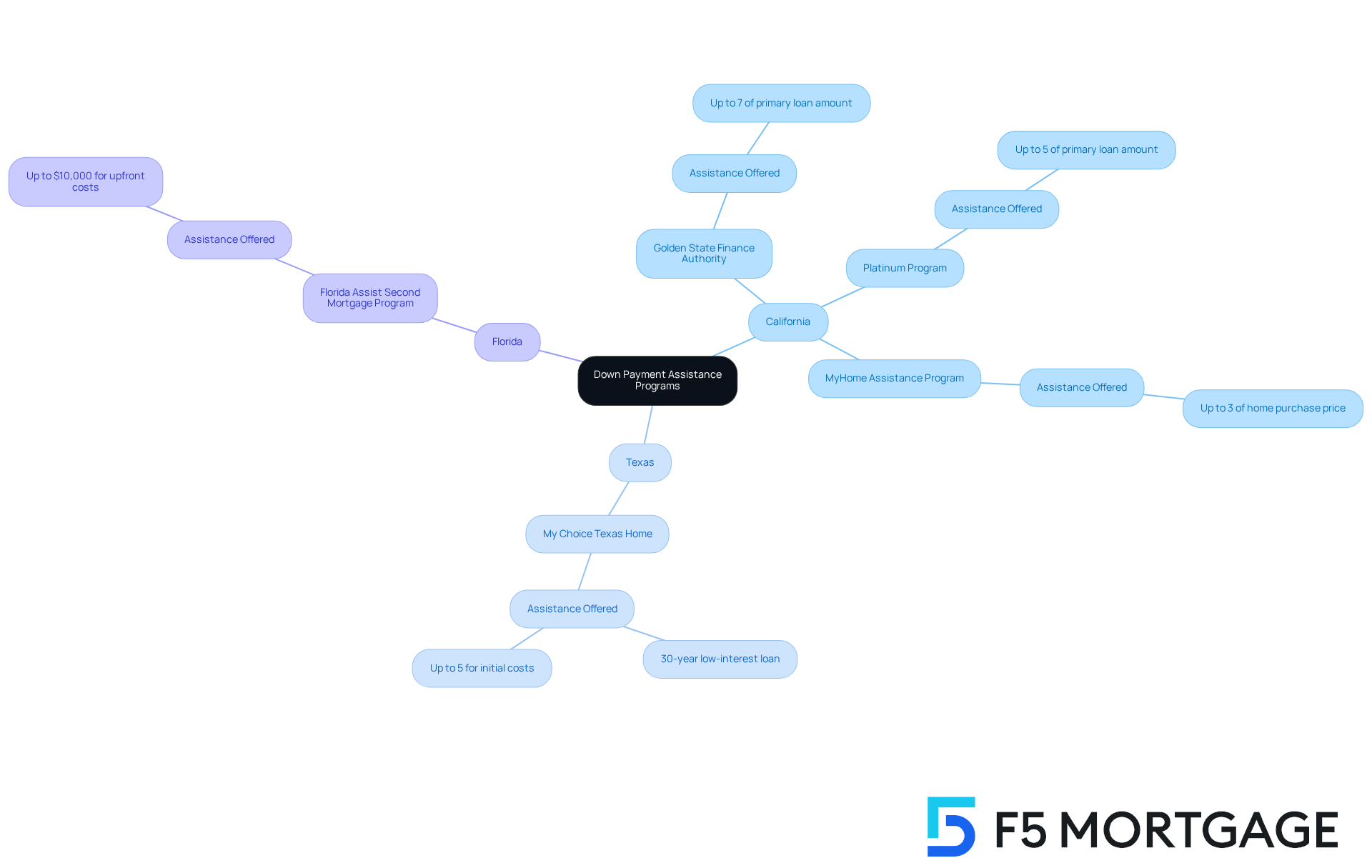

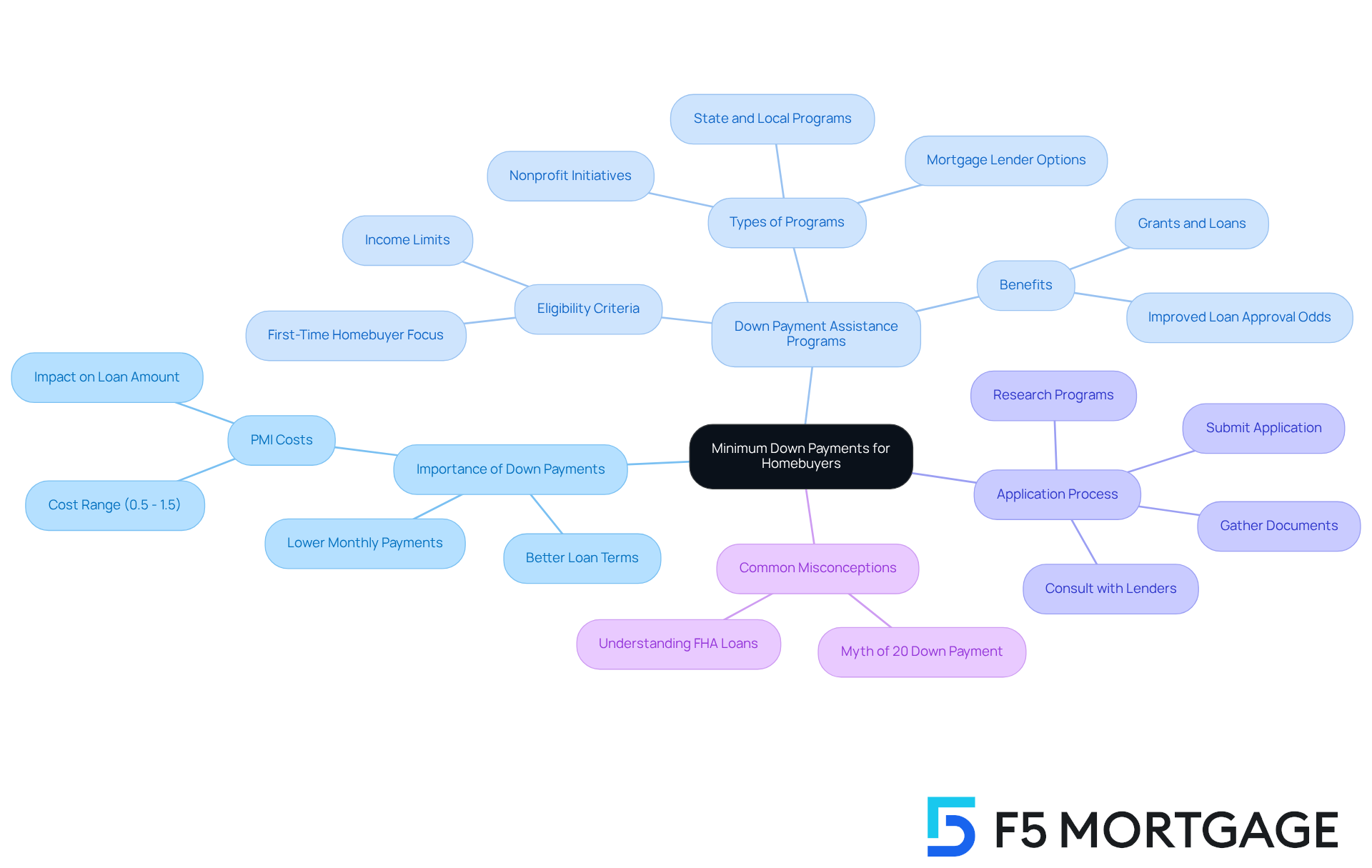

Exploring Down Payment Assistance Programs

are essential assets for and individuals with limited savings, particularly to help them meet the . These programs provide various types of , including grants, low-interest loans, and forgivable financing, to help ease the challenges of initial costs. In California, for instance, programs like the Golden State Finance Authority’s Open Doors program offer up to 7% of the primary loan amount toward closing costs, while the Platinum Program covers up to 5%. Additionally, the (CalHFA) provides up to 3% of the home’s purchase price.

In Texas, the My Choice Texas Home initiative offers a , along with up to 5% for initial costs and closing support. Florida also has several programs, such as the Florida Assist Second Mortgage Program, which offers up to $10,000 for upfront costs. Researching these programs is crucial, as eligibility criteria can vary significantly by state and county. We know how challenging this can be, and , like those at F5 Finance, can assist buyers in navigating these options effectively, ensuring they find the best fit for their financial situation.

The importance of is underscored by the statistic that 46% of low- and middle-income borrowers were denied mortgages due to high debt-to-income ratios, highlighting the for a house. This highlights the critical role these programs play in facilitating homeownership. Moreover, checking credit prior to applying for DPA is vital, as favorable credit can lead to a lower minimum down payment for a house.

Successful utilization of these programs can be illustrated by real-life stories where families transitioned from renting to owning their homes, significantly improving their financial security. Overall, down payment assistance programs play a crucial role in empowering first-time homebuyers, making the dream of homeownership more achievable. We’re here to support you every step of the way in this journey.

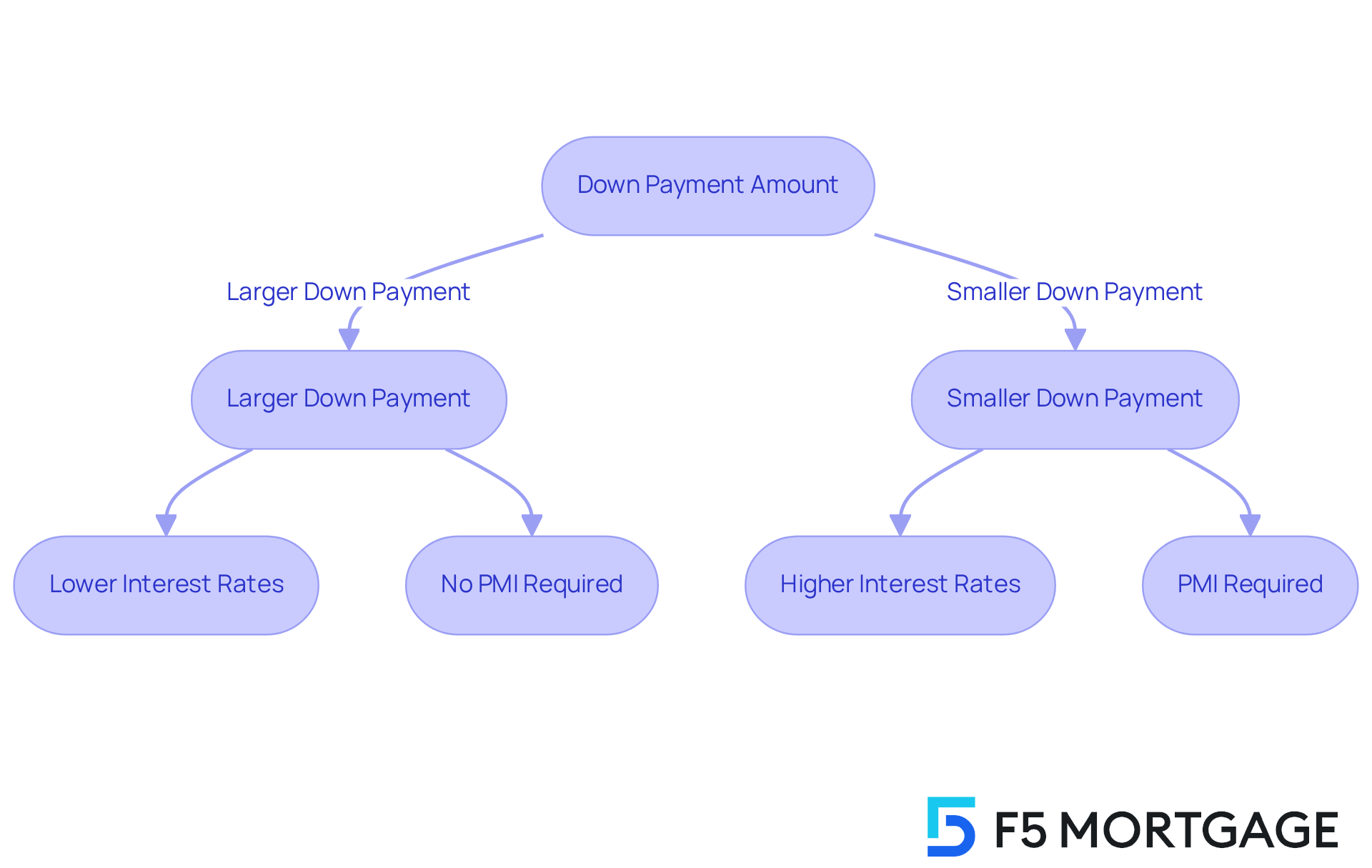

Impact of Down Payments on Mortgage Rates

The is a significant factor in determining loan rates, and we understand how crucial this can be for families navigating the . Typically, can decrease the lender’s risk, leading to reduced interest rates. For example, a deposit of 20% or more can eliminate the requirement for (PMI), which usually costs between 0.5% and 1.5% of the loan amount each year. In contrast, smaller initial contributions often result in higher rates, as lenders perceive increased risk when borrowers have less equity in their property.

In 2023, the average initial contribution for was around 8%, while repeat buyers typically provided about 19%. This difference illustrates how the amount of the deposit can but also the total cost of borrowing. For instance, a borrower providing a 10% deposit on a $350,000 house would need to finance $315,000, which is below the minimum down payment for a house, possibly facing higher interest rates compared to a borrower who contributes 20% and finances only $280,000.

is particularly beneficial for first-time home purchasers, offering a minimum down payment for a house, which enhances accessibility to homeownership. These financial products are designed to support buyers who may not have significant savings for a large upfront cost, providing a pathway to homeownership. that even a slight increase in the minimum down payment for a house can greatly influence mortgage rates. A larger initial contribution not only reduces the amount borrowed but also strengthens the borrower’s equity position, potentially leading to more favorable loan conditions. For example, borrowers who can afford a larger down payment may secure rates that are significantly lower than those available to buyers who only make the minimum down payment for a house.

Additionally, the lender will order a to assess the current market value of the property. This evaluation determines how much equity the borrower has, which can influence loan rates. Factors such as inflation and the Federal Reserve’s monetary policy decisions can also impact loan rates, making it essential for homebuyers to stay informed about these dynamics. Ultimately, understanding the is vital for homebuyers. By carefully considering how much to contribute, purchasers can make informed decisions that align with their long-term financial goals, potentially saving thousands over the life of their financing.

Key Takeaways on Minimum Down Payments for Homebuyers

Understanding the is crucial for homebuyers as they navigate the complexities of purchasing a home. A larger initial contribution not only reduces monthly payments but also leads to better loan terms. Conversely, smaller contributions may incur additional costs, like private mortgage insurance (PMI), which can range from 0.5% to 1.5% of the loan amount each year.

Mortgage specialists stress the importance of . For instance, Rob Chrane, CEO of Down Payment Resource, points out that there are thousands of available, particularly for . These programs can significantly alleviate the , allowing buyers to focus on their .

First-time homebuyers often set savings goals that reflect the average down payment, which has fluctuated between 6% and 10% from 2018 to 2024. Many buyers mistakenly believe that a 20% down payment is mandatory, but knowing the can prevent this misconception from deterring potential homeowners. In reality, options like allow for the minimum down payment for a house to be as low as 3.5%, making homeownership more achievable.

To improve their chances of securing down payment assistance, buyers can partner with , who can guide them through the application process. Here’s a simple step-by-step guide to applying for down payment assistance:

- Research available programs such as YourChoice!, Grant for Grads, and Ohio Heroes.

- Gather necessary documents, including proof of income and employment verification.

- Consult with F5 Mortgage to understand eligibility criteria and get pre-qualified.

- Officially submit your application.

Making informed decisions about initial costs can have a profound impact on the overall home buying experience. By exploring various assistance programs and developing a strategic savings plan, buyers can improve their loan-to-value (LTV) ratios, lower monthly payments, and enhance their chances of mortgage approval. Testimonials from satisfied clients of F5 Mortgage showcase the positive experiences of working with their team, highlighting the value of their support. Ultimately, understanding and utilizing can empower homebuyers to realize their dreams of homeownership.

Conclusion

Understanding the minimum down payment for a house is crucial for prospective homebuyers. We know how challenging this can be, as it directly influences affordability and overall mortgage costs. The insights shared throughout this article emphasize that a well-informed approach to down payments can significantly impact financial outcomes, making homeownership more accessible and manageable.

Key points highlighted include:

- The varying minimum down payment requirements based on home price and financing type.

- The financial implications of larger versus smaller down payments are significant.

- Down payment assistance programs play a critical role.

- The connection between down payment size and mortgage rates underscores the importance of strategic planning in the home buying process.

By leveraging resources like personalized mortgage consultations, buyers can navigate these complexities with confidence.

Ultimately, the journey to homeownership does not have to be overwhelming. By understanding down payment options and utilizing available assistance programs, potential buyers can take proactive steps toward achieving their homeownership dreams. Embracing these insights and strategies can empower individuals to make informed decisions that align with their financial goals, ensuring a smoother transition into their new homes.

Frequently Asked Questions

What services does F5 Mortgage offer for down payment guidance?

F5 Mortgage provides personalized mortgage consultations to help clients navigate the mortgage process, evaluate their financial situations, and suggest customized loan options and deposit strategies.

Who can benefit from F5 Mortgage’s consultations?

First-time homebuyers particularly benefit from F5 Mortgage’s consultations, as they provide targeted advice that simplifies the complexities of minimum down payments and financing.

What are the typical minimum down payment requirements based on home price and financing type?

Minimum down payments vary by financing type: traditional financing typically requires 5% to 20%, FHA loans can require as low as 3.5% for those with a credit score of 580 or above, and VA loans may require no upfront cost for qualified veterans and active military members.

What was the average minimum down payment for first-time homebuyers in 2023?

The average minimum down payment for first-time homebuyers in 2023 was around 8%, while repeat buyers had an average minimum down payment of approximately 19%.

How does the size of the down payment affect total mortgage costs?

A larger down payment reduces the borrowed amount, monthly payments, and overall interest paid. For example, a 20% down payment on a $600,000 house leads to significantly lower monthly payments and total costs compared to a 10% down payment.

What are the potential savings from making a larger down payment?

Making a larger down payment can lead to significant savings by reducing monthly payments, total interest paid, and eliminating the need for private mortgage insurance, which adds to yearly expenses.

What should buyers consider regarding closing costs?

Buyers should be aware that closing costs can vary significantly and typically range from 2% to 5% of the home’s value, which is an important factor to consider alongside the down payment.

Why is it important to keep some resources available after making a down payment?

Keeping some resources available after making a down payment is vital to avoid being cash-strapped and to ensure financial stability for emergencies.