Overview

This article is dedicated to helping you navigate the journey of homeownership by identifying essential down payment assistance programs available in Florida. We understand how challenging this process can be, especially when it comes to managing upfront costs. Programs like the Florida Housing Homebuyer Program and the Florida Hometown Heroes Program offer significant financial support to first-time buyers. These initiatives are designed to alleviate the burden of those initial expenses, making homeownership more accessible for you and your family.

Imagine the relief of having assistance that eases the financial strain of buying your first home. With these programs, you can take a step closer to achieving your dream of homeownership. We’re here to support you every step of the way, guiding you through the options available to you.

Explore these valuable resources and consider how they can empower you to make informed decisions. Your journey to owning a home doesn’t have to be overwhelming; let’s take this important step together.

Introduction

Navigating the path to homeownership can often feel like an uphill battle. We know how challenging this can be, especially when faced with the daunting task of saving for a down payment. Fortunately, Florida offers a variety of down payment assistance programs designed to ease this burden and empower aspiring homeowners. This article explores seven essential programs that provide not only financial support but also open the door to homeownership for many families. However, with so many options available, how can prospective buyers determine which program best fits their unique needs and circumstances? We’re here to support you every step of the way.

F5 Mortgage: Personalized Mortgage Consultations and Loan Access

At F5 Mortgage, we understand that navigating the can be challenging. That’s why we excel in providing tailored to your unique needs. With access to a strong network of over twenty lenders, we offer a diverse selection of financing options, including:

- Fixed-rate mortgages

- VA mortgages

- Jumbo mortgages

This customized approach ensures you secure the most favorable rates and terms, making your home buying or refinancing experience smoother and more efficient.

In 2025, in enhancing the mortgage application process. At F5 Mortgage, we utilize cutting-edge tools to streamline applications, allowing you to achieve . This commitment to technology not only speeds up the process but also empowers you with the information and support you need throughout your mortgage journey. We know how important it is to have that address your specific requirements, and we stand out in the competitive arena by emphasizing outstanding service and your satisfaction.

Moreover, we recognize that can lead to substantial savings over the life of your loan. That’s why it’s essential to explore your options. To expedite your pre-approval process, consider gathering your financial documents early. Additionally, our rapid closing procedure, with most loans concluding in under three weeks, sets us apart from competitors, addressing common challenges faced by homebuyers, such as high interest rates and complex documentation.

Clients consistently praise F5 Mortgage for our , with testimonials highlighting the personalized guidance and support received throughout the mortgage process. Furthermore, we offer that enhance home buying opportunities, making it easier for families to secure their dream homes. We’re here to support you every step of the way.

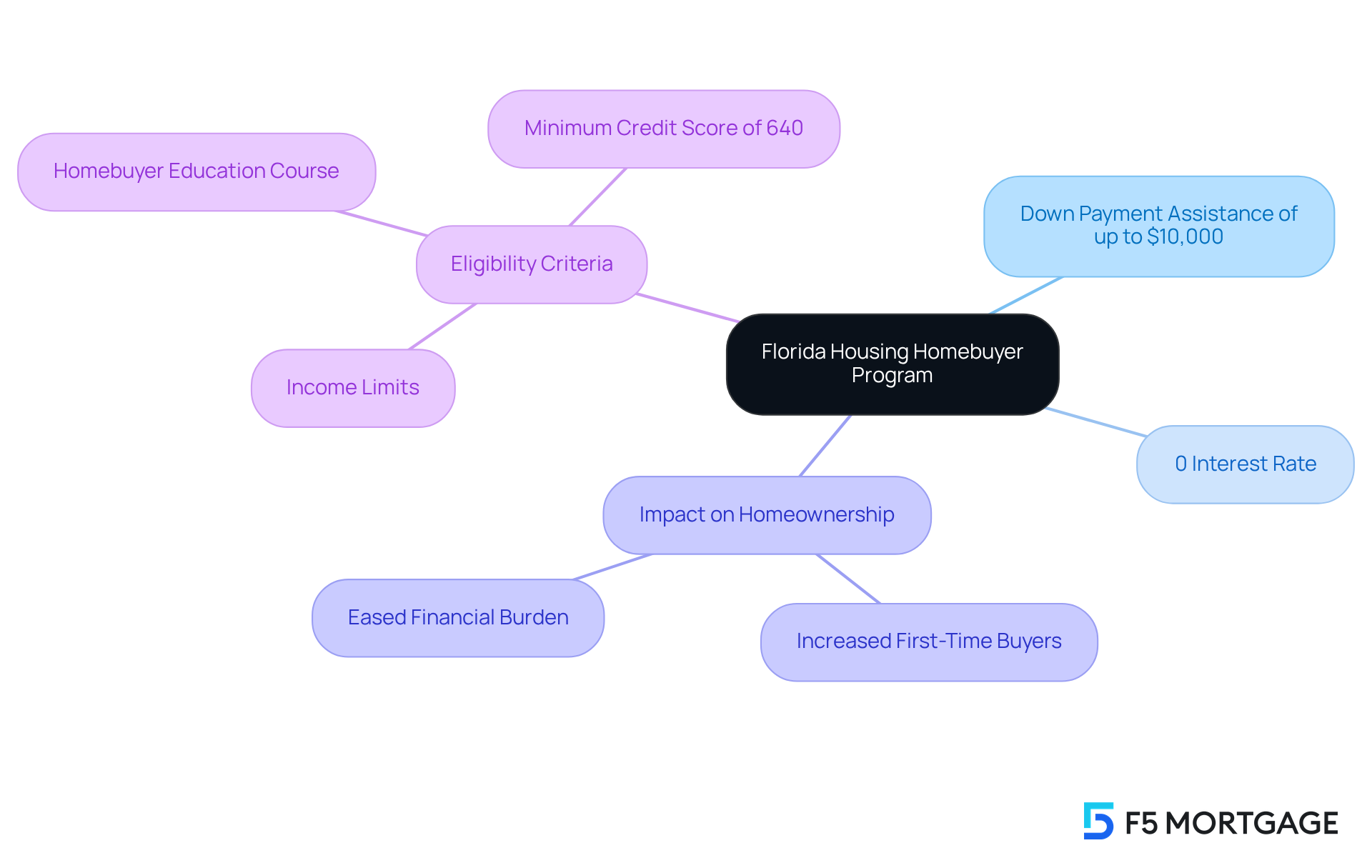

Florida Housing Homebuyer Program: Essential Down Payment Assistance

The Florida Housing Homebuyer Program is here to offer vital support to , providing of up to $10,000 for down payments and closing costs. This program provides [[down payment assistance Florida](https://f5mortgage.com/?p=10227)](https://f5mortgage.com/loan-programs/down-payment-assistance/colorado), structured as a second mortgage with a 0% interest rate, making it a welcoming option for those who find it challenging to save for a down payment. By utilizing this program, prospective homeowners can significantly ease their , paving the way for more attainable homeownership.

To qualify, applicants need to meet , including:

- Income limits

- Completion of a

We understand how important it is for participants to be equipped with the knowledge necessary to . In 2025, we’ve seen a remarkable increase in taking advantage of this support, showcasing its positive impact on the housing market and the lives of many families throughout Florida.

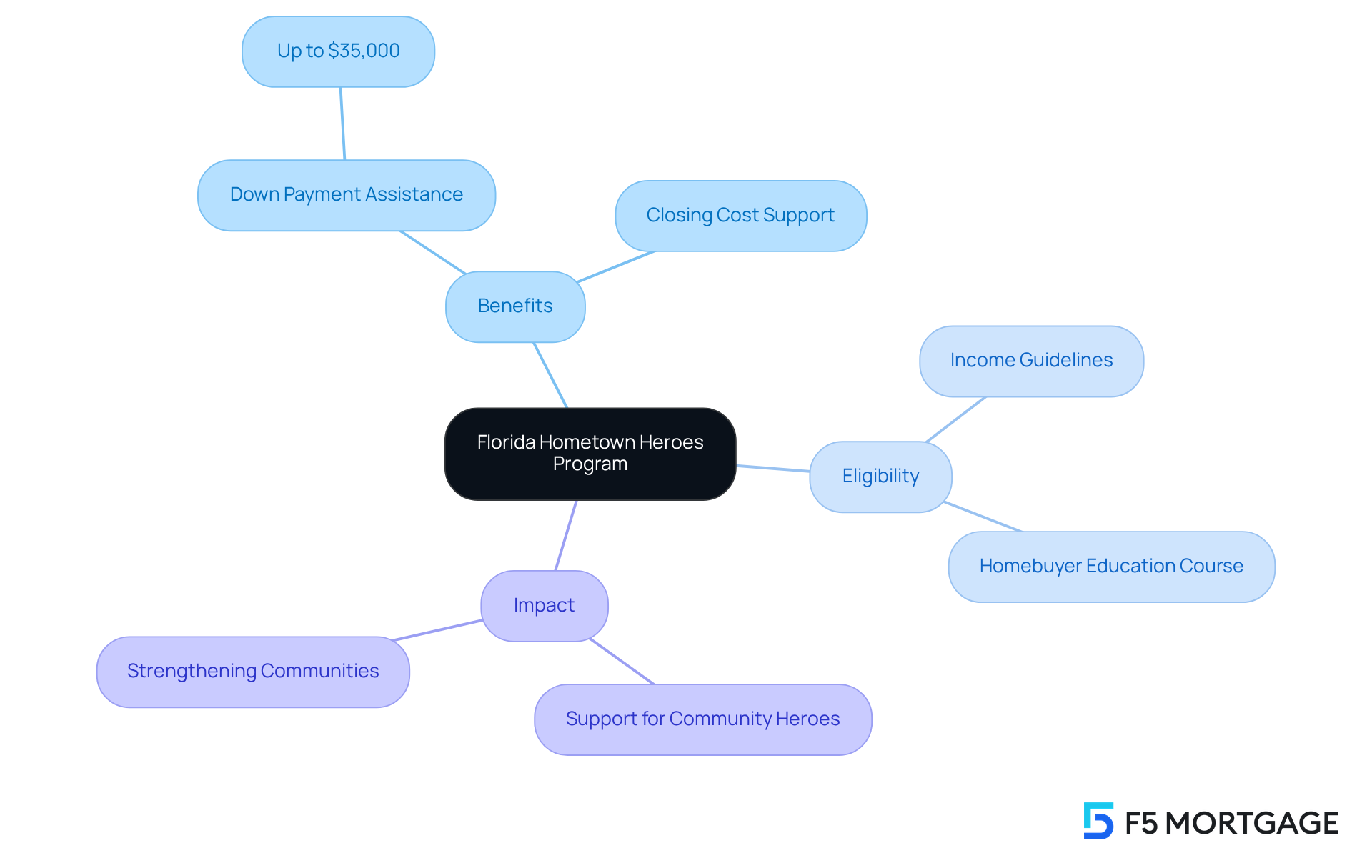

Florida Hometown Heroes Program: Specialized Assistance for Community Heroes

The Florida Hometown Heroes Program is a vital initiative designed to empower who serve in , such as healthcare workers, educators, and first responders. By offering up to $35,000 in and closing cost support, this program greatly facilitates the for these dedicated individuals.

We understand how challenging this process can be. To qualify, applicants must meet specific income guidelines and complete a , ensuring they are well-prepared for the responsibilities that come with owning a home. By recognizing and assisting the efforts of our , this initiative not only helps them achieve homeownership but also they serve.

In 2025, many community heroes have benefited from [down payment assistance Florida](https://f5mortgage.com/loan-programs/dscr-loans/florida), which highlights the program’s positive impact on enhancing the lives of essential workers across the state. We’re here to as you navigate this important milestone.

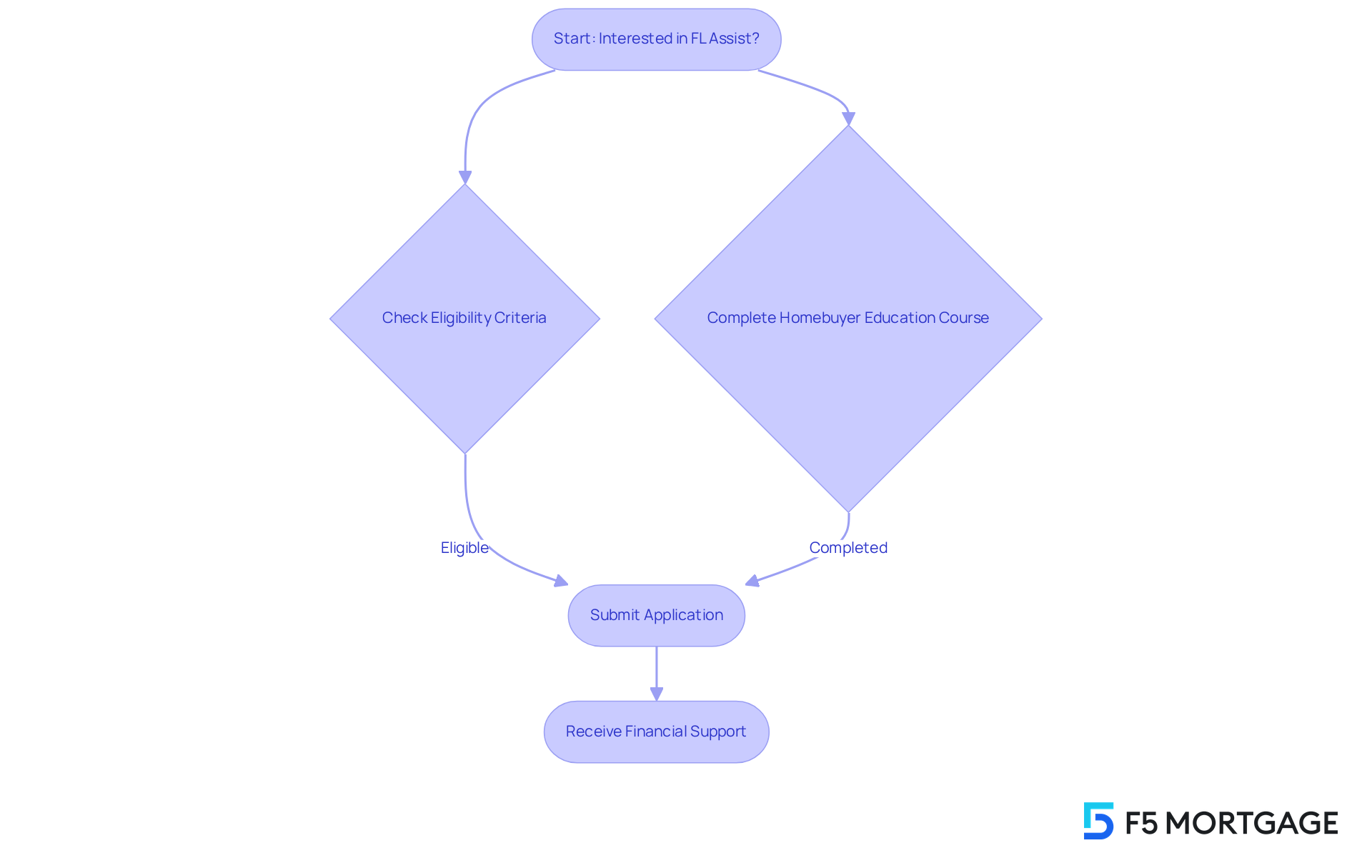

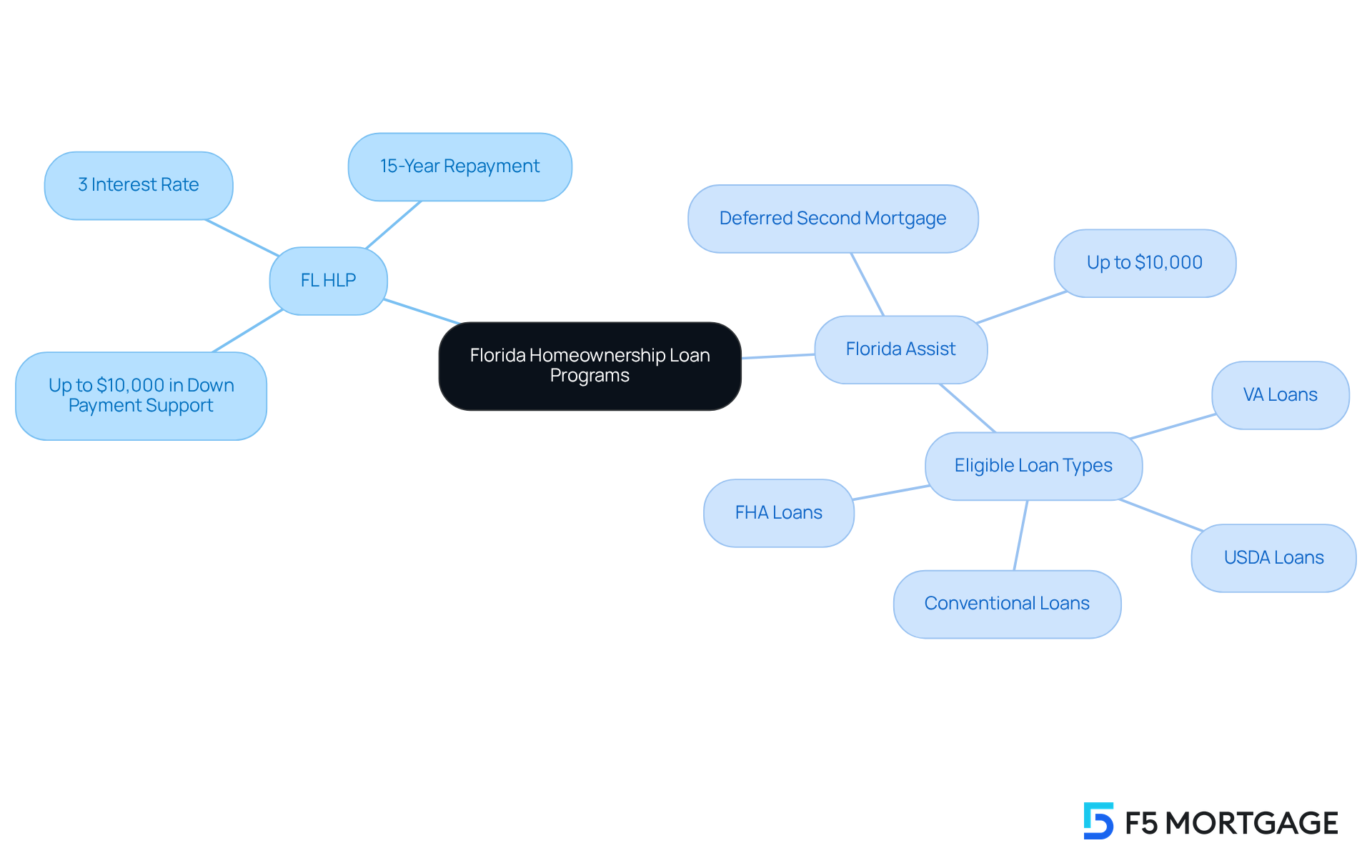

Florida Assist Second Mortgage Program (FL Assist): Additional Financial Support

The Florida Assist Second Mortgage Program (FL Assist) is a vital resource for qualified purchasers, offering up to $10,000 in the form of a deferred second mortgage. This for and closing costs, making it an appealing option for those who may find it challenging to cover upfront expenses. Notably, the loan is interest-free and does not require monthly payments, significantly easing the financial burden on .

We understand how daunting the journey to can be. To qualify for FL Assist, applicants must adhere to and complete a , ensuring they are well-prepared for the responsibilities that come with owning a home. This initiative has proven particularly beneficial for , empowering them to achieve their dream of homeownership. In recent years, many families have effectively utilized FL Assist to secure their homes, showcasing its effectiveness in facilitating affordable housing solutions throughout Florida.

Additionally, the Florida Homeownership Loan Program complements FL Assist by offering down payment assistance Florida of up to $10,000 toward down payment or closing costs, further enhancing opportunities for aspiring homeowners. As financial expert Mike Diamond notes, “Deferred second mortgages like FL Assist provide essential support for first-time homebuyers, allowing them to focus on their new home without the immediate pressure of repayment.”

from clients, with 5/5 star reviews on platforms like Lending Tree, Google, and Zillow. Content clients emphasize the offered by the F5 Mortgage team, strengthening the firm’s dedication to customer satisfaction in navigating these support options.

If you’re interested in applying for the FL Assist initiative, we encourage you to visit the official website for detailed application instructions and to ensure all eligibility criteria are met. We’re here to support you every step of the way.

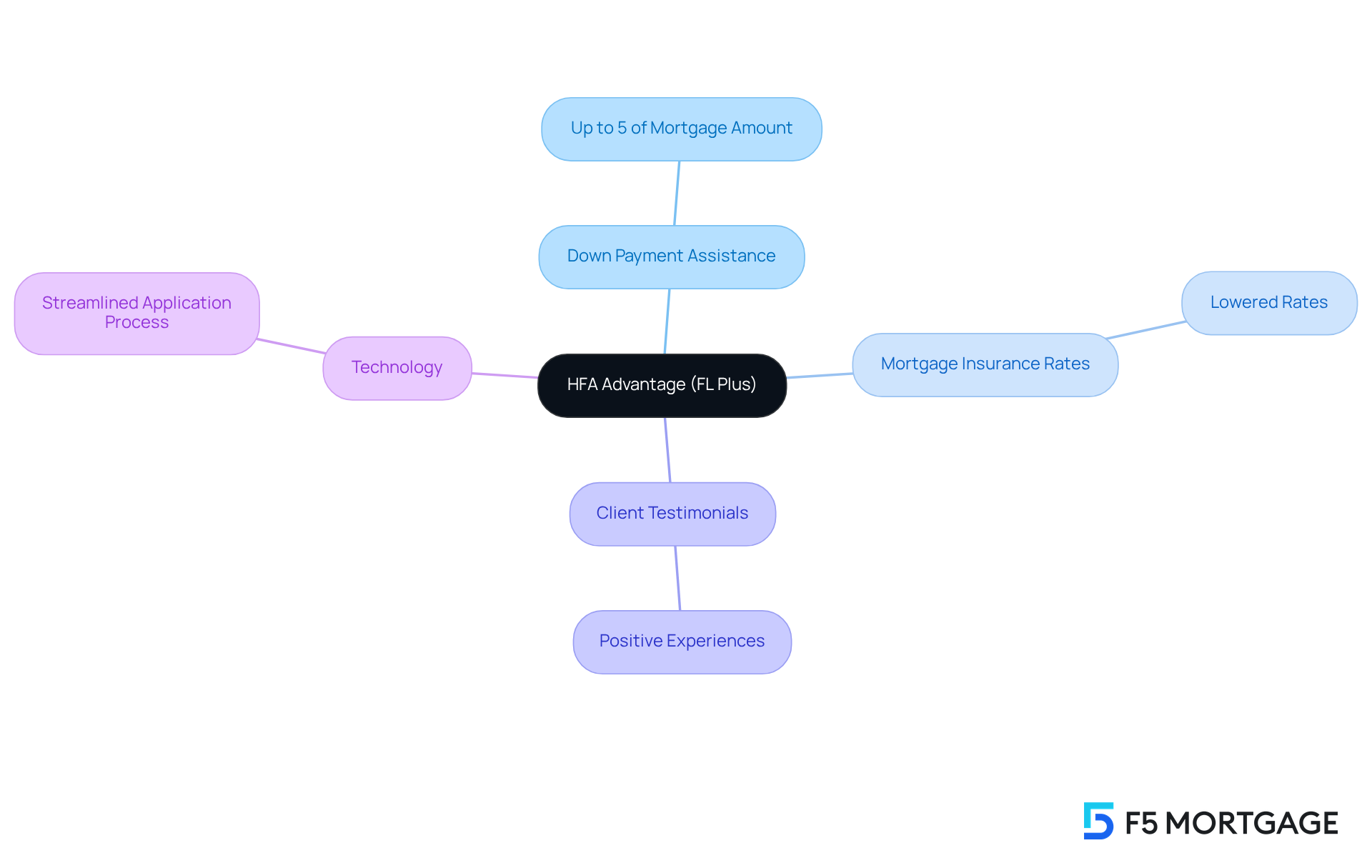

HFA Advantage (FL Plus): Competitive Rates for First-Time Homebuyers

Are you a feeling overwhelmed by the challenges of entering the housing market? The HFA Advantage (FL Plus) initiative offers to help you. Designed specifically for low-to-moderate income families, this program provides access to and down payment assistance Florida. You can receive down payment assistance Florida of up to 5% of the mortgage amount to cover down payment and closing costs, significantly easing the .

In addition to direct , the initiative provides , further reducing the total cost of buying a home. We understand how crucial it is to meet specific income and credit criteria, which is why this initiative is an ideal choice for those eager to .

Our clients have shared heartwarming stories about their experiences with . One satisfied client expressed, “I enjoyed getting help with my loan through F5 Mortgage. Highly recommend to anyone who is looking for true experts.” This feedback highlights our unwavering commitment to transparency and exceptional service, ensuring you feel supported throughout the mortgage process.

At F5 Mortgage, we utilize advanced technology to streamline your application experience, allowing you to benefit from competitive rates and personalized support. With an average credit score of 707 in Florida and interest rates starting as low as 3%, the HFA Advantage program provides down payment assistance Florida for first-time buyers seeking affordable financing. We’re here to as you embark on this exciting journey toward homeownership.

Florida Homeownership Loan Program (FL HLP): Affordable Financing Options

The Florida Homeownership Loan Program (FL HLP) serves as a vital resource for , offering up to $10,000 in down payment support. We understand how daunting the journey to homeownership can be, and this can be paired with a first mortgage, significantly easing your path. This support is structured as a second mortgage with a competitive 3% interest rate, repayable over 15 years. It’s an attractive option for those who may not have enough savings for a down payment but have a .

In addition to FL HLP, the provides in Florida of up to $10,000 as a deferred second mortgage for VA, FHA, USDA, and conventional loans. This further empowers aspiring homeowners in Florida. These initiatives, such as down payment assistance Florida, are crucial in helping many individuals bridge the financial gap, allowing thousands of first-time homebuyers to secure their dream homes.

As housing finance experts emphasize, like FL HLP and Florida Assist are essential in promoting homeownership, especially in a market where rising prices can feel overwhelming. The remarkable reflected in 5/5 star ratings on platforms such as Lending Tree, Google, and Zillow highlights the effectiveness of through these services. Clients like Bryce Leonard and Alley Cohen have praised the smooth experience and expert support provided by F5 Mortgage. This demonstrates how the FL HLP and Florida Assist initiatives not only support individual s but also contribute to the overall stability and growth of communities throughout Florida.

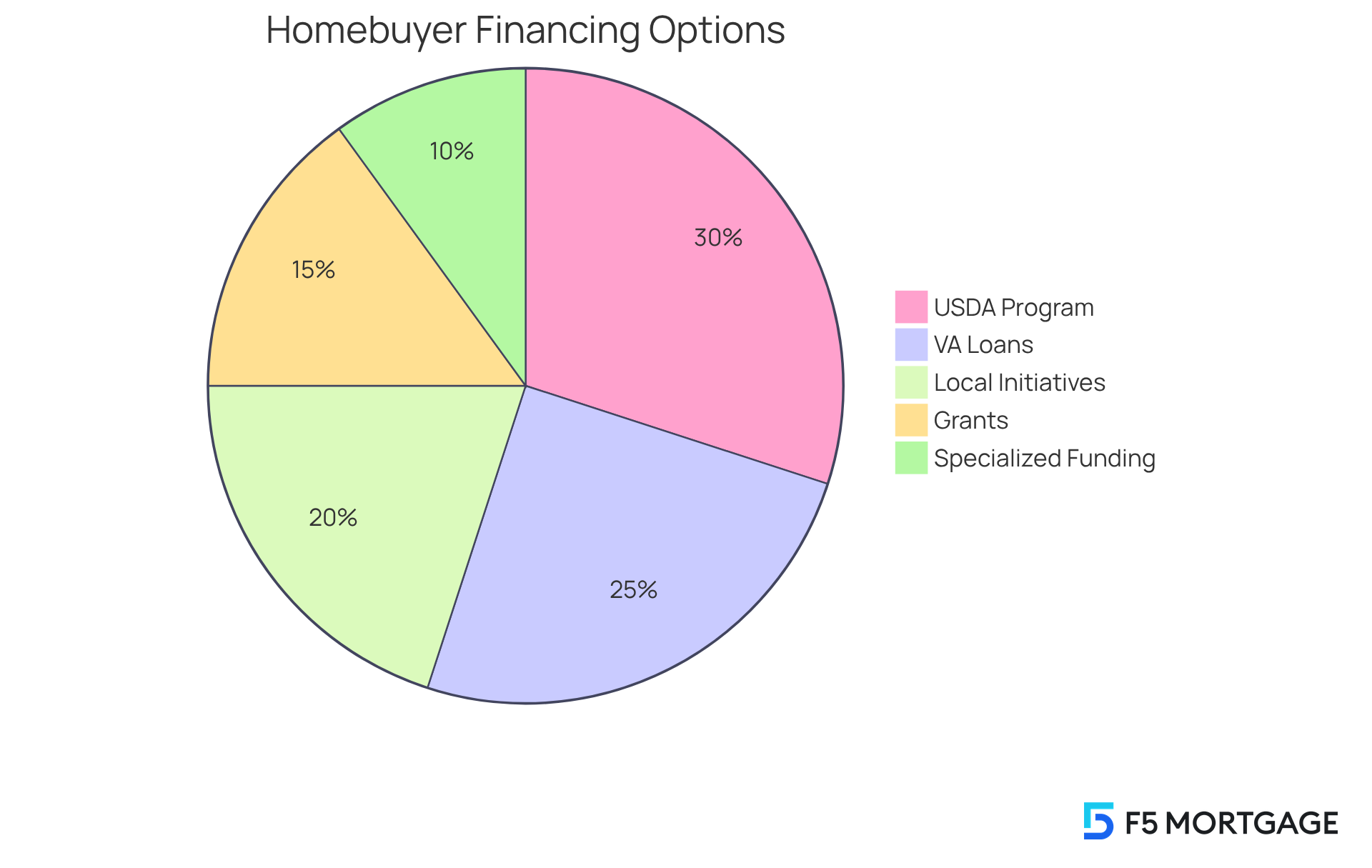

Other First-Time Homebuyer Loans and Programs: Expanding Financial Options

Florida offers a range of and programs designed to help you. These include local initiatives, grants, and specialized funding tailored for specific groups, such as veterans and low-income families. One standout option is the , which provides significant advantages, including no down payment requirements. This makes for eligible borrowers. Similarly, present unique benefits for veterans, allowing them to secure homes without the burden of a down payment.

In 2025, are actively supporting homebuyers like you by providing down payment assistance Florida, ensuring that diverse to meet your varying needs. We know how challenging this can be, and we encourage you to explore these resources thoroughly. By doing so, you can and identify the best solutions tailored to your individual circumstances. Utilizing these initiatives allows prospective homeowners to with increased assurance and simplicity. We’re here to .

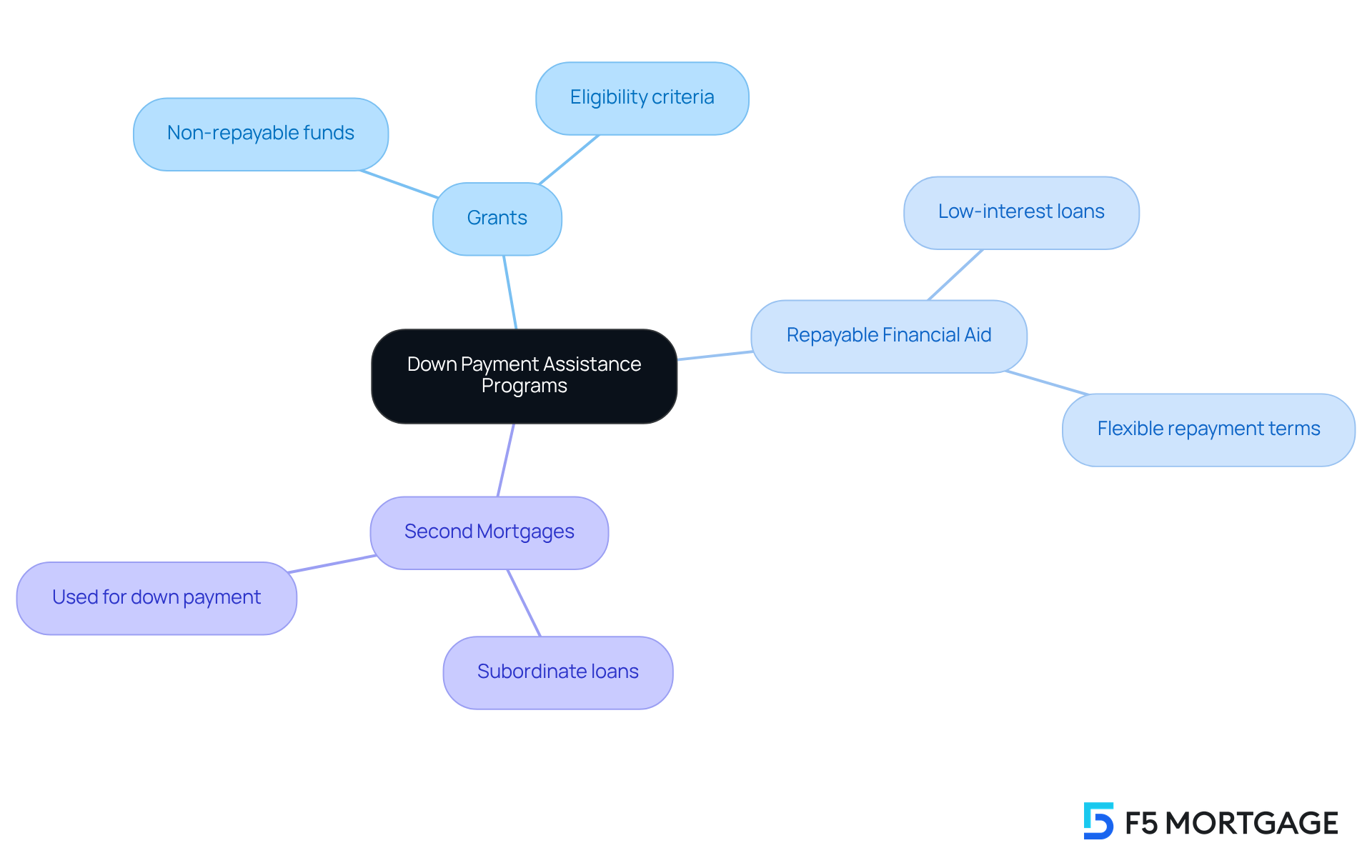

Down Payment Assistance Programs: Overcoming Financial Barriers

programs are essential in helping homebuyers navigate the financial hurdles of . We understand how challenging it can be for many potential buyers to save enough for a down payment, which often stands as a significant barrier in the home buying journey. These initiatives provide crucial down payment assistance Florida to cover down payments and closing costs, making the dream of homeownership more attainable.

By offering various forms of support—such as grants, repayable financial aid, and second mortgages—these initiatives empower buyers to embark on their without the burden of high initial expenses. We’re here to , ensuring that your is as smooth as possible.

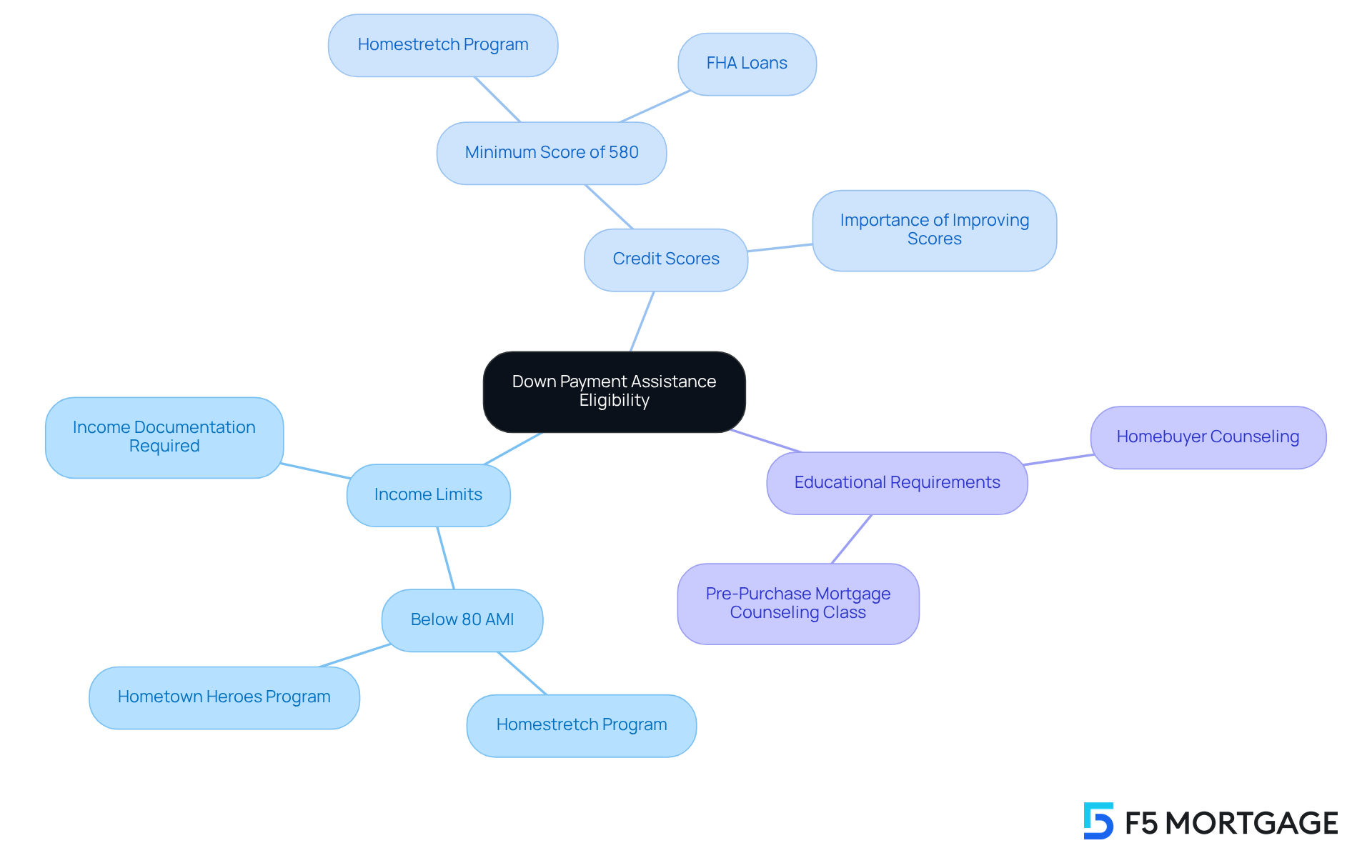

Eligibility Criteria for Down Payment Assistance: Navigating Your Options

Eligibility requirements for can significantly influence a homebuyer’s journey. In Ohio, prospective home purchasers have access to support ranging from a few thousand dollars to over $30,000, which may be offered as . Some initiatives provide loans that can be repaid or canceled over time, while grants require no repayment at all. Typically, these criteria include:

- Income limits

- Credit scores

- Educational requirements related to homebuyer counseling

For instance, many initiatives require applicants to earn below 80 percent of the Area Median Income, especially for the Homestretch Down Payment Assistance initiative, which has a minimum credit score requirement of 580. This approach ensures that assistance reaches those who truly need it, often necessitating documentation of income and assets.

Moreover, certain initiatives might impose additional requirements based on the type of property being purchased or its location. Understanding these nuances is essential for prospective buyers interested in , as it enables them to explore their options effectively and recognize the initiatives for which they may qualify.

Success stories highlight the impact of these programs, such as the , which provided a $25,000 deferred loan to first-generation homebuyers, helping them tackle upfront costs and secure stable housing. These initiatives not only facilitate homeownership but also promote economic stability and the potential for generational wealth.

As financial advisors emphasize, being well-informed about [down payment assistance Florida](https://f5mortgage.com/loan-programs/down-payment-assistance/texas) is crucial. They recommend that individuals looking to purchase a home focus on and gathering necessary documentation to enhance their chances of qualifying for these valuable programs. By understanding eligibility requirements and utilizing available resources, toward realizing their homeownership aspirations.

Additionally, from clients, boasting 5/5 star reviews on platforms like Lending Tree, Google, and Zillow. This showcases the team’s expertise and unwavering support throughout the loan process. Such a enriches the home buying experience, positioning F5 Mortgage as a trustworthy partner in navigating down payment support options.

Explore Other First-Time Homebuyer Programs by State: Maximizing Assistance Opportunities

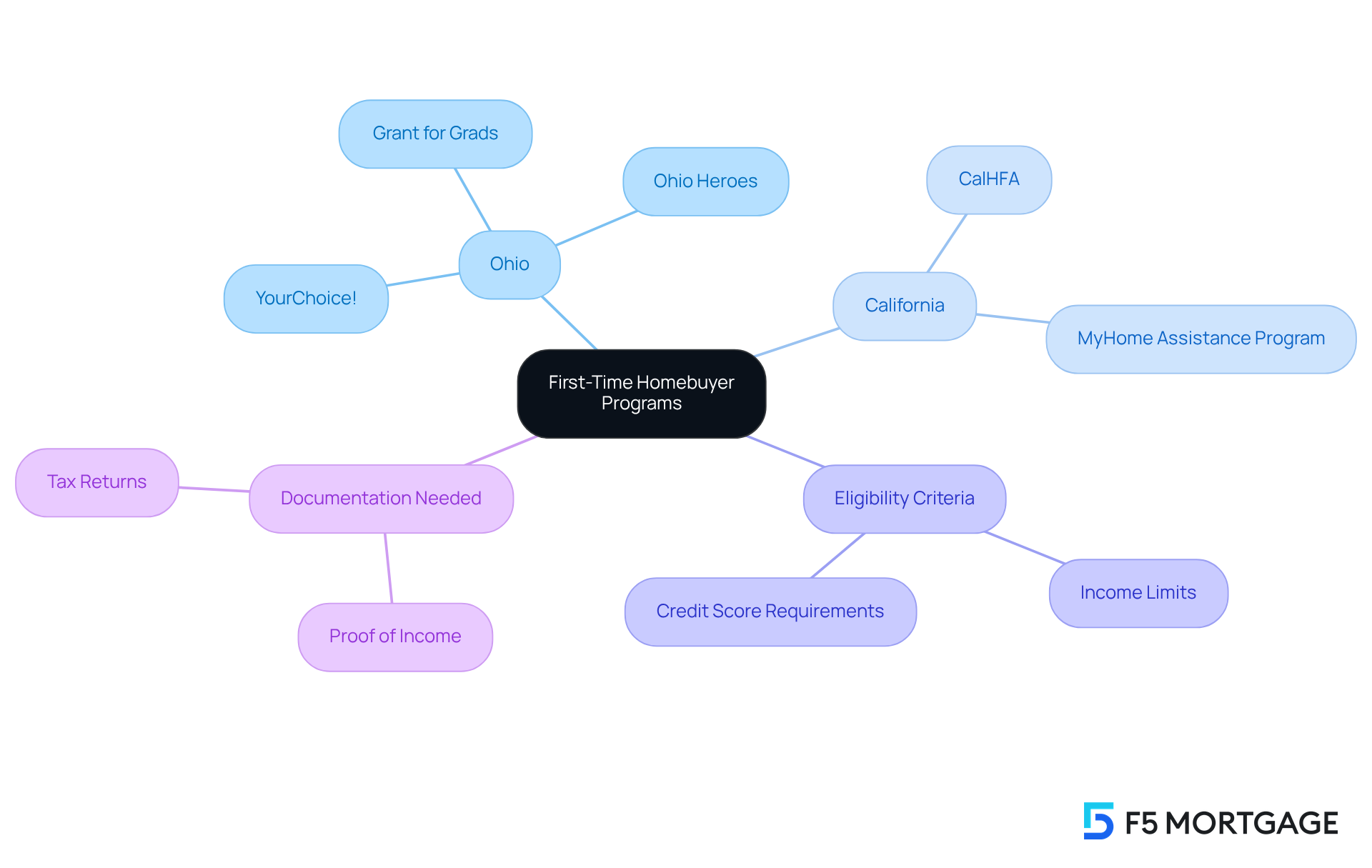

Homebuyers, we understand how daunting the journey to owning a home can be. That’s why it’s essential to explore available in other states. Many states offer unique support options tailored to their residents. For instance, in Ohio, programs like YourChoice!, Grant for Grads, and Ohio Heroes provide valuable assistance for . This support can significantly ease the , making it vital for buyers to investigate which option aligns best with their needs.

To fully leverage these opportunities, it’s important for buyers to consider the for these programs. Gathering necessary documentation, such as proof of income and tax returns, will empower you in this process. like can also guide through the , ensuring you take full advantage of the . This exploration can be especially beneficial if you’re contemplating relocating or investing in different areas. Remember, we’re here to support you every step of the way.

Conclusion

Navigating the path to homeownership in Florida can feel overwhelming, but various down payment assistance programs are here to help. These initiatives are vital for first-time homebuyers, easing financial burdens and making dream homes more attainable. By understanding the options available, you can find the support you need to embark on your homeownership journey with confidence.

In this article, we highlighted several key programs, including:

- The Florida Housing Homebuyer Program

- The Florida Hometown Heroes Program

- The FL Assist Second Mortgage Program

Each of these offers unique benefits, such as substantial financial assistance and favorable repayment terms, especially for community heroes. It’s essential to be aware of the eligibility criteria, as being well-informed and prepared is crucial when applying for these valuable resources.

As the landscape of homeownership evolves, exploring down payment assistance programs in Florida remains essential. By taking advantage of these offerings, you can significantly reduce your financial burden and enhance your chances of achieving homeownership. Embracing the available resources and seeking guidance from experienced lenders can empower you to navigate your options effectively. Remember, we know how challenging this can be, and we’re here to support you every step of the way towards a secure and fulfilling future in your new home.

Frequently Asked Questions

What services does F5 Mortgage offer?

F5 Mortgage provides personalized mortgage consultations and access to a network of over twenty lenders, offering various financing options such as fixed-rate mortgages, FHA mortgages, VA mortgages, and jumbo mortgages.

How does F5 Mortgage utilize technology in the mortgage application process?

F5 Mortgage employs advanced technology to streamline applications, enabling pre-approval in under an hour, which speeds up the process and provides clients with the necessary information and support throughout their mortgage journey.

What is the typical closing time for loans at F5 Mortgage?

Most loans at F5 Mortgage conclude in under three weeks, which is designed to address common challenges faced by homebuyers.

What kind of assistance does the Florida Housing Homebuyer Program provide?

The Florida Housing Homebuyer Program offers down payment assistance of up to $10,000 for down payments and closing costs, structured as a second mortgage with a 0% interest rate.

What are the eligibility criteria for the Florida Housing Homebuyer Program?

Applicants must meet specific income limits and complete a homebuyer education course to qualify for the Florida Housing Homebuyer Program.

What support does the Florida Hometown Heroes Program provide?

The Florida Hometown Heroes Program offers up to $35,000 in down payment assistance and closing cost support to first-time homebuyers who serve in essential community roles, such as healthcare workers and educators.

What are the qualification requirements for the Florida Hometown Heroes Program?

Applicants must meet specific income guidelines and complete a homebuyer education course to qualify for the Florida Hometown Heroes Program.

How has the Florida Housing Homebuyer Program impacted first-time buyers in 2025?

In 2025, there has been a significant increase in first-time buyers utilizing the Florida Housing Homebuyer Program, demonstrating its positive impact on the housing market and family lives throughout Florida.