Overview

The primary focus of this article is to guide you through the essential steps for securing a mortgage loan pre-approval. We understand how challenging this process can be, and we want to ensure you feel prepared and confident. It’s crucial to gather the necessary documentation and fully understand the terms of pre-approval. This preparation not only enhances your credibility but also strengthens your negotiating power in the competitive housing market.

By taking these steps, you empower yourself as a buyer, making the journey smoother and more manageable. Remember, we’re here to support you every step of the way, helping you navigate through any uncertainties you may face. With thorough preparation, you can approach the housing market with greater assurance and peace of mind.

Introduction

Navigating the path to homeownership can feel overwhelming, especially in a competitive real estate market where every advantage counts. We understand how challenging this can be. Securing a mortgage loan pre-approval is not merely a formality; it is a strategic move that empowers buyers. It clarifies budgets and enhances your standing with sellers, giving you a vital edge in your journey.

Yet, many prospective homeowners find themselves uncertain about the steps involved in achieving this essential milestone. What critical actions must be taken to ensure a smooth pre-approval process? How can you effectively leverage this advantage in your home buying journey? We’re here to support you every step of the way, guiding you through the process with empathy and expert advice.

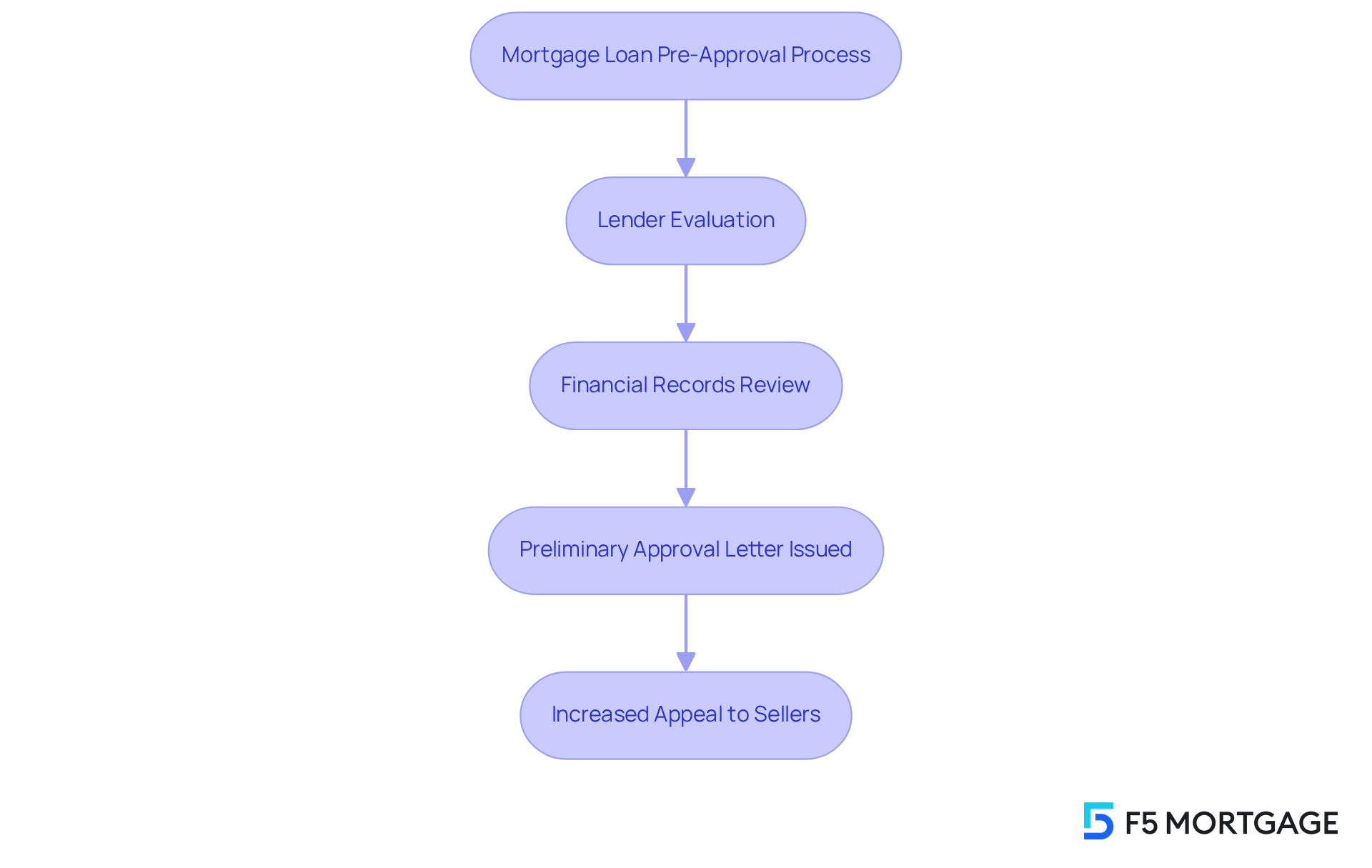

Understand Mortgage Loan Pre-Approval

Mortgage loan pre-approval is a vital step in the home buying process. It’s where a lender conducts a thorough evaluation of your financial situation to determine how much they are willing to lend for your dream home. Unlike pre-qualification, which relies on self-reported data and only provides a rough estimate, pre-authorization involves a detailed examination of your financial records, including credit history, income, and current debts. This rigorous process culminates in a preliminary approval letter that specifies the maximum loan amount you can borrow. This significantly enhances your appeal to sellers in a competitive market.

The importance of securing prior authorization for mortgage loan pre-approval cannot be overstated. It not only clarifies your budget but also strengthens your negotiating position when making an offer on a property. In fact, over 70% of homebuyers obtain prior authorization before they even start their house-hunting journey. This proactive approach signals to sellers that you are a serious buyer, increasing your chances of success in bidding wars, where the average home receives about 4.8 offers per sale. Most sellers are unlikely to consider proposals without an authorization document, highlighting the urgency of securing this essential paperwork.

Financial advisors emphasize that obtaining a mortgage loan pre-approval document is crucial in today’s fast-paced housing market. Peter Warden, Editor of The Mortgage Reports, points out that “there are way more buyers than homes in today’s market — which means you need to be ultra-prepared if you want to win a bidding war.” A preliminary approval letter provides a clear budget for house hunting and assures sellers of your financial readiness to move forward with a purchase. By understanding the key differences between loan authorization and pre-qualification, you can navigate the mortgage landscape more effectively, ensuring a smoother path to homeownership. We know how challenging this can be, and we’re here to .

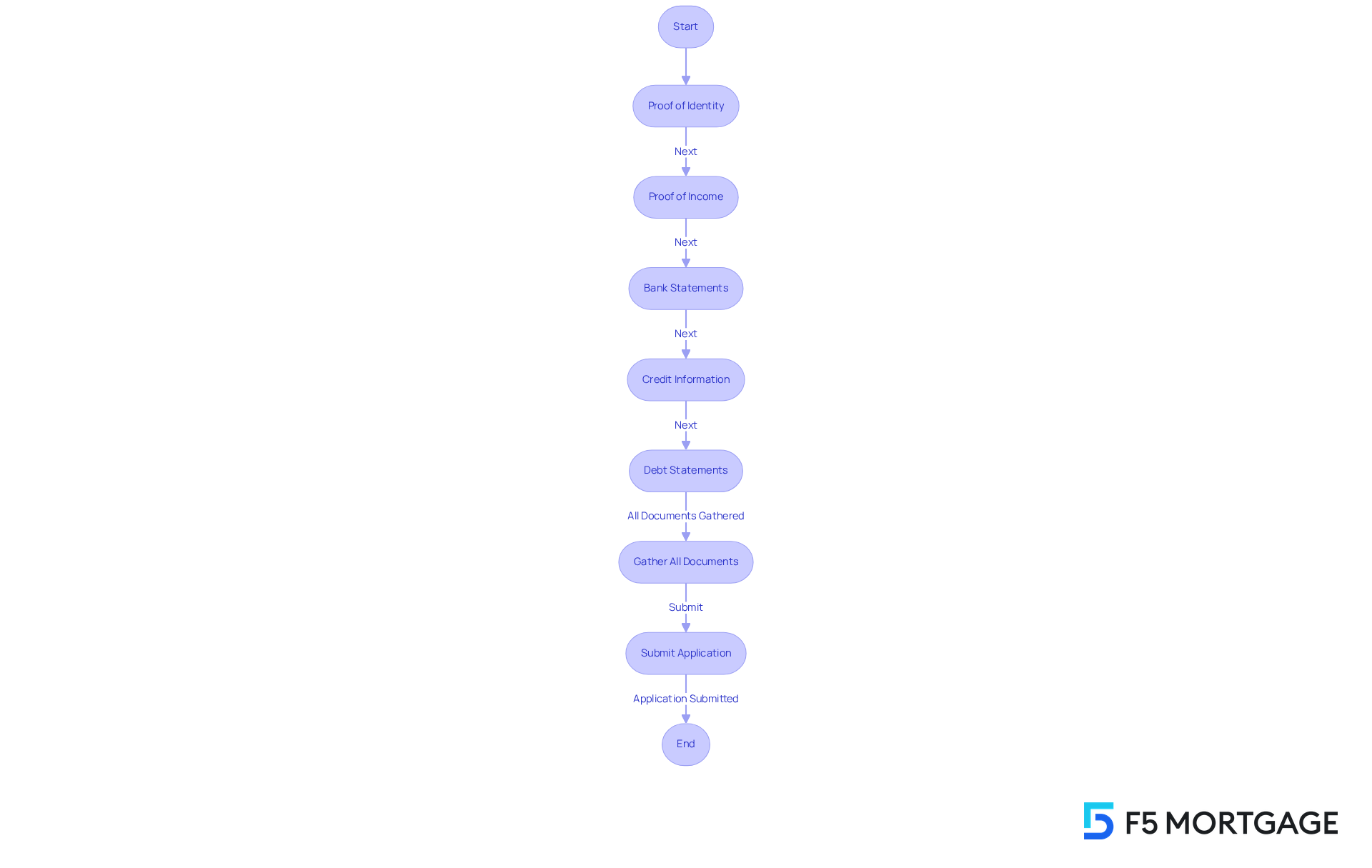

Gather Necessary Documentation

To obtain your mortgage loan pre-approval, we understand how crucial it is to gather several important documents that financial institutions typically require. Let’s walk through these together:

- Proof of Identity: You’ll need a government-issued photo ID, such as a driver’s license or passport, to verify your identity.

- Proof of Income: Recent pay stubs, W-2 forms, or tax returns from the past two years are essential. If you’re self-employed, additional documentation like 1099 forms may be necessary to demonstrate income stability.

- Bank Statements: It’s important to provide recent statements from all your bank accounts. This helps verify your assets and savings, ensuring you have enough funds for the down payment and closing costs.

- Credit Information: While financial institutions will conduct a hard credit inquiry—potentially lowering your credit score by a few points—it’s beneficial to check your credit score beforehand. This way, you can identify and resolve any discrepancies that might affect your initial approval.

- Debt Statements: You’ll need documentation of any existing debts, including student loans, car loans, and credit card statements. This information is vital for assessing your debt-to-income ratio (DTI). Maintaining a DTI below 36% is preferred for conventional loans, making this documentation critical in the approval process.

Having these documents organized and ready can significantly streamline your application process. This preparation allows your lender to make a timely decision, enhancing your chances of securing the mortgage you need. Remember, pre-authorization letters typically expire after 60 to 90 days, so timely preparation is key. We’re here to .

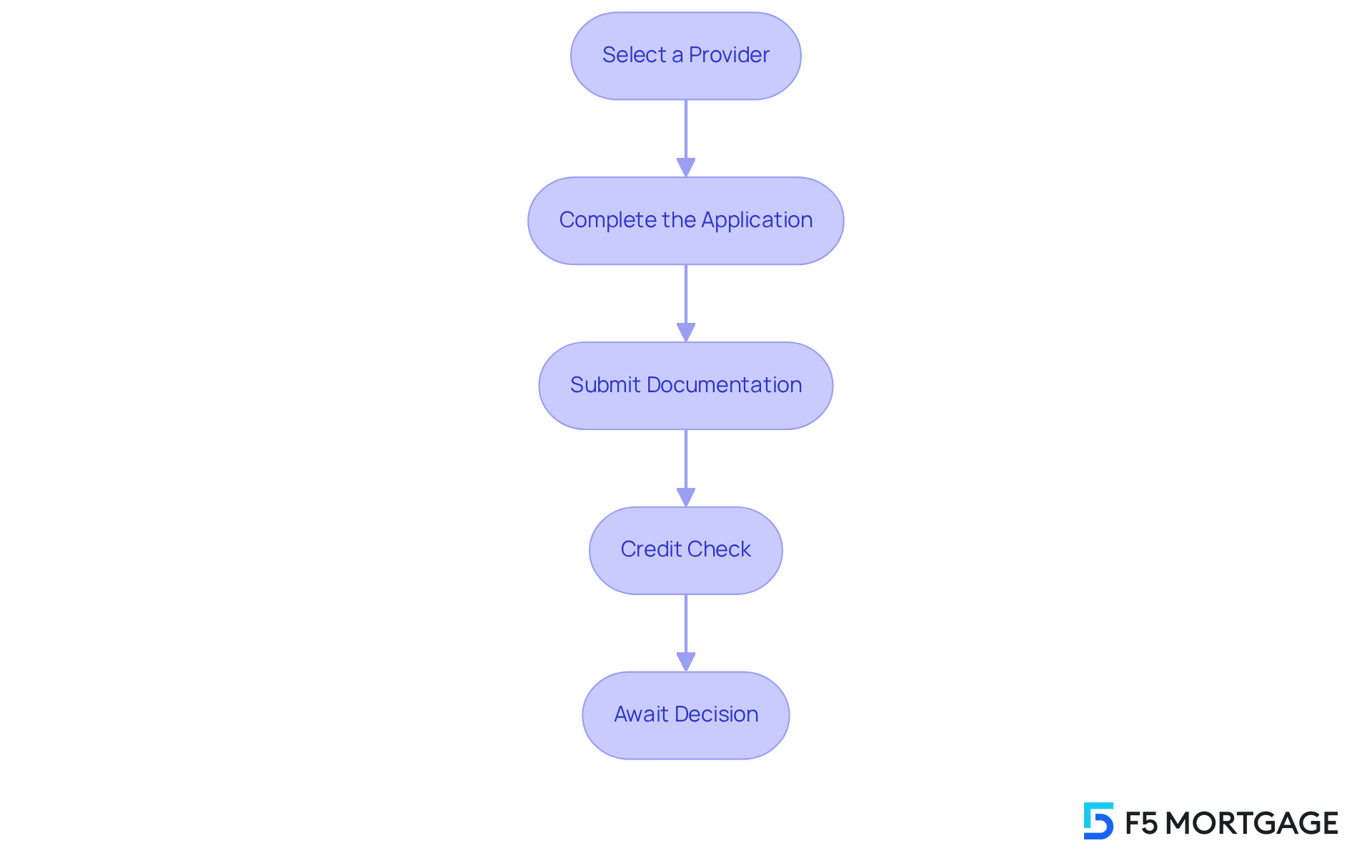

Apply for Mortgage Pre-Approval

Navigating the mortgage pre-approval process can feel overwhelming, but we’re here to support you every step of the way. To make this journey easier, follow these essential steps:

- Select a Provider: Start by exploring financial institutions that offer competitive rates and favorable terms. While F5 Mortgage stands out for its , it’s important to compare several providers. This way, you can ensure you’re securing the best rates possible.

- Complete the Application: Once you’ve chosen a provider, fill out the mortgage application form they provide. Many institutions offer online applications for added convenience, making this step simpler for you.

- Submit Documentation: Along with your application, submit all necessary documentation, including proof of income, banking information, and tax forms. Remember, accuracy and completeness are crucial to avoid any delays in the process.

- Credit Check: Be prepared for the financial institution to conduct a credit check to evaluate your creditworthiness. A credit score of at least 620 is generally recommended, with scores above 740 qualifying for the best rates. It’s important to note that the average rejection rate for mortgage applications has increased to nearly 21 percent. Additionally, about 28 million Americans are ‘credit invisible‘ with no credit history, underscoring the importance of maintaining a strong credit profile.

- Await Decision: After submitting your application, the lender will review your information and usually notify you of their decision within a few business days. Keep in mind that mortgage pre-qualification typically expires in three months or less, so acting quickly is essential.

By following these steps, you can navigate the mortgage approval process more effectively, enhancing your chances of obtaining favorable financing for your new home. We know how challenging this can be, but with the right preparation, you can achieve your homeownership dreams.

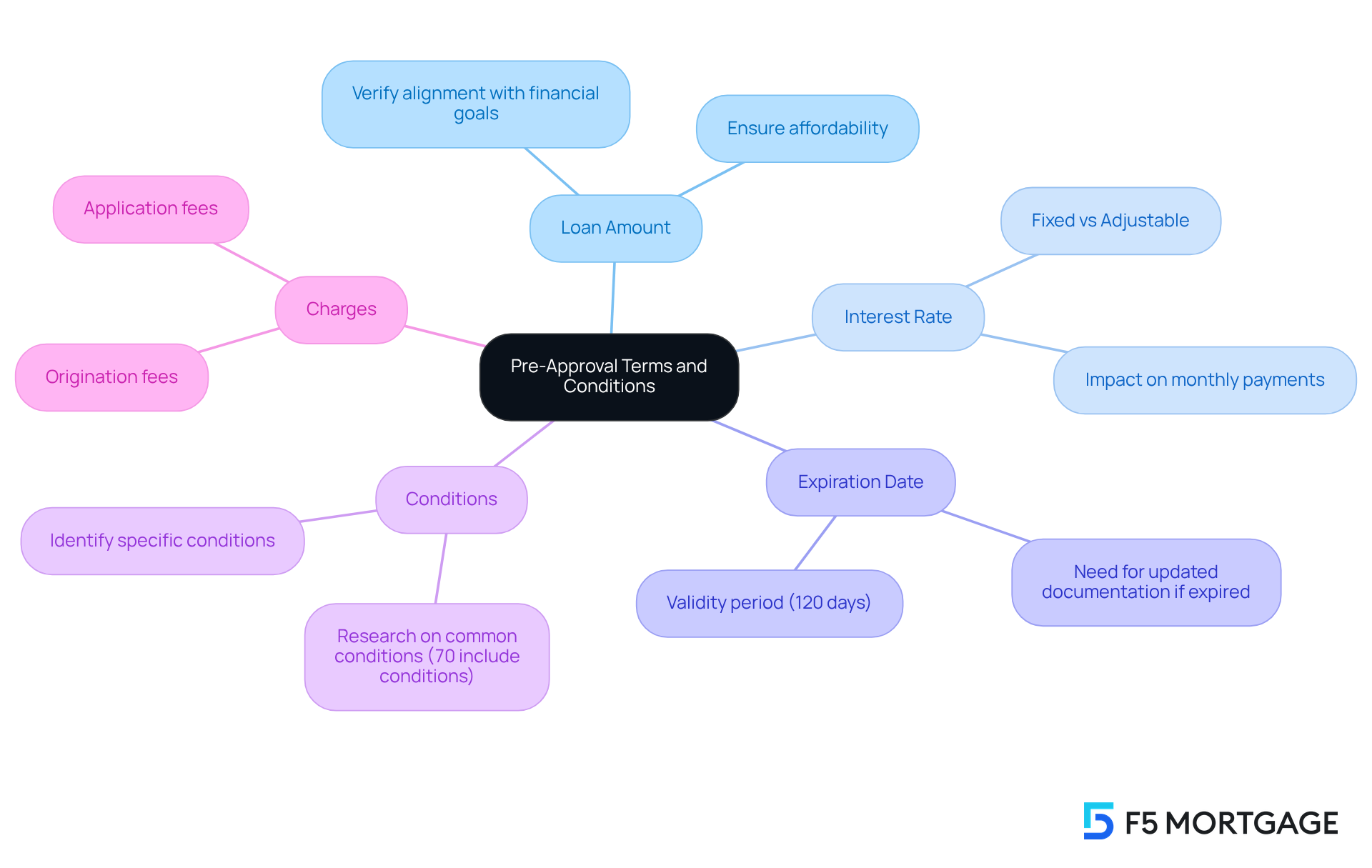

Review Pre-Approval Terms and Conditions

Upon receiving your , we know how crucial it is to examine the terms and conditions to ensure a seamless property purchasing experience. Here are key elements to review:

- Loan Amount: Verify that the pre-approved amount aligns with your financial goals and budget. This figure should reflect what you can comfortably afford.

- Interest Rate: Assess the interest rate provided, noting whether it is fixed or adjustable. Fixed rates remain constant throughout the loan term, while adjustable rates can fluctuate, impacting your monthly payments and overall loan cost. Understanding these implications is crucial.

- Expiration Date: Pre-approval documents usually have an expiration date, typically lasting around 120 days. Be mindful of this timeline to ensure you complete your home purchase within the validity period.

- Conditions: Identify any conditions that must be satisfied before final approval. Research indicates that approximately 70% of initial approval letters include specific conditions that may require additional documentation or meeting certain financial criteria, which can vary by lender.

- Charges: Get to know any charges related to the prior approval process, such as application or origination fees. Knowing these costs upfront can help you budget effectively.

As Pappy Johnson, VP Senior Mortgage Loan Officer, states, “Securing a mortgage in advance is essential for potential homebuyers.” By thoroughly examining these conditions, you empower yourself to make knowledgeable choices and confidently progress in your property purchasing journey. Remember, we’re here to support you every step of the way.

Proceed with Home Buying After Pre-Approval

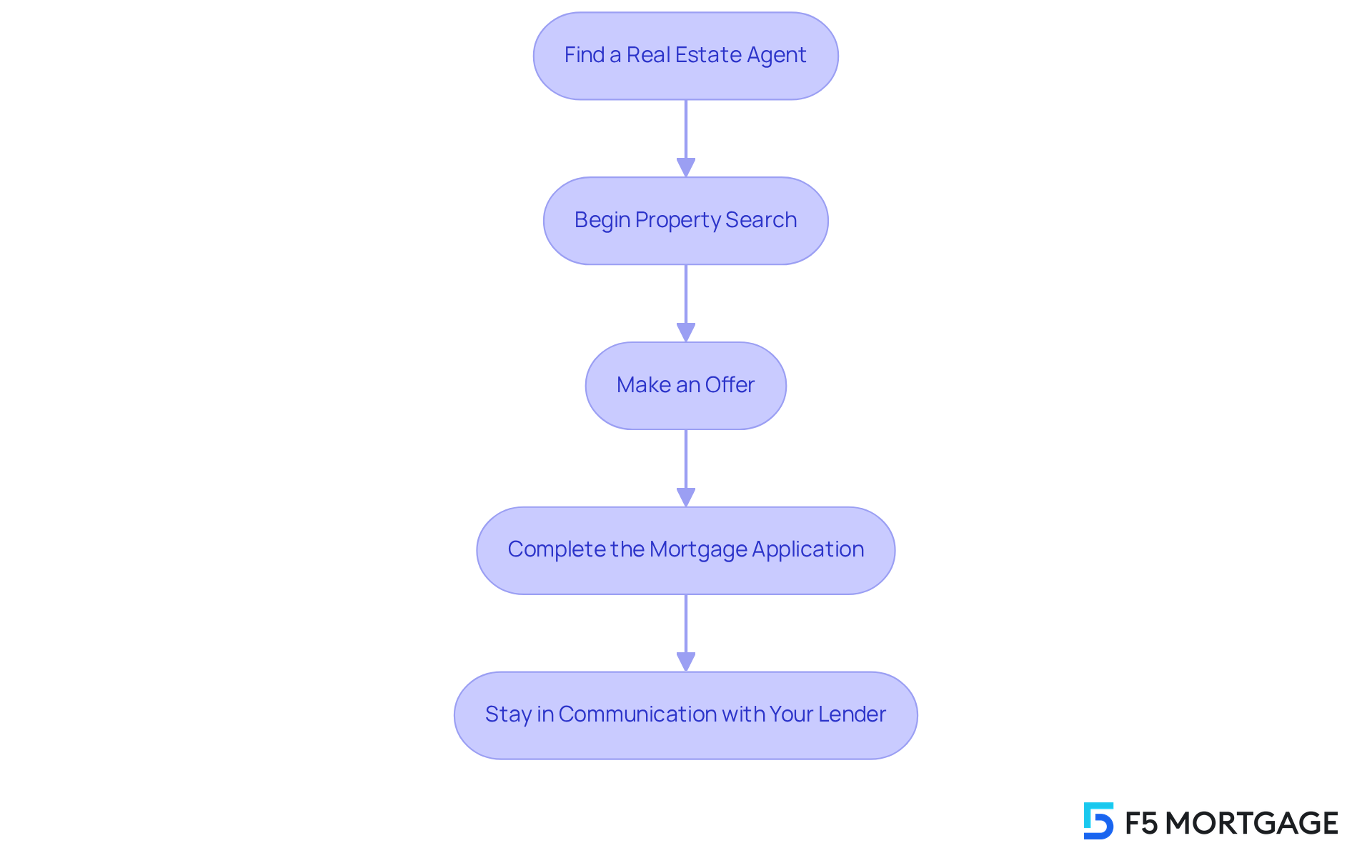

Once you obtain your mortgage authorization, you are well-positioned to begin your property purchasing journey. We understand how exciting yet overwhelming this process can be. Here’s how to maximize the advantages of your pre-approval:

- Find a Real Estate Agent: Work with a knowledgeable real estate agent who understands the local market and can assist you in discovering properties that meet your needs. Their expertise will help ease your concerns.

- Begin Property Search: Equipped with your pre-approval document, you can confidently investigate residences within your budget. This message indicates to sellers that you are a serious buyer, boosting your credibility and making your search more effective.

- Make an Offer: When you discover a home that captures your interest, work closely with your agent to craft a competitive offer. Including your pre-approval letter can significantly strengthen your position against other buyers, giving you peace of mind.

- Complete the Mortgage Application: Once your offer is accepted, you will need to finalize the mortgage application process with your financial institution, providing any necessary documentation. We know how challenging this can be, but your agent will guide you through it.

- Stay in : Keep your lender informed about any changes in your financial situation and promptly address any requests for additional information. Open communication is key to a smooth process.

By adhering to these steps, you can navigate the home buying process with confidence and efficiency, ensuring a smoother transition into your new home. Remember, we’re here to support you every step of the way.

Conclusion

Securing a mortgage loan pre-approval is a pivotal step in your home buying journey. We know how challenging this can be, and obtaining pre-approval provides the clarity and confidence needed to navigate a competitive market. Not only does this process establish a clear budget, but it also significantly enhances your appeal to sellers. This makes pre-approval an essential strategy for anyone looking to purchase a home.

Throughout this article, we’ve outlined key steps to ensure a successful mortgage pre-approval:

- Understanding the importance of pre-approval

- Gathering necessary documentation

- Applying for pre-approval

- Reviewing terms

Each phase is designed to equip you with the tools you need for effective homeownership. By following these steps, you can improve your chances of securing favorable financing and streamline your home buying experience.

Ultimately, the journey to homeownership is about preparation and empowerment. By prioritizing mortgage loan pre-approval, you position yourself as a serious buyer and gain a competitive edge in a crowded market. Embrace this process, stay organized, and leverage this powerful tool to turn your homeownership dreams into reality. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is mortgage loan pre-approval?

Mortgage loan pre-approval is a process where a lender evaluates your financial situation to determine the maximum amount they are willing to lend you for a home. This involves a detailed examination of your financial records, including credit history, income, and current debts, resulting in a preliminary approval letter.

How does pre-approval differ from pre-qualification?

Pre-approval involves a thorough evaluation of your financial records and provides a specific loan amount, while pre-qualification is based on self-reported data and offers only a rough estimate of what you might qualify for.

Why is mortgage loan pre-approval important?

Pre-approval clarifies your budget and strengthens your negotiating position when making an offer on a property. It signals to sellers that you are a serious buyer, increasing your chances of success in competitive bidding situations.

What percentage of homebuyers obtain mortgage loan pre-approval before house hunting?

Over 70% of homebuyers secure mortgage loan pre-approval before starting their house-hunting journey.

What documents are necessary for obtaining mortgage loan pre-approval?

Necessary documents include:

- Proof of Identity (government-issued photo ID)

- Proof of Income (recent pay stubs, W-2 forms, or tax returns)

- Bank Statements (recent statements from all bank accounts)

- Credit Information (check your credit score and allow for a hard inquiry)

- Debt Statements (documentation of existing debts)

How can I prepare for the mortgage loan pre-approval process?

Organize the required documents listed above to streamline your application process. This preparation allows your lender to make a timely decision, enhancing your chances of securing the mortgage you need.

How long is a pre-approval letter valid?

Pre-approval letters typically expire after 60 to 90 days, so timely preparation is crucial.