Overview

We understand how challenging it can be to determine what home you can afford. To help you navigate this important journey, it’s essential to assess your financial situation. Start by:

- Calculating your monthly budget

- Evaluating your debt-to-income ratio

- Exploring your down payment options

- Considering the different types of loans available

Utilizing mortgage calculators can provide clarity and help you visualize your options. Additionally, getting pre-approved for a mortgage is a crucial step that empowers you in the home-buying process. Remember, these five steps are not just numbers; they are vital tools that can guide you toward making informed decisions about homeownership.

By understanding your financial capacity and using the resources available, you can approach this journey with confidence. We’re here to support you every step of the way.

Introduction

Navigating the complex world of home buying can feel like an overwhelming puzzle. We understand how challenging this can be, especially when determining what home you can truly afford. A clear understanding of your personal finances is essential; it lays the foundation for making informed decisions throughout the mortgage process. This article provides a step-by-step guide to help you evaluate your financial situation, calculate budgets, and explore various loan options.

But how can you ensure that you strike the right balance between your dream home and financial reality? We’re here to support you every step of the way.

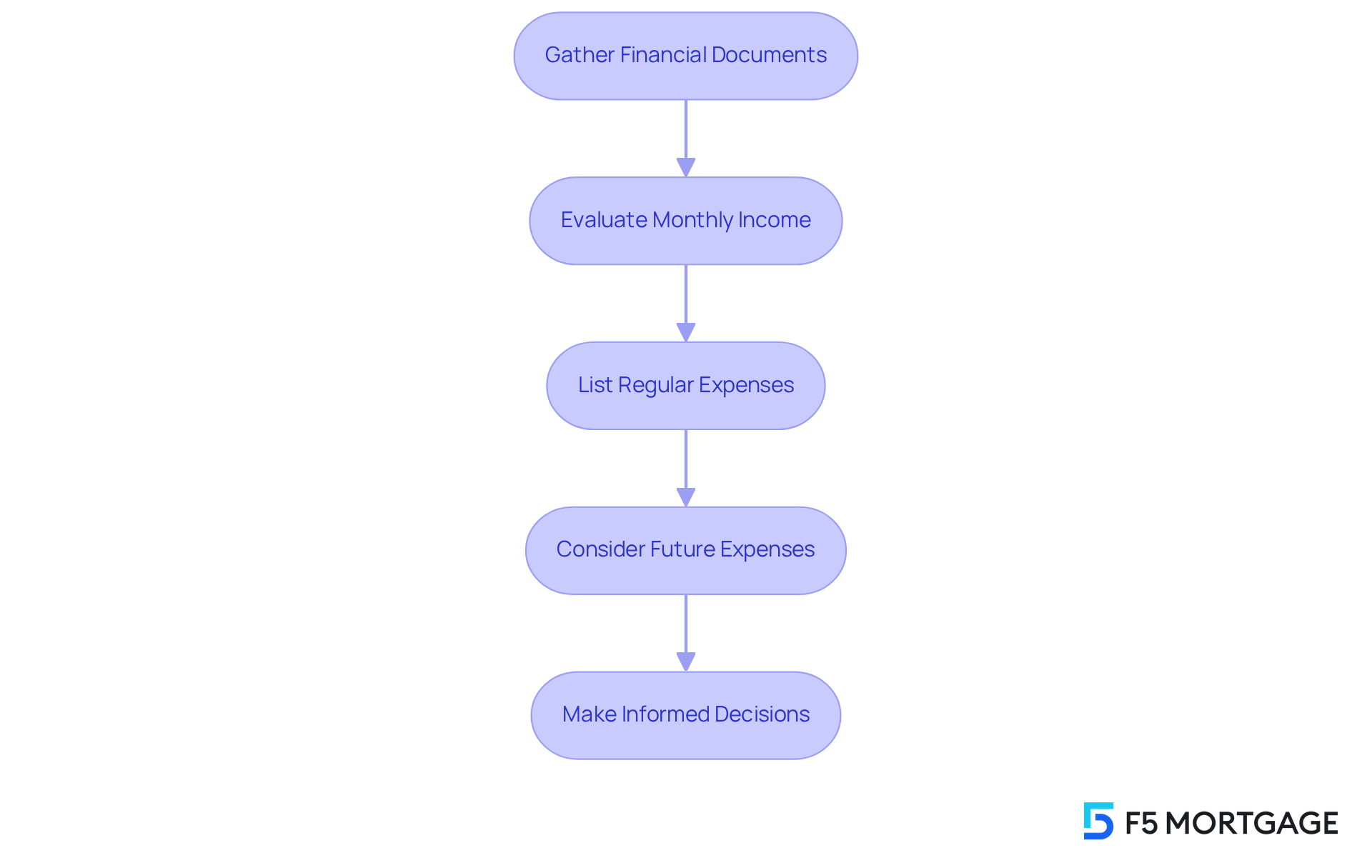

Understand Your Financial Situation

We understand how overwhelming financial planning can be, especially when considering a mortgage. Begin by gathering all relevant financial documents—your income statements, tax returns, and current debts. Take a moment to evaluate your overall income for the month, including salaries, bonuses, and any extra sources of revenue.

Next, list all your regular expenses, such as utilities, groceries, and current debt obligations. This comprehensive overview will assist you in understanding what home you can afford by showing how much you can comfortably allocate toward a mortgage expense without straining your finances. Remember, it’s also important to consider future expenses, like property taxes and homeowners insurance, as these will impact your budget moving forward.

By taking these steps, you’re empowering yourself to make informed decisions. We’re here to support you every step of the way, ensuring you feel confident in your financial journey.

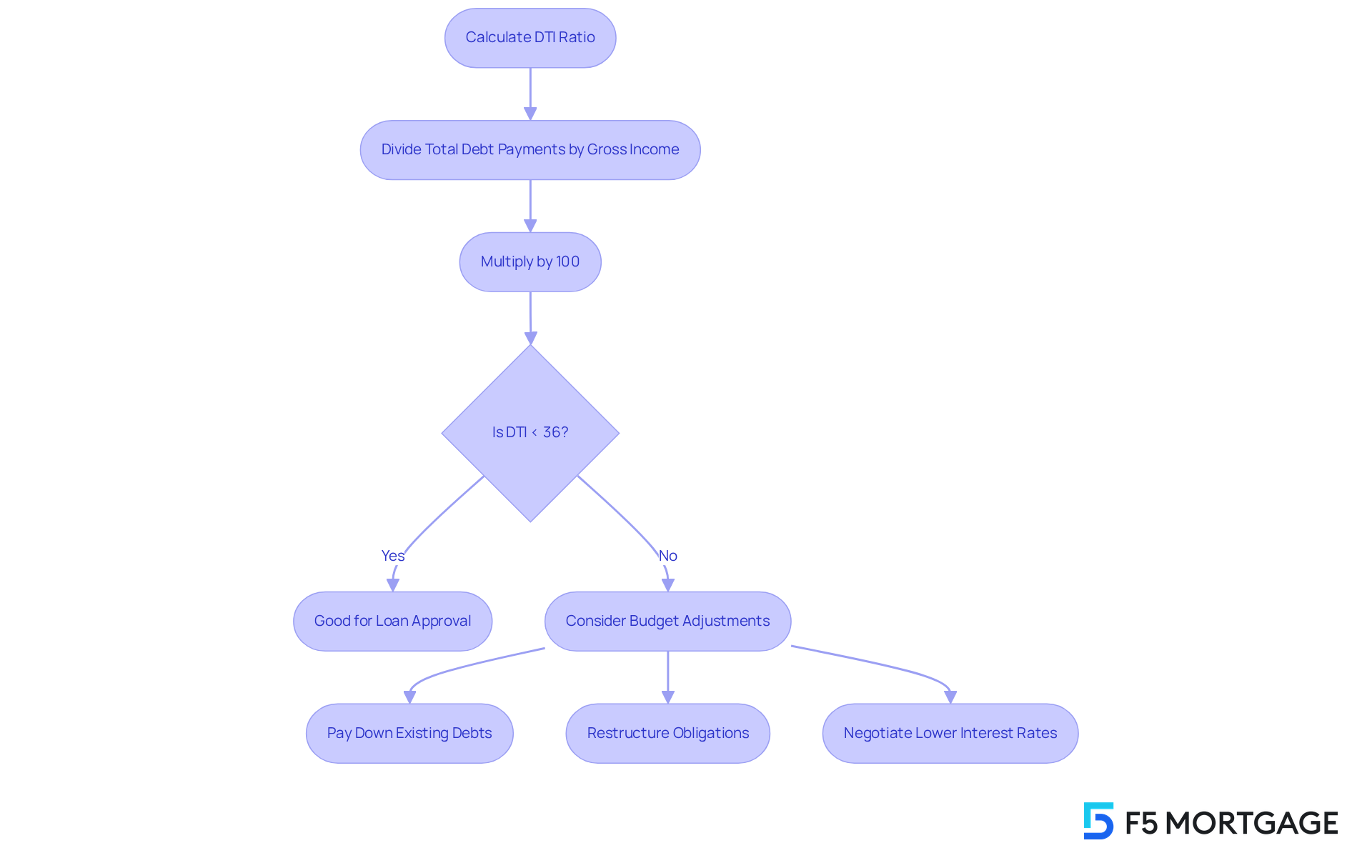

Calculate Your Monthly Budget and Debt-to-Income Ratio

To determine your debt-to-income (DTI) ratio, start by dividing your total debt payments by your gross income and then multiply by 100. Ideally, we recommend keeping your DTI below 36%, with no more than 28% allocated to housing costs. For example, if your monthly debts amount to $1,200 and your gross income is $4,000, your DTI ratio would be 30%. This calculation is essential; it helps you determine what home can I afford while maintaining your financial stability.

Having a DTI ratio of 36% or less is beneficial for loan approval, as it helps answer the question of what home can I afford by indicating a lower risk of default. To enhance your financial health, consider adjusting your budget to stay within these recommended limits. Many families successfully managing their DTI ratios prioritize:

- Paying down existing debts

- Restructuring larger obligations

- Negotiating with creditors for lower interest rates

Remember, a lower DTI not only boosts your chances of loan approval but also positions you for better financing options in the future.

If your DTI exceeds 36%, be aware that you may need to meet specific credit score and reserve requirements to qualify for a mortgage. We know how challenging this can be, but we’re here to support you every step of the way. Taking these steps can lead to a more secure financial future for you and your family.

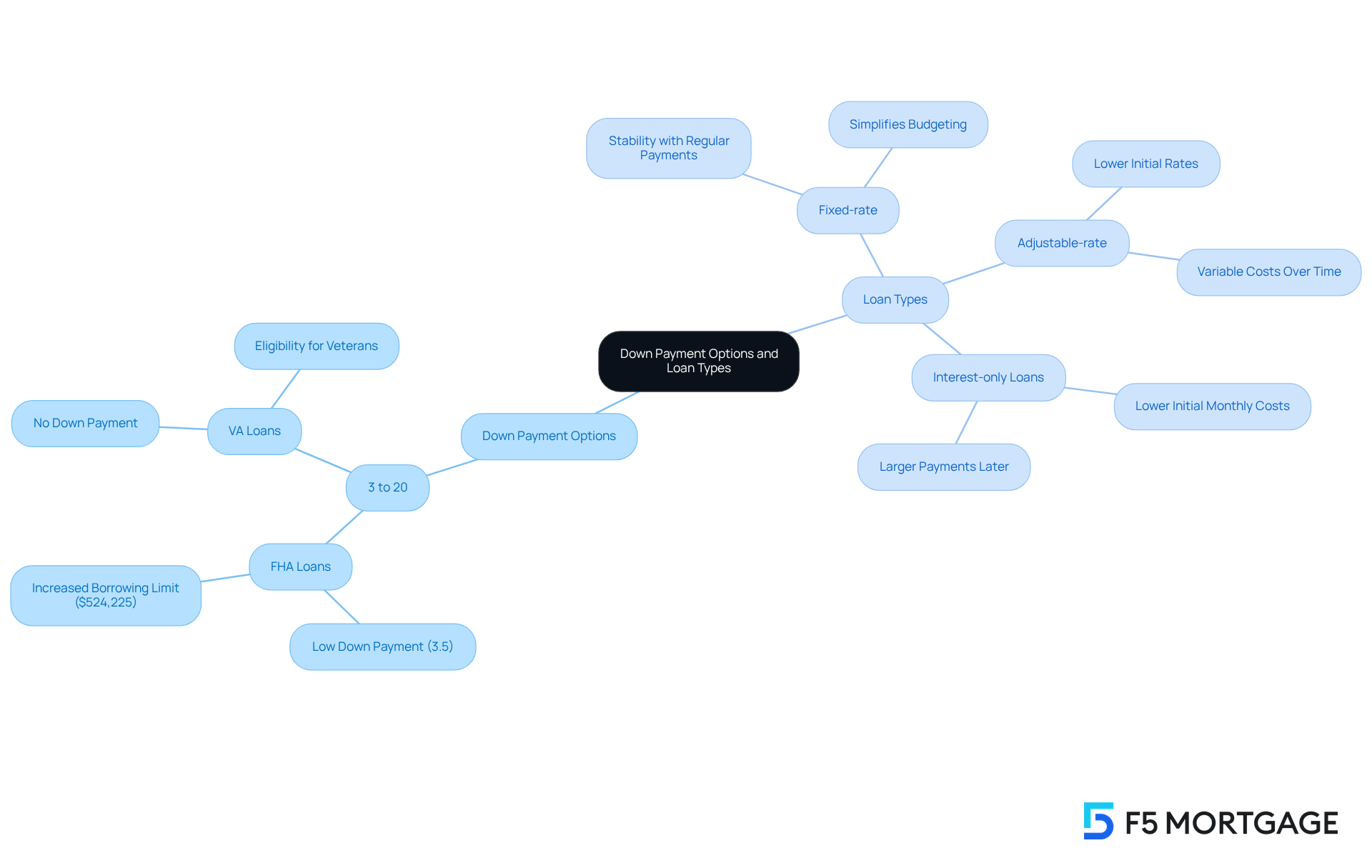

Consider Down Payment Options and Loan Types

When examining deposit choices, we know how challenging this can be. It’s crucial to understand that they can differ considerably, usually falling between 3% to 20% of the property’s purchase cost. For instance, FHA loans permit qualifying borrowers to provide a down sum as low as 3.5%, whereas VA loans present eligible veterans the chance to buy a home with no initial contribution whatsoever. In 2025, the FHA raised borrowing limits to $524,225 in most areas, which can enhance affordability for families looking to maintain their savings while entering the housing market.

It is essential to grasp what home can I afford while providing a down payment without depleting your savings. Additionally, it’s important to research different types of mortgage loans available, including:

- Fixed-rate

- Adjustable-rate

- Interest-only loans

Each category offers unique benefits and drawbacks that can affect your regular expenses and overall financial well-being.

For example, fixed-rate loans offer stability with regular installments, simplifying budgeting. Conversely, adjustable-rate mortgages may provide lower initial rates but can result in varying costs over time. Interest-only loans can initially reduce monthly costs but may lead to larger amounts later on when the principal needs to be repaid.

As you consider these options, we’re here to support you every step of the way. Consulting with financial advisors can provide tailored advice based on your unique situation. Financial specialist Melissa Cohn highlights that ‘the best priced loans will require a larger deposit, so the less you contribute, the higher the rate becomes, the greater the risk.’ Their insights can assist you in navigating the complexities of home financing and selecting the loan type that best aligns with your long-term financial objectives.

Moreover, investigating down deposit assistance initiatives designed for particular states can offer additional help in your property purchasing journey. With the right information and support, families can make informed decisions regarding what home can I afford to enhance their homeownership journey.

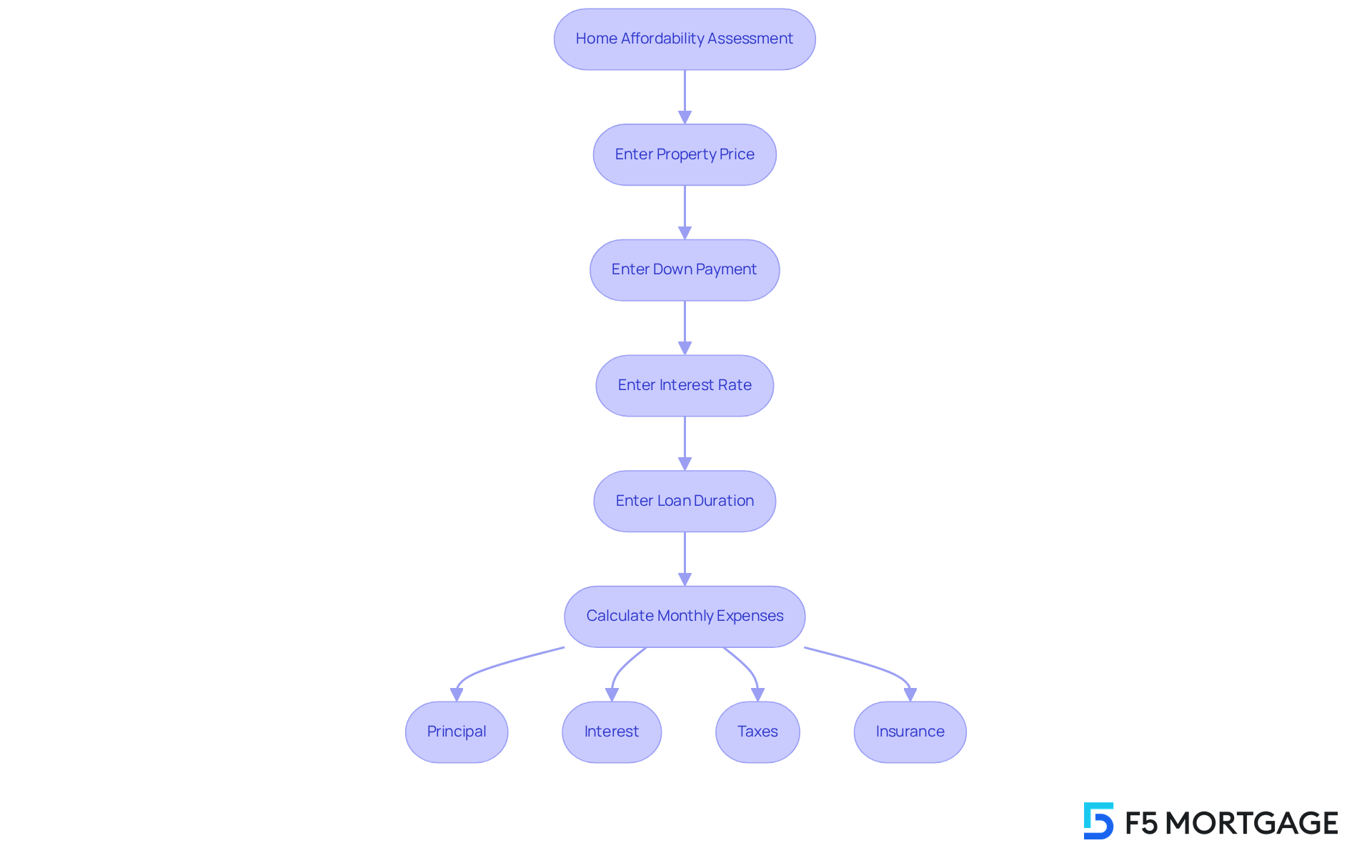

Utilize Mortgage Calculators for Accurate Estimates

Using online loan calculators is essential for figuring out what home can I afford. By entering your desired property price, down payment, interest rate, and loan duration, these tools provide estimates for your monthly mortgage expenses, which include principal, interest, taxes, and insurance. For instance, families can explore various scenarios—adjusting the initial amount or interest rates—to see how these changes impact their regular expenses. This practice not only helps in identifying what home can I afford but also ensures you remain within your budget.

Financial specialists recommend that your monthly housing expenses should ideally not exceed 30% of your gross income. In 2025, the average monthly loan payment for a $400,000 property is expected to be around $2,200, assuming a 3.5% interest rate and a 30-year fixed loan. To manage such a loan, families would need an annual income of approximately $130,000. It’s also important to factor in future expenses like property taxes, insurance, maintenance, and HOA fees when planning for homeownership. By utilizing loan calculators, families can determine what home can I afford, make informed decisions, set realistic budget goals, and enhance their readiness for the home buying journey.

Additionally, F5 Mortgage offers a streamlined application process with pre-approval in under an hour, which can significantly aid families in preparing for their property acquisition. We know how challenging this can be, and we’re here to support you every step of the way.

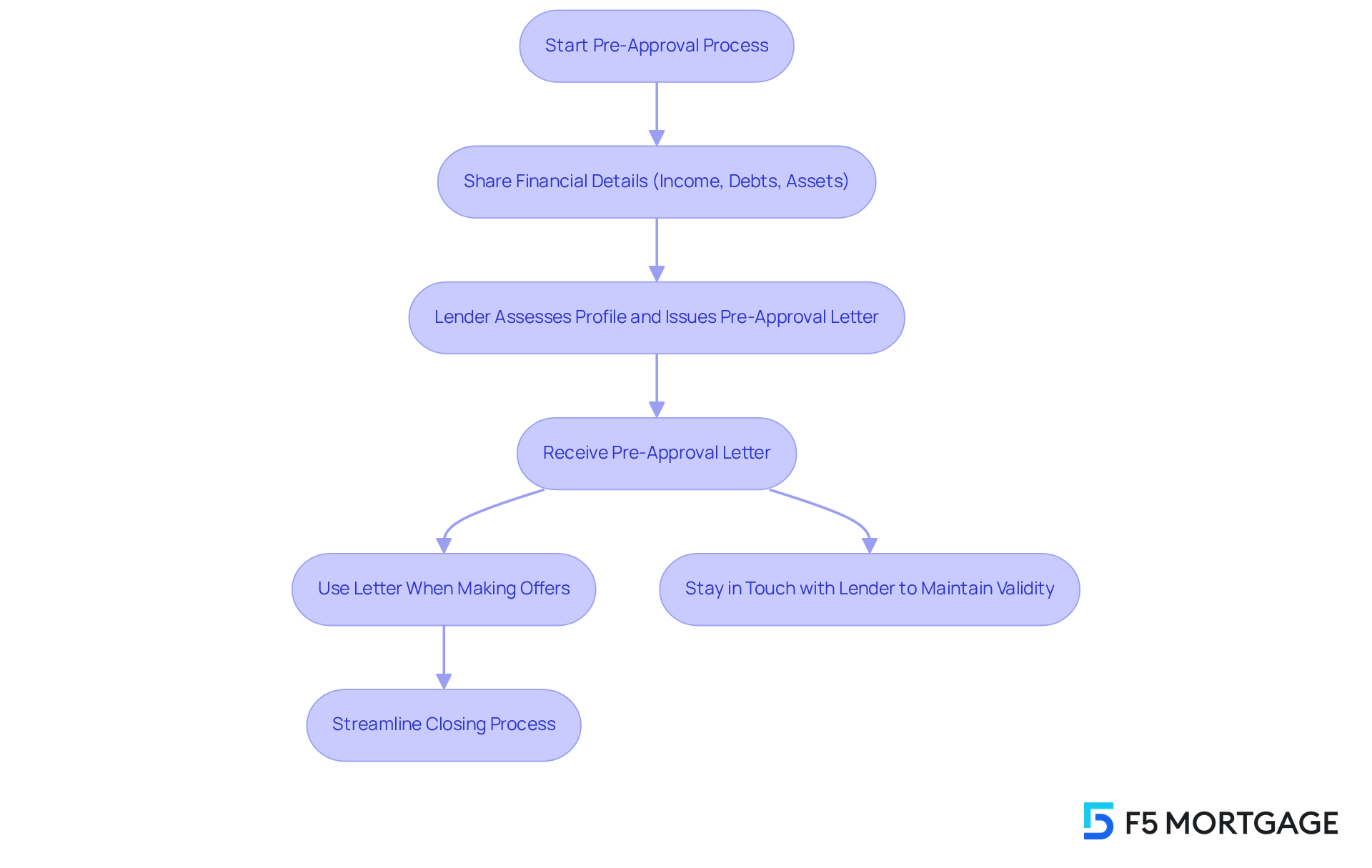

Get Pre-Approved for a Mortgage

To initiate the pre-approval process, we understand that reaching out to a mortgage broker or lender can feel daunting. Start by sharing your financial details, including income, debts, and assets. They will assess your financial profile and issue a pre-approval letter, specifying the amount you can borrow. This letter is crucial when making an offer on a property, as it shows sellers that you are a committed buyer with the necessary financial support.

Furthermore, obtaining pre-approval can significantly streamline the closing process once you find a suitable property. Much of the required paperwork will already be in order, easing your journey. Mortgage experts emphasize that getting pre-approved early not only clarifies your budget but also helps you determine what home can I afford, positioning you favorably in a competitive market.

In 2025, the average time to obtain pre-approval is anticipated to remain efficient, usually requiring under an hour. This allows families to act swiftly when they discover their perfect residence. Many families have successfully navigated the pre-approval process, leveraging it to enhance their home buying experience and secure favorable mortgage terms.

However, it’s important to remember that pre-approval letters can expire. Staying in touch with your lender is crucial to ensure your approval remains valid. We know how challenging this can be, but we’re here to support you every step of the way.

Conclusion

Understanding what home can be afforded is a crucial step in your journey to homeownership. We know how challenging this can be, but by taking a structured approach to financial planning, you can gain clarity on your financial situation. This clarity empowers you to make informed decisions about your housing options. This guide outlines essential steps that will help you navigate the complexities of mortgage financing with confidence.

Let’s start by assessing your financial situation. Carefully documenting your income and expenses is vital. Calculating your debt-to-income ratio will help maintain your financial stability. Additionally, exploring various down payment options and loan types is key. Utilizing mortgage calculators can further aid in estimating your monthly payments, ensuring that you stay within your budget. Remember, obtaining pre-approval for a mortgage not only streamlines the buying process but also positions you favorably in a competitive market.

Ultimately, determining what home you can afford is not just about numbers; it’s about making informed decisions that align with your long-term financial goals. By following these steps, you can enhance your readiness for the housing market, paving the way for a more secure and fulfilling homeownership experience. Taking action today—whether through financial assessments or consulting with experts—can significantly impact your ability to achieve the dream of owning a home. We’re here to support you every step of the way.

Frequently Asked Questions

What should I do to understand my financial situation before applying for a mortgage?

Begin by gathering all relevant financial documents, such as income statements, tax returns, and current debts. Evaluate your overall monthly income, including salaries and any extra revenue, and list all regular expenses like utilities and groceries. This will help you determine how much you can comfortably allocate toward a mortgage without straining your finances.

Why is it important to consider future expenses when planning for a mortgage?

Future expenses, such as property taxes and homeowners insurance, will impact your budget moving forward. Considering these costs ensures you have a comprehensive understanding of your financial situation and can make informed decisions about what home you can afford.

How do I calculate my debt-to-income (DTI) ratio?

To calculate your DTI ratio, divide your total debt payments by your gross income and multiply by 100. For example, if your monthly debts are $1,200 and your gross income is $4,000, your DTI ratio would be 30%.

What is the recommended DTI ratio for mortgage approval?

It is recommended to keep your DTI below 36%, with no more than 28% allocated to housing costs. A lower DTI ratio indicates a lower risk of default and enhances your chances of loan approval.

What steps can I take to improve my DTI ratio?

To improve your DTI ratio, consider paying down existing debts, restructuring larger obligations, and negotiating with creditors for lower interest rates. These actions can help you stay within the recommended limits and enhance your financial health.

What should I be aware of if my DTI exceeds 36%?

If your DTI exceeds 36%, you may need to meet specific credit score and reserve requirements to qualify for a mortgage. This can make the mortgage approval process more challenging, so it’s important to be prepared.