Overview

Securing mortgage prequalification can feel overwhelming, but we’re here to support you every step of the way. This article outlines four essential steps to help you navigate this process with confidence:

- Understanding the process

- Gathering required documentation

- Applying for prequalification

- Troubleshooting common issues

Each step is designed to empower you, offering practical guidance that emphasizes the importance of thorough preparation. We know how challenging this can be, and by proactively managing your financial health, you can significantly enhance your chances of successfully obtaining a mortgage prequalification. Remember, taking these steps is not just about paperwork—it’s about building a brighter future for you and your family.

Introduction

Navigating the path to homeownership can feel overwhelming, especially when it comes to understanding mortgage prequalification—a crucial first step in securing financing. We know how challenging this can be. This process not only clarifies your borrowing potential but also empowers you to address financial hurdles before you begin your house-hunting journey.

However, many prospective homeowners might wonder: what are the essential steps to ensure a smooth prequalification experience, and how can they avoid common pitfalls?

This guide will illuminate the four vital steps to secure mortgage prequalification, equipping you with the knowledge you need to approach this critical phase with confidence. We’re here to support you every step of the way.

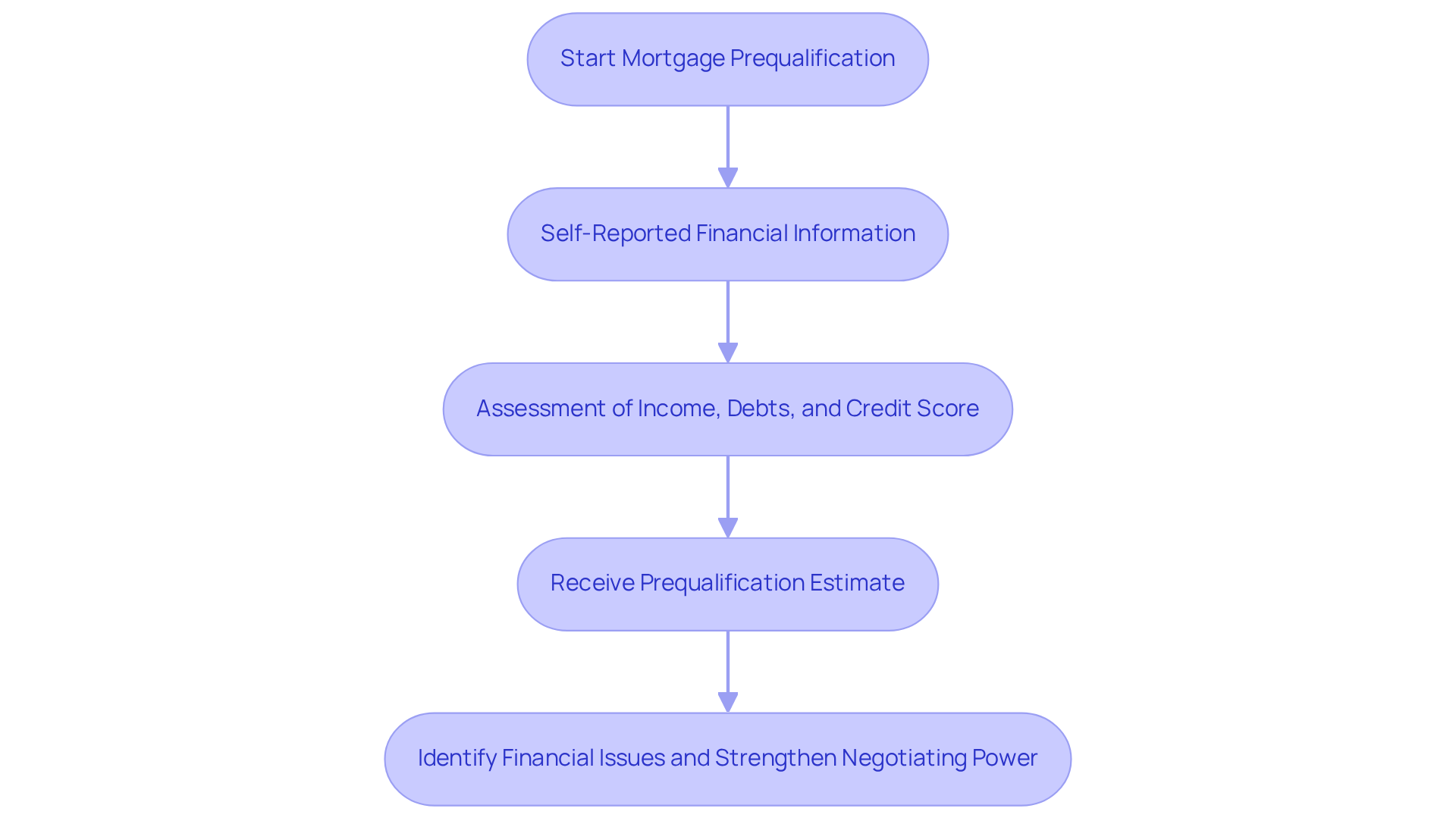

Understand Mortgage Prequalification

Prequalification for a mortgage is a crucial first step in your home buying journey. It’s where a lender estimates how much you might be able to borrow based on your self-reported financial information. This process typically includes a brief assessment of your income, debts, and credit score. While this preliminary assessment does not guarantee a loan, it serves as a and the types of properties you can consider. In 2025, over 60% of homebuyers are choosing to get approved in advance, recognizing its importance in streamlining their home search.

By getting prequalification, you can identify potential financial issues early. This proactive approach allows you to address them before you start house hunting. Not only does this enhance your confidence, but it also positions you as a serious buyer in the eyes of sellers. Financial advisors emphasize that obtaining prior approval can strengthen your negotiating power, making it easier to secure your dream home.

Successful stories abound, especially among first-time homebuyers who have utilized advance approval to navigate the competitive market effectively. One client shared, “I was puzzled initially, but the F5 lending team assisted me in navigating the initial qualification process, simplifying my understanding of the choices available.”

The key benefits of mortgage prequalification include:

- Gaining clarity on your borrowing capacity

- Understanding your financial standing

- Enhancing your overall experience in buying a home

With the right preparation and the support of F5 Mortgage’s client-centric approach, you can embark on your homeownership journey with confidence and clarity.

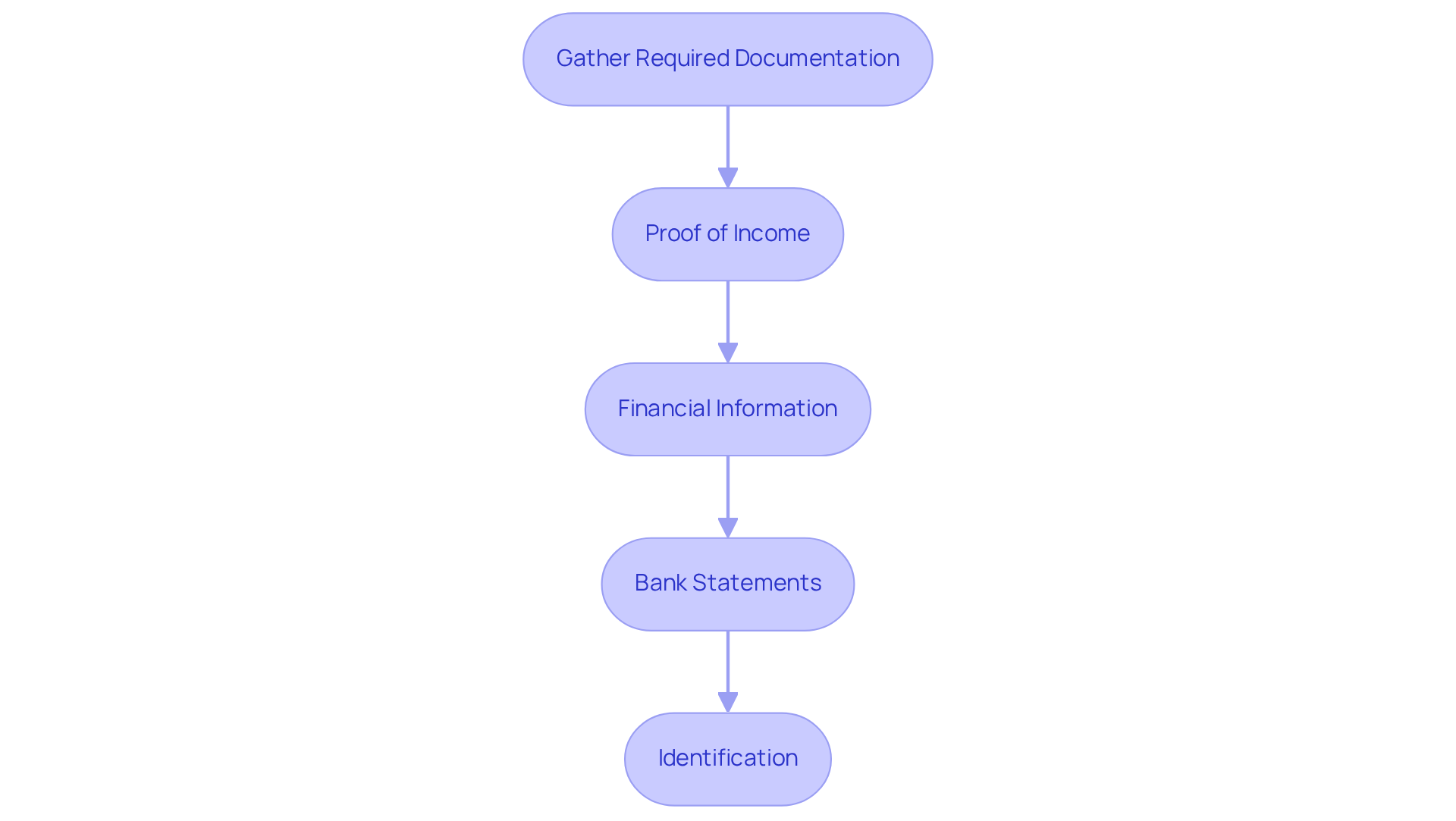

Gather Required Documentation

Getting a mortgage prequalification can feel overwhelming, but we’re here to support you every step of the way. To make this process smoother, it’s essential to gather several that will provide insight into your financial situation.

- Proof of Income: You’ll want to collect recent pay stubs, W-2 forms, or tax returns if you’re self-employed. This documentation will help lenders understand your earning capacity.

- Financial Information: While lenders will retrieve your credit report, knowing your score and any outstanding debts is beneficial. Keeping your credit debt low can significantly improve your chances of qualifying for a better mortgage.

- Bank Statements: Recent statements from your checking and savings accounts are crucial for verifying your assets. Take a moment to examine your bank accounts and billing statements; this can provide you with a clear view of your monthly earnings and expenses.

- Identification: A government-issued ID, such as a driver’s license or passport, will also be necessary.

Before applying, it’s important to assess your overall financial health. Ask yourself: Do you have a stable income? Do you have a plan for managing existing debts? Are you saving for emergencies and down payments? By having these documents prepared, you not only simplify the prequalification process at F5 Home Loans but also demonstrate to lenders your commitment to securing a loan. This can empower you to access various financing options effectively.

Apply for Prequalification

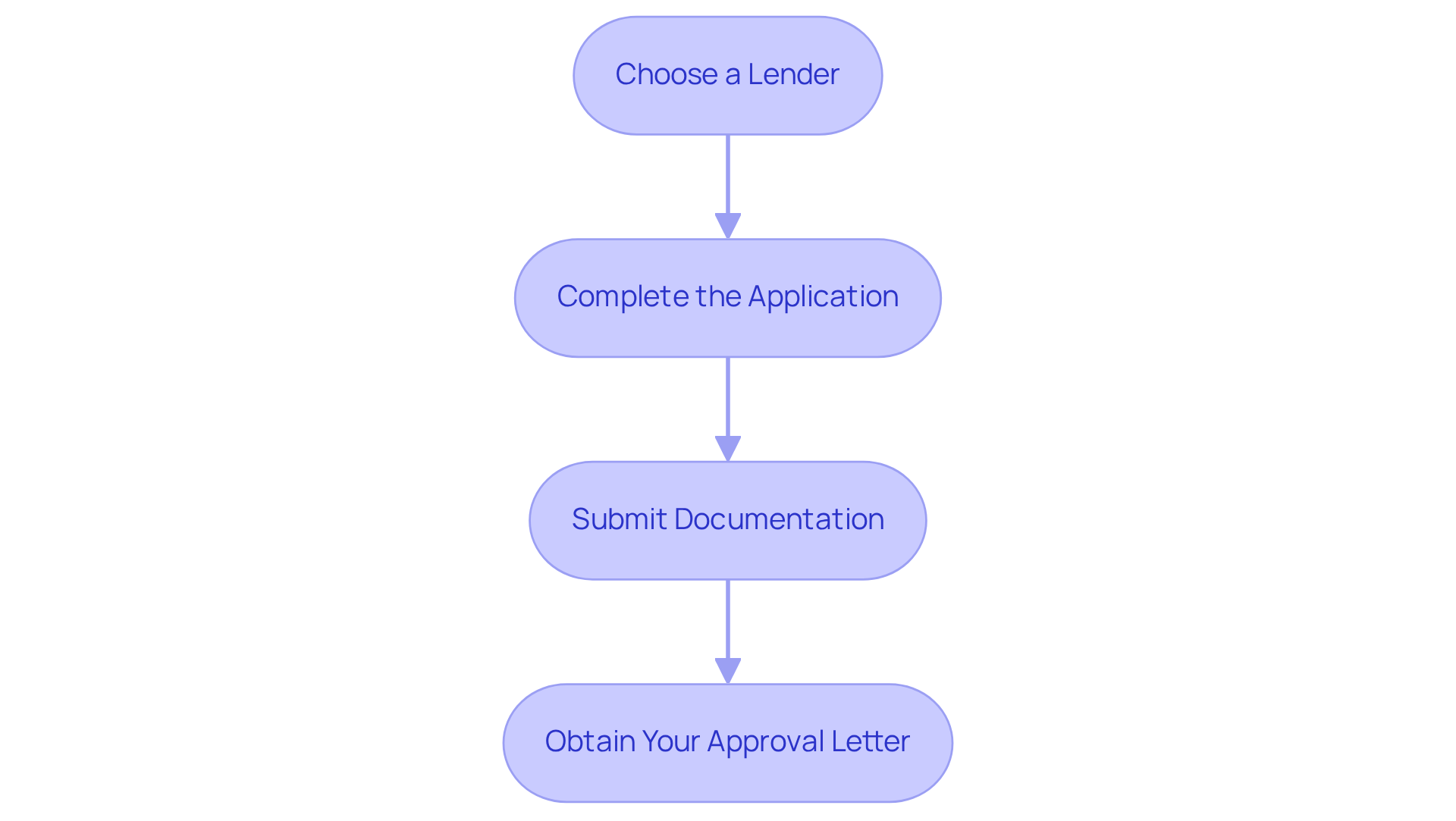

Once you have gathered your documentation, we know how important it is to feel confident in your next steps. You can apply for through F5 Finance, and we’re here to support you every step of the way. Here’s how to navigate this process with ease:

-

Choose a Lender: Start by researching and selecting F5 Financing. We offer convenient application options that fit your needs. Whether you prefer to apply online, over the phone, or via chat, our loan experts are ready to help you custom-tailor a loan that aligns with your goals.

-

Complete the Application: Fill out F5’s loan prequalification form. It’s important to provide accurate information about your financial situation, including your income, debts, and assets. This will help us understand your unique circumstances better.

-

Submit Documentation: Organize your financial documents to ensure a smooth process. You’ll need:

- Driver’s License

- Social Security Card

- Two years of tax returns

- At least two months of bank statements

- Pay stubs

- A list of your debts

- Employment history details

Attach these required documents to your application to ensure everything is complete and avoid delays.

-

Obtain Your Approval Letter: After we assess your application, F5 Mortgage will provide you with an approval letter. This letter details the amount you may be eligible to borrow and can be a powerful tool when making offers on homes. We understand that this step can be both exciting and nerve-wracking, and we’re here to guide you through it.

Troubleshoot Common Prequalification Issues

While applying for can feel straightforward, we know how challenging this process can be. Several common issues may arise, but with a little guidance, you can troubleshoot them effectively:

- Incomplete Documentation: If your application is delayed due to missing documents, take a moment to meticulously review your submission against the lender’s requirements. Ensure that all necessary paperwork, such as tax returns and bank statements, is included to avoid unnecessary delays. We’re here to support you every step of the way. A low credit score can hinder your ability to achieve prequalification. To enhance your score, focus on reducing outstanding debts and rectifying any errors on your financial report. Remember, regularly checking your credit reports is crucial—studies show that 26% of participants found errors that could negatively impact their scores.

- Earnings Verification Issues: For self-employed individuals or those with variable earnings, verifying finances can be challenging. Be prepared to offer additional documentation, like profit and loss statements or bank statements, to support your financial status. We understand that this can feel overwhelming, but you’re not alone.

- Debt-to-Income Ratio Concerns: A high debt-to-income ratio can affect your eligibility. Consider strategies to lower this ratio, such as paying off outstanding debts or increasing your income through side jobs or freelance work. Taking these steps can make a significant difference.

By anticipating these issues and knowing how to address them, you can significantly enhance your chances of a successful prequalification for a mortgage. Remember, maintaining a credit score of 760 or higher can lead to better loan terms, making proactive credit management essential before applying.

Conclusion

Securing a mortgage prequalification is a crucial step in your home buying journey. It serves as a foundation for understanding your financial capabilities and enhancing your confidence as a buyer. This process clarifies how much you can borrow and positions you favorably in a competitive market, making it a vital component of successful homeownership.

We know how challenging this can be, so throughout the article, we outlined key steps to navigate the prequalification process effectively:

- Gathering necessary documentation, such as proof of income and bank statements

- Applying through a lender like F5 Mortgage

Each phase is essential in ensuring a smooth experience. Additionally, common issues such as incomplete documentation and high debt-to-income ratios were addressed, providing valuable insights on how to troubleshoot and enhance your chances of approval.

Ultimately, being proactive in obtaining mortgage prequalification not only streamlines the home buying process but also empowers you with critical knowledge about your financial standing. By taking these steps, you can approach the market with confidence, making informed decisions that align with your homeownership goals. Embrace this opportunity to secure your financial future and move closer to owning your dream home.

Frequently Asked Questions

What is mortgage prequalification?

Mortgage prequalification is the initial step in the home buying process where a lender estimates how much you might be able to borrow based on your self-reported financial information, including income, debts, and credit score.

Does mortgage prequalification guarantee a loan?

No, mortgage prequalification does not guarantee a loan. It is a preliminary assessment that helps you understand your budget and the types of properties you can consider.

Why is mortgage prequalification important for homebuyers?

Mortgage prequalification is important because it helps identify potential financial issues early, enhances your confidence as a buyer, and positions you as a serious buyer in the eyes of sellers.

How can mortgage prequalification improve negotiating power?

Obtaining prior approval can strengthen your negotiating power, making it easier to secure your desired home by demonstrating to sellers that you are a qualified buyer.

Who benefits from mortgage prequalification?

First-time homebuyers and all homebuyers can benefit from mortgage prequalification as it helps them navigate the competitive market and enhances their overall home buying experience.

What are the key benefits of mortgage prequalification?

The key benefits include gaining clarity on your borrowing capacity, understanding your financial standing, and enhancing your overall experience in buying a home.

How can F5 Mortgage assist in the prequalification process?

F5 Mortgage offers a client-centric approach that simplifies the initial qualification process and helps clients understand their choices available for homeownership.