Overview

The article titled “10 Refinance Lenders to Help Families Upgrade Their Homes” aims to identify and evaluate refinance lenders that can truly assist families in enhancing their home financing options. We understand how challenging this process can be, and it’s essential to highlight the importance of personalized services, competitive rates, and tailored loan solutions.

Lenders like F5 Mortgage and Quicken Loans offer features that can significantly benefit families looking to refinance their homes. By choosing the right lender, families can find the support they need to make informed decisions and improve their financial well-being.

Introduction

Navigating the world of home refinancing can feel overwhelming for many families. With fluctuating interest rates and a multitude of lenders competing for your attention, it’s understandable to feel uncertain. In this article, we present a curated list of ten refinance lenders that not only offer competitive rates but also prioritize personalized service. Our goal is to help families like yours achieve their homeownership dreams.

As you consider your options, you might wonder: how can you effectively choose the right lender? It’s essential to find one that aligns with your financial goals while ensuring a smooth refinancing experience. We know how challenging this can be, and we’re here to support you every step of the way.

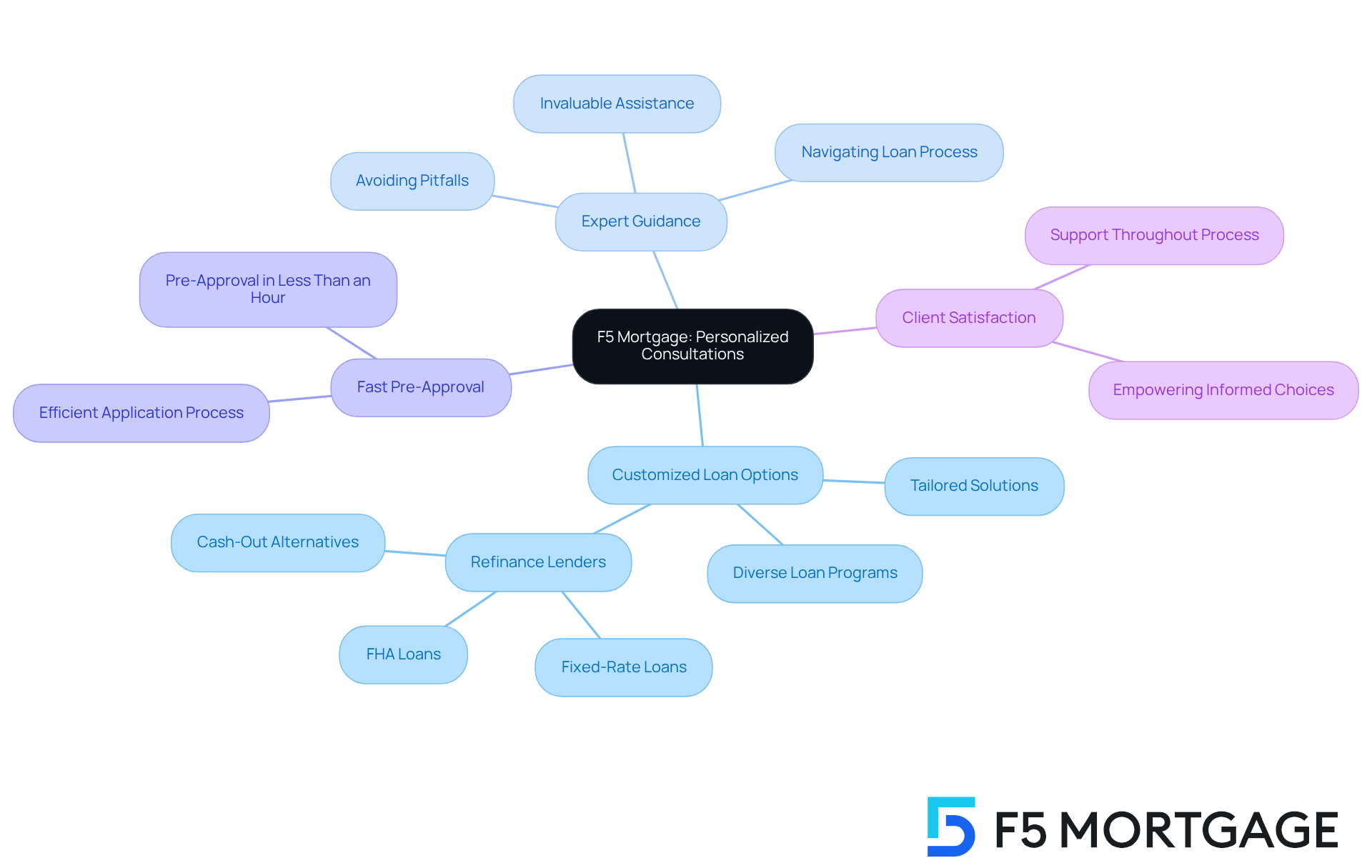

F5 Mortgage: Personalized Consultations for Tailored Refinancing Solutions

At F5 Mortgage, we understand that navigating the world of loans can be overwhelming for families. That’s why we offer that truly address your unique financial circumstances. By thoroughly evaluating each client’s situation, our brokerage is able to suggest the most suitable for you, including those provided by , whether that’s a fixed-rate loan, an , or a . This tailored approach not only simplifies the but also empowers you to make informed choices that align with your financial goals. With a strong emphasis on , we guarantee that you will feel supported every step of the way during your loan modification journey.

- Customized Loan Options: You gain access to a diverse range of loan programs tailored to your specific needs, enhancing your ability to find the right fit.

- Expert Guidance: Our seasoned brokers provide invaluable assistance, guiding you through the intricacies of obtaining new loans and helping you avoid potential pitfalls.

- Fast Pre-Approval: Our efficient application process allows for , giving you the confidence to move forward.

Successful case studies of highlight the positive impact of on family satisfaction. For instance, homeowners who acquired their properties during the high-rate period of 2023 or early 2024, often facing rates exceeding 7%, have found significant relief by adjusting to rates closer to 6%. This shift not only lowers monthly payments but also enhances overall financial stability.

Refinance lenders emphasize the importance of providing tailored solutions. As one satisfied customer shared, ‘F5 made the loan adjustment process so simple and stress-free. I felt like they truly understood my needs and guided me every step of the way.’ This commitment to personalized service is what sets F5 apart, ensuring that families receive the support they need to achieve their homeownership dreams.

Quicken Loans: Fast Online Refinancing with Competitive Rates

At F5 Mortgage, we understand how challenging it can be to navigate the . That’s why we offer a streamlined online experience tailored specifically for California homeowners, allowing you to submit your applications quickly and effectively. Many families have already benefited from our , with numerous clients securing some of the best conditions available through in the market.

Currently, to around 6.5%. This presents a favorable opportunity for households with rates exceeding 7% to consider options with refinance lenders, potentially saving thousands each year. Our commitment to rapid processing means that refinance lenders can often conclude transactions in as little as 30 days, enabling families to access funds swiftly and save money without enduring lengthy procedures.

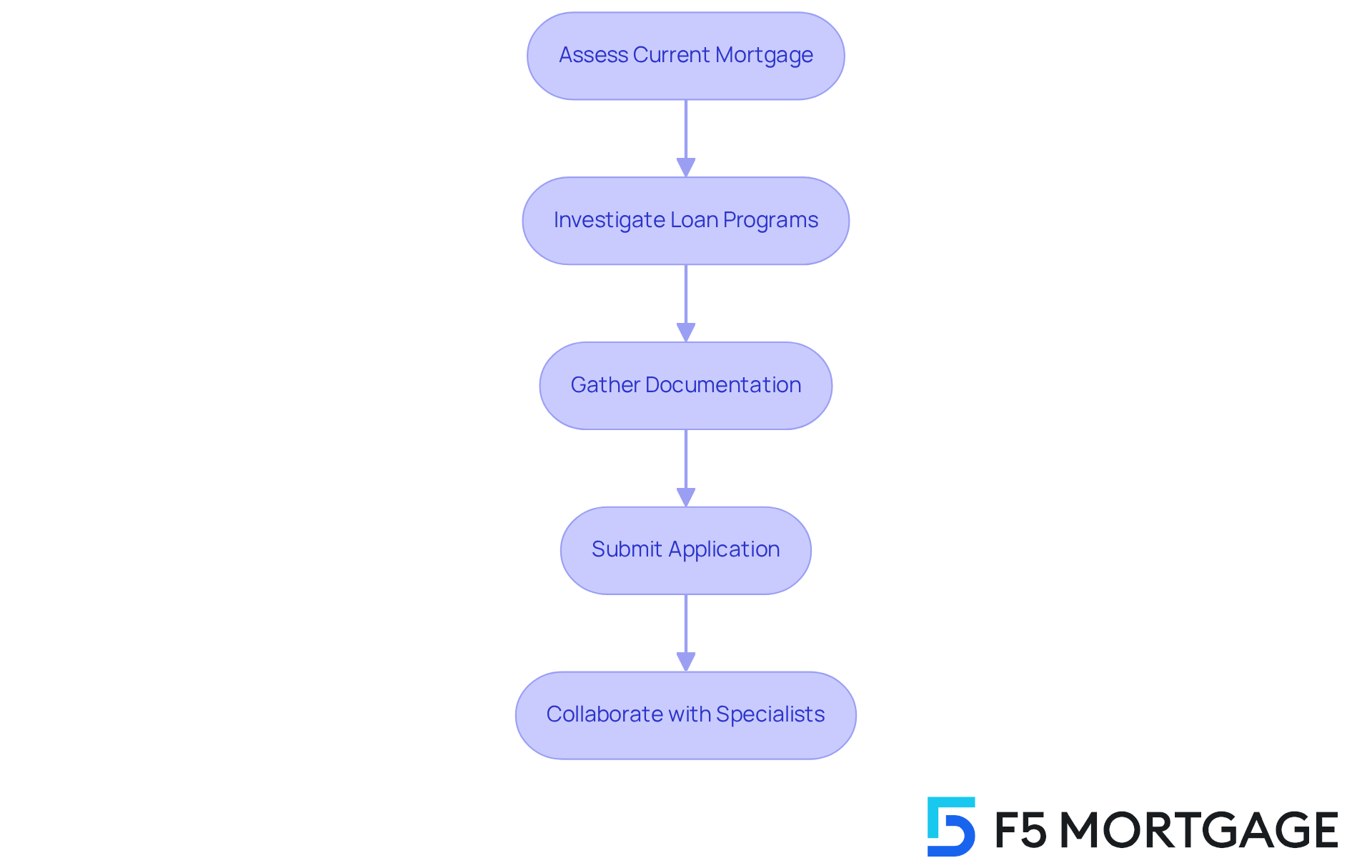

To refinance in California, we recommend following these simple steps:

- Assess your current mortgage and determine your .

- Investigate and evaluate the , including both standard and nontraditional options.

- Gather the necessary documentation to expedite your application process.

- Submit your application through our .

- Collaborate with our specialists to complete your loan and conclude within your desired timeframe.

- User-Friendly Platform: Our intuitive design ensures easy navigation, making your application experience seamless.

- : With many loans concluding within 30 days, you can enjoy .

- Expert Recommendations: Our financial specialists emphasize the importance of verifying that rates have decreased adequately before making changes. Timing is crucial for achieving savings. Additionally, having your documents ready can significantly speed up the loan modification process, helping you avoid any setbacks that could jeopardize your agreements.

We’re here to .

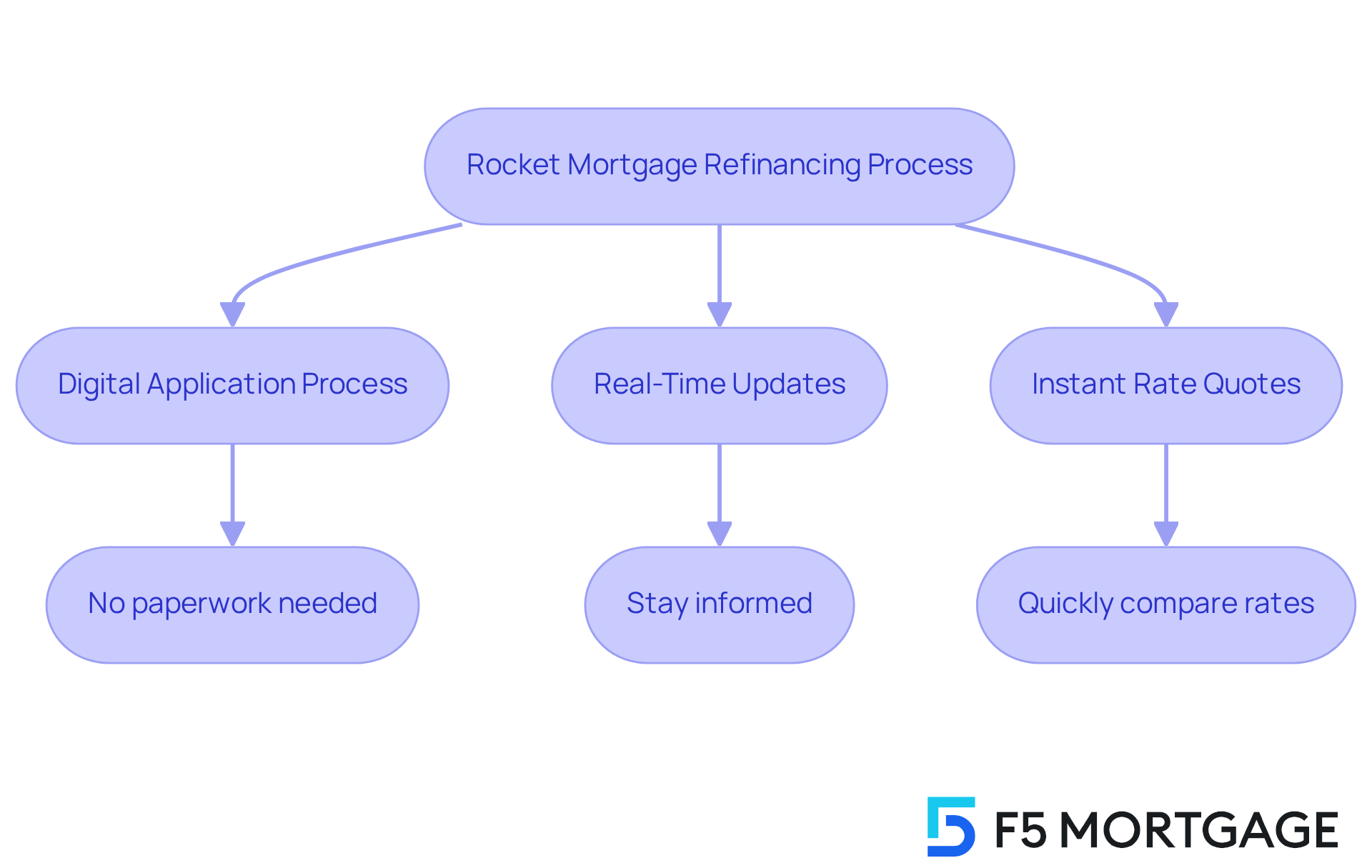

Rocket Mortgage: Simplified Refinancing Through Innovative Technology

At Rocket Mortgage, we understand how daunting the can be for homeowners. That’s why we’ve harnessed advanced technology to make this journey easier for you. With our , families can manage their applications effortlessly, monitor progress, and receive . This tech-focused approach not only enhances convenience but also significantly reduces the time and effort involved. Homeowners truly appreciate features like and instant quote estimates, creating a smoother and more effective .

- : Complete applications online with ease, eliminating the need for cumbersome paperwork.

- Real-Time Updates: Stay informed about the status of your refinance with , ensuring transparency throughout the process.

- Instant Rate Quotes: Quickly compare rates to secure the best deal available, enabling households to .

Families across the nation have successfully utilized Rocket’s platform to with refinance lenders. We know how challenging this can be, and we’re here to support you every step of the way, demonstrating the tangible benefits of embracing technology in the lending sector.

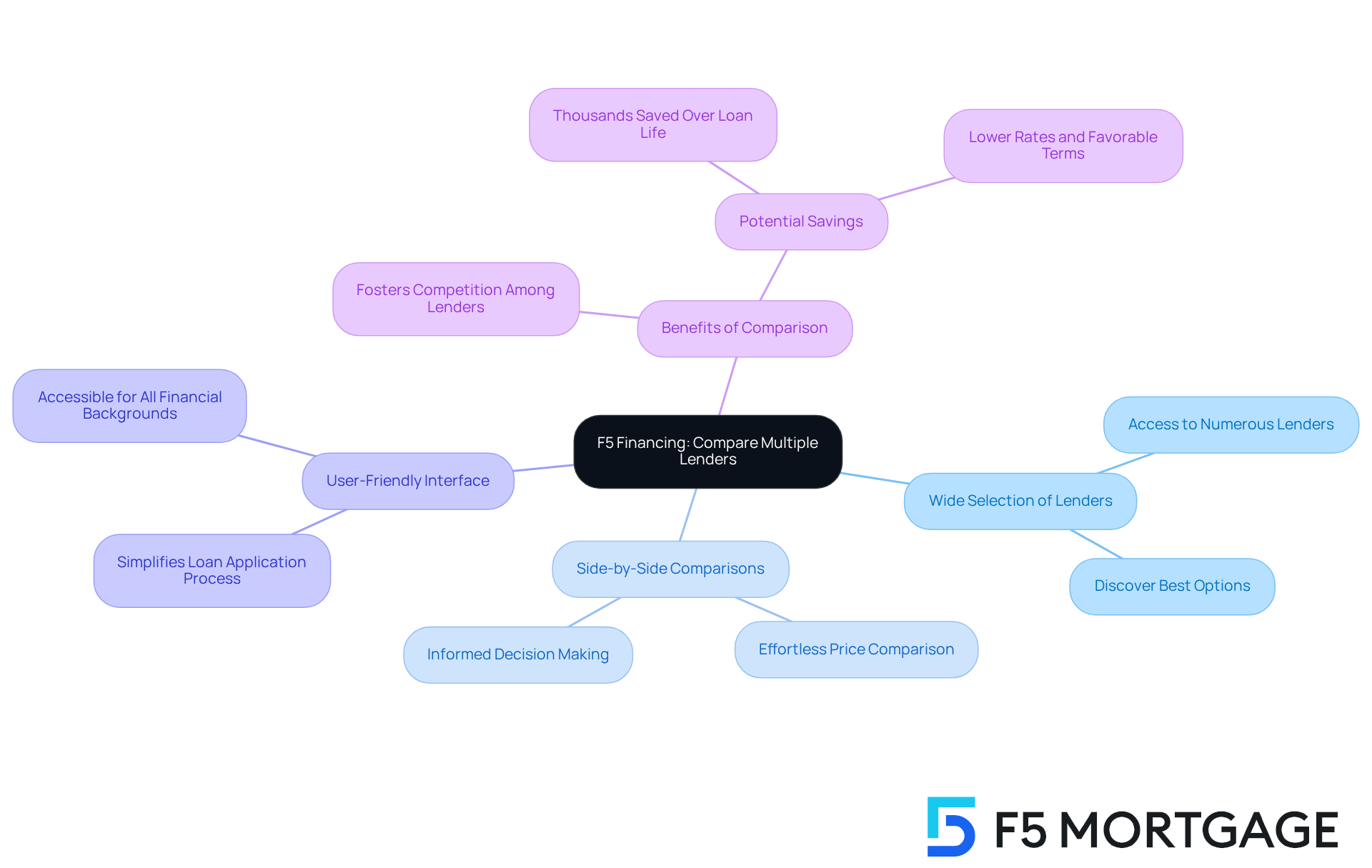

LendingTree: Compare Multiple Lenders for Optimal Refinancing Choices

F5 Financing serves as a vital resource for households seeking refinance lenders to assist with their . It offers a system that allows you to effortlessly . This marketplace approach empowers homeowners to assess different loan options, interest rates, and terms side by side, enabling you to make informed decisions that align with your financial goals. By utilizing F5 Financing, you can foster competition among lenders, often resulting in .

Financial advisors emphasize the significance of using comparison platforms like . John Thibaudeau, Vice President of Single-Family Real Estate Asset Management, highlights that ” can result in .” Imagine the potential savings for households that compare five or more quotes—thousands of dollars saved over the life of their loans. This strategic approach not only enhances financial outcomes but also ensures that you are well-prepared to .

Key features of F5 Mortgage include:

- : Access to numerous lenders in one convenient location, allowing families to discover the best options available.

- Side-by-Side Comparisons: Effortlessly compare prices and terms to find the best match for your needs, ensuring that families can make informed decisions.

- : Simplifies the process of finding and applying for loans, making it accessible for everyone, regardless of their financial background.

Better.com: No-Fee Refinancing for Budget-Savvy Borrowers

F5 Mortgage stands out in the by offering and valuable insights into the expenses associated with loan adjustments in Colorado. We understand that restructuring often leads to , but it can also involve initial costs ranging from 2% to 5% of the total loan amount. For instance, securing a new loan on a home in Denver valued at $500,000 might incur closing costs of up to $25,000. However, F5 Mortgage partners with to assist families in navigating these costs and exploring , making refinancing more accessible. This approach is especially beneficial for families aiming to lower their monthly payments without facing overwhelming expenses.

Key Features:

- Competitive Rate Comparisons: Access to the best rates from top lenders.

- Understanding Costs: Clear insights into loan restructuring expenses and assistance programs.

- : Efficient steps to secure your new mortgage.

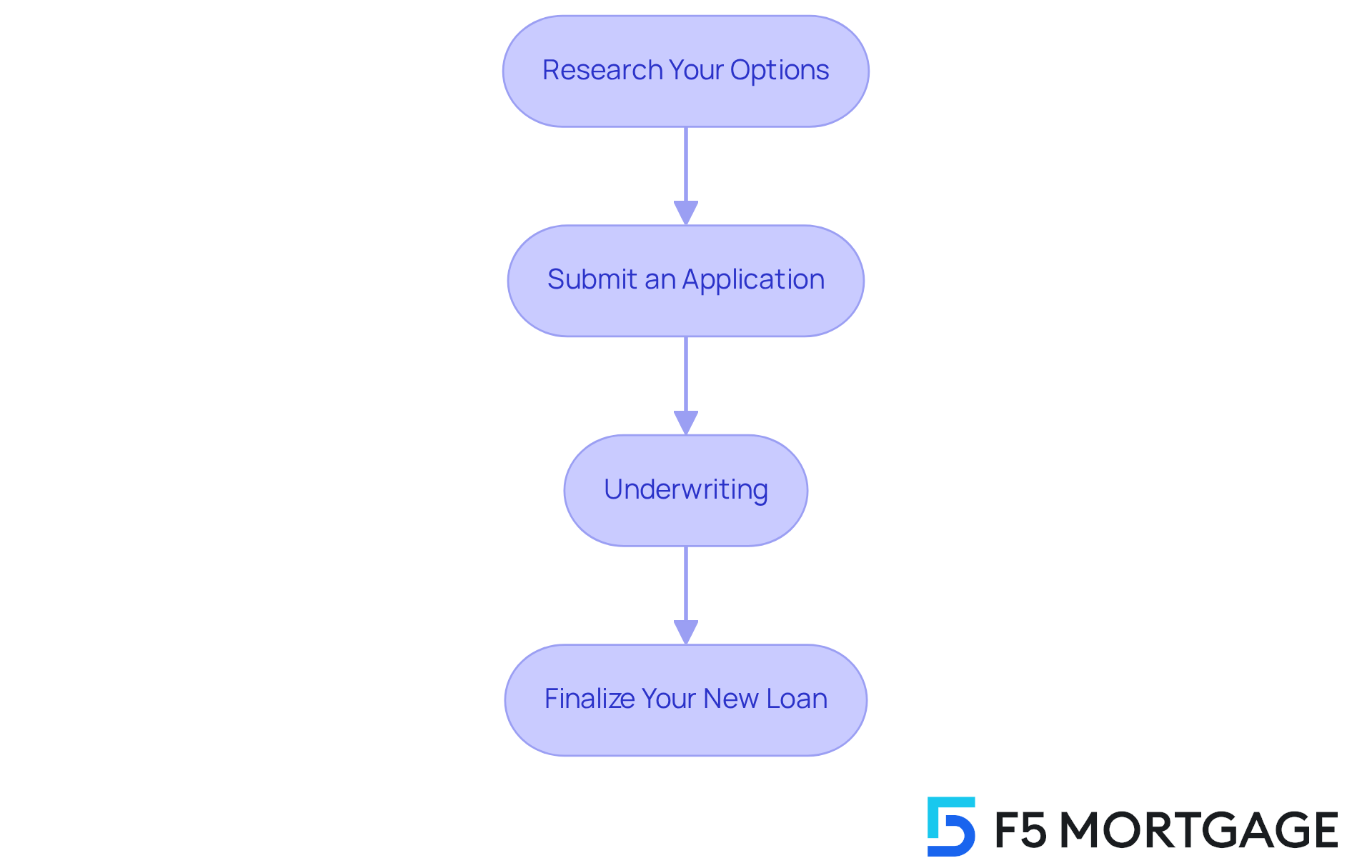

Step-by-Step Guide to Refinancing:

- Research Your Options: We know how challenging this can be. Assess your financial situation and compare multiple refinance lenders to find the best option.

- Submit an Application: Provide information about your property and financial documents.

- Underwriting: The lender reviews your application and credit history.

- Finalize Your New Loan: Sign documents and pay closing expenses to complete the process. We’re here to .

Chase Bank: Rewarding Existing Customers with Competitive Refinancing Rates

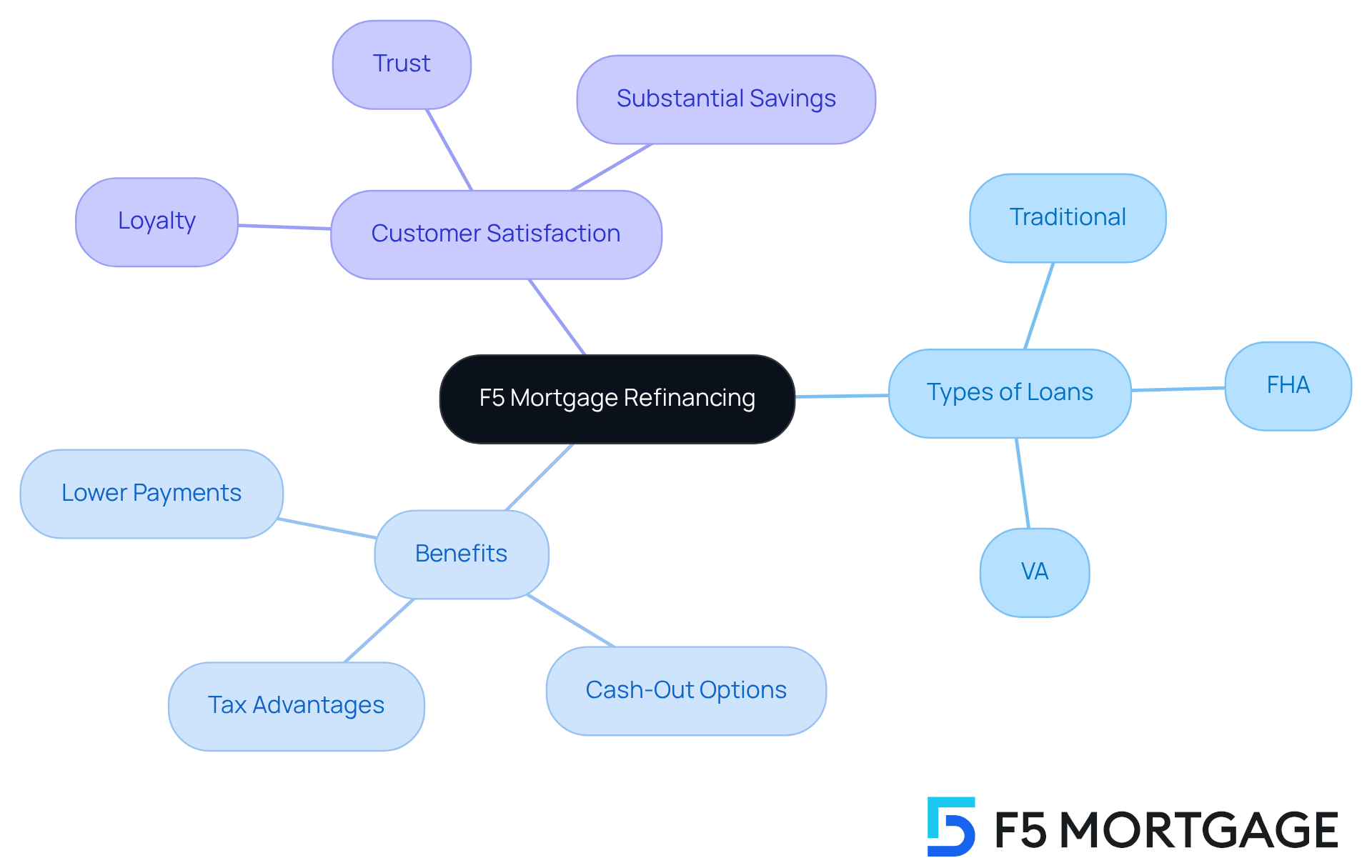

F5 stands out as a top choice among for households looking to refinance, especially with its . We understand how important it is for families to find the right fit, which is why F5 Mortgage offers , including traditional, FHA, and VA loans. This flexibility not only addresses the diverse needs of households but also enhances their loan modification experience with personalized service. Our goal is to ensure that families can access the most favorable terms available in the market.

The firm provides an extensive range of restructuring options to meet the unique financial objectives of every household. Moreover, F5 Home Loans is renowned for its , offering . This commitment to service builds trust and satisfaction, making F5 a reliable partner for families seeking to .

Currently, mortgage rates in Colorado have dropped, creating an ideal opportunity for restructuring. Families who select refinance lenders such as F5 Mortgage can enjoy and reduced interest over the life of their loans. Additionally, the possibility of cash-out loan options allows homeowners to tap into their home equity for essential improvements or to establish an emergency fund.

Restructuring debts may also provide tax advantages, offering families additional financial benefits. Statistics show that current customers are significantly more likely to benefit from favorable loan modification conditions, highlighting the importance of loyalty in securing better rates. Families who have refinanced with F5 through refinance lenders have reported substantial savings and improved loan terms, demonstrating the real benefits of choosing a dedicated lender. As financial analysts emphasize, plays a crucial role in achieving better loan outcomes, making F5 an excellent choice for households looking to enhance their homes.

Wells Fargo: Comprehensive Refinancing Solutions with Personalized Service

At F5, we understand how challenging it can be to navigate the complexities of loan restructuring. That’s why we excel in offering to meet the diverse needs of households. Our , each with unique qualifications and a personal touch, work closely with you to fully grasp your financial objectives. Together, we can explore the most suitable options for .

Whether you’re looking to lower your monthly payments or tap into your home equity through a , F5 provides a wide array of products from designed to help you achieve your goals. We know how important it is to feel supported during this process, and our commitment to your satisfaction ensures you receive the essential assistance you need.

- : Our dedicated mortgage specialists are here to guide you through the process, ensuring a smooth and reassuring experience.

- : With options including rate-and-term refinances and s, we cater to your specific financial needs through our refinance lenders.

- : With a remarkable and over 1,000 households assisted, F5 is recognized for its reliability and service excellence. Numerous client testimonials reflect our team’s outstanding support and tailored solutions.

We’re here to support you every step of the way, making sure you feel confident and informed as you embark on this journey.

Bank of America: Digital Refinancing Solutions for Modern Homeowners

At F5 Finance, we understand how challenging navigating the mortgage landscape can be for contemporary homeowners in California. That’s why we leverage our extensive network and expertise to provide tailored solutions that truly meet your needs. With our dedicated team by your side, you can effortlessly manage the , whether your goal is to lower your payments or tap into your home equity.

We’re here to support you every step of the way, ensuring that you receive the assistance you need during your . Our commitment to client service connects you with leading realtors and helps you secure the .

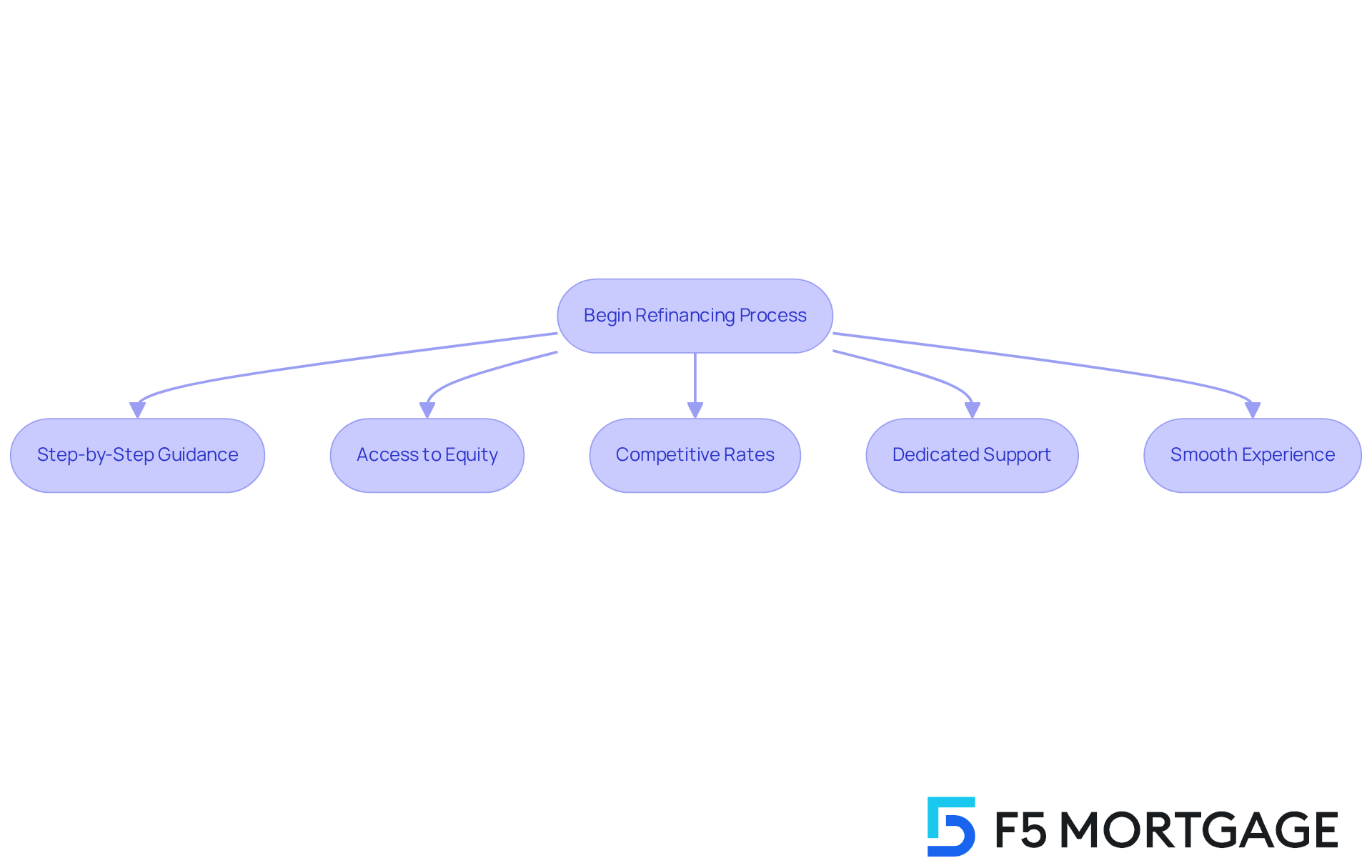

Key Features:

- Step-by-Step Guidance: We simplify the , helping families understand each stage.

- Access to Equity: Explore options for through .

- Competitive Rates: We provide a thorough assessment of mortgage refinance costs through refinance lenders, ensuring you get the best offer.

- Dedicated Support: Our team of experts is always available to assist with your questions and concerns, ensuring a smooth experience.

We know how important it is to feel supported during this process, and we are committed to making your experience as seamless as possible.

USAA: Specialized Refinancing for Military Families

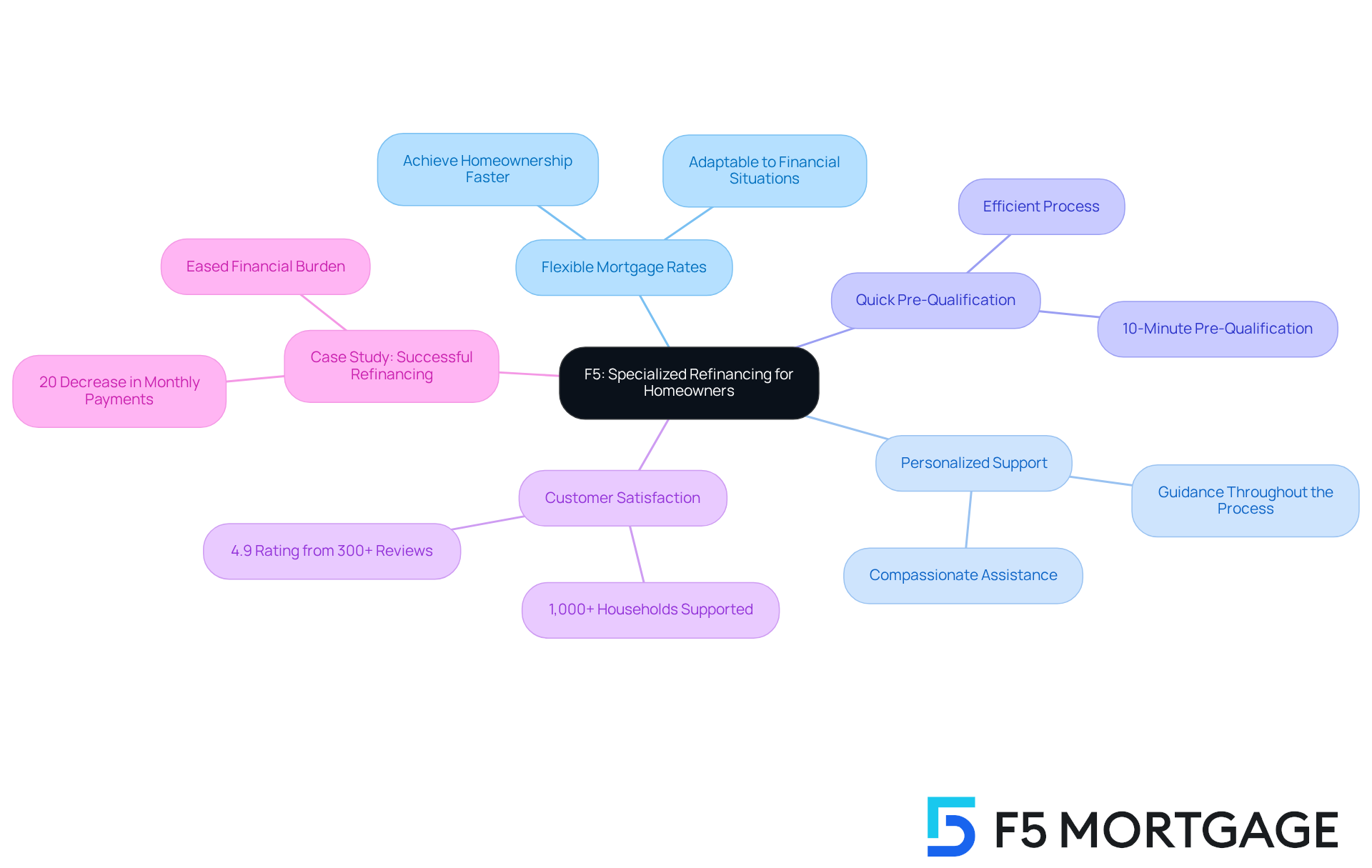

At F5, we understand how challenging it can be to navigate the complexities of home financing. That’s why we specialize in offering designed specifically for households looking to enhance their residences. With a focus on competitive rates and , we empower homeowners to approach the with confidence and ease, supported by .

Our services are tailored to meet the varied requirements of families, ensuring that you receive the finest possible direction and support throughout your journey.

Key features of F5 Mortgage’s offerings include:

- : We provide a variety of mortgage options that adapt to your unique financial situation, helping you achieve homeownership faster.

- Personalized Support: Our dedicated representatives are here to assist you, committed to helping you reach your with compassion and care.

- : In just 10 minutes, you can get pre-qualified, paving the way for a smooth and efficient loan modification experience.

With a of 4.9 from over 300 reviews, and having supported more than 1,000 households in , our commitment to exceptional service makes it easier for refinance lenders. For instance, one family recently utilized our flexible solutions with refinance lenders to refinance their home, resulting in a remarkable 20% decrease in their monthly payments. This not only eased their financial burden but also helped them adjust seamlessly to their new living circumstances.

At F5, we’re here to support you every step of the way, empowering you to make informed decisions about your home financing choices. Let us help you turn your aspirations of homeownership into reality.

SoFi: Competitive Refinancing Rates with Member Benefits

At F5 Mortgage, we understand how challenging the borrowing process can be for families. That’s why we offer along with various advantages that enhance your overall experience. As an , our focus is on serving your interests, not those of the lenders. This means we work diligently to help you find the best possible conditions for your loan needs.

Homeowners can access appealing terms through our extensive network of , which includes over two dozen options. This allows us to assist you in securing the lowest available. We’re here to support you every step of the way, providing dedicated assistance throughout your refinancing journey. Our team is committed to guiding households at each stage, ensuring you feel confident and informed.

We’ve made the as easy as possible, offering streamlined methods online, by phone, or through chat. This combination of , exceptional customer service, and our independent broker status makes F5 Mortgage a compelling choice among refinance lenders for families looking to refinance. Our clients absolutely adore us, as reflected in our 5/5 star reviews on Lending Tree, Google, and Zillow, where they praise our expertise and smooth processes. Let us help you turn your into reality.

Conclusion

Navigating the refinancing landscape can feel overwhelming for families, but finding the right lenders can truly make a difference. In this article, we highlight ten exceptional refinance lenders that offer tailored solutions, helping families upgrade their homes and achieve their financial goals. From the personalized consultations at F5 Mortgage to the innovative technology of Rocket Mortgage, each lender brings unique advantages to the table, ensuring families can discover the perfect fit for their refinancing journey.

Key insights from our discussion emphasize the significance of personalized service, competitive rates, and user-friendly platforms. Lenders like Quicken Loans and LendingTree empower homeowners by simplifying the comparison process. Meanwhile, Better.com offers no-fee refinancing options that cater to budget-savvy borrowers. Additionally, specialized services for military families from USAA and flexible solutions from SoFi highlight how these lenders prioritize the unique circumstances of their clients.

Ultimately, choosing the right refinance lender can lead to significant savings and enhanced financial stability. We understand how important this decision is for families, and we encourage you to explore your options. Leverage comparison tools and seek personalized guidance to navigate the refinancing process effectively. Embracing these resources can transform your homeownership dreams into reality, allowing families to enjoy the benefits of lower monthly payments and improved loan terms.

Frequently Asked Questions

What services does F5 Mortgage offer for refinancing?

F5 Mortgage provides personalized consultations to address unique financial circumstances, suggesting suitable loan options such as fixed-rate loans, FHA loans, and cash-out alternatives.

How does F5 Mortgage ensure client satisfaction during the loan modification process?

F5 Mortgage emphasizes client satisfaction by offering expert guidance, customized loan options, and support throughout the loan modification journey.

What are the benefits of the customized loan options at F5 Mortgage?

Customized loan options give clients access to a diverse range of loan programs tailored to their specific needs, enhancing their ability to find the right fit.

How quickly can clients expect to receive pre-approval from F5 Mortgage?

F5 Mortgage’s efficient application process allows for pre-approval in less than an hour.

What is the current mortgage rate trend mentioned in the article?

Mortgage rates have fallen to around 6.5%, providing a favorable opportunity for households with rates exceeding 7% to consider refinancing.

What steps should California homeowners follow to refinance through F5 Mortgage?

Homeowners should assess their current mortgage, investigate loan programs, gather necessary documentation, submit their application, and collaborate with specialists to complete the loan process.

How does Rocket Mortgage simplify the refinancing process?

Rocket Mortgage uses advanced technology to offer a fully digital platform that allows families to manage applications, monitor progress, and receive real-time updates.

What features does Rocket Mortgage provide to enhance the refinancing experience?

Rocket Mortgage offers a digital application process, real-time updates on application status, and instant rate quotes for comparing options.

How does F5 Mortgage support families during the refinancing process?

F5 Mortgage provides expert recommendations, emphasizes the importance of timing for rate changes, and assists in preparing necessary documents to expedite the process.

What advantage does a streamlined online experience provide for clients of F5 Mortgage?

The streamlined online experience allows homeowners to submit applications quickly and effectively, leading to faster processing and access to funds.