Overview

This article offers essential insights into earnest money deposits for homebuyers, addressing a topic that many find daunting. We understand how challenging the home-buying process can be, and we’re here to support you every step of the way. Earnest money serves as a good faith gesture, reassuring sellers of your commitment. Typically, this amount ranges from 1% to 3% of the home’s price.

It’s crucial to consider key factors and contingencies that can protect your earnest money throughout the purchasing journey. By being informed and prepared, you can navigate this process with confidence and peace of mind. Remember, understanding these elements is a vital step toward securing your dream home.

Introduction

Understanding the nuances of earnest money deposits is crucial for anyone embarking on the journey of homebuying. These deposits, typically ranging from 1% to 3% of a property’s purchase price, not only demonstrate a buyer’s commitment but also offer essential protections for both parties involved in the transaction. We know how challenging this can be; the stakes are high. Failing to grasp the intricacies of earnest money can lead to unexpected financial losses or missed opportunities.

So, what are the key insights that every homebuyer should know? Navigating this critical aspect of real estate transactions can feel overwhelming, but we’re here to support you every step of the way. With the right knowledge, you can approach this process with confidence and clarity.

F5 Mortgage: Streamlined Process for Earnest Money Deposits

At F5 Mortgage, we understand how challenging can be, especially when it comes to managing . Our streamlined approach empowers you to navigate this crucial phase effortlessly. With cutting-edge technology and an intuitive interface, we help you gain a clear understanding of the requirements and implications related to your .

This not only reduces stress but also enhances efficiency, particularly for who may feel overwhelmed. We’re here to support you every step of the way, ensuring that you feel confident in your decisions.

Additionally, we offer , including such as:

- VA

- Conventional Loans

Our commitment to means you can , making your dreams a reality.

What Is Earnest Money and Its Purpose?

When considering the purchase of a property, you may come across the term ‘.’ These are sums provided by buyers to show their genuine intention to acquire a home. Consider this as a , reassuring the seller that you are truly committed to the transaction.

Typically held in trust, the earnest money deposit serves to protect both you and the seller. They offer a for you to move forward with the acquisition. Additionally, they provide a safeguard for the seller by ensuring compensation through the earnest money deposit if you decide to withdraw without justifiable reasons.

We understand how challenging navigating the can be. By grasping the purpose of , you can feel more confident in your . Remember, we’re here to support you every step of the way.

Typical Amounts for Earnest Money Deposits

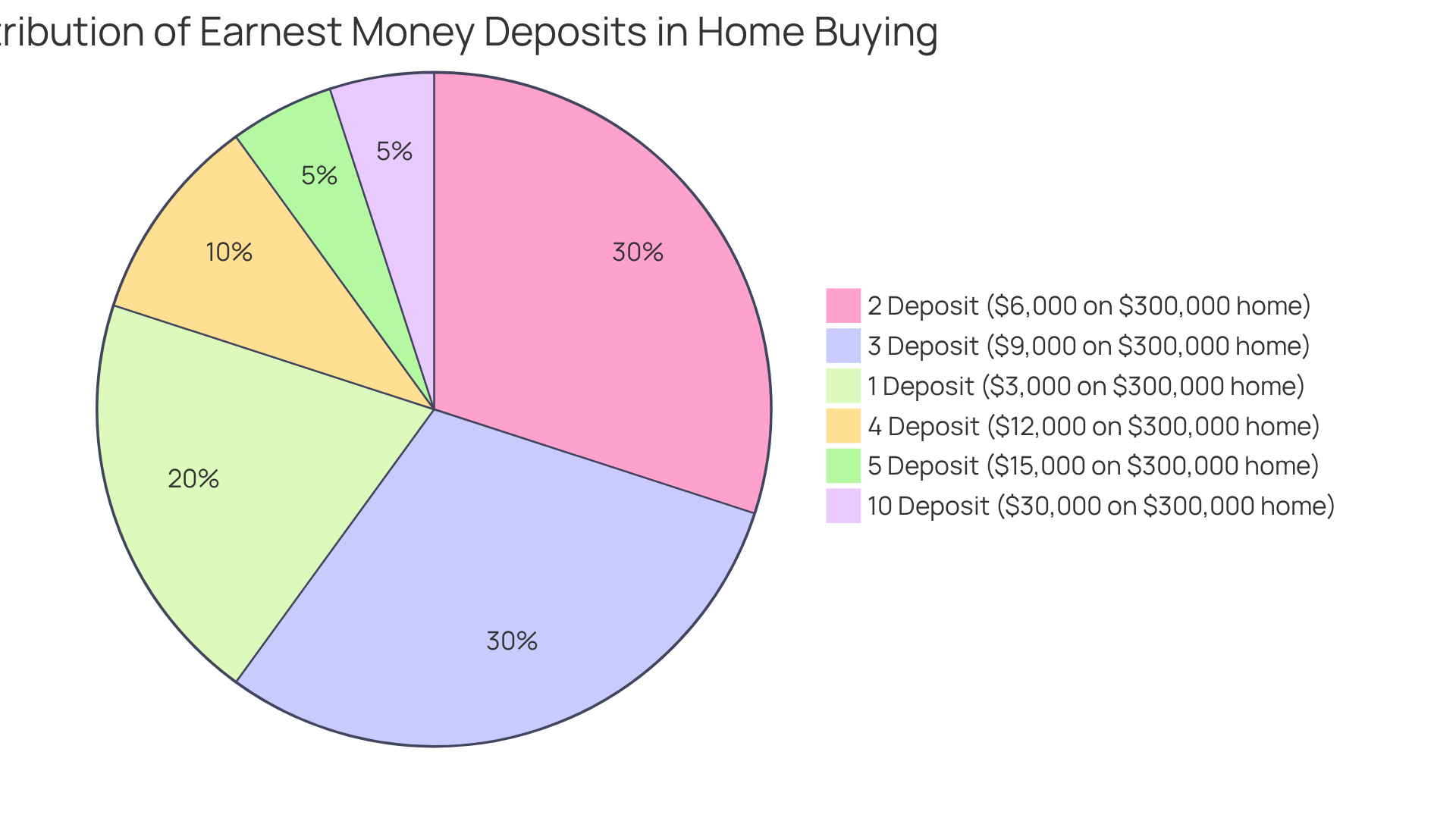

Understanding the is crucial for anyone looking to buy a home, especially regarding its impact on your . Typically, earnest funds range from 1% to 3% of the home’s purchase price. However, this can vary based on local market conditions and the specific terms agreed upon between you and the seller. For instance, if you’re looking at a $300,000 house, you might expect that your earnest money deposit will be between $3,000 and $9,000.

In competitive markets, such as Silicon Valley, sellers often ask for a , which can sometimes reach 3% or even 5% to 10% of the purchase price. This reflects the heightened demand for homes in those areas. Conversely, in purchasing markets, you may find that an earnest money deposit of about 1% to 2% can be arranged. We know how challenging this can be, and is essential to help you prepare financially and engage in effective negotiations.

As you navigate this process, remember that presenting a is key. As Jessica Rapp wisely notes, ‘An earnest money deposit is usually 1% to 3% of a home’s purchase price.’ This highlights the significance of grasping these numbers. Additionally, consider utilizing an your earnest money deposit. It’s also important to understand the to prevent possible forfeiture if you need to withdraw from the agreement without a valid reason. We’re here to .

Refundability of Earnest Money: Key Considerations

Understanding the can be challenging, but we’re here to support you every step of the way. These funds are typically refundable under specific circumstances, such as if you decide to withdraw during the due diligence phase or if you’re unable to secure financing. However, it’s crucial to comply with the conditions laid out in your purchase contract; failing to do so may result in losing your payment. Key factors to consider include the , like and , which allow you to recover your funds if significant issues arise or if you can’t obtain a loan.

During negotiations, it’s common for buyers to request sellers to make repairs as part of the sale agreement. This could involve asking for upgrades, such as new carpet, which may affect the overall purchase price. Knowing how to negotiate these requests is vital, as it not only influences the sale terms but also impacts your good faith deposit.

It’s important to be aware of . These can include:

- Waiving contingencies

- Missing contractual deadlines

- Changing your mind outside of the agreed-upon terms related to the earnest money deposit

Generally, deposit amounts vary from 1% to 5% of the purchase price, but in competitive markets, they can reach up to 10%.

Real estate attorneys stress the importance of . For instance, if you skip a home inspection and later discover significant issues, you may not be able to recover your deposit. Understanding these conditions and protections is essential for and avoiding potential conflicts.

Scenarios Where You Might Lose Your Earnest Money

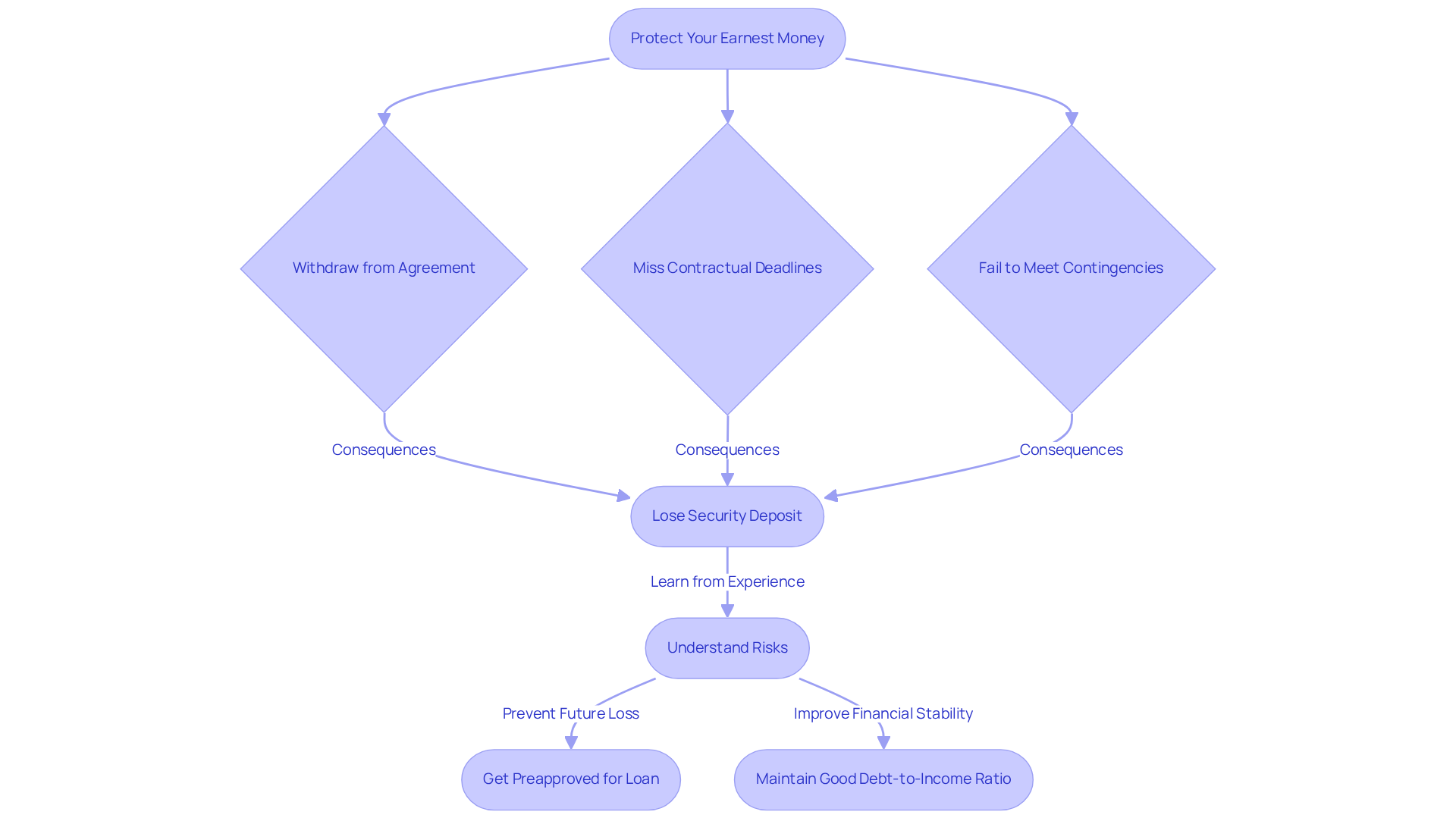

Navigating the world of real estate can be challenging, and we understand how important it is to protect your —a vital element in these dealings. Several situations can result in the forfeiture of this payment, and being aware of them can help you avoid pitfalls.

Firstly, withdrawing from the agreement without a legitimate cause can lead to . Secondly, , such as those for loan approval or inspections, may jeopardize your entitlement to the advance payment. Lastly, failing to comply with contingencies specified in the purchase contract, like financing or inspection provisions, can also put your funds at risk.

For instance, consider a scenario where a purchaser’s mortgage funding fails. In such a case, they might forfeit their . A real-life example illustrates this point: an individual lost a $10,000 payment due to funding problems, similar to what Jenny faced. This highlights the importance of being cautious, especially in competitive markets where relinquishing contingencies can heighten the risk of forfeiting your deposit.

Real estate experts emphasize the significance of . As Bill Gassett wisely puts it, ‘good faith funds are like the adhesive in a successful real estate deal.’ To navigate this process more efficiently and , it’s crucial to recognize these typical traps. Obtaining before searching for a home can minimize the risk of losing your deposit, and is essential.

Lastly, remember that deposit funds typically total at least 1% of the sales price, reflecting your commitment to the transaction. We know how challenging this can be, but by staying informed and prepared, you can move forward with confidence.

Who Holds the Earnest Money Deposit?

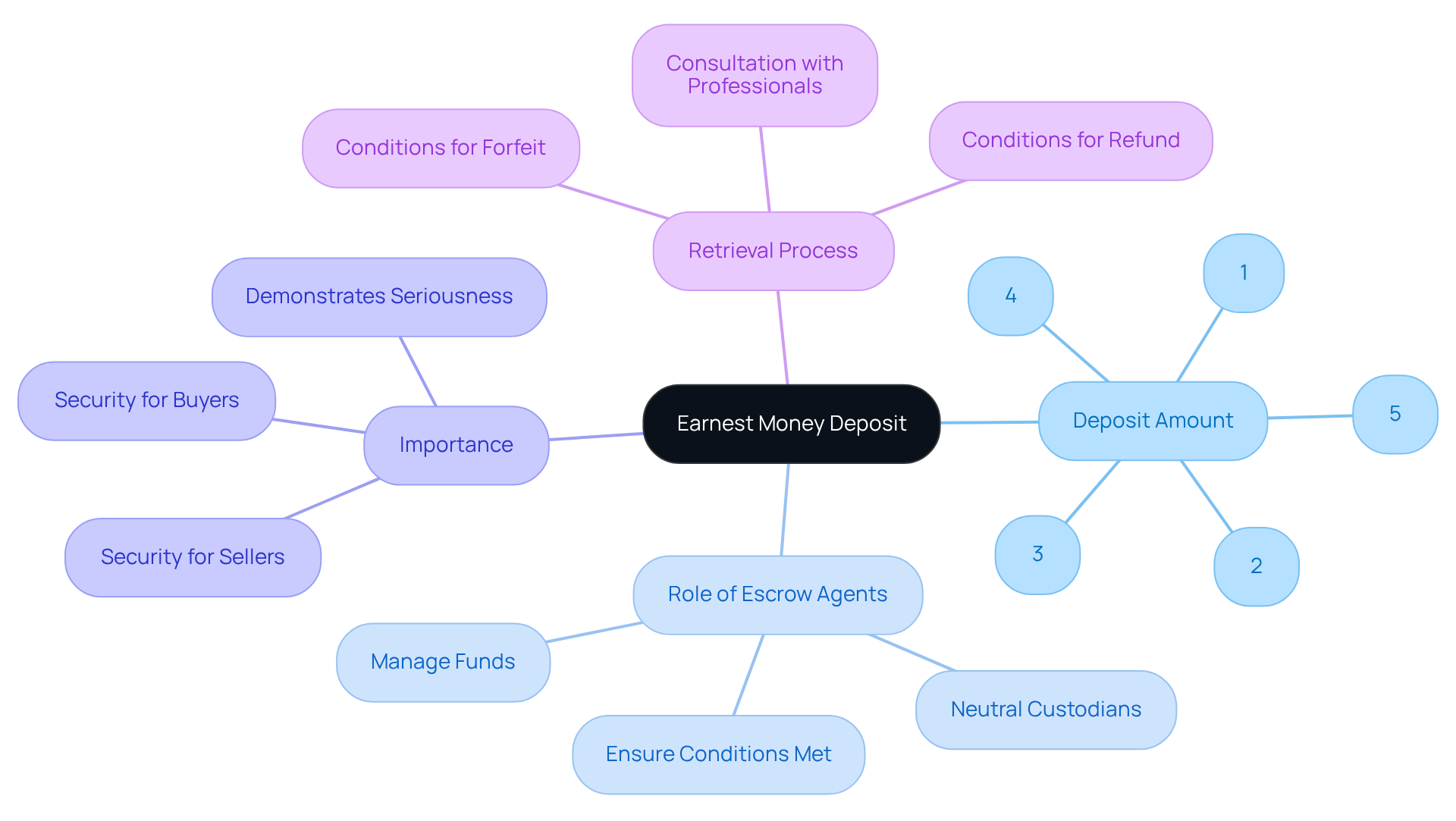

When it comes to real estate dealings, we understand how important it is to feel secure in your . The contributions typically range from 1% to 5% of the home’s purchase price. These funds are held by impartial third parties, like escrow agents or , until the agreement is finalized. This arrangement not only but also ensures that both buyers and sellers fulfill their obligations as outlined in the purchase agreement.

to this process, acting as neutral custodians of the funds. They manage the money, ensuring it is safely held in an escrow account until all sale conditions are met. As a buyer, it’s essential to confirm who will be responsible for holding your deposit and to familiarize yourself with the retrieval process. Understanding these procedures can help prevent disputes and lead to a .

As we often say, “A serious monetary contribution is a crucial component of the , providing assurance to both purchasers and vendors.” Reputable escrow agents will guide you through how the earnest money deposit will be managed, including the conditions under which it may be refunded or forfeited. To protect your investment, we encourage you to or lawyer who can provide tailored advice.

By working with skilled escrow professionals, you can navigate the complexities of the with confidence, knowing that you’re supported every step of the way.

Strategies to Protect Your Earnest Money

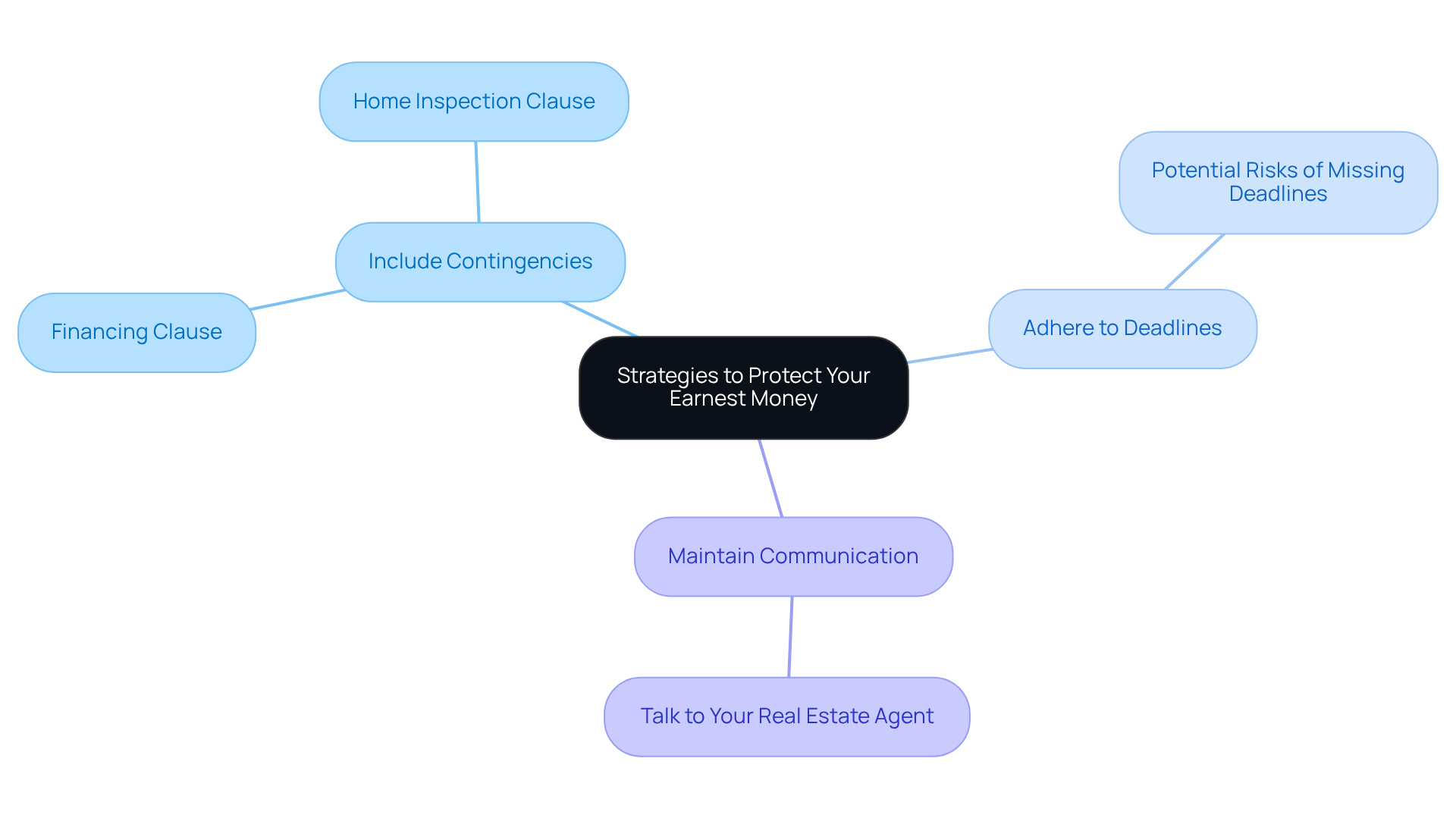

To effectively protect your hard-earned funds during the , we understand how important it is to feel secure with your . Here are some strategies to consider:

- , such as . These can safeguard your deposit if any issues arise.

- Adhere strictly to all deadlines outlined in the contract. Missing these can jeopardize your ability to recover your deposit, and we know how challenging that can be.

- Maintain open communication with your real estate agent to address any concerns or questions promptly.

Studies show that roughly 70% of purchasers include contingencies in their contracts, acknowledging their significance in protecting their deposits. For instance, Matthew B. Lane, a paralegal at Lane, Lane & Kelly, LLP, states, ‘One of the best methods to safeguard your is by including contingencies in your purchase offer.’ , enabling you to renegotiate or exit the agreement without losing your payment if major problems are found.

By being proactive and knowledgeable, and perhaps to ensure your purchase agreement is well-organized, you can greatly minimize the chance of losing your earnest money deposit. Remember, we’re here to support you every step of the way, ensuring a smoother transaction.

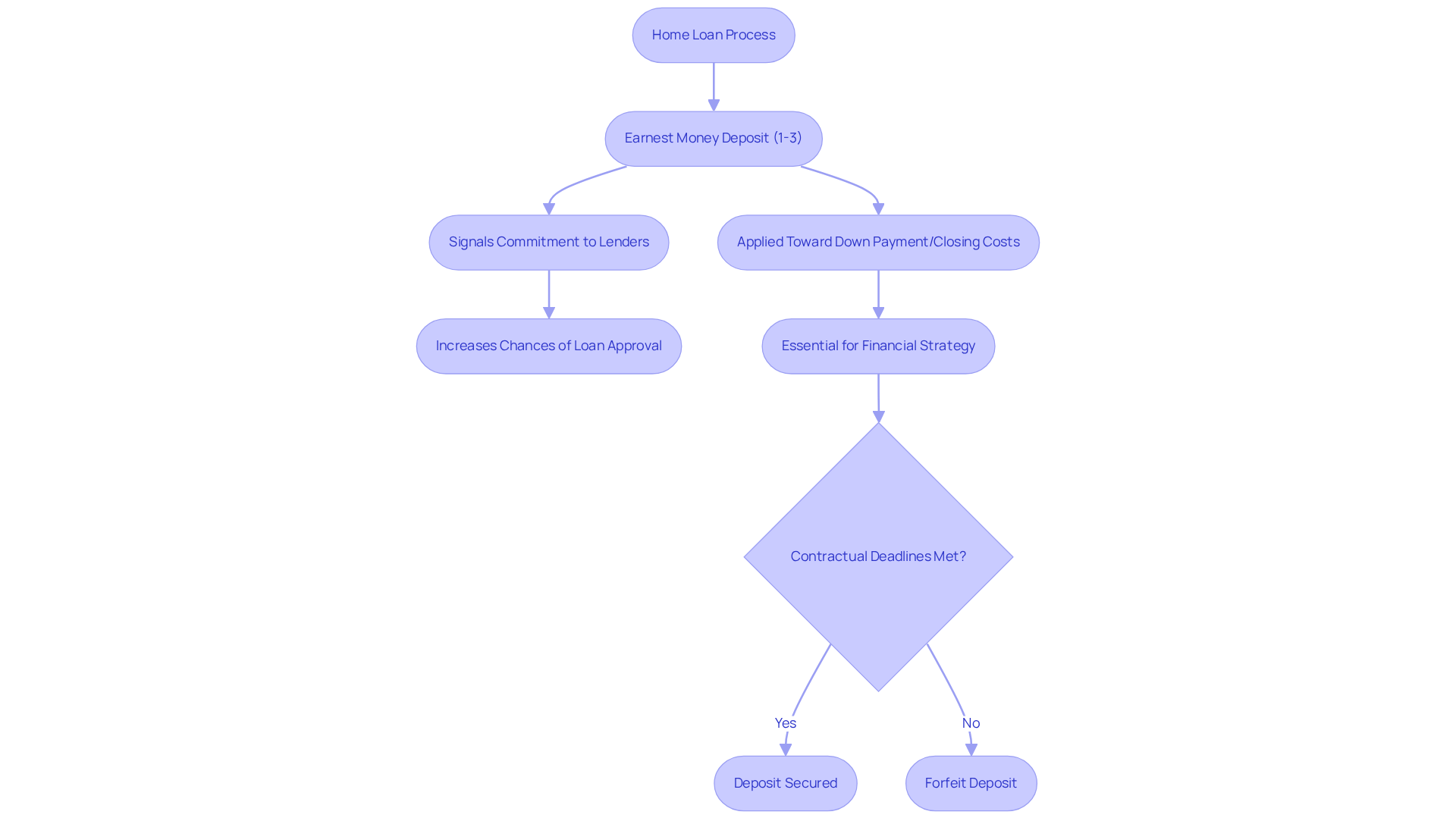

How Earnest Money Relates to Home Loans

We understand how challenging the home loan process can be, and earnest deposits play a vital role in demonstrating a buyer’s seriousness. When considering lenders, think about how and can enhance your approach to deposits. A substantial —typically ranging from 1% to 3% of the home’s purchase price—signals a strong commitment to lenders, significantly boosting your chances of loan approval. For instance, a $5,000 can greatly reduce the total amount due at closing, showcasing its importance in your financing strategy.

Moreover, the earnest money deposit is generally applied toward the or closing costs, making it an essential part of . By strategically utilizing good faith deposits, you can not only strengthen your proposals but also with greater confidence. However, it’s important to be aware that missing key contractual deadlines or violating the agreement without contingencies may lead to forfeiting your earnest money deposit.

Working with , as their expertise ensures that you fully understand the regarding the earnest money deposit and its refunds. As real estate expert Nick Wemyss wisely notes, ‘Providing a more substantial advance payment can indicate a purchaser’s .’ This underscores the importance of grasping these terms. By securing your mortgage rate with F5 Mortgage, you can ensure that your deposit works effectively to your advantage, allowing you to move forward with peace of mind.

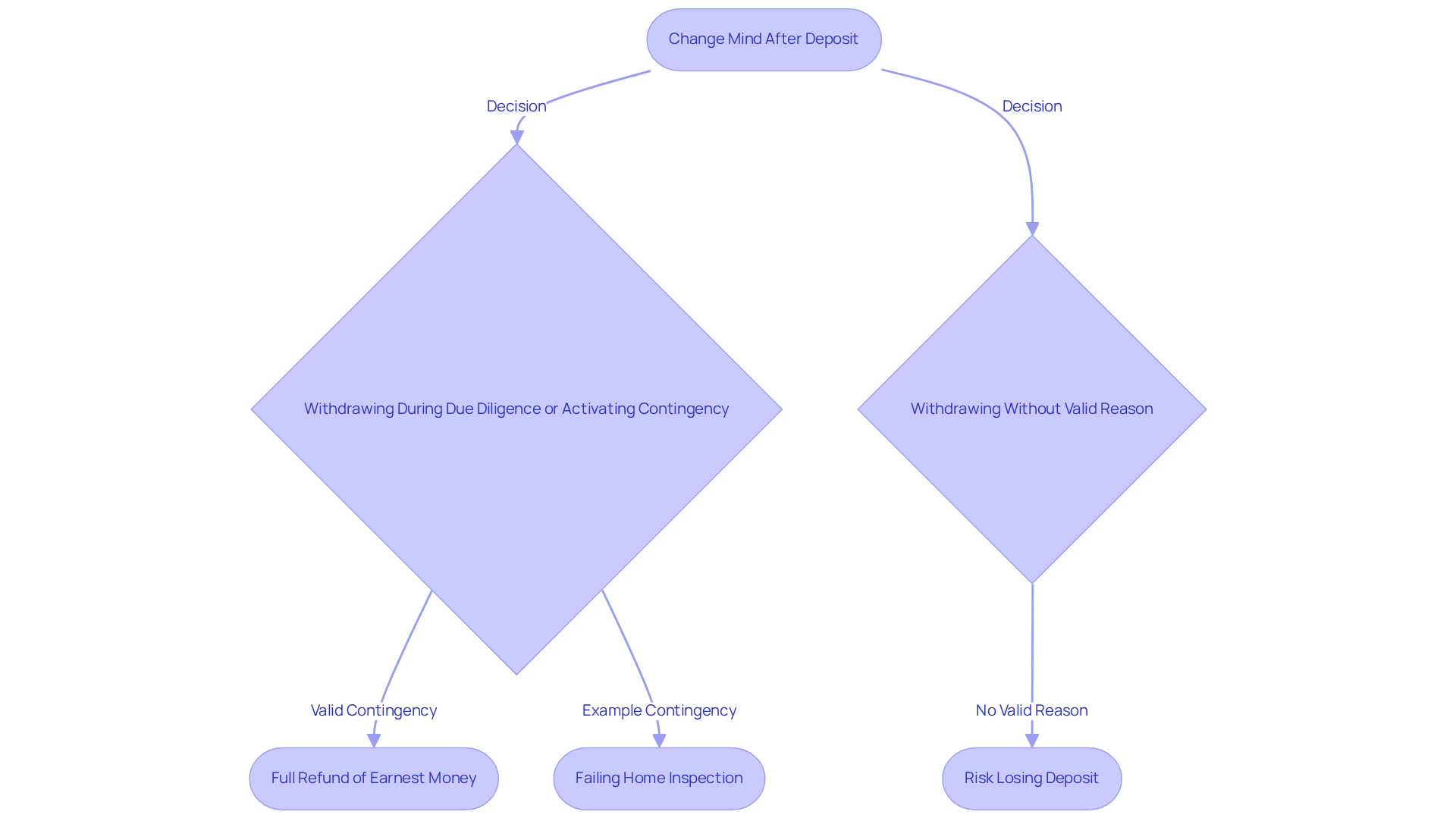

What Happens If You Change Your Mind After Depositing Earnest Money?

When you find yourself reconsidering your decision after making a significant payment, it’s important to understand that the outcome is primarily determined by the . If you decide to withdraw during the due diligence phase or activate a contingency—such as failing a —you are typically entitled to a of your . An earnest money deposit usually ranges from about 1 to 2 percent of the home’s selling price, which could mean a cost of between $4,000 and $8,000 based on the median U.S. home value of around $400,000. However, if you choose to withdraw without a valid reason, you risk losing your upfront payment, and the seller may even pursue , including a lawsuit for breach of contract.

To navigate these situations effectively, it’s crucial to carefully review your contracts and seek guidance from your real estate agent. As Heather Murphy wisely points out, ‘Withdrawing for a non-contingent reason could imply losing the earnest money deposit.’ Understanding the nuances of an earnest money deposit is essential for making informed choices. For example, a knowledgeable agent, as Josh Lavik emphasizes, can clarify the implications of and ensure that all contingencies—like home inspection, financing, and appraisal contingencies—are clearly stated in the agreement. This proactive approach not only protects your interests but also enhances your position in a competitive market. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

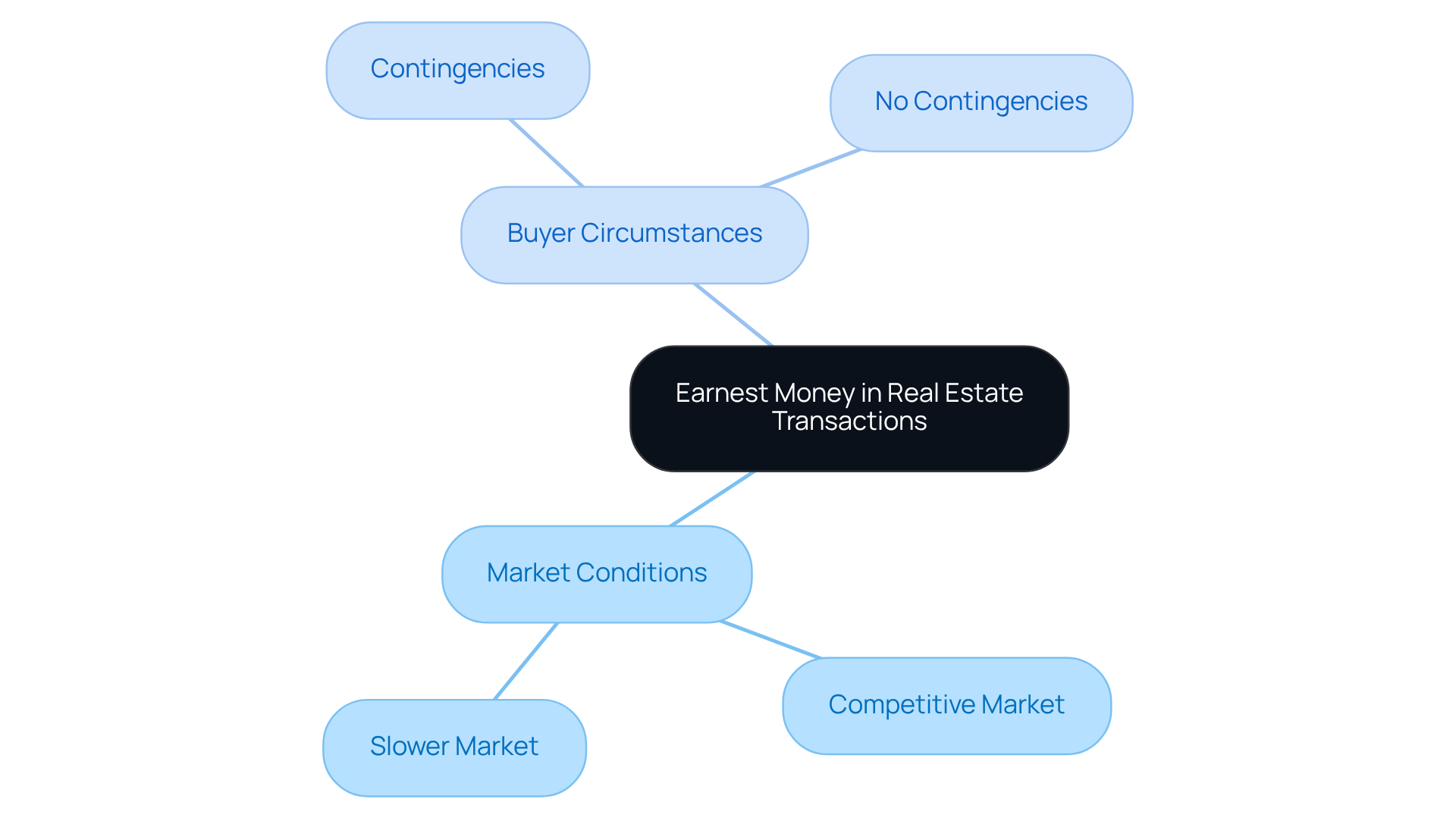

Examples of Earnest Money in Real Estate Transactions

In real estate deals, we know how challenging it can be to navigate . These deposits can vary significantly based on the property’s value and the regional market circumstances. For instance, in a competitive market, a purchaser might submit a larger to strengthen their proposal. Conversely, in a slower market, a smaller payment may suffice.

It’s also important to consider , such as needing to sell their current home first. In such cases, the conditions can be reflected in the structure of the . This approach ensures that both parties feel secure in the transaction, fostering a sense of trust and understanding.

We’re here to support you every step of the way as you . Understanding the nuances of good faith deposits can empower you to make informed decisions in your .

Conclusion

Navigating the complexities of earnest money deposits can feel daunting for any homebuyer. We understand how challenging this can be, but grasping this essential financial commitment is crucial. It not only signifies your serious intent but also protects both you and the seller in the transaction. By understanding the purpose and implications of earnest funds, you can approach the home purchasing process with greater confidence and clarity.

In this article, we’ve shared valuable insights about:

- Typical earnest money deposit amounts

- The conditions that determine refundability

- Potential pitfalls to avoid

We’ve also emphasized strategies for safeguarding your earnest money, such as:

- Including contingencies

- Adhering to contractual deadlines

Recognizing the role of escrow agents and understanding how earnest money relates to home financing enriches your knowledge, empowering you to make informed decisions.

Ultimately, the earnest money deposit is more than just a financial formality; it’s a critical component of your home-buying journey. By staying informed and proactive, you can protect your interests and navigate the complexities of real estate transactions with assurance. Engaging with knowledgeable professionals, like those at F5 Mortgage, ensures that each step you take is well-informed and strategically sound. We’re here to support you every step of the way.

Frequently Asked Questions

What is F5 Mortgage’s approach to earnest money deposits?

F5 Mortgage offers a streamlined process for managing earnest money deposits, utilizing cutting-edge technology and an intuitive interface to help buyers understand the requirements and implications of their earnest funds, reducing stress and enhancing efficiency, particularly for first-time homebuyers.

What is earnest money and what purpose does it serve?

Earnest money is a sum provided by buyers to demonstrate their genuine intention to purchase a property. It acts as a good faith gesture to reassure the seller of the buyer’s commitment, protects both parties, and ensures compensation for the seller if the buyer withdraws without justifiable reasons.

What are the typical amounts for earnest money deposits?

Earnest money deposits typically range from 1% to 3% of the home’s purchase price. However, this can vary based on local market conditions and agreements between the buyer and seller. In competitive markets, deposits may reach 3% to 10%, while in less competitive markets, they may be around 1% to 2%.

How can I safeguard my earnest money deposit?

To safeguard your earnest money deposit, consider utilizing an escrow account and understanding the conditions of your contingencies to prevent forfeiture if you need to withdraw from the agreement without a valid reason.

What types of loans does F5 Mortgage offer?

F5 Mortgage offers competitive rates and low down payment options, including FHA, VA, and Conventional Loans, to assist buyers in their home purchasing journey.

How does F5 Mortgage support first-time homebuyers?

F5 Mortgage provides support through a streamlined process for earnest money deposits, helping first-time homebuyers navigate the complexities of the home purchasing process with confidence and clarity.