Overview

Navigating the mortgage process can feel overwhelming, especially when it comes to understanding the loan-to-value (LTV) ratio. This important financial metric compares the amount of your loan to the appraised value of your property. We know how crucial this is for homebuyers, as it significantly influences loan approval, interest rates, and overall borrowing costs.

A lower LTV ratio, ideally 80% or less, indicates less risk to lenders. This can lead to better loan terms and lower costs for you. On the other hand, higher ratios may require private mortgage insurance (PMI), which can increase your borrowing expenses. We’re here to support you every step of the way as you consider how your LTV ratio impacts your financial journey.

Understanding these factors can empower you to make informed decisions. Remember, you have options, and we’re here to help you explore them.

Introduction

Navigating the complex world of mortgage lending can be daunting, and understanding the intricacies of the loan-to-value (LTV) ratio is paramount for prospective homebuyers. We know how challenging this can be, as this critical financial metric not only influences loan approval but also significantly impacts interest rates and overall borrowing costs.

As home values fluctuate and lending standards evolve, the question arises: how can buyers optimize their LTV to secure the best possible financial terms? By exploring the nuances of LTV ratios, you can empower yourself to make informed decisions that align with your financial goals.

Ultimately, this knowledge paves the way for successful homeownership, and we’re here to support you every step of the way.

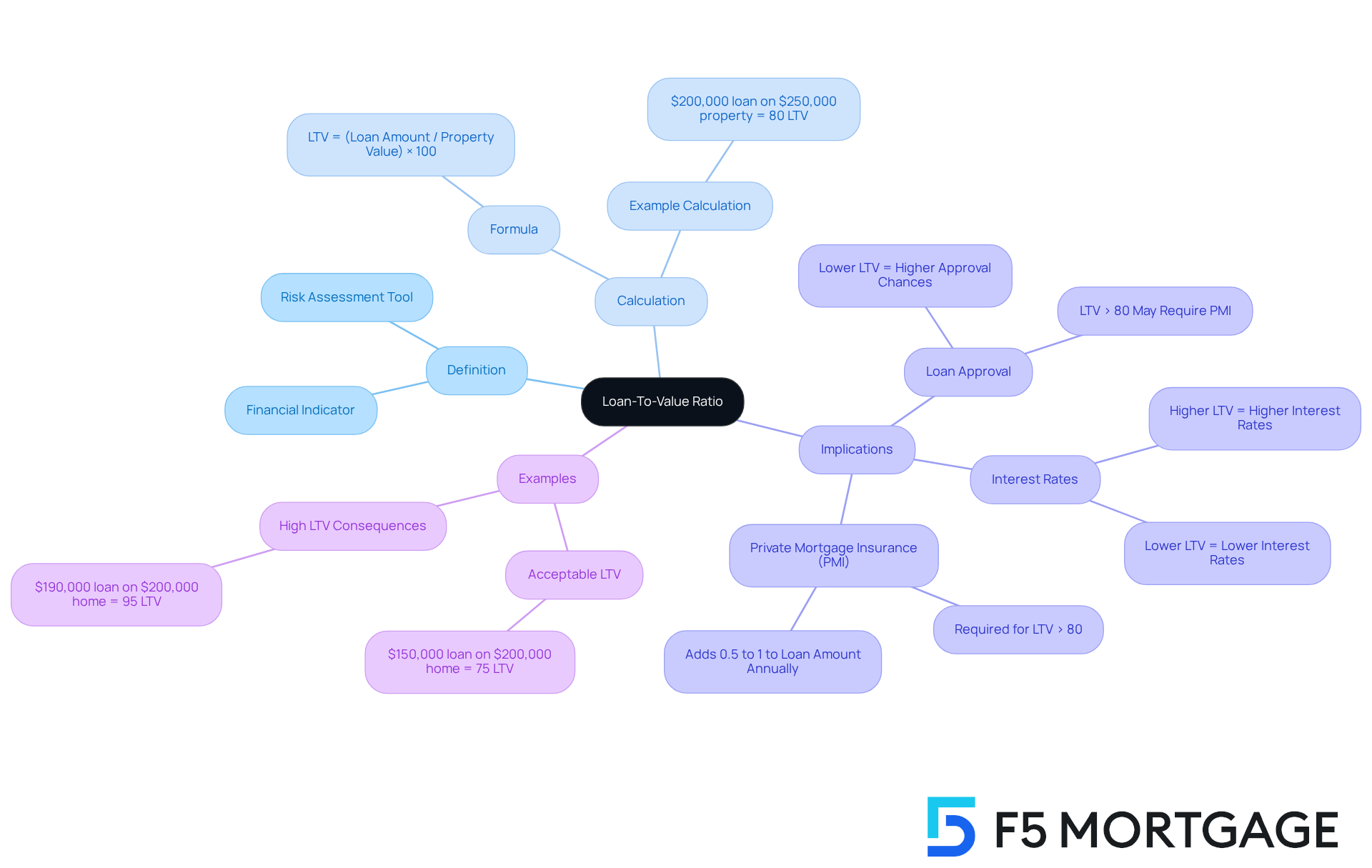

Define Loan-To-Value Ratio: Understanding the Basics

What is loan to value ratio is an essential financial indicator that lenders use to assess the risk associated with a home loan. It represents the relationship between the loan amount and the appraised value of the property, expressed as a percentage. To calculate the LTV ratio, simply divide the loan amount by the property’s assessed value and multiply by 100. For instance, if a borrower applies for a $200,000 loan on a property appraised at $250,000, the LTV calculation would be 80% (200,000 ÷ 250,000 × 100).

For homebuyers, understanding what is loan to value ratio is crucial, as it significantly impacts loan approval and interest rates. A lower LTV measurement generally indicates less risk for lenders, often resulting in better loan terms. For example, an LTV of 80% or lower is typically viewed favorably, while levels above 80% may require private mortgage insurance (PMI), which can add 0.5% to 1% to the overall loan amount each year. PMI payments are necessary until the LTV ratio, which is what is loan to value ratio, drops to 80% or less. Additionally, higher-risk borrowers with a higher LTV often face higher interest rates.

A key step in determining what is loan to value ratio involves obtaining a home appraisal, which establishes the current market value of the property. This appraisal not only reveals how much equity a homeowner has but also influences the mortgage rates available to them. Many lenders require homeowners to maintain a minimum of 80% loan-to-value, meaning they must have reduced at least 20% of their initial loan amount or that their home has appreciated in value. Furthermore, a maximum debt-to-income (DTI) ratio of 43% is typically required for home loans, reflecting the relationship between existing debt and income. A better DTI can lead to more competitive mortgage rates, making it essential for homebuyers to prepare adequately for mortgage approval.

In 2025, average LTV figures vary by state, reflecting regional differences in home values and lending practices. For example, states with higher home prices may see average LTV levels closer to 90%, while others may have lower averages.

Experts emphasize that while a higher measurement of what is loan to value ratio does not automatically disqualify borrowers, it often leads to increased borrowing costs. As mortgage specialist Dan Green notes, “A good LTV measurement should be no greater than 80%.” This highlights the importance of making a larger down payment to secure more favorable loan conditions. Additionally, LTVs exceeding 95% are frequently deemed unacceptable, underscoring the risks associated with elevated LTV figures.

Real-world scenarios illustrate the impact of LTV metrics. For instance, a borrower seeking a $150,000 loan for a $200,000 home would have a 75% LTV, which is generally acceptable and might qualify them for lower interest rates. Conversely, a $190,000 loan on the same property would result in a 95% LTV, likely leading to higher costs and the need for PMI.

In summary, understanding what is loan to value ratio is crucial for homebuyers since it affects loan eligibility, interest rates, and overall borrowing expenses. We know how challenging this can be, and we’re here to support you every step of the way.

Context and Importance of LTV Ratio in Mortgage Lending

Understanding what is loan to value ratio is essential in home financing, as it significantly influences the decisions made by lenders. When the LTV measurement is lower, it indicates that you have a larger equity position in your property. This can ease the lender’s concerns, reducing their risk. Conversely, a higher LTV means you are financing a larger share of your home’s value, which may lead to higher interest rates or even the need for private mortgage insurance (PMI). Many lenders prefer an LTV of 80% or lower, as this is linked to lower risk and more favorable loan conditions.

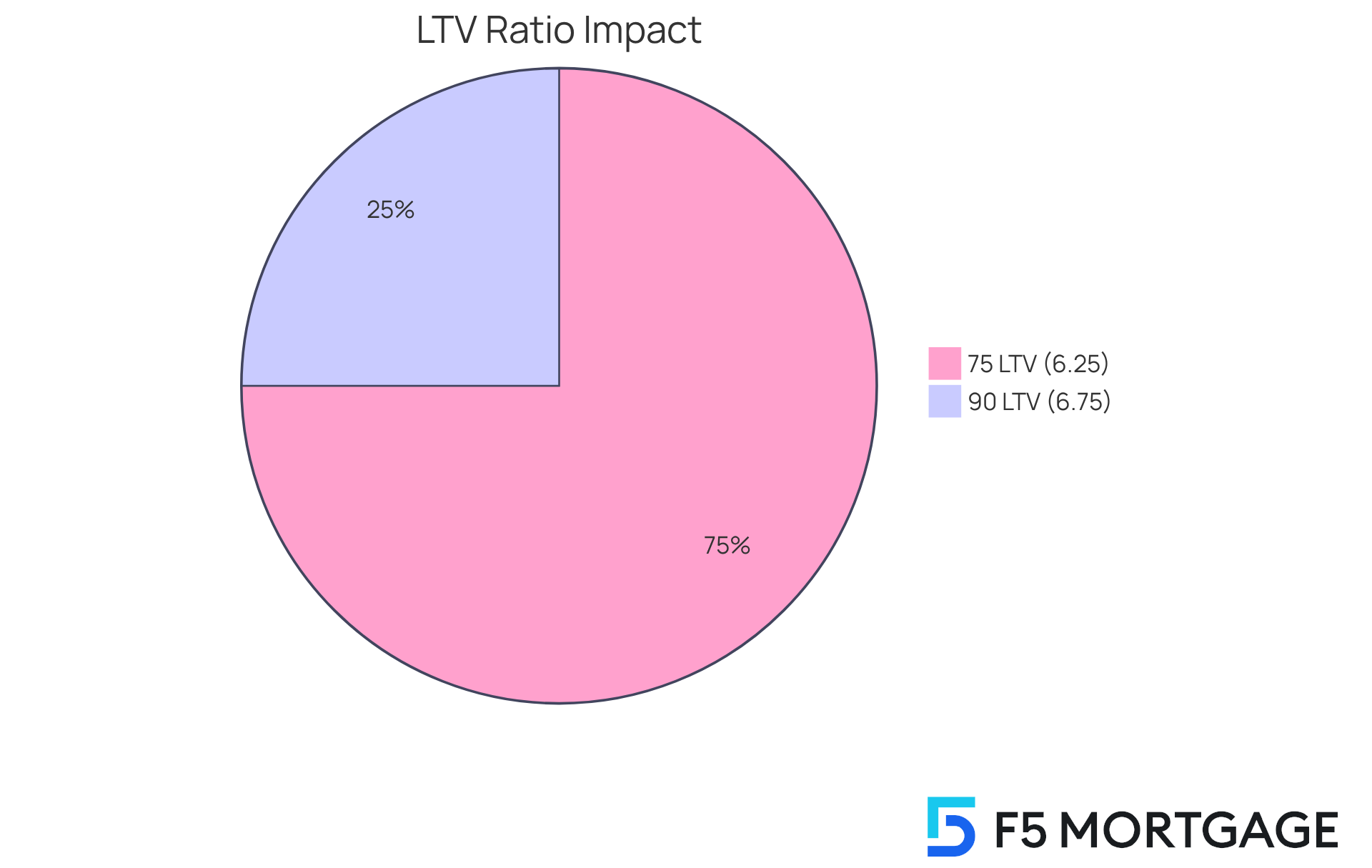

In 2025, the average interest rates reflect this relationship: borrowers with an LTV of 75% might face rates around 6.25%, while those with an LTV of 90% could see rates climb to about 6.75%. This difference underscores the importance of understanding what is loan to value ratio for homebuyers, as it directly impacts your borrowing capacity and the overall cost of your loan.

To understand what is loan to value ratio, lenders assess it by comparing the loan amount to the appraised value of the property. For instance, if you request a $300,000 loan for a home valued at $400,000, your LTV would be 75%. This favorable ratio can lead to a smoother approval process and lower interest rates. However, if you seek a $350,000 loan for the same property, your LTV would rise to 87.5%, potentially resulting in higher costs and stricter lending conditions.

Recognizing the implications of LTV measures is vital for homebuyers. It not only influences loan approval but also shapes the financial landscape of your borrowing journey. We know how challenging this can be, and we’re here to support you every step of the way.

Calculate the LTV Ratio: Methods and Examples

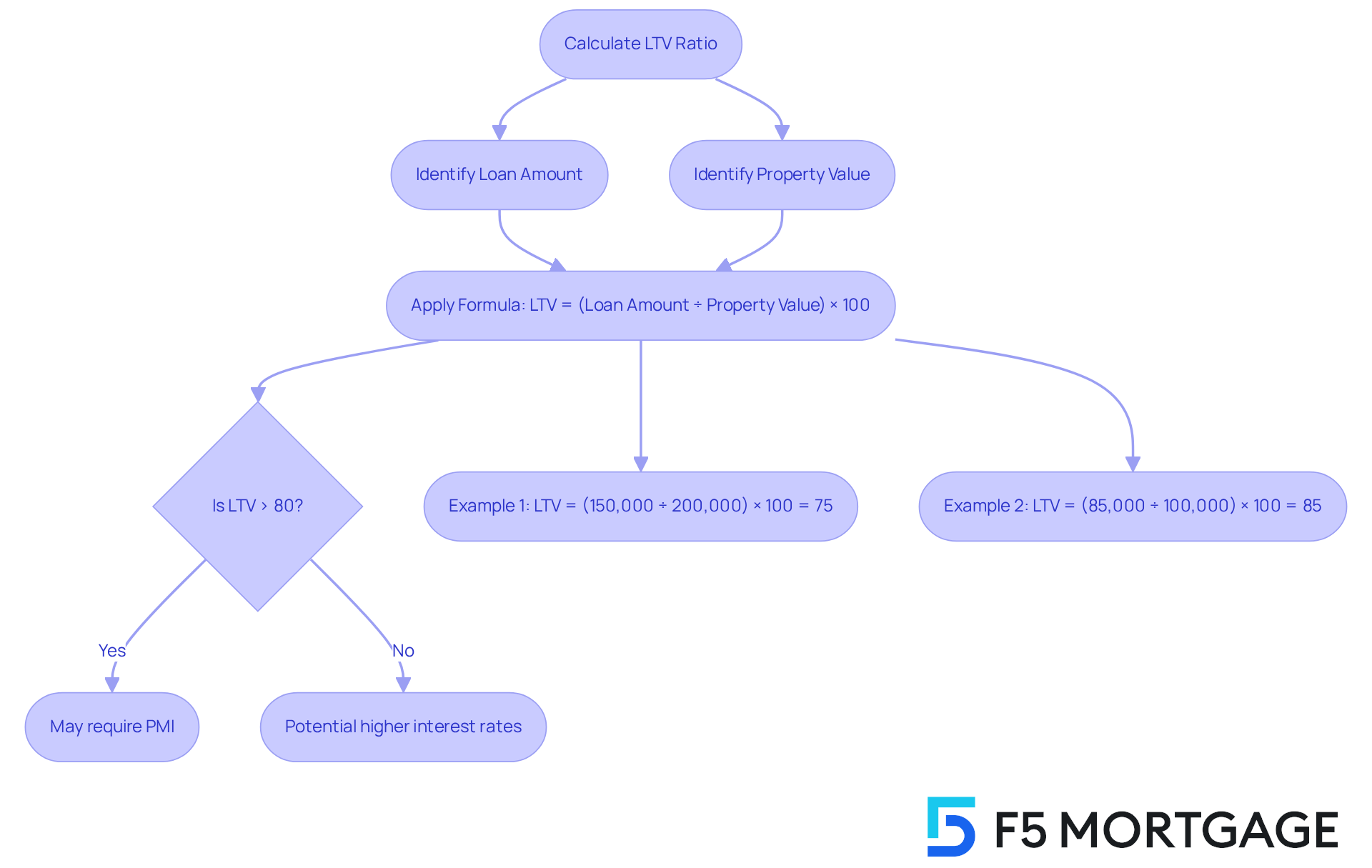

Understanding what is loan to value ratio is a straightforward yet vital step in the financing process. The formula is simple:

LTV = (Loan Amount ÷ Property Value) × 100.

For example, if you request a $150,000 loan on a property valued at $200,000, the calculation would be:

LTV = (150,000 ÷ 200,000) × 100 = 75%.

This means you’re financing 75% of your home’s value, which is an important figure to understand.

We know how challenging it can be to navigate the mortgage landscape. Understanding what is loan to value ratio is crucial for anyone seeking loans, as it helps you assess your financial standing and make informed decisions about your mortgage options. For instance, understanding what is loan to value ratio can help you realize that an LTV ratio above 80% may necessitate Private Mortgage Insurance (PMI), which can increase your monthly payments. Conversely, maintaining an LTV at or below 80% often secures the lowest interest rates from lenders, which is a practical example of what is loan to value ratio, creating a more favorable situation for you.

Let’s consider another example. Imagine you put down $15,000 on a home appraised at $100,000. This results in an LTV of 85%, calculated as follows:

LTV = (85,000 ÷ 100,000) × 100.

In this case, you might face higher interest rates and PMI costs, which can add to your financial burden.

Fortunately, numerous online calculators are available to help you quickly and easily calculate LTV percentages. These tools empower you to evaluate your financing options effectively. By understanding these calculations, you can navigate the complexities of loan financing more confidently and make decisions that align with your financial goals. Remember, we’re here to support you every step of the way.

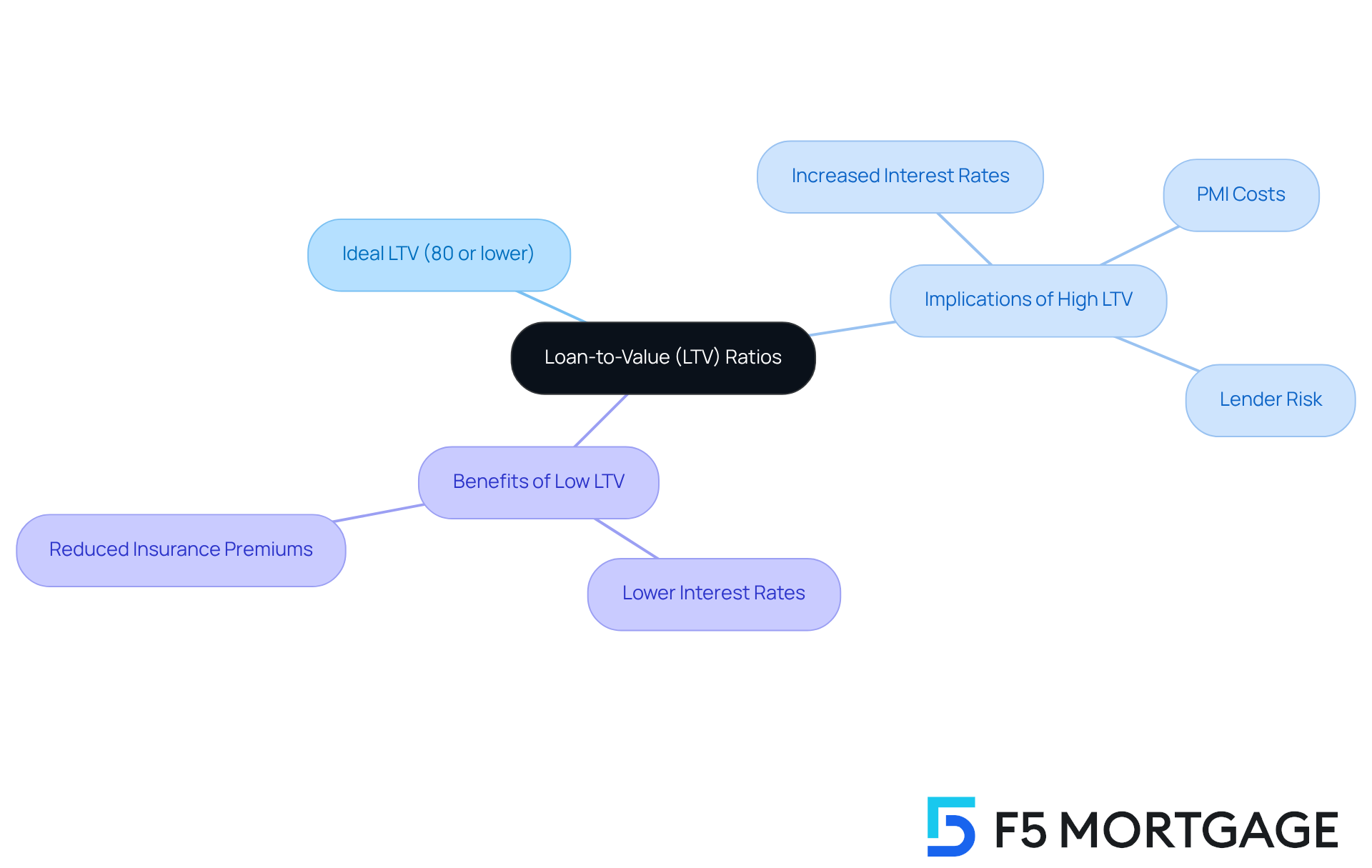

Implications of LTV Ratios: What Is Considered Good and Why It Matters

An ideal loan-to-value (LTV) measure is typically 80% or lower. We know how challenging navigating mortgage options can be, and understanding what is loan to value ratio is a crucial step in this journey. Ratios exceeding this threshold can lead to increased interest rates and the requirement for private mortgage insurance (PMI), which can add significant costs to your mortgage. For instance, an individual with a 90% LTV may face extra monthly costs due to PMI, which serves as a safety net for lenders in case of default.

In contrast, maintaining a lower LTV not only mitigates risk for lenders but also opens the door to more advantageous loan terms for you as a borrower. This includes reduced interest rates and lower insurance premiums. Comprehending these dynamics is essential as you explore your financing options and strive for long-term financial stability. Moreover, statistics show that PMI can contribute between 0.5% to 1% to the overall loan amount each year, highlighting the financial impact of elevated LTV levels.

Therefore, striving for an LTV ratio at or below 80% helps in understanding what is loan to value ratio and is beneficial. It enhances the likelihood of securing favorable mortgage conditions, making your homeownership dreams more attainable. Remember, we’re here to support you every step of the way in this process.

Conclusion

Understanding the loan-to-value (LTV) ratio is vital for homebuyers, as it serves as a key determinant in securing favorable mortgage terms. We know how challenging this can be, but this financial metric, which compares the amount of a loan to the appraised value of a property, directly impacts loan approval, interest rates, and overall borrowing costs. A lower LTV ratio is generally associated with reduced risk for lenders, leading to better loan conditions for borrowers.

Throughout this article, we’ve emphasized the importance of maintaining an LTV ratio at or below 80%. This threshold not only helps avoid private mortgage insurance (PMI) but also opens the door to lower interest rates and more competitive mortgage options. Real-world examples illustrate how different LTV calculations can affect borrowing experiences, highlighting the importance of being informed and prepared when navigating the mortgage landscape.

Ultimately, achieving a favorable LTV ratio is essential for aspiring homeowners. By understanding its implications, homebuyers can make informed decisions that enhance their financial stability and ease the path toward homeownership. We’re here to support you every step of the way. Taking the time to calculate and strategize around the LTV ratio can lead to significant long-term savings and a more secure investment in your future.

Frequently Asked Questions

What is the loan-to-value (LTV) ratio?

The loan-to-value (LTV) ratio is a financial indicator that lenders use to assess the risk of a home loan. It represents the relationship between the loan amount and the appraised value of the property, expressed as a percentage.

How do you calculate the LTV ratio?

To calculate the LTV ratio, divide the loan amount by the property’s assessed value and multiply by 100. For example, if a borrower applies for a $200,000 loan on a property appraised at $250,000, the LTV would be 80% (200,000 ÷ 250,000 × 100).

Why is the LTV ratio important for homebuyers?

Understanding the LTV ratio is crucial for homebuyers because it significantly impacts loan approval and interest rates. A lower LTV typically indicates less risk for lenders, resulting in better loan terms.

What LTV ratio is considered favorable for loan approval?

An LTV of 80% or lower is generally viewed favorably by lenders, while levels above 80% may require private mortgage insurance (PMI).

What is private mortgage insurance (PMI)?

Private mortgage insurance (PMI) is an insurance policy that lenders may require if the LTV ratio exceeds 80%. It can add 0.5% to 1% to the overall loan amount each year and is necessary until the LTV drops to 80% or less.

How does LTV affect mortgage interest rates?

Higher-risk borrowers with a higher LTV often face higher interest rates. A better LTV measurement can lead to more competitive mortgage rates.

What role does a home appraisal play in determining the LTV ratio?

A home appraisal establishes the current market value of the property, revealing how much equity a homeowner has and influencing the mortgage rates available to them.

What is the typical maximum debt-to-income (DTI) ratio required for home loans?

A maximum debt-to-income (DTI) ratio of 43% is typically required for home loans, reflecting the relationship between existing debt and income.

How do average LTV figures vary by state?

Average LTV figures vary by state due to regional differences in home values and lending practices. States with higher home prices may see average LTV levels closer to 90%, while others may have lower averages.

What is a good LTV measurement according to experts?

Experts suggest that a good LTV measurement should be no greater than 80%. LTVs exceeding 95% are often deemed unacceptable due to the associated risks.