Overview

When it comes to loans, understanding the origination fee is essential. This one-time charge, usually a percentage of the loan amount, compensates lenders for the work involved in processing your loan application and handling related tasks. We know how challenging navigating these costs can be, and recognizing this fee is crucial. It not only impacts your immediate borrowing costs but also has lasting financial implications.

By grasping the significance of this fee, you can make more informed decisions when choosing loan providers and financing options. We’re here to support you every step of the way, guiding you through the mortgage process with empathy and expertise. Remember, being well-informed empowers you to select the best financial path for your family.

Introduction

Understanding the intricacies of loan financing can feel overwhelming, especially when considering the costs involved. Among these costs, the origination fee emerges as a crucial yet often misunderstood element that can greatly impact the overall expense of borrowing. In this article, we will explore the meaning, purpose, and calculation of origination fees, illuminating how they affect both lenders and borrowers.

But what happens when these fees become a hidden hurdle for potential homeowners? We know how challenging this can be. Navigating this complex landscape is essential to making informed financial decisions. Together, we can empower you to understand and manage these costs effectively.

Define Origination Fee: Understanding the Basics

To understand what is an , it is essential to know that it is a one-time cost that financial institutions apply to applicants for processing a credit request. What is an origination fee on a loan? This fee, typically expressed as a percentage of the total borrowed amount, compensates the financial institution for the administrative work involved in evaluating and approving the credit. For example, if you take out a $300,000 mortgage with a 1% origination fee, you would pay $3,000 at closing. Understanding what is an origination fee on a loan is essential, as this charge directly impacts the total expense of financing and can influence your decision when choosing a provider.

At , we recognize that can feel overwhelming. Since we operate as an intermediary and do not manage financing, you will make payments to the entity with which your financing concludes. This distinction is particularly important for , as it clarifies the payment process and highlights the need to compare lenders for .

By collaborating with F5 Mortgage, you can ensure that you receive . We’re here to support you every step of the way, helping you make that align with your family’s needs.

Explain the Purpose of Origination Fees in Loan Transactions

We understand that what is an origination fee on a loan can feel overwhelming, as . These charges serve several key functions, primarily reimbursing creditors for the various expenses incurred during the borrowing application process, such as underwriting, credit assessments, and administrative tasks. They also encompass the provider’s risk evaluation and the time spent reviewing your financial profile.

By introducing an origination fee, financial institutions ensure they are fairly compensated for the . This practice not only supports the lender’s operational expenses but also enables them to offer competitive interest rates and a variety of , including those available through F5 Mortgage.

is crucial for anyone seeking funds, as this fee . We know how challenging this can be, so we encourage you to . can provide you with tailored to your unique financial situation. We’re here to every step of the way.

Detail How Origination Fees Are Calculated and Determined

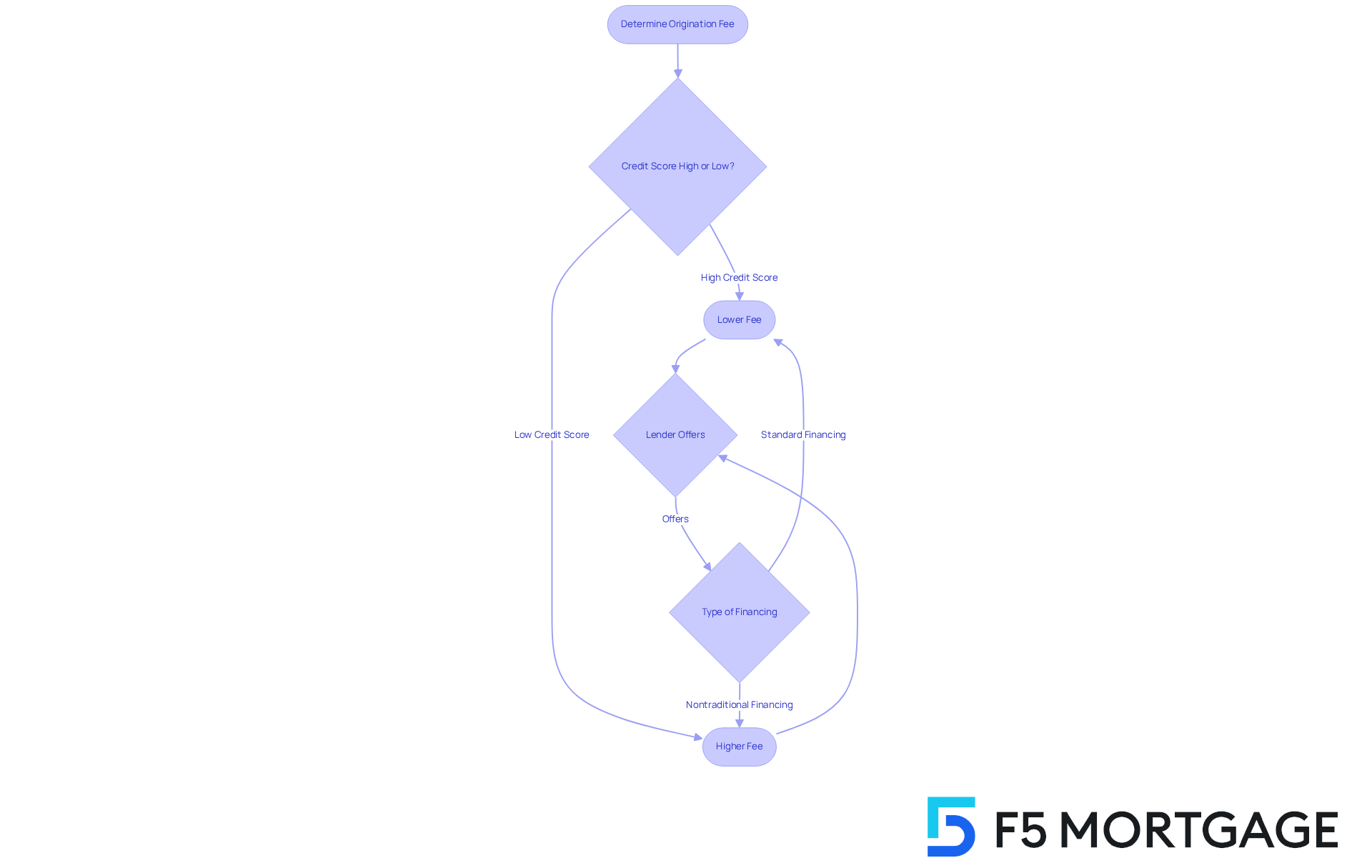

Understanding can feel overwhelming, particularly when navigating the mortgage landscape. Typically, these fees are a percentage of the total amount borrowed, ranging from 0.5% to 1% for mortgages. Yet, this percentage can change based on various factors, such as the lender’s policies, your creditworthiness, and the type of financing you seek. For example, if you have a higher credit score, you may qualify for a lower origination fee compared to someone with a lower score.

It’s important to remember that some lenders might offer reduced initiation charges in exchange for higher interest rates. This trade-off is something you should carefully consider as you evaluate your financing options. When you choose to , we encourage you to . We offer a range of both standard and nontraditional loan programs that can meet your .

Being aware of your refinancing eligibility is crucial. This includes and the role of appraisals, both of which can significantly impact your overall expenses, particularly when considering what is an origination fee on a loan. We know how challenging this can be, but by navigating the with F5 Mortgage, you can make informed decisions that align with your financial goals. Remember, we’re here to support you every step of the way.

Evaluate the Pros and Cons of Paying Origination Fees

Navigating initial costs can be a challenging journey, and we understand how overwhelming it may feel. At F5 Mortgage, we prioritize a technology-focused strategy that aims to provide while ensuring a . On the positive side, paying these fees can lead to , potentially resulting in significant savings over the life of your loan. For example, if you’re willing to pay a higher amount when considering , you might secure a lower interest rate, which can decrease your monthly payments.

This approach aligns with our commitment to offering ultra-competitive mortgage rates, free from the hard sales tactics often employed by traditional lenders. However, it’s important to consider the drawbacks as well. Understanding what is an is important, as these charges can increase your and pose an obstacle, especially for . If you opt for a loan without any initial charges, you might face elevated interest rates, leading to greater total expenses over time.

Therefore, we encourage you to carefully evaluate your financial situation and long-term goals when considering what is an origination fee on a loan. By doing so, you can make informed decisions that reflect our consumer-centric philosophy and the transformative change we strive to bring to the mortgage industry. Remember, we’re here to support you every step of the way.

Conclusion

Understanding the intricacies of origination fees is vital for anyone navigating the loan process. These fees, often a percentage of the loan amount, serve as a compensation mechanism for lenders, covering the administrative costs associated with processing credit applications. By grasping the significance of these fees, borrowers can make more informed decisions that directly affect their financial outcomes.

We know how challenging this can be, especially for first-time homebuyers. Throughout the article, we’ve provided key insights regarding the definition, purpose, calculation, and implications of origination fees. While these fees can lead to lower interest rates and potential savings over time, they can also increase initial costs. Factors such as creditworthiness and lender policies play a crucial role in determining the specific fees applicable to each borrower.

Ultimately, being informed about origination fees empowers borrowers to evaluate their financing options critically. As the mortgage landscape continues to evolve, understanding these fees can lead to better financial decisions and enhanced overall loan experiences. It’s essential to weigh the pros and cons carefully and seek personalized advice to navigate this complex terrain effectively. Making educated choices today can pave the way for a more secure financial future.

Frequently Asked Questions

What is an origination fee on a loan?

An origination fee is a one-time cost charged by financial institutions to loan applicants for processing a credit request. It compensates the institution for the administrative work involved in evaluating and approving the credit.

How is the origination fee typically expressed?

The origination fee is usually expressed as a percentage of the total borrowed amount.

Can you provide an example of an origination fee?

For instance, if you take out a $300,000 mortgage with a 1% origination fee, you would pay $3,000 at closing.

Why is it important to understand the origination fee?

Understanding the origination fee is essential because it directly impacts the total expense of financing and can influence your decision when choosing a lender.

What role does F5 Mortgage play in the mortgage process?

F5 Mortgage acts as an intermediary in the mortgage process, helping clients navigate the process but not managing financing directly. Payments are made to the entity with which the financing concludes.

How can F5 Mortgage assist borrowers?

F5 Mortgage provides customized assistance throughout the financing process, helping borrowers make informed decisions that align with their family’s needs.