Overview

Navigating the mortgage landscape can feel overwhelming, especially when considering the many factors at play. Your ability to afford a mortgage hinges on key elements like your income, debt-to-income ratio, credit score, and the size of your down payment. We understand how challenging this can be, but by carefully evaluating these aspects, you can gain clarity.

This article sheds light on the different types of mortgages available, helping you make informed decisions that align with your financial capabilities. Imagine feeling empowered to choose a mortgage that not only fits your budget but also supports a sustainable homeownership experience. We’re here to support you every step of the way.

As you explore your options, remember that understanding these factors is crucial. By taking the time to assess your situation, you can embark on your homeownership journey with confidence, ensuring that your decisions reflect your needs and aspirations.

Introduction

Navigating the complexities of mortgage affordability is essential for anyone embarking on the journey of homeownership. We understand how overwhelming it can feel as housing prices rise and financial responsibilities grow. Prospective buyers face the challenging task of figuring out what kind of mortgage they can realistically afford.

This article explores the key factors that influence mortgage affordability, including:

- Income

- Credit scores

- The various types of loans available

With so much at stake, how can you ensure that your decisions align with your financial stability and long-term goals? We’re here to support you every step of the way.

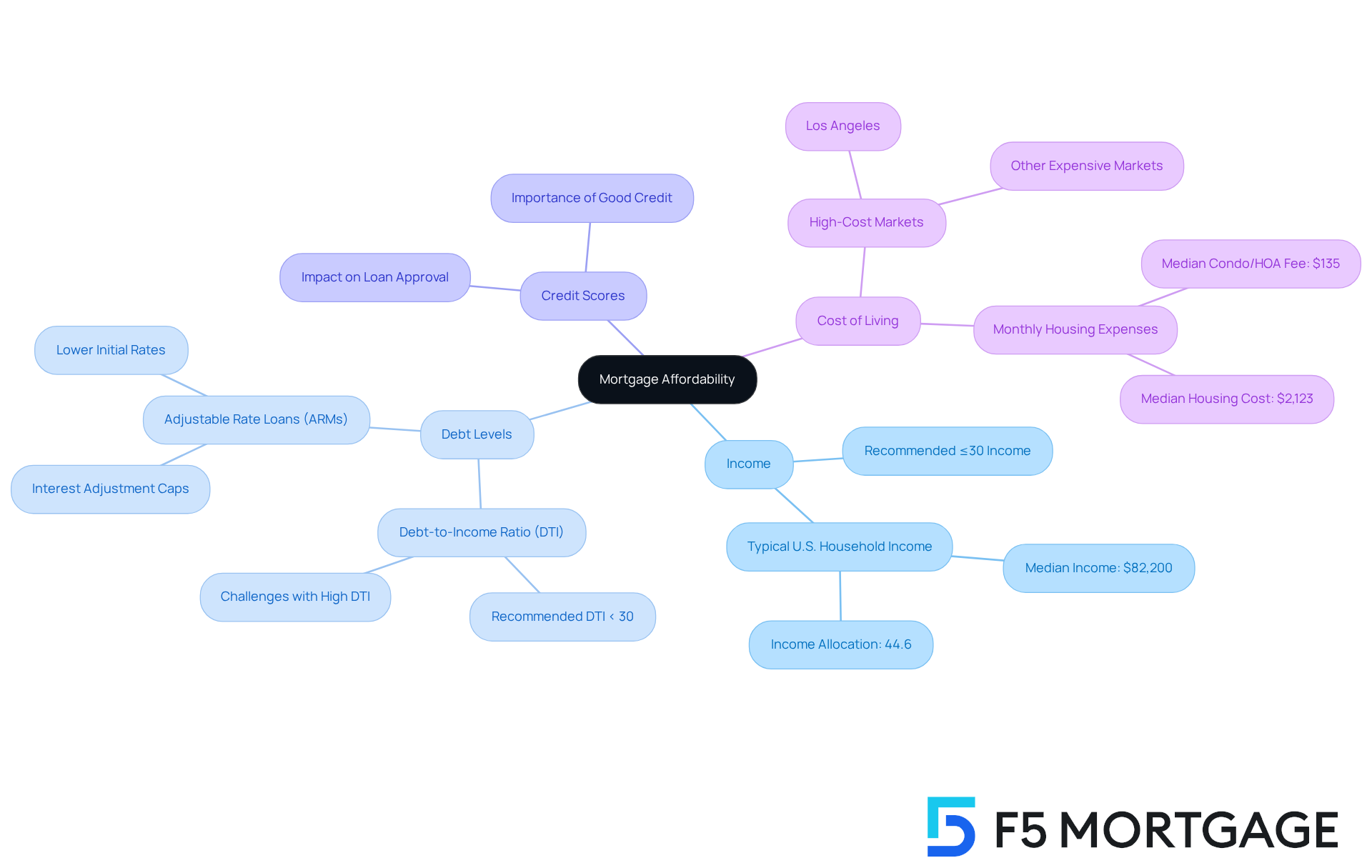

Defining Mortgage Affordability

Loan affordability is about understanding how well a borrower can manage regular housing costs alongside other financial responsibilities. It involves various factors, such as income, debt levels, credit scores, and the overall cost of living. For prospective homebuyers, knowing what kind of mortgage can I afford is essential. It helps them determine what kind of mortgage can I afford without jeopardizing their financial stability. This concept goes beyond merely qualifying for a loan; it’s about ensuring that monthly expenses fit comfortably within a borrower’s budget, paving the way for a worry-free homeownership experience.

In 2025, the typical U.S. household may need to allocate 44.6% of their income to afford a median-priced home. This figure significantly exceeds the recommended threshold of 30%. Spending around 30% or less of your pre-tax income on housing allows room for other essential expenses and savings, as noted by Realtor.com. This reality underscores the challenges many families face, particularly in high-cost markets like Los Angeles, where annual housing costs often surpass typical annual incomes.

To determine what kind of mortgage can I afford, it is essential to assess housing affordability by closely examining personal finances, including current income, existing debts, and anticipated housing expenses. For those considering adjustable-rate loans (ARMs), it’s important to recognize that while they often come with lower initial rates, the potential for rate changes can introduce uncertainty into regular costs. Borrowers should also be mindful of interest adjustment caps, which can help shield them from steep increases. By carefully examining these elements, potential homebuyers can make informed decisions that align with their financial goals. As industry specialists emphasize, understanding housing affordability is not just about meeting financing criteria; it’s about ensuring that monthly payments fit comfortably within a borrower’s budget, creating a pathway for a stress-free homeownership experience.

Key Factors Influencing Mortgage Affordability

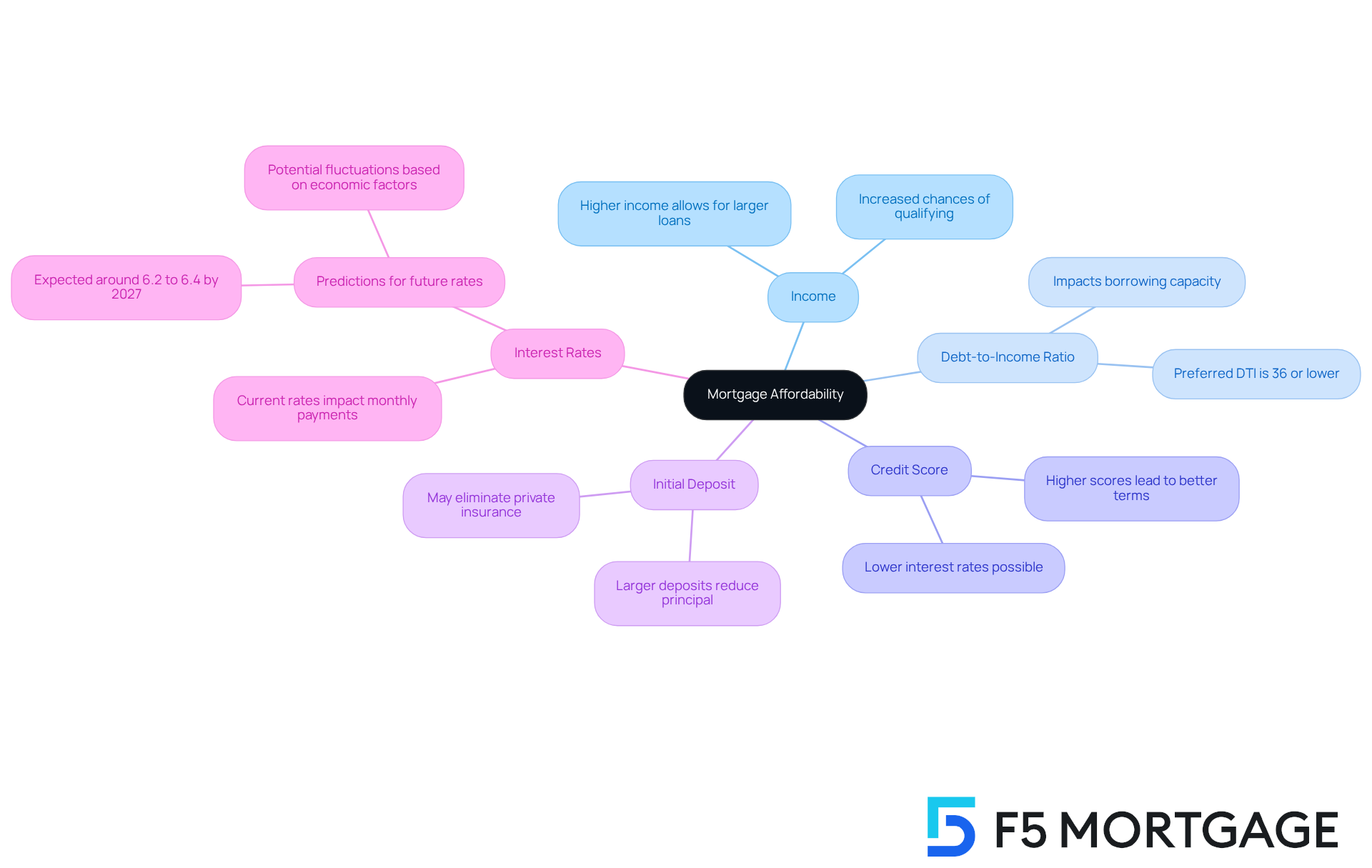

When evaluating what kind of mortgage can I afford, several key factors come into play that can significantly impact your journey to homeownership.

-

Income: We understand how important your income is in determining your borrowing ability. A higher income can enhance your chances of qualifying for larger loan amounts, making your dream home more attainable.

-

Debt-to-Income Ratio (DTI): This ratio compares your total monthly debt obligations to your gross income. Lenders typically prefer a DTI of 36% or lower, so it’s essential to keep this in mind as you plan.

-

Credit Score: Your credit score plays a crucial role in the financing conditions you receive. A higher score can lead to better terms and lower interest rates, ultimately making home loans more affordable for you.

-

Initial Deposit: The size of your initial deposit can greatly influence the amount you need to borrow and your monthly payments. A larger deposit reduces the principal and may eliminate private insurance, especially for conventional loans with less than 20% down. This is particularly beneficial in markets with high home appreciation rates, like California, where refinancing can help you achieve a favorable loan-to-value (LTV) ratio.

-

Interest Rates: Lastly, be aware that current home loan rates have a significant impact on your monthly payments. Even a slight increase in rates can affect what you can afford, so staying informed is key.

We know how challenging this can be, but understanding these factors can empower you to make informed decisions regarding what kind of mortgage can I afford on your path to homeownership. We’re here to support you every step of the way.

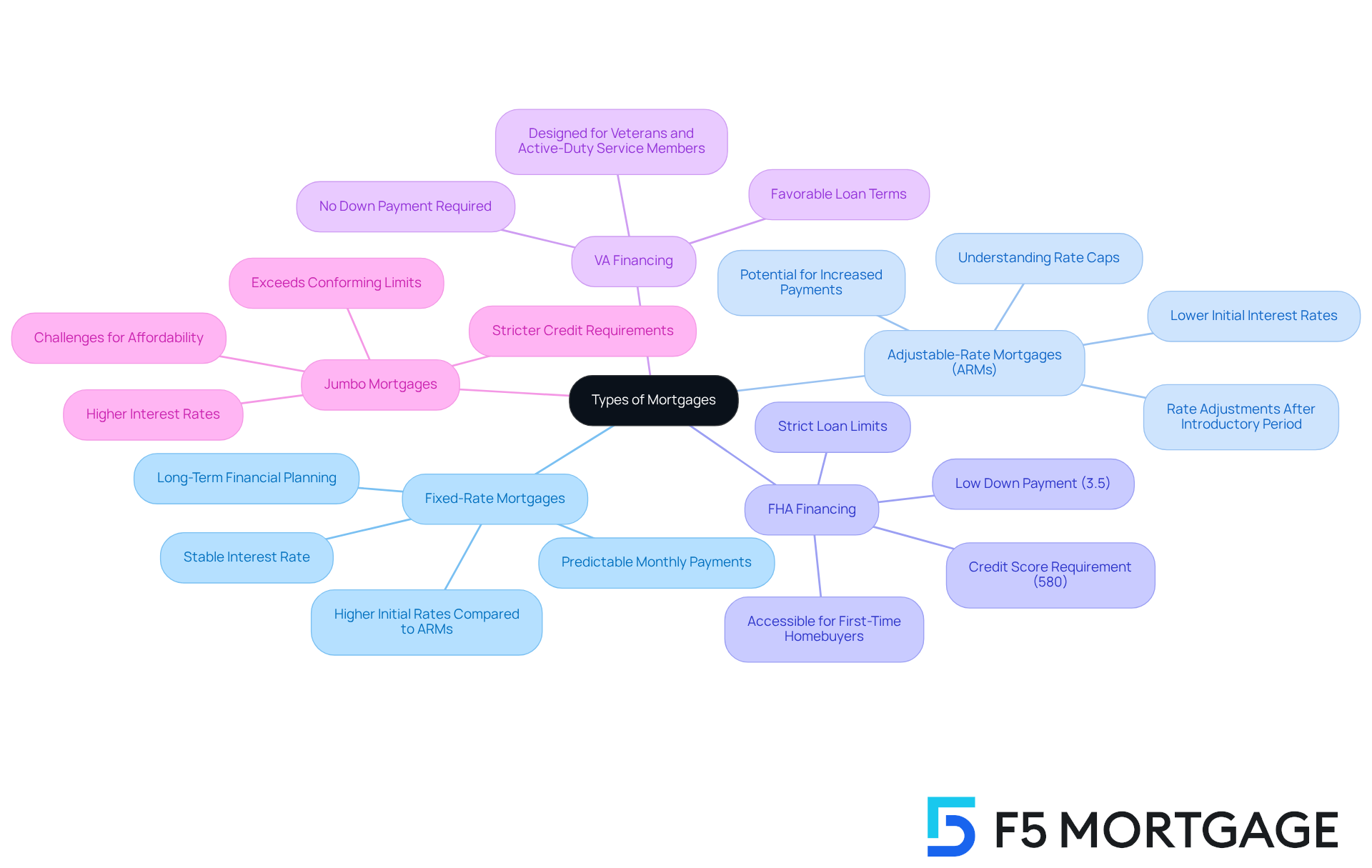

Types of Mortgages and Their Impact on Affordability

Choosing the right loan is a significant step toward achieving your homeownership dreams, and it helps you understand what kind of mortgage can I afford, playing a crucial role in determining overall affordability. We understand how overwhelming this process can be, so let’s explore some common mortgage types and their implications together.

-

Fixed-Rate Mortgages: These loans maintain a stable interest rate throughout the entire loan duration, providing you with consistent monthly expenses. This stability is beneficial for your long-term financial planning. However, it’s important to note that they may start with higher rates compared to adjustable-rate mortgages.

-

Adjustable-Rate Mortgages (ARMs): ARMs typically begin with lower interest rates that adjust after an introductory period. While this can lead to reduced initial costs, it’s essential to be cautious of potential rate hikes that could impact your long-term affordability. Understanding the terms of an ARM, including how often rates adjust and any caps on increases, is vital for managing your future costs.

-

FHA Financing: Supported by the Federal Housing Administration, FHA financing is designed for low-to-moderate-income borrowers. With a down payment as low as 3.5% and a credit score requirement of 580, these loans are attainable for many first-time homebuyers. In 2025, FHA financing continues to be a crucial option for individuals seeking affordable funding solutions.

-

VA Financing: Tailored for veterans and active-duty service members, VA financing often requires no down payment and features favorable terms, significantly enhancing affordability for eligible borrowers. This makes it an attractive choice for those who qualify, allowing for easier entry into homeownership.

-

Jumbo Mortgages: These financial products exceed conforming limits and usually come with stricter credit requirements and higher interest rates. Consequently, they can pose challenges for affordability, especially for buyers looking at high-value properties.

In summary, understanding what kind of mortgage can I afford is essential for making informed choices that align with your financial objectives. For instance, FHA loans have proven beneficial in enhancing affordability for low-income borrowers, while fixed-rate loans provide the stability necessary for long-term financial planning. As the housing market evolves, being aware of these options can empower you to navigate your financing journey successfully. Remember, we’re here to support you every step of the way.

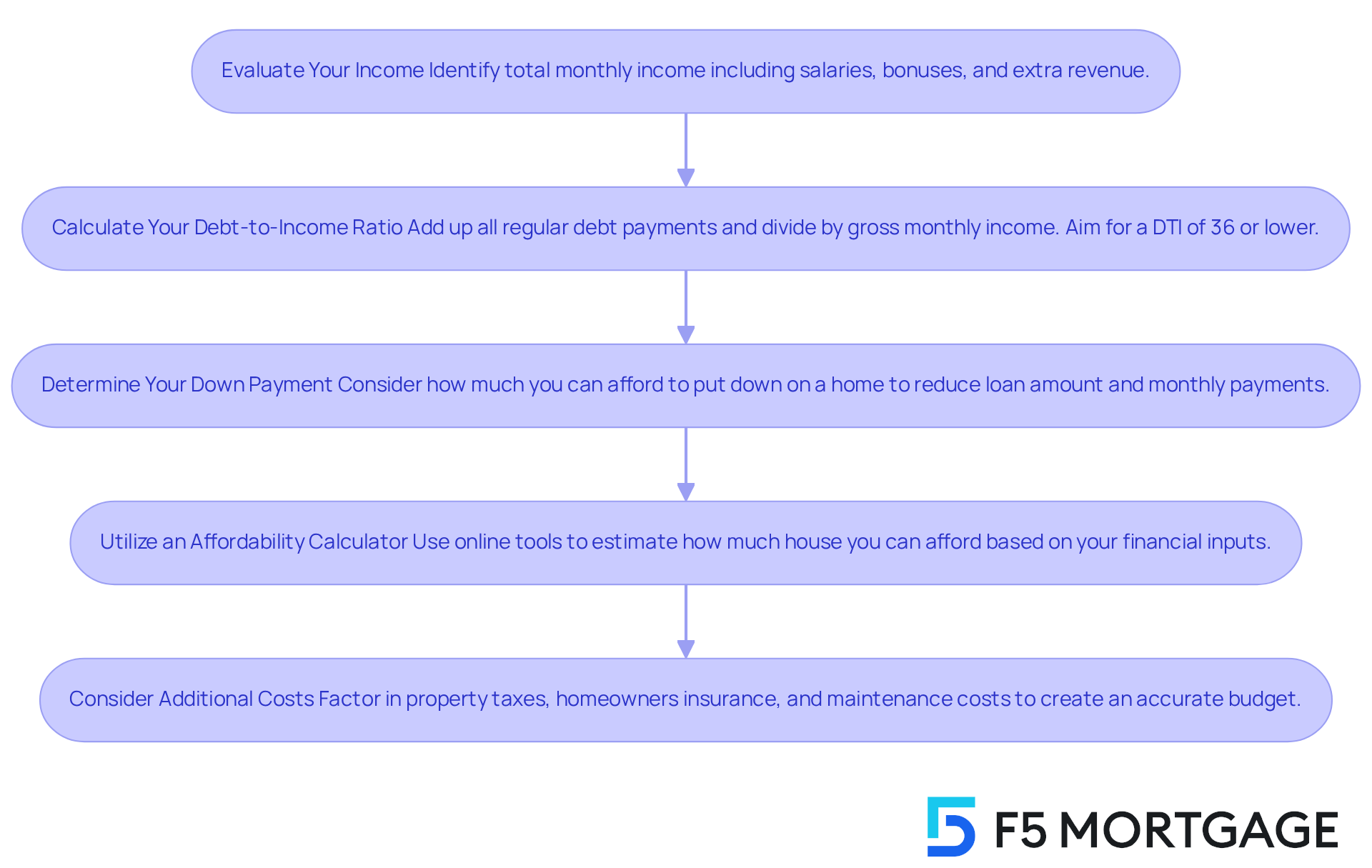

Calculating Your Mortgage Affordability

Understanding what kind of mortgage can I afford can feel overwhelming, but we’re here to support you every step of the way. Let’s break it down into manageable steps:

-

Evaluate Your Income: Begin by identifying your total monthly income. This includes all sources of earnings—salaries, bonuses, and any extra revenue. Understanding your financial landscape is the first step toward making informed decisions.

-

Calculate Your Debt-to-Income Ratio (DTI): Next, add up all your regular debt payments. This includes credit cards, vehicle debts, and other financial responsibilities. Divide this total by your gross monthly income. Ideally, aim for a DTI of 36% or lower. This is a common threshold that lenders use to assess your borrowing eligibility, and it can help you feel more secure in your financial choices.

-

Determine Your Down Payment: Consider how much you can afford to put down on a home. A larger down payment not only reduces your loan amount but also lowers your monthly payments and can help you avoid private mortgage insurance (PMI). This step can significantly impact your long-term financial health.

-

Utilize an Affordability Calculator: Take advantage of online tools, such as those from Fannie Mae or Zillow, to estimate how much house you can afford based on your financial inputs. These calculators can provide a quick and easy assessment of your purchasing power, making the process less daunting.

-

Consider Additional Costs: Remember to factor in property taxes, homeowners insurance, and maintenance costs. These expenses can greatly affect your overall housing budget each month. By being aware of these additional costs, you can create a more accurate picture of what you can afford.

By following these steps, you can gain a clearer understanding of what kind of mortgage can I afford. We know how challenging this can be, but understanding that your monthly housing payment should ideally not exceed 28% of your gross monthly income can guide your budgeting process effectively. You have the power to make informed decisions about your home purchase.

Conclusion

Understanding mortgage affordability is crucial for prospective homebuyers like you, who are aiming to make informed financial decisions. We know how challenging this can be, but by grasping the various elements that influence what kind of mortgage you can afford, you can navigate the complexities of homeownership without compromising your financial well-being. It is essential to prioritize affordability, ensuring that housing costs remain manageable within the broader context of your personal finances.

Key factors such as:

- Income

- Debt-to-income ratio

- Credit scores

- The type of mortgage chosen

play significant roles in determining what you can afford. Fixed-rate mortgages offer stability, while adjustable-rate mortgages may present initial savings but come with potential risks. Additionally, understanding financing options like FHA and VA loans can provide valuable pathways for families with varying financial backgrounds. By evaluating these aspects, you can better assess your purchasing power and align your choices with your long-term financial goals.

Ultimately, the journey to homeownership requires careful planning and a thorough understanding of your financial landscape. By taking proactive steps to calculate mortgage affordability and considering all related expenses, you can position yourself for success. Embracing this knowledge not only empowers you to make sound financial choices but also fosters a more sustainable approach to homeownership, paving the way for a secure and fulfilling living experience.

Frequently Asked Questions

What is mortgage affordability?

Mortgage affordability refers to how well a borrower can manage regular housing costs alongside other financial responsibilities, considering factors like income, debt levels, credit scores, and the overall cost of living.

Why is it important for prospective homebuyers to know what kind of mortgage they can afford?

Knowing what kind of mortgage one can afford is essential for prospective homebuyers to ensure they do not jeopardize their financial stability and that their monthly expenses fit comfortably within their budget.

What percentage of income is recommended to be spent on housing?

It is recommended to spend around 30% or less of pre-tax income on housing to allow room for other essential expenses and savings.

What percentage of income may a typical U.S. household need to allocate for housing in 2025?

In 2025, a typical U.S. household may need to allocate 44.6% of their income to afford a median-priced home, which exceeds the recommended threshold.

What factors should be assessed to determine mortgage affordability?

To determine mortgage affordability, it is essential to assess personal finances, including current income, existing debts, and anticipated housing expenses.

What should borrowers consider when looking at adjustable-rate loans (ARMs)?

Borrowers should recognize that ARMs often have lower initial rates, but the potential for rate changes can introduce uncertainty into regular costs. They should also be mindful of interest adjustment caps to protect against steep increases.

How does understanding housing affordability contribute to homeownership?

Understanding housing affordability helps ensure that monthly payments fit comfortably within a borrower’s budget, paving the way for a stress-free homeownership experience.