Overview

Navigating the journey of securing a home equity loan can feel daunting, but we’re here to support you every step of the way. To make this process easier, it’s essential to gather a few key documents. You’ll need:

- Proof of identity

- Proof of income

- Verification of homeownership

- A good credit score

- Information about any existing debts

By preparing these necessities, families can better equip themselves for the application process. We know how challenging this can be, but having the right documentation and understanding the eligibility criteria can truly streamline your borrowing experience. This preparation not only enhances your chances of approval but also empowers you to take confident steps toward your financial goals.

Introduction

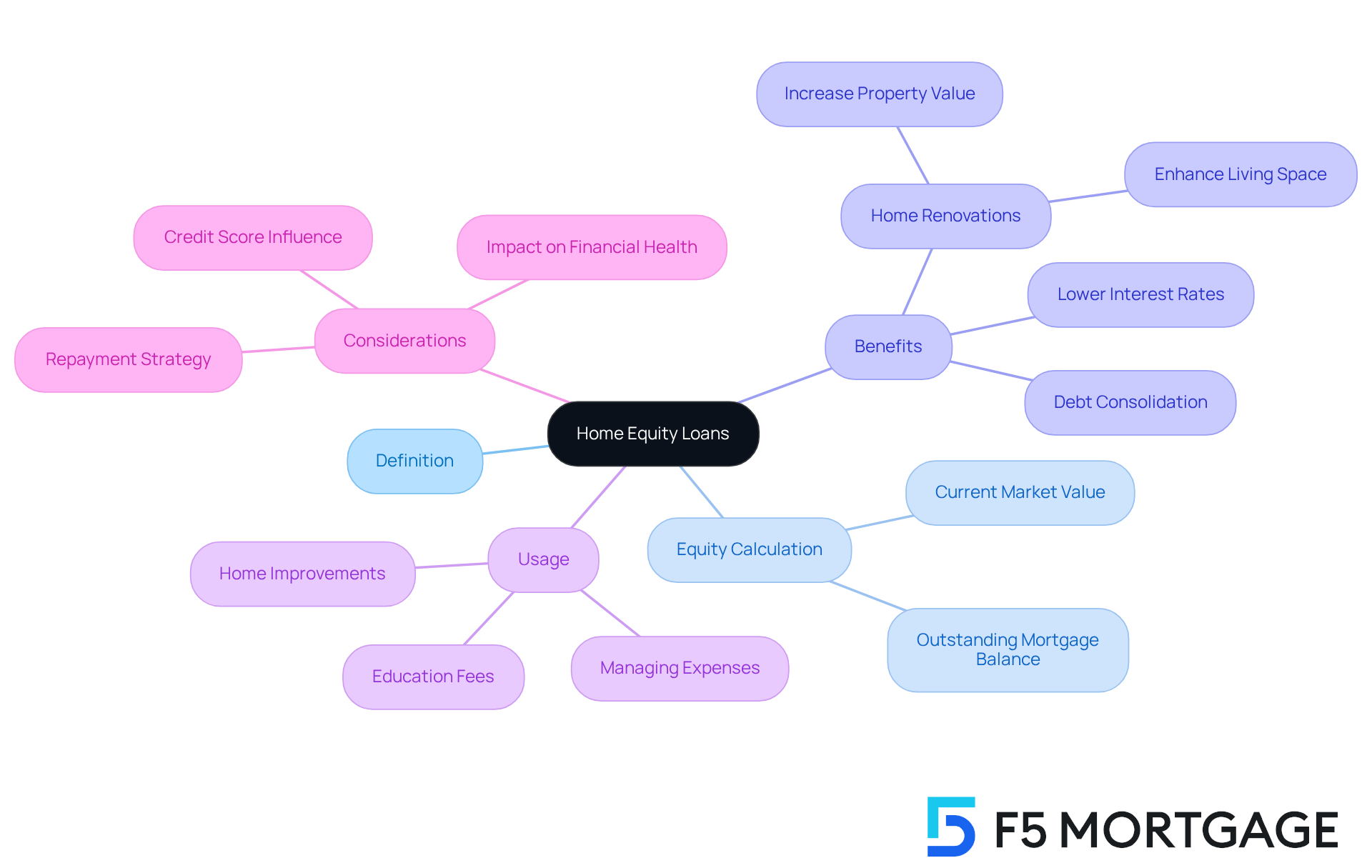

Home equity loans offer a valuable opportunity for families looking to tap into the worth of their homes, often seen as a second mortgage. We understand how daunting it can be to navigate this financial resource. By leveraging this option, homeowners can manage significant expenses—whether it’s for renovations, education, or debt consolidation—while enjoying lower interest rates compared to unsecured loans.

However, securing a home equity loan can raise important questions. What are the eligibility requirements? What documentation is necessary? What potential costs should you consider? We know how challenging this can be, and it’s crucial to address these concerns.

So, what essential steps and considerations must families navigate to make informed decisions in this complex landscape? Let’s explore these together, ensuring you feel empowered every step of the way.

Defining Home Equity Loans: What They Are and How They Work

A property value financing option, often known as a second mortgage, offers a way for homeowners to tap into the value they’ve built up in their homes. Equity is calculated as the difference between the current market value of the property and the outstanding mortgage balance. Typically, residential asset financing provides a lump sum that is repaid over a set period at a fixed interest rate. In 2025, the average interest rate for housing-related financing is expected to be around 7.90%. This makes it an appealing choice for families looking to manage significant expenses like home renovations, education fees, or debt consolidation. This option is particularly beneficial since residential collateralized financing usually comes with lower interest rates compared to unsecured borrowing, which can average about 12.57%.

Families have successfully utilized mortgage financing for a variety of renovations, enhancing their living spaces and increasing property value. Many homeowners have shared positive experiences from using these financial products to update kitchens or add extra rooms. Not only do these improvements elevate their quality of life, but they also boost the market appeal of their properties.

Understanding what do I need for a home equity loan is crucial for families as they explore home financing options. These options are backed by the homeowner’s assets, allowing for potentially larger borrowing amounts compared to personal loans. Financial advisors emphasize the importance of having a clear repayment strategy when considering these types of credit, as they can significantly impact long-term financial health. With the right approach, property-backed financing can serve as a valuable resource for families looking to invest in their homes and secure their futures.

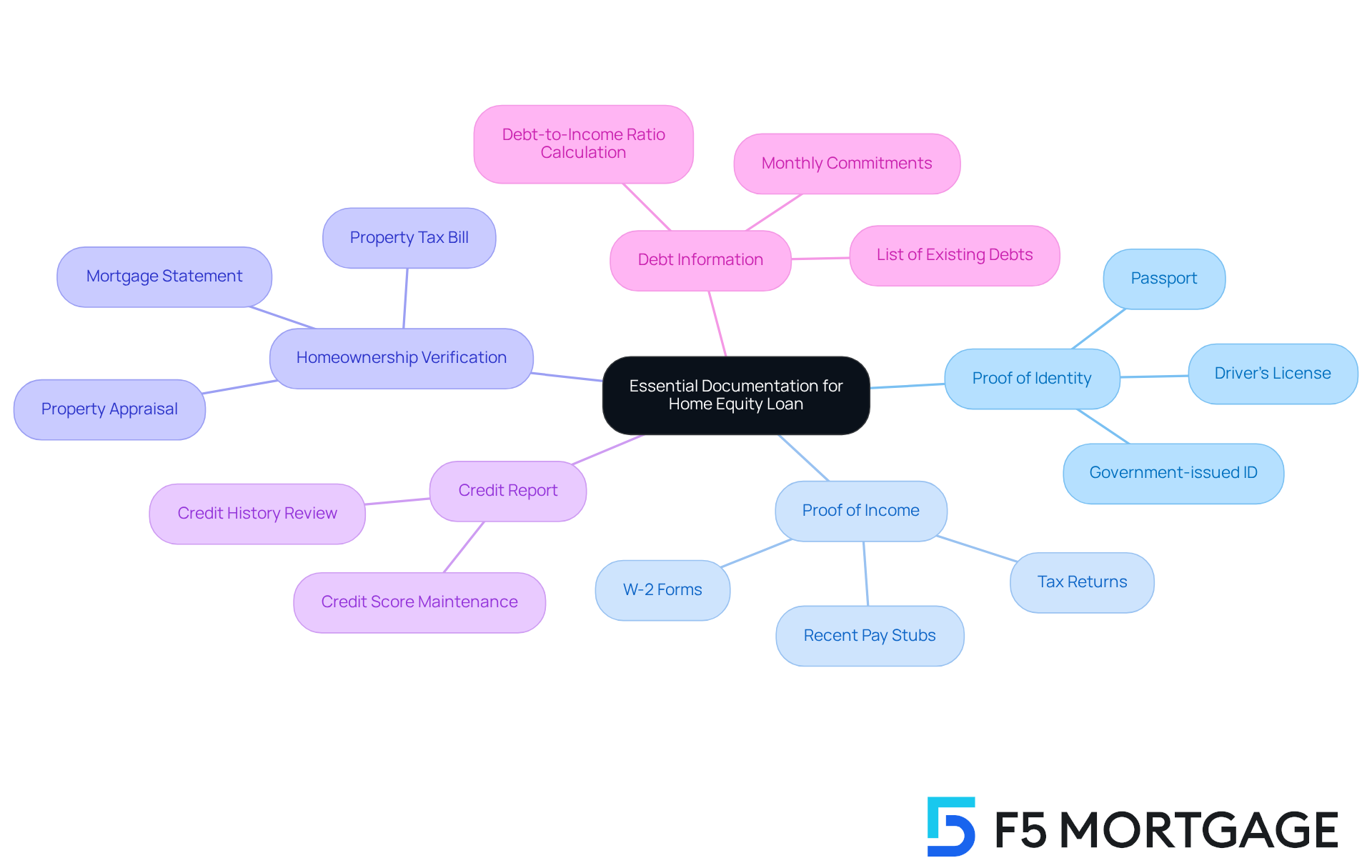

Essential Documentation for Securing a Home Equity Loan

Obtaining a property-backed loan can feel overwhelming, but we’re here to support you every step of the way. To help you navigate this process, it’s essential to gather several key documents that answer the question of what do I need for a home equity loan, which demonstrate your financial stability and ownership. Here’s what you’ll need:

- Proof of Identity: A government-issued ID, like a driver’s license or passport, is crucial for verifying your identity.

- Proof of Income: Recent pay stubs, W-2 forms, or tax returns are necessary to confirm your income stability, ensuring you can meet your repayment obligations.

- Homeownership Verification: Documents such as your mortgage statement and property tax bill are vital to verify ownership and determine the value accessible for borrowing. Additionally, a property appraisal will be requested by the lender to assess the current market value of your asset, which influences the borrowing potential.

- Credit Report: Lenders will review your credit history to assess your creditworthiness, making it important to maintain a good credit score.

- Debt Information: A detailed list of your existing debts and monthly commitments helps in assessing your debt-to-income (DTI) ratio. Ideally, this should remain below 43% for favorable borrowing conditions.

Gathering these documents in advance can significantly streamline your application process by clarifying what do I need for a home equity loan, potentially reducing the time from application to approval. In fact, the entire process can take anywhere from two weeks to two months, depending on the lender and the complexity of your application. By being well-prepared, you can enhance your chances of securing a property financing option and achieving your financial goals.

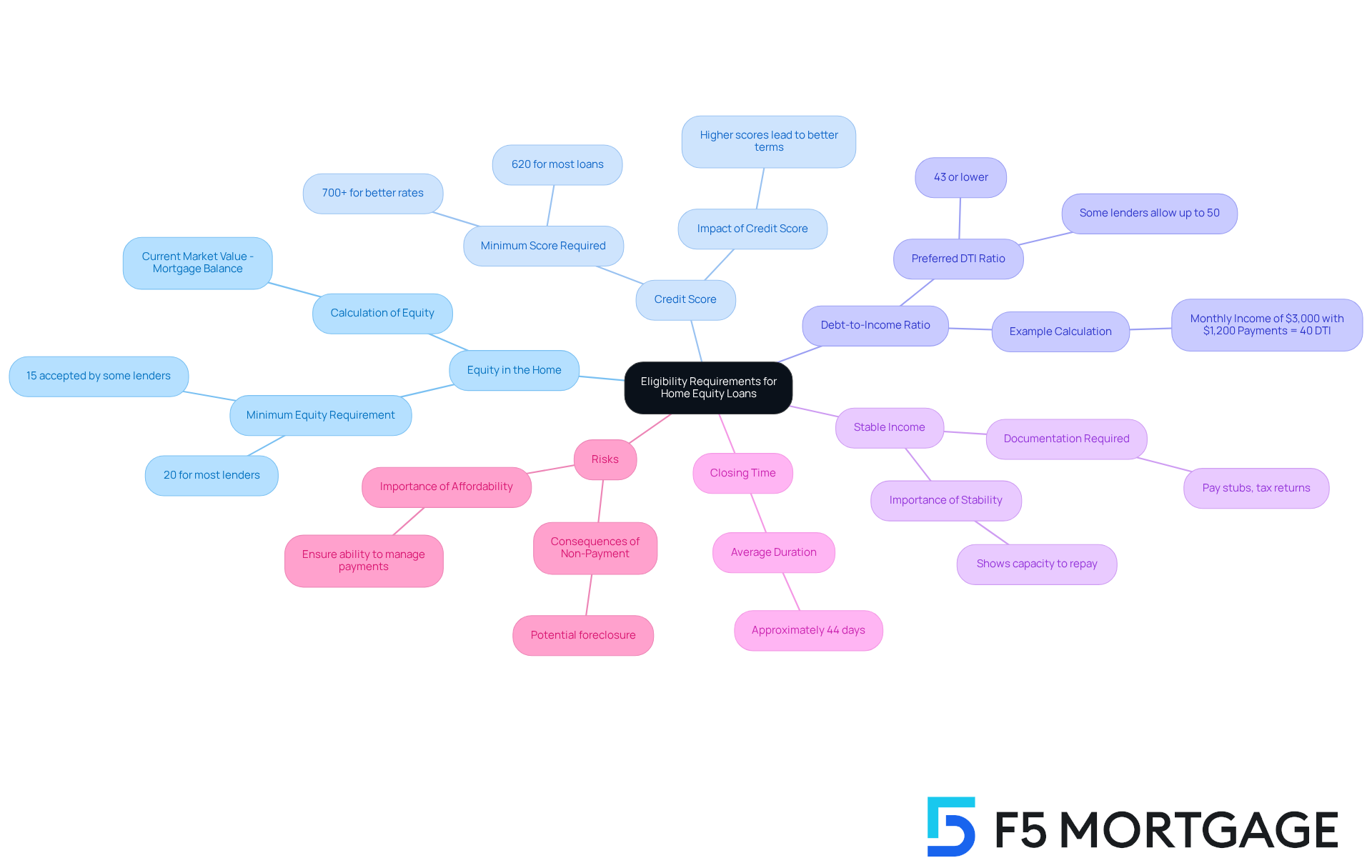

Understanding Eligibility Requirements for Home Equity Loans

Eligibility for a home equity loan is an important consideration for many families, and it generally hinges on several key factors:

- Equity in the Home: Most lenders require homeowners to have at least 20% equity in their property, though some may accept as low as 15%. This asset is assessed as the difference between the property’s current market value, established through an appraisal, and the outstanding mortgage balance. Understanding this evaluation is essential; it reveals how much ownership you possess, which directly influences your rates.

- Credit Score: A minimum credit score of around 620 is often necessary to qualify for a home equity line of credit. However, we know that borrowers with scores of 700 or higher typically secure better interest rates and terms, which can make a significant difference.

- Debt-to-Income Ratio: Lenders generally prefer a debt-to-income (DTI) ratio of 43% or lower. This ratio is calculated by dividing total monthly debt payments by gross monthly income, ensuring that families can manage their monthly payments effectively. For instance, a household with a monthly income of $3,000 and total monthly payments of $1,200 would have a DTI of 40%, which meets most lenders’ requirements.

- Stable Income: Evidence of stable income is essential, as it shows your capacity to repay the debt. Lenders will typically require documentation of income sources, which may include pay stubs, tax returns, or other financial statements. We understand how crucial this stability is for your peace of mind.

- Closing Time: The typical duration to finalize on a property financing option is roughly 44 days. This is an important timeframe for families to consider when organizing their borrowing procedure.

- Risks: It’s crucial to acknowledge that not repaying a mortgage can lead to foreclosure on the property. We want to emphasize the importance of confirming that you can manage the extra payments before proceeding.

By understanding these criteria and the competitive rates and tailored assistance offered by F5 Mortgage, families can assess what do I need for a home equity loan to be prepared for property refinancing. We’re here to support you every step of the way, helping you navigate the borrowing procedure more efficiently.

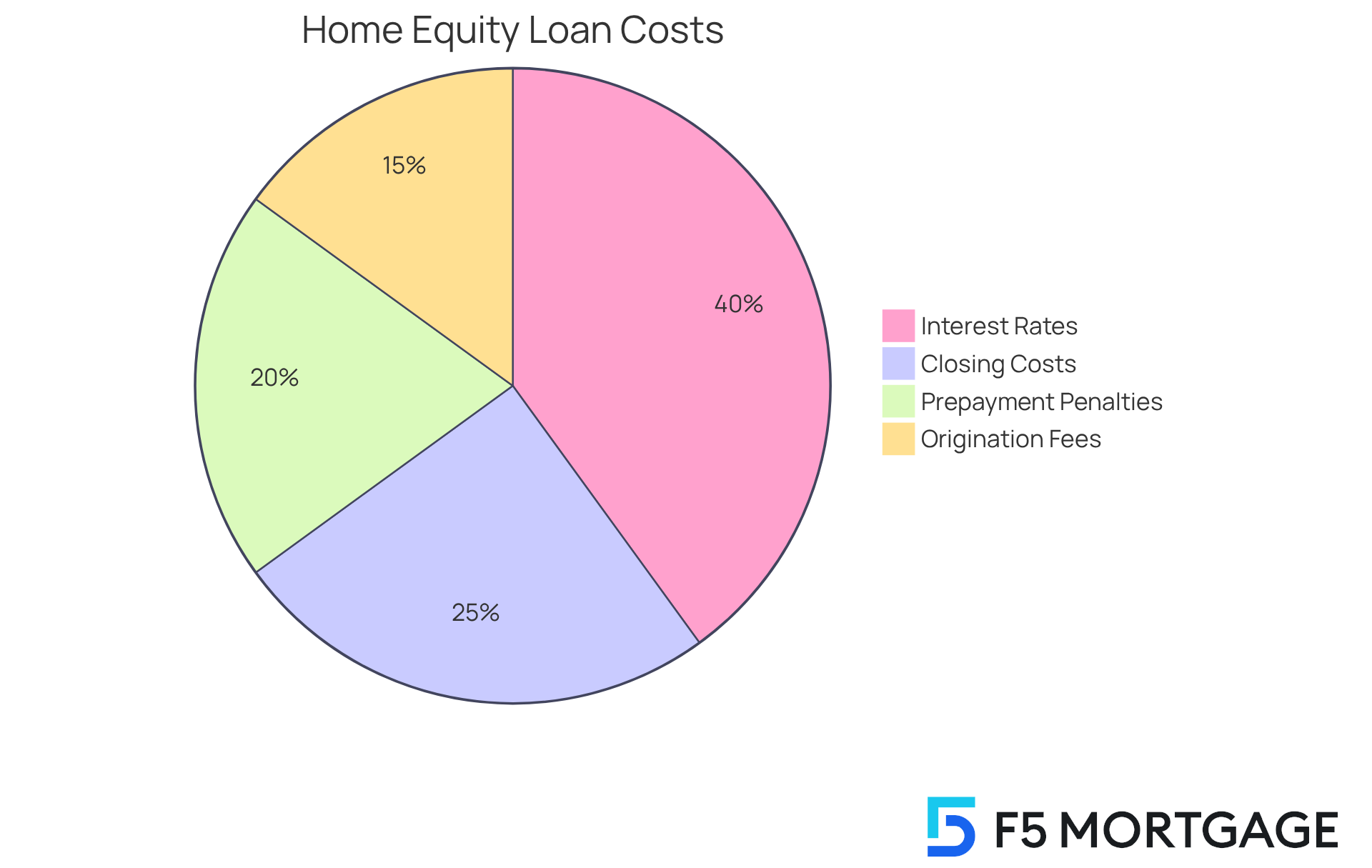

Evaluating Costs and Fees Involved in Home Equity Loans

When considering a home equity loan, it is crucial for borrowers to understand what do I need for a home equity loan, including the various costs and fees that may arise throughout the process. This understanding can make a significant difference in your financial journey.

- Closing Costs: Typically ranging from 2% to 5% of the loan amount, these costs can encompass appraisal fees, title insurance, and attorney fees. For instance, on a $50,000 borrowing, closing expenses might total between $1,000 and $2,500. This highlights the importance of planning accordingly to avoid surprises.

- Origination Fees: Many lenders charge a fee for processing the application, which can vary considerably, usually ranging from 0.5% to 1% of the loan amount or a fixed fee. Understanding what do I need for a home equity loan upfront can help families gauge the total cost of borrowing and prepare effectively.

- Prepayment Penalties: It’s essential to verify whether the financing includes penalties for early repayment. These penalties can reduce potential long-term savings and may range from 2% to 5% of the outstanding balance or a flat fee, depending on the lender’s terms.

- Interest Rates: Home equity credit options generally offer lower rates compared to unsecured alternatives. However, rates can vary based on creditworthiness and current market conditions. A lower debt-to-income ratio can lead to more favorable interest rates, making it beneficial for households to enhance their financial profiles before applying.

By understanding what do I need for a home equity loan, families can plan more efficiently and evade unforeseen expenses during the financing process. For example, establishing a comprehensive budget that encompasses all possible expenses ensures readiness for the financial obligations of a home equity arrangement. We’re here to support you every step of the way, and consulting with a financial advisor can provide valuable insights into managing these expenses and optimizing loan terms.

Conclusion

Home equity loans can be a powerful financial tool for families eager to leverage the value of their homes. By allowing homeowners to access the equity they have built, these loans can facilitate significant investments in home improvements, education, and debt consolidation. We understand how challenging it can be to navigate these options, and grasping the intricacies of home equity loans—from the documentation required to the eligibility criteria and associated costs—is essential for families aiming to make informed financial decisions.

Gathering essential documents such as:

- Proof of identity

- Income verification

- A clear understanding of equity and credit scores

is crucial. Additionally, it’s important to be aware of the costs and fees that can arise during the loan process. Careful budgeting and planning can help families enhance their chances of securing favorable loan terms while avoiding unexpected financial burdens.

Ultimately, home equity loans can be a strategic option for families seeking to improve their financial situation or invest in their homes. With proper preparation and a clear understanding of the requirements, families can navigate the borrowing process more effectively. Embracing this opportunity can lead to enhanced living spaces and a more secure financial future. We encourage you to explore how home equity loans can align with your personal financial goals, and remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is a home equity loan?

A home equity loan, often referred to as a second mortgage, is a financing option that allows homeowners to access the value they’ve built up in their homes. It is calculated as the difference between the current market value of the property and the outstanding mortgage balance.

How does a home equity loan work?

Home equity loans typically provide a lump sum amount that is repaid over a set period at a fixed interest rate. The loan is secured by the homeowner’s property, which allows for potentially larger borrowing amounts compared to unsecured loans.

What is the average interest rate for home equity loans in 2025?

The average interest rate for housing-related financing, including home equity loans, is expected to be around 7.90% in 2025.

What are the benefits of using a home equity loan?

Home equity loans often come with lower interest rates compared to unsecured borrowing, which can average about 12.57%. They can be used for significant expenses such as home renovations, education fees, or debt consolidation, making them an appealing choice for families.

How have families used home equity loans for renovations?

Families have successfully utilized home equity loans for various renovations, such as updating kitchens or adding extra rooms. These improvements not only enhance their quality of life but also increase the market appeal and value of their properties.

What should homeowners consider before taking out a home equity loan?

Homeowners should have a clear repayment strategy when considering a home equity loan, as it can significantly impact their long-term financial health. It is important to understand the implications of borrowing against their property.

Why is it important to understand the requirements for a home equity loan?

Understanding what is needed for a home equity loan is crucial for families as they explore financing options. Knowing the requirements can help them prepare and make informed decisions about their borrowing potential.