Overview

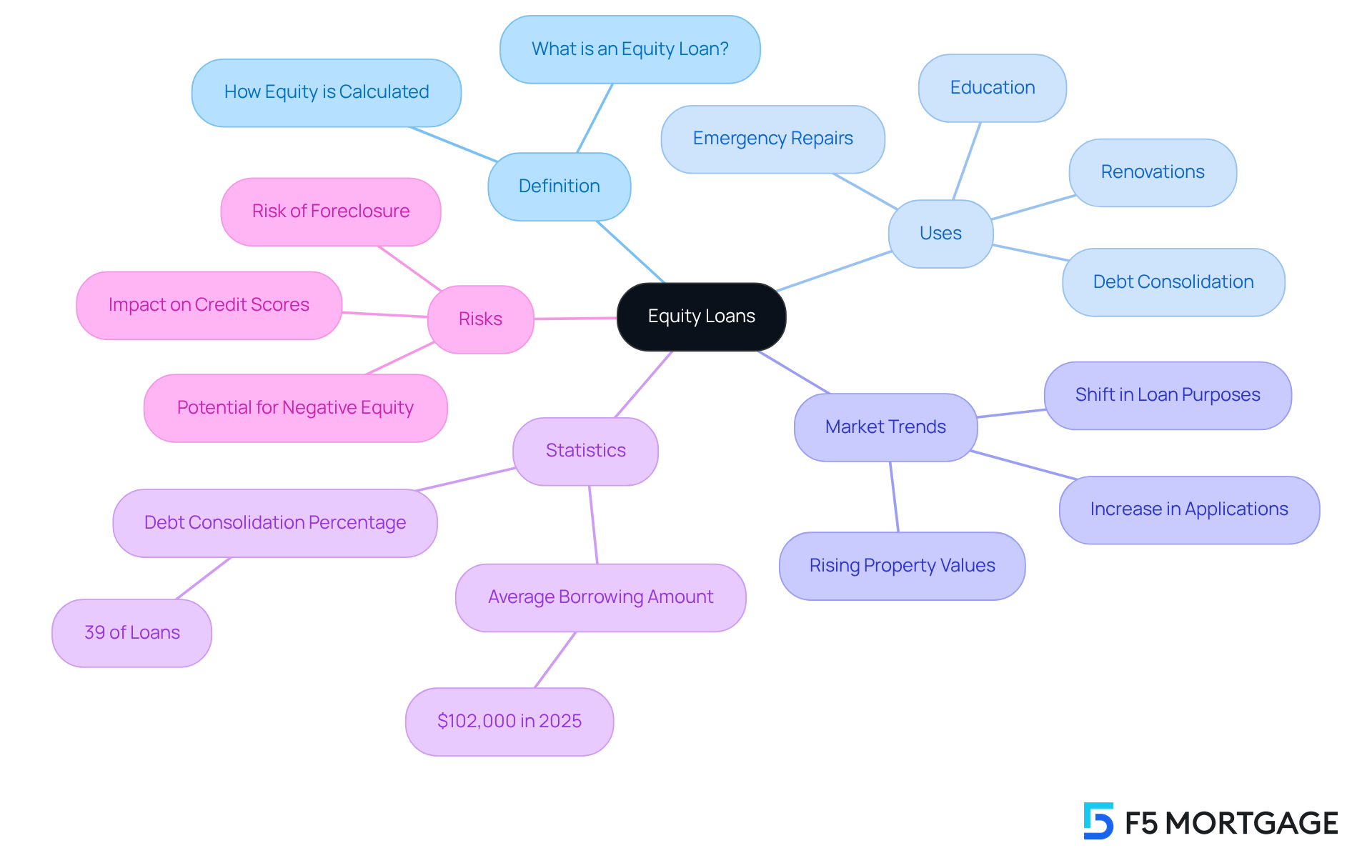

An equity loan is a financing option that allows homeowners to borrow against the value of their property. This value is determined by the difference between the home’s current market value and the outstanding mortgage balance. We understand how challenging navigating financial options can be, and this article outlines both the benefits and risks of equity loans.

It’s important to recognize how to effectively utilize this financial resource while being mindful of potential pitfalls, such as:

- Foreclosure

- Rising interest rates

We’re here to support you every step of the way as you explore this option.

Introduction

Navigating the nuances of equity loans can be a transformative experience for homeowners eager to tap into their property’s value. We understand how challenging it can be to make sense of these financial tools, which not only open doors to funds for significant expenses—like home renovations or debt consolidation—but also come with their own set of benefits and risks.

As property values continue to rise, many homeowners find themselves wondering: how can they effectively navigate the complexities of equity loans? It’s essential to make informed decisions that protect your financial future. We’re here to support you every step of the way.

Define Equity Loans: Understanding the Basics

An ownership advance is a financing option that helps to explain what is an equity loan, as it allows homeowners to borrow against the value they have built in their property. Equity, which is the difference between the current market value of the property and the outstanding mortgage balance, leads to the question of what is an equity loan and how it can be a valuable resource. Property owners can utilize what is an equity loan through various financing options to help cover significant costs like renovations, education, or debt consolidation.

In 2025, the typical borrowing amount for property owners is expected to be around $102,000, reflecting the rising property values across the nation. We understand how important it is to grasp . Andrew Dehan, a Senior Writer at Bankrate, emphasizes, “Comprehending how property value functions, and how to utilize it, is vital for any property owner.”

However, it’s essential to approach borrowing for educational financing with caution. Failing to make payments could put your home at risk. Additionally, it’s significant to note that 39% of residential property financing acquired last year was for debt consolidation, highlighting a major trend in how families are using this financing.

Homeowners should also consider that taking on a home financing option can affect their credit scores. Therefore, it’s crucial to evaluate the benefits against potential risks. For property owners looking to utilize their asset’s worth effectively, understanding what is an equity loan among these financing options is key. Remember, we’re here to support you every step of the way.

Explore Types of Equity Loans: HELOCs vs. Home Equity Loans

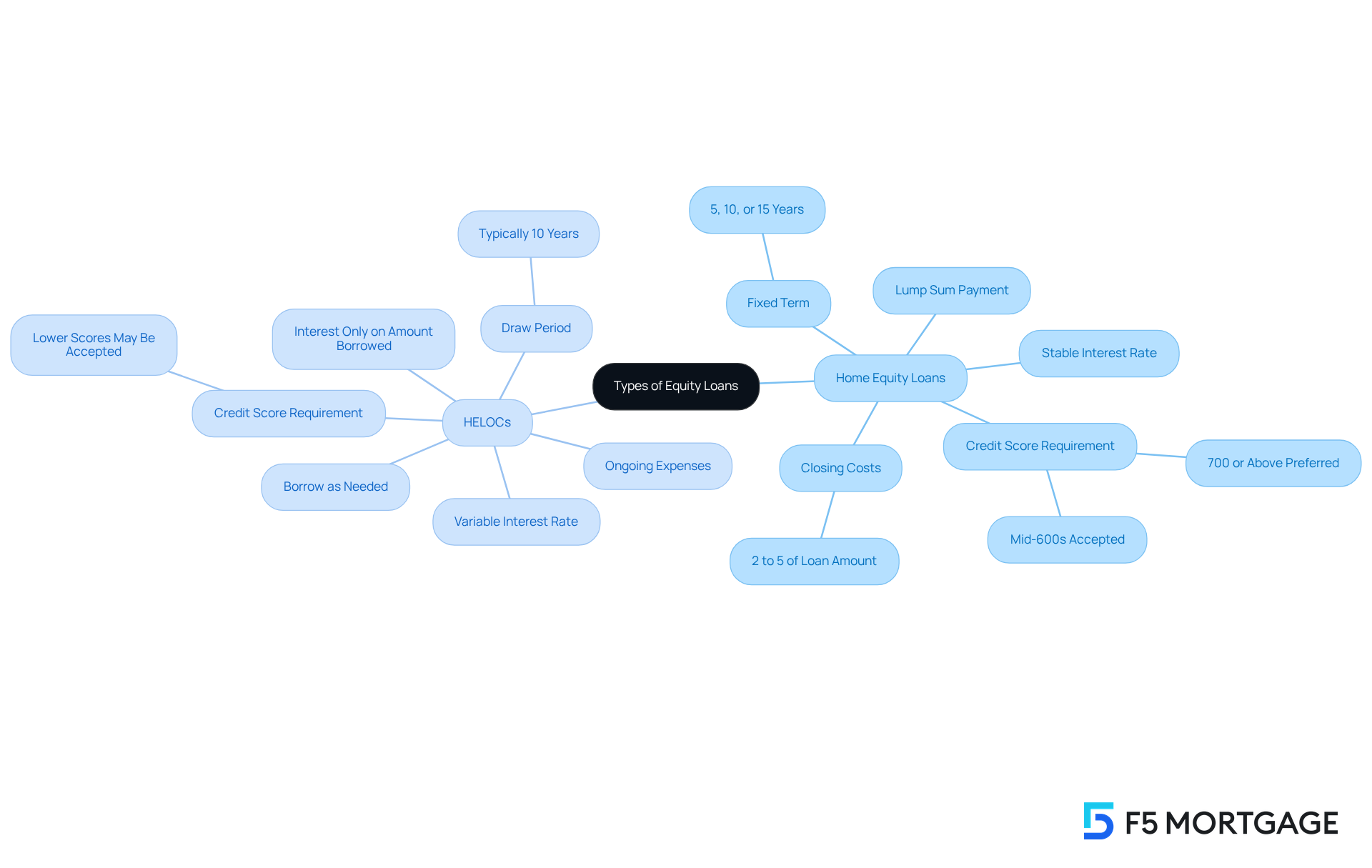

When it comes to securing loans with property, it’s important to understand in addition to the two main categories: Home Loans and [Home Lines of Credit](https://f5mortgage.com/10-essential-insights-on-earnest-money-deposit-for-homebuyers/) (HELOCs). A [[Home Equity Loan](https://f5mortgage.com/home-equity-loan-vs-home-equity-line-of-credit-key-differences-explained)](https://lendingtree.com/home/home-equity) is essentially what is an equity loan, as it provides a lump sum payment to you, the borrower, which is then repaid over a fixed term at a stable interest rate. This option is ideal for property owners who need a specific amount for a one-time expense.

On the other hand, a HELOC functions similarly to a credit card. It allows property owners to borrow against their equity as needed, but with a variable interest rate. This flexibility makes HELOCs particularly suitable for ongoing expenses or projects that may arise over time.

We know how challenging it can be to navigate these financial decisions. Understanding what is an equity loan and the differences between these options is essential for choosing the right one for your unique circumstances. We’re here to support you every step of the way in making the best choice for your financial future.

Assess Benefits and Risks: What to Consider Before Borrowing

For many property owners, understanding what is an equity loan can make equity financing a valuable option, offering several benefits. For instance, it provides access to lower interest rates compared to unsecured loans, potential tax deductions on interest payments, and the flexibility to use funds for various purposes, such as home improvements or debt consolidation. However, we know how challenging this can be, and it’s crucial to stay alert to the associated risks.

One significant concern is the possibility of foreclosure if the debt is not repaid. With , monthly payments may increase, making it harder for some borrowers to manage their finances. Additionally, it’s important to be cautious about borrowing beyond your means; this can lead to a cycle of escalating debt that can feel overwhelming.

Currently, what is an equity loan refers to home collateral financing that has an average interest rate of 8.45%, which is considerably lower than credit card rates. However, misusing these funds for non-essential expenses can worsen financial strain. We’re here to support you every step of the way, so it’s essential to carefully assess your financial status and repayment abilities before agreeing to a financing option. By doing so, you can ensure that you are well-informed about the possible risks and benefits involved.

Navigate the Application Process: Steps to Secure an Equity Loan

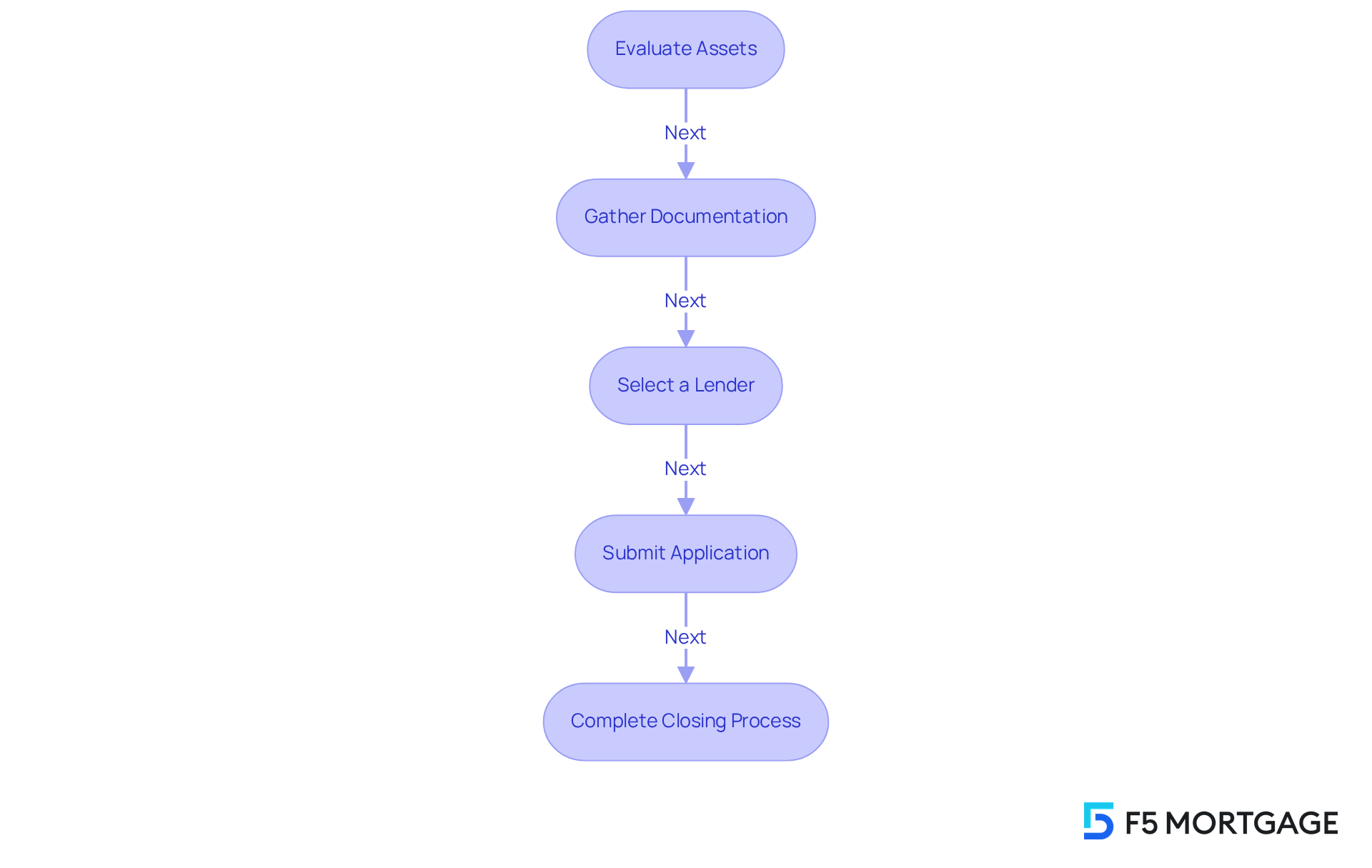

Obtaining a home loan can feel overwhelming, but by following a few crucial steps, you can ensure a smoother process. First, take a moment to evaluate your assets. Find your property’s current market value and deduct any remaining mortgage balances. For instance, if your residence is valued at $500,000 and you owe $400,000, you possess $100,000 in ownership, which represents 20%. Understanding this calculation can help clarify how much you might be able to borrow.

Next, gather the necessary documentation. You’ll need , credit history, and details about any existing debts. Lenders require this information to evaluate your application, so having it ready can ease some of the stress. Remember, selecting a lender that meets your needs is crucial. It’s important to compare offers from multiple lenders to find the best terms and rates available. Generally, lenders look for a minimum of 15% to 20% ownership in your property, and a FICO score of at least 680 is often preferred for approval.

As Tim Maxwell, a mortgage specialist, wisely points out, “The prerequisites for a home equity line of credit or HELOC comprise adequate ownership stake in your residence, strong credit, reliable payment history, verification of income, low debt-to-income ratio, and evidence of property insurance.”

After you’ve chosen a lender, it’s time to submit your application for review. While the approval process might take some time, many homeowners can expect to receive financing options within a few weeks. In 2025, the average duration to obtain a financial advance is anticipated to be around 2-4 weeks. Once approved, you’ll need to complete the closing process, which may involve additional paperwork and fees.

By following these steps, you can effectively navigate what is an equity loan and its application process to access the funds you need. We know how challenging this can be, and we’re here to support you every step of the way.

Conclusion

Understanding equity loans is crucial for homeowners looking to leverage the value of their property. These loans provide an opportunity to borrow against the equity built in a home, allowing for significant financial flexibility. Whether for home renovations, education, or consolidating debt, knowing how to navigate the various options available—such as Home Equity Loans and HELOCs—can empower homeowners to make informed decisions.

We know how challenging this can be, and key insights discussed in the article highlight the importance of comprehending both the benefits and risks associated with equity loans. While these loans can offer lower interest rates and potential tax deductions, they also pose risks, such as the threat of foreclosure if repayments are missed. Therefore, it is essential to carefully evaluate your financial situation before proceeding with an equity loan, ensuring that you are well-prepared to manage your obligations.

In conclusion, equity loans can be a valuable financial tool when used wisely. We encourage homeowners to:

- Assess their individual circumstances

- Understand the application process

- Weigh the pros and cons of borrowing against their home’s equity

By being informed and strategic, you can harness the power of equity loans to enhance your financial well-being and secure your future.

Frequently Asked Questions

What is an equity loan?

An equity loan is a financing option that allows homeowners to borrow against the value they have built in their property, which is the difference between the current market value of the property and the outstanding mortgage balance.

How can homeowners use equity loans?

Homeowners can utilize equity loans to cover significant costs such as renovations, education, or debt consolidation.

What is the expected typical borrowing amount for property owners in 2025?

The typical borrowing amount for property owners in 2025 is expected to be around $102,000, reflecting the rising property values across the nation.

What trend was noted regarding residential property financing last year?

Last year, 39% of residential property financing was acquired for debt consolidation, indicating a major trend in how families are using this type of financing.

What should homeowners be cautious about when borrowing for educational financing?

Homeowners should approach borrowing for educational financing with caution, as failing to make payments could put their home at risk.

How can taking on a home financing option affect credit scores?

Taking on a home financing option can affect homeowners’ credit scores, so it’s important to evaluate the benefits against potential risks.

Why is it important for property owners to understand equity loans?

Understanding equity loans is vital for property owners as it helps them effectively utilize their asset’s worth while being aware of the potential risks involved.