Overview

Navigating a $250,000 mortgage payment over 30 years can feel overwhelming, but understanding the components—principal, interest, taxes, and insurance—can empower you. We know how challenging this can be, and we’re here to support you every step of the way. By breaking down these elements, you can take charge of your financial responsibilities.

Utilizing tools like mortgage calculators and budgeting applications can make a significant difference in your journey. These resources not only help you manage your payments effectively but also assist in making informed decisions about home financing. Imagine the peace of mind that comes from knowing you have a clear plan in place.

As you explore these strategies, remember that you’re not alone. Many families share similar concerns, and by addressing these together, we can foster a sense of community and support. Taking actionable steps today will pave the way for a more secure financial future.

Introduction

Navigating the complexities of a $250,000 mortgage over 30 years can feel overwhelming. We know how challenging this can be, but understanding the payment structure is crucial for sound financial planning. This article explores the essential components of mortgage payments—principal, interest, taxes, and insurance.

- We’ll also delve into how interest rates and loan terms impact overall costs.

- With so many variables at play, how can you, as a potential homeowner, ensure you’re making informed decisions that align with your financial goals?

- We’re here to support you every step of the way.

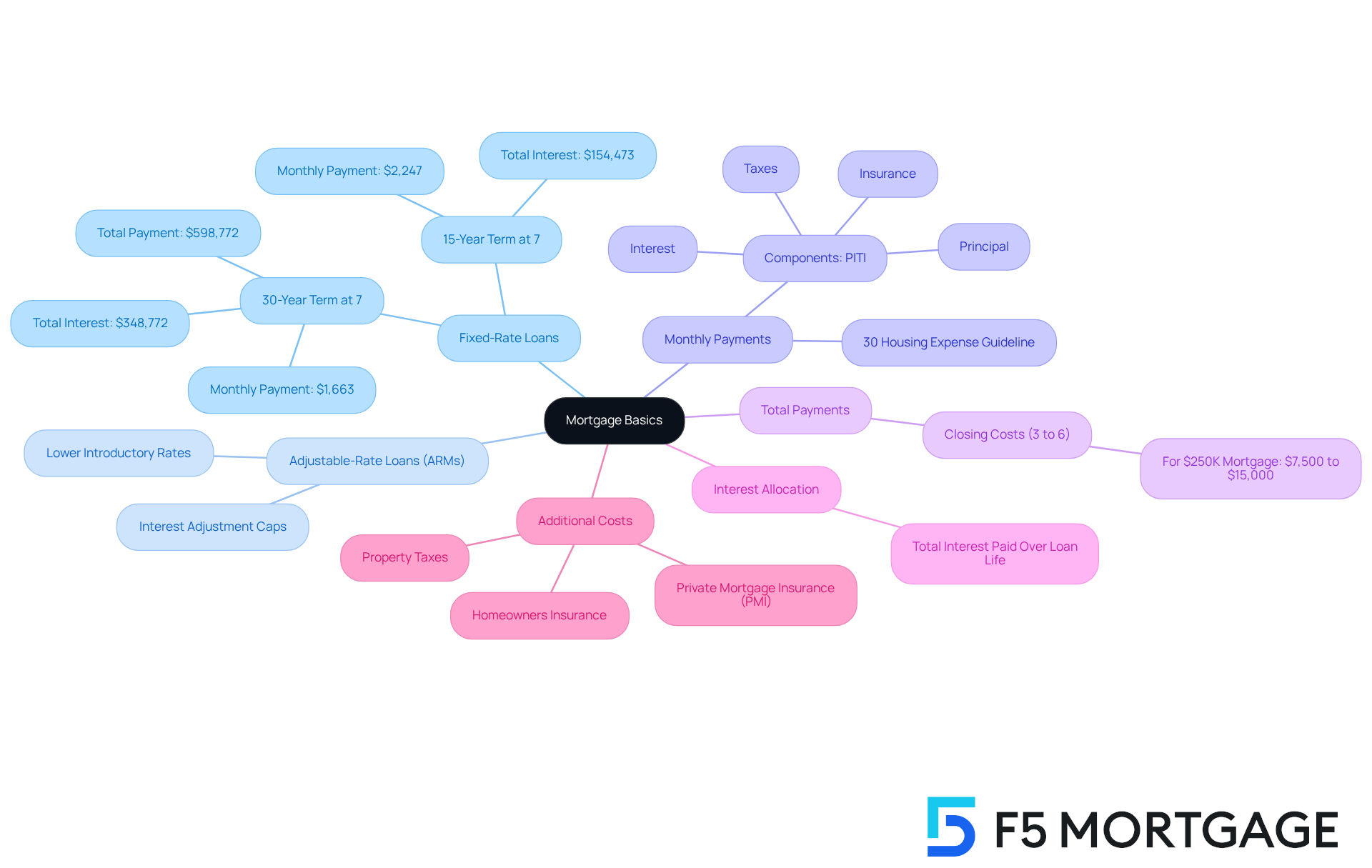

Explore the Basics of a $250K Mortgage Over 30 Years

Typically, a $250k mortgage 30 years payment employs a . This guarantees that the rate remains steady throughout the loan’s duration, providing a sense of stability that can be a substantial benefit for your . For instance, the at a 7% rate would be around $1,663. Over the life of the loan, this results in a total payment of approximately $598,772, with around $348,772 allocated to interest.

However, we know how challenging it can be to . It’s also important to consider (ARMs) as an alternative. ARMs often start with lower introductory rates, making them appealing for those who plan to pay off their mortgage quickly or refinance in a few years. While ARMs come with some unpredictability due to rate adjustments, they include interest adjustment caps that help protect borrowers from significant increases. Understanding these figures is crucial for potential borrowers, allowing you to .

Including additional housing costs, like property taxes and homeowners insurance, in your calculations for regular expenses is vital for a . According to the , individuals should aim to spend no more than 30% of their gross income each month on housing expenses. This can aid in evaluating affordability. Furthermore, closing expenses, which usually vary from 3% to 6% of the loan amount, can be incorporated into monthly installments, raising the total amount owed.

This comprehensive method not only assists in planning but also empowers you to make informed choices about your financing alternatives. We’re here to support you every step of the way, particularly with the provided by .

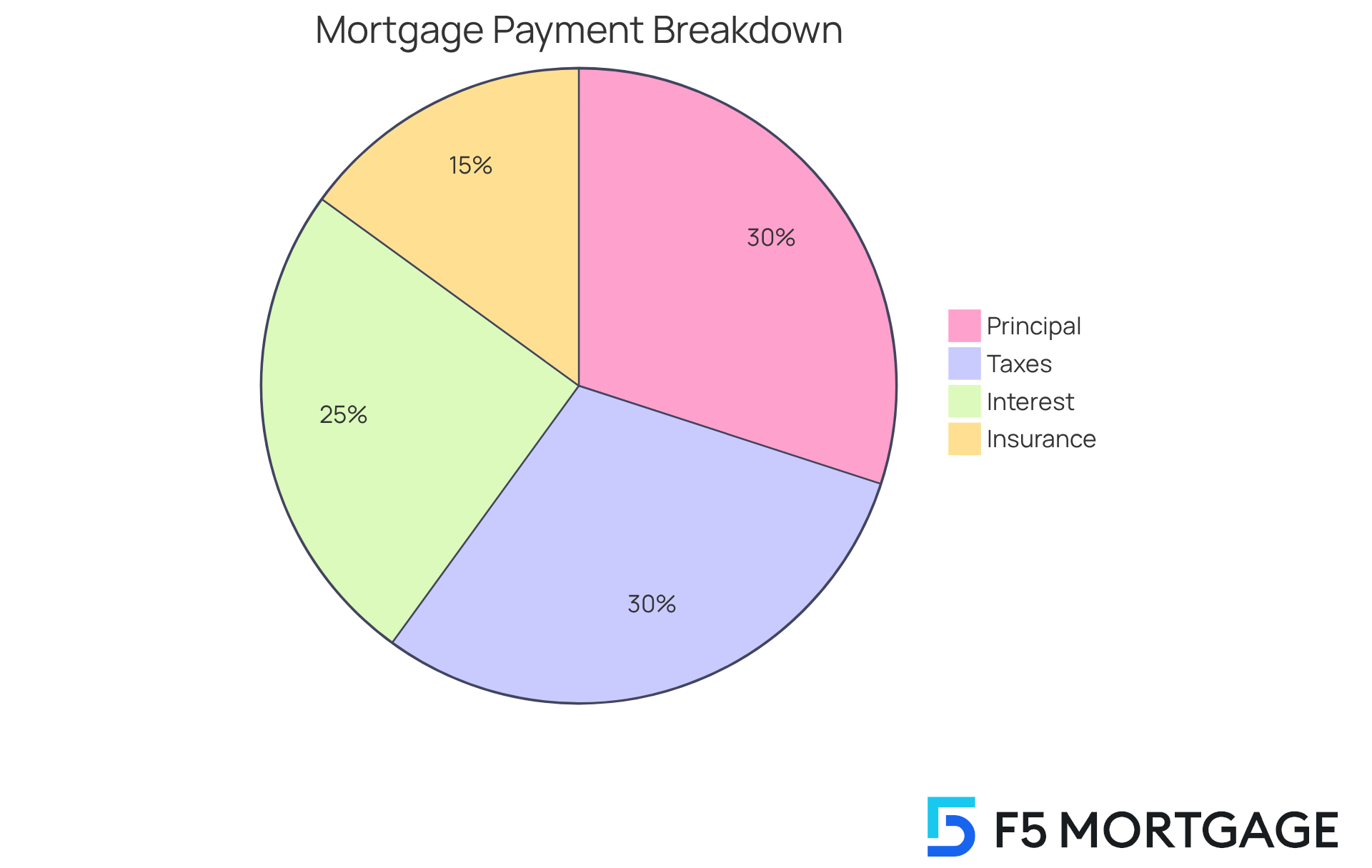

Break Down Monthly Payment Components: Principal, Interest, Taxes, and Insurance

Understanding your is vital for every homeowner, and there are four essential components to consider:

- Principal: This part of your payment directly reduces the loan balance. Paying down the principal is crucial for over time, offering you a sense of security and investment in your future.

- Interest: This represents the cost of borrowing money, calculated as a percentage of the remaining loan balance. We know how challenging it can be to grasp how interest builds up, but can assist you in making informed choices regarding additional contributions or refinancing alternatives.

- Taxes: can vary greatly depending on your area and are often included in your regular payments through an escrow account. In 2024, the reached $3,500, reflecting a 2.8% increase from the previous year. Keeping track of these changes can help you anticipate your financial responsibilities.

- Insurance: is essential for protecting against damages and is typically required by lenders. The in the U.S. is approximately $2,110, but this can vary widely based on factors such as location and home value.

Comprehending these elements is essential for you to foresee your total expenses each month and organize your budget effectively. For instance, if you have a $250k mortgage 30 years payment, you might find that your recurring charge includes not just the , but also portions allocated for property taxes and insurance. This understanding can significantly influence your overall financial situation. By grasping how these components interact, you can and make strategic financial choices that empower you on your homeownership journey.

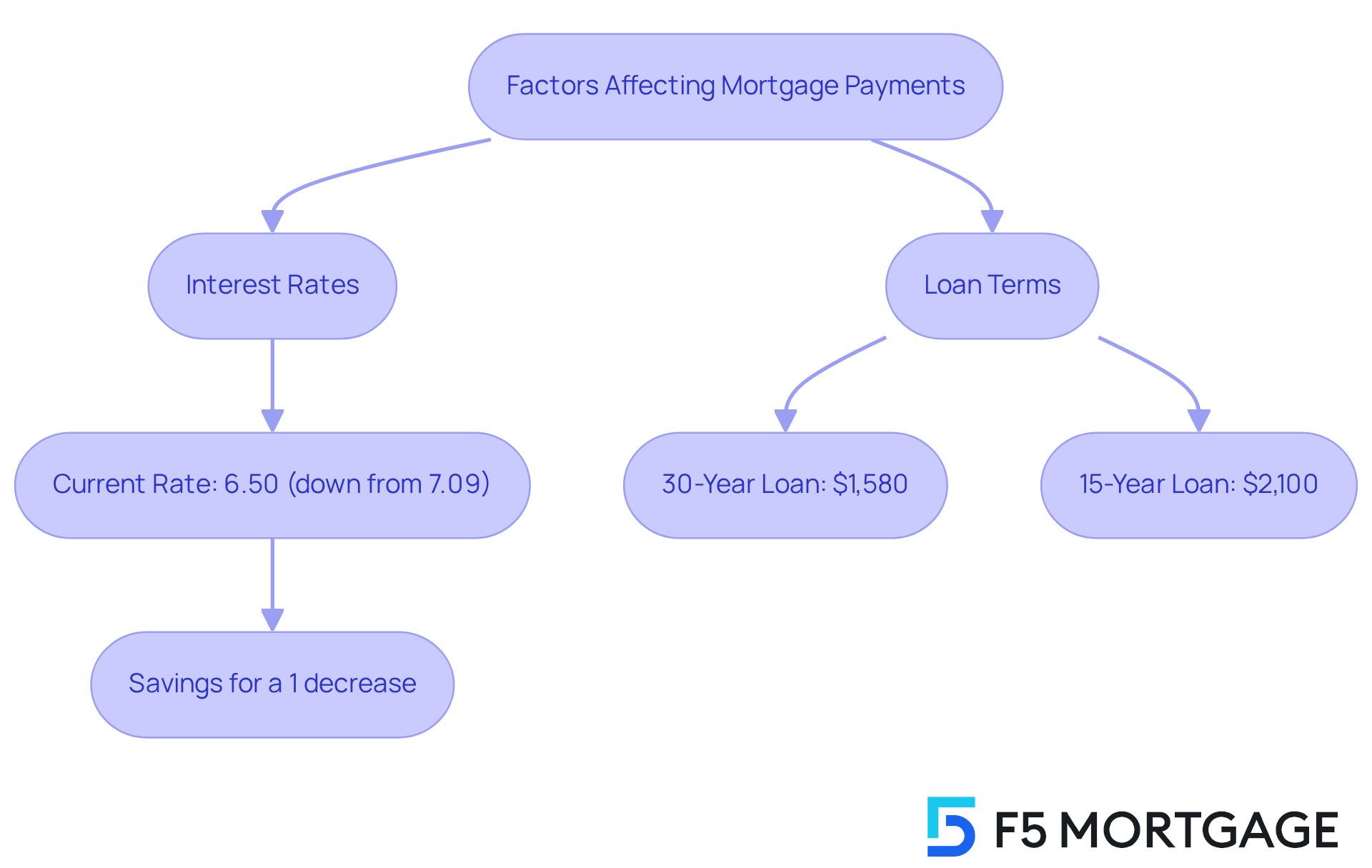

Analyze Factors Affecting Your Mortgage Payment: Interest Rates and Loan Terms

Several factors significantly influence your , and we understand how important it is to navigate these choices wisely:

- : We know how challenging it can be to keep track of interest rates. A can lead to on your and the total interest paid over the life of the loan. For instance, a 1% decrease in the interest rate can save borrowers thousands of dollars. Currently, the typical rate for a is approximately 6.50%, down from a high of 7.09% earlier this year. This decrease can significantly lower your monthly expenses.

- : The length of your loan plays a crucial role in determining your regular installments. A generally offers reduced payments compared to a 15-year loan, making it more attainable for families looking to improve their homes. However, it’s essential to recognize that while the monthly payments are lower, the overall cost over a 30-year term is greater. For example, on a , a loan of $250,000 at a 6.50% rate would result in monthly payments of roughly $1,580, while a 15-year term at the same rate would require around $2,100.

Understanding these factors empowers you to make informed choices about your loan options, aligning them with your financial goals and circumstances. We’re here to support you every step of the way as you .

Utilize Tools and Strategies for Calculating and Managing Your Mortgage Payment

Managing your $250k mortgage 30 years payment can feel overwhelming, but remember, you’re not alone. Here are some tools and strategies designed to help you navigate this journey with confidence.

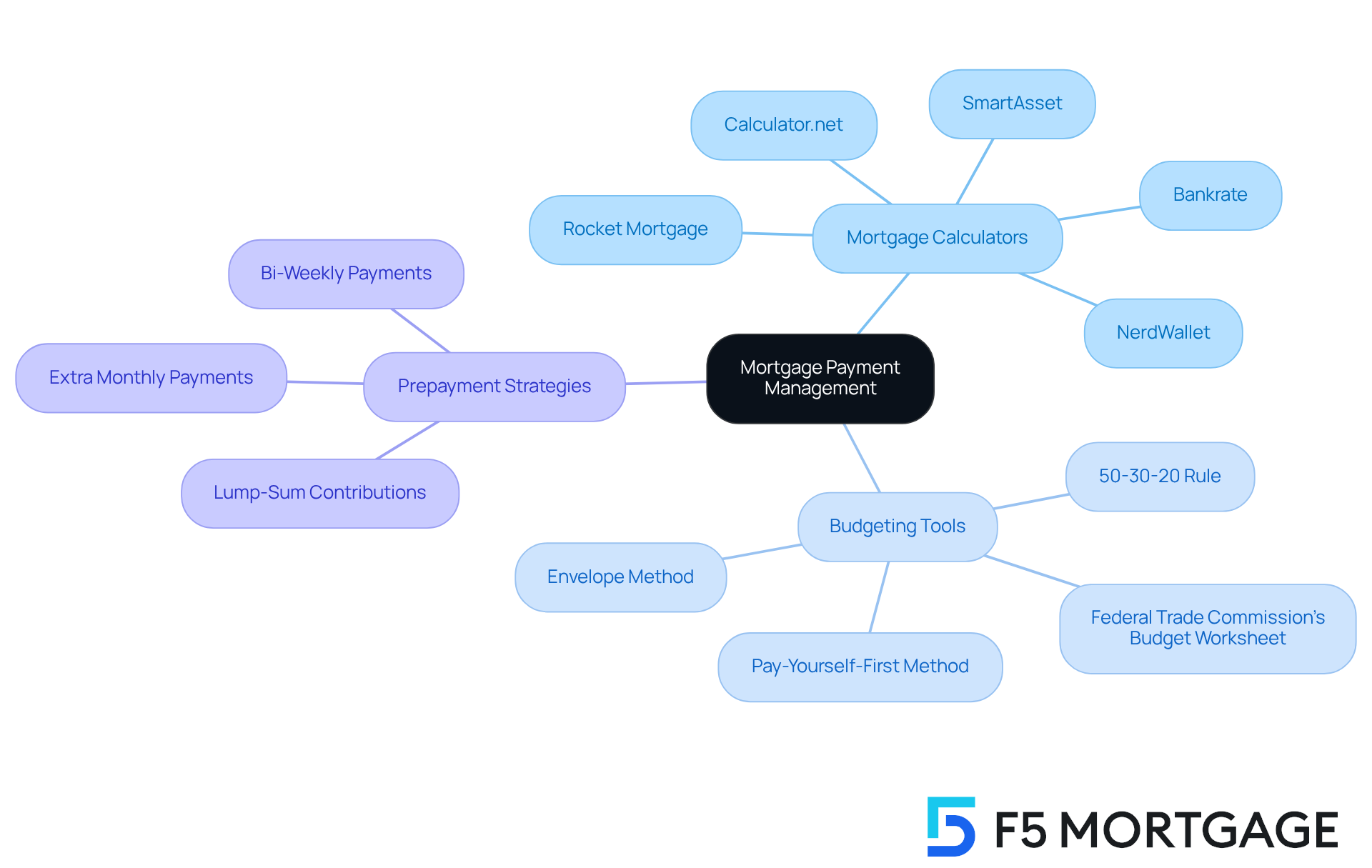

- s: Online calculators are invaluable for estimating your based on different interest rates and loan terms. , like Bankrate and NerdWallet, offer user-friendly interfaces and detailed breakdowns of costs, including principal, interest, taxes, and insurance. These tools help you visualize your billing timeline and understand the long-term financial effects of your .

- : We know how challenging it can be to keep track of expenses. Utilizing can significantly enhance your ability to monitor monthly costs, ensuring your housing expenses align comfortably with your financial strategy. Tools that follow the can effectively allocate funds, directing 50% to essentials, 30% to discretionary spending, and 20% to savings. This organized method not only helps manage mortgage expenses but also promotes healthy financial habits.

- : If you’re looking to save money, consider contributing extra amounts towards your principal. This can speed up loan repayment and lower total financing costs. Homeowners can benefit from strategies like bi-weekly installments or occasional lump-sum contributions, leading to . For example, paying just a little extra each month can greatly shorten your loan term and reduce the total interest paid.

By understanding and utilizing these tools and strategies, you can take control of your $250k mortgage 30 years payment and improve your overall financial health. Remember, we’re here to support you every step of the way.

Conclusion

Understanding a $250k mortgage over 30 years goes beyond simply knowing the monthly payment; it involves the complexities of interest rates, loan terms, and various factors that contribute to the overall cost. We know how challenging this can be, but by grasping these concepts, homeowners can navigate their financial landscape with greater confidence and make informed decisions that align with their long-term goals.

In this article, we have explored essential aspects such as the breakdown of monthly payments—comprising principal, interest, taxes, and insurance. The impact of interest rates and loan terms on overall costs underscores the importance of careful consideration when choosing a mortgage. Additionally, practical tools and strategies for managing payments empower borrowers to take control of their financial commitments effectively.

Ultimately, understanding the nuances of a $250k mortgage not only aids in budgeting but also fosters a greater sense of financial security. By leveraging available resources and staying aware of market conditions, homeowners can optimize their mortgage experience and pave the way for a stable financial future. Taking proactive steps today can lead to significant savings and peace of mind in the years to come. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What type of loan is typically used for a $250k mortgage over 30 years?

A fixed-rate loan is typically used for a $250k mortgage over 30 years, ensuring that the interest rate remains steady throughout the loan’s duration.

What would be the monthly payment for a $250k mortgage at a 7% interest rate?

The monthly payment for a $250k mortgage at a 7% interest rate would be approximately $1,663.

How much would a borrower pay in total over the life of a $250k mortgage at a 7% interest rate?

Over the life of the loan, a borrower would pay approximately $598,772, with around $348,772 allocated to interest.

What is an adjustable-rate mortgage (ARM)?

An adjustable-rate mortgage (ARM) is a type of loan that often starts with lower introductory rates, making it appealing for those who plan to pay off their mortgage quickly or refinance in a few years.

What protections do ARMs offer borrowers?

ARMs include interest adjustment caps that help protect borrowers from significant increases in interest rates.

Why is it important to consider additional housing costs when budgeting for a mortgage?

Including additional housing costs, such as property taxes and homeowners insurance, is vital for a comprehensive financial overview and helps in evaluating overall affordability.

What is the 30% guideline for housing expenses?

The 30% guideline suggests that individuals should aim to spend no more than 30% of their gross income each month on housing expenses.

What are closing costs, and how do they affect a mortgage?

Closing costs usually range from 3% to 6% of the loan amount and can be incorporated into monthly installments, raising the total amount owed on the mortgage.

How can potential borrowers make informed choices about financing options?

Understanding the figures related to mortgage payments, additional housing costs, and closing expenses can help potential borrowers evaluate their financial readiness and make informed choices about their financing alternatives.