Overview

We understand how challenging the journey to homeownership can be, especially for our veterans. The minimum credit score for VA loan approval typically falls between 580 and 620. This range exists because the Department of Veterans Affairs allows individual lenders to set their own criteria. This flexibility is a beacon of hope, enabling many veterans to qualify for loans even with lower scores.

What truly matters is demonstrating strong financial stability. If you can show that you meet other eligibility factors, such as:

- Debt-to-income ratios

- A history of timely payments

You may still find yourself on the path to securing a loan. We’re here to support you every step of the way, guiding you through the process and helping you understand your options.

Introduction

Navigating the intricacies of VA loans can feel overwhelming, especially when it comes to understanding credit scores. We know how challenging this can be. While the Department of Veterans Affairs does not set a strict minimum credit score, most lenders typically look for scores between 580 and 620. This means veterans can still secure financing, even with less-than-perfect credit histories.

However, this flexibility raises an important question: what specific strategies can you employ to enhance your creditworthiness and improve your chances of approval? As the landscape of VA loan requirements continues to evolve, it becomes crucial for prospective homeowners to explore the factors that influence credit scores and the steps to bolster them. We’re here to support you every step of the way.

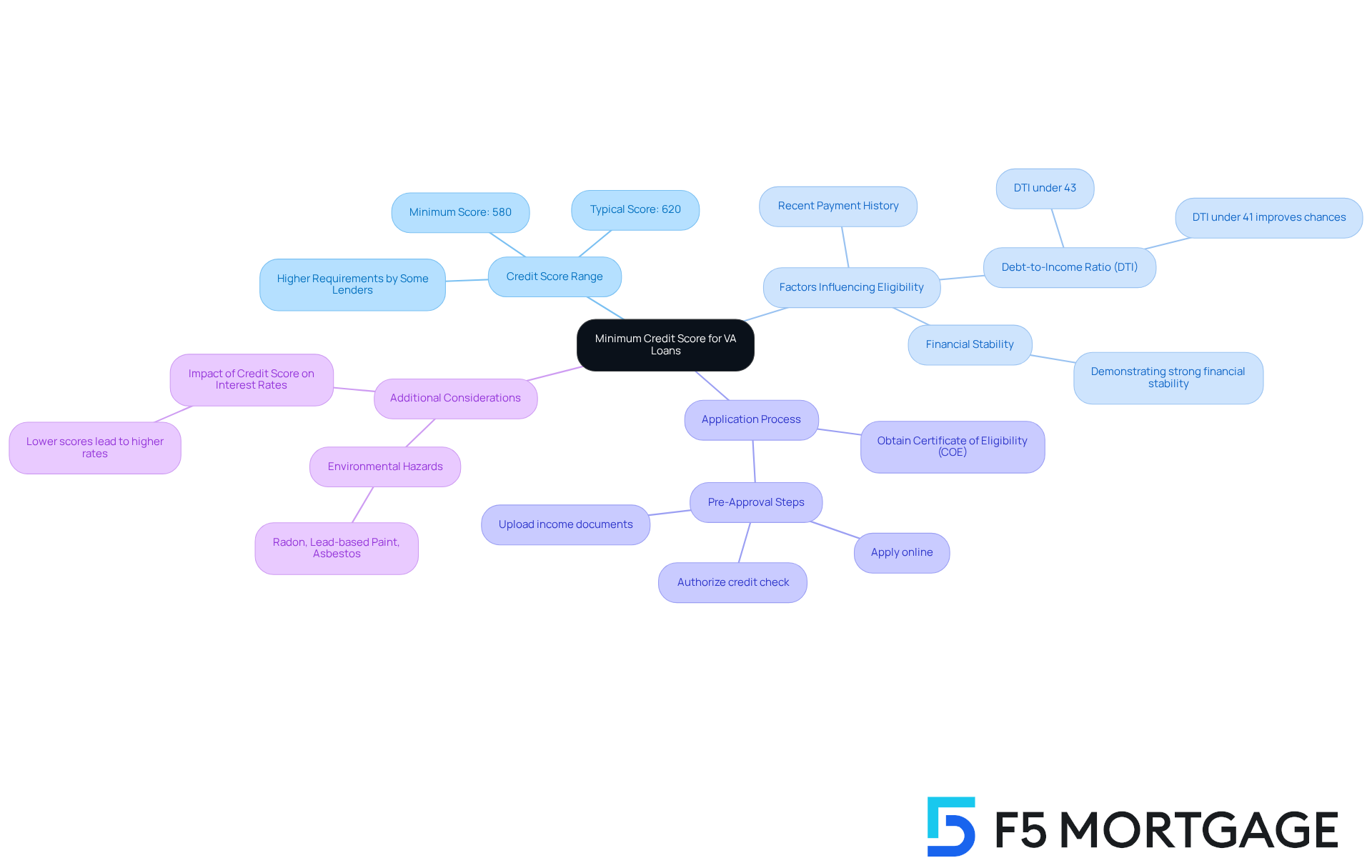

Define Minimum Credit Score for VA Loans

Navigating the world of can feel overwhelming, especially when it comes to understanding credit ratings. The Department of Veterans Affairs (VA) does not enforce a rigid minimum credit score for VA loans, allowing individual lenders to establish their own criteria. Generally, most lenders consider a to be between 580 and 620. For instance, some may approve applicants with a minimum credit score for a VA loan as low as 580, while others may require a higher limit of 620 or more, reflecting their own risk assessment policies. This flexibility is particularly beneficial for veterans and active-duty personnel, enabling them to secure even if their financial history isn’t perfect.

As we look ahead to 2025, the typical minimum credit score for a VA loan financing approval is around 620. However, many lenders are willing to work with borrowers who demonstrate solid financial stability, even if their ratings are lower. For example, is dedicated to helping veterans navigate these requirements, ensuring they are informed about their options. Additionally, borrowers with ratings below 580 may still qualify for a VA mortgage by showcasing strong .

It’s important to remember that lenders often consider additional factors beyond credit scores. Elements like and recent payment history can significantly impact financing eligibility. Typically, a Debt-to-Income Ratio (DTI) under 43% is required for , and maintaining a DTI under 41% can improve the chances of qualifying for a VA mortgage. This approach allows veterans facing to explore viable funding options, making VA financing a more attainable path to homeownership.

Furthermore, obtaining a (COE) is a crucial step in the application process, as it verifies military service and eligibility for . Lastly, being aware of potential environmental risks that could influence the VA financing process is essential. We understand how challenging this can be, and we’re here to support you every step of the way.

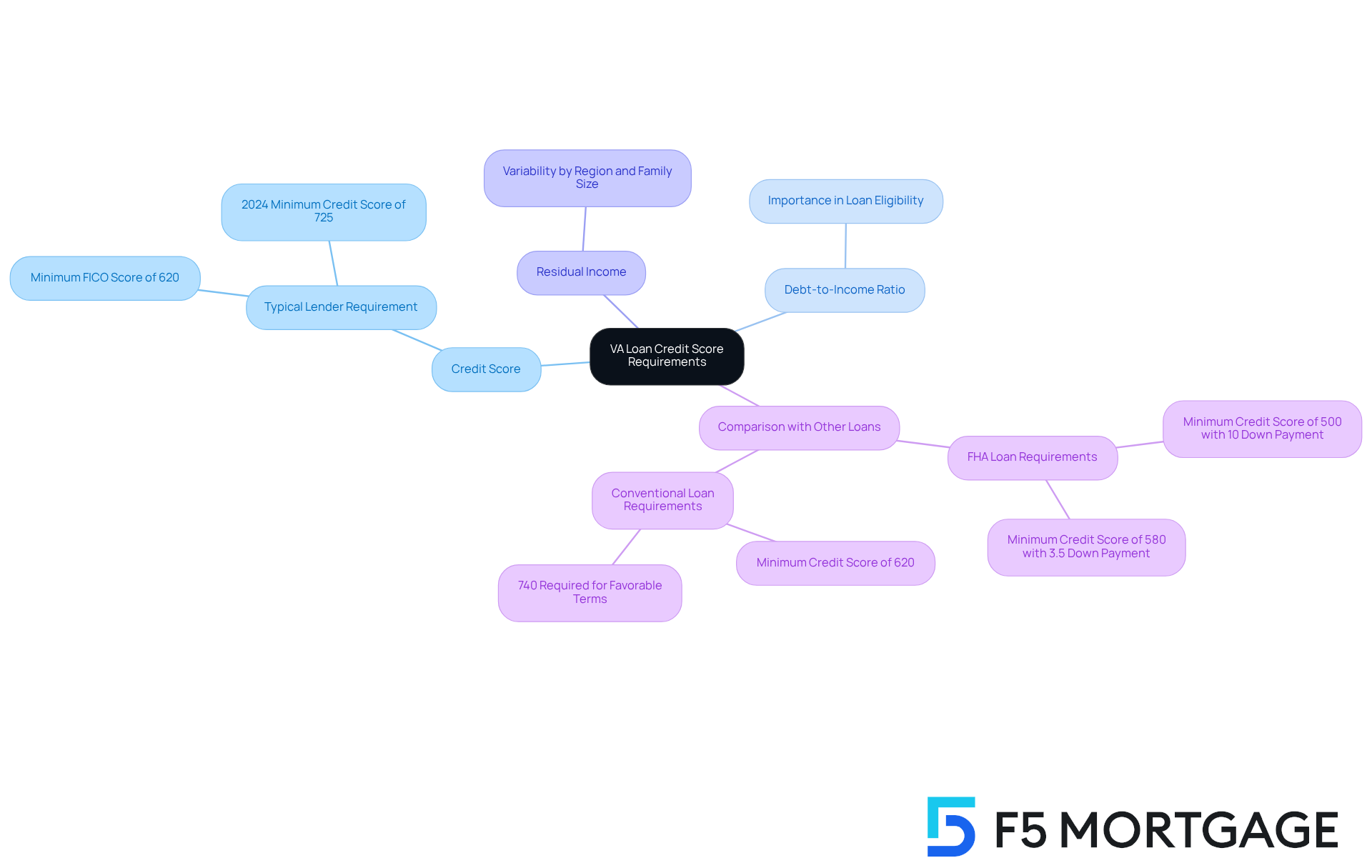

Contextualize VA Loan Credit Score Requirements

The VA financing program is designed to help veterans and active-duty military personnel achieve their dream of homeownership. We know how challenging this can be, and while the VA does not set a minimum credit score for , lenders typically look for a . This score helps them assess your creditworthiness and repayment capacity, which is essential in this process.

In addition to financial ratings, factors like debt-to-income (DTI) ratios and in determining loan eligibility. For instance, lenders often evaluate a family’s residual income, which varies by region and family size, to ensure they can comfortably manage their . Understanding these standards is crucial for prospective borrowers, as many can improve their ratings within months through focused efforts. This can significantly increase your chances of obtaining a VA mortgage.

As industry specialists note, the flexibility in rating requirements allows more veterans to qualify, especially when supported by . Plus, while VA financing provides the opportunity to purchase a home without a , it’s important to consider closing costs, which can range from 2% to 5% of the property’s value.

In 2024, the was 725, creating a favorable environment for potential borrowers. Tim Alvis, a mortgage officer, highlights that ‘many borrowers can qualify for VA financing after just a few months of dedicated efforts.’ Additionally, FHA mortgages typically require a 3.5% down payment, while conventional mortgages may need 5% or even as low as 3% for highly qualified buyers.

This comprehensive approach to evaluating creditworthiness ensures that veterans can access the benefits of VA financing, which include and a funding fee that varies based on the loan amount. We’re here to support you every step of the way as you .

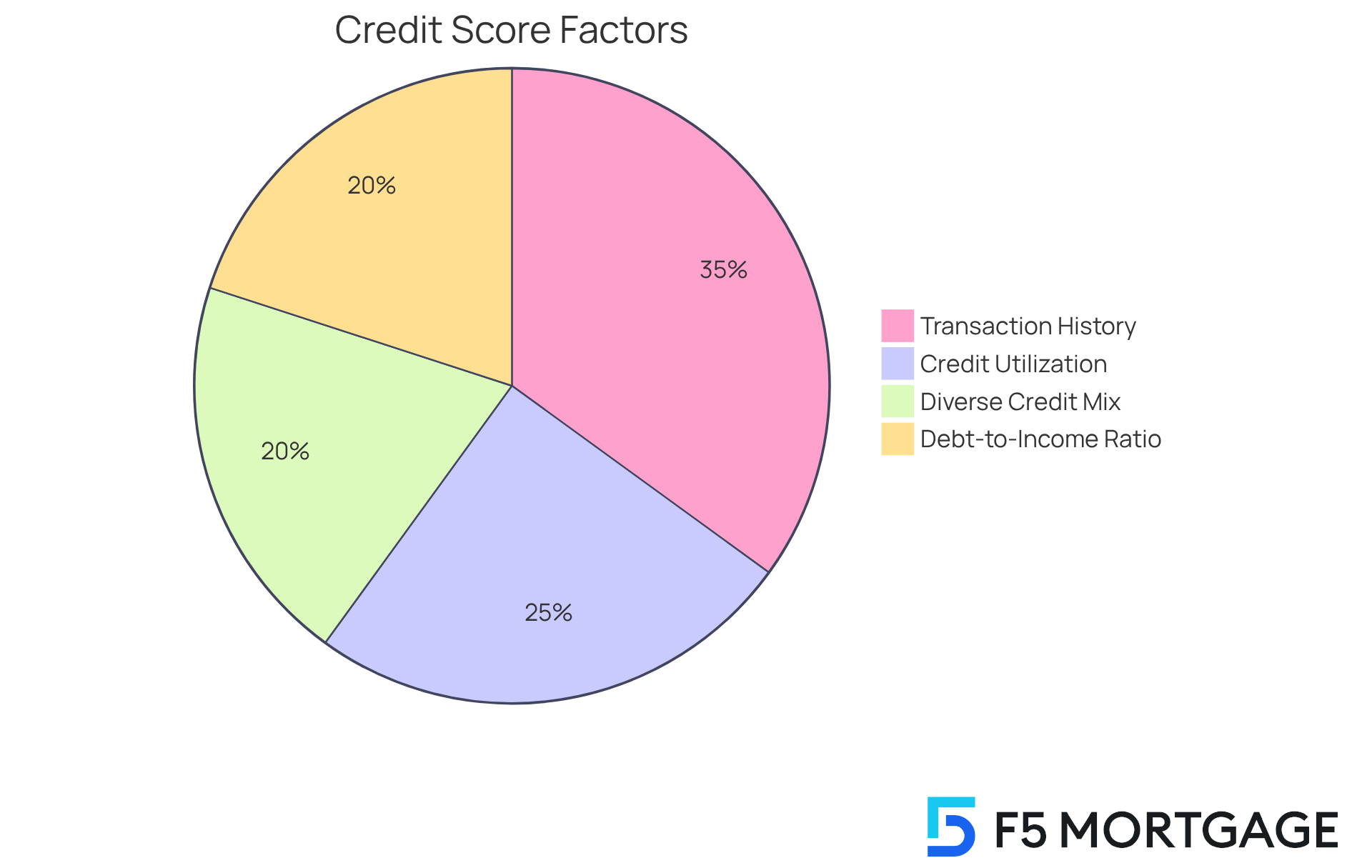

Examine Factors Influencing VA Loan Credit Scores

, with transaction history being the most significant, accounting for about 35% of the total rating. We know how important it is to ensure ; doing so can lead to , which is essential for . For instance, a 50-point increase in credit score can lower the interest rate on a $300,000 mortgage by approximately 0.5%, translating to monthly savings of $100 to $150.

In 2025, maintaining a solid financial history is crucial, as creditors carefully evaluate this aspect when considering credit approval. Real-life examples show that borrowers who maintain a consistent record of are more likely to meet the , while those with missed payments may face challenges.

Additionally, managing the usage of available funds—the ratio of current card balances to available credit—should ideally remain below 30% to positively impact ratings. A diverse mix of borrowing types, including both installment loans and revolving accounts, can further enhance a borrower’s financial profile. By understanding these factors, borrowers can take proactive steps to improve their credit scores to meet the minimum credit score for a VA loan before applying for a VA mortgage, ultimately increasing their chances of securing favorable terms.

Furthermore, grasping the is vital for homebuyers. A maximum DTI ratio of 43% is generally required for home financing, representing the relationship between existing debt and income. Lowering your DTI can lead to more competitive mortgage rates. For families in Colorado, there are various , including conventional mortgages, FHA programs, and VA products, each with unique eligibility criteria and benefits. By keeping their DTI low and understanding these refinancing choices, borrowers can take proactive steps to improve their financial situation before applying for a VA mortgage, ultimately enhancing their likelihood of obtaining advantageous terms.

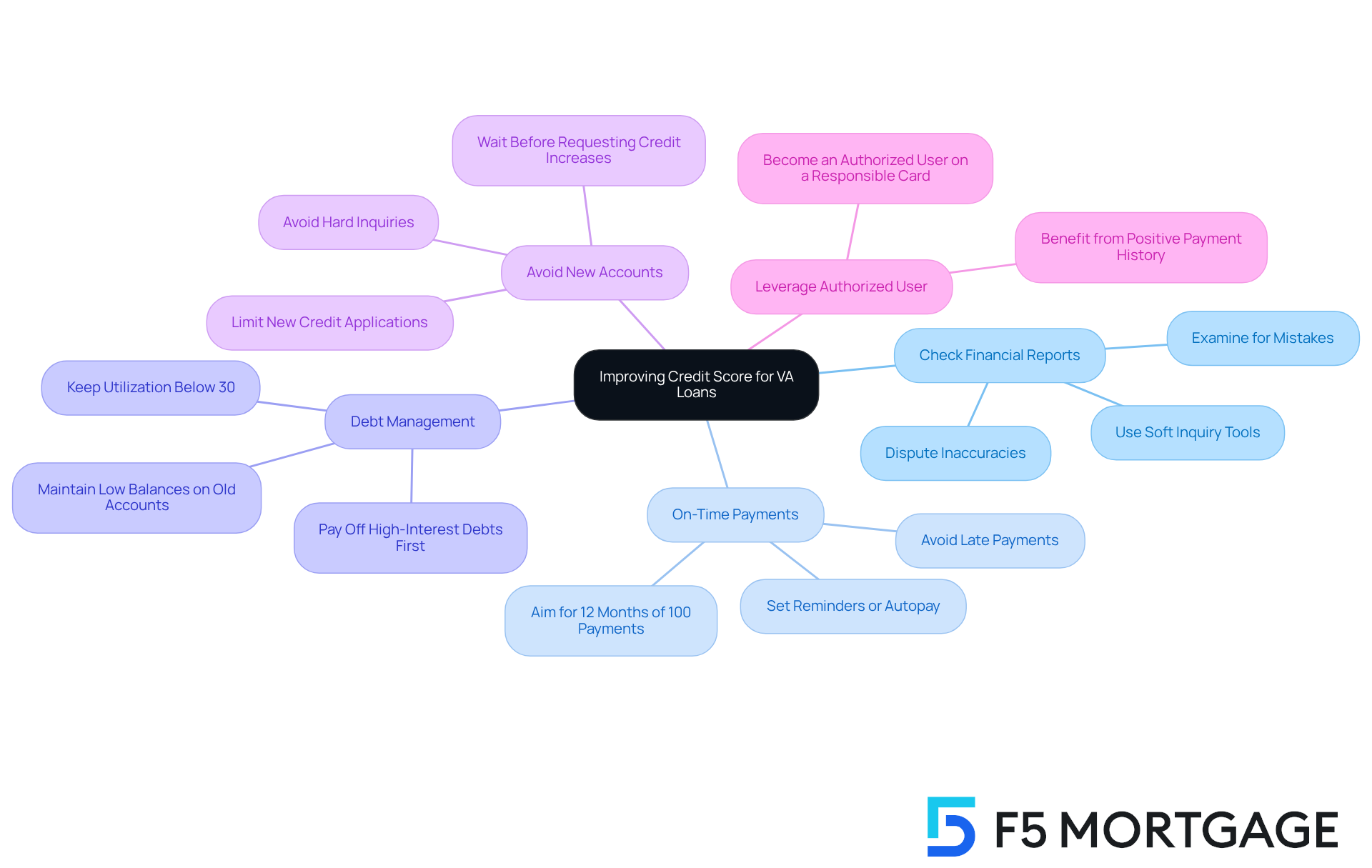

Explore Strategies to Improve Your Credit Score for VA Loans

A thoughtful and strategic approach is necessary for for a . We know how challenging this can be, so it’s essential to start by carefully examining your for any mistakes. Inaccuracies can significantly lower your score, and challenging these mistakes is crucial. Prompt rectification can lead to a meaningful improvement in your financial profile. Consistently reviewing your financial reports for accuracy through online methods that allow for a ‘soft inquiry’ is also vital for proactive financial management.

Regular, on-time contributions play a significant role in your score, representing 35% of it. Aim for at least 12 months of 100% on-time payments to show lenders your reliability. Remember, late and missed payments in the 12 months before applying for a loan can greatly impact your chances of approval.

Another important step is to , especially on credit cards. Keeping your utilization ratio below 30%—and ideally under 10%—signals to lenders that you manage borrowing responsibly. For instance, if you have a limit of $10,000, strive to maintain a balance under $3,000.

It’s wise to refrain from opening new accounts before applying for a VA loan. Each application results in a hard inquiry, which can temporarily lower your rating. Instead, consider becoming an authorized user on a responsible individual’s card. This can enhance your rating by leveraging their positive payment history without taking on debt obligations yourself.

Real-life examples highlight the effectiveness of these strategies. Many individuals who have successfully challenged inaccuracies on their financial reports often see significant improvements in their ratings, which enhances their chances of approval. Additionally, keeping older accounts can positively impact your credit history length, further boosting your rating. Providing a on a VA mortgage can lead to reduced VA financing fees, offering additional financial advantages.

As a finance expert wisely noted, “; establish reminders or autopay to prevent late payments.” By implementing these strategies, you can effectively enhance your credit profile, positioning yourself for better loan terms and ensuring you meet the . We’re here to .

Conclusion

Understanding the nuances of minimum credit scores for VA loan approval is essential for veterans and active-duty personnel seeking home financing. We know how challenging this can be, but the flexibility offered by the Department of Veterans Affairs allows lenders to set their own criteria, typically ranging from 580 to 620. This adaptability is crucial, as it enables more individuals to access VA loans, even those with less-than-perfect credit histories.

Key insights from this discussion highlight the importance of not only credit scores but also other financial factors such as debt-to-income ratios and payment histories. Maintaining a solid financial profile and addressing any inaccuracies in credit reports can significantly enhance one’s chances of securing a VA loan. Moreover, strategies like managing credit utilization and ensuring timely payments can lead to substantial improvements in credit scores, making homeownership more attainable.

Ultimately, the path to securing a VA loan is navigable with the right knowledge and proactive measures. Veterans and service members are encouraged to take charge of their financial health, utilize available resources, and explore options that align with their unique situations. By doing so, they can unlock the benefits of VA financing and move closer to achieving their homeownership dreams. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

Is there a minimum credit score required for VA loans?

The Department of Veterans Affairs (VA) does not enforce a rigid minimum credit score for VA loans, allowing individual lenders to set their own criteria. Generally, most lenders consider a minimum credit score to be between 580 and 620.

What is the typical minimum credit score for VA loan approval as we approach 2025?

The typical minimum credit score for VA loan financing approval is around 620 as we look ahead to 2025.

Can borrowers with a credit score below 580 qualify for a VA mortgage?

Yes, borrowers with credit scores below 580 may still qualify for a VA mortgage by demonstrating strong financial stability in other areas.

What additional factors do lenders consider beyond credit scores when evaluating VA loan applications?

Lenders often consider additional factors such as debt-to-income ratios and recent payment history, which can significantly impact financing eligibility.

What is the recommended Debt-to-Income Ratio (DTI) for VA loan financing?

Typically, a Debt-to-Income Ratio (DTI) under 43% is required for home financing, and maintaining a DTI under 41% can improve the chances of qualifying for a VA mortgage.

What is a Certificate of Eligibility (COE) and why is it important?

A Certificate of Eligibility (COE) is crucial in the VA loan application process as it verifies military service and eligibility for financial assistance.

Are there any environmental risks that could influence the VA financing process?

Yes, being aware of potential environmental risks is essential as they could influence the VA financing process.