Overview

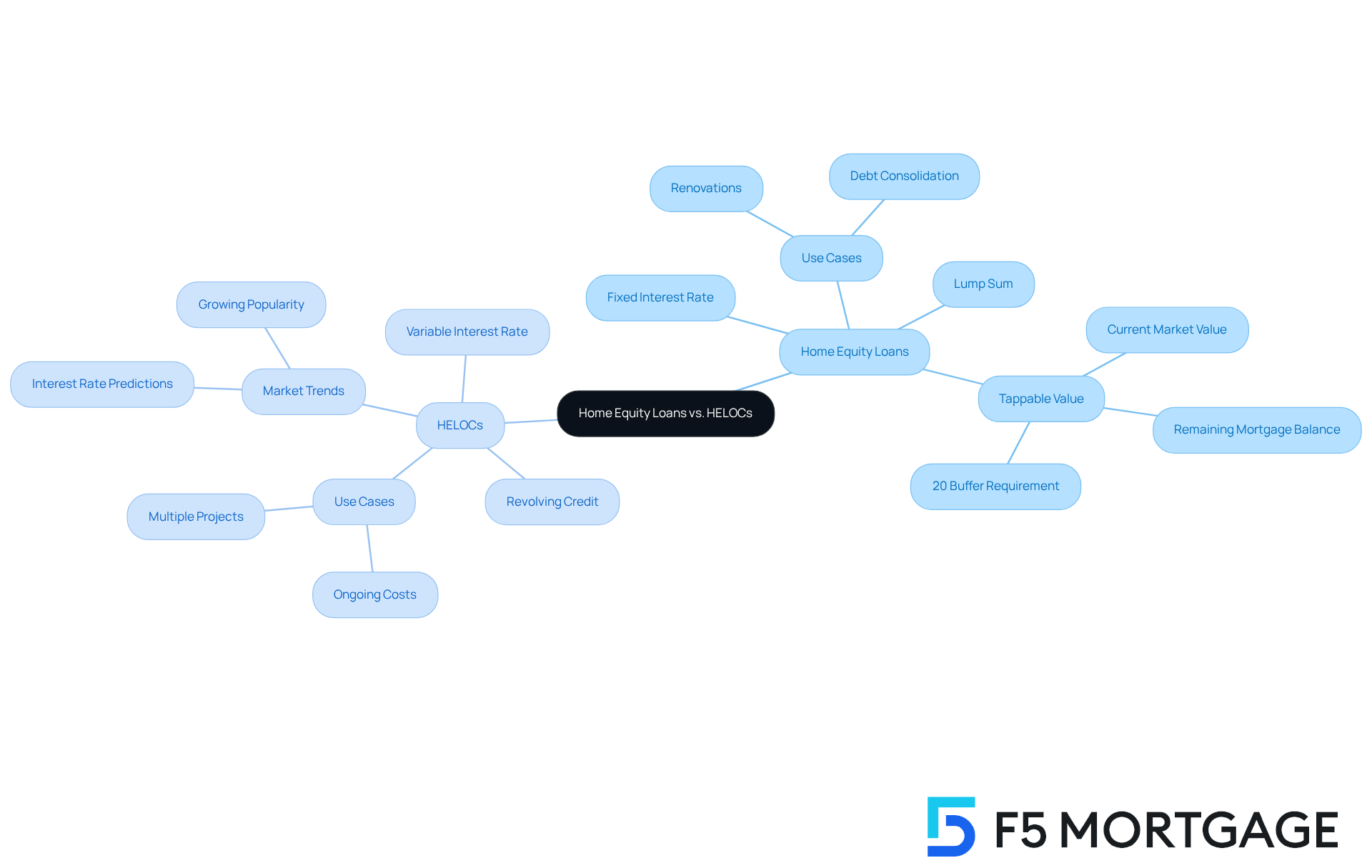

Navigating the world of home financing can feel overwhelming, and we know how challenging this can be. Understanding the main difference between home equity loans and home equity lines of credit (HELOCs) is crucial for making informed decisions.

- Home equity loans provide a lump sum at a fixed interest rate, which can be a comforting option for those facing one-time expenses.

- On the other hand, HELOCs offer a revolving line of credit with variable interest rates, allowing for flexible borrowing over time.

This flexibility can be particularly beneficial for ongoing costs, but it’s important to be aware of the risk of fluctuating payments. By recognizing your unique financial situation, you can choose the option that best meets your needs. Remember, we’re here to support you every step of the way as you explore these choices.

Introduction

Navigating the financial landscape of home equity can feel overwhelming for homeowners looking to make the most of their property’s value. We understand how challenging this can be. It’s crucial to grasp the differences between home equity loans and Home Equity Lines of Credit (HELOCs), as each option offers distinct benefits and potential pitfalls.

As more homeowners consider these borrowing avenues—especially in a time of rising home values—how can they determine which choice aligns best with their financial needs? This article explores the essential differences, empowering you to make informed decisions that resonate with your goals.

Define Home Equity Loans and HELOCs

Understanding the difference between [home equity loan and line of credit](https://f5mortgage.com/home-equity-loan-vs-home-equity-line-of-credit-key-differences-explained) is crucial for homeowners exploring home value borrowing options, such as Home Value Lines of Credit (HELOCs), to tap into their property’s worth. A property-backed borrowing option offers a lump sum of cash, which is repaid over a set period at a fixed interest rate. This makes it suitable for significant, one-time expenses like renovations or debt consolidation. For instance, if a homeowner borrows $50,000 through an equity loan, they can expect consistent monthly payments throughout the loan’s duration.

On the other hand, a HELOC serves as a revolving line of credit, enabling homeowners to borrow as needed, similar to a credit card. This flexibility proves beneficial for ongoing costs, such as funding multiple home improvement projects. However, it’s important to note the difference between home equity loan and line of credit, as HELOCs often come with variable interest rates, which may fluctuate based on market conditions. As of 2025, the average introductory rate for second lien HELOCs has fallen below 7.5%, with predictions indicating rates could dip into the mid-6% range by 2026.

Both options leverage the value accumulated in a home, which highlights the difference between home equity loan and line of credit, defined as the property’s current market value minus the remaining mortgage balance. For example, if a home is valued at $500,000 with a mortgage balance of $300,000, the homeowner has $200,000 in total value. However, lenders typically require a 20% buffer, meaning only $100,000 would be considered tappable value.

Recent trends reveal a growing interest in both residential value advances and HELOCs, emphasizing the difference between home equity loan and line of credit, with originations for residential value advances increasing by 13% year-over-year as of Q4 2024. Additionally, around 25% of homeowners are contemplating a mortgage against their assets or a HELOC in the coming year, reflecting the substantial value increases many have experienced. With the surpassing $420,000 in May 2025, homeowners are increasingly leveraging their assets to meet various needs, from renovations to consolidating high-interest debt.

In the realm of refinancing, California homeowners might also explore rate-and-term options. These aim to lower monthly mortgage payments by replacing existing mortgages with new ones that offer better terms or conditions. This option can be particularly appealing during periods of declining interest rates, allowing homeowners to reduce their overall borrowing while effectively utilizing their assets.

Compare Structures and Terms of Home Equity Loans and HELOCs

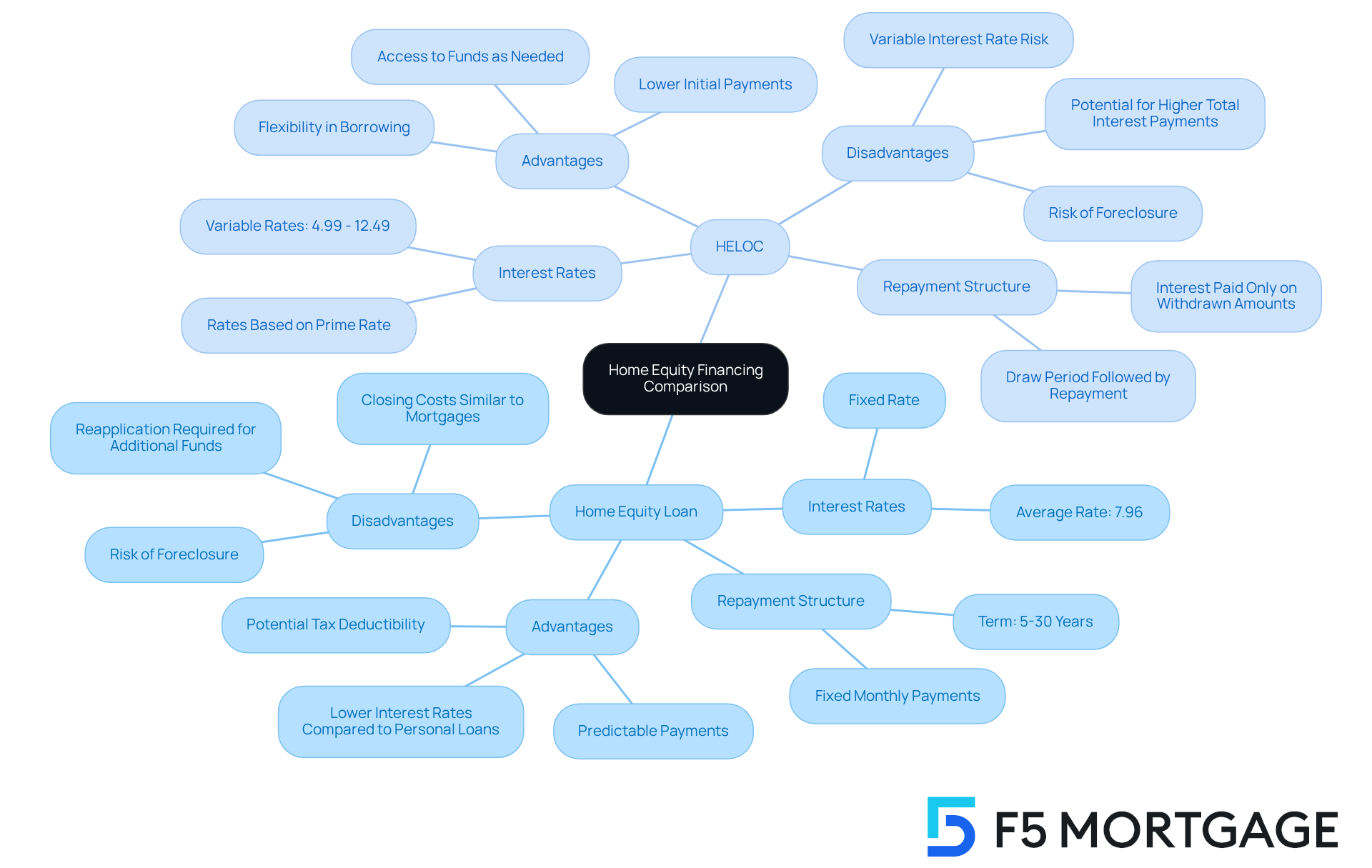

Home equity financing can be a reassuring option for many families, as it features fixed interest levels and a clear repayment plan. This structure allows borrowers to make regular monthly payments throughout the financing term, which can bring peace of mind. The entire loan amount is provided as a lump sum at the start, making it ideal for those who have a specific borrowing need.

On the other hand, the difference between home equity loan and line of credit is that a Home Equity Line of Credit (HELOC) offers a different approach. With and a draw period, borrowers can access funds as needed. After this initial period, they enter a repayment phase, where both principal and interest must be repaid. This flexibility can be beneficial, allowing homeowners to gradually access funds, but it may also result in fluctuating monthly payments due to changes in the outstanding balance and interest rates.

For instance, while the typical fixed interest rate for home financing options hovers around 7.96%, HELOC rates can vary widely, currently ranging from 4.99% to 12.49%. These differences depend on the lender and the borrower’s credit profile. We understand how challenging it can be to navigate these options, and that’s why it’s crucial for homeowners to grasp the difference between home equity loan and line of credit. By doing so, you can make informed decisions that align with your financial needs and goals. Remember, we’re here to support you every step of the way.

Evaluate Pros and Cons of Home Equity Loans vs. HELOCs

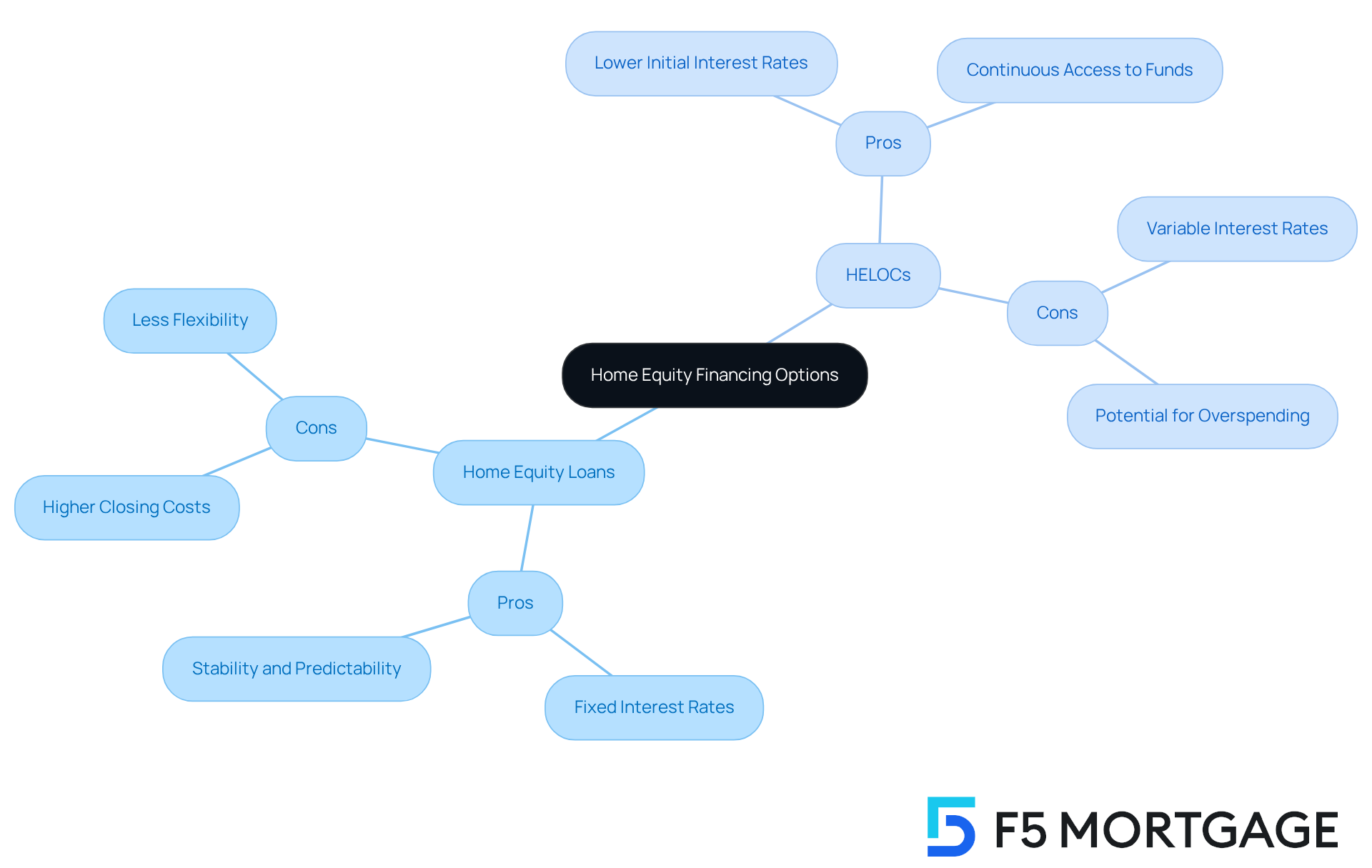

Home equity financing offers unique benefits that many families find appealing. With fixed interest terms and consistent monthly payments, it provides a sense of stability, allowing you to plan your finances effectively. However, it’s important to be aware that these loans often come with higher closing costs and less flexibility in borrowing compared to other options.

On the other hand, Home Equity Lines of Credit (HELOCs) offer continuous access to funds, typically at lower initial interest rates. This means you can draw only what you need, which can be incredibly helpful for managing expenses over time. Yet, it’s crucial to consider that HELOCs come with the , which can increase and lead to higher payments as rates rise. This variability can create uncertainty in budgeting, especially if you find yourself only making interest payments during the draw period.

Moreover, the flexibility of HELOCs can sometimes lead to overspending. It’s easy to be tempted to draw from the line of credit repeatedly. In 2024, the typical closing expenses for property-backed financing and HELOCs were similar, but remember that HELOCs might involve additional charges like annual or transaction fees. It’s essential to take these into account when assessing your total expenses.

In summary, while residential value financing options provide a structured repayment plan and predictability, HELOCs offer flexibility and lower initial costs. Understanding the difference between home equity loan and line of credit is vital for homeowners who aim to utilize their assets effectively. We know how challenging this can be, and we’re here to support you every step of the way as you navigate these important financial decisions.

Guide to Choosing Between Home Equity Loans and HELOCs

When considering a for your property, it’s essential to align your choice with your unique financial needs and aspirations. If you’re looking for a significant sum for a specific, one-time expense—such as major home improvements or debt consolidation—a home equity line may be ideal. This option offers consistent monthly payments and a stable interest rate, providing you with predictability in your budgeting.

On the other hand, if you anticipate needing access to funds over time for ongoing projects or variable expenses, a HELOC could be a better fit. It allows you to borrow as needed, functioning similarly to a credit card, but with the added benefit of lower interest rates compared to unsecured loans.

It’s important to consider your comfort level with fluctuating interest rates, as HELOCs typically come with variable amounts that can impact your monthly payments. Assessing your ability to manage these payments is crucial, especially if rates increase. As Jennifer Beeston wisely advises, “Do a home equity line and don’t touch it unless you need it,” underscoring the importance of cautious borrowing.

Additionally, be mindful of potential hidden costs associated with HELOCs, such as annual fees or transaction fees, which can influence your overall financial strategy. For personalized guidance tailored to your situation, consulting with a mortgage broker can be incredibly beneficial. They can help you navigate the complexities of both options, ensuring you make an informed choice that aligns with your long-term financial goals. Remember, we’re here to support you every step of the way.

Conclusion

Understanding the distinctions between home equity loans and Home Equity Lines of Credit (HELOCs) is essential for homeowners looking to leverage their property’s value. We know how challenging it can be to navigate these options, and recognizing the unique features and benefits of each can empower you to make informed financial decisions that align with your specific needs and circumstances.

Home equity loans provide a lump sum with fixed interest rates, making them ideal for substantial, one-time expenses. In contrast, HELOCs offer a flexible borrowing option with variable interest rates, allowing you to draw funds as needed for ongoing projects. It’s important to consider the stability of payments with home equity loans versus the potential fluctuations in costs associated with HELOCs. Moreover, understanding the implications of closing costs and potential hidden fees is crucial in evaluating these financing options.

Ultimately, the choice between a home equity loan and a HELOC should be guided by your individual financial goals and comfort with interest rate variability. We encourage you to assess your specific needs, weigh the pros and cons of each option, and seek professional advice if necessary. By doing so, you can effectively utilize your home equity to meet your financial aspirations while minimizing risks associated with borrowing.

Frequently Asked Questions

What are home equity loans and HELOCs?

Home equity loans provide a lump sum of cash that is repaid over a set period at a fixed interest rate, suitable for significant one-time expenses. HELOCs (Home Equity Lines of Credit) function as a revolving line of credit, allowing homeowners to borrow as needed, similar to a credit card.

How does a home equity loan work?

A home equity loan offers a fixed amount of money that homeowners repay through consistent monthly payments over the loan’s duration. This option is ideal for large expenses like renovations or debt consolidation.

What is a HELOC and how does it differ from a home equity loan?

A HELOC is a flexible borrowing option that allows homeowners to withdraw funds as needed, making it useful for ongoing costs. Unlike home equity loans, HELOCs often have variable interest rates that can fluctuate based on market conditions.

What are the current interest rates for HELOCs?

As of 2025, the average introductory rate for second lien HELOCs has fallen below 7.5%, with predictions suggesting rates could decrease into the mid-6% range by 2026.

How is tappable home equity calculated?

Tappable home equity is calculated as the property’s current market value minus the remaining mortgage balance, with lenders typically requiring a 20% buffer. For example, if a home is valued at $500,000 and has a $300,000 mortgage, the tappable equity would be $100,000.

What recent trends have been observed in home equity borrowing?

There has been a 13% year-over-year increase in originations for residential value advances as of Q4 2024, and around 25% of homeowners are considering a mortgage against their assets or a HELOC in the coming year.

What should California homeowners consider regarding refinancing?

California homeowners may explore rate-and-term refinancing options to lower monthly mortgage payments by replacing existing mortgages with new ones that offer better terms, especially during periods of declining interest rates.