Overview

Mortgage amortization is a structured method of repaying a loan through regular payments that cover both principal and interest, ultimately aiming for a zero balance by the end of the loan term. We know how challenging this can be, and understanding this process is crucial. It affects your monthly payments and total interest costs, enabling you to make informed financial decisions.

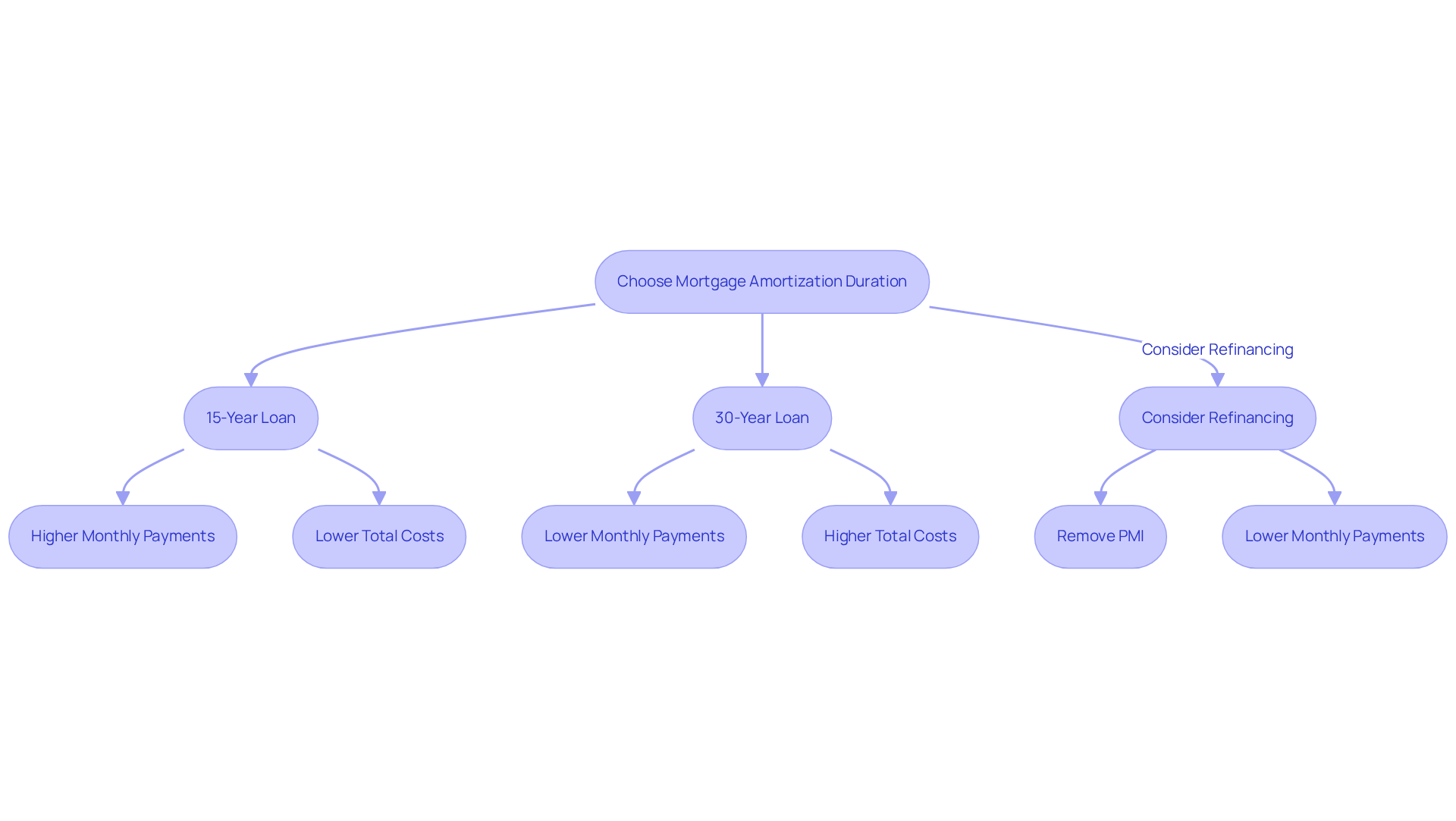

Consider the different amortization periods available to you. Each option can significantly impact your overall financial health. Additionally, think about refinancing options that could help you save on interest over time. We’re here to support you every step of the way as you navigate these choices.

Introduction

Navigating the complexities of home financing can be daunting, and understanding mortgage amortization is crucial in this journey. This structured approach to debt repayment not only affects your monthly payments but also plays a significant role in your long-term financial health. We know how challenging it can be for families to choose the right amortization period and mortgage term. The potential savings and costs can feel overwhelming at times.

How can you make informed decisions that align with your financial goals while minimizing interest payments over time? We’re here to support you every step of the way, ensuring that you feel empowered and confident in your choices.

Define Mortgage Amortization and Its Importance

for settling a debt through consistent contributions that encompass both principal and charges is known as . Each installment progressively reduces the borrowed amount, aiming for a . We understand how challenging this can be, and comprehending this procedure is essential, as it directly impacts your and the overall cost incurred over the loan’s duration.

For , grasping the mechanics of amortization can significantly aid in budgeting and planning for . For instance, in the initial installment of a $200,000 mortgage:

- Roughly $708 is allocated for charges

- Only $276 decreases the principal

This illustrates how, in the early phases, a larger share of payments goes toward charges rather than principal repayment.

By , families can make about financing options that align with their financial circumstances. Additionally, methods like can lead to . For example, an additional $100 monthly contribution on a $200,000 mortgage at 6.5% interest can save nearly $56,000 in interest over the mortgage’s duration and reduce the repayment period by more than five years.

Ultimately, understanding mortgage amortization empowers families to manage their finances more effectively and plan for a secure financial future. We’re here to support you every step of the way as you navigate this important journey.

Differentiate Between Amortization Periods and Mortgage Terms

Understanding the mortgage process can feel overwhelming, but we’re here to support you every step of the way. The is the total duration required to settle your debt, typically ranging from 15 to 30 years. In contrast, the is the duration until your agreement must be renewed or settled, which can be shorter than the amortization period. For example, you might have a loan term of 5 years with a mortgage amortization period of 30 years. Recognizing this distinction is crucial because it directly impacts your and the interest rate options available.

As you consider your long-term financial objectives, it’s important to weigh and mortgage amortization periods. Additionally, (ARMs) can be a beneficial choice, especially if you plan to relocate or refinance within a few years. These loans often come with lower introductory rates, providing you with financial relief at the start. ARMs feature an introductory period with a lower interest rate, followed by adjustments based on market conditions, all while having caps to protect you from significant increases.

Moreover, can empower you to modify your financial terms. This could lead to decreased monthly costs or even the removal of private mortgage insurance (PMI) by utilizing home appreciation. Lastly, comprehending the is essential, as it determines your eligibility for different financing options and influences your overall financial planning. We know how challenging this can be, but with the right knowledge and support, you can navigate these decisions confidently.

Analyze Financial Implications of Amortization Choices

When selecting a , we know how challenging this can be. It’s essential to consider how this choice influences your monthly expenses and the overall throughout the life of your loan. A shorter mortgage amortization duration typically results in higher monthly payments but reduces overall charges. In contrast, a longer duration of mortgage amortization lowers your monthly payments but increases the total costs.

For instance, a 30-year loan may seem more budget-friendly each month, but over time, you could pay significantly more in fees compared to a . Recent statistics show that borrowers can save an average of $50,000 in interest by opting for a 15-year loan instead of a 30-year loan. This is a substantial amount that can make a real difference in your financial future.

Furthermore, an opportunity to adjust your financing term, which can be a strategic decision for families looking to or . If you purchased your home with a traditional mortgage and made a down payment of less than 20%, refinancing might enable you to remove PMI, especially with rising home values.

It’s vital for families to assess their current financial situation, future income prospects, and overall financial goals to determine the best mortgage amortization choice for their needs. As noted by financial experts, ‘Choosing the right amortization period is not just about monthly affordability; it’s about long-term financial health.’ Understanding these implications is crucial, particularly with set to be renewed in the coming years. This highlights the importance of . We’re here to support you every step of the way.

Conclusion

Understanding mortgage amortization is essential for anyone facing the complexities of home financing. This structured repayment method not only dictates how debt is settled over time but also shapes monthly payments and the total cost of borrowing. By grasping the intricacies of amortization, families can make informed financial decisions that align with their long-term objectives. This knowledge ultimately leads to a more secure financial future.

Throughout this article, we explored key concepts like the distinction between amortization periods and mortgage terms. These choices significantly impact monthly payments and overall interest costs. We discussed the substantial savings associated with shorter amortization periods and the potential benefits of refinancing. It’s crucial to evaluate your financial situation and goals when selecting the right mortgage strategy.

In essence, comprehending mortgage amortization goes beyond an academic exercise; it is a vital component of effective financial planning. We know how challenging this can be, and we encourage families to actively engage with these concepts. Seeking professional guidance and making choices that foster long-term financial health is empowering. By doing so, you can take control of your mortgage journey and pave the way for a more prosperous future.

Frequently Asked Questions

What is mortgage amortization?

Mortgage amortization is a structured method for settling a debt through consistent payments that include both principal and interest. Each payment progressively reduces the borrowed amount, aiming for a zero balance by the end of the loan period.

Why is understanding mortgage amortization important?

Understanding mortgage amortization is essential as it directly impacts monthly payments and the overall cost incurred over the loan’s duration. It helps families budget and plan for future financial obligations.

How does mortgage amortization affect early payments?

In the early phases of a mortgage, a larger portion of the payments goes toward interest rather than reducing the principal. For example, on a $200,000 mortgage, roughly $708 may go to interest while only $276 reduces the principal in the first installment.

How can families benefit from understanding amortization?

By grasping the mechanics of amortization, families can make informed choices about financing options that align with their financial circumstances. They can also explore methods like making extra payments to save on interest and reduce the repayment period.

What is an example of how extra payments can impact a mortgage?

Making an additional $100 monthly payment on a $200,000 mortgage at 6.5% interest can save nearly $56,000 in interest over the loan’s duration and reduce the repayment period by more than five years.

How does understanding mortgage amortization empower families?

Understanding mortgage amortization empowers families to manage their finances more effectively and plan for a secure financial future by making informed decisions regarding their mortgage and payment strategies.