Overview

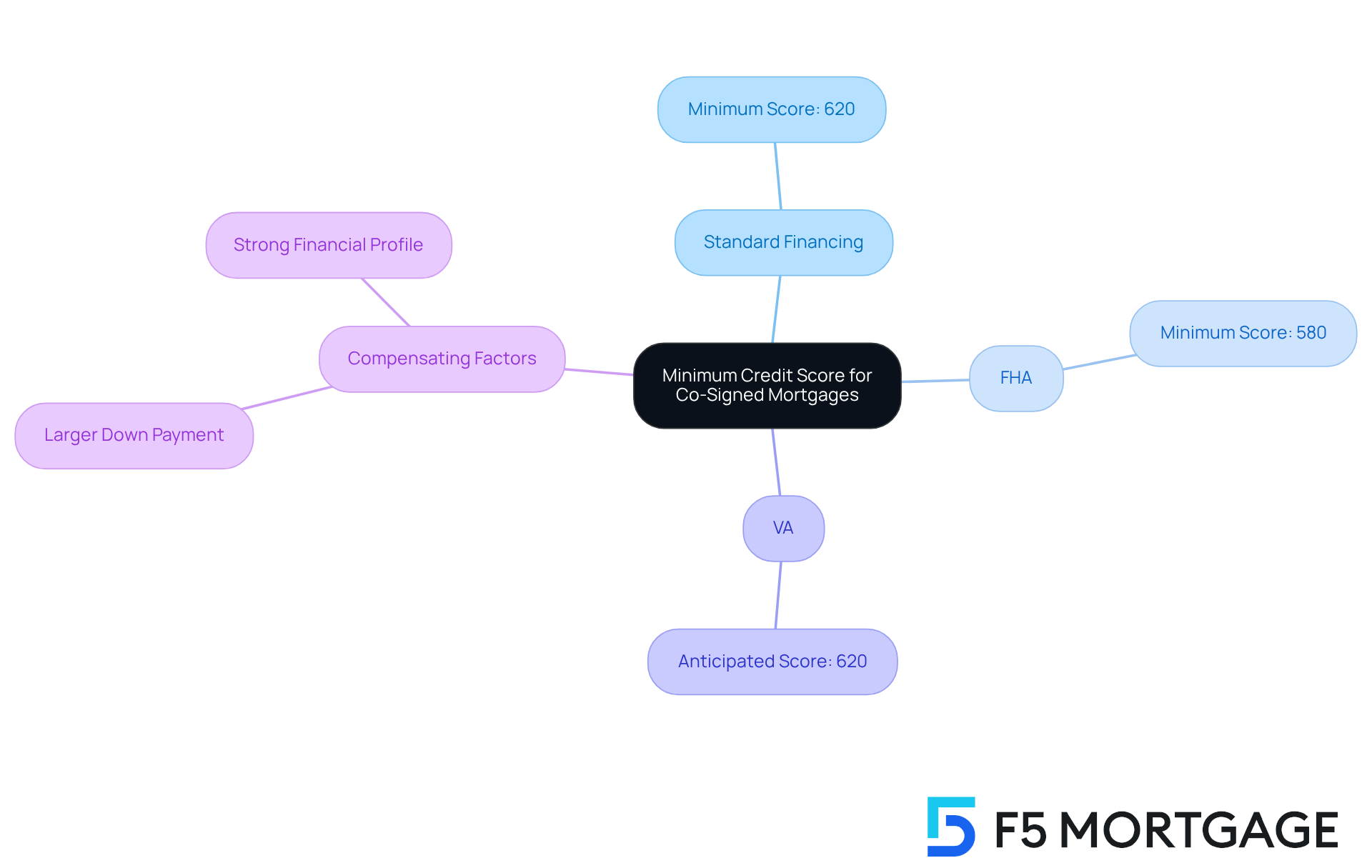

Navigating the mortgage process can be daunting, especially when it comes to understanding credit scores. For those considering a mortgage with a co-signer, it’s important to know that:

- The minimum credit score typically starts at 620 for standard financing.

- If you’re looking at government-backed options like FHA and VA loans, you might find that scores as low as 580 are accepted.

We understand how challenging this can be, and it’s reassuring to know that lenders often consider compensating factors. For instance:

- A larger down payment

- A strong financial profile

These factors can significantly enhance your chances of mortgage approval, even if your credit score isn’t where you’d like it to be.

Remember, you’re not alone in this journey. We’re here to support you every step of the way, helping you explore all your options and find the best path forward for your family.

Introduction

Navigating the complexities of co-signed mortgages can be daunting, and we understand how challenging this can be. One of the most significant hurdles is deciphering the minimum credit score requirements, which can vary by lender and loan type. Understanding these thresholds is crucial, as they can significantly influence not only your chances of approval but also the terms of your mortgage.

But what happens when a primary applicant’s credit score falls short? Can a co-signer truly bridge the gap and enhance the likelihood of securing favorable financing? This article delves into the essential criteria for co-signed mortgages, highlighting the pivotal role of co-signers and the factors that can sway credit score requirements. We’re here to support you every step of the way, providing valuable insights for prospective homebuyers and their supporters.

Define Minimum Credit Score for Co-Signed Mortgages

Navigating the world of co-signed mortgages can feel overwhelming, particularly in understanding the minimum credit score for mortgage with co-signer required by different mortgage types. For standard financing, lenders typically ask for a minimum rating of 620. However, if you’re exploring government-supported options like FHA and VA programs, you might be relieved to know that the minimum eligibility ratings can be as low as 580.

It’s important to remember that some lenders are willing to consider applicants with ratings below these thresholds, especially if you can present compensating factors. These might include:

- A larger down payment

- A strong financial profile

These factors can make a significant difference in your application.

As we look ahead to 2025, trends reveal that while the average minimum rating for FHA financing remains at 580, VA financing often anticipates a similar rating around 620. Understanding the minimum credit score for mortgage with co-signer requirements is crucial for both prospective loan applicants and their co-signers, as it greatly influences the ability to secure financing.

Moreover, the impact of financial ratings on co-signed mortgage acceptance cannot be overstated. A higher rating not only enhances your chances of acceptance but can also lead to more favorable terms. This makes it essential for you to have a clear understanding of your financial status before applying. We know how challenging this can be, but we’re here to support you every step of the way.

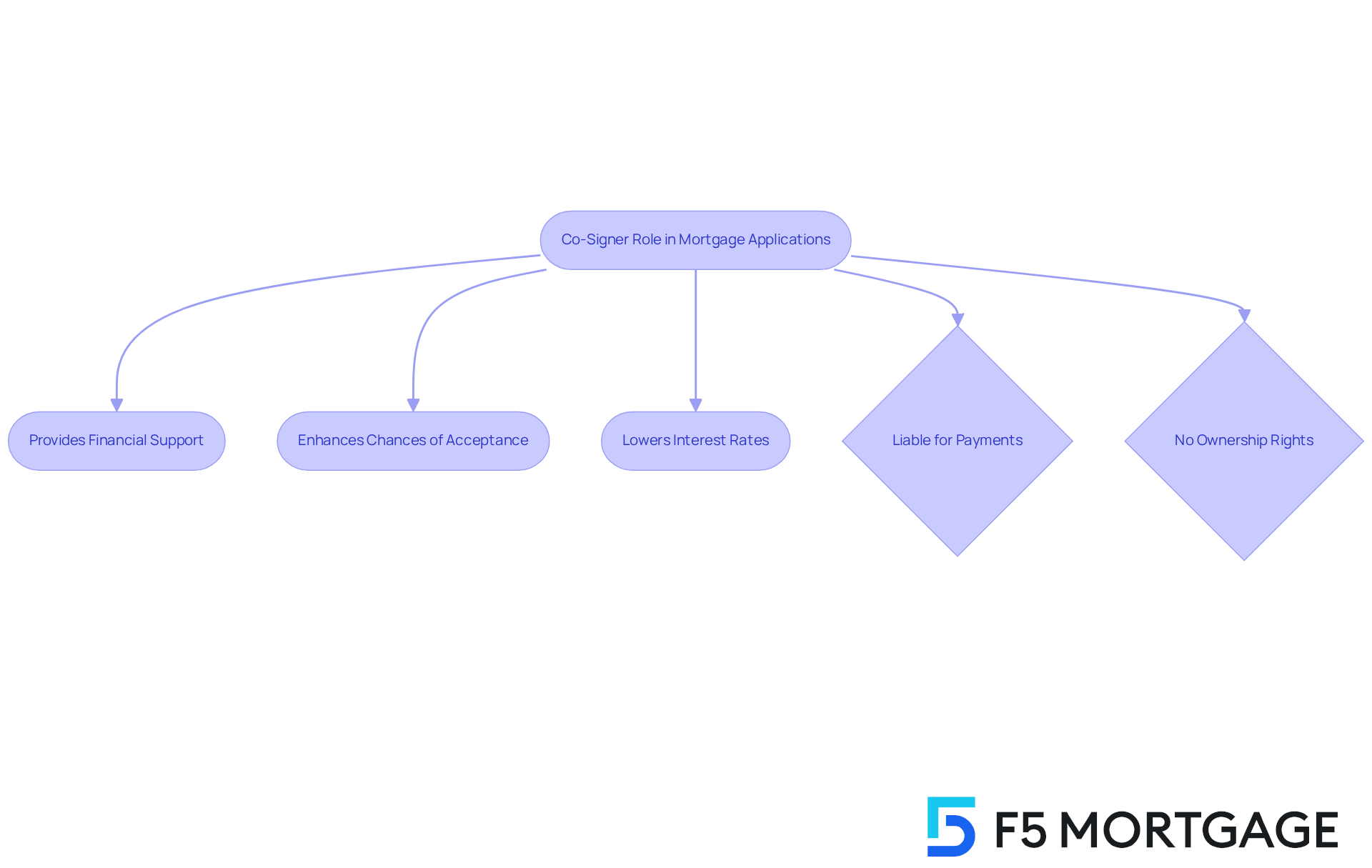

Explain the Role of Co-Signers in Mortgage Applications

Co-signers play a vital role in mortgage applications, providing essential financial support for the main applicant. When a co-signer agrees to the mortgage, they take on responsibility for the debt. This can significantly enhance the chances of acceptance for the primary applicant, especially if they have a lower credit score or insufficient income. Lenders see co-signers as a safety net, as they are legally obligated to repay the debt if the primary borrower defaults. This added security can lead to better borrowing conditions, such as lower interest rates or higher credit limits, making it an attractive option for many homebuyers.

It’s important to understand that co-signers are fully liable for loan payments but do not hold legal ownership or occupancy rights to the property. Many lenders allow up to four individuals, including co-signers, on a mortgage application, providing applicants with more options. For those considering becoming co-borrowers, it’s important to remember that the minimum credit score for a mortgage with a co-signer is typically required to be 620.

Moreover, co-signers can help loan recipients build a positive financial history over time. Timely payments on a co-signed mortgage can enhance both the main applicant’s and the co-signer’s credit scores, establishing a stronger financial foundation for future lending. However, it’s essential for potential co-signers to recognize the risks involved, as missed payments can adversely affect their financial history and stability.

Before entering a financial agreement, discussing exit strategies is crucial to ensure clear communication between the main party and the co-signer. In summary, co-signers not only strengthen mortgage applications but also play an integral role in shaping the financial landscape for homebuyers. They are truly an invaluable asset on the journey toward homeownership, and we’re here to support you every step of the way.

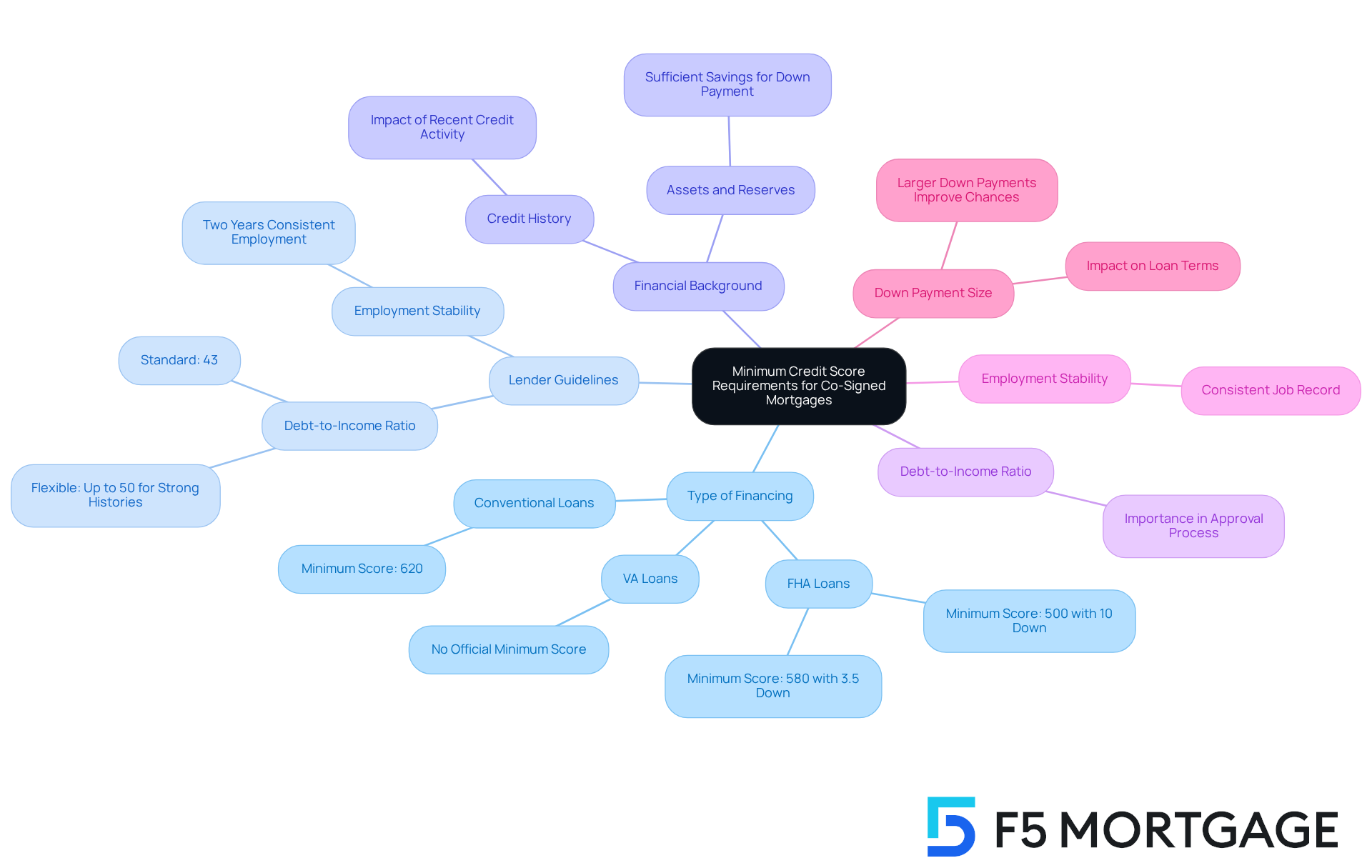

Detail Factors Influencing Minimum Credit Score Requirements

Navigating the world of co-signed mortgages can feel overwhelming, but understanding the minimum credit score for mortgage with co-signer can help ease your concerns. Various important elements come into play, such as the type of financing, lender guidelines, and the financial backgrounds of both the main applicant and the co-signer. For example, FHA mortgages often have more flexible rating criteria compared to traditional mortgages, allowing scores as low as 500 with a larger down payment of at least 10%.

It’s essential to consider the debt-to-income (DTI) ratio, which typically should not exceed 43% for standard financing. However, some lenders may allow up to 50% for individuals with strong financial histories. Employment stability and the size of your down payment are additional factors that can enhance your eligibility. If you have a solid financial profile, characterized by steady income and manageable debt levels, you may find that a lower rating can be offset, enabling you to secure more favorable borrowing conditions.

This comprehensive approach to evaluating creditworthiness emphasizes the importance of understanding lender policies, particularly the minimum credit score for mortgage with co-signer, and their implications for mortgage approval. We know how challenging this can be, but being informed empowers you to make better decisions. Moreover, for Colorado residents, there are various refinancing options available, including conventional loans, FHA loans, and VA loans. Each of these comes with distinct DTI requirements and benefits that can assist families in upgrading their homes. We’re here to support you every step of the way as you explore these opportunities.

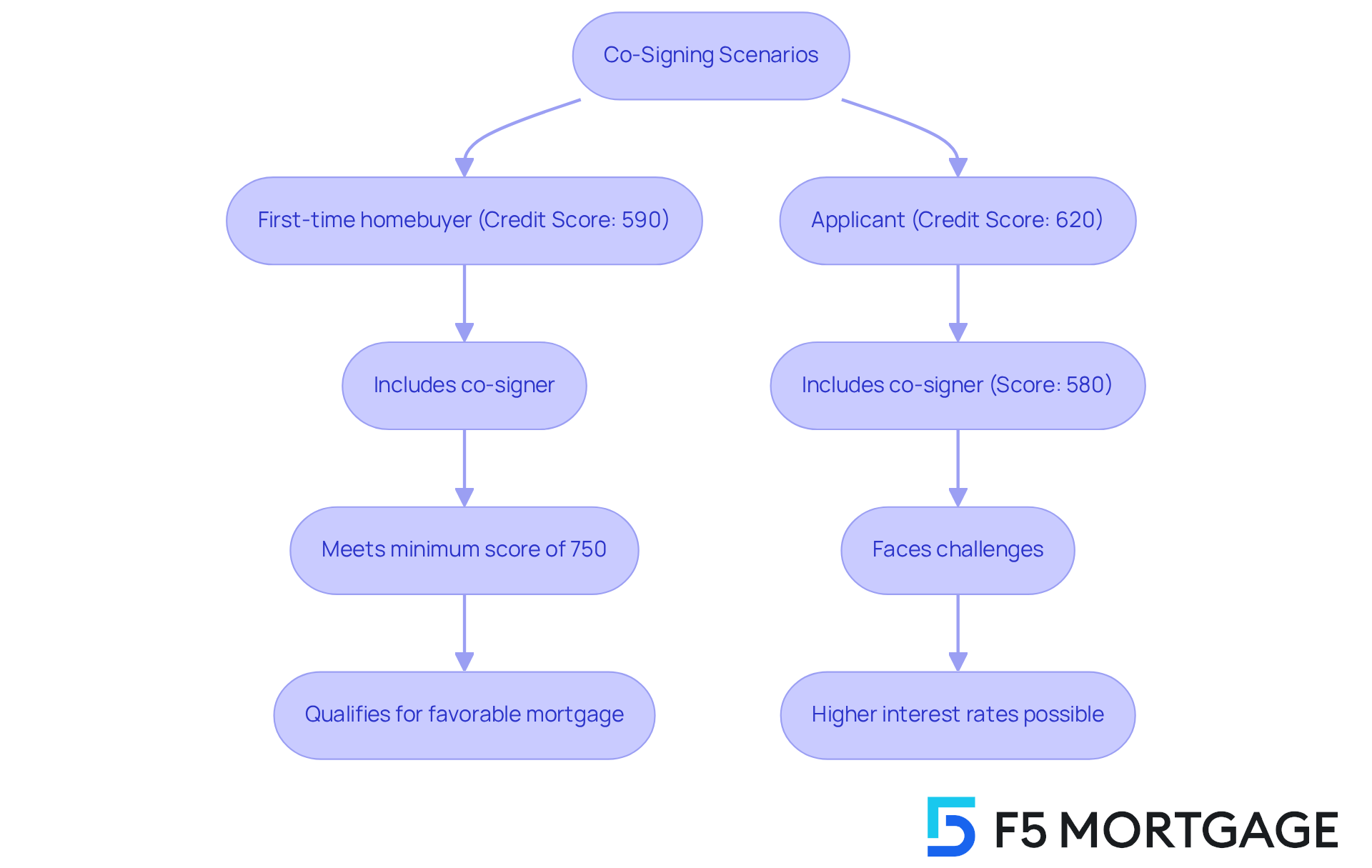

Provide Examples of Co-Signing Scenarios and Outcomes

Imagine the journey of a first-time homebuyer with a credit rating of 590, as they learn about the minimum credit score for mortgage with co-signer needed to purchase a home. By including a co-signer, the individual can meet the minimum credit score for mortgage with co-signer of 750, significantly enhancing their chances of approval. The lender may then offer a traditional mortgage with a more favorable interest rate, reflecting the co-signer’s strong financial history. With F5 Mortgage’s low down payment options, this hopeful buyer could qualify for a mortgage with as little as 3% down, making the dream of homeownership feel more attainable.

In contrast, consider another applicant with a credit rating of 620 applying for an FHA mortgage, accompanied by a co-signer who has a rating of 580. Although the co-signer meets the minimum credit score for mortgage with co-signer, the overall application may still face challenges due to the lower score. This could lead to higher interest rates or increased scrutiny from the lender.

These scenarios highlight the vital importance of the minimum credit score for mortgage with co-signer and the primary borrower’s credit profiles in the mortgage approval process. They illustrate how strategic co-signing can significantly influence loan outcomes. At F5 Mortgage, we understand how challenging this can be, and we’re here to support you every step of the way, ensuring that you explore all available options for a successful home-buying experience.

Conclusion

Understanding the minimum credit score for a mortgage with a co-signer is crucial for prospective homebuyers navigating the complexities of mortgage applications. We know how challenging this can be, but the role of a co-signer can significantly enhance your chances of approval, especially if your credit score is on the lower side. By grasping the requirements and implications of co-signing, you can make informed decisions that pave the way toward homeownership.

It’s important to note that the typical minimum credit score for standard financing is 620, while government-backed loans like FHA and VA may allow scores as low as 580. Factors such as your debt-to-income ratio, the size of your down payment, and the financial profiles of both you and your co-signer play crucial roles in determining eligibility. Real-world scenarios illustrate how strategic co-signing can improve loan outcomes, showcasing both the risks and benefits involved.

Ultimately, the journey to homeownership is multifaceted, and understanding the dynamics of co-signing is a vital step in this process. By being informed about the minimum credit score requirements and the potential advantages of including a co-signer, you can better position yourself for success in securing a mortgage. Embracing this knowledge empowers you to take control of your financial future and make confident decisions on your path to owning a home. We’re here to support you every step of the way.

Frequently Asked Questions

What is the minimum credit score required for a standard co-signed mortgage?

For standard financing, lenders typically require a minimum credit score of 620.

Are there lower credit score requirements for government-supported mortgage options?

Yes, government-supported options like FHA and VA programs can have minimum eligibility ratings as low as 580.

Can applicants with credit scores below the minimum thresholds still qualify for a co-signed mortgage?

Yes, some lenders may consider applicants with ratings below the minimum thresholds if they can present compensating factors, such as a larger down payment or a strong financial profile.

What are the anticipated minimum credit score ratings for FHA and VA financing in 2025?

The average minimum rating for FHA financing is expected to remain at 580, while VA financing is anticipated to have a similar rating around 620.

How does a higher credit score impact the chances of acceptance for a co-signed mortgage?

A higher credit score not only enhances the chances of acceptance but can also lead to more favorable terms for the mortgage.