Overview

Understanding average home equity loan rates is essential for homeowners considering borrowing against their property equity. We know how challenging financial decisions can be, and it’s important to grasp these rates along with factors like credit scores and market conditions. By doing so, you can secure favorable borrowing terms that align with your needs.

However, it’s crucial to remain aware of the risks involved, such as foreclosure and the potential for over-borrowing. We’re here to support you every step of the way as you navigate these decisions, ensuring you make informed choices that protect your family’s financial future.

Introduction

Home equity loans can be a valuable resource for homeowners, offering a way to access the equity in their properties for various needs, such as renovations or debt consolidation. We understand how significant this decision can be, especially with average home equity loan rates that change based on economic conditions. It’s essential to grasp these rates and their implications, as this knowledge empowers you to make informed borrowing choices.

As you navigate this landscape, it’s natural to have questions about the potential risks involved. Concerns like over-borrowing or the impact of fluctuating interest rates on your financial future are valid. We know how challenging this can be, and we’re here to support you every step of the way as you explore your options.

Define Home Equity Loans and Their Functionality

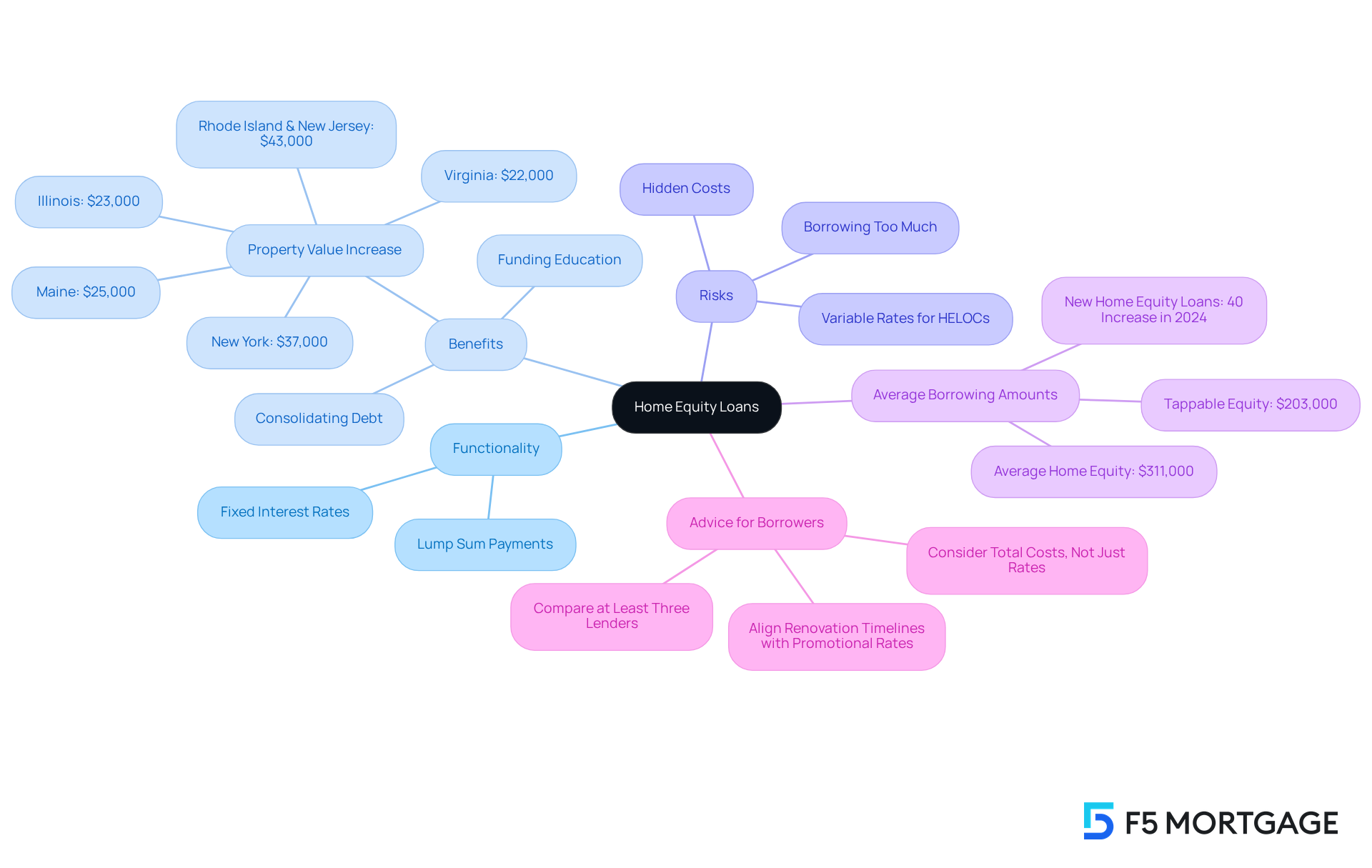

Home equity financing options offer homeowners a way to access the equity they’ve built in their properties, considering the average home equity loan rates. Equity is simply the difference between your home’s current market value and the outstanding mortgage balance. These financial tools work similarly to traditional loans, providing a lump sum that you repay over time at a fixed interest rate. Many families find them useful for significant expenses, like renovations, consolidating debt, or covering educational costs.

In 2025, the average amount borrowed through home financing has seen significant growth, reflecting rising property values across the country. More homeowners are tapping into their assets, often choosing to borrow funds to finance renovations that enhance their property’s value and appeal. For instance, families in Rhode Island and New Jersey have reported value increases of $43,000. Meanwhile, homeowners in New York have seen increases of $37,000, and those in Maine, Illinois, and Virginia have experienced gains of $25,000, $23,000, and $22,000, respectively. These figures highlight the potential financial benefits of homeownership.

Key features of home financing loans include predictable monthly payments and fixed interest rates, which provide stability for borrowers compared to average home equity loan rates. However, it’s essential to understand the implications of borrowing against your equity. We understand how challenging this can be, which is why financial consultants suggest comparing offers from various lenders to secure the best average home equity loan rates. It’s wise to speak with at least three lenders to find the best terms, as differences can significantly impact your overall borrowing costs. For example, some lenders may offer promotional rates as low as 5.99% for the initial months, which can be advantageous for those planning immediate upgrades.

While loans based on property value can be beneficial, it’s crucial to recognize the potential risks, such as borrowing too much or the differences between fixed and variable rates for Home Value Lines of Credit (HELOCs). Real-life examples show how homeowners have successfully utilized these financial products to fund important renovations, consolidate high-interest debts, or manage educational expenses, effectively leveraging their property value. As homeowners continue to build wealth through their assets, understanding the purpose and benefits of residential financing becomes increasingly important. We’re here to support you every step of the way as you navigate these options.

Explore Factors Influencing Home Equity Loan Rates

Several key factors can significantly influence average home equity loan rates, and understanding them can empower you in your borrowing journey.

-

Credit Score: We know how challenging it can be to manage your credit score, but remember that a higher score typically results in lower interest rates. This signals to lenders that you pose less risk. For instance, borrowers with strong credit histories may qualify for promotional offers that are significantly lower than typical charges. To improve your credit score, consider addressing outstanding debts and correcting any errors on your credit report.

-

Combined Loan-to-Value Ratio (CLTV): This ratio compares the total loan amount to the appraised value of your home. Generally, a lower CLTV can lead to better terms, as it indicates more equity in your property. Many lenders offer their most favorable terms to borrowers with CLTVs below 80%, which can be a great advantage.

Market conditions, particularly economic factors such as inflation and average home equity loan rates set by the Federal Reserve, play a crucial role in determining your borrowing costs. For example, home equity financing costs are closely tied to bond market yields, which can fluctuate based on broader economic circumstances. Experts suggest that prices may remain steady following the Fed’s recent meetings, but it’s wise to stay informed about market trends.

- Borrowing Amount and Duration: The amount you borrow and the duration of the loan can also affect costs. Larger amounts may attract different pricing approaches; some lenders offer better terms for larger sums, while others might impose premium charges for exceptionally high amounts. Additionally, shorter-duration loans often come with lower costs due to reduced risk for lenders.

By comprehending these elements, you can negotiate better conditions and prepare for potential variations in your borrowing costs. Actively enhancing your financial profile, timing your applications with favorable economic conditions, and comparing offers from various lenders can help you secure more favorable borrowing terms. We’re here to support you every step of the way in this process.

Analyze Current Trends in Home Equity Loan Rates

As we approach mid-2025, many families are feeling the impact of significant variations in residential financing costs, influenced by a range of economic factors. Recent data indicates a gradual rise in prices, largely driven by the Federal Reserve’s adjustments to interest rates aimed at managing inflation. For instance, the typical rate for a 10-year property financing is currently at 8.42%, while the 15-year rate stands at 8.35%, and the 5-year rate is at 8.26%. These fluctuations highlight the importance for homeowners to stay informed, as costs can differ greatly among lenders and can change over time.

We understand that many property owners are looking to tap into their asset value for various reasons, such as renovations or debt consolidation. This trend is particularly evident as homeowners respond to the evolving financial landscape. For example, some are opting for property value borrowing rather than cash-out refinancing, allowing them to maintain their favorable current mortgage terms.

Looking ahead, economists predict that residential financing costs may continue to fluctuate throughout 2025, with potential decreases anticipated as the Federal Reserve considers further interest rate cuts. Debra Shultz, a Vice President of Lending, shares her insights, noting, “it’s very likely that your rate will drop by 0.25% once or twice in 2025 and hopefully more in 2026.” This perspective underscores the ever-changing nature of the market, making it essential for borrowers to consult mortgage experts to navigate these changes effectively and make informed decisions about their property financing.

It’s also important to recognize that Black and Hispanic property owners often face significant challenges in securing financing against their properties, which can complicate their financial decisions. We know how challenging this can be, and we’re here to support you every step of the way as you explore your options.

Evaluate Advantages and Disadvantages of Home Equity Loans

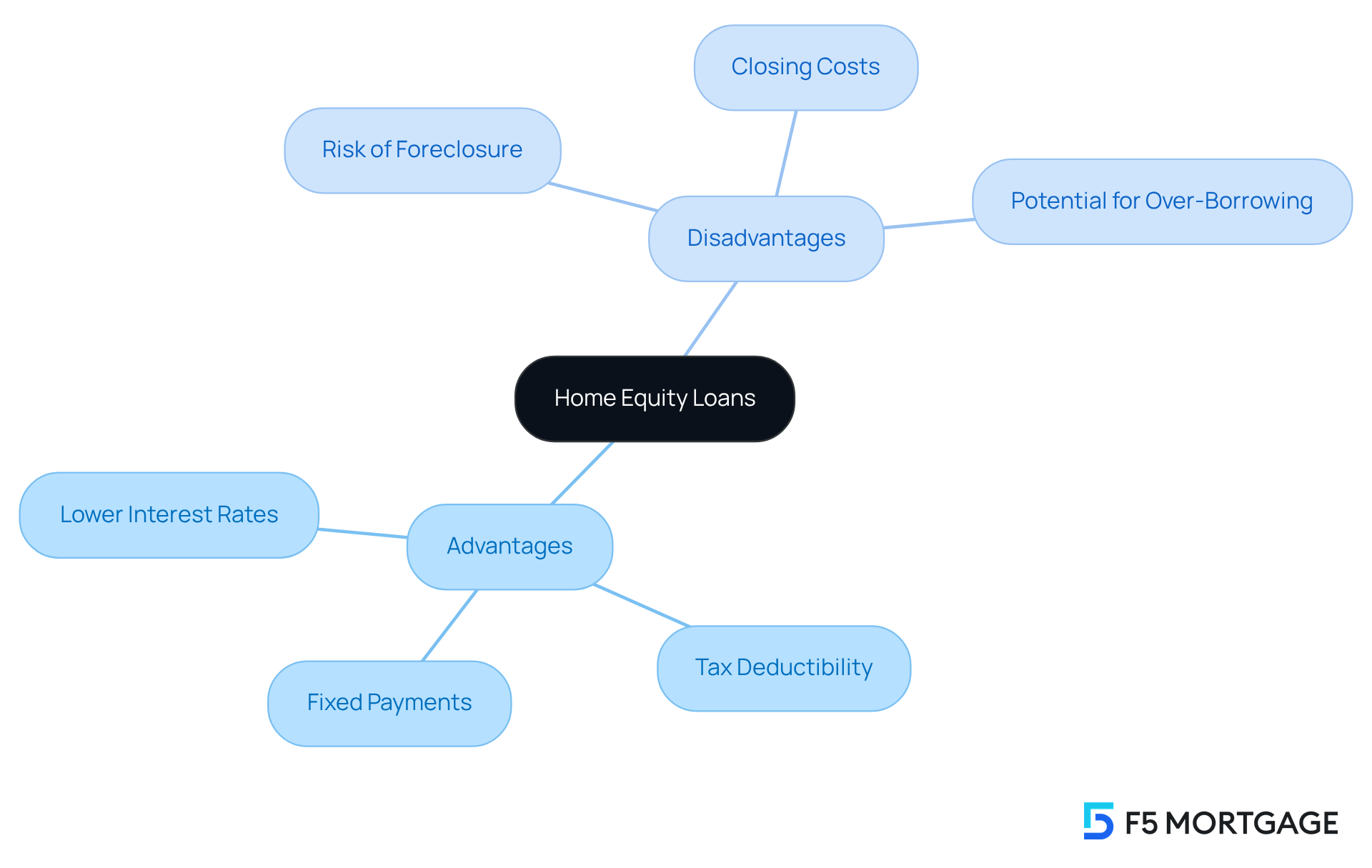

Home equity loans can be a valuable option for homeowners, yet they come with both advantages and disadvantages that deserve careful consideration.

Advantages:

- Lower Interest Rates: We understand that managing finances can be challenging. Home equity loans often provide lower interest rates compared to credit cards or personal loans, especially when looking at average home equity loan rates, making them a more affordable borrowing choice. Currently, the average mortgage rate of 8.44% is significantly lower than the record average home equity loan rates of 23% for credit cards.

- Tax Deductibility: Another benefit is that the interest on equity borrowing may be tax-deductible, especially when the funds are used for major property improvements. This can provide some financial relief during tax season, which many families appreciate.

- Fixed Payments: Additionally, borrowers enjoy the predictability of fixed monthly payments throughout the loan term, simplifying budgeting and financial planning.

Disadvantages:

- Risk of Foreclosure: However, it’s essential to recognize the risks involved. Since these loans are secured by your home, failing to make repayments could lead to foreclosure, putting your financial stability at risk.

- Closing Costs: Moreover, financing your home’s value often incurs significant closing costs, which can range from 1% of the borrowed amount to several thousand dollars. This adds to the overall expense of borrowing, something to keep in mind.

- Potential for Over-Borrowing: Lastly, homeowners might feel tempted to borrow more than necessary, which can lead to financial strain. We recommend calculating your exact needs beforehand to avoid any potential overextension.

Financial consultants emphasize that while home equity loans can be beneficial, it’s important to carefully weigh the risks associated with average home equity loan rates. For instance, a significant drop in real estate market value can lead to unfavorable financial situations. Therefore, it’s crucial to understand local market dynamics before making a decision. Currently, the average homeowner has about $320,000 in asset value, which can be tempting to access, but thoughtful evaluation is vital to prevent financial overreach.

In conclusion, assessing these factors is crucial for homeowners considering a home equity loan. By doing so, you can ensure that your decision aligns with your long-term financial goals, and remember, we’re here to support you every step of the way.

Conclusion

Home equity loans can be a powerful financial tool for homeowners, enabling them to tap into the equity in their properties for various needs. We understand how important it is to grasp the dynamics of average home equity loan rates and the broader implications of borrowing against home value. As many homeowners look to leverage their assets for renovations, debt consolidation, or educational expenses, recognizing both the advantages and risks associated with these loans is crucial.

In this article, we’ve explored key insights, including the definition of home equity loans and the factors influencing average home equity loan rates. We’ve placed emphasis on the importance of:

- Credit scores

- Combined loan-to-value ratios

- Market conditions

All of which significantly impact favorable loan terms. While the advantages, such as lower interest rates and fixed payments, are appealing, it’s essential to remain aware of potential drawbacks, including the risk of foreclosure and the temptation to over-borrow.

Given the fluctuating economic landscape and evolving trends in home equity loan rates, staying informed and proactive is vital. We encourage you to:

- Evaluate your personal financial situation

- Consult with mortgage experts

- Compare offers from multiple lenders

By approaching home equity loans with careful consideration and a strategic mindset, you can navigate your financial journey effectively and make choices that align with your long-term goals. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What are home equity loans and how do they function?

Home equity loans allow homeowners to access the equity built in their properties, which is the difference between the home’s current market value and the outstanding mortgage balance. They function similarly to traditional loans, providing a lump sum that is repaid over time at a fixed interest rate.

What are common uses for home equity loans?

Home equity loans are commonly used for significant expenses such as home renovations, debt consolidation, or covering educational costs.

How has the average amount borrowed through home equity financing changed in 2025?

In 2025, the average amount borrowed through home equity financing has significantly increased, reflecting rising property values across the country.

What financial benefits have homeowners experienced in certain states?

Homeowners in states like Rhode Island and New Jersey have reported increases in property value of $43,000, while those in New York have seen increases of $37,000. Homeowners in Maine, Illinois, and Virginia have experienced gains of $25,000, $23,000, and $22,000, respectively.

What are the key features of home equity loans?

Key features of home equity loans include predictable monthly payments and fixed interest rates, which provide stability compared to average home equity loan rates.

What should homeowners consider before borrowing against their equity?

Homeowners should understand the implications of borrowing against their equity, including the risks of borrowing too much and the differences between fixed and variable rates for Home Value Lines of Credit (HELOCs).

How can homeowners find the best home equity loan rates?

It is advisable for homeowners to compare offers from various lenders to secure the best average home equity loan rates. Speaking with at least three lenders can help find the best terms, as differences can significantly impact overall borrowing costs.

What are some real-life examples of how homeowners have used home equity loans?

Homeowners have successfully used home equity loans to fund important renovations, consolidate high-interest debts, or manage educational expenses, effectively leveraging their property value.