Overview

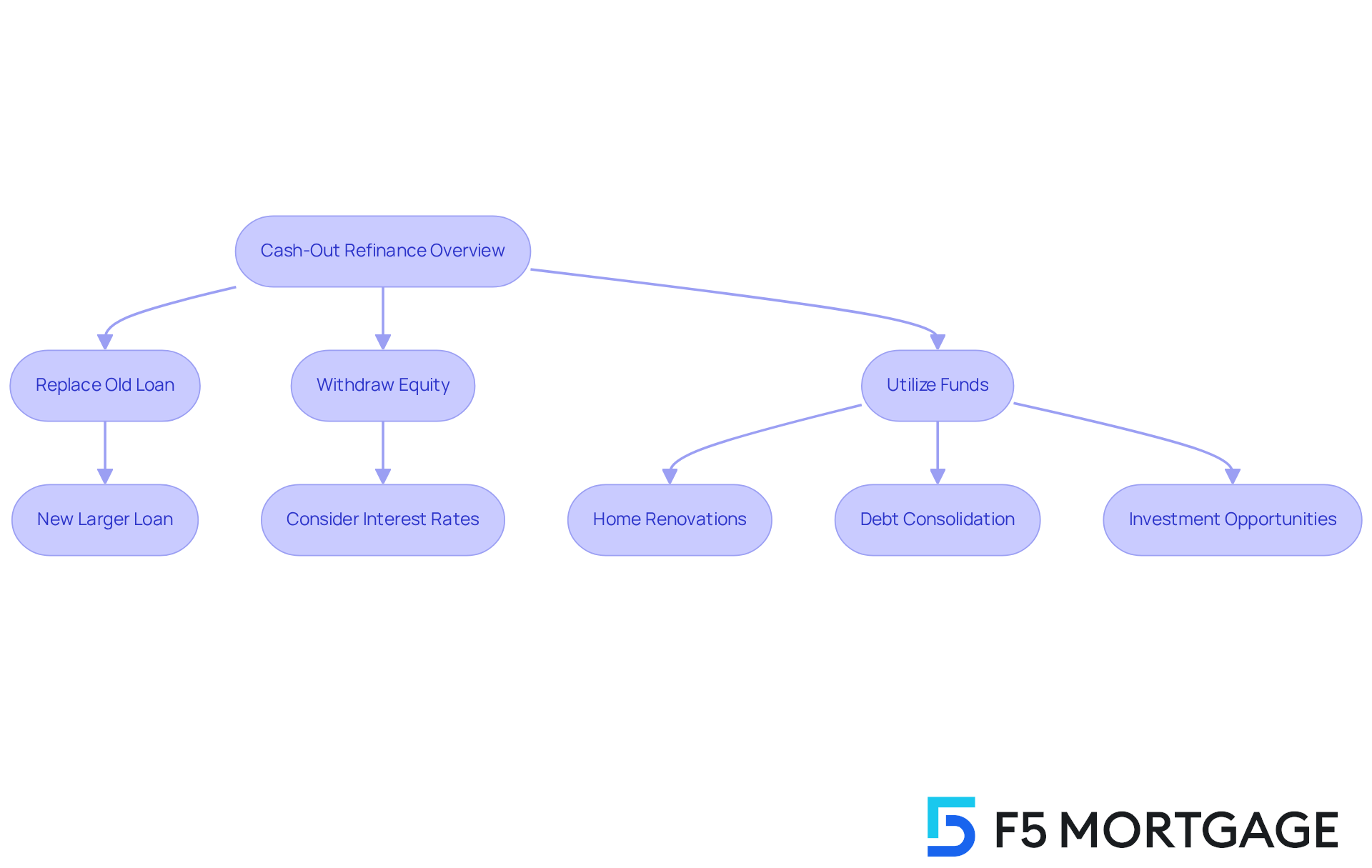

Cash-out refinancing for investment properties can be a valuable opportunity for homeowners. It allows you to replace your existing loans with larger ones, providing access to the equity in your home. This equity can be used for important purposes, such as renovations or consolidating debt.

We understand that navigating this process can be overwhelming, which is why it’s crucial to be informed. The article highlights the steps involved, the eligibility criteria, and the potential risks. By understanding market conditions and managing increased debt, you can make informed financial decisions that align with your goals.

Remember, you are not alone in this journey. We’re here to support you every step of the way, helping you to explore your options and make choices that benefit your family’s future.

Introduction

Navigating the world of cash-out refinancing can truly be a game-changer for property owners eager to leverage their investment. We understand how important it is to tap into your home equity, whether for renovations or debt consolidation, as this strategy also offers a chance to enhance your property’s value.

Yet, we know that with rising interest rates and potential risks—like increased debt and foreclosure—many may wonder: is cash-out refinancing the right choice in today’s fluctuating market?

Understanding the intricacies of this process is essential, and we’re here to support you every step of the way in making informed decisions that can significantly impact your financial future.

Understand Cash-Out Refinance Basics

Cash out refinance investment property can be a valuable financial decision for property owners facing various challenges. This process allows you to replace your current loan with a new, larger one. The cash difference between the old and new loan amounts is disbursed to you, which can be utilized for important purposes, such as home renovations, debt consolidation, or investment opportunities. Essentially, this involves securing a new mortgage that pays off your existing one, effectively leveraging your home equity.

We understand that equity withdrawal is often preferred for its flexibility, enabling you to access funds for significant projects or investments. However, it’s crucial to recognize that equity refinancing typically comes with higher interest rates compared to traditional refinancing options. This reflects the increased risk that lenders assume, and it’s something to consider as you make your decision.

In the second quarter of 2025, equity refinances accounted for nearly 60% of all home loan refinances. On average, homeowners withdrew around $94,000 in equity, which led to an increase of about $590 in their monthly payments. This trend highlights the growing reliance on home equity as a financial resource, and we know how challenging it can be to navigate these choices.

For instance, consider Mr. A, a senior executive who successfully utilized equity withdrawal to secure £2.4 million for a renovation project on his UK property valued at £4 million. This strategic move not only provided him with the necessary funds but also allowed him to maintain predictable monthly payments through a structured two-year fixed-rate, interest-only mortgage. His experience illustrates how equity extraction can be a powerful tool when managed wisely.

Overall, utilizing a cash out refinance investment property offers significant advantages for property owners like you, including the ability to finance substantial investments while potentially increasing property value. As you explore your financial options, understanding the mechanics and consequences of refinancing can empower you to make informed decisions. Remember, we’re here to support you every step of the way.

Identify Eligibility Criteria for Cash-Out Refinance

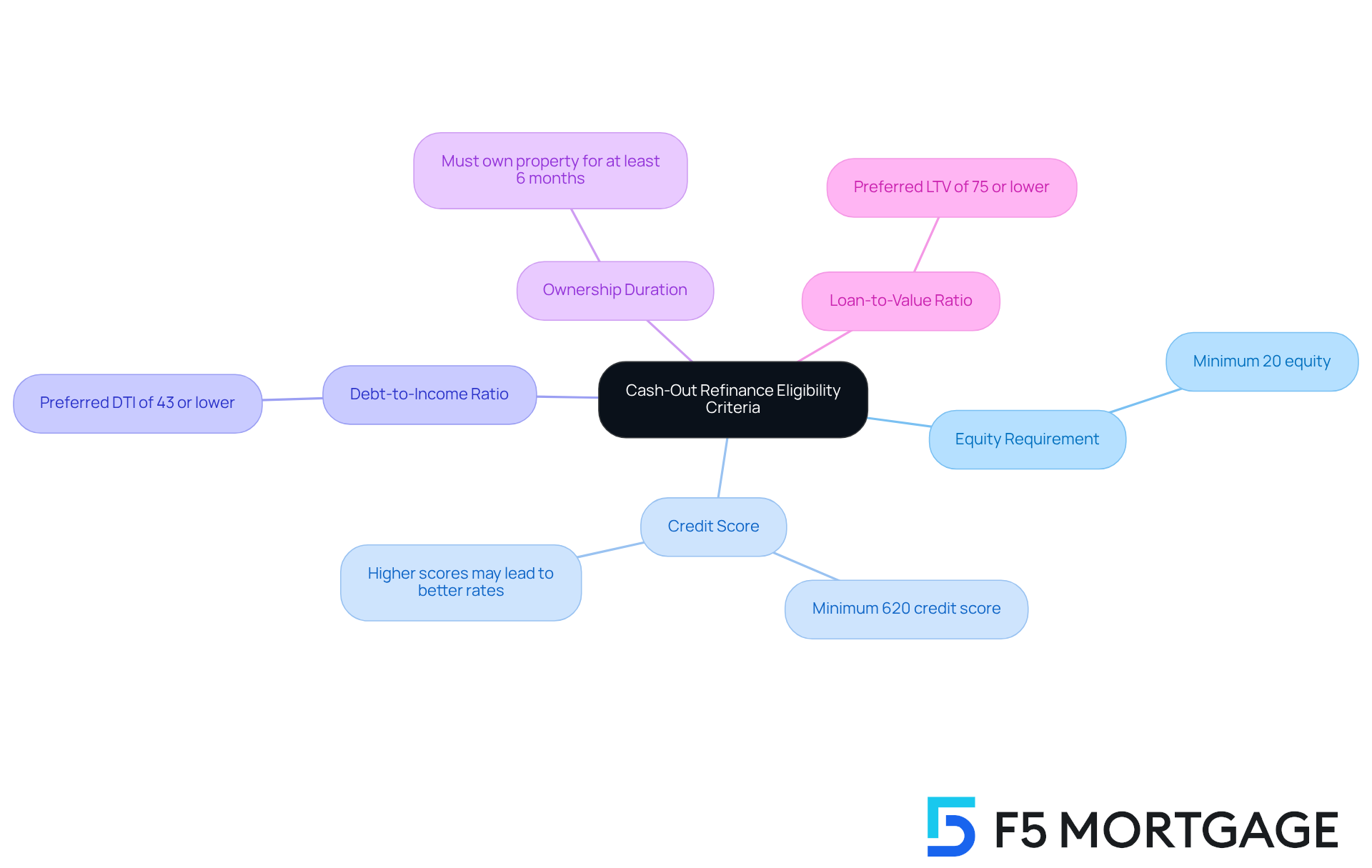

Navigating the world of cash out refinance investment property can feel overwhelming, but understanding the essential criteria can help ease your concerns. Here’s what you need to know:

-

Equity Requirement: Most lenders ask for at least 20% equity in your home after the refinance. This means you should have made significant progress on your mortgage, allowing you to tap into your equity effectively.

-

Credit Score: A minimum credit score of 620 is generally required. However, if your score is higher, you may enjoy more favorable interest rates, reflecting the lender’s assessment of risk.

-

Debt-to-Income Ratio: Lenders typically prefer a debt-to-income (DTI) ratio of 43% or lower. This ensures that you can comfortably manage your new mortgage payments alongside your existing debts, promoting financial stability.

-

Ownership Duration: To qualify, you must have owned your property for at least six months. This period allows time for your equity to grow, which is crucial for refinancing.

-

Loan-to-Value Ratio (LTV): Most lenders favor an LTV ratio of 75% or lower. This means your new loan should not exceed 75% of your home’s appraised value, protecting the lender’s investment.

As you prepare for this journey, remember that documentation is key. Be ready to provide financial documents like tax returns, pay stubs, and bank statements to verify your income and assets. This thorough documentation is essential for a smooth approval process.

Looking ahead to mid-2025, it’s noteworthy that equity withdrawal activity has surged, reaching a nearly three-year high. This indicates that many homeowners are opting for a cash out refinance investment property to leverage their home equity, even in the face of higher mortgage rates. Understanding these requirements and preparing adequately can empower you to navigate the refinancing landscape confidently. We know how challenging this can be, and we’re here to support you every step of the way.

Follow the Step-by-Step Cash-Out Refinance Process

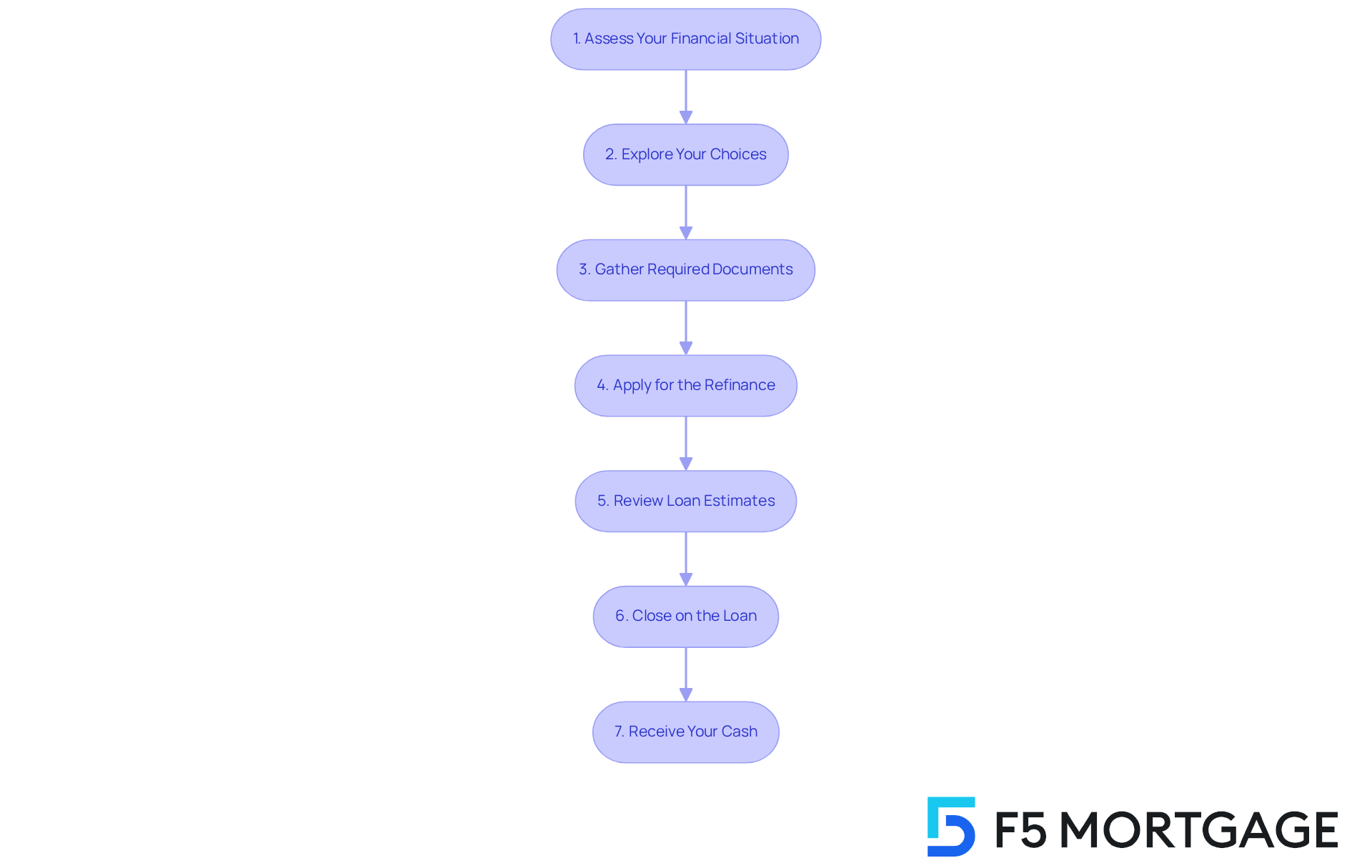

Navigating the cash-out refinance process can feel overwhelming, but we’re here to support you every step of the way. Let’s break it down into manageable steps:

-

Assess Your Financial Situation: Start by reviewing your current mortgage and equity. Clarify your financial goals. Consider how much cash you need and how you plan to use it. We know how challenging this can be, and taking this first step will help you feel more in control.

-

Explore Your Choices: While restructuring with your current lender is an option, exploring several lenders can help you discover the most favorable rates and conditions. Look for lenders who specialize in cash out refinance investment property, as they can better meet your needs.

-

Gather Required Documents: Prepare the necessary documentation, such as proof of income, tax returns, bank statements, and mortgage details. Having these ready will streamline the application process, making it less stressful.

-

Apply for the Refinance: Once you’ve selected a lender, submit your application. Be prepared for a credit check and an appraisal of your property. This is an important step, and being organized can make it easier.

-

Review Loan Estimates: After processing your application, you will receive loan estimates. Take the time to review these carefully to understand the terms, fees, and interest rates. This ensures you make informed decisions.

-

Close on the Loan: If you agree to the terms, you’ll proceed to closing. This involves signing the new mortgage documents related to the cash out refinance investment property and paying any closing costs. At F5 Mortgage, we aim to make this process stress-free by leveraging user-friendly technology to simplify each step.

-

Receive Your Cash: After closing, the lender will disburse the cash from the refinance, which you can use as planned. This is the moment you’ve been waiting for.

Tips for a Smooth Process:

- Stay organized and keep all documents readily available.

- Communicate openly with your lender about any questions or concerns.

In 2025, the average duration to finalize a refinance is about three weeks, making it a fairly fast choice for obtaining funds. However, it’s essential to evaluate your monetary situation thoroughly before proceeding, especially considering the recent decline in refinance applications, which dropped by 35.1 percent week over week as of late September. This trend underscores the importance of making informed decisions in a fluctuating market. Remember, F5 Mortgage is here to help you navigate these challenges effectively.

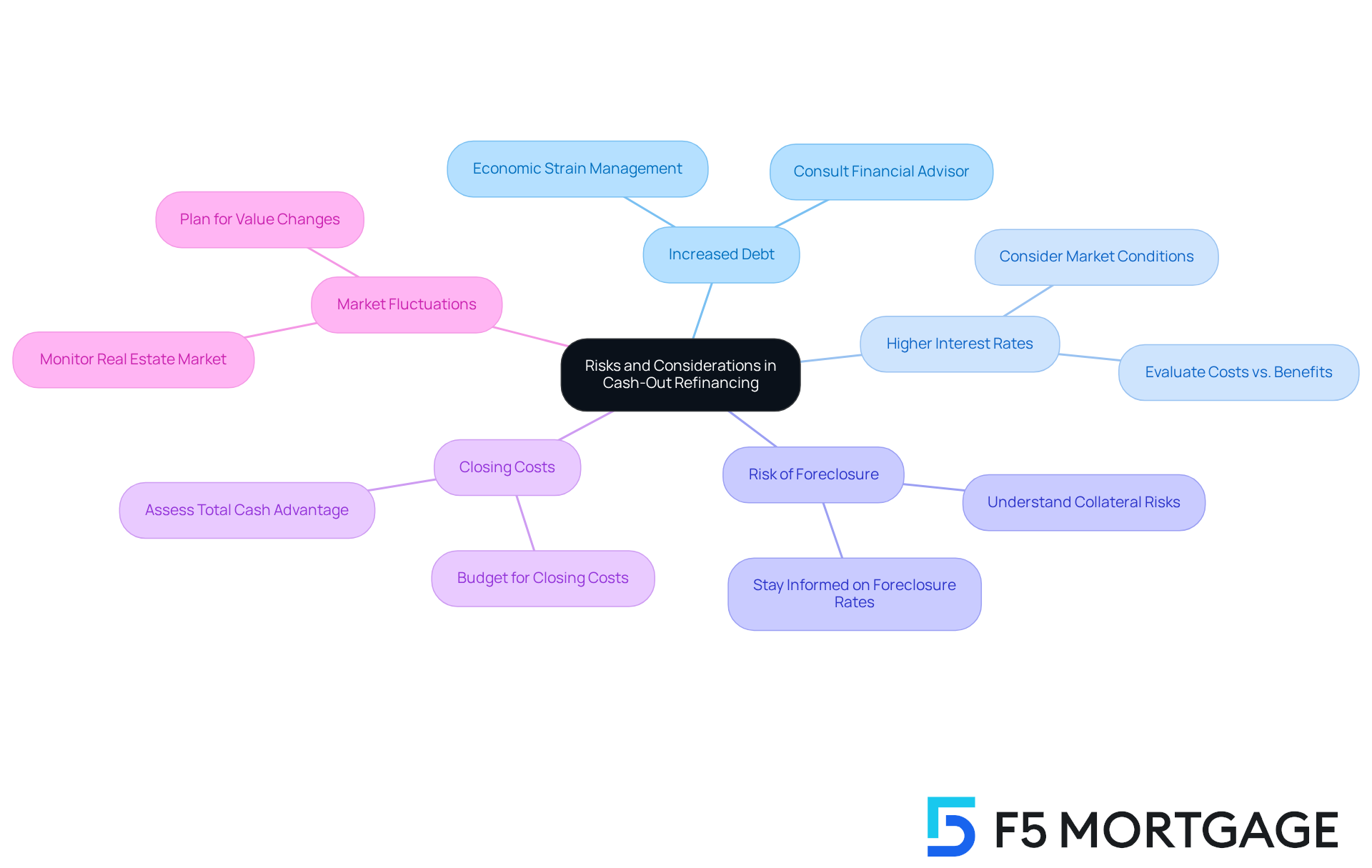

Recognize Risks and Considerations in Cash-Out Refinancing

While cash-out refinancing can offer significant benefits, it’s essential to recognize the risks that homeowners should thoughtfully consider:

-

Increased Debt: By obtaining a larger loan, you are raising your overall debt, which can lead to economic strain if not managed properly. We know how challenging this can be, especially during significant life changes. Financial experts emphasize that managing increased debt is crucial.

-

Higher interest rates are typically associated with a cash out refinance investment property, which can increase your monthly payments compared to traditional refinances. It’s important to evaluate whether the benefits outweigh the costs, particularly in light of current market conditions.

-

Risk of Foreclosure: Since your home serves as collateral, failing to make payments could result in foreclosure, putting your home at risk. Recent statistics show that foreclosure rates associated with cash out refinance investment property loans have been a growing concern in 2025, making it essential to stay informed.

-

Closing Costs: Cash-out loan modifications often involve closing costs that can accumulate, diminishing the total cash advantage you receive. Homeowners should consider these costs in their budgeting to avoid unexpected expenses.

-

Market Fluctuations: Changes in the real estate market can affect your home’s value, potentially impacting your equity and future refinancing options. A decrease in property value may complicate your monetary situation, emphasizing the need for careful planning.

To navigate these challenges, consider these mitigation strategies:

- Carefully assess your financial situation and ensure you can afford the new payments. Consulting with a monetary advisor can provide insights into managing your debt effectively.

- Think about obtaining advice from a certified money planner, particularly if your monetary situation has changed considerably. As investing author Alana Benson points out, significant life events can have major monetary implications, and proactive planning can assist in creating a stable economic future.

- Utilize resources to verify the credentials of any monetary advisor you consult, ensuring you receive sound advice tailored to your needs.

Understanding these risks is vital for homeowners considering a cash out refinance investment property, as it can significantly impact their financial future. We’re here to support you every step of the way.

Conclusion

Mastering the cash-out refinance process for investment properties can truly unlock significant financial opportunities for property owners. By leveraging home equity, you can access funds for various purposes, from renovations to consolidating debt. We understand how important it is to grasp the intricacies of this financial tool, as it empowers you to make informed decisions that align with your personal financial goals.

Throughout this article, we have explored key aspects of cash-out refinancing, including:

- The basic mechanics

- Eligibility criteria

- Step-by-step processes

- Potential risks involved

The recent surge in equity withdrawals, along with the importance of thorough documentation and financial assessment, highlights the growing reliance on home equity as a resource in today’s market. Moreover, real-life examples, such as Mr. A’s successful renovation funding, illustrate how strategic equity management can lead to substantial benefits.

As you consider cash-out refinancing, it’s crucial to weigh the advantages against the associated risks. Engaging with financial advisors and conducting thorough research can enhance your understanding and promote better decision-making. Remember, embracing this financial strategy thoughtfully can empower you to optimize your investment properties, ultimately leading to greater financial security and growth. We’re here to support you every step of the way.

Frequently Asked Questions

What is a cash-out refinance investment property?

A cash-out refinance investment property allows property owners to replace their current loan with a new, larger one. The cash difference between the old and new loan amounts is disbursed to the owner, which can be used for purposes such as home renovations, debt consolidation, or investment opportunities.

Why might someone choose to do a cash-out refinance instead of traditional refinancing?

Equity withdrawal through cash-out refinance is often preferred for its flexibility, enabling access to funds for significant projects or investments. It allows homeowners to leverage their home equity for financial needs.

What are the potential downsides of cash-out refinancing?

Cash-out refinancing typically comes with higher interest rates compared to traditional refinancing options. This reflects the increased risk that lenders assume, which is an important consideration for borrowers.

How common is cash-out refinancing among homeowners?

In the second quarter of 2025, equity refinances accounted for nearly 60% of all home loan refinances, indicating a growing reliance on home equity as a financial resource.

What is the average amount of equity withdrawn by homeowners during cash-out refinancing?

On average, homeowners withdrew around $94,000 in equity during cash-out refinancing, which led to an increase of about $590 in their monthly payments.

Can you provide an example of how cash-out refinancing can be beneficial?

An example is Mr. A, a senior executive who used equity withdrawal to secure £2.4 million for a renovation project on his UK property valued at £4 million. This allowed him to maintain predictable monthly payments through a structured two-year fixed-rate, interest-only mortgage.

What are the advantages of utilizing cash-out refinancing for property owners?

Cash-out refinancing offers significant advantages, including the ability to finance substantial investments and potentially increase property value, empowering property owners to make informed financial decisions.