Overview

Amortizing loans are structured debts designed to help you manage your finances effectively. They allow borrowers to repay both principal and interest through regular payments. This approach not only provides predictability in budgeting but also ensures that you can fully repay the loan by its end.

We understand how challenging financial planning can be, and that’s why this article emphasizes the importance of grasping amortization. It plays a crucial role in your decision-making process regarding refinancing and selecting the right loan type. By understanding these concepts, you can better manage your debt, ultimately leading to potential savings.

We’re here to support you every step of the way.

Introduction

Navigating the complexities of borrowing can be overwhelming, and understanding the intricacies of amortizing loans is crucial. We know how challenging this can be, but these loans offer a structured repayment plan that fosters financial predictability. They also play a significant role in long-term investment strategies, especially in real estate. Yet, many borrowers feel uncertain about how to manage these loans effectively and leverage their benefits.

What if mastering the art of amortization could unlock financial opportunities and enhance your ability to make informed decisions? We’re here to support you every step of the way.

Define Amortizing Loans and Their Importance

Debts that you can settle over time with consistent contributions are known as an amortizing loan. Each payment includes both the principal sum borrowed and the interest charged. This systematic repayment framework for an amortizing loan is essential for borrowers because it provides predictability in budgeting. It also ensures that your debt is fully settled by the end of its term.

We understand how challenging managing debt can be, especially for homebuyers and homeowners looking to refinance. Comprehending an amortizing loan is crucial, as it directly influences your financial planning and long-term investment in real estate. By grasping this concept, you empower yourself to make informed decisions that can lead to a more secure financial future. We’re here to support you every step of the way.

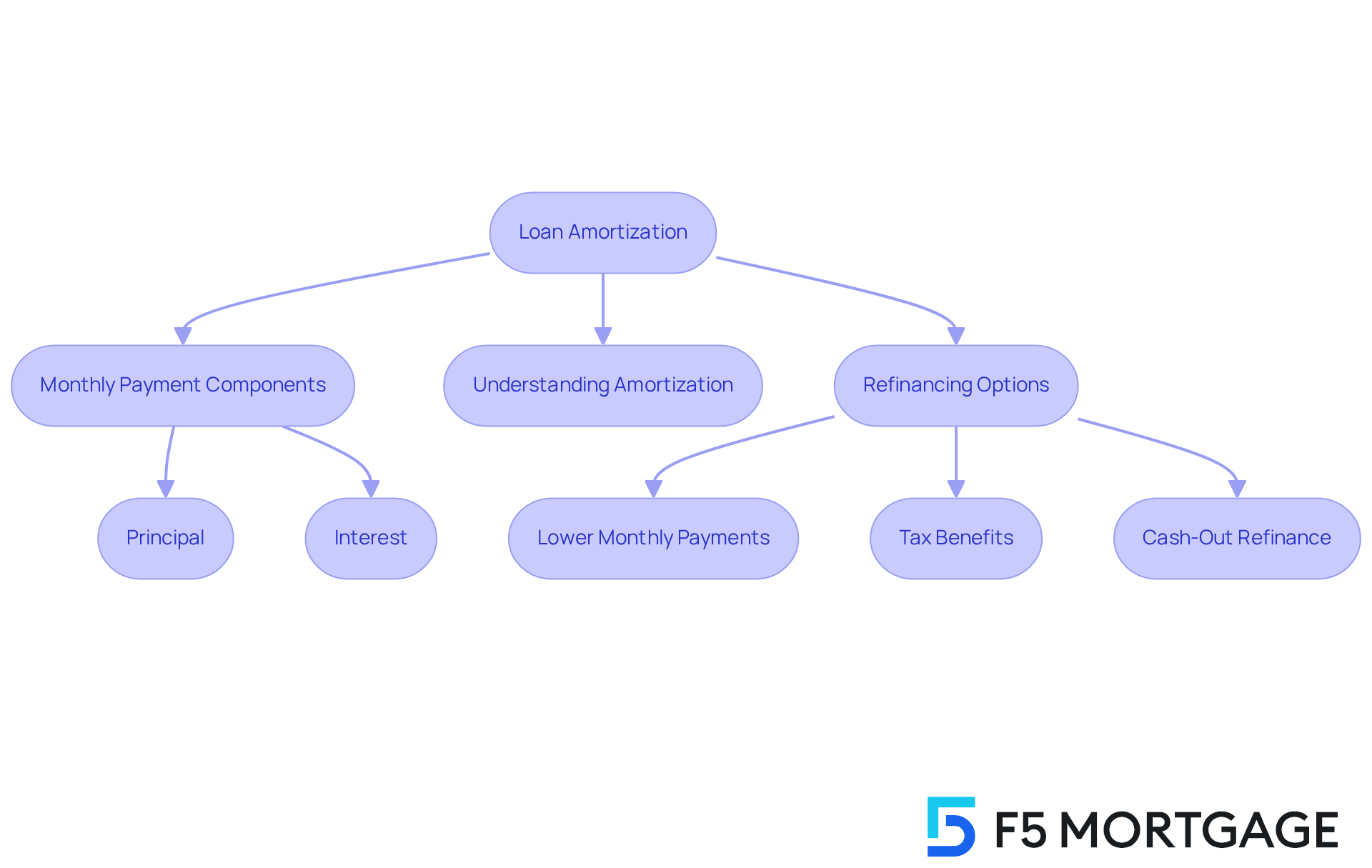

Explain How Loan Amortization Works

Debt amortization can feel overwhelming, but understanding it is essential for making informed financial decisions. It involves determining the monthly payment based on the amount borrowed, the interest rate, and the length of the loan. Each payment consists of two parts: the principal and the interest. In the early stages of borrowing, a larger portion of your payment goes toward interest. However, over time, more of your payment will be applied to the principal. This gradual shift is known as amortization.

Recognizing this process helps you see how your contributions affect your loan balance and the total cost over time. For homeowners in Colorado considering refinancing, it’s important to know that a lower interest rate can significantly reduce your monthly payments and the total interest paid throughout the loan term. Additionally, refinancing may offer potential tax benefits, which can help you maximize your financial advantages.

By refinancing, you could lower your monthly expenses, making it easier to manage your household budget, especially in a time when property taxes and insurance costs are on the rise. Recent trends show that Colorado’s housing market has experienced a 3.4% increase year over year, highlighting the importance of exploring refinancing options.

Furthermore, refinancing can provide access to cash through a cash-out refinance, allowing you to tap into your home equity for improvements or unexpected expenses. Understanding the amortizing loan, along with the benefits of refinancing, empowers families to make informed decisions about their mortgage options. We know how challenging this can be, and we’re here to support you every step of the way.

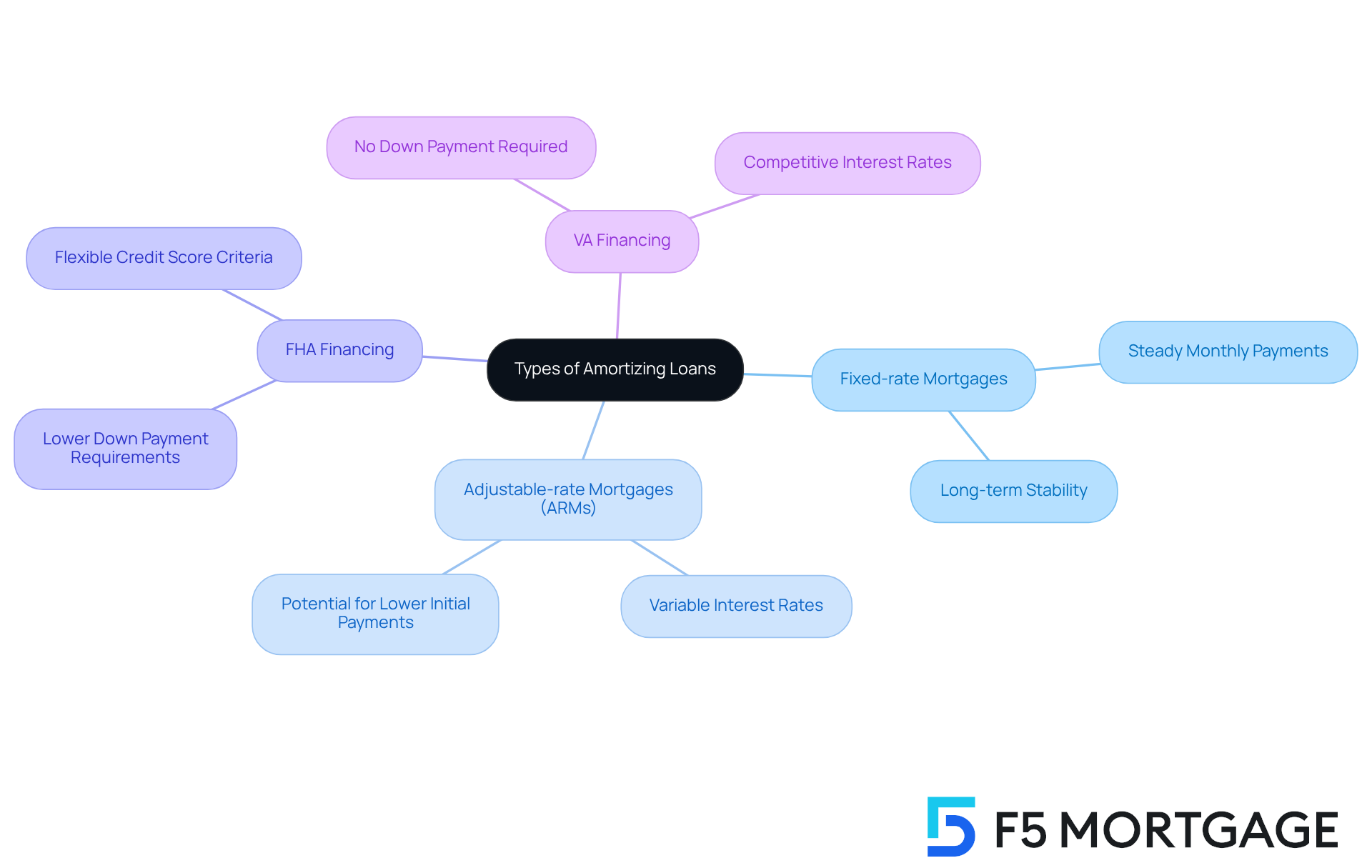

Explore Types of Amortizing Loans

Navigating the world of mortgages can feel overwhelming, and we understand how challenging this can be. There are several types of amortizing loan products available to you, including:

- Fixed-rate mortgages

- Adjustable-rate mortgages (ARMs)

- FHA financing

- VA financing

Fixed-rate mortgages are a popular choice because they maintain a steady cost throughout the borrowing period, offering you consistency in your monthly expenses. On the other hand, ARMs come with interest rates that may change periodically, depending on market conditions, which can create uncertainty.

For those who qualify, FHA and VA financing are excellent government-supported options that often feature reduced down payment requirements and favorable terms. Understanding these types of mortgages is essential as it empowers you to select the best option for your financial goals. Remember, we’re here to support you every step of the way in making this important decision.

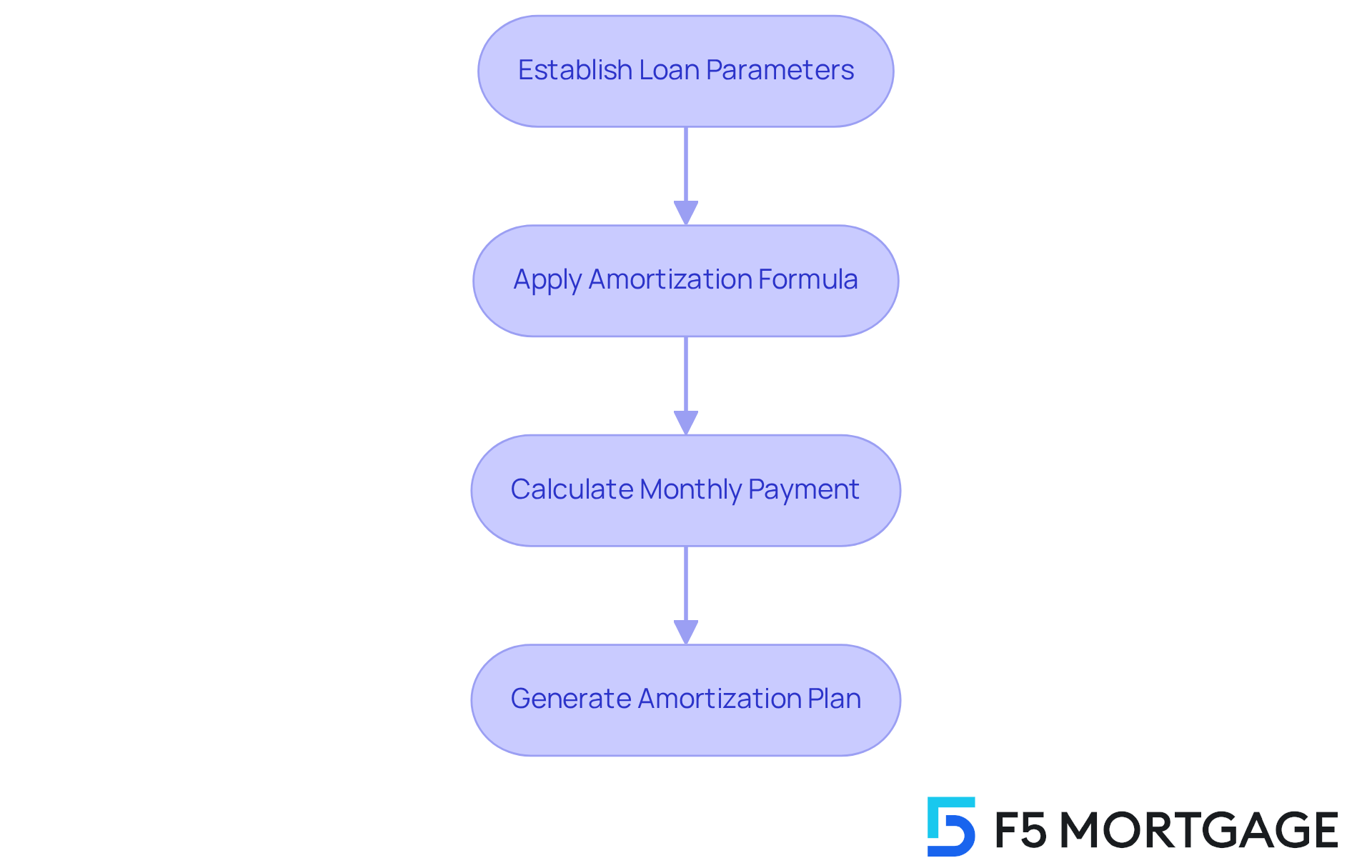

Guide to Calculating Loan Amortization

Understanding how to calculate repayment amortization can feel overwhelming, but we’re here to support you every step of the way. To begin, establish the borrowing amount, interest rate, and duration of your loan. This foundational step is crucial in setting the stage for your financial journey.

Next, you can use the formula:

M = P[r(1 + r)^n] / [(1 + r)^n - 1]

Here, M represents the monthly payment, P is the loan principal, r is the monthly interest rate (which you get by dividing the annual rate by 12), and n is the number of installments or the loan term in months. Plugging in your figures will help you determine the monthly amount you need to budget for.

Once you have your monthly payment, it’s time to generate an amortizing loan plan. This plan will detail each installment, separating the principal and financing elements, while also monitoring the remaining balance after each payment. This process not only clarifies how your amortizing loan is settled over time but also empowers you to take control of your financial future. Remember, we know how challenging this can be, but with each step, you’re moving closer to your goals.

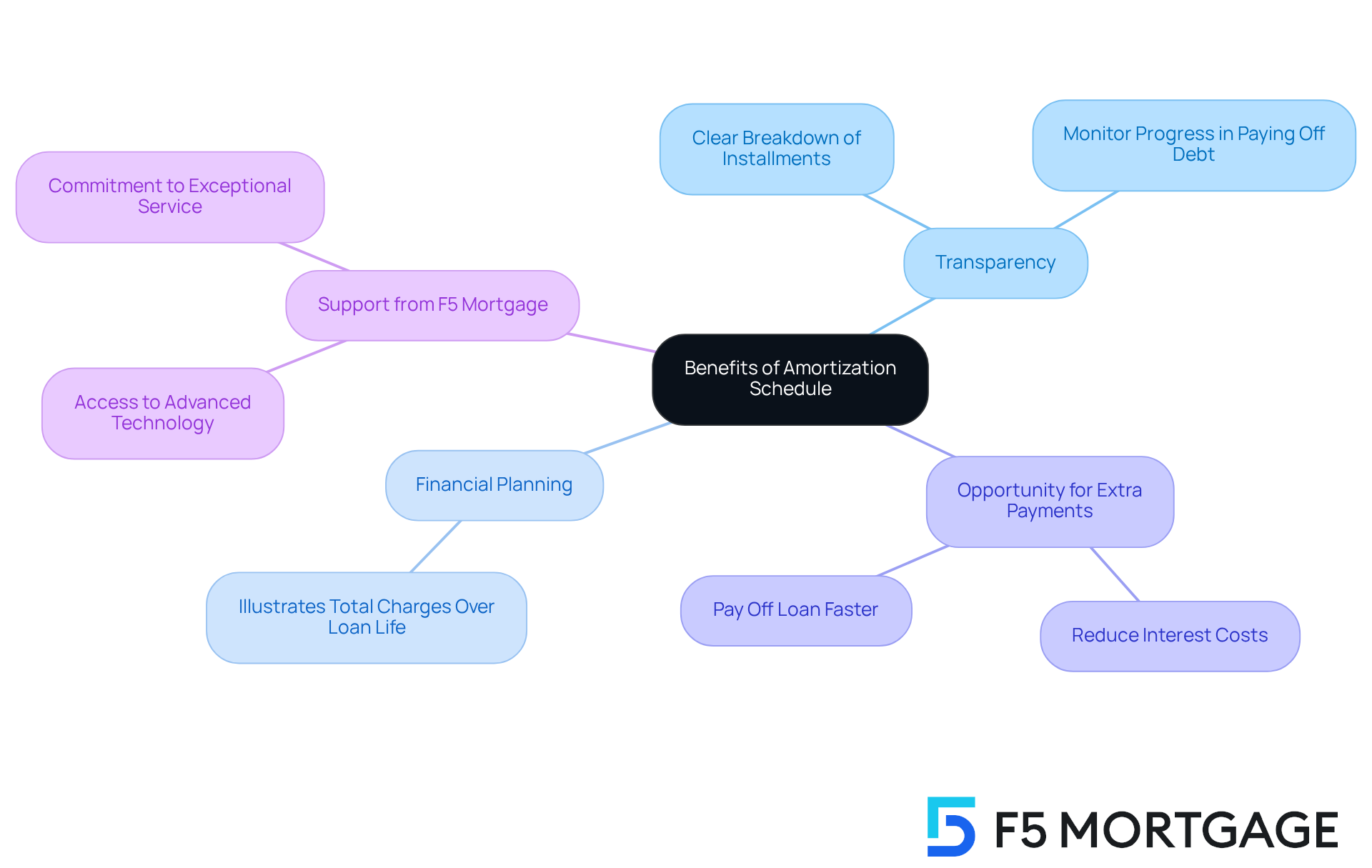

Highlight Benefits of an Amortization Schedule

An amortizing loan schedule provides several advantages that can truly benefit you. It provides a clear breakdown of each installment, showing exactly how much goes toward the principal and charges. This transparency helps you monitor your progress in paying off the debt. Moreover, it aids in financial planning by illustrating how much you will pay in charges over the life of an amortizing loan.

At F5 Mortgage, we understand how important it is to have clarity during this process. We believe that transparency empowers our clients. By leveraging advanced technology, we ensure that you have access to this invaluable tool. It allows you to identify opportunities for extra payments, helping to reduce interest costs and pay off your loan faster.

This approach not only enriches your mortgage experience but also aligns with our commitment to exceptional service and competitive rates. We’re here to make it easier for families like yours to achieve homeownership, without the stress often associated with traditional hard sales tactics. We know how challenging this can be, and we’re here to support you every step of the way.

Conclusion

Understanding amortizing loans is a vital step for anyone looking to manage their finances effectively. We know how challenging this can be, but these loans allow borrowers to repay their debt systematically. This clear structure not only helps in budgeting but also ensures complete debt settlement by the end of the loan term. By mastering the concept of amortization, you can make informed decisions that significantly impact your financial future, especially in the realm of homeownership and refinancing.

This article delves into the mechanics of loan amortization, explaining how monthly payments are structured and how there is a gradual shift from interest to principal repayment over time. It highlights the various types of amortizing loans available, such as fixed-rate and adjustable-rate mortgages. Understanding these options is essential to choosing the best fit for your financial goals. Additionally, we provide a straightforward method for calculating loan payments, reinforcing how you can take control of your financial planning through an amortization schedule.

Ultimately, mastering amortizing loans goes beyond just understanding payments; it empowers you to navigate your financial journey with confidence. Whether you are considering refinancing options or simply aiming to manage existing debt, recognizing the benefits of amortization can lead to substantial savings and a more secure financial future. Taking action today to educate yourself about these loans can pave the way for smarter financial decisions tomorrow. We’re here to support you every step of the way.

Frequently Asked Questions

What is an amortizing loan?

An amortizing loan is a type of debt that is paid off over time through consistent payments, which include both the principal amount borrowed and the interest charged.

Why are amortizing loans important for borrowers?

Amortizing loans provide predictability in budgeting since borrowers know their payment amounts and schedules. They also ensure that the debt is fully settled by the end of the loan term.

How does loan amortization work?

Loan amortization involves determining the monthly payment based on the amount borrowed, the interest rate, and the loan duration. Each payment consists of a portion that goes toward interest and a portion that goes toward the principal. Initially, a larger portion of the payment is applied to interest, but over time, more is applied to the principal.

What is the impact of refinancing on amortizing loans?

Refinancing can lower monthly payments and reduce the total interest paid over the loan term, especially if a borrower secures a lower interest rate. It can also provide potential tax benefits and help manage household budgets.

What is a cash-out refinance?

A cash-out refinance allows homeowners to access cash by tapping into their home equity, which can be used for home improvements or unexpected expenses.

Why is understanding amortizing loans and refinancing important for homeowners in Colorado?

Understanding these concepts helps homeowners make informed decisions about their mortgage options, especially in a rising housing market, which has seen a 3.4% increase year over year. This knowledge can lead to better financial planning and security.