Overview

Homeowners, we understand how challenging it can be to navigate the complexities of mortgage payments. One way to alleviate some of this burden is by removing Private Mortgage Insurance (PMI). To do this, you need to ensure you have at least 20% equity in your home. This equity allows you to request cancellation once your loan balance reaches 80% of the original property value.

To help you through this process, we’ve outlined the necessary steps:

- Check your equity to see if you meet the criteria.

- Maintain a good financial record, which can be crucial in this process.

- Submit a formal request to your lender.

Understanding these criteria and processes can lead to significant savings on your monthly mortgage payments, empowering you to take control of your financial future. We’re here to support you every step of the way.

Introduction

Navigating the financial landscape of homeownership can be daunting, especially when it comes to understanding Private Mortgage Insurance (PMI). This necessary yet often burdensome expense weighs heavily on many buyers. We know how challenging this can be, particularly for homeowners who have invested in their properties but still face ongoing PMI costs. The prospect of removing PMI brings hope for substantial savings and greater financial freedom.

However, the journey to eliminate PMI is not always straightforward. What are the essential steps and conditions that homeowners need to know to successfully navigate this process? In this article, we will explore these important considerations, empowering you with the knowledge to take control of your financial future.

Understand Private Mortgage Insurance (PMI)

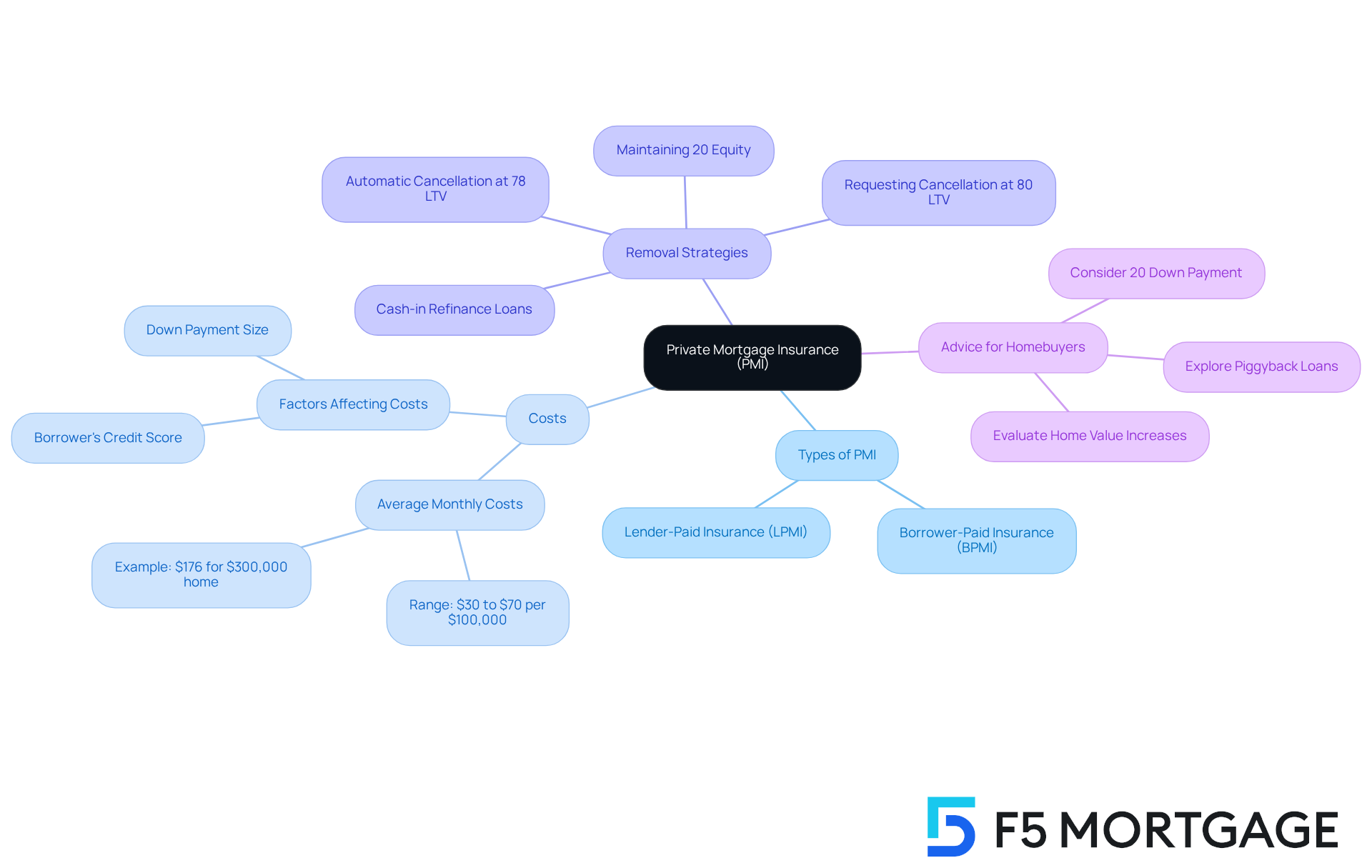

Private Mortgage Insurance (PMI) is an important aspect for homebuyers who are making a down payment of less than 20% of the home’s purchase price. This insurance serves as a safety net for lenders against potential defaults, making it essential for those stepping into the housing market with limited upfront capital. We understand how crucial it is to comprehend PMI, as it adds to your . Knowing can lead to significant savings down the line.

PMI is categorized into two types: (BPMI) and lender-paid insurance (LPMI). BPMI is typically paid monthly and directly impacts your loan cost, while LPMI is built into the interest rate, often leading to higher overall borrowing expenses. For instance, on a $300,000 home with a 30-year mortgage at a 7% interest rate and a 10% down payment, PMI can increase your monthly expenses by about $176.

On average, the monthly cost of PMI ranges from $30 to $70 for every $100,000 borrowed, depending on factors like the size of the down payment and the borrower’s credit score. If you’ve established at least 20% equity in your home, you can explore [how to get PMI removed](https://magazine.utdallas.edu/2025/07/22/timely-topic-is-now-the-time-for-homeowners-to-dump-their-pmi), potentially saving you between $150 to $250 each month. One effective way to achieve this is through , where homeowners can by paying down a portion of the principal. This can lower your loan-to-value (LTV) ratio, which is one way to learn how to get PMI removed. This choice can also lead to lower interest rates and reduced monthly payments.

Moreover, when the loan principal balance reaches 78% of the original home value, provided that the borrower is current on payments. To , consider making a down payment of at least 20% or explore alternatives like piggyback loans. Additionally, adjusting the loan term during refinancing is one way to understand how to get PMI removed while also helping to lower monthly payments. By understanding these dynamics, you can make informed choices about your financing options and financial planning. We’re here to support you every step of the way.

Identify Conditions for PMI Removal

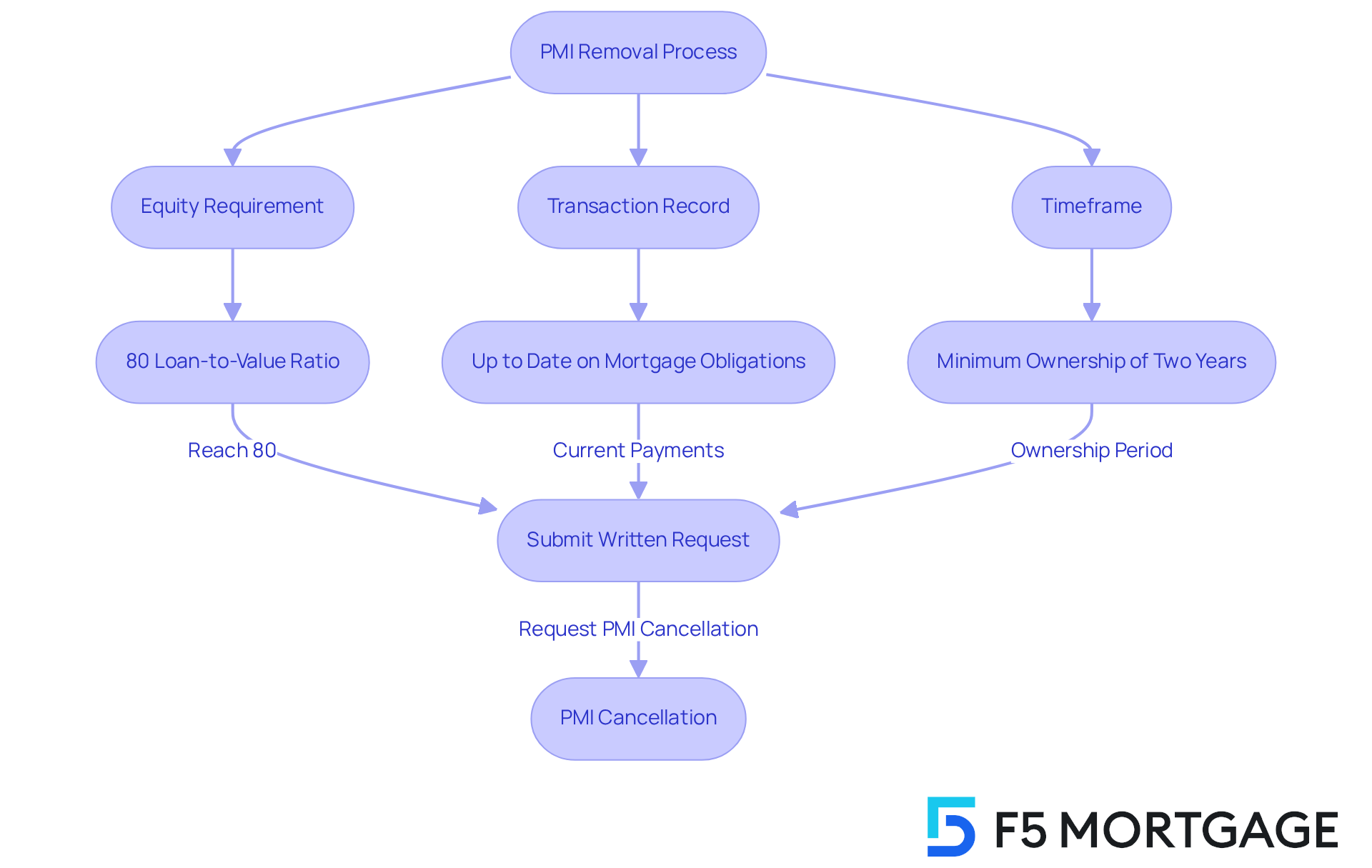

To successfully remove PMI, homeowners must meet specific criteria.

- Equity Requirement: when your loan balance reaches 80% or less of the home’s original value. This typically indicates that you have accrued at least 20% equity. Many lenders require property owners to have at least an 80% loan-to-value ratio, meaning they have either reduced at least 20% of their original loan amount or their property has appreciated in value. when the principal balance reaches 78% of the original home value. On average, property owners need approximately five to seven years to attain this equity benchmark, influenced by their loan conditions and financial practices.

- Transaction Record: A . Lenders typically stipulate that you are up to date on your mortgage obligations and have no overdue amounts in the previous year. This demonstrates your financial responsibility and reliability.

- Timeframe: Many lenders impose a , often around two years, before allowing PMI removal requests. This timeframe ensures that property owners have developed a regular financial pattern.

We know how challenging this can be, and understanding how to is vital for property owners preparing to take the next steps toward PMI cancellation. For instance, diligently tracking your mortgage balance and contributing additional funds can help you reach that faster. Mortgage professionals emphasize that maintaining a good payment history and being proactive about equity can significantly influence the likelihood of PMI cancellation. Once you reach the 80% balance, remember to submit a written request to your lender regarding . We’re here to support you every step of the way.

Follow Steps to Remove PMI

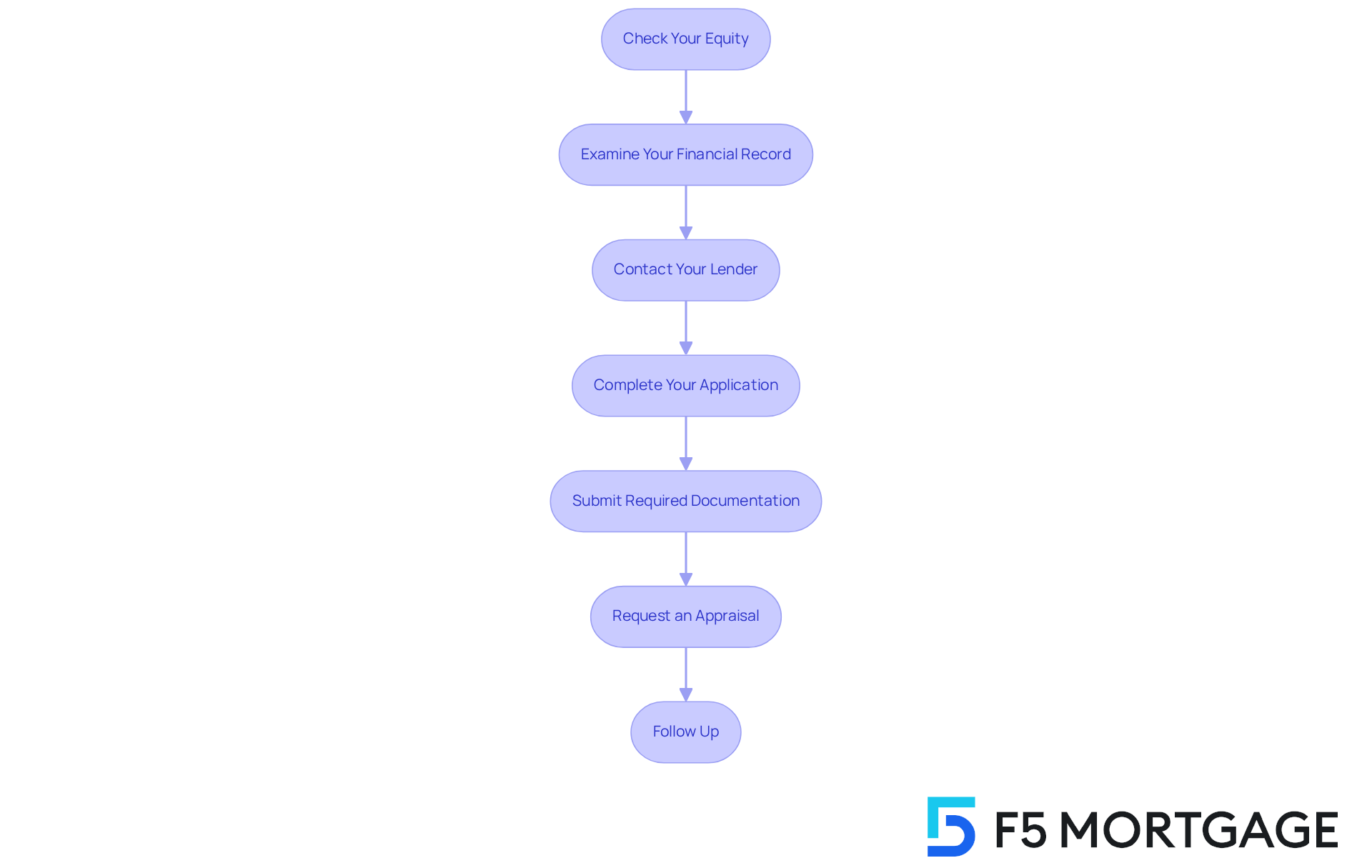

can feel overwhelming, but we’re here to support you in understanding how to get PMI removed every step of the way. Follow these simple steps to navigate the process with confidence:

- Check Your Equity: Start by determining your current . If it’s 80% or lower, you might qualify for . For instance, if your home is valued at $400,000 and your loan balance is $320,000, your LTV is 80%.

- Examine Your Financial Record: It’s important to confirm that your loan payments are current and that you have a solid financial history. Lenders typically require a good financial record to process your request.

- Contact Your Lender: Reach out to your loan servicer to inquire about the . They may ask for a written request, so be ready to provide details about your loan and any necessary documentation.

- Complete Your Application: If refinancing is part of your plan to remove PMI, fill out a . You’ll need to provide information such as Social Security numbers, bank statements, tax returns, and pay stubs.

- Submit Required Documentation: Be sure to provide any necessary documentation, like proof of your . This may include recent tax assessments or a comparative market analysis.

- Request an Appraisal (if needed): Some lenders might require a new appraisal to confirm your home’s current value, especially if it has appreciated significantly since your purchase. This appraisal is key in determining your .

- Follow Up: After submitting your request, don’t hesitate to follow up with your lender to ensure the cancellation is processed. It’s essential to stay proactive, as PMI must be automatically terminated when the loan balance reaches 78% of the initial value. However, property owners can request cancellation at 80% LTV.

By following these steps, you can effectively understand how to get PMI removed and take a significant step towards financial freedom.

Access Resources and Additional Tips

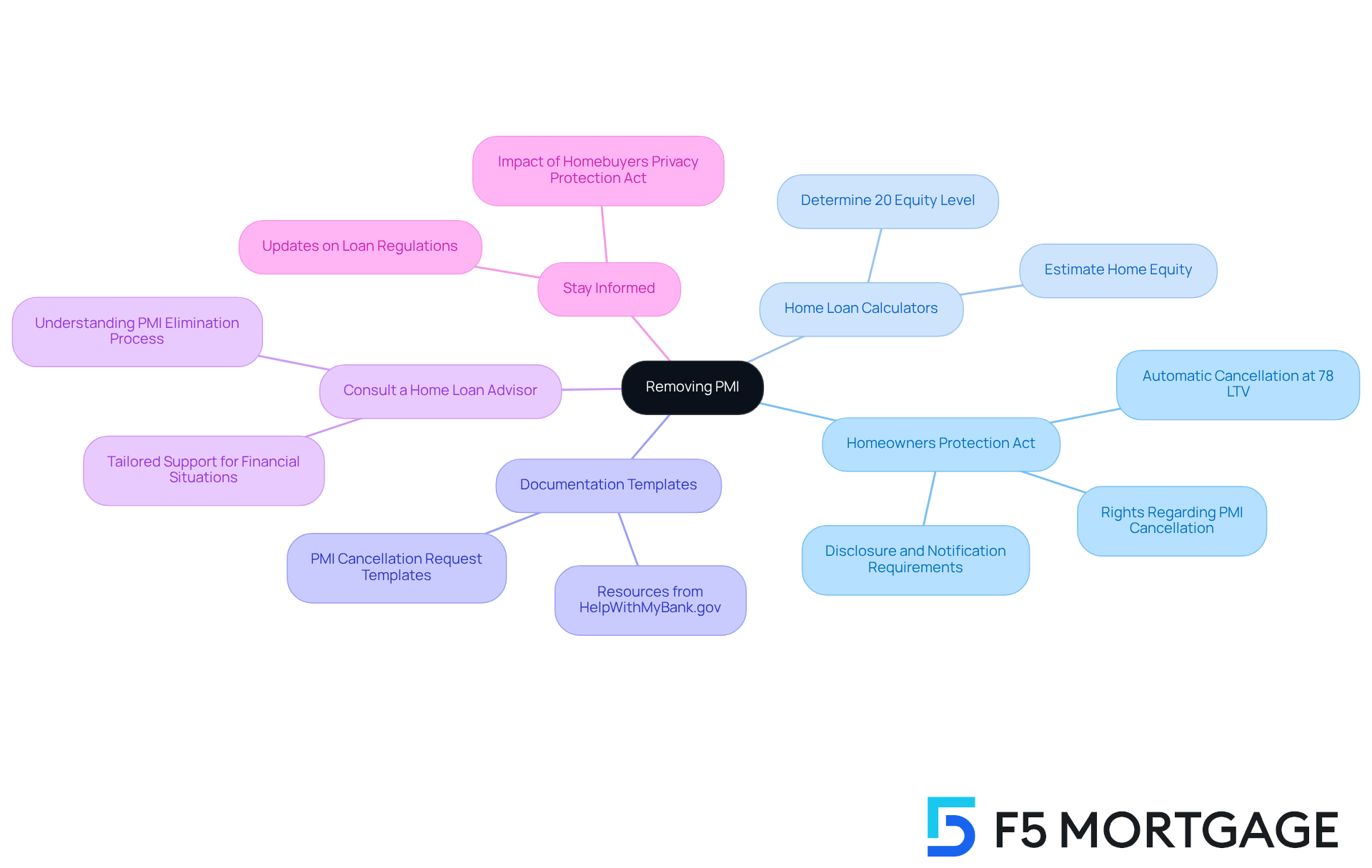

Navigating how to get PMI removed can feel overwhelming, but we’re here to support you every step of the way. Homeowners can leverage a to make this journey smoother:

- : Understanding the Homeowners Protection Act is essential. This law outlines your rights regarding , including automatic cancellation when the loan balance reaches 78% of your property’s original value.

- : Online home loan calculators are invaluable tools for estimating your home equity. They can help you determine when you might achieve the 20% equity level necessary for PMI removal. For instance, if you have a $400,000 loan, these calculators can show you how your equity increases over time.

- : Using templates for PMI cancellation requests can streamline your communication with your lender. This ensures that you provide all necessary information efficiently. Resources like HelpWithMyBank.gov offer templates and guidance to help homeowners seeking to cancel PMI.

- : Working with a home loan advisor can offer tailored support suited to your unique financial situation. They can help you understand the intricacies of the . As finance advisor Jeff Ostrowski points out, “Grasping the PMI elimination procedure can result in .”

- Stay Informed: Staying up-to-date with changes in loan regulations is crucial. New laws may impact PMI requirements and cancellation processes. For example, the recent aims to enhance consumer protections in this area.

By employing these resources and strategies, homeowners can understand how to get PMI removed more effectively. This proactive approach could lead to .

Conclusion

Understanding how to remove Private Mortgage Insurance (PMI) is essential for homeowners who want to ease their monthly financial burden and gain more freedom. We know how challenging this can be, and this article serves as a comprehensive guide, detailing the significance of PMI, the conditions necessary for its removal, and the steps to navigate the cancellation process effectively.

Key insights include:

- Recognizing the importance of achieving at least 20% equity in your home to qualify for PMI removal.

- Maintaining a solid financial record and understanding the specific requirements set by lenders are also crucial.

- Emphasizing the value of resources such as home loan calculators and the Homeowners Protection Act, which can empower you in your quest to eliminate PMI.

Ultimately, taking proactive steps toward removing PMI can lead to significant savings, allowing you to allocate your finances more effectively. By leveraging the knowledge and strategies outlined here, you can confidently approach the PMI cancellation process and work towards achieving greater financial security. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is Private Mortgage Insurance (PMI)?

Private Mortgage Insurance (PMI) is insurance that protects lenders against potential defaults when homebuyers make a down payment of less than 20% of the home’s purchase price.

Why is PMI important for homebuyers?

PMI is important because it allows homebuyers with limited upfront capital to enter the housing market, although it adds to their monthly housing costs.

What are the two types of PMI?

The two types of PMI are borrower-paid insurance (BPMI), which is typically paid monthly and impacts loan costs directly, and lender-paid insurance (LPMI), which is built into the interest rate and can lead to higher overall borrowing expenses.

How much can PMI increase monthly expenses?

For example, on a $300,000 home with a 30-year mortgage at a 7% interest rate and a 10% down payment, PMI can increase monthly expenses by about $176.

What is the average monthly cost of PMI?

The average monthly cost of PMI ranges from $30 to $70 for every $100,000 borrowed, depending on factors like the size of the down payment and the borrower’s credit score.

How can PMI be removed?

PMI can be removed if you have established at least 20% equity in your home. This can be achieved through options like cash-in refinance loans, which lower the loan-to-value (LTV) ratio.

When is PMI automatically terminated?

PMI is automatically terminated when the loan principal balance reaches 78% of the original home value, provided that the borrower is current on payments.

How can homebuyers avoid PMI altogether?

Homebuyers can avoid PMI by making a down payment of at least 20% or exploring alternatives like piggyback loans.

Can refinancing help with PMI?

Yes, adjusting the loan term during refinancing can help remove PMI and potentially lower monthly payments.