Overview

Choosing the right mortgage brokers in California can feel overwhelming, but we know how challenging this can be. It’s essential to evaluate their:

- Licensing

- Experience

- Range of lenders

- Customer service

- Fee structure

By focusing on these criteria, you can feel more confident in your decision.

Thorough research is crucial. We encourage you to seek referrals and read client testimonials. This approach not only helps you gather valuable insights but also ensures that you are making an informed choice. Remember, you deserve a knowledgeable partner who understands your needs.

Ultimately, taking these steps will lead to a smoother home financing experience. We’re here to support you every step of the way, empowering you to make the best decisions for your family’s future.

Introduction

Navigating the complex world of home financing can feel overwhelming, especially in a competitive market like California. We understand how daunting this process can be. Mortgage brokers play a vital role, acting as compassionate guides who bridge the gap between borrowers and lenders, simplifying the mortgage journey.

In this article, we will explore the essential factors to consider when choosing the right mortgage broker. Our goal is to empower you, the homebuyer, with insights that can help you make informed decisions.

How can you ensure that you select a broker who not only understands your unique financial situation but also offers the best loan options in this ever-changing landscape? We’re here to support you every step of the way.

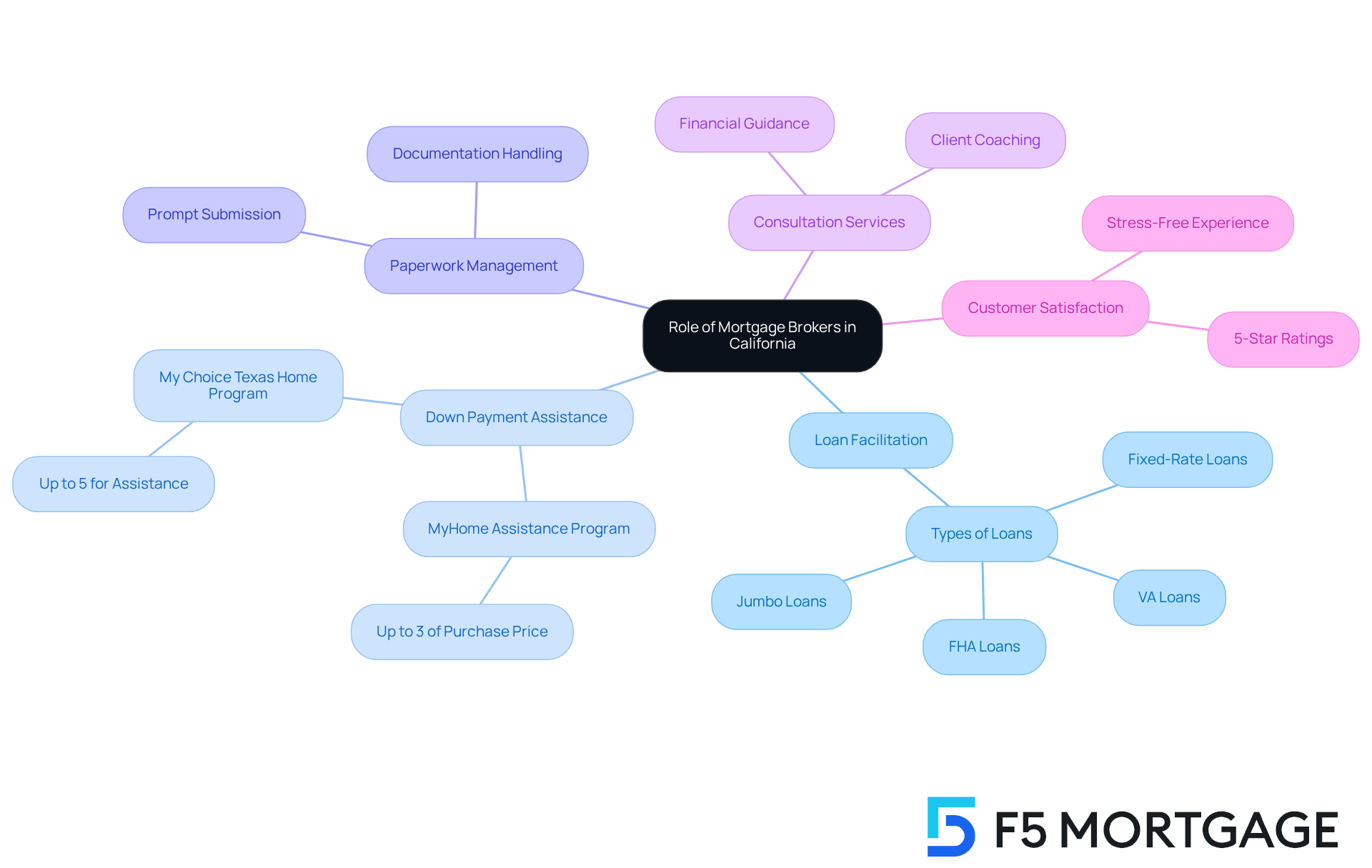

Understand the Role of Mortgage Brokers in California

Mortgage brokers California play a vital role as intermediaries between borrowers and lenders, simplifying the mortgage process. At F5 Mortgage, we understand how challenging this can be, which is why we utilize user-friendly technology to ensure a stress-free experience for everyone we serve. Our caring team is here to support you through a variety of loan options, including fixed-rate, FHA, VA, and jumbo loans, leveraging our established relationships with numerous lenders to secure the most favorable rates and terms.

We also offer valuable down payment assistance programs, such as the MyHome Assistance Program from CalHFA, providing up to 3% of the home’s purchase price, and the My Choice Texas Home program, which offers up to 5% for down payment and closing assistance. By managing the intricacies of paperwork and ensuring prompt submission of all necessary documentation, our agents significantly reduce the stress associated with securing a home loan. This support is especially crucial in a challenging market marked by elevated interest rates and high home prices, where expert guidance can truly make a difference.

Industry specialists emphasize that intermediaries do more than simply facilitate transactions; they also act as trusted consultants, helping individuals navigate their unique financial circumstances. Successful case studies from California illustrate how mortgage brokers California, including those at F5 Mortgage, have effectively assisted individuals in achieving their homeownership goals. This highlights our ability to streamline the financing process and enhance customer satisfaction.

Our commitment to providing no-pressure guidance and rapid loan closing in less than three weeks has earned us 5-star ratings from customers who appreciate our outstanding service. We’re here to support you every step of the way, and understanding the crucial role of loan advisors empowers clients to make informed decisions. Ultimately, this leads to a more seamless and effective home purchasing experience.

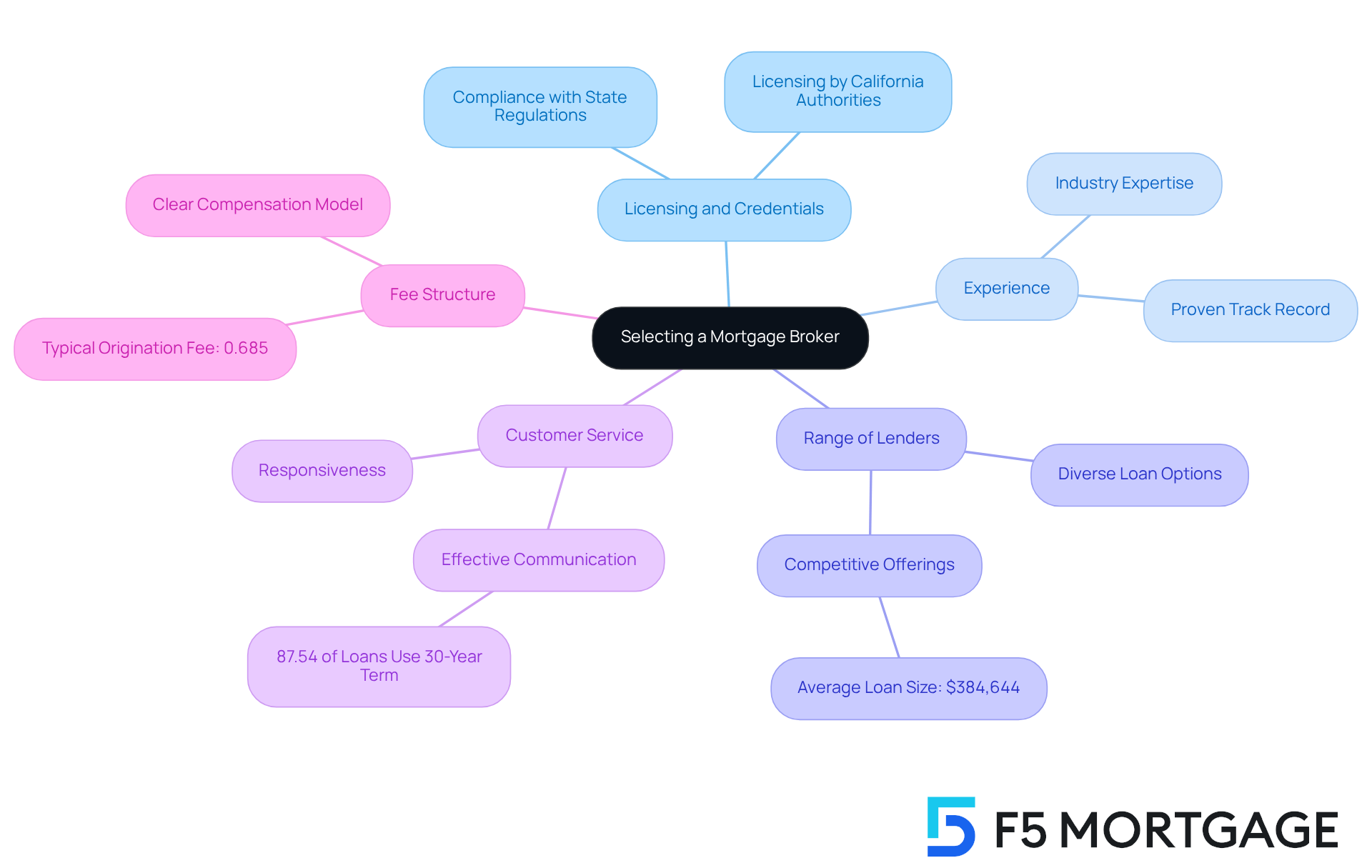

Identify Key Criteria for Selecting a Mortgage Broker

When selecting a mortgage broker in California, it’s essential to consider some key criteria that can make a difference in your experience:

Licensing and Credentials: First and foremost, confirm that the agent is licensed by the California Department of Business Oversight or the Department of Real Estate. This ensures compliance with state regulations and protects your interests.

Experience: Look for agents with significant industry expertise. Those with a proven track record are better equipped to navigate potential challenges and provide valuable insights.

Range of Lenders: An intermediary with access to a diverse array of lenders can present a broader selection of loan options, enhancing your chances of securing favorable terms. In 2023, the average loan size in California was approximately $384,644, highlighting the significance of competitive offerings.

Customer Service: Evaluate the agent’s responsiveness and readiness to address your inquiries. Effective communication is essential for a smooth loan experience, particularly considering that 87.54% of loans in 2023 used a 30-year term, which can be complicated.

Fee Structure: Familiarize yourself with the agent’s compensation model. Clear fee structures are crucial to prevent unforeseen expenses, as the typical origination fee for a standard loan in 2023 was approximately 0.685%.

By concentrating on these factors, we know how challenging this can be, but you can make a more knowledgeable choice when selecting mortgage brokers California as your loan advisor. This ensures a smoother journey to homeownership, and we’re here to support you every step of the way.

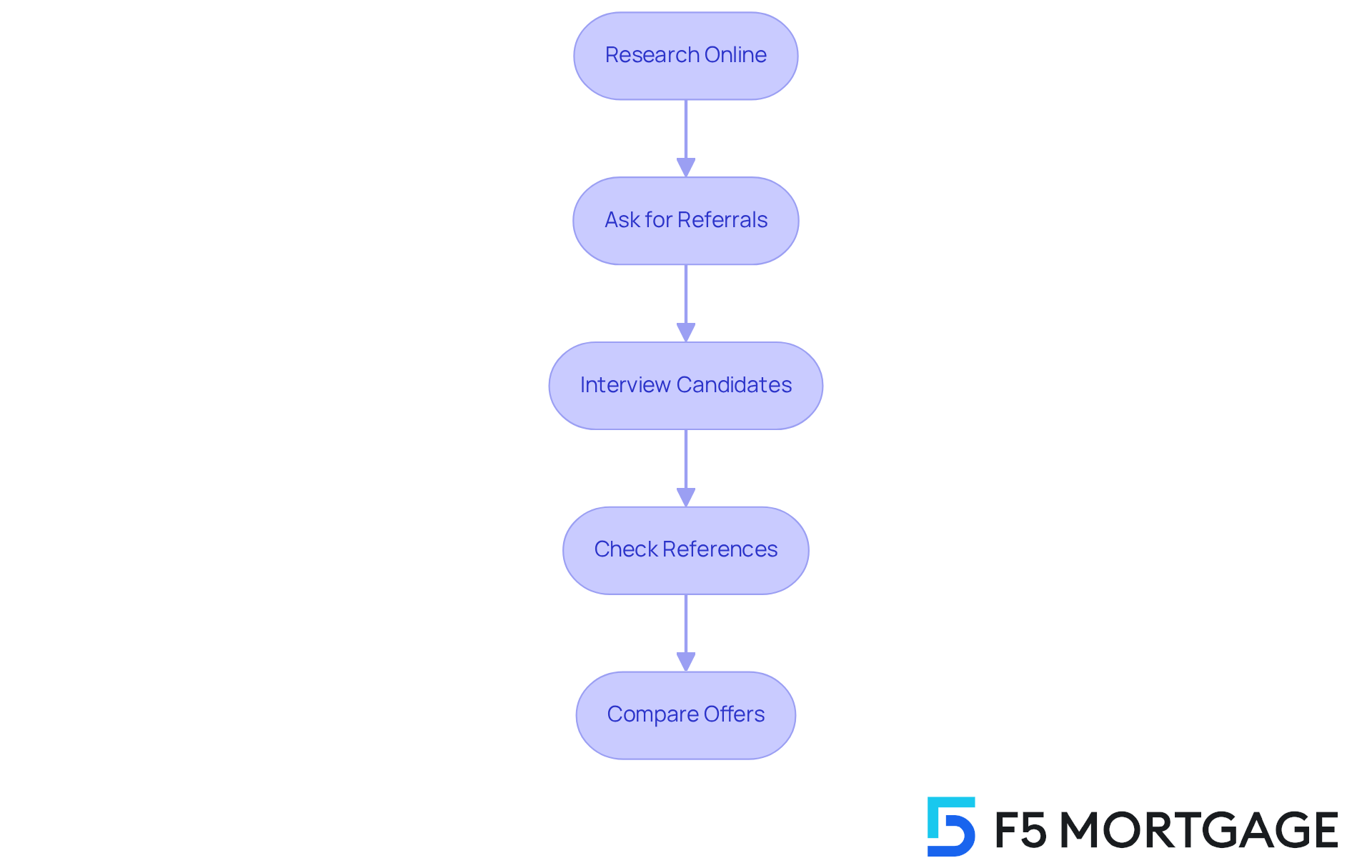

Evaluate Potential Brokers: Steps to Take

To effectively evaluate potential mortgage brokers in California, we understand how crucial this decision can be for you. Here are some steps to guide you through the process:

Research Online: Start by looking for financial agents in your area. Utilize platforms like Zillow and Yelp, where over 90% of homebuyers prefer to handle their mortgages online. Access reviews and ratings that reflect client satisfaction, and remember, this is your journey.

Ask for Referrals: Don’t hesitate to consult friends, family, or real estate agents for recommendations. Personal experiences can offer valuable insights into the agent’s dependability and quality of assistance, helping you feel more secure in your choice.

Interview Candidates: Schedule consultations with several brokers. Prepare targeted questions regarding their experience, the lenders they collaborate with, and their customer service approach. This will help you gauge compatibility and ensure they align with your needs.

Check References: Request referrals from previous customers. Interacting with former clients can provide a clearer insight into what to anticipate and how well the agent can address client requirements, reinforcing your confidence in your decision.

Compare Offers: After narrowing down your options, compare the services and charges each agent provides. This comparison will help you identify the best value tailored to your specific requirements, ensuring you make a well-informed choice.

By following these steps, you can feel empowered to select mortgage brokers in California, paving the way for a smoother home financing experience. We know how challenging this can be, and we’re here to support you every step of the way.

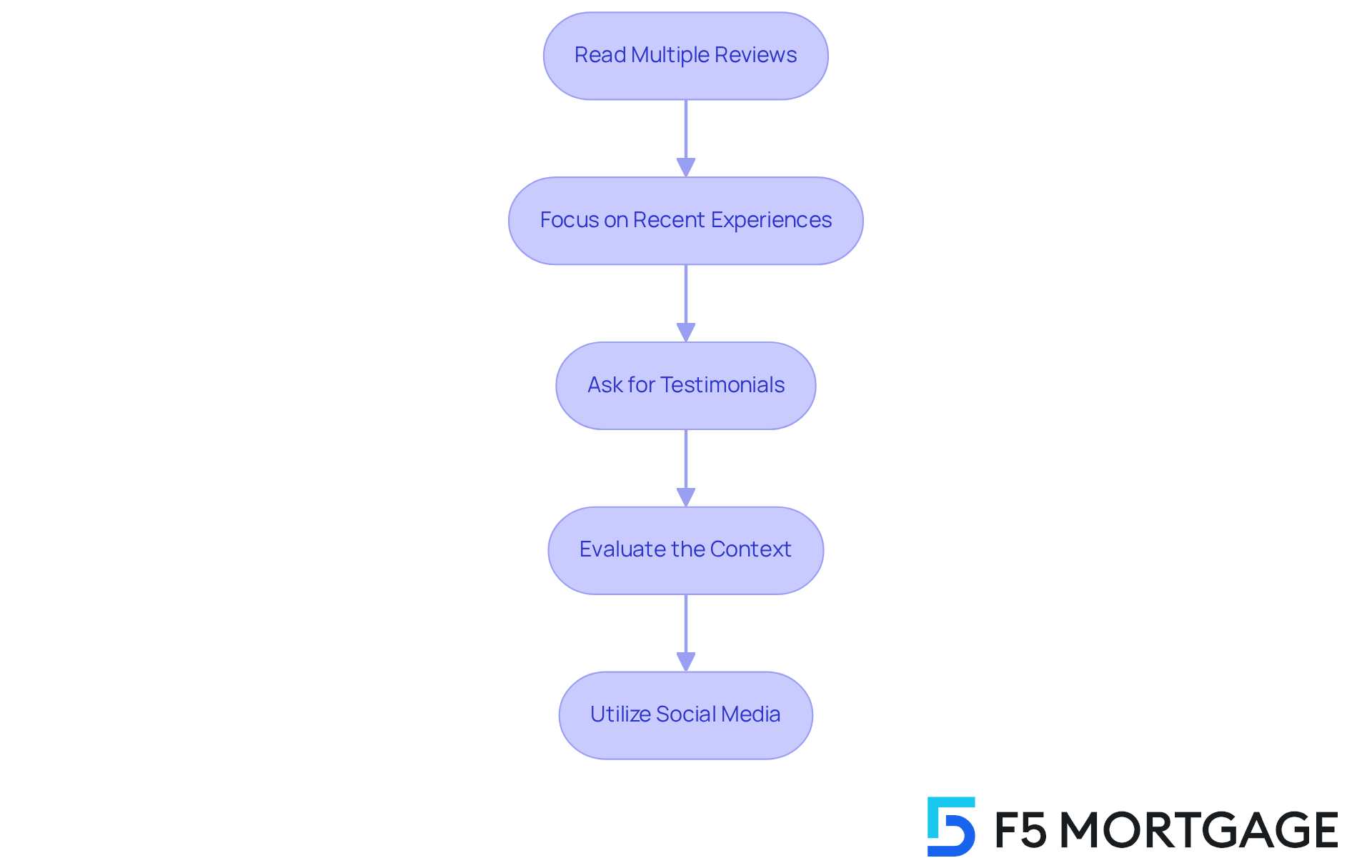

Leverage Client Testimonials and Reviews for Informed Choices

Client testimonials and reviews are invaluable resources in your journey to find the right mortgage specialist. We understand how challenging this can be, so here’s how to utilize them effectively:

Read Multiple Reviews: Take the time to analyze feedback across various platforms. Look for consistent patterns. An agent with a strong track record of positive remarks is likely to be dependable. For instance, Alley Cohen praised F5 Mortgage, saying, “Everything went very smoothly!”

Focus on Recent Experiences: Prioritize recent reviews, as they provide insight into the firm’s current practices and customer service quality. Ruth Vest shared her experience, noting that F5 Mortgage handled her financial needs exceptionally well, highlighting the team’s responsiveness and expertise.

Ask for Testimonials: During consultations, don’t hesitate to request endorsements from previous customers. A trustworthy intermediary will willingly provide positive reviews, showcasing their dedication to customer satisfaction. Artie Kamarhie expressed gratitude for the patience and guidance he received as a first-time homebuyer, emphasizing the team’s attention to detail.

Evaluate the Context: Consider the context of reviews. While a few negative remarks may arise, if they are handled professionally, it can reflect positively on the agent’s customer service approach. Joe Simms conveyed that Jeff and his team made the process simple and stress-free, showcasing their commitment to excellent service.

Utilize Social Media: Investigate the firm’s social media presence. Active involvement with customers online can reveal further insights into their responsiveness and overall quality of assistance. Ryan Witucki, who refinanced with F5 Mortgage, remarked on the outstanding service compared to other agents, highlighting the importance of individualized assistance.

In California, where client satisfaction with mortgage brokers is paramount, understanding the impact of reviews can significantly influence your choice. We’re here to support you every step of the way.

Conclusion

Choosing the right mortgage broker in California is a crucial step in your home buying journey. These professionals act as vital intermediaries between you and lenders, making the financing process smoother and more enjoyable. With their expertise, you receive personalized guidance tailored to your unique financial situation. Understanding the role of mortgage brokers and the value they bring can help you navigate the complexities of securing a home loan with greater confidence.

When selecting a mortgage broker, consider key factors like:

- Licensing

- Experience

- The range of lenders they work with

- Customer service

- Fee structures

Take the time to evaluate potential brokers through thorough research, referrals, interviews, and comparisons. This diligence ensures you find a reliable partner to assist you in achieving your homeownership goals. Additionally, leveraging client testimonials and reviews can offer invaluable insights into a broker’s reputation and service quality, making it easier for you to make an informed decision.

Ultimately, choosing a mortgage broker should be approached with care and thoughtfulness. By prioritizing the right criteria and utilizing available resources, you can set yourself up for a successful and stress-free home financing experience. Remember, selecting a knowledgeable and trustworthy mortgage broker is significant; it can profoundly impact your journey to homeownership in California. We know how challenging this can be, and we’re here to support you every step of the way.

Frequently Asked Questions

What is the role of mortgage brokers in California?

Mortgage brokers in California act as intermediaries between borrowers and lenders, simplifying the mortgage process and providing support through various loan options.

What types of loans do mortgage brokers in California offer?

They offer a variety of loan options, including fixed-rate loans, FHA loans, VA loans, and jumbo loans.

How do mortgage brokers help with down payment assistance?

Mortgage brokers provide access to down payment assistance programs, such as the MyHome Assistance Program from CalHFA, which offers up to 3% of the home’s purchase price, and the My Choice Texas Home program, which offers up to 5% for down payment and closing assistance.

What benefits do mortgage brokers provide during the loan process?

They manage the intricacies of paperwork, ensure prompt submission of necessary documentation, and reduce the stress associated with securing a home loan, especially in challenging market conditions.

How do mortgage brokers serve as consultants to borrowers?

They help individuals navigate their unique financial circumstances and provide expert guidance to achieve homeownership goals.

What is the customer feedback regarding the services of mortgage brokers like F5 Mortgage?

F5 Mortgage has received 5-star ratings from customers who appreciate their outstanding service, no-pressure guidance, and rapid loan closing in less than three weeks.

Why is understanding the role of loan advisors important for clients?

Understanding the role of loan advisors empowers clients to make informed decisions, leading to a more seamless and effective home purchasing experience.