Overview

Navigating the journey to homeownership can feel overwhelming, but understanding your financial situation is the first step. To determine how much home you can qualify for, it’s important to evaluate your gross monthly earnings and financial obligations. We know how challenging this can be, and ideally, you should aim for a debt-to-income (DTI) ratio below 36%, while keeping your housing expenses within 28% of your income.

By grasping these financial metrics, you empower yourself to make informed decisions about your future. Utilizing tools like affordability calculators can significantly ease this process, helping you visualize your options. Remember, you are not alone in this journey; we’re here to support you every step of the way.

Taking these steps can help you navigate the complexities of home financing with confidence, ensuring that your choices align with your financial health and goals.

Introduction

Understanding how much home one can qualify for is a crucial step in the journey toward homeownership. We know how challenging this can be, as it often feels like navigating a complex maze of financial metrics and market trends. This guide aims to demystify the process by breaking down essential factors, such as:

- Income

- Debt-to-income ratios

- Local housing costs

Our goal is to provide you with the tools you need to make informed decisions.

However, with rising home prices and fluctuating interest rates, how can prospective buyers effectively assess their financial readiness? We’re here to support you every step of the way in securing the best mortgage options available.

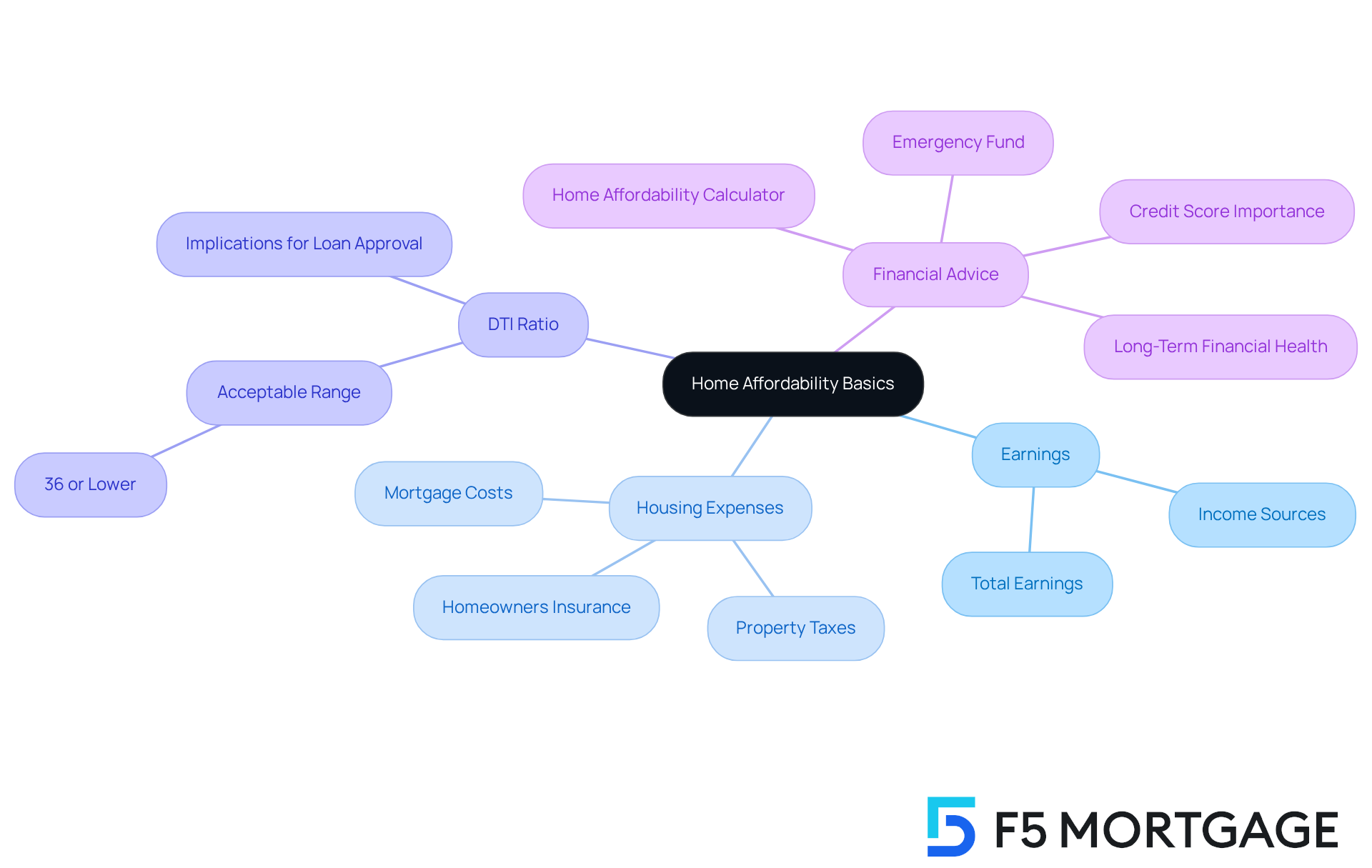

Understand Home Affordability Basics

Your earnings, financial obligations, and local housing costs all influence . We know how challenging this can be, and a commonly acknowledged guideline suggests that your housing expenses should ideally not exceed 28% of your total earnings. This includes mortgage costs, property taxes, and homeowners insurance. Additionally, lenders evaluate the ratio of total financial obligations to gross earnings. A DTI ratio of 36% or lower is typically considered acceptable, which can lead to a more favorable loan approval process.

For instance, if your total earnings are $5,000, your housing expenses should ideally remain below $1,400. This encompasses not only the mortgage but also property taxes and insurance. If your total monthly financial obligations—such as credit cards, student loans, and auto loans—amount to $1,500, your DTI would be 30%. This is within the acceptable range for most lenders, providing you with a sense of security.

Financial advisors emphasize the importance of understanding how much home can I qualify for based on these metrics. They suggest that potential homebuyers consider all sources of income when assessing affordability and aim for a DTI ratio below 40% to enhance their chances of securing a mortgage. As one advisor wisely noted, ‘By approaching the process practically, you’ll be able to find a home that fits both your financial situation and your lifestyle.’

Looking ahead to 2025, the average DTI ratio for homebuyers is around 36%, reflecting a cautious approach to borrowing. To accurately determine how much home can I qualify for, utilize tools like the Home Affordability Calculator. This resource takes into account your earnings, debts, and mortgage details, providing a conservative estimate. It encourages you to think long-term about your financial health and potential future expenses, ensuring you make informed decisions that align with your goals.

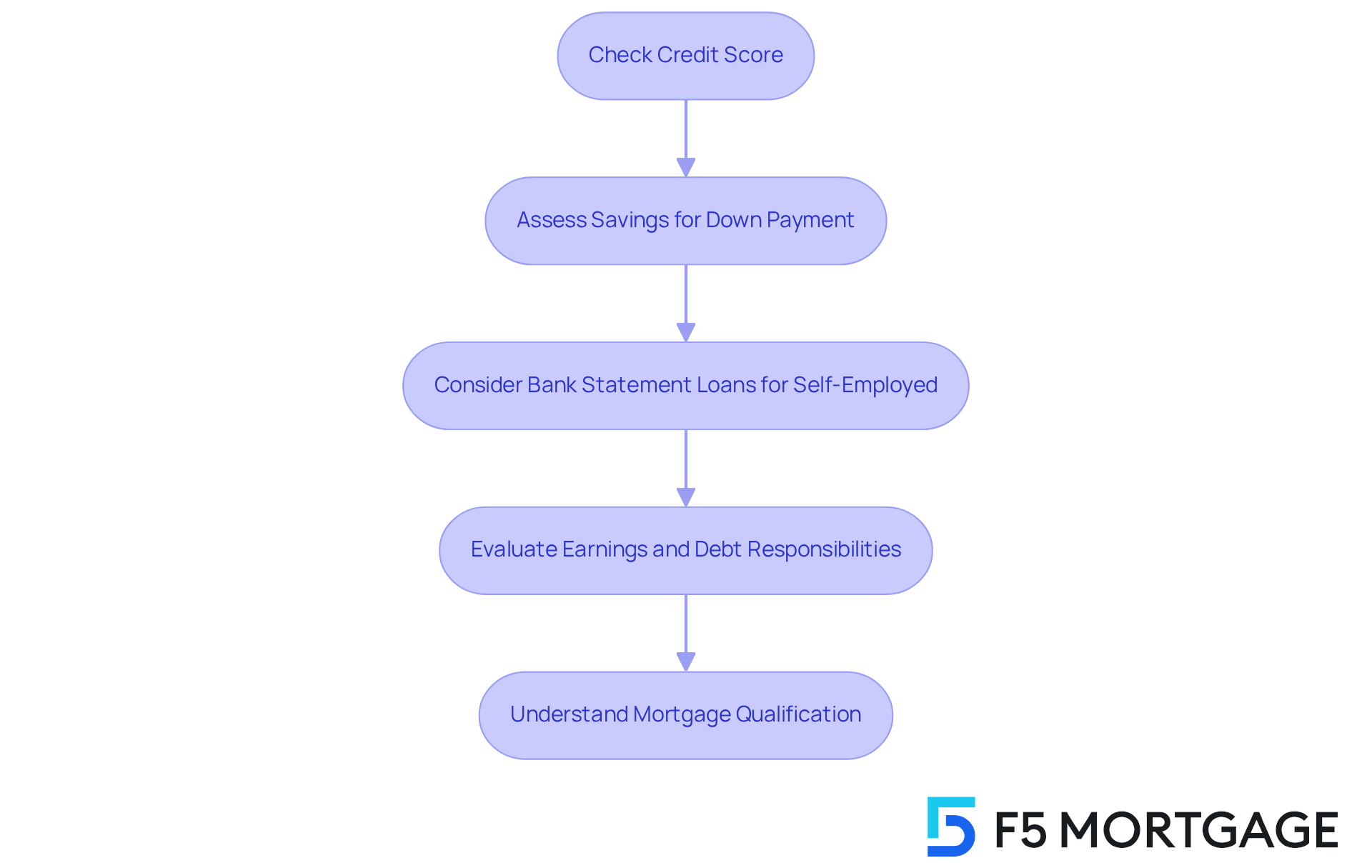

Evaluate Key Financial Metrics

We know how challenging it can be to evaluate your financial metrics. Start by checking your credit score, as it significantly impacts your mortgage eligibility and interest rates. Aim for a score of at least 620 for conventional loans, though remember that higher scores will yield better rates.

Next, assess your savings for a down payment. Ideally, you should have at least 20% of the home’s price saved to avoid private mortgage insurance (PMI). If you are self-employed, consider how bank statement loans work. These loans allow underwriters to assess your earnings based on your business cash flow using either 12 or 24 months of bank statements.

Ultimately, take a close look at your regular earnings and current debt responsibilities to determine how much home you can qualify for based on your debt-to-income (DTI) ratio. Understanding how much home you can qualify for in the is equally important. This involves the lender evaluating your financial details to determine if you are a suitable candidate for a mortgage. Typically, this includes an estimate of your loan amount, interest rate, and potential monthly payment.

This comprehensive evaluation will give you a clearer picture of your financial readiness. We’re here to support you every step of the way as you navigate this process.

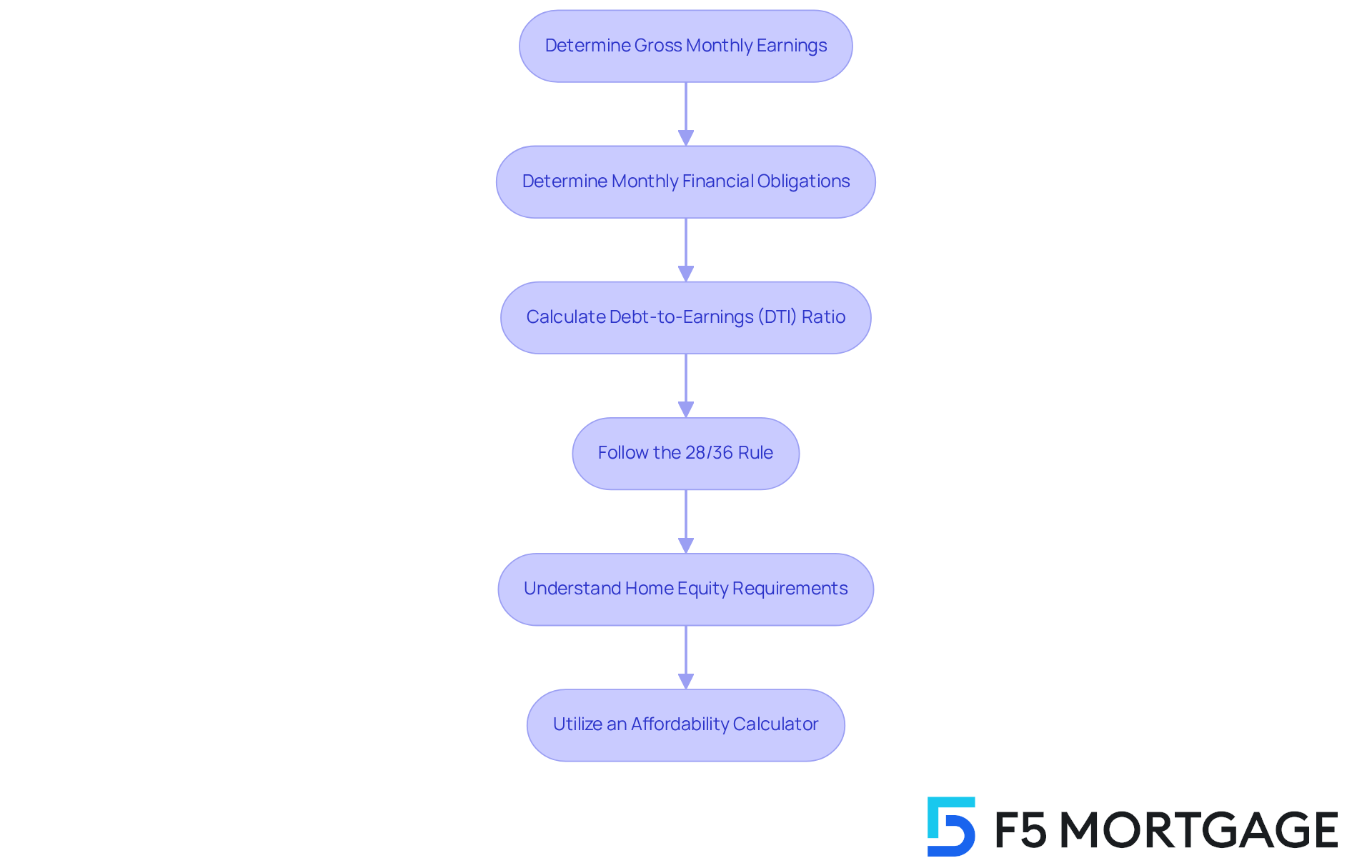

Calculate Your Home Affordability Step-by-Step

Determining how much home you can afford can feel overwhelming, but by following these essential steps, you can navigate this journey with confidence:

- Determine Your Gross Monthly Earnings: Begin by identifying your total earnings before taxes and deductions. This figure is crucial for accurate calculations. In 2025, the average gross earnings for home purchasers are projected to be approximately $7,000, reflecting the financial landscape many families navigate.

- Determine Your Monthly Financial Obligations: Take a moment to list all ongoing liabilities, such as credit cards, student loans, and car installments. Understanding your is a vital step in this process.

- Calculate Your Debt-to-Earnings (DTI) Ratio: To assess your financial health, divide your total regular obligations by your gross earnings and multiply by 100 to express it as a percentage. A lower DTI indicates better financial health and is essential for qualifying for competitive mortgage rates. Many lenders typically require a maximum DTI ratio of 43% for home loans, so keeping this in mind is important.

- Follow the 28/36 Rule: This guideline suggests that your housing expenses should not exceed 28% of your total earnings, while your overall financial obligations should remain under 36%. For instance, if your total monthly earnings are $7,000, your housing expenses should ideally be limited to $1,960, and overall financial obligations at $2,520. This guideline helps ensure you maintain a healthy balance between housing costs and other financial commitments.

- Understand Home Equity Requirements: Many lenders require homeowners to have at least an 80% home-to-value loan ratio. This means you should have paid down at least 20% of your original loan amount, or your home should have appreciated in value. This understanding is particularly important if you are considering a cash-out home equity loan, which may have even higher equity requirements.

- Utilize an Affordability Calculator: Take advantage of online affordability calculators by entering your income, debts, and down payment. These tools provide a more precise estimate of how much home you can qualify for, helping you visualize your budget and refine your home search. Remember to consider all expenses involved in your monthly housing costs, including homeowners insurance and real estate taxes, as these can significantly impact your overall affordability.

By following these steps and considering current economic factors, such as high mortgage rates and housing prices, you can make informed decisions and enhance your home-buying experience. We know how challenging this can be, and we’re here to support you every step of the way.

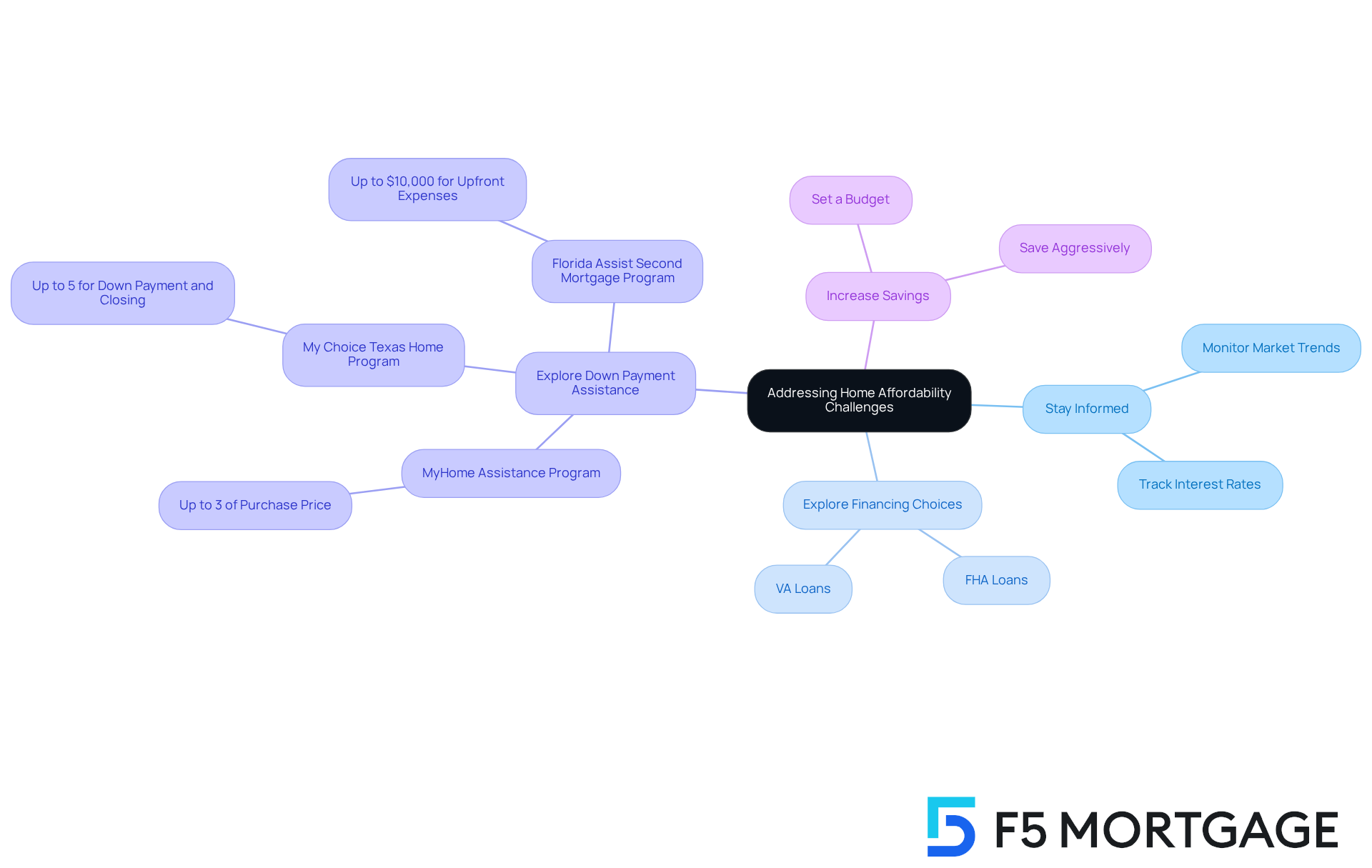

Address Common Challenges in Home Affordability

We understand can be a challenging aspect of housing affordability. Typical obstacles include rising home prices, fluctuating interest rates, and insufficient savings for a deposit, all of which impact how much home can I qualify for. But there are ways to navigate these hurdles and determine how much home can I qualify for on your path to homeownership.

- Stay Informed: Keeping an eye on market trends and interest rates can empower you to make informed decisions about when to buy.

- Explore Different Financing Choices: Investigating options like FHA or VA loans may lead to reduced upfront costs, making homeownership more attainable.

- Explore Down Payment Assistance Programs: F5 Mortgage is here to help you access various financial assistance programs for down payments. For instance, the MyHome Assistance Program from the California Housing Finance Authority offers up to 3% of the home’s purchase price. Additionally, the My Choice Texas Home program provides up to 5% for down deposit and closing assistance. In Florida, the Florida Assist Second Mortgage Program can offer up to $10,000 for upfront expenses.

- Increase Your Savings: Setting a budget to save more aggressively for a down payment can make a significant difference in your journey.

Consult a mortgage broker to help you navigate the complexities of mortgage options and determine how much home you can qualify for, ensuring you find the best fit for your financial situation. At F5 Mortgage, we are committed to supporting you by connecting you with top realtors and securing the best mortgage deals tailored to your needs. Remember, we’re here to support you every step of the way.

Conclusion

Understanding how much home one can qualify for is crucial for making informed financial decisions in the home-buying process. We know how challenging this can be, but by grasping the fundamentals of home affordability—such as earnings, expenses, and financial obligations—potential buyers can navigate the complexities of securing a mortgage with greater confidence and clarity.

Throughout this guide, we’ve shared key insights, including the importance of:

- Maintaining a healthy debt-to-income ratio

- The significance of credit scores

- The necessity of utilizing affordability calculators

Additionally, practical steps have been outlined to assess financial readiness, from evaluating gross earnings to understanding home equity requirements. These elements collectively empower prospective homeowners to make sound decisions that align with their financial capabilities.

Ultimately, the journey to homeownership may present challenges, but with the right knowledge and resources, these obstacles can be overcome. Staying informed about market trends, exploring various financing options, and seeking assistance with down payments can significantly ease the path to owning a home. Embracing these strategies not only enhances the likelihood of qualifying for a home but also fosters a more sustainable financial future. We’re here to support you every step of the way.

Frequently Asked Questions

What factors influence how much home I can qualify for?

Your earnings, financial obligations, and local housing costs all influence how much home you can qualify for.

What is the recommended percentage of total earnings that should be spent on housing expenses?

It is commonly suggested that housing expenses should ideally not exceed 28% of your total earnings.

What does the 28% guideline include?

The 28% guideline includes mortgage costs, property taxes, and homeowners insurance.

What is the acceptable Debt-to-Income (DTI) ratio for loan approval?

A DTI ratio of 36% or lower is typically considered acceptable for loan approval.

How is the DTI ratio calculated?

The DTI ratio is calculated by dividing total monthly financial obligations by gross earnings.

Can you provide an example of how to calculate housing expenses and DTI?

If your total earnings are $5,000, your housing expenses should ideally remain below $1,400. If your total monthly financial obligations amount to $1,500, your DTI would be 30% (1,500/5,000), which is within the acceptable range for most lenders.

What do financial advisors suggest regarding DTI for potential homebuyers?

Financial advisors suggest that potential homebuyers consider all sources of income and aim for a DTI ratio below 40% to enhance their chances of securing a mortgage.

What is the average DTI ratio for homebuyers projected for 2025?

The average DTI ratio for homebuyers is projected to be around 36% in 2025.

How can I determine how much home I can qualify for?

You can determine how much home you can qualify for by utilizing tools like the Home Affordability Calculator, which considers your earnings, debts, and mortgage details.

What is the purpose of using a Home Affordability Calculator?

The Home Affordability Calculator provides a conservative estimate of how much home you can afford, encouraging you to think long-term about your financial health and potential future expenses.