Overview

Understanding the key differences between a home equity line of credit (HELOC) and a home equity loan can be crucial for your financial well-being.

- A home equity loan offers a lump sum with fixed interest rates, providing predictability in payments.

- On the other hand, a HELOC presents a revolving line of credit with variable interest rates, allowing you to draw funds as needed.

We know how challenging it can be to navigate these options, especially when considering your family’s financial needs.

- The fixed payment structure of home equity loans can provide peace of mind, while the flexible funding access of HELOCs can adapt to your changing circumstances.

Ultimately, the choice between these two options depends on your unique situation and risk tolerance. By understanding these distinctions, you can make an informed decision that best supports your family’s financial goals. We’re here to support you every step of the way as you explore these possibilities.

Introduction

Navigating the world of home equity financing can feel overwhelming for homeowners eager to tap into their property’s value. With borrowing rates on the rise and a growing interest in home equity lines of credit (HELOCs) and loans, understanding the key differences between these options is essential.

This article explores the unique benefits and potential pitfalls of home equity loans versus HELOCs, encouraging you to consider which option aligns best with your financial goals and risk tolerance.

As you weigh your choices, ask yourself: will you prioritize the stability of fixed payments or the flexibility of a revolving line of credit?

We know how challenging this can be, and we’re here to support you every step of the way.

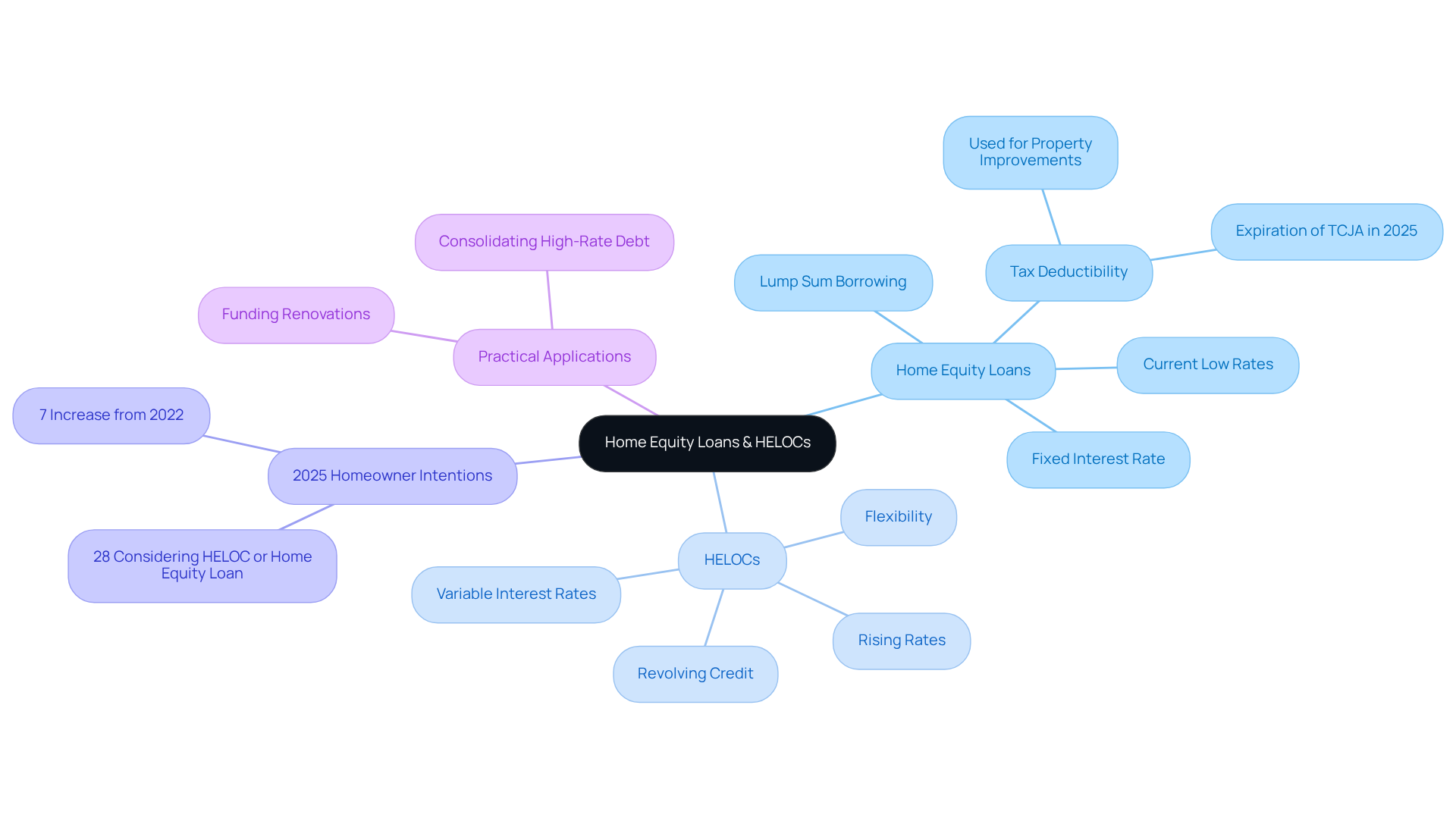

Define Home Equity Loans and Lines of Credit

A home equity line of credit can be a valuable option for property owners looking to leverage the equity they’ve built in their homes. This second mortgage allows you to borrow a lump sum, typically at a fixed interest rate, providing predictability in your monthly payments. On the other hand, a Home Equity Line of Credit (HELOC) functions more like a credit card, offering a revolving line of credit that you can draw from as needed. While HELOCs generally come with variable interest rates and a draw period, they give you flexibility when accessing funds. Both options utilize your home’s value, but the home equity line of credit vs loan differs significantly in their structure and application.

As we look ahead to 2025, we see that residential property borrowing rates have reached a new low, making these options particularly appealing for homeowners who want to consolidate high-rate debt. However, recent trends indicate that HELOC rates have risen and are now approaching those of traditional residential asset financing, averaging around 8.20%. This shift suggests that homeowners may find more stability and predictability in their mortgage choices, especially with fixed-rate options available.

Consider practical examples:

- If you’re looking to fund renovations, a property-backed credit could be the right choice due to its fixed terms.

- Conversely, if you need flexible access to funds for ongoing expenses, a HELOC might suit your needs better.

By 2025, around 28% of American homeowners are considering obtaining a housing line of credit or HELOC in the coming year. This marks a 7% increase from 2022, reflecting a growing interest in utilizing property value despite the uncertainties in the economy.

It’s also important to note that under the Tax Cut and Jobs Act (TCJA), the interest on HELOCs and property value loans is only tax-deductible if used for specific enhancements to the property. This is a crucial consideration for borrowers. However, be mindful of the potential risks associated with HELOCs, such as their variable rates, which could lead to higher payments down the line. We understand how challenging this can be, and we’re here to support you every step of the way as you navigate these options.

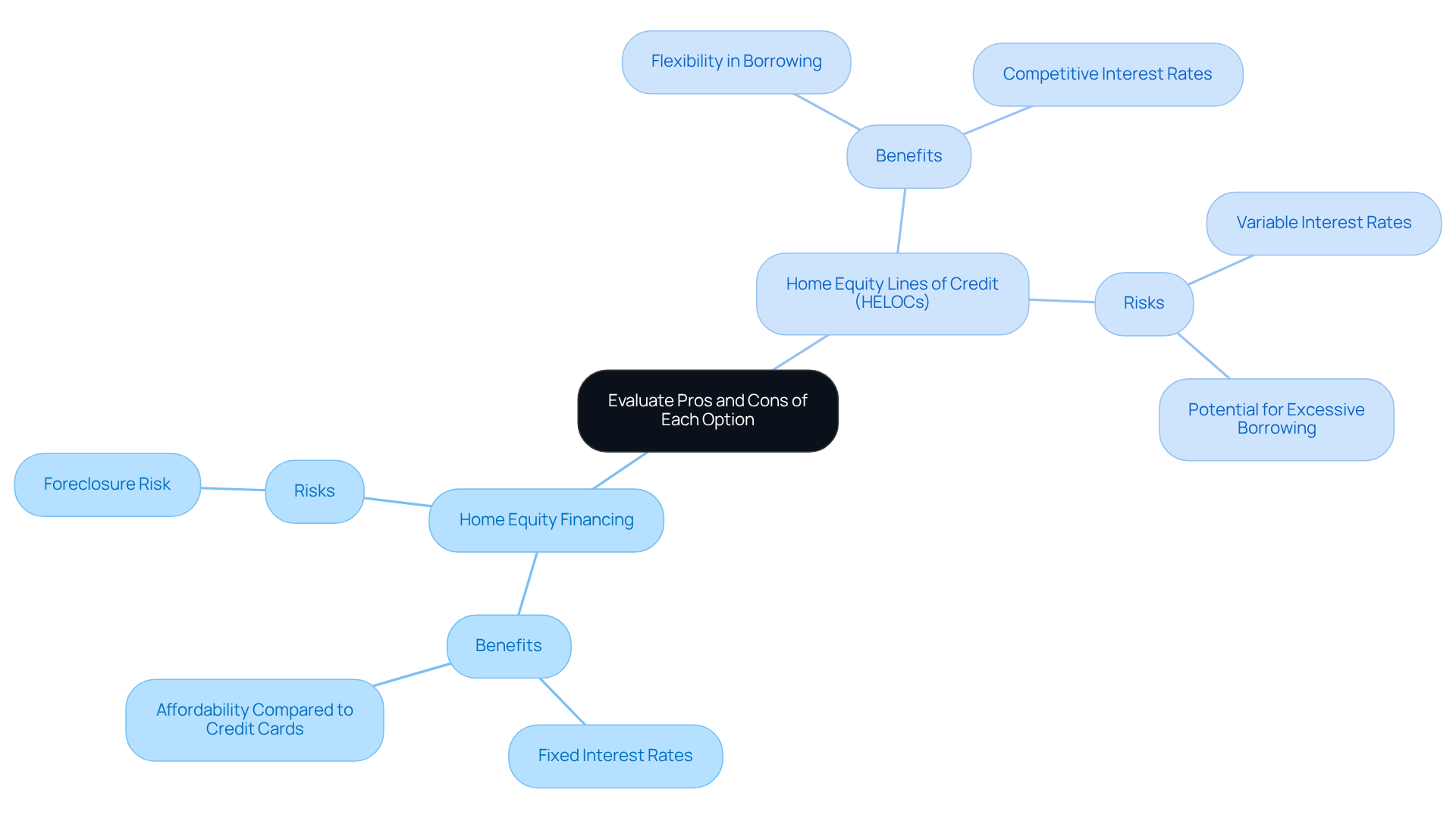

Evaluate Pros and Cons of Each Option

Home equity financing offers unique benefits that can truly help families, including fixed interest rates and consistent monthly payments. This makes them particularly suitable for significant expenses like home renovations. With an average interest rate of 8.45%, they stand out as a more affordable option compared to credit cards, which often hover around 23%. However, it’s important to recognize that these loans come with risks. Missing payments could lead to foreclosure, a serious concern for any property owner.

On the other hand, Home Equity Lines of Credit (HELOCs) provide valuable flexibility. They allow property owners to borrow only what they need and pay interest solely on the withdrawn amount during the draw period. This feature can be especially beneficial for ongoing costs, such as property enhancements or debt consolidation. Yet, it’s essential to be aware that HELOCs carry variable interest rates, which can result in fluctuating payments and complicate budgeting. As of early 2025, HELOC rates average around 7.8%, making them competitive but also unpredictable.

While the convenience of accessing funds through a HELOC is appealing, it can lead to excessive borrowing, potentially straining your finances. Financial experts emphasize the importance of discipline when using HELOCs to avoid falling into debt traps. Understanding the risks associated with home equity line of credit vs loan and HELOCs is crucial, especially as you navigate your financial future in a volatile market. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

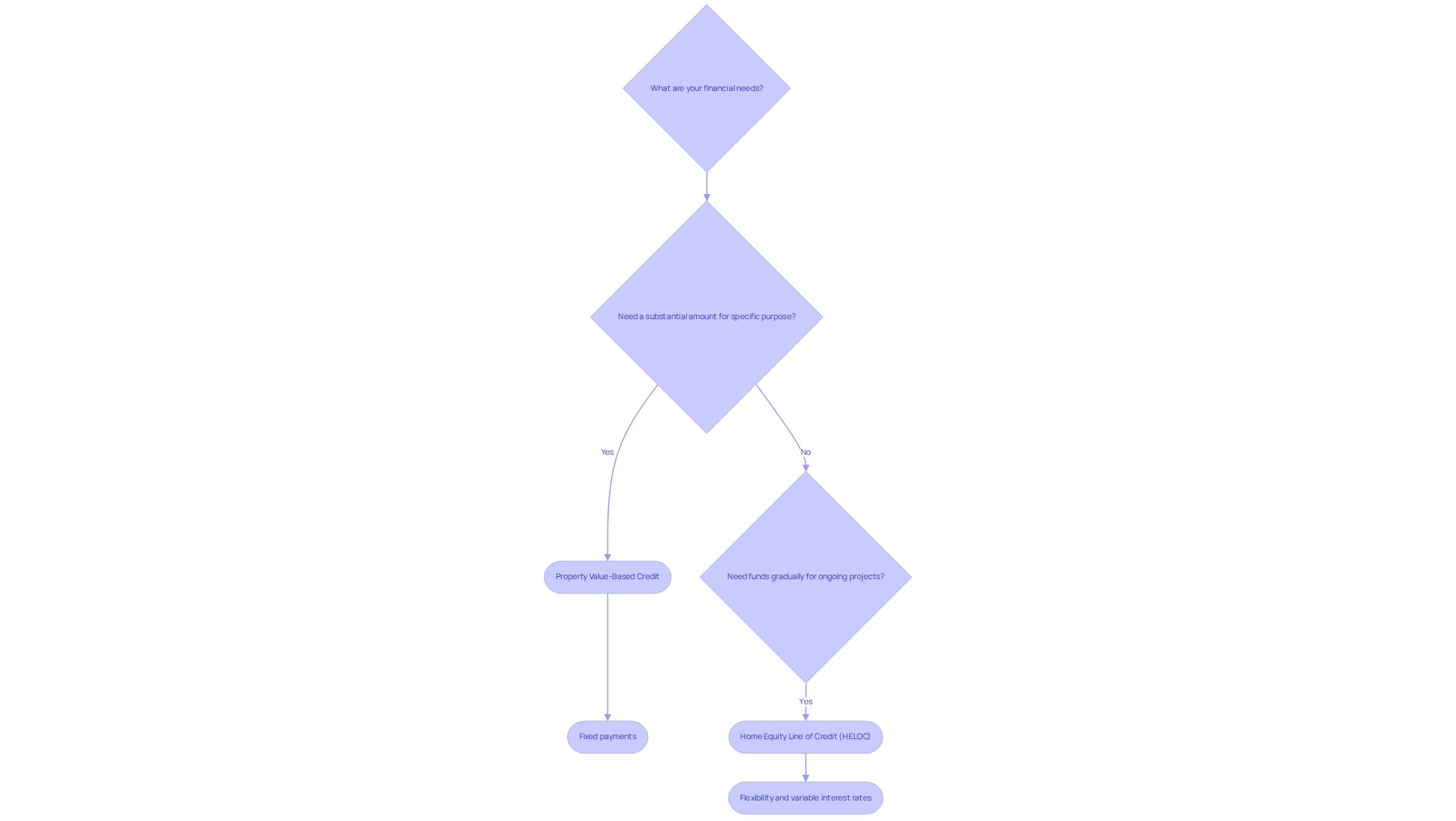

Determine Suitability Based on Financial Needs

When considering the best option for your financial needs, it’s important to reflect on your goals and current situation. If you find yourself needing a substantial amount for a specific purpose—like a major renovation or debt consolidation—a property value-based credit may be the right fit for you. This option offers the predictability of fixed payments, allowing you to plan your finances with confidence.

Alternatively, if you anticipate needing funds gradually for ongoing projects or expenses, such as education costs or home improvements, a Home Equity Line of Credit (HELOC) might be more suitable. This option provides flexibility, allowing you to access funds as needed. If you feel comfortable managing variable interest rates and have a disciplined approach to borrowing, a HELOC can be a valuable tool.

Ultimately, the decision between a home equity line of credit vs loan should align with your financial strategy and risk tolerance. We understand how challenging these choices can be, and we’re here to support you every step of the way in making the best decision for your unique situation.

Conclusion

Understanding the differences between home equity loans and lines of credit is crucial for homeowners like you, who are looking to make informed financial decisions. Each option offers unique benefits and challenges that cater to your varying needs. Home equity loans provide a fixed amount with predictable payments, making them ideal for significant expenses. In contrast, HELOCs offer flexible access to funds, albeit with variable interest rates that require careful management.

As you navigate these choices, it’s important to assess your personal financial situation. Home equity loans are suitable for those needing a lump sum for specific projects, while HELOCs cater to homeowners who prefer gradual access to funds for ongoing expenses. Additionally, understanding the implications of interest rates, tax deductions, and potential risks is essential in navigating these financing choices.

Ultimately, the decision between a home equity line of credit and a loan should align with your individual financial goals and risk tolerance. As interest rates fluctuate and borrowing trends evolve, staying informed about these options is vital. Whether you’re considering a home equity loan for a major renovation or a HELOC for flexible funding, thorough evaluation and planning can lead to better financial outcomes. Take the time to assess your needs, and remember, we’re here to support you every step of the way in making the best choice for your unique circumstances.

Frequently Asked Questions

What is a home equity loan?

A home equity loan is a second mortgage that allows homeowners to borrow a lump sum at a fixed interest rate, providing predictability in monthly payments.

How does a Home Equity Line of Credit (HELOC) work?

A HELOC functions like a credit card, offering a revolving line of credit that homeowners can draw from as needed, typically with variable interest rates and a draw period.

What are the key differences between a home equity loan and a HELOC?

The main difference is that a home equity loan provides a lump sum at a fixed rate, while a HELOC offers a flexible, revolving line of credit with variable rates.

What are the current trends in borrowing rates for home equity loans and HELOCs?

As of 2025, residential property borrowing rates have reached a new low, making these options appealing; however, HELOC rates have risen and are averaging around 8.20%, approaching traditional residential financing rates.

What should homeowners consider when deciding between a home equity loan and a HELOC?

Homeowners should consider their needs: a home equity loan may be better for funding renovations due to its fixed terms, while a HELOC offers flexible access to funds for ongoing expenses.

What percentage of American homeowners are considering a housing line of credit or HELOC in 2025?

Approximately 28% of American homeowners are considering obtaining a housing line of credit or HELOC in 2025, which is a 7% increase from 2022.

Are the interest payments on HELOCs tax-deductible?

Yes, under the Tax Cut and Jobs Act (TCJA), the interest on HELOCs and home equity loans is tax-deductible only if used for specific enhancements to the property.

What are the potential risks associated with HELOCs?

The potential risks of HELOCs include variable interest rates, which could lead to higher payments over time.