Overview

Home equity loans can be a valuable financial resource for homeowners, allowing them to tap into the equity of their properties. This equity is essentially the difference between your home’s market value and what you still owe on your mortgage. We understand how overwhelming navigating this process can be, so let’s explore the key requirements together.

To secure a home equity loan, it’s essential to have at least 20% equity in your home. This is a critical factor that lenders consider. Additionally, a strong credit score plays a vital role in determining your eligibility. We know how challenging it can be to maintain a good credit score, but it can significantly impact your loan terms.

Moreover, a favorable debt-to-income ratio is crucial. This ratio helps lenders assess your ability to manage monthly payments alongside your existing debt. By focusing on these elements, you can improve your chances of securing approval and obtaining favorable loan terms.

We’re here to support you every step of the way as you consider your options. Take the time to evaluate your financial situation and prepare for this important decision. Remember, understanding these requirements can empower you to make informed choices about your home equity loan.

Introduction

Home equity loans have become an essential financial resource for homeowners eager to tap into their property’s value. With the average homeowner now holding around $302,000 in available equity, it’s no wonder that nearly 30% of U.S. homeowners are considering these options in the upcoming year. We understand how daunting this process can be, and that’s why it’s vital to grasp the key requirements for securing a home equity loan.

However, the journey to obtaining this financing can be challenging. Homeowners face various hurdles, from credit score issues to fluctuating property values. We know how challenging this can be, and it’s important to explore the steps you can take to navigate this complex landscape. By doing so, you can unlock the potential of your home equity and achieve your financial goals.

Define Home Equity Loans and Their Functionality

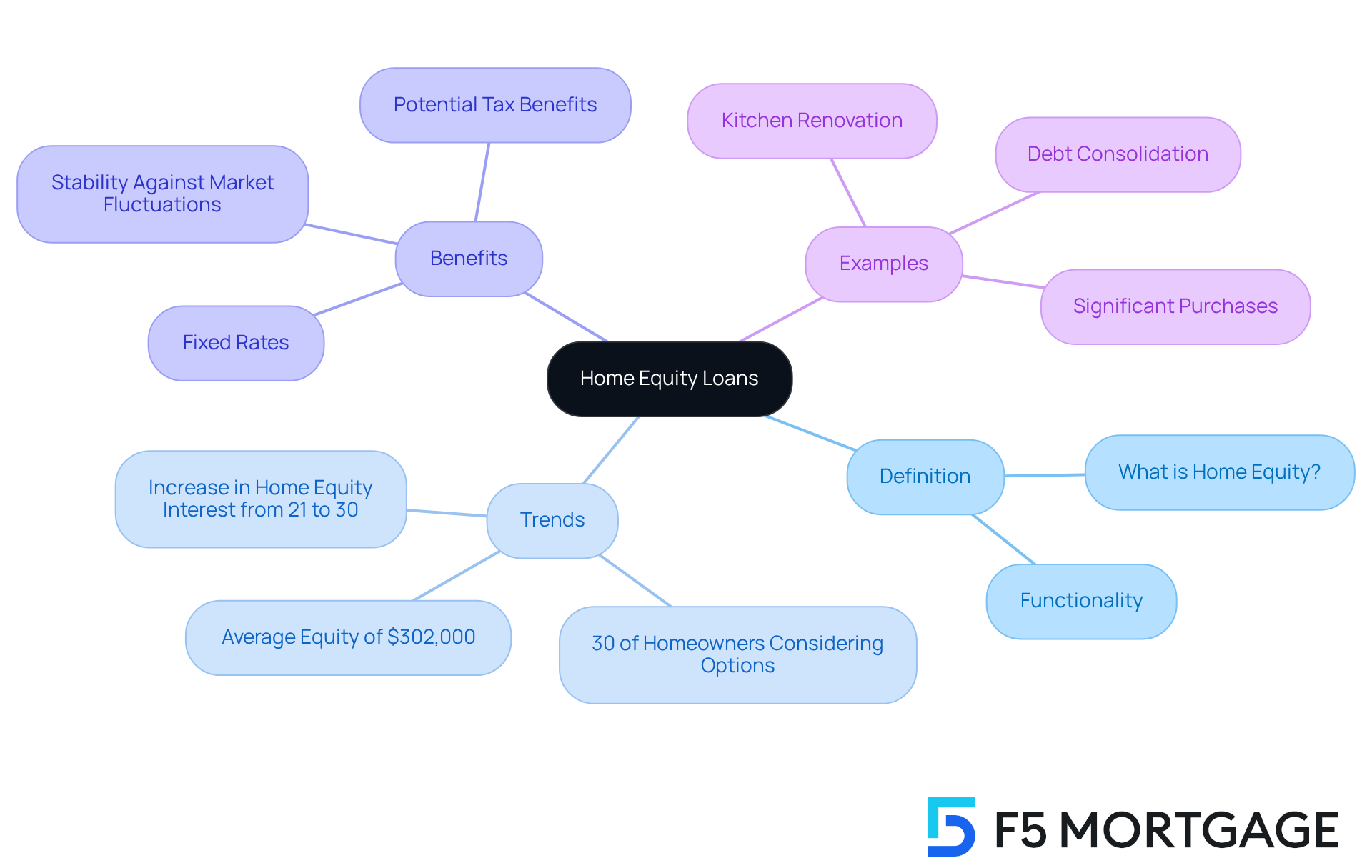

Home equity financing options are valuable tools that allow homeowners to tap into the equity they’ve built in their properties. Equity is simply the difference between your home’s current market value and the remaining mortgage balance. These financial products work much like traditional loans, offering a lump sum that you can repay over time at a fixed interest rate. The funds you secure against your property can be used for various purposes, such as home improvements, consolidating debt, or making significant purchases, making them a versatile financial resource.

As we look ahead to 2025, the average homeowner has about $302,000 in available equity. Many are considering using this resource, especially during uncertain economic times. Recent trends show a growing interest in residential financing, with nearly 30% of U.S. homeowners thinking about these options in the coming year. This is a notable increase from 21% in 2022, highlighting a shift in how homeowners view their properties as potential financial lifelines.

Experts emphasize the importance of understanding the requirements for home equity loans and how residential equity loans function. They provide , unlike home equity lines of credit (HELOCs), which typically have variable rates. This stability is especially appealing today, as homeowners are concerned about rising interest rates. Additionally, property-backed financing may offer tax benefits for qualifying renovations, which can further encourage their use.

Real-life examples illustrate the practical benefits of residential financing. Homeowners often use these options for significant renovations that can boost property value and improve living conditions. For instance, imagine a homeowner who decides to fund a kitchen renovation through a home equity loan. Not only does this enhance the home’s market value, but it also creates a more enjoyable living space.

In summary, understanding the requirements for home equity loans is essential as residential property financing serves as a crucial financial resource for homeowners, providing access to substantial funds while maintaining the security of fixed interest rates. As the landscape of residential equity continues to evolve, understanding the key roles and benefits of these financing options is essential for homeowners looking to make informed financial decisions. We know how challenging this can be, and we’re here to support you every step of the way.

Outline Eligibility Criteria for Home Equity Loans

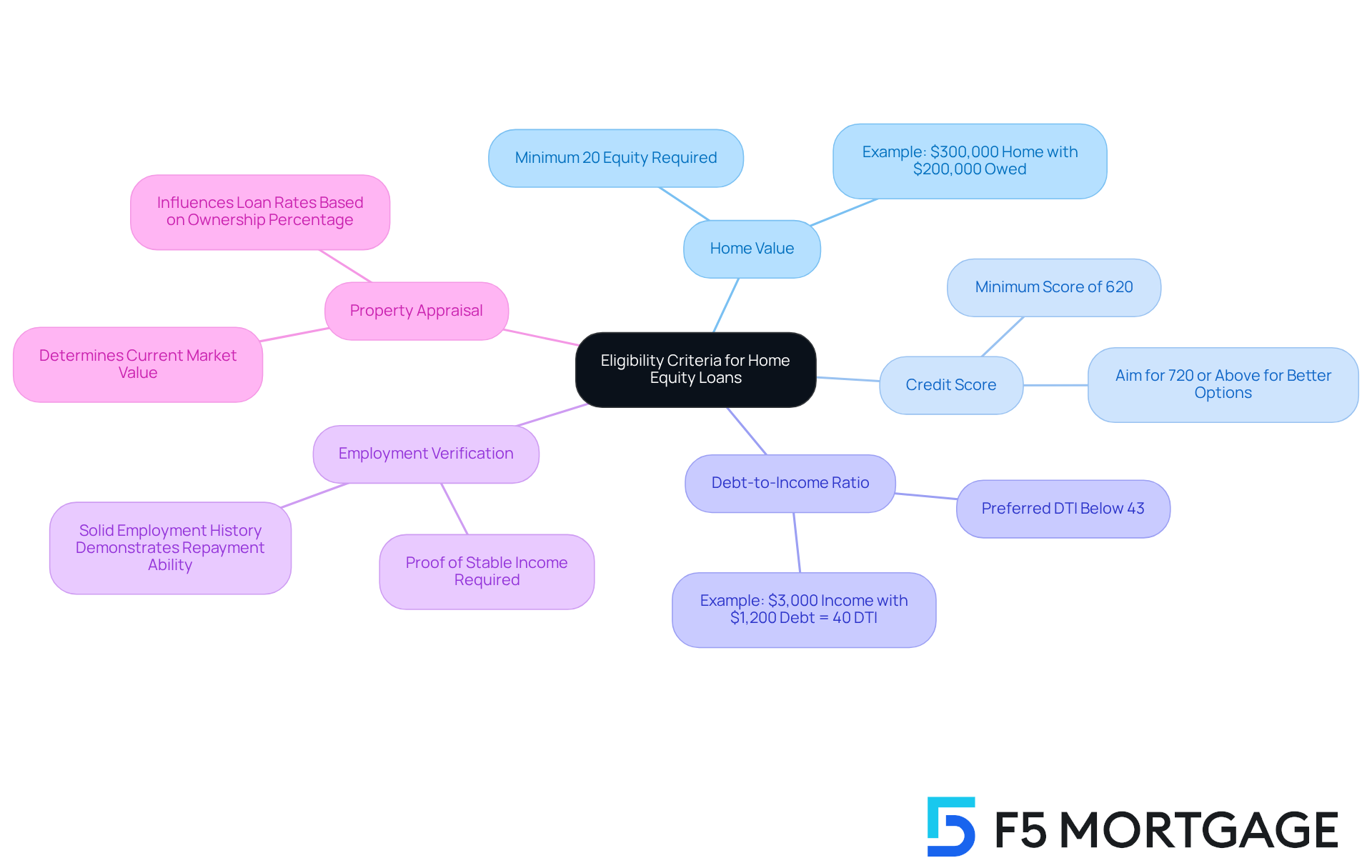

Qualifying for a property-backed loan can feel daunting, but understanding the essential requirements can make the process smoother. Here are some key factors to consider:

- Home Value: Many mortgage lenders require homeowners to have at least 20% equity in their property. For instance, if your home is valued at $300,000 and you owe $200,000, that means you own $100,000—about 33%. Knowing your home’s equity is crucial, as it directly impacts your loan costs and conditions. We understand how important it is to find the right fit, so consider partnering with F5 Mortgage for competitive pricing and personalized service tailored to your needs.

- Credit Score: A strong credit score is vital. Most lenders look for a minimum score of 620, but aiming for 720 or above can lead to better financing options. We know how challenging it can be to improve your score, but every step counts.

- Debt-to-Income Ratio: Lenders typically prefer a debt-to-income (DTI) ratio of 43% or lower. For example, if your monthly income is $3,000 and your total monthly debt payments are $1,200, your DTI would be 40%, which is acceptable. A lower DTI can enhance your chances of approval and lead to favorable terms.

- Employment and Income Verification: Providing proof of stable income and a solid employment history is essential. This demonstrates your ability to repay the loan, and we’re here to support you in gathering the necessary documentation.

- Property Appraisal: The lender will request a property appraisal to determine your asset’s current market value. This assessment is key, as it influences your rates based on your ownership percentage.

Understanding the can significantly improve your chances of acceptance and help you prepare your finances before seeking a property financing option. As Peter Warden wisely notes, “If you meet basic requirements for available assets, credit score, and DTI, there’s a very good chance you can get approved for a property line of credit.”

Be aware that common disqualifications include inadequate property value, poor credit history or low credit scores, and unstable income with a high debt-to-income ratio. Remember, we’re here to guide you every step of the way as you navigate this journey.

Detail the Application Process and Required Documentation

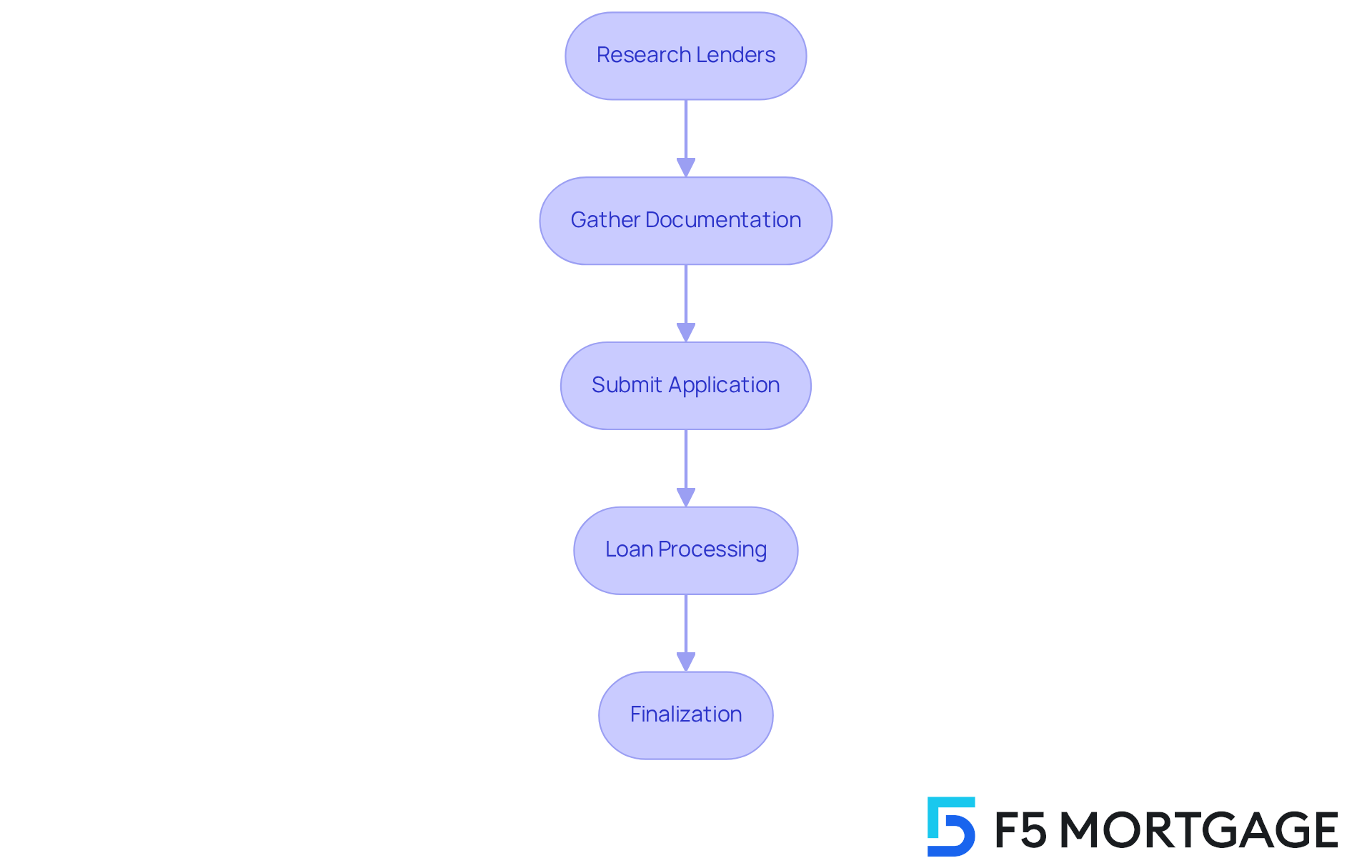

Navigating the application process for a home equity loan can feel overwhelming, but we’re here to support you every step of the way. It involves several key steps that can lead you to a brighter financial future:

Research Lenders: Start by evaluating different lenders to find the most advantageous offers and conditions. We recommend considering for competitive rates and personalized service that truly understands your needs.

Gather Documentation: Essential documents typically required include:

- Proof of income (such as pay stubs and tax returns)

- Home appraisal report

- Current mortgage statement

- Credit report

- Identification (driver’s license and Social Security number)

Submit Application: Complete the lender’s application form and submit the gathered documentation. This step is crucial in moving forward.

Loan Processing: The lender will examine your application, confirm the information given, and perform a property appraisal. We know how challenging this can be, but rest assured that this is a standard part of the process.

Finalization: Upon approval, you will receive a closing disclosure outlining the financing terms, followed by a closing meeting to sign the final paperwork. Being well-organized and prepared can significantly streamline this process, enhancing your chances of approval.

To qualify for the best rates, property owners are recommended to confirm they possess at least 20% equity in their residence and a credit score of 750 or above. Furthermore, a maximum debt-to-income (DTI) ratio of 43% is generally necessary for housing financing. Understanding the requirements for home equity loan is crucial for effectively leveraging your property’s value.

The duration to obtain a property financing option usually varies from 2 to 6 weeks, so preparation in advance is key. Remember, we’re here to help you navigate this journey with confidence.

Identify Common Challenges and How to Overcome Them

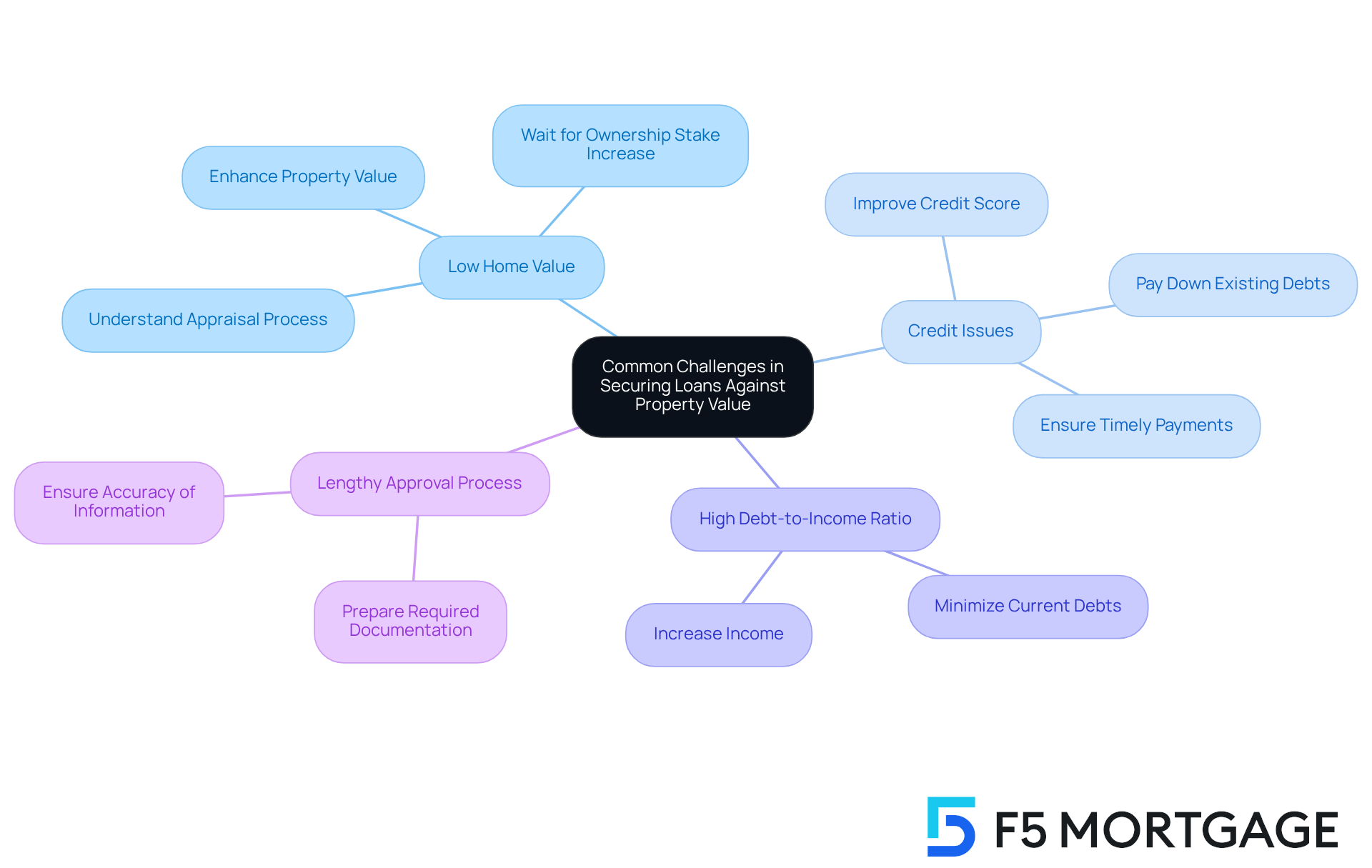

When seeking loans against property value, we know how challenging this can be. Borrowers frequently face various hurdles that can feel overwhelming. Here are some key challenges and how to navigate them:

- Low Home Value: Insufficient ownership stake can hinder approval. To tackle this, consider making strategic enhancements to increase your property’s worth or wait until your ownership stake rises through consistent mortgage payments. The lender will request a property appraisal to assess the current market value of your asset. This appraisal will reveal how much ownership you possess and influence your rates. As of the first quarter of 2025, around 1.2 million properties in the U.S. are underwater, accounting for 2.1% of all mortgaged dwellings. This emphasizes the significance of sustaining positive value. The requirements for home equity loan approval typically include that most lenders require at least 15% to 20% equity in your home, meaning your loan-to-value ratio (LTV) should be 80% to 85% or lower.

- Credit Issues: A low credit score can significantly impact your chances of approval. While numerous lenders accept scores beginning at 620, individuals with scores beneath this might encounter and more rigid conditions. Focus on improving your score by paying down existing debts and ensuring timely payments. Aiming for a score of 740 or higher can unlock better interest rates and terms.

- High Debt-to-Income Ratio: Lenders typically prefer a debt-to-income (DTI) ratio of 43% or less. Minimizing your current debts can assist in enhancing this ratio, making you a more appealing candidate for credit.

- Lengthy Approval Process: To expedite the approval process, ensure that all required documentation—such as pay stubs, tax returns, and current mortgage balance details—is complete and accurate before submission.

By proactively addressing these challenges, including understanding the requirements for home equity loan and the role of appraisals in determining equity, we’re here to support you every step of the way. This can significantly enhance your chances of securing a home equity loan.

Conclusion

Home equity loans can be a powerful financial resource for homeowners, allowing you to tap into the equity built in your property. These loans not only provide access to substantial funds but also offer the stability of fixed interest rates. In times of economic uncertainty, this makes them an attractive option for many. Understanding the essential requirements and processes involved in securing a home equity loan is crucial for you to make informed financial decisions.

We know how important it is to have sufficient home equity, maintain a strong credit score, and manage a favorable debt-to-income ratio. The application process can seem daunting, with necessary documentation and common challenges that borrowers may face. By being well-prepared and informed, you can navigate the complexities of home equity loans and enhance your chances of approval.

Ultimately, the significance of understanding home equity loans cannot be overstated. As more homeowners view their properties as financial assets, being proactive in addressing potential challenges becomes essential. Knowing the requirements for home equity loans empowers you to make sound financial choices, paving the way for a more secure financial future. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is a home equity loan?

A home equity loan is a financial product that allows homeowners to borrow against the equity they have built in their properties, which is the difference between the home’s current market value and the remaining mortgage balance.

How do home equity loans work?

Home equity loans function like traditional loans, providing a lump sum of money that can be repaid over time at a fixed interest rate. The funds can be used for various purposes, such as home improvements, debt consolidation, or significant purchases.

What is the average amount of equity available to homeowners as of 2025?

As of 2025, the average homeowner has about $302,000 in available equity.

What trends are being observed regarding home equity loans?

There is a growing interest in home equity financing, with nearly 30% of U.S. homeowners considering these options in the coming year, an increase from 21% in 2022.

What are the benefits of home equity loans compared to home equity lines of credit (HELOCs)?

Home equity loans offer stable fixed interest rates, protecting borrowers from market fluctuations, whereas HELOCs typically have variable rates. This stability is particularly appealing in times of rising interest rates.

Can home equity loans provide tax benefits?

Yes, property-backed financing through home equity loans may offer tax benefits for qualifying renovations, which can encourage their use.

How can homeowners benefit from using home equity loans for renovations?

Homeowners can use home equity loans to fund significant renovations, which can enhance the property’s market value and improve living conditions, making their homes more enjoyable.

Why is it important to understand the requirements for home equity loans?

Understanding the requirements for home equity loans is essential for homeowners to make informed financial decisions and to effectively utilize this crucial financial resource.