Overview

Navigating the mortgage process can feel overwhelming for families. That’s why this article focuses on identifying the best mortgage advisors, with a special spotlight on F5 Mortgage as a leading choice. We understand how challenging this can be, and F5 Mortgage stands out for its client-centric approach.

With an extensive variety of loan options, rapid service, and a high customer satisfaction rate, F5 Mortgage truly prioritizes your needs. These factors all contribute to a superior experience for families seeking mortgage financing, and we’re here to support you every step of the way.

Introduction

Navigating the mortgage landscape can feel overwhelming for families. With a myriad of options and ever-changing market conditions, it’s easy to feel lost. We understand how challenging this can be. The right mortgage advisor can make all the difference, offering personalized support that simplifies the home financing journey.

But with so many choices available, how can families identify the best mortgage advisors that truly cater to their unique needs and circumstances? This article delves into a comparative analysis of leading mortgage advisors, highlighting what sets them apart and how families can benefit from their expertise in achieving homeownership.

We’re here to support you every step of the way.

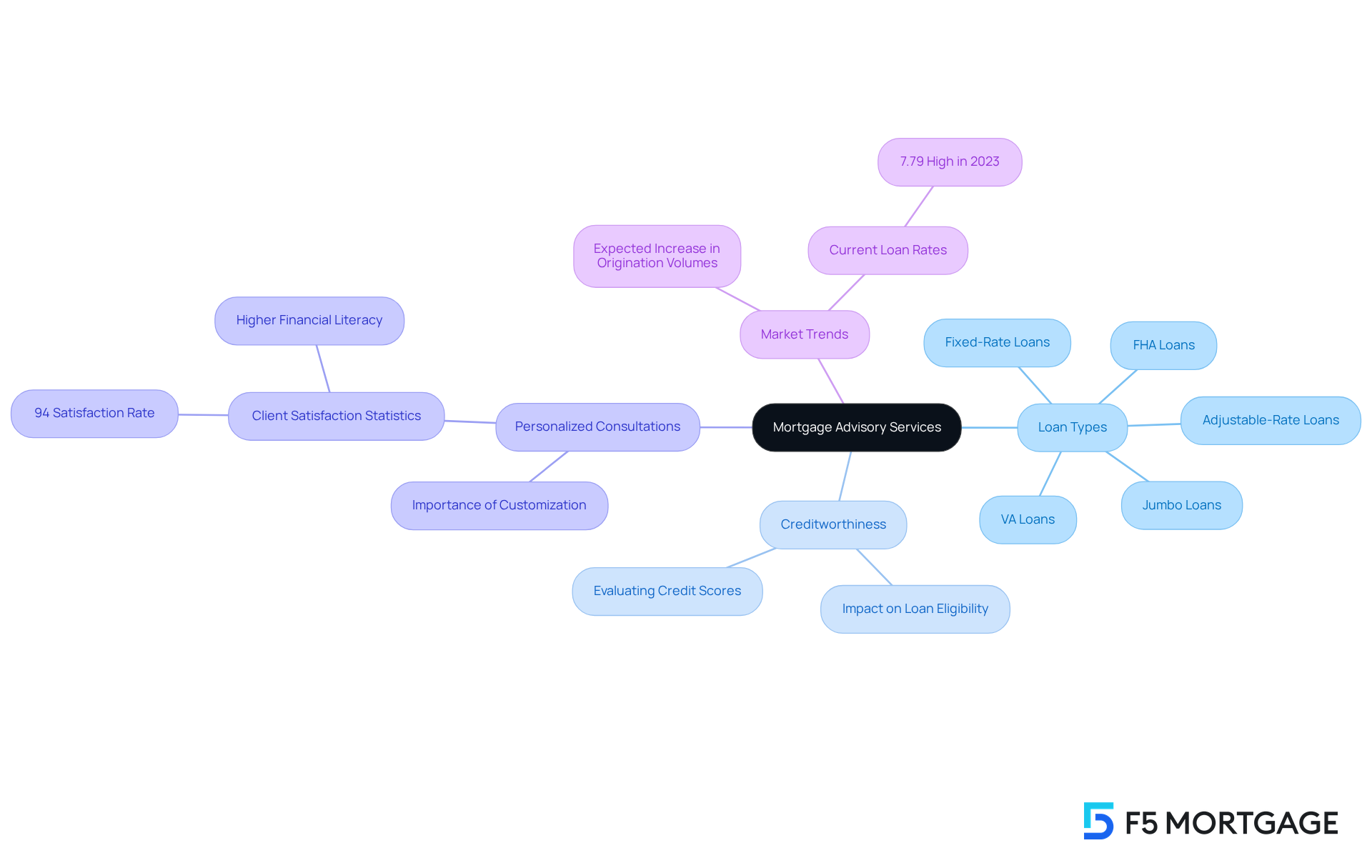

Understanding Mortgage Advisory Services

The best mortgage advisors offer mortgage advisory services that encompass a range of support mechanisms designed to assist households in navigating the complexities of home financing. We know how challenging this can be. These services typically include personalized consultations, access to various loan products, and guidance through the application process. Advisors help clients understand their financial options, assess their eligibility for different loan types, and provide insights into market trends. For households, the best mortgage advisors can significantly impact obtaining advantageous terms and ensuring a seamless transaction. Key aspects of these services include:

- Understanding loan types (fixed-rate, adjustable-rate, FHA, VA, etc.)

- Evaluating creditworthiness

- Providing tailored advice based on individual financial situations

The importance of personalized consultations cannot be overstated. Financial consultants highlight that these customized interactions can lead to improved results for households. For instance, clients who engage in personalized consultations often report higher satisfaction rates and improved financial literacy, which are essential for making informed decisions. Effective loan advisory services, like those from the best mortgage advisors at F5 Mortgage, showcase the success of this method. They have assisted over 1,000 households in reaching their homeownership objectives, boasting an outstanding customer satisfaction rate of 94%.

In a competitive market where loan origination volumes are expected to increase substantially, households that utilize tailored loan consultations are better equipped to handle challenges like changing interest rates and intricate paperwork. According to recent data, loan rates reached a high of 7.79% in 2023. This makes it crucial for families to have expert guidance. This proactive method not only improves their chances of obtaining favorable loan conditions but also promotes a sense of confidence throughout the home purchasing process. We’re here to every step of the way.

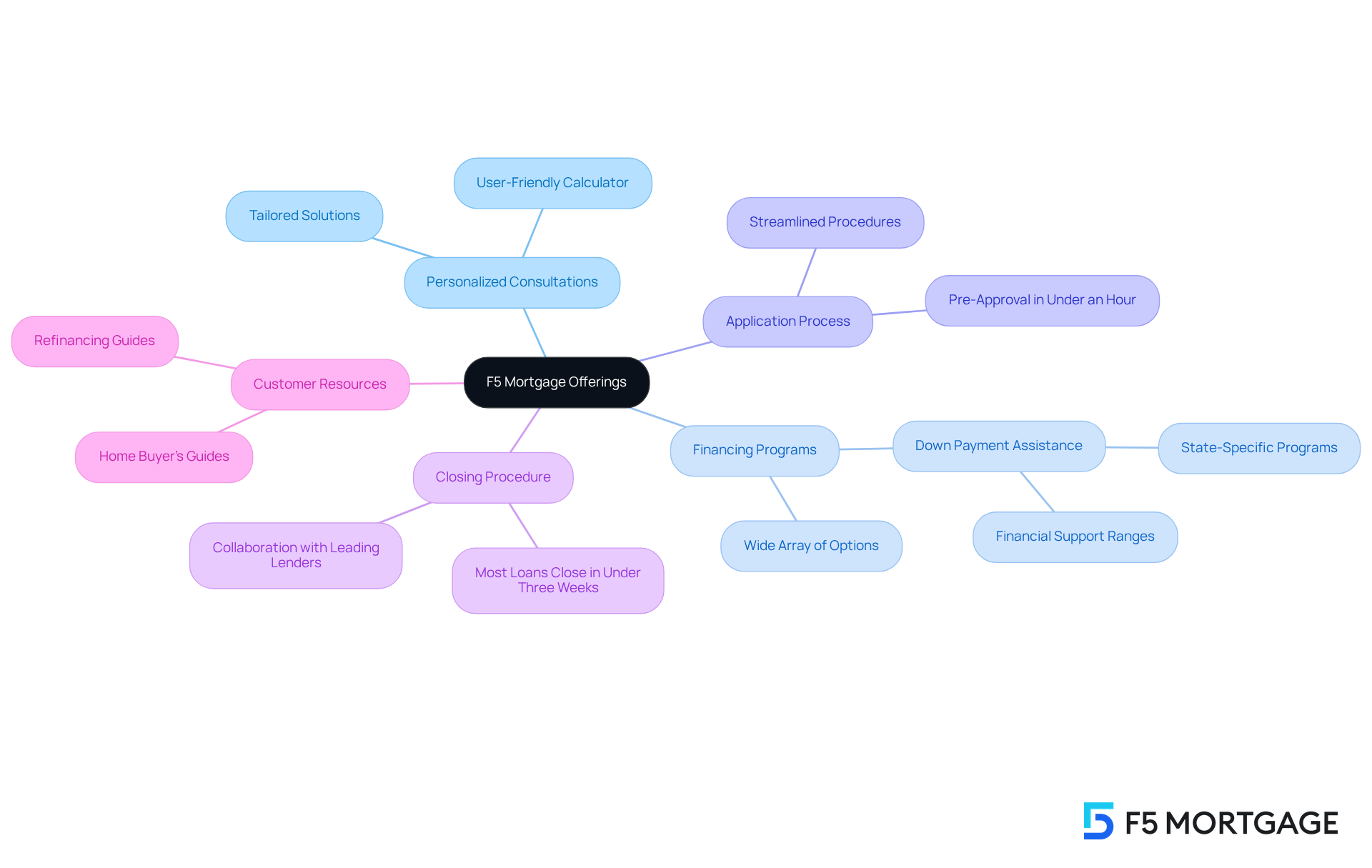

F5 Mortgage: Unique Offerings and Client Benefits

At F5 Mortgage, we understand how challenging the journey to homeownership can be. That’s why we set ourselves apart as the best mortgage advisors in the loan advisory field, with a steadfast dedication to your satisfaction and an independent brokerage approach. Unlike traditional lenders, we prioritize your interests, ensuring a tailored solution for your family’s unique financial situation.

Our key offerings include:

- Personalized loan consultations that address your specific needs

- Access to a wide array of financing programs

- A user-friendly calculator designed to simplify your decision-making process

We know how overwhelming it can be to navigate mortgage financing, especially for first-time homebuyers. That’s why our streamlined application process guarantees pre-approval in under an hour, giving you a significant advantage.

Additionally, we pride ourselves on our rapid and effective closing procedure, with most loans concluding in under three weeks. We collaborate with over two dozen leading lenders, including the best mortgage advisors, to offer you a varied selection of options, ensuring you obtain the most favorable deals available. To further support you, we provide valuable resources like detailed home buyer’s guides and state-specific down payment assistance programs, which can offer financial support ranging from a few thousand dollars to over $30,000.

This commitment to tailored service and education has contributed to our impressive customer satisfaction rate of 94%. We’re here to support you every step of the way as you .

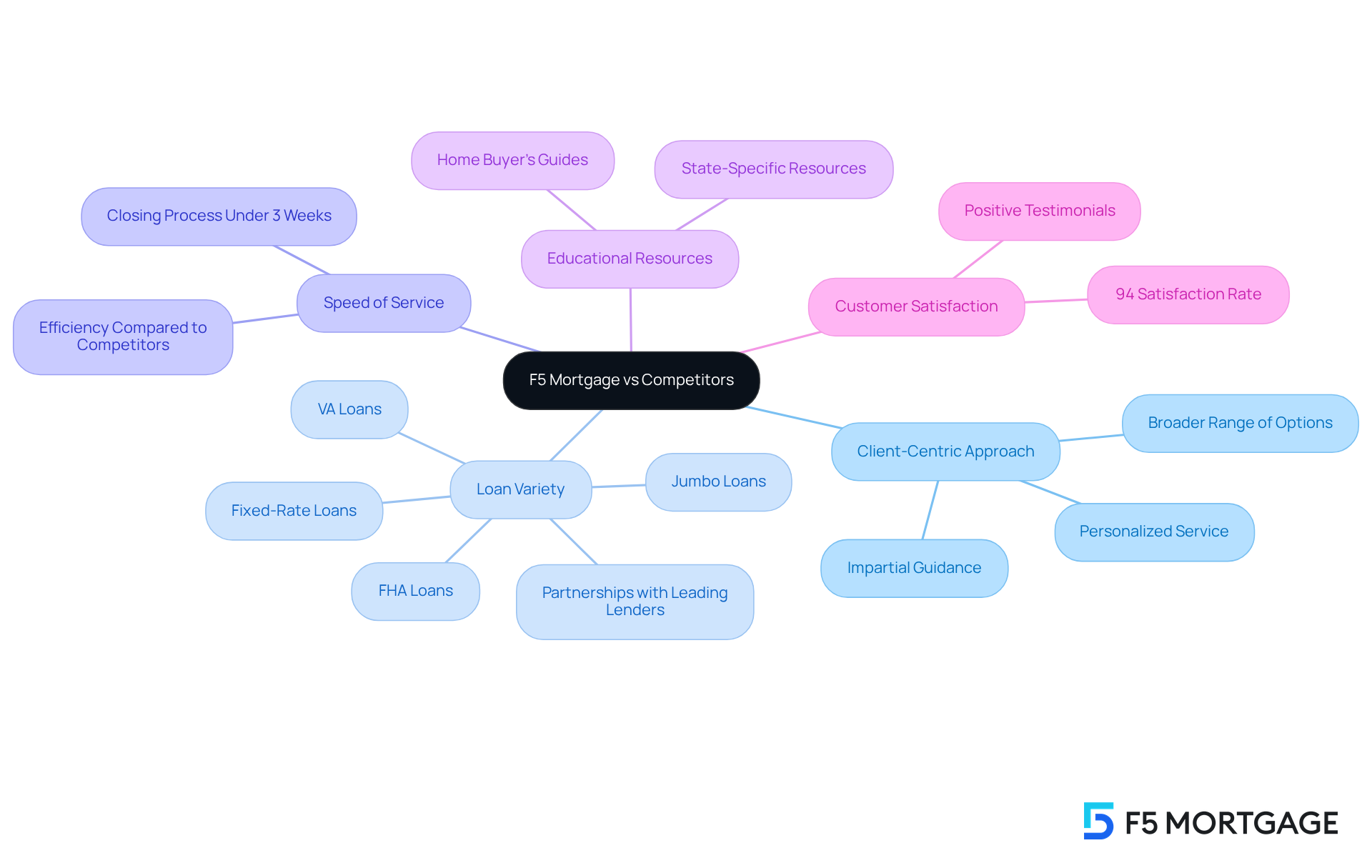

Comparative Analysis of Leading Mortgage Advisors

When navigating the mortgage landscape, families often face significant challenges. At F5 Mortgage, we understand how daunting this process can be, and we’re here to support you every step of the way. When comparing F5 Mortgage with other prominent mortgage advisors, several critical factors stand out:

- Client-Centric Approach: F5 Mortgage prioritizes personalized service, exclusively representing clients rather than lenders. This focus allows for a broader range of options tailored to your unique needs, unlike some competitors who may prioritize lender relationships, potentially limiting your choices. As an independent broker, F5 can provide impartial guidance and a wider array of products.

- Loan Variety: F5 Financing offers a broad range of loan choices, including fixed-rate, FHA, VA, and jumbo loans. This diverse offering serves households with unique financial situations. Additionally, F5 Financing partners with over two dozen leading lenders, ensuring you have access to the best deals available. In contrast, other advisors may have a more limited focus, restricting your options.

- Speed of Service: With a closing process that usually lasts under three weeks, F5 Financing excels in efficiency—a vital benefit for families needing swift access to funds. In contrast, some competitors may experience longer processing times, which can hinder time-sensitive transactions. Industry averages indicate that numerous lenders require considerably more time, highlighting F5’s speed as a distinctive attribute.

- Educational Resources: F5 Financing stands out for its comprehensive educational materials, including detailed home buyer’s guides and refinancing resources tailored to specific states. While other advisors may offer some resources, the are especially remarkable, empowering you with knowledge throughout your financing journey.

- Customer Satisfaction: With an impressive customer satisfaction rate of 94%, F5 demonstrates a strong dedication to your happiness. This metric acts as an important standard when evaluating overall service quality against competitors, particularly considering industry trends showing that lenders who actively guide customers tend to attain higher satisfaction scores.

In summary, while many of the best mortgage advisors deliver essential services, F5 Mortgage’s unique combination of personalized service, extensive loan options, and dedication to client education distinctly positions it as a premier choice for families navigating the complexities of the mortgage landscape.

Conclusion

Navigating the mortgage landscape can indeed feel overwhelming for families. However, with the right mortgage advisor by your side, the journey can become much smoother. This analysis highlights how F5 Mortgage emerges as a top choice among mortgage advisors, showcasing its dedication to personalized service, a wide array of loan options, and educational resources specifically designed to meet the unique needs of each household.

Personalized consultations are essential, leading to greater satisfaction and increased financial literacy. F5 Mortgage excels in its application and closing processes, ensuring efficiency and clarity. When compared to other advisors, F5’s client-centric approach and diverse loan offerings stand out, providing families with the support they need to achieve their homeownership dreams. With an impressive customer satisfaction rate of 94%, F5 demonstrates a strong commitment to ensuring that clients feel confident and informed throughout their mortgage journey.

Choosing the right mortgage advisor is crucial for families seeking favorable financing terms. The insights shared in this analysis highlight the importance of tailored advice, prompt service, and comprehensive educational resources. As families explore their options, turning to F5 Mortgage could be a transformative step toward realizing their homeownership aspirations. Embracing expert guidance not only simplifies the mortgage process but also empowers families to make informed financial decisions that align with their long-term goals.

Frequently Asked Questions

What are mortgage advisory services?

Mortgage advisory services are support mechanisms provided by mortgage advisors to help households navigate the complexities of home financing. They include personalized consultations, access to various loan products, and guidance through the application process.

What types of loan products do mortgage advisors help clients understand?

Mortgage advisors help clients understand various loan types, including fixed-rate, adjustable-rate, FHA, VA, and more.

How do mortgage advisors evaluate a client’s creditworthiness?

Mortgage advisors assess a client’s creditworthiness as part of the advisory process to determine eligibility for different loan types and to provide tailored advice based on individual financial situations.

Why are personalized consultations important in mortgage advisory services?

Personalized consultations are crucial because they lead to improved results for households, higher satisfaction rates, and enhanced financial literacy, which are essential for making informed decisions.

What success has F5 Mortgage achieved with their advisory services?

F5 Mortgage has assisted over 1,000 households in achieving their homeownership goals, boasting an outstanding customer satisfaction rate of 94%.

How do tailored loan consultations help households in a competitive market?

Tailored loan consultations equip households to better handle challenges such as changing interest rates and complex paperwork, increasing their chances of obtaining favorable loan conditions.

What was the loan rate high in 2023, and why is this significant?

The loan rates reached a high of 7.79% in 2023, making it crucial for families to have expert guidance to navigate the market effectively.